Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

176 viewsStock Screens 080217

Stock Screens 080217

Uploaded by

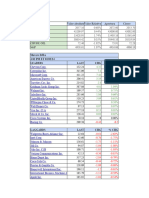

sarav10The document lists various stocks and the changes in their closing prices, trading volumes, and other metrics from the previous day. It includes the ticker, company name, changes in close price and volume, key performance indicators, and 52-week highs and lows. The stocks are categorized as big movers from the previous day as well as historical movers from 1-3 days ago.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Elce4012 4Document8 pagesElce4012 4ameerNo ratings yet

- MarketSmith Growth 250Document28 pagesMarketSmith Growth 250tothetechNo ratings yet

- Yahoo! Finance SpreadsheetDocument9 pagesYahoo! Finance Spreadsheetsandip_exlNo ratings yet

- Waverly Advisors ScreenersDocument28 pagesWaverly Advisors Screenershecha82No ratings yet

- Order Symbol Name Current Price Price $ CHG Price % CHGDocument8 pagesOrder Symbol Name Current Price Price $ CHG Price % CHGtrungNo ratings yet

- Name Daily 1 Week 1 Month YTD 1 Year 3 YearsDocument54 pagesName Daily 1 Week 1 Month YTD 1 Year 3 Yearsmdyakubhnk85No ratings yet

- Análisis de Datos para PortafolioDocument8 pagesAnálisis de Datos para PortafolioAlberto Elías Gómez PalacioNo ratings yet

- Name Daily 1 Week 1 Month YTD 1 Year 3 YearsDocument31 pagesName Daily 1 Week 1 Month YTD 1 Year 3 Yearsyakubpasha.mohdNo ratings yet

- Technidex: Stock Futures IndexDocument3 pagesTechnidex: Stock Futures IndexRaya DuraiNo ratings yet

- Pi Daily Strategy 24112023 SumDocument7 pagesPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitNo ratings yet

- Order Symbol Name Current Price Price $ CHG Price % CHGDocument4 pagesOrder Symbol Name Current Price Price $ CHG Price % CHGtrungNo ratings yet

- Healthcare WorkingDocument13 pagesHealthcare Workingsunway.senai2No ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220506Document30 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220506matrixitNo ratings yet

- Investment Ideas - High Growth Stocks Close To New HighsDocument8 pagesInvestment Ideas - High Growth Stocks Close To New HighsTom RobertsNo ratings yet

- ESG IndustriaDocument5 pagesESG IndustriaDiego PonceNo ratings yet

- Hot-Accounts Google FinanceDocument5 pagesHot-Accounts Google Financerbp_1973No ratings yet

- Lab 110409Document6 pagesLab 110409Andre SetiawanNo ratings yet

- Stock % Portfolio Value % ChangeDocument4 pagesStock % Portfolio Value % ChangeRianSetiawanNo ratings yet

- Name Daily 1 Week 1 Month YTD 1 Year 3 YearsDocument24 pagesName Daily 1 Week 1 Month YTD 1 Year 3 Yearsyakubpasha.mohdNo ratings yet

- Moc 2.2018 PP Ops - TNDocument93 pagesMoc 2.2018 PP Ops - TNHaja Mohamed SheriffNo ratings yet

- BreakdownDocument103 pagesBreakdownhandiNo ratings yet

- MERCADOTECNIADocument2 pagesMERCADOTECNIAyonniry JiménezNo ratings yet

- Charting Filter - 02242018Document115 pagesCharting Filter - 02242018Titus Keith CaddauanNo ratings yet

- Stock Screener172818Document6 pagesStock Screener172818Rafiq ShaikhNo ratings yet

- CorregidoDocument31 pagesCorregidoEleonor de PortillaNo ratings yet

- Yahoo! Finance SpreadsheetDocument7 pagesYahoo! Finance SpreadsheetAnonymous 5lDTxtNo ratings yet

- Next 50Document631 pagesNext 50Kasthuri CoimbatoreNo ratings yet

- FNCE90062 RDY Valuation ModelsDocument56 pagesFNCE90062 RDY Valuation Modelsharpreet gumberNo ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220511Document61 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220511matrixitNo ratings yet

- 07 - 2301896803 - Ikhsan Uiandra Putra Sitorus - LB53Document9 pages07 - 2301896803 - Ikhsan Uiandra Putra Sitorus - LB53Ikhsan Uiandra Putra SitorusNo ratings yet

- KLSE KLCI Closing Price 18-Sep-08Document1 pageKLSE KLCI Closing Price 18-Sep-08starchaser082243No ratings yet

- L Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CDocument5 pagesL Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CdineshNo ratings yet

- Market Statistics - Friday, October 30 2009: Japan - Nikkei 225Document7 pagesMarket Statistics - Friday, October 30 2009: Japan - Nikkei 225Andre SetiawanNo ratings yet

- Dividend Yield StocksDocument3 pagesDividend Yield StocksSushilNo ratings yet

- Ações AtualDocument18 pagesAções Atualyatan001No ratings yet

- Açoes-Baratas BolsaDocument33 pagesAçoes-Baratas BolsaCarlos CelestinoNo ratings yet

- Breakout Stock: Thursday, September 16, 2021Document1 pageBreakout Stock: Thursday, September 16, 2021Imran KhanNo ratings yet

- Screener DataDocument12 pagesScreener DataKartikay GoswamiNo ratings yet

- Calculadora Bonos en USD OnDocument198 pagesCalculadora Bonos en USD OnFrann ZanczukNo ratings yet

- Caution Stock WatchlistDocument47 pagesCaution Stock WatchlistSatyasundar PanigrahiNo ratings yet

- My Research - Hindustan Tin WorksDocument17 pagesMy Research - Hindustan Tin Worksranjan.duttaNo ratings yet

- Dividend Yield Stocks: Retail ResearchDocument3 pagesDividend Yield Stocks: Retail ResearchAmeerHamsaNo ratings yet

- Real Estate Investing Trust: Empresa Sigla Segmento $$ D. Yield P/VPDocument3 pagesReal Estate Investing Trust: Empresa Sigla Segmento $$ D. Yield P/VPGabriel WaitikoskiNo ratings yet

- Simpli-3 Business Plan 2023Document24 pagesSimpli-3 Business Plan 2023Asiful AlamNo ratings yet

- Planilha (Aulas Iniciais) Curso Avançado de ExcelDocument8 pagesPlanilha (Aulas Iniciais) Curso Avançado de ExcelluanaNo ratings yet

- StocksDocument22 pagesStocksTanmayNo ratings yet

- Lab 110509Document6 pagesLab 110509Andre SetiawanNo ratings yet

- Industry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITDocument3 pagesIndustry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITruchi gulatiNo ratings yet

- Year 2013 2014 2015 2016 2017 Latest: CompetitionDocument3 pagesYear 2013 2014 2015 2016 2017 Latest: CompetitionDahagam SaumithNo ratings yet

- Index PerformanceDocument2 pagesIndex PerformanceghodababuNo ratings yet

- Best CompaniesDocument6 pagesBest Companiesar8ku9sh0aNo ratings yet

- Project Cost Overrun ScenariosDocument318 pagesProject Cost Overrun ScenariosAli SibtainNo ratings yet

- Fortune List 2022Document52 pagesFortune List 2022JonNo ratings yet

- S Curve TableDocument2 pagesS Curve TableGio heterozaNo ratings yet

- BSE Sensex Status: World IndicesDocument28 pagesBSE Sensex Status: World IndicesHirendra PatilNo ratings yet

- Dividend Yield StocksDocument2 pagesDividend Yield Stocksunu_uncNo ratings yet

- USL - 21070126112 - ColaboratoryDocument3 pagesUSL - 21070126112 - ColaboratoryVihan ChoradaNo ratings yet

- Bài tập tài chính định lượng 2Document23 pagesBài tập tài chính định lượng 2THÀNH NGUYỄN THỊ MINHNo ratings yet

- Performance Placement Consolidated 2018 %HR FCR ALW BEI Gross NETDocument95 pagesPerformance Placement Consolidated 2018 %HR FCR ALW BEI Gross NETjdgregorioNo ratings yet

- New Statement UnfinishedDocument2 pagesNew Statement UnfinishedAhsan RasheedNo ratings yet

- RMCDocument3 pagesRMCsarav10No ratings yet

- Busn214 Week03Document1,394 pagesBusn214 Week03sarav10No ratings yet

- India Auto Component SupplierDocument10 pagesIndia Auto Component Suppliersarav10No ratings yet

- Advancement Phase Trader Level Max Daily Position Size: BeginnerDocument15 pagesAdvancement Phase Trader Level Max Daily Position Size: Beginnersarav10No ratings yet

- SMR Exam Content Update: Andy Nourse, CPI February 20, 2009Document14 pagesSMR Exam Content Update: Andy Nourse, CPI February 20, 2009sarav10No ratings yet

- The Spider and The Beehive Folk Fairy TalesDocument27 pagesThe Spider and The Beehive Folk Fairy TalesAleksandra VuNo ratings yet

- FrootiDocument5 pagesFrootiRachel MonisNo ratings yet

- NAPLAN 2011 Paper Test Answers: Numeracy Calculator Allowed Numeracy Non-Calculator Language ConventionsDocument2 pagesNAPLAN 2011 Paper Test Answers: Numeracy Calculator Allowed Numeracy Non-Calculator Language ConventionsnadaNo ratings yet

- Aerospace Engineering - Wikipedia, The Free EncyclopediaDocument7 pagesAerospace Engineering - Wikipedia, The Free EncyclopediaSanket RavalNo ratings yet

- Unix - Introduction: Prepared by Jadala Vijaya ChandraDocument6 pagesUnix - Introduction: Prepared by Jadala Vijaya ChandraCherukupalli SowjanyaNo ratings yet

- Meitei Mayek: Typeface Design (M. Thesis Presentation)Document53 pagesMeitei Mayek: Typeface Design (M. Thesis Presentation)ishanidayal536No ratings yet

- Elforsk English 01Document58 pagesElforsk English 01ecatworldNo ratings yet

- De 1Document6 pagesDe 1Thắng Phạm ĐứcNo ratings yet

- RMT 11100Document63 pagesRMT 11100halle cNo ratings yet

- Inspection ChecklistDocument2 pagesInspection ChecklistBerp OnrubiaNo ratings yet

- Sundram Fasteners Limited, HosurDocument38 pagesSundram Fasteners Limited, Hosurjaydeepsinh100% (1)

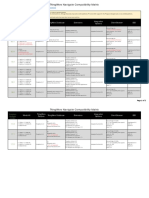

- ThingWorx Navigate Compatibility MatrixDocument2 pagesThingWorx Navigate Compatibility Matrixair_jajaNo ratings yet

- Open GLDocument161 pagesOpen GLRavi ParkheNo ratings yet

- Economics Grade 9 & 10 (Quiz 2)Document2 pagesEconomics Grade 9 & 10 (Quiz 2)Nofel AmeenNo ratings yet

- Brkipm-2011 - Multicast MplsDocument106 pagesBrkipm-2011 - Multicast MplsmatarakiNo ratings yet

- Rezene Business PlanDocument37 pagesRezene Business PlanMehari GebreyohannesNo ratings yet

- DR SW Config Matrix - 6K0323 - January 2016Document62 pagesDR SW Config Matrix - 6K0323 - January 2016Mastin SneadNo ratings yet

- Catalogo Electrobisturi ALSA NHPTDocument6 pagesCatalogo Electrobisturi ALSA NHPTJose JdavierNo ratings yet

- CVS 4150 & 4160 Pressure Controller July 2012Document12 pagesCVS 4150 & 4160 Pressure Controller July 2012Zts MksNo ratings yet

- Poem Alam SekitarDocument1 pagePoem Alam SekitarSITI SYAHIRAH BINTI A MALEKNo ratings yet

- Pipe Stress Amp SupportDocument24 pagesPipe Stress Amp SupportShilpa GanganNo ratings yet

- Cap Observation Form 1 Announced PolizzoittiDocument3 pagesCap Observation Form 1 Announced Polizzoittiapi-317761911No ratings yet

- Course Overview A1.1 5L EdDocument2 pagesCourse Overview A1.1 5L EdTere Huestis VargasNo ratings yet

- Project Report of Motorcycle ModelDocument15 pagesProject Report of Motorcycle ModelM Kashif RafiqueNo ratings yet

- Kill Team Campaign Cheat SheetDocument3 pagesKill Team Campaign Cheat SheetangelofmenothNo ratings yet

- Link - DesarmarDocument5 pagesLink - DesarmarCristobal Gutierrez CarrascoNo ratings yet

- PN Initial Exam Form 2015 160629 5774473c03485Document2 pagesPN Initial Exam Form 2015 160629 5774473c03485Syam ChandrasekharanNo ratings yet

- Rueddenklau Snowman PreventionDocument102 pagesRueddenklau Snowman PreventionIonela Dorobantu100% (2)

- Fifth Year Quiz 2021 EndoDocument6 pagesFifth Year Quiz 2021 Endohoho2019kuNo ratings yet

Stock Screens 080217

Stock Screens 080217

Uploaded by

sarav100 ratings0% found this document useful (0 votes)

176 views50 pagesThe document lists various stocks and the changes in their closing prices, trading volumes, and other metrics from the previous day. It includes the ticker, company name, changes in close price and volume, key performance indicators, and 52-week highs and lows. The stocks are categorized as big movers from the previous day as well as historical movers from 1-3 days ago.

Original Description:

Stock screens

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists various stocks and the changes in their closing prices, trading volumes, and other metrics from the previous day. It includes the ticker, company name, changes in close price and volume, key performance indicators, and 52-week highs and lows. The stocks are categorized as big movers from the previous day as well as historical movers from 1-3 days ago.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

176 views50 pagesStock Screens 080217

Stock Screens 080217

Uploaded by

sarav10The document lists various stocks and the changes in their closing prices, trading volumes, and other metrics from the previous day. It includes the ticker, company name, changes in close price and volume, key performance indicators, and 52-week highs and lows. The stocks are categorized as big movers from the previous day as well as historical movers from 1-3 days ago.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 50

Big Movers

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

LL Lumber Liquidators Inc 33.61 36.0% 17.3 180 35.2 33.75 14.02 99%

CGNX Cognex Corp 105.28 10.8% 8.0 141 10.73 110.69 44.14 92%

APD Air Products & Chem Inc 148.92 4.8% 7.3 99 4.3 150.45 129.00 93%

XYL Xylem, Inc. 59.30 4.5% 5.4 121 4.34 59.77 45.60 97%

SHOP Shopify Inc 104.08 12.2% 5.2 110 12.7 105.79 32.85 98%

BTU Peabody Energy Corp 30.09 7.0% 4.9 120 7.91 N/A N/A N/A

NCLH Norwegian Cruise Line Hldg 56.91 3.3% 3.3 90 3.1 57.25 34.16 99%

TMHC Taylor Morrison Home Corp 23.36 1.9% 3.2 40 2.39 24.79 15.82 84%

DISH DISH Network Corp Cl A 65.49 2.3% 3.2 67 2.1 66.50 48.51 94%

RCL Royal Caribbean Cruises 116.87 3.4% 3.2 89 2.99 120.00 65.10 94%

ADM Archer-Daniels-Midland 43.30 2.5% 3.1 102 2.8 47.88 40.22 40%

ENR Energizer Hldgs Inc 47.74 3.2% 3.0 59 2.89 60.07 41.97 32%

VMC Vulcan Materials 119.20 -2.9% -3.0 0 -3.9 138.18 105.71 42%

WPZ Williams Partners LP 40.61 -1.9% -3.1 48 -1.82 42.32 32.93 82%

PCAR PACCAR Inc 67.04 -2.1% -3.2 37 -2.1 70.32 52.78 81%

CDK CDK Glbl Inc 64.02 -2.7% -3.3 41 -2.77 67.49 53.46 75%

HCP HCP Inc 30.25 -4.0% -3.7 -4 -4.5 36.81 27.61 29%

UAA Under Armour Inc Cl A 18.30 -9.1% -4.3 -4 -8.68 43.85 18.01 1%

UA Under Armour Inc Cl C 16.23 -10.8% -5.0 -20 -10.4 42.94 16.15 0%

ETN Eaton Corp 74.26 -5.8% -8.4 -22 -5.39 81.63 59.07 67%

CMI Cummins Inc 157.48 -6.5% -12.7 -2 -6.2 170.68 116.03 76%

ATR ConsCloses AvgVol Extension

1.21 1 1.2 -

2.77 2 0.8 -

1.80 1 1.2 -

0.86 1 1.3 -

3.95 1 2.3 -

0.88 3 1.2 -

1.04 1 1.6 -

0.53 1 1.3 -

1.21 3 2.0 -

2.11 1 1.2 -

0.66 3 3.0 -

1.07 2 0.8 -

2.45 -5 1.1 OS

0.64 -1 1.1 -

1.19 -1 1.8 -

1.00 -2 1.0 -

0.57 -4 3.2 -

0.70 -1 4.9 -

0.65 -1 3.8 -

1.21 -5 2.2 OS

2.74 -1 1.4 -

Historical Movers

Ticker Desc DaysAgo Hspike Close Change VolSpike KPos 52WkH 52WkL C%52Wk

DISCK Discovery Comm Inc Ser C 1 -7.3 22.98 -0.6% -0.2 -15 29.18 22.84 2%

CLVS Clovis Oncology Inc 1 -5.4 81.86 -3.5% -0.7 23 99.45 13.71 79%

DISCA Discovery Communications Inc 1 -5.4 24.38 -0.9% -0.3 2 30.25 23.96 7%

MOH Molina Healthcare 1 -4.7 66.91 0.1% 0.1 17 72.79 42.56 81%

HTZ Hertz Global Hldgs 1 -4.6 14.48 5.8% 0.7 45 52.27 8.52 14%

GPOR Gulfport Energy Corp 1 -3.6 12.71 1.2% 0.2 21 30.47 12.47 1%

COH Coach Inc 1 -3.5 47.77 1.4% 1.1 51 48.85 34.07 93%

PTLA Portola Pharmaceuticals Inc 1 -3.3 61.11 -0.9% -0.5 49 67.10 15.68 88%

CNC Centene Corp 1 -3.1 80.46 1.3% 0.8 32 87.94 50.00 80%

HSBC HSBC Hldg PLC 1 3.2 50.81 1.4% 1.6 158 50.86 32.03 100%

CMCSA Comcast Cl A 1 3.5 40.34 -0.3% -0.3 75 42.18 30.02 85%

VLO Valero Energy 1 3.6 68.82 -0.2% -0.2 71 71.40 60.69 76%

COST Costco Wholesale Corp 1 4.2 159.72 0.7% 0.7 92 182.72 135.11 52%

DVAX Dynavax Tech Corp 1 13.0 15.20 -4.1% -0.4 142 17.50 3.20 84%

FLS Flowserve Corp 2 -11.1 41.59 1.1% 0.4 -16 52.10 39.13 19%

SBUX Starbucks Corp 2 -10.7 54.73 1.4% 0.6 -9 64.87 50.84 28%

GT Goodyear Tire & Rub 2 -10.6 31.48 -0.1% 0.0 -27 37.20 26.82 45%

OZRK Bank Of The Ozarks 2 -7.9 43.71 1.3% 0.4 10 56.86 35.11 40%

SCG Scana Corp 2 -6.9 67.58 5.0% 2.5 87 75.92 60.00 48%

IP Intl Paper 2 -5.2 55.35 0.6% 0.5 25 58.95 43.55 77%

WIX Wix.com Ltd 2 -4.9 62.35 1.0% 0.3 -3 86.15 42.80 45%

BTI British Amer Tobacco ADS 2 -4.9 63.59 1.7% 0.7 -6 73.41 52.71 53%

CAA CalAtlantic Inc 2 -4.6 35.71 1.7% 1.0 24 40.00 30.18 56%

MAC Macerich Co 2 -4.1 57.91 0.9% 0.5 40 94.51 56.06 5%

WDC Western Digital 2 -4.1 85.67 0.6% 0.3 8 95.77 67.61 64%

KLAC KLA-Tencor Corp 2 -3.9 92.63 0.0% 0.0 3 109.59 66.88 60%

WMGI Wright Medical Grp NV 2 -3.8 26.13 -0.5% -0.3 18 31.53 22.14 42%

FET Forum Energy Technologies Inc 2 -3.6 12.95 -2.3% -0.6 -3 26.25 12.75 1%

EMN Eastman Chemical 2 -3.3 83.66 0.6% 0.7 35 86.60 62.70 88%

SKT Tanger Factory Outlet Centers 2 -3.3 27.07 2.4% 1.3 61 42.20 24.71 13%

GGP GGP Inc 2 -3.2 23.06 1.9% 1.0 42 31.84 21.05 19%

EAT Brinker Intl Inc 2 -3.1 35.62 0.4% 0.3 27 55.84 34.92 3%

WLTW Willis Towers Watson Pub Ltd 2 3.0 149.62 0.5% 0.6 69 151.02 120.87 95%

FE FirstEnergy Corp 2 3.1 31.93 0.1% 0.1 96 35.51 27.93 53%

AIV Apt Inv & Mgmt'A' 2 3.1 45.60 0.1% 0.1 104 47.91 39.66 72%

EXPE Expedia Inc 2 3.4 152.69 -2.5% -1.9 44 161.00 105.62 85%

FTV Fortive Corp 2 3.4 65.20 0.7% 0.7 85 65.73 46.81 97%

AJG Gallagher (Arthur J.) 2 3.5 59.19 0.7% 0.8 77 59.64 47.16 96%

LYB LyondellBasell Ind N.V. 'A' 2 3.9 89.26 -0.9% -0.7 87 97.64 71.55 68%

GIMO Gigamon Inc 2 4.0 40.65 2.3% 0.9 71 61.25 28.50 37%

ACHC Acadia Healthcare Co, Inc 2 4.0 52.09 -1.6% -0.6 78 57.29 32.54 79%

UNM Unum Grp 2 4.0 50.31 0.4% 0.4 105 50.67 43.55 95%

FSLR First Solar Inc 2 4.4 49.65 1.3% 0.3 126 50.21 25.56 98%

AFL AFLAC Inc 2 5.9 80.89 1.4% 1.8 116 80.95 66.50 100%

COL Rockwell Collins 2 6.3 111.18 4.5% 2.2 73 114.21 78.54 92%

HIG Hartford Finl Svcs Grp 2 7.5 55.66 1.3% 1.3 119 55.80 38.92 99%

ALGN Align Tech 2 8.0 169.43 1.3% 0.5 107 173.79 83.27 95%

BIDU Baidu Inc 2 9.6 225.60 -0.4% -0.2 163 230.00 156.23 94%

AAN Aaron's Inc 2 12.1 45.98 -0.7% -0.2 140 48.22 21.50 92%

SAVE Spirit Airlines Inc 3 -11.2 40.79 5.1% 1.1 -35 60.40 37.17 16%

AZN Astrazeneca ADS 3 -11.2 29.95 -0.9% -0.2 -23 35.60 25.55 44%

XL XL Grp Ltd 3 -9.9 44.51 0.3% 0.1 40 47.27 36.50 74%

TWTR Twitter Inc 3 -9.2 16.21 0.7% 0.2 -16 20.88 14.12 31%

JCI Johnson Controls Intl Plc 3 -8.0 38.73 -0.5% -0.3 -46 48.97 38.54 2%

UPS United Parcel'B' 3 -6.2 110.14 -0.1% -0.1 40 118.19 102.12 50%

MMC Marsh & McLennan Companies Inc 3 -5.7 78.74 1.0% 0.9 48 81.00 62.33 88%

PSA Pub Storage 3 -5.2 203.17 -1.3% -0.7 32 244.75 192.15 21%

IVZ Invesco Ltd 3 -5.0 35.19 1.2% 0.8 40 36.84 27.46 82%

DFS Discover Finl Svcs 3 -4.8 60.61 -0.5% -0.4 34 74.33 53.91 33%

LUV Southwest Airlines 3 -4.7 55.72 0.4% 0.2 -13 64.39 35.42 70%

BEN Franklin Resources 3 -4.5 44.72 -0.1% -0.1 21 47.65 33.02 80%

TER Teradyne Inc 3 -4.3 34.49 -0.3% -0.1 57 36.86 25.24 80%

CAVM Cavium, Inc. 3 -4.2 62.24 0.5% 0.2 24 76.26 45.63 54%

BMY Bristol-Myers SQUIBB 3 -4.2 56.11 -1.4% -1.1 62 76.48 46.01 33%

FTNT Fortinet Inc 3 -4.2 36.80 -0.3% -0.2 -2 41.56 28.51 64%

LM Legg Mason Inc 3 -4.1 39.88 -0.3% -0.2 51 42.08 28.10 84%

EXR Extrage Space Storage Inc 3 -4.1 79.29 -0.3% -0.2 68 88.88 68.09 54%

AON Aon Plc 3 -3.9 139.52 1.0% 1.2 85 141.31 105.35 95%

ADNT Adient plc 3 -3.5 63.95 -1.8% -1.6 7 N/A N/A N/A

VAR Varian Medical Systems Inc 3 -3.3 97.90 0.8% 0.8 -8 107.08 76.94 70%

KNX Knight Trasportation Inc 3 -3.2 35.25 -1.0% -0.6 35 38.80 26.85 70%

TDOC Teladoc Inc 3 -3.2 32.60 -0.8% -0.3 29 36.90 15.65 80%

ALKS Alkermes plc 3 -3.1 54.45 0.1% 0.0 12 63.40 41.93 58%

KSU Kansas City Southern 3 -3.1 101.31 -1.8% -2.0 26 106.35 79.05 82%

UNP Union Pacific Corp 3 -3.0 101.90 -1.0% -0.9 2 115.15 101.06 6%

SWFT Swift Transportation 3 -3.0 25.24 -1.0% -0.5 36 27.23 19.21 75%

DNKN Dunkin' Brands Grp Inc 3 3.0 52.83 -0.3% -0.5 28 59.70 43.81 57%

KIM Kimco Realty 3 3.1 20.61 2.1% 0.8 94 32.24 17.02 24%

DIS Disney (Walt) Co 3 3.1 110.61 0.7% 0.6 107 116.10 90.32 79%

PAYX Paychex Inc 3 3.5 56.82 -1.8% -1.2 30 63.03 52.78 39%

RICE Rice Energy Inc 3 3.5 28.04 0.3% 0.1 80 29.55 18.30 87%

TPX Tempur Sealy Intl Inc 3 3.9 59.73 3.6% 1.2 97 70.45 39.57 65%

FOX Twenty-First Century Fox Inc B 3 3.9 28.92 0.8% 0.5 84 31.94 23.88 63%

FOXA Twenty-First Century Fox Inc A 3 4.0 29.23 0.4% 0.3 83 32.60 23.33 64%

BF.B Brown-Forman Corp Cl B 3 4.1 49.16 -0.5% -0.4 59 59.71 43.72 34%

CHTR Charter Communications Inc 3 4.1 387.42 -1.1% -0.6 134 399.95 233.00 92%

EQT Equitable Resources 3 4.2 63.93 0.4% 0.2 68 75.74 49.63 55%

TSCO Tractor Supply 3 4.3 56.19 0.1% 0.0 85 78.25 49.87 22%

MRK Merck & Co 3 5.0 63.92 0.1% 0.1 67 66.80 57.18 70%

BUD Anheuser-Busch InBev SA/NV 3 6.9 119.80 -0.7% -0.5 97 136.08 98.28 57%

TDC Teradata Corp 3 7.6 32.50 2.0% 1.0 123 33.32 26.55 88%

ADP Automatic Data Proc 3 7.8 116.78 -1.8% -0.8 132 121.77 85.48 86%

VZ Verizon Communications 3 8.2 48.89 1.0% 0.5 146 54.83 42.80 51%

TGI Triumph Grp 4 -13.3 25.60 -0.6% 0.0 -23 34.80 19.65 39%

AKAM Akamai Technologies 4 -11.3 47.53 0.8% 0.2 18 71.64 45.41 8%

HLS HealthSouth Corporation 4 -6.5 43.52 3.4% 1.6 11 49.71 36.97 51%

WNC Wabash National 4 -6.0 18.72 -1.9% -0.6 -20 24.16 15.68 36%

RHI Robert Half Intl 4 -5.9 45.12 -0.3% -0.1 11 50.98 34.42 65%

GD General Dynamics Corp 4 -5.5 196.45 0.1% 0.0 25 205.90 145.05 84%

ANTM Anthem Inc 4 -5.3 186.67 0.2% 0.2 35 194.94 114.85 90%

TKR Timken Co 4 -5.2 45.00 -1.1% -0.6 13 51.75 39.40 45%

IR Ingersoll-Rand Plc 4 -4.8 86.45 -1.6% -1.4 -6 94.39 62.40 75%

TMO Thermo Fisher Scientific Inc 4 -4.1 175.53 0.0% 0.0 31 182.87 139.88 83%

HA Hawaiian Hldg Inc 4 -4.0 42.25 1.6% 1.3 15 60.90 39.45 13%

USG USG Corp 4 -3.9 27.02 -0.1% 0.0 14 34.67 26.06 11%

NUE Nucor Corp 4 -3.7 57.15 -0.9% -0.5 25 68.00 44.81 53%

TRN Trinity Industries 4 -3.6 27.70 1.1% 0.8 54 30.13 25.01 53%

CMC Commercial Metals 4 -3.4 18.37 -1.2% -0.5 17 24.64 14.58 38%

QCP Quality Care Pptys Inc 4 -3.4 17.25 2.6% 1.2 31 N/A N/A N/A

AMGN Amgen Inc 4 -3.3 174.13 -0.2% -0.2 43 184.21 133.64 80%

TEL TE Connectivity Ltd 4 -3.1 79.84 -0.7% -0.5 36 85.20 66.20 72%

X U.S. Steel Corporation 4 3.3 22.71 -3.4% -1.0 37 41.83 18.55 18%

BIIB Biogen Inc 4 3.8 291.15 0.5% 0.4 82 333.65 244.28 52%

AMP Ameriprise Finl Inc 4 4.2 145.95 0.7% 0.6 123 146.23 86.25 100%

R Ryder System 4 4.4 70.87 -2.7% -1.7 27 85.42 62.03 38%

SIX Six Flags Entertainment Corp 4 4.6 56.86 0.0% 0.0 38 65.19 47.61 53%

IRBT iRobot Corporation 4 6.1 106.58 1.0% 0.2 110 109.78 37.29 96%

OC Owens Corning 4 6.9 67.53 0.7% 0.4 76 68.80 46.45 94%

SERV ServiceMaster Glbl Hldgs Inc 4 9.6 43.97 0.1% 0.0 129 44.91 32.41 92%

BA Boeing Co 4 14.7 239.44 -1.2% -0.6 171 246.49 126.31 94%

STX Seagate Tech 5 -6.7 33.37 1.2% 0.3 -4 50.96 31.88 8%

HCA HCA Hldg Inc 5 -5.2 79.28 -0.7% -1.0 -9 91.03 67.00 51%

ZTS Zoetis Inc 5 -5.1 62.27 -0.4% -0.4 45 63.85 52.00 87%

LLY Lilly (Eli) 5 -4.3 82.37 -0.4% -0.4 37 86.72 64.18 81%

THC Tenet Healthcare 5 -3.7 17.31 -0.2% -0.1 9 22.72 14.50 34%

CLB Core Laboratories N.V. 5 -3.2 100.62 0.1% 0.0 35 125.83 96.30 15%

SCHW Charles Schwab Corp (The) 5 3.1 43.13 0.5% 0.6 66 44.10 27.71 94%

DSW DSW Inc 5 3.1 18.39 1.9% 0.7 78 26.22 15.98 24%

PSX Phillips 66 5 3.1 85.62 2.2% 2.6 101 88.87 73.82 78%

BBL BHP Billiton Plc ADS 5 3.1 36.14 -0.7% -0.7 117 37.44 24.91 90%

TECK Teck Res Ltd Cl B 5 3.2 21.56 -0.6% -0.4 110 26.46 14.56 59%

BHP BHP Billiton Ltd ADR 5 3.2 41.39 -0.6% -0.6 116 41.79 28.77 97%

BIG Big Lots Inc 5 3.3 50.37 1.2% 0.8 79 56.54 42.40 56%

SKX Skechers U.S.A. Cl'A' 5 3.3 27.93 -0.6% -0.3 38 30.00 18.81 82%

RIO Rio Tinto plc ADS 5 3.7 47.11 -0.5% -0.4 104 47.51 29.62 98%

HOMB Home BancShs Inc 5 3.7 25.03 0.9% 0.6 56 29.69 19.74 53%

VFC VF Corp 5 3.7 62.52 0.5% 0.4 127 62.65 48.05 99%

ST Sensata Technologies Hldg N.V. 5 3.7 45.42 0.7% 0.5 70 47.24 38.71 79%

CDNS Cadence Design Systems 5 4.5 36.72 -0.5% -0.4 92 37.51 23.83 94%

NEM Newmont Mining 5 5.1 36.95 -0.3% -0.3 106 46.07 30.19 43%

ATI Allegheny Technologies 5 5.6 18.39 -3.0% -0.9 61 23.69 13.15 50%

CAT Caterpillar Inc 5 6.1 113.10 -0.7% -0.5 85 114.90 79.93 95%

MCD McDonald's Corp 5 6.3 154.04 -0.7% -0.5 41 159.98 110.33 88%

HAS Hasbro Inc 6 -11.7 105.95 0.1% 0.0 16 116.20 76.14 74%

RPM RPM Intl 6 -6.7 52.07 0.4% 0.2 16 56.48 46.25 57%

ITW Illinois Tool Works 6 -4.1 139.88 -0.6% -0.6 11 150.29 111.50 73%

FL Foot Locker 6 -3.7 46.87 -0.7% -0.4 33 79.43 44.59 7%

ACOR Acorda Therapeutics Inc 6 4.0 21.75 0.5% 0.2 69 33.00 13.60 42%

WBMD WebMD Health Corp 6 12.6 66.30 0.0% 0.0 134 66.45 48.10 99%

SGMS Scientific Games Cl'A' 6 13.4 38.20 3.1% 0.4 141 39.25 8.07 97%

ASB Associated Banc-Corp 7 -5.9 23.95 0.0% 0.0 39 26.70 18.23 68%

MXIM Maxim Integrated Prod 7 -5.3 45.67 0.5% 0.3 47 49.70 37.25 68%

WBS Webster Finl 7 -4.4 51.64 -0.6% -0.3 37 57.50 46.85 45%

NCR NCR Corp 7 -4.3 38.10 0.7% 0.3 17 49.90 29.83 41%

HRB Block (H&R) 7 -3.1 30.62 0.4% 0.4 60 31.70 19.85 91%

BZUN Baozun Inc ADS 7 3.1 32.49 -0.2% 0.0 82 34.98 6.85 91%

AEP Amer Electric Pwr 7 3.3 70.62 0.1% 0.1 77 72.97 57.89 84%

CL Colgate-Palmolive Co 7 4.0 71.70 -0.7% -0.9 25 77.27 63.43 60%

SYF Synchrony Finl 7 4.1 29.88 -1.5% -1.1 48 38.06 26.01 32%

MCO Moody's Corp 7 5.6 131.59 0.0% 0.0 89 135.20 93.51 91%

ETFC E Trade Finl Corporation 7 6.2 41.16 0.4% 0.3 84 42.19 24.35 94%

FNF Fidelity Natl Finl Inc 7 6.9 48.23 -0.4% -1.2 108 49.37 31.64 94%

COF Cap One Finl 7 8.0 86.01 -0.2% -0.1 77 96.92 66.00 65%

PPG PPG Indus Inc 8 -12.4 105.11 -0.1% -0.1 1 113.67 89.64 64%

CHKP Check Point Software Tech 8 -6.5 106.99 1.1% 0.6 27 116.63 74.34 77%

LOW Lowe's Cos 8 -5.3 77.83 0.6% 0.4 71 86.25 64.87 61%

CHRW C.H. Robinson Worldwide Inc 8 -4.9 64.98 -0.9% -0.6 17 81.16 63.41 9%

QCOM Qualcomm Inc 8 -4.9 53.41 0.4% 0.3 25 71.62 51.05 11%

DHR Danaher Corp 8 -4.6 80.82 -0.8% -0.9 4 88.01 75.71 42%

BC Brunswick Corp 8 -4.6 55.80 -1.4% -0.7 -8 63.82 42.02 63%

HD Home Depot Inc 8 -4.5 149.85 0.2% 0.1 49 160.86 119.20 74%

PTC PTC Inc 8 -4.4 55.48 0.5% 0.2 40 60.22 39.19 77%

SNA Snap-On Inc 8 -4.2 152.96 -0.8% -0.5 45 181.73 145.17 21%

IRWD Ironwood Pharmaceuticals Inc'A 8 -4.1 17.50 -1.4% -0.5 35 19.94 12.48 67%

XRAY Dentsply Sirona Inc 8 -3.8 61.52 -0.8% -1.1 4 65.68 55.00 61%

CMG Chipotle Mexican Grill Inc 8 -3.4 347.24 1.0% 0.5 0 499.00 336.52 7%

FBHS Fortune Brands Home & Security 8 -3.2 66.16 0.7% 1.1 57 67.50 52.05 91%

PRGO Perrigo Co plc 8 3.0 74.22 -1.0% -0.6 46 99.14 65.47 26%

ABT Abbott Laboratories 8 3.2 49.15 -0.1% -0.1 42 51.13 37.38 86%

BBT BB&T Corp 8 3.4 47.85 1.1% 1.0 104 49.88 36.21 85%

OMC Omnicom Grp 8 3.8 79.16 0.5% 0.5 25 89.66 77.50 14%

SRPT Sarepta Therapeutics Inc 8 8.6 38.74 0.4% 0.1 56 44.24 26.26 69%

NTRS Northern Trust 9 -11.8 88.11 0.7% 0.3 10 99.30 65.92 66%

IBM Intl Business Machines Corp 9 -6.8 145.30 0.4% 0.4 7 182.79 143.64 4%

ATHM Autohome Inc 9 -4.5 49.01 0.4% 0.5 75 49.59 21.21 98%

CSX CSX Corp 9 -4.5 48.60 -1.5% -0.8 -11 55.48 27.46 75%

GWW Grainger (W.W.) 9 -4.3 169.72 1.8% 0.8 48 262.72 160.29 9%

MKC Mccormick & Co 9 -4.2 95.21 -0.1% -0.1 40 106.50 88.64 37%

UAL United Continental Hldgs Inc 9 -3.8 67.86 0.3% 0.1 -8 83.04 64.16 20%

ASML ASML Hldg N.V. New York 9 3.1 150.92 0.4% 0.3 92 155.73 98.71 92%

PF Pinnacle Foods Inc 9 3.1 59.16 -0.4% -0.3 31 66.67 46.36 63%

MS Morgan Stanley 9 3.2 47.21 0.8% 0.6 75 48.04 27.79 96%

ZAYO Zayo Grp Hldgs Inc 9 3.2 32.61 -0.5% -0.4 78 35.49 29.30 53%

GRMN Garmin Ltd 9 3.3 49.99 -0.4% -0.3 19 56.19 46.05 39%

HP Helmerich & Payne 9 3.4 49.20 -2.8% -1.1 -1 85.78 48.62 2%

VNO Vornado Realty Trust 9 3.5 79.54 0.2% 0.2 74 90.29 73.69 35%

MUR Murphy Oil Corp 9 3.6 26.28 -1.4% -0.4 64 35.19 23.61 23%

PTEN Patterson-UTI Energy 9 3.7 19.27 -0.4% -0.1 34 29.76 17.61 14%

TTD The Trade Desk Inc Cl A 9 3.9 53.42 0.2% 0.1 56 N/A N/A N/A

JKS JinkoSolar Hldg Co Ltd 9 3.9 27.53 -0.4% -0.1 95 28.44 12.72 94%

CPB Campbell Soup 9 4.1 52.52 -0.6% -0.6 49 64.23 50.62 14%

LPI Laredo Petro Inc 9 5.6 12.80 -1.2% -0.4 80 16.47 9.20 50%

VRTX Vertex Pharmaceuticals 9 9.9 153.20 0.9% 0.2 75 167.86 71.46 85%

SNI Scripps Ntwrks Interactive Inc 9 14.0 87.57 0.2% 0.1 151 88.45 59.32 97%

ConsCloses ATR Extension

-2 0.69 -

-2 4.59 -

-2 0.76 -

1 1.67 -

1 1.24 -

1 0.64 -

1 0.74 -

-2 2.33 -

1 1.86 -

2 0.50 -

-1 0.60 -

-1 1.18 -

4 2.16 -

-1 1.19 -

1 1.14 -

1 1.01 -

-5 0.81 -

2 1.37 -

2 1.44 -

2 0.96 -

1 3.22 -

1 1.80 -

1 0.79 -

1 1.30 -

2 2.47 -

-3 2.12 -

-3 0.70 -

-4 0.75 OS

2 1.16 -

2 0.65 -

1 0.57 -

2 0.72 -

1 2.23 -

1 0.53 -

5 0.65 -

-2 2.83 -

4 0.87 -

1 0.80 -

-1 1.57 -

1 1.34 -

-2 1.57 -

4 0.75 -

3 1.50 -

3 0.81 -

1 2.21 -

3 0.61 -

1 3.89 -

-1 5.24 -

-2 1.21 -

1 1.79 -

-2 0.90 -

3 0.75 -

1 0.74 -

-5 0.77 -

-1 1.42 -

1 0.94 -

-1 4.08 -

2 0.66 -

-1 0.97 -

1 1.34 -

-1 0.69 -

-1 0.91 -

2 1.84 -

-1 1.09 -

-5 0.97 OS

-1 0.85 -

-1 1.63 -

1 1.60 -

-4 1.58 -

1 1.61 -

-1 0.90 -

-2 1.33 -

1 1.50 -

-1 1.81 -

-2 1.73 -

-1 0.65 -

-1 0.93 -

1 0.58 -

1 1.23 OB

-1 0.93 -

1 0.70 -

1 1.97 -

1 0.55 -

1 0.57 -

-3 0.74 -

-1 8.09 -

1 1.74 -

1 1.49 -

1 0.79 -

-3 1.76 -

2 0.70 -

-1 2.65 -

6 0.80 -

-1 1.28 -

4 1.30 OB

1 0.91 -

-1 0.82 -

-1 1.00 -

1 2.72 -

1 2.87 -

-1 1.13 -

-2 1.52 -

-1 2.43 -

1 1.44 -

-3 0.70 -

-1 1.45 -

1 0.59 -

-1 0.67 -

2 0.52 -

-2 2.59 -

-2 1.51 -

-1 1.10 -

2 5.77 -

3 2.45 -

-1 1.53 -

-2 1.63 -

1 4.12 -

1 1.09 -

2 0.94 -

-1 3.80 -

4 1.40 -

-2 1.62 -

-1 0.76 -

-2 1.14 -

-2 0.79 -

1 3.14 -

3 0.63 -

1 0.61 -

2 1.09 -

-1 0.65 -

-1 0.60 -

-1 0.70 -

1 1.11 -

-2 0.83 -

-1 0.88 -

2 0.60 -

3 1.02 -

2 0.80 -

-2 0.58 -

-1 0.80 -

-1 0.76 -

-3 1.80 -

-3 2.12 -

2 2.18 -

1 1.01 -

-2 1.94 -

-1 1.19 OB

1 0.94 -

2 1.37 -

1 1.73 -

3 0.53 -

1 0.83 -

-3 1.19 -

1 1.22 -

2 0.52 -

1 1.85 -

2 0.71 -

-4 1.03 -

-1 0.62 -

-2 1.96 -

1 0.72 -

-1 0.68 -

-1 1.58 -

-5 1.46 -

1 2.16 -

2 1.35 OB

-1 1.23 -

3 0.83 -

-1 1.11 -

-1 1.55 OS

4 2.08 OB

1 1.49 -

-1 3.57 -

-1 0.63 -

-4 0.85 OS

1 11.55 -

2 0.77 -

-1 1.44 -

-5 0.65 -

3 0.66 OB

1 1.35 -

1 2.15 -

2 1.73 -

2 1.79 -

1 1.37 -

-4 1.24 OS

2 4.82 -

-2 1.47 OB

1 1.96 -

1 2.51 -

-5 1.02 -

2 0.79 -

-1 0.62 -

-5 0.82 -

-5 1.92 -

2 1.48 -

-2 0.92 -

-2 0.85 -

1 2.39 -

-2 1.30 -

-3 0.64 OB

-2 0.55 -

1 5.59 -

6 2.43 -

PB Buy

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

TPX Tempur Sealy Intl Inc 59.73 3.6% 1.2 97 4.1 82.32 39.57 47%

DFT Dupont Fabros Tech Inc 63.55 1.8% 2.0 95 2.57 66.18 37.54 91%

NKE Nike Inc Cl B 59.84 0.5% 1.2 91 1.2 60.33 49.01 96%

MSI Motorola Inc 91.94 1.4% 1.9 90 1.21 92.67 68.36 97%

AON Aon Plc 139.52 1.0% 1.2 85 0.7 141.31 105.35 95%

BK Bank of New York Mellon Corp 53.71 1.1% 1.3 84 0.99 54.59 38.53 95%

KEM KEMET Corp. 17.09 0.9% 0.5 83 1.6 17.89 3.24 95%

AGO Assured Guaranty 45.10 0.2% 0.2 83 0.02 45.59 26.37 97%

TRP Transcanada Corp 51.22 0.2% 0.2 81 0.0 51.81 42.69 94%

MA Mastercard Inc 129.49 1.3% 1.8 80 0.94 132.20 94.41 93%

AER Aercap Hldg NV 49.40 0.6% 0.7 79 0.6 50.24 35.28 94%

ARNA Arena Pharmaceuticals Inc 24.06 1.3% 0.1 78 0.72 27.86 11.30 77%

JPM JPMorgan Chase & Co 93.03 1.2% 1.8 78 1.1 94.51 63.38 95%

CM Canadian Imperial Bank of Comm 86.22 -0.7% -0.9 78 -0.50 92.22 72.62 69%

NVS Novartis Ag ADS 85.34 0.2% 0.2 77 0.4 86.90 66.93 92%

COF Cap One Finl 86.01 -0.2% -0.1 77 -0.43 96.92 66.00 65%

VRTX Vertex Pharmaceuticals 153.20 0.9% 0.2 75 -0.5 167.86 71.46 85%

MNST Monster Beverage Corporation 53.12 0.7% 0.8 74 0.43 55.50 40.64 84%

ALB Albemarle Corp 117.43 1.4% 1.3 72 0.8 119.59 75.11 95%

KEYS Keysight Tech Inc 42.00 1.0% 0.9 71 0.34 42.98 26.87 94%

ST Sensata Technologies Hldg N.V. 45.42 0.7% 0.5 70 -0.1 47.24 35.10 85%

MET Metlife Inc 55.70 0.8% 1.4 70 0.99 58.09 38.87 88%

ACOR Acorda Therapeutics Inc 21.75 0.5% 0.2 69 -0.7 33.00 13.60 42%

NTAP NetApp Inc 43.55 0.3% 0.2 69 -0.37 45.24 25.82 91%

EQT Equitable Resources 63.93 0.4% 0.2 68 0.2 75.74 49.63 55%

FOLD Amicus Therapeutics Inc 13.11 1.3% 0.2 68 -0.06 14.05 4.41 90%

CAR Avis Budget Grp 31.75 3.2% 1.1 66 1.6 41.53 20.71 53%

CDW CDW Corp 63.97 0.8% 1.0 64 0.72 66.33 40.56 91%

VRSN Verisign Inc 99.37 -1.7% -2.4 62 -1.7 103.79 74.01 85%

KITE Kite Pharma Inc 107.98 -0.4% -0.2 61 -0.82 114.69 39.82 91%

HRB Block (H&R) 30.62 0.4% 0.4 60 0.6 31.70 19.85 91%

BDX Becton, Dickinson 201.24 -0.1% -0.1 58 -0.39 206.63 161.29 88%

STZ Constellation Brands 'A' 194.75 0.9% 0.9 57 0.7 199.89 144.00 91%

TER Teradyne Inc 34.49 -0.4% -0.1 57 -1.22 36.86 19.43 86%

SRPT Sarepta Therapeutics Inc 38.74 0.4% 0.1 56 -1.7 63.73 23.51 38%

AMTD TD Ameritrade Hldg Corp 45.41 -0.7% -0.5 56 -1.28 47.41 29.37 89%

CAH Cardinal Health Inc 77.33 0.2% 0.1 51 0.0 85.52 62.70 64%

MAS Masco Corp 38.32 0.5% 0.5 51 0.73 39.37 29.38 89%

WTW Weight Watchers Intl 35.75 -0.2% -0.1 50 -1.2 39.71 9.37 87%

PTLA Portola Pharmaceuticals Inc 61.11 -0.9% -0.5 49 -2.38 67.10 15.68 88%

FLIR Flir Systems 37.08 -0.6% -0.4 46 -1.5 38.95 28.26 83%

NTNX Nutanix Inc Cl A 21.44 0.9% 0.3 46 -1.45 N/A N/A N/A

OMER Omeros Corporation 21.01 0.2% 0.1 46 -1.3 27.09 7.20 69%

OSUR Orasure Technologies 17.75 1.2% 0.6 45 0.32 19.33 6.42 88%

HTZ Hertz Global Hldgs 14.48 5.8% 0.7 45 2.0 52.27 8.52 14%

JUNO Juno Therapeutics Inc 28.27 -2.0% -0.2 45 -1.73 35.04 17.52 61%

HRTX Heron Therapeutics Inc 15.55 -1.9% -0.4 43 -3.5 24.00 12.21 28%

LRCX Lam Research 157.46 -1.3% -0.8 43 -1.92 170.00 88.13 85%

ABT Abbott Laboratories 49.15 -0.1% -0.1 42 -0.8 51.13 37.38 86%

RH Restoration Hardware Hldg 63.12 -2.7% -0.6 20 -5.33 79.91 24.41 70%

ATR ConsCloses AvgVol Extension

1.97 1 1.3 -

1.03 2 1.2 -

0.88 3 10.4 -

1.13 1 1.0 -

1.60 1 1.2 -

0.78 2 4.6 -

0.77 2 1.1 -

0.59 3 0.8 -

0.74 1 1.3 -

1.69 1 3.3 -

0.77 4 1.3 -

1.61 1 1.1 OS

1.15 2 14.0 -

0.97 -1 1.2 -

0.92 2 2.1 -

1.58 -1 2.9 -

5.59 1 2.1 -

0.79 1 2.1 OS

2.07 1 1.1 -

0.69 1 1.1 -

0.80 2 1.6 -

0.74 1 4.9 OS

0.94 1 0.8 -

0.95 1 3.3 -

1.74 1 4.0 -

0.78 1 3.8 -

1.30 1 3.8 -

0.88 3 0.8 -

1.46 -2 0.8 -

3.65 -2 1.3 -

0.52 2 3.0 -

2.30 -2 1.7 OS

2.41 1 1.4 -

0.91 -1 3.0 -

2.15 1 2.4 -

0.84 -5 2.5 OS

1.08 1 1.9 OS

0.58 1 2.4 OS

1.38 -2 1.1 OS

2.33 -2 1.0 -

0.74 -1 1.1 -

0.95 1 4.1 -

1.04 1 1.1 -

0.52 1 0.8 -

1.24 1 9.5 -

1.17 -2 1.9 OS

0.85 -2 0.9 OS

3.69 -4 2.5 OS

0.65 -5 6.4 -

4.35 -3 2.5 -

PB Sell

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

ALDR Alder BioPharmaceuticals Inc 10.50 -2.3% -0.4 18 -3.7 36.48 10.05 2%

AKAM Akamai Technologies 47.53 0.8% 0.2 18 -1.75 71.64 45.41 8%

TSLA Tesla Inc 319.57 -1.2% -0.4 23 -2.2 386.99 178.19 68%

CAG Conagra Brands Inc 33.83 -1.2% -1.1 29 -1.15 48.86 32.93 6%

FL Foot Locker 46.87 -0.7% -0.4 33 0.0 79.43 44.59 7%

YUMC Yum China Hldgs Inc 36.46 2.0% 0.5 35 1.25 N/A N/A N/A

HSY The Hershey Co 105.65 0.3% 0.4 36 -0.1 116.49 94.03 52%

MDLZ Mondelez Int'l Inc Cl A 43.62 -0.9% -1.8 36 -1.02 47.23 40.50 46%

HTA Healthcare Trust of America 30.19 -1.3% -1.1 38 -1.0 34.64 26.34 46%

AMC AMC Entertainment Hldg Inc 20.80 2.0% 0.6 39 1.47 35.65 19.65 7%

GOV Gov't Properties Income Trust 18.13 2.3% 1.6 39 2.5 24.61 17.36 11%

MKC Mccormick & Co 95.21 -0.2% -0.1 40 0.02 106.50 88.64 37%

LB L Brands Inc 46.26 -0.3% -0.1 46 0.2 79.67 43.04 9%

CARS Cars.com Inc 24.57 1.1% 0.6 46 1.26 N/A N/A N/A

QRVO Qorvo Inc 68.07 -0.7% -0.5 46 -1.0 79.34 48.28 64%

MRC MRC Global Inc 16.41 0.5% 0.2 47 0.15 22.52 11.50 45%

K Kellogg Co 67.50 -0.8% -0.9 48 -0.6 84.28 65.32 11%

HD Home Depot Inc 149.85 0.1% 0.1 49 0.57 160.86 119.20 74%

GPC Genuine Parts 84.96 0.0% 0.0 49 0.5 105.18 80.86 17%

CPB Campbell Soup 52.52 -0.6% -0.6 49 -0.46 64.23 50.62 14%

CTL CenturyLink Inc 23.36 0.4% 0.2 49 0.7 33.45 22.26 10%

BURL Burlington Stores Inc 88.23 1.4% 0.7 50 1.43 104.07 68.94 55%

HPP Hudson Pacific Properties, Inc 32.70 -0.1% 0.0 52 0.3 36.75 31.53 22%

SEMG Semgrp Corp Cl A 26.70 -1.5% -0.7 54 -0.80 43.20 22.55 20%

RMP Rice Midstream Partners LP 20.75 -0.5% -0.5 54 -0.4 26.42 16.87 41%

ROST Ross Stores 55.60 0.5% 0.4 56 1.04 69.81 52.91 16%

FTR Frontier Communications Corp 15.84 3.8% 0.9 57 4.0 78.30 13.13 4%

DBD Diebold Nixdorf Inc 23.45 0.0% 0.0 60 0.60 31.85 19.95 29%

SLG SLGreen Realty 104.11 0.8% 0.5 61 1.1 120.63 93.90 38%

BAH Booz Allen Hamilton Hldg Cp 34.41 0.3% 0.3 67 0.43 39.68 29.55 48%

LOW Lowe's Cos 77.83 0.6% 0.4 71 1.1 86.25 64.87 61%

ATR ConsCloses AvgVol Extension

0.81 -2 1.8 OB

1.30 4 2.6 OB

12.53 -2 8.0 OB

0.51 -2 4.2 OB

1.19 -1 3.8 OB

1.09 1 3.4 OB

1.19 1 1.1 OB

0.45 -1 6.8 OB

0.52 -1 2.0 OB

0.82 1 2.1 OB

0.38 1 1.4 OB

1.47 -2 0.8 OB

1.53 -1 3.5 OB

0.76 3 0.0 OB

1.41 -4 1.8 OB

0.56 3 0.9 OB

0.74 -1 2.2 OB

2.08 4 4.8 OB

1.75 2 1.1 OB

0.64 -3 1.7 OB

0.51 1 9.7 OB

2.51 2 1.3 OB

0.52 -1 1.2 OB

0.89 -1 1.0 OB

0.46 -1 0.7 OB

0.95 2 3.7 OB

0.94 1 2.7 OB

1.09 4 1.3 OB

1.83 4 0.7 OB

0.53 3 1.3 OB

1.35 2 6.3 OB

NR7

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL

UAL United Continental Hldgs Inc 67.86 0.3% 0.1 -8 -0.3 83.04 44.15

BTI British Amer Tobacco ADS 63.59 1.7% 0.7 -6 -0.47 73.41 52.71

UBSI United Bankshs 34.50 0.0% 0.0 -6 -2.2 49.35 34.18

STX Seagate Tech 33.37 1.2% 0.3 -4 1.08 50.96 30.09

CMG Chipotle Mexican Grill Inc 347.24 0.1% 0.5 0 0.7 499.00 336.52

AOS A O Smith Corp 53.74 0.4% 0.4 6 -0.24 57.97 43.66

MLCO Melco Resorts & Entertainment 20.19 0.7% 0.0 9 -1.6 23.94 11.54

RPM RPM Intl 52.07 0.4% 0.2 16 0.11 56.48 46.25

DXCM DexCom Inc 66.84 0.4% 0.2 17 -0.7 96.38 57.68

CMC Commercial Metals 18.37 -1.2% -0.5 17 -3.52 24.64 14.58

QCOM Qualcomm Inc 53.41 0.4% 0.3 25 0.4 71.62 51.05

HOG Harley-Davidson 48.83 0.4% 0.2 26 0.57 63.40 46.00

GOOG Alphabet Inc Cl C Cap Stock 930.83 0.0% 0.0 30 -0.4 988.25 727.54

XOG Extraction Oil & Gas Inc 12.04 -1.1% -0.4 31 -1.38 N/A N/A

BERY Berry Plastics Grp Inc 56.38 0.5% 0.8 33 0.2 58.95 39.45

PUMP ProPetro Hldg Corp 12.84 -1.2% -0.4 34 -1.31 N/A N/A

PTEN Patterson-UTI Energy 19.27 -0.4% -0.1 34 -0.8 29.76 17.61

CXW CoreCivic Inc 27.53 -0.6% -0.4 34 -1.38 35.33 12.99

CIT CIT Grp Inc 47.90 0.5% 0.5 34 0.1 50.40 32.90

ULTA Ulta Beauty Inc 255.27 1.6% 0.8 35 1.14 314.86 225.13

GEO The GEO Grp Inc 29.40 0.1% 0.1 35 -0.5 34.32 10.84

PENN Penn National Gaming 20.36 0.1% 0.6 35 -0.56 22.19 11.93

CRZO Carrizo Oil & Gas 15.51 -1.4% -0.4 36 -1.3 43.96 14.58

EW Edwards Lifesciences Corp 115.27 0.1% 0.1 36 -0.05 121.75 81.12

ASB Associated Banc-Corp 23.95 0.0% 0.0 39 0.2 26.70 18.23

DGX Quest Diagnostics 108.34 0.0% 0.0 39 0.05 112.97 79.12

PTC PTC Inc 55.48 0.5% 0.2 40 0.3 60.22 39.19

ADI Analog Devices 78.95 -0.1% -0.1 41 -0.22 90.49 59.01

FULT Fulton Finl Corp 18.30 0.3% 0.2 42 -0.1 19.90 13.37

LHO Lasalle Hotel Properties 29.57 0.1% 0.1 42 -0.18 31.87 23.05

LW Lamb Weston Hldgs Inc 44.01 0.1% 0.1 44 -0.8 N/A N/A

NVO Novo-Nordisk A/S ADR 42.32 -0.2% -0.2 45 -0.06 57.41 30.89

OSUR Orasure Technologies 17.75 1.2% 0.6 45 0.3 19.33 6.42

OMER Omeros Corporation 21.01 0.2% 0.1 46 -1.30 27.09 7.20

MCHP Microchip Tech 80.33 0.4% 0.3 46 0.1 87.49 54.51

EBAY eBay Inc 35.91 0.5% 0.4 46 0.14 37.48 27.28

SNV Synovus Finl Corp 43.74 0.6% 0.6 47 0.1 45.38 29.74

JNJ Johnson & Johnson 132.51 -0.1% -0.2 47 -0.02 137.08 109.32

CTL CenturyLink Inc 23.36 0.4% 0.2 49 0.7 33.45 22.26

AMD Advanced Micro Devices Inc 13.71 0.7% 0.2 50 -0.06 15.65 5.66

CE Celanese Corporation 96.11 -0.1% -0.1 52 -0.1 99.97 60.59

NTCT NetScout Systems 34.75 0.7% 0.5 55 1.05 38.48 26.25

ROST Ross Stores 55.60 0.5% 0.4 56 1.0 69.81 52.91

TTD The Trade Desk Inc Cl A 53.42 0.2% 0.1 56 -0.74 N/A N/A

AMT American Tower Corp 135.97 -0.3% -0.2 57 -0.3 139.50 99.72

PACW PacWest Bancorp 48.24 0.5% 0.3 57 -0.20 57.53 40.01

FRC First Repub Bank 101.63 1.2% 1.3 63 0.9 104.17 70.46

TXN Texas Instruments 81.71 0.3% 0.4 63 0.40 84.65 66.30

PDCE PDC Energy Inc 46.99 -0.4% -0.1 65 -0.4 84.88 40.12

TJX TJX Companies 70.71 0.5% 0.4 66 1.09 83.64 66.66

ATH Athene Hldg Ltd 50.79 0.4% 0.6 67 0.4 N/A N/A

EQT Equitable Resources 63.93 0.4% 0.2 68 0.24 75.74 49.63

NTAP NetApp Inc 43.55 0.3% 0.2 69 -0.4 45.24 25.82

XEC Cimarex Energy 98.54 -0.8% -0.3 69 -0.13 146.96 89.49

ETR Entergy Corp 77.14 0.6% 0.8 69 0.9 82.00 66.71

MTDR Matador Resources Co 24.00 -1.1% -0.5 70 -1.12 28.51 18.56

ST Sensata Technologies Hldg N.V. 45.42 0.7% 0.5 70 -0.1 47.24 35.10

KEYS Keysight Tech Inc 42.00 1.0% 0.9 71 0.34 42.98 26.87

AGN Allergan plc 252.20 -0.1% -0.1 71 -0.3 260.24 184.50

EGN Energen Corp 52.99 -0.6% -0.3 72 -0.50 64.44 44.20

SQ Square Inc 26.80 1.5% 0.7 74 1.3 27.97 9.85

CSIQ Canadian Solar Inc 16.99 0.4% 0.1 74 0.79 18.12 10.25

MS Morgan Stanley 47.21 0.7% 0.6 75 0.3 48.04 27.79

AEP Amer Electric Pwr 70.62 0.1% 0.1 77 0.66 72.97 57.89

AJG Gallagher (Arthur J.) 59.19 0.7% 0.8 77 0.6 59.64 47.16

SNPS Synopsys Inc 76.77 0.2% 0.4 77 0.31 77.29 53.53

NVS Novartis Ag ADS 85.34 0.2% 0.2 77 0.4 86.90 66.93

BKU BankUnited Inc 34.65 0.6% 0.5 79 1.11 41.00 28.13

UL Unilever ADR 56.83 -0.3% -0.4 80 -0.1 57.45 38.58

RICE Rice Energy Inc 28.04 0.3% 0.1 80 0.56 29.55 18.30

CTRP Ctrip.com Intl Ltd 59.52 -0.4% -0.3 80 0.4 60.65 39.71

LPI Laredo Petro Inc 12.80 -1.2% -0.4 80 -1.22 16.47 9.20

PYPL PayPal Hldgs Inc 59.34 1.3% 0.8 81 1.5 61.30 36.28

SAP Sap Ag ADS 107.02 1.1% 1.3 82 1.53 108.72 80.93

FITB Fifth Third Bancorp 26.92 0.8% 0.8 82 0.9 28.97 18.46

BIIB Biogen Inc 291.15 0.5% 0.4 82 1.06 333.65 244.28

KEM KEMET Corp. 17.09 0.9% 0.5 83 1.6 17.89 3.24

UN Unilever N.V. 58.12 -0.1% -0.1 86 0.07 58.61 38.41

MCO Moody's Corp 131.59 0.2% 0.0 89 -0.2 135.20 93.51

CC The Chemours Company 47.94 0.7% 0.4 95 0.50 48.65 8.62

FE FirstEnergy Corp 31.93 0.1% 0.1 96 0.8 35.51 27.93

YY YY Inc 71.74 0.3% 0.1 96 -0.13 73.94 37.81

RIO Rio Tinto plc ADS 47.11 -0.5% -0.4 104 0.1 47.51 29.62

IRBT iRobot Corporation 106.58 1.0% 0.2 110 5.51 109.78 37.29

SQM Sociedad Quimica Y Minera ADS 41.09 0.0% 0.0 124 1.1 41.77 24.18

SNI Scripps Ntwrks Interactive Inc 87.57 0.2% 0.1 151 1.81 88.45 59.32

C%52Wk ATR ConsCloses AvgVol Extension

61% 1.96 1 3.9 -

53% 1.80 1 5.9 -

2% 0.92 -4 0.7 -

16% 1.40 4 5.1 -

7% 11.55 1 1.3 -

70% 0.91 1 1.4 -

70% 0.60 -6 4.2 -

57% 1.01 1 0.8 -

24% 1.76 1 1.1 -

38% 0.67 -1 2.0 -

11% 0.83 3 9.6 -

16% 1.34 1 2.7 -

78% 15.35 1 1.8 -

N/A 0.66 -2 1.4 -

87% 0.79 2 0.9 -

N/A 0.67 -3 0.8 -

14% 0.85 -2 4.6 -

65% 0.69 -1 1.0 -

86% 0.73 1 3.0 -

34% 7.82 2 1.0 -

79% 0.71 1 0.8 -

82% 0.59 2 1.2 -

3% 1.00 -2 3.2 -

84% 2.16 1 1.2 -

68% 0.53 3 0.9 -

86% 1.43 1 0.8 -

77% 1.49 1 1.4 -

63% 1.39 -4 3.8 -

75% 0.45 2 0.9 -

74% 0.74 3 1.2 -

N/A 0.95 2 0.9 -

43% 0.64 -1 1.9 -

88% 0.52 1 0.8 -

69% 1.04 1 1.1 -

78% 1.53 1 2.5 -

85% 0.70 1 9.0 -

89% 0.70 2 0.8 -

84% 1.66 -1 5.8 -

10% 0.51 1 9.7 OB

81% 0.68 1 84.6 -

90% 1.72 -1 0.9 -

70% 0.89 1 0.8 -

16% 0.95 2 3.7 OB

N/A 2.39 1 1.3 -

91% 2.22 -2 1.8 -

47% 0.96 2 0.9 -

92% 1.67 2 0.8 -

84% 1.31 2 4.5 -

15% 1.84 -3 1.2 -

24% 1.14 2 4.9 -

N/A 0.74 2 1.6 -

55% 1.74 1 4.0 -

91% 0.95 1 3.3 -

16% 2.37 -1 1.2 -

68% 0.76 5 1.0 -

55% 0.80 -2 2.0 -

85% 0.80 2 1.6 -

94% 0.69 1 1.1 -

89% 3.41 -4 2.2 -

43% 1.45 -2 1.6 -

94% 0.90 3 8.0 -

86% 0.59 3 1.3 -

96% 0.79 2 9.2 -

84% 0.71 2 2.6 -

96% 0.80 1 0.8 -

98% 0.88 3 1.0 -

92% 0.92 2 2.1 -

51% 0.60 1 0.9 -

97% 0.55 -1 1.4 -

87% 0.70 1 7.1 -

95% 1.37 -1 3.6 -

50% 0.55 -2 4.2 -

92% 1.37 1 8.7 -

94% 1.27 1 0.7 -

80% 0.47 3 6.1 -

52% 5.77 2 1.5 -

95% 0.77 2 1.1 -

98% 0.54 -1 1.6 -

91% 1.96 -2 0.8 -

98% 1.39 1 3.0 -

53% 0.53 1 4.5 -

94% 2.57 1 1.3 -

98% 0.88 -1 3.3 -

96% 4.12 1 1.0 -

96% 0.87 -1 0.9 -

97% 2.43 6 2.6 -

ID/NR5

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

TGI Triumph Grp 25.60 -0.6% 0.0 -23 -5.1 36.36 19.65 36%

FLS Flowserve Corp 41.59 1.1% 0.4 -16 -1.79 52.10 40.25 11%

WDC Western Digital 85.67 0.6% 0.3 8 -1.4 95.77 43.09 81%

USG USG Corp 27.02 -0.1% 0.0 14 -1.65 34.67 23.71 30%

RPM RPM Intl 52.07 0.4% 0.2 16 0.1 56.48 49.81 34%

AMAT Applied Materials 44.10 -0.5% -0.3 26 -1.47 47.86 31.66 77%

HOG Harley-Davidson 48.83 0.4% 0.2 26 0.6 63.40 46.00 16%

PANW Palo Alto Networks Inc 132.95 1.4% 0.7 26 -0.35 157.65 107.31 51%

GOOG Alphabet Inc Cl C Cap Stock 930.83 0.0% 0.0 30 -0.4 988.25 770.41 74%

CNC Centene Corp 80.46 1.3% 0.8 32 0.38 87.94 55.89 77%

PUMP ProPetro Hldg Corp 12.84 -1.2% -0.4 34 -1.3 N/A N/A N/A

CIT CIT Grp Inc 47.90 0.5% 0.5 34 0.09 50.40 39.48 77%

ANTM Anthem Inc 186.67 0.2% 0.2 35 -0.3 194.94 140.50 85%

GEO The GEO Grp Inc 29.40 0.1% 0.1 35 -0.53 34.32 22.86 57%

PENN Penn National Gaming 20.36 0.1% 0.6 35 -0.6 22.19 13.00 80%

SSNC SS&C Technologies Hldgs Inc 38.69 -0.2% -0.2 36 -0.77 40.21 28.43 87%

SIX Six Flags Entertainment Corp 56.86 0.0% 0.0 38 0.4 65.19 54.67 21%

DGX Quest Diagnostics 108.34 0.0% 0.0 39 0.05 112.97 90.13 80%

PTC PTC Inc 55.48 0.5% 0.2 40 0.3 60.22 45.72 67%

A Agilent Technologies Inc 59.94 0.3% 0.3 40 -0.03 61.84 45.38 88%

CERN Cerner Corp 64.81 0.7% 0.6 41 0.3 69.28 47.09 80%

FULT Fulton Finl Corp 18.30 0.3% 0.2 42 -0.09 19.90 16.85 48%

NTNX Nutanix Inc Cl A 21.44 0.9% 0.3 46 -1.4 N/A N/A N/A

MEOH Methanex Corp 44.55 0.6% 0.3 46 -0.58 53.35 39.48 37%

MCHP Microchip Tech 80.33 0.4% 0.3 46 0.1 87.49 62.21 72%

FLIR Flir Systems 37.08 -0.6% -0.4 46 -1.47 38.95 33.75 64%

EBAY eBay Inc 35.91 0.5% 0.4 46 0.1 37.48 29.21 81%

JNJ Johnson & Johnson 132.51 -0.2% -0.2 47 -0.02 137.08 110.76 83%

VRX Valeant Pharma Intl Inc 16.76 1.5% 1.0 48 0.2 32.75 8.31 35%

CTL CenturyLink Inc 23.36 0.4% 0.2 49 0.69 27.61 22.26 21%

MDSO Medidata Solutions Inc 77.64 1.1% 0.6 50 0.7 85.92 47.77 78%

AVGO Broadcom Ltd 248.39 0.7% 0.6 50 0.03 258.49 173.31 88%

NTCT NetScout Systems 34.75 0.7% 0.5 55 1.1 38.48 29.50 58%

RDC Rowan Companies Plc (UK) new 11.46 -1.8% -0.5 56 -1.78 20.50 9.74 16%

TTD The Trade Desk Inc Cl A 53.42 0.2% 0.1 56 -0.7 N/A N/A N/A

UDR UDR Inc 39.10 0.0% 0.0 57 0.26 40.71 32.79 80%

VIAB Viacom Inc Cl 'B' 35.53 1.7% 1.0 59 1.7 46.72 32.68 20%

WDAY Workday Inc 103.50 1.4% 1.0 63 0.99 106.75 65.79 92%

NSA Natl Storage Affiliates Tr 22.96 0.0% 0.0 63 0.3 26.15 21.15 36%

NVDA Nvidia Corp 164.49 1.2% 0.6 64 0.83 169.93 95.17 93%

NOW ServiceNow Inc 110.79 0.3% 0.2 64 0.9 115.85 73.66 88%

MRK Merck & Co 63.92 0.1% 0.1 67 0.60 66.80 58.56 65%

XEC Cimarex Energy 98.54 -0.5% -0.3 69 -0.1 146.96 89.49 16%

AABA Altaba Inc 58.50 0.3% 0.2 72 0.30 60.22 38.26 92%

BABA Alibaba Group Holding Ltd 154.73 -0.1% -0.1 75 0.2 160.39 86.01 92%

AJG Gallagher (Arthur J.) 59.19 0.7% 0.8 77 0.56 59.64 51.58 94%

BKU BankUnited Inc 34.65 0.6% 0.5 79 1.1 41.00 32.33 27%

CTRP Ctrip.com Intl Ltd 59.52 -0.4% -0.3 80 0.36 60.65 39.71 95%

LPI Laredo Petro Inc 12.80 -1.2% -0.4 80 -1.2 15.55 9.57 54%

PYPL PayPal Hldgs Inc 59.34 1.3% 0.8 81 1.46 61.30 39.02 91%

UN Unilever N.V. 58.12 -0.1% -0.1 86 0.1 58.61 38.41 98%

JD JD.com Inc 45.55 0.8% 0.6 87 1.20 46.85 25.29 94%

MCO Moody's Corp 131.59 0.0% 0.0 89 -0.2 135.20 93.51 91%

CC The Chemours Company 47.94 0.7% 0.4 95 0.50 48.65 20.76 97%

FE FirstEnergy Corp 31.93 0.1% 0.1 96 0.8 32.54 27.93 87%

YY YY Inc 71.74 0.3% 0.1 96 -0.13 73.94 37.81 94%

FB Facebook Inc 169.86 0.4% 0.3 101 0.9 175.49 114.77 91%

IRBT iRobot Corporation 106.58 1.0% 0.2 110 5.51 109.78 52.12 94%

SQM Sociedad Quimica Y Minera ADS 41.09 0.0% 0.0 124 1.1 41.77 27.95 95%

SNI Scripps Ntwrks Interactive Inc 87.57 0.2% 0.1 151 1.81 88.45 64.87 96%

ATR ConsCloses AvgVol Extension

1.28 -1 1.1 -

1.14 1 1.3 -

2.47 2 4.0 -

0.70 -3 1.4 -

1.01 1 0.8 -

1.07 -4 10.8 -

1.34 1 2.7 -

2.89 1 1.8 -

15.35 1 1.8 -

1.86 1 1.6 -

0.67 -3 0.8 -

0.73 1 3.0 -

2.87 1 1.5 -

0.71 1 0.8 -

0.59 2 1.2 -

0.68 -5 1.2 -

1.63 -2 1.2 -

1.43 1 0.8 -

1.49 1 1.4 -

0.76 1 2.0 -

1.11 1 1.9 -

0.45 2 0.9 -

0.95 1 4.1 -

1.24 1 0.9 -

1.53 1 2.5 -

0.74 -1 1.1 -

0.70 1 9.0 -

1.66 -1 5.8 -

0.59 1 23.4 -

0.51 1 9.7 OB

2.25 1 0.7 -

4.37 1 2.8 -

0.89 1 0.8 -

0.52 -1 4.0 -

2.39 1 1.3 -

0.59 1 1.3 -

0.87 1 5.0 -

2.14 1 1.6 -

0.53 2 0.6 -

5.11 1 23.7 -

2.49 1 2.2 -

0.79 1 9.0 -

2.37 -1 1.2 -

1.09 1 23.3 -

3.42 -2 17.9 -

0.80 1 0.8 -

0.60 1 0.9 -

1.37 -1 3.6 -

0.55 -2 4.2 -

1.37 1 8.7 -

0.54 -1 1.6 -

1.30 1 11.8 -

1.96 -2 0.8 -

1.39 1 3.0 -

0.53 1 4.5 -

2.57 1 1.3 -

2.90 1 18.7 -

4.12 1 1.0 -

0.87 -1 0.9 -

2.43 6 2.6 -

WR10

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

ETN Eaton Corp 74.26 -4.9% -8.4 -22 -5.4 81.63 59.07 67%

PDCO Patterson Companies 40.75 -1.5% -1.4 -20 -2.97 49.69 36.46 32%

UA Under Armour Inc Cl C 16.23 -10.8% -5.0 -20 -10.4 42.94 16.15 0%

HCP HCP Inc 30.25 -4.5% -3.7 -4 -4.46 36.81 27.61 29%

UAA Under Armour Inc Cl A 18.30 -9.1% -4.3 -4 -8.7 43.85 18.01 1%

CMI Cummins Inc 157.48 -6.1% -12.7 -2 -6.18 170.68 116.03 76%

VMC Vulcan Materials 119.20 -4.1% -3.0 0 -3.9 138.18 105.71 42%

GBT Glbl Blood Therapeutics Inc 25.10 -3.8% -1.5 9 -5.77 41.15 13.35 42%

VTR Ventas Inc 66.01 -2.0% -2.4 9 -2.2 76.80 56.20 48%

BLUE BlueBird Bio Inc 89.15 -5.4% -2.2 10 -6.38 123.75 37.05 60%

CARA Cara Therapeutics Inc 13.07 -6.9% -1.3 16 -8.2 28.50 5.07 34%

SUM Summit Materials Inc 27.59 -3.0% -2.4 21 -3.32 29.67 17.31 83%

ICHR Ichor Hldgs 20.67 -10.1% -2.9 23 -10.0 N/A N/A N/A

MOS The Mosaic Co (New) 22.89 -5.2% -2.5 24 -5.25 34.36 21.79 9%

HCN Welltower Inc 72.40 -1.5% -1.5 27 -1.2 80.19 59.39 63%

CCP Care Cap Pptys Inc 24.87 2.8% 1.9 30 1.46 31.56 22.70 24%

CNX Consol Energy 15.45 -7.8% -2.9 31 -8.0 22.34 13.55 22%

IDTI Integrated Device Tech 25.43 -2.7% -2.0 32 -3.17 27.09 18.49 81%

TRIP TripAdvisor Inc When-Issued 37.35 -4.3% -2.0 35 -4.2 71.69 35.34 6%

HR Healthcare Realty Tr 33.09 -0.7% -0.5 35 -0.71 36.60 26.66 65%

MNK Mallinckrodt Pub Ltd Co 44.51 -2.4% -1.4 37 -3.6 85.83 38.80 12%

HTA Healthcare Trust of America 30.19 -1.3% -1.1 38 -1.04 34.64 26.34 46%

TMHC Taylor Morrison Home Corp 23.36 3.2% 3.2 40 2.4 24.79 15.82 84%

CDK CDK Glbl Inc 64.02 -2.7% -3.3 41 -2.77 67.49 53.46 75%

PBYI Puma Biotech Inc 89.95 -5.3% -2.1 42 -5.4 98.85 28.35 87%

OLN Olin Corp 30.19 2.4% 1.5 42 0.90 33.88 18.24 76%

IPXL Impax Laboratories Inc 17.85 -7.7% -2.7 44 -7.8 31.85 7.75 42%

GOOS Canada Goose Hldgs Inc 19.45 2.1% 1.6 47 1.33 N/A N/A N/A

WPZ Williams Partners LP 40.61 -1.9% -3.1 48 -1.8 42.32 32.93 82%

EMR Emerson Electric Co 59.95 0.6% 0.8 52 0.27 64.37 49.22 71%

PTCT PTC Therapeutics Inc 19.96 -3.2% -1.1 53 -3.7 21.85 4.03 89%

TOL Toll Brothers 39.45 2.2% 1.8 54 1.54 41.07 26.65 89%

PH Parker-Hannifin 164.45 -1.2% -1.3 55 -0.9 167.50 112.26 94%

ALSN Allison Transmission Hldg 37.79 0.0% 0.0 55 0.39 40.25 26.74 82%

KBH KB Home 23.40 2.1% 2.1 56 1.4 24.37 14.06 91%

AME Ametek, Inc 61.66 0.0% 0.2 56 0.06 62.89 43.30 94%

ARMK Aramark 40.35 1.3% 1.3 57 1.0 41.72 32.73 85%

ENR Energizer Hldgs Inc 47.74 3.1% 3.0 59 2.89 60.07 41.97 32%

AMBA Ambarella Inc 51.40 2.7% 2.2 62 2.4 74.95 46.80 16%

CDEV Centennial Res Dev Inc Cl A 16.56 -1.3% -0.5 63 -1.03 20.97 11.07 55%

SBAC SBA Communications'A' 137.43 -0.1% -0.1 63 0.3 140.38 95.66 93%

OLLI Ollies Bargain Outlet Hldgs 44.45 -0.6% -0.3 66 -0.33 46.08 24.12 93%

DISH DISH Network Corp Cl A 65.49 2.3% 3.2 67 2.1 66.50 48.51 94%

CME CME Grp Inc 123.79 1.0% 1.1 69 1.09 127.96 98.95 86%

ENB Enbridge Inc 41.61 0.4% 0.4 71 0.2 45.77 37.37 50%

INTU Intuit Inc 137.43 0.1% 0.3 72 0.22 143.81 103.22 84%

SPG Simon Ppty Grp 164.58 2.9% 2.2 74 3.4 229.10 150.15 18%

CCL Carnival Corp 67.48 1.0% 1.2 74 0.92 68.29 44.11 97%

SPR Spirit Aerosystems Hldgs Inc 61.04 1.0% 1.3 74 0.9 62.90 42.26 91%

POST Post Hldg Inc 83.04 -0.2% -0.2 75 -0.25 89.04 68.76 70%

SRE Sempra Energy 114.51 1.1% 2.3 76 1.4 117.97 92.95 86%

VRSK Verisk Analytics Inc 87.17 -0.1% -0.2 79 -0.01 88.17 75.60 92%

CNK Cinemark Hldg Inc 39.75 2.2% 1.8 79 2.2 44.84 36.08 42%

HRS Harris Corp 115.92 1.3% 1.5 81 1.17 116.49 85.41 98%

WYN Wyndham Worldwide Corporation 105.38 0.9% 1.7 87 1.0 105.86 62.60 99%

TOT Total 'B' ADS 51.22 1.1% 1.3 88 1.47 54.71 45.05 64%

NNN National Retail Properties Inc 41.21 2.3% 2.7 88 2.9 53.60 36.45 28%

RCL Royal Caribbean Cruises 116.87 3.1% 3.2 89 2.99 120.00 65.10 94%

HAIN Hain Celestial Grp Inc 43.62 -2.4% -1.8 89 -2.0 56.99 31.01 49%

NCLH Norwegian Cruise Line Hldg 56.91 3.3% 3.3 90 3.06 57.25 34.16 99%

TV Grupo Televisa S.A.GDS 27.25 2.4% 1.7 90 2.5 27.89 19.69 92%

DLR Digital Realty Trust Inc 117.59 2.0% 2.0 92 2.54 121.53 85.63 89%

APD Air Products & Chem Inc 148.92 4.8% 7.3 99 4.3 150.45 129.00 93%

PSX Phillips 66 85.62 1.7% 2.6 101 2.04 88.87 73.82 78%

ADM Archer-Daniels-Midland 43.30 2.7% 3.1 102 2.8 47.88 40.22 40%

BRZU Direxion Dly Brazil Bull 3X 35.88 2.3% 0.8 104 3.39 55.29 20.38 44%

SHOP Shopify Inc 104.08 12.6% 5.2 110 12.7 105.79 32.85 98%

INTC Intel Corp 36.35 2.5% 2.6 114 3.01 38.45 33.23 60%

BTU Peabody Energy Corp 30.09 7.3% 4.9 120 7.9 N/A N/A N/A

XYL Xylem, Inc. 59.30 4.5% 5.4 121 4.34 59.77 45.60 97%

CGNX Cognex Corp 105.28 10.8% 8.0 141 10.7 110.69 44.14 92%

LL Lumber Liquidators Inc 33.61 35.9% 17.3 180 35.19 33.75 14.02 99%

ATR ConsCloses AvgVol Extension

1.21 -5 2.2 OS

0.84 -5 1.2 -

0.65 -1 3.8 -

0.57 -4 3.2 -

0.70 -1 4.9 -

2.74 -1 1.4 -

2.45 -5 1.1 OS

1.15 -6 0.8 OS

1.00 -1 1.7 -

3.85 -2 1.1 -

1.10 -1 2.7 -

0.60 -2 1.2 -

1.15 -2 0.8 -

0.74 -2 4.3 -

1.10 -1 1.6 -

0.58 1 1.8 -

0.62 -3 2.9 -

0.66 -1 1.6 -

1.16 -2 2.7 -

0.57 -1 0.8 -

1.49 -3 2.6 -

0.52 -1 2.0 OB

0.53 1 1.3 -

1.00 -2 1.0 -

4.72 -2 1.7 -

0.77 1 2.2 -

0.94 -2 1.8 -

0.55 2 1.0 -

0.64 -1 1.1 -

0.76 2 3.3 -

1.04 -2 0.8 -

0.76 1 1.8 -

2.43 -1 1.0 -

0.79 -1 1.5 -

0.52 1 2.4 -

0.64 1 1.1 -

0.51 2 1.3 -

1.07 2 0.8 -

1.26 2 1.1 -

0.66 -3 1.6 -

2.29 -2 1.0 -

1.19 -2 0.7 -

1.21 3 2.0 -

1.75 2 1.4 -

0.73 2 3.3 -

1.68 2 1.5 -

3.47 1 2.0 -

0.88 3 3.0 -

0.86 1 0.9 -

1.26 -2 0.9 -

1.11 1 1.2 -

0.96 -2 0.8 -

0.75 1 1.0 -

1.44 3 0.9 -

1.22 2 1.0 -

0.63 6 1.6 -

0.78 1 1.4 -

2.11 1 1.2 -

0.94 -2 2.5 -

1.04 1 1.6 -

0.68 1 1.6 -

1.88 2 1.3 -

1.80 1 1.2 -

1.09 2 2.1 -

0.66 3 3.0 -

1.31 3 1.2 -

3.95 1 2.3 -

0.52 6 21.6 -

0.88 3 1.2 -

0.86 1 1.3 -

2.77 2 0.8 -

1.21 1 1.2 -

HighVolume

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

LL Lumber Liquidators Inc 33.61 35.9% 17.3 180 35.2 33.75 14.02 99%

CGNX Cognex Corp 105.28 10.8% 8.0 141 10.73 110.69 44.14 92%

UA Under Armour Inc Cl C 16.23 -10.8% -5.0 -20 -10.4 42.94 16.15 0%

TRU TRU 45.95 0.9% 0.5 80 0.73 46.53 28.92 97%

SHOP Shopify Inc 104.08 12.7% 5.2 110 12.7 105.79 32.85 98%

ETN Eaton Corp 74.26 -5.7% -8.4 -22 -5.39 81.63 59.07 67%

SCG Scana Corp 67.58 5.0% 2.5 87 4.9 75.92 60.00 48%

IDTI Integrated Device Tech 25.43 -1.3% -2.0 32 -3.17 27.09 18.49 81%

CMI Cummins Inc 157.48 -6.7% -12.7 -2 -6.2 170.68 116.03 76%

ALSN Allison Transmission Hldg 37.79 0.0% 0.0 55 0.39 40.25 26.74 82%

UAA Under Armour Inc Cl A 18.30 -9.1% -4.3 -4 -8.7 43.85 18.01 1%

APD Air Products & Chem Inc 148.92 4.8% 7.3 99 4.30 150.45 129.00 93%

SNI Scripps Ntwrks Interactive Inc 87.57 0.2% 0.1 151 1.8 88.45 59.32 97%

VMC Vulcan Materials 119.20 -4.1% -3.0 0 -3.86 138.18 105.71 42%

DVAX Dynavax Tech Corp 15.20 -4.1% -0.4 142 6.3 17.50 3.20 84%

ENR Energizer Hldgs Inc 47.74 3.6% 3.0 59 2.89 60.07 41.97 32%

GT Goodyear Tire & Rub 31.48 -1.7% 0.0 -27 -2.8 37.20 26.82 45%

ICHR Ichor Hldgs 20.67 -10.1% -2.9 23 -10.03 N/A N/A N/A

DISCK Discovery Comm Inc Ser C 22.98 -0.6% -0.2 -15 -2.4 29.18 22.84 2%

ATR ConsCloses AvgVol Extension

1.21 1 1.2 -

2.77 2 0.8 -

0.65 -1 3.8 -

0.80 2 1.2 -

3.95 1 2.3 -

1.21 -5 2.2 OS

1.44 2 1.1 -

0.66 -1 1.6 -

2.74 -1 1.4 -

0.79 -1 1.5 -

0.70 -1 4.9 -

1.80 1 1.2 -

2.43 6 2.6 -

2.45 -5 1.1 OS

1.19 -1 2.4 -

1.07 2 0.8 -

0.81 -5 3.0 -

1.15 -2 0.8 -

0.69 -2 2.1 -

52WkHigh

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

C Citigrp Inc 69.60 1.7% 1.7 102 1.8 69.62 42.50 100%

CBOE CBOE Hldg Inc 95.21 0.5% 1.0 96 0.99 95.25 61.58 100%

ACN Accenture PLC (Ireland) NEW 129.86 0.8% 1.3 89 0.8 129.89 108.83 100%

FISV Fiserv Inc 129.27 -0.4% 0.9 103 0.97 129.35 92.81 100%

LNC Lincoln Natl Corp 73.58 0.7% 0.7 94 0.9 73.65 42.24 100%

HSBC HSBC Hldg PLC 50.81 1.4% 1.6 158 1.84 50.86 32.03 100%

PRU Prudential Finl 114.40 1.0% 1.5 91 1.0 114.55 72.25 100%

SPNC Spectranetics Corp 38.48 0.0% -0.4 91 0.01 38.55 19.80 100%

AFL AFLAC Inc 80.89 1.4% 1.8 116 1.9 80.95 66.50 100%

AMP Ameriprise Finl Inc 145.95 0.7% 0.6 123 1.71 146.23 86.25 100%

GPN Global Payments Inc 95.49 1.2% 1.4 89 1.0 95.68 64.63 99%

LL Lumber Liquidators Inc 33.61 36.0% 17.3 180 35.19 33.75 14.02 99%

WBMD WebMD Health Corp 66.30 0.0% 0.0 134 0.1 66.45 48.10 99%

HIG Hartford Finl Svcs Grp 55.66 1.3% 1.3 119 1.64 55.80 38.92 99%

PGR Progressive Corporation (The) 47.24 0.3% 0.3 101 0.3 47.38 30.54 99%

L Loews Corp 49.19 1.0% 1.7 101 1.14 49.27 39.71 99%

DE Deere & Co 129.02 0.6% 0.6 81 0.6 129.54 76.73 99%

WYN Wyndham Worldwide Corporation 105.38 0.9% 1.7 87 0.96 105.86 62.60 99%

RDS.A Royal Dutch Shell 'A' 56.81 0.5% 0.7 125 1.4 56.93 46.57 99%

V Visa Inc 100.87 1.0% 1.8 100 1.22 101.18 75.17 99%

MPC Marathon Petro Corp 56.56 1.0% 1.0 84 1.0 56.81 37.02 99%

ICE Intercontinental Exchange Grp 67.28 0.4% 1.1 83 0.97 67.48 52.27 99%

PVH PVH Corp. 120.01 0.6% 0.6 98 0.7 120.49 84.53 99%

NCLH Norwegian Cruise Line Hldg 56.91 3.3% 3.3 90 3.06 57.25 34.16 99%

WMT Wal-Mart Stores 80.50 0.8% 0.6 113 1.1 80.73 65.28 99%

TRV The Travelers Companies Inc 129.21 0.9% 1.1 91 0.99 129.60 103.45 99%

CONE CyrusOne Inc 60.19 0.8% 0.7 97 1.2 60.55 38.80 98%

NEE NextEra Energy Inc 146.60 0.3% 0.6 95 0.81 147.22 110.49 98%

CC The Chemours Company 47.94 0.7% 0.4 95 0.5 48.65 8.62 98%

HRS Harris Corp 115.92 1.2% 1.5 81 1.17 116.49 85.41 98%

UNM Unum Grp 50.31 0.4% 0.4 105 1.0 50.67 32.36 98%

ATHM Autohome Inc 49.01 0.7% 0.5 75 0.83 49.59 21.21 98%

UNH UnitedHealth Grp Inc 192.10 0.2% 0.2 81 0.3 193.40 132.39 98%

APH Amphenol Corp A 77.35 1.0% 1.2 95 1.18 77.77 58.38 98%

SNPS Synopsys Inc 76.77 0.3% 0.4 77 0.3 77.29 53.53 98%

RIO Rio Tinto plc ADS 47.11 -0.5% -0.4 104 0.13 47.51 29.62 98%

FSLR First Solar Inc 49.65 0.7% 0.3 126 2.6 50.21 25.56 98%

SYK Stryker Corp 147.87 0.6% 0.5 85 0.68 148.84 106.48 98%

SHOP Shopify Inc 104.08 12.7% 5.2 110 12.7 105.79 32.85 98%

CCE Coca-Cola Euro Prtnrs 43.47 0.6% 0.5 94 0.85 43.78 30.55 98%

LYV Live Nation Entertainment 37.52 0.7% 0.8 101 1.1 37.82 25.56 98%

UN Unilever N.V. 58.12 -0.1% -0.1 86 0.07 58.61 38.41 98%

SEDG SolarEdge Tech Inc 23.30 1.7% 0.8 94 1.8 23.60 11.35 98%

AGO Assured Guaranty 45.10 0.2% 0.2 83 0.02 45.59 26.37 97%

EXC Exelon Corp 38.55 0.5% 0.6 109 1.3 38.78 29.82 97%

LMT Lockheed Martin Corp 292.57 0.2% 0.2 83 0.33 294.33 228.50 97%

MOMO Momo Inc ADS 45.04 2.5% 1.4 86 2.5 45.95 13.00 97%

FTV Fortive Corp 65.20 0.7% 0.7 85 1.30 65.73 46.81 97%

PNC PNC Finl Svcs Grp 130.41 1.3% 1.7 89 1.2 131.83 81.35 97%

ATVI Activision Blizzard Inc 62.40 1.0% 0.6 77 1.31 63.19 35.12 97%

PLD ProLogis Inc 61.36 0.9% 0.7 91 1.1 61.81 45.93 97%

ANSS Ansys Inc 130.23 0.5% 1.0 99 0.81 131.63 82.28 97%

TRU TRU 45.95 0.3% 0.5 80 0.7 46.53 28.92 97%

MSI Motorola Inc 91.94 1.4% 1.9 90 1.21 92.67 68.36 97%

BHP BHP Billiton Ltd ADR 41.39 -0.6% -0.6 116 0.1 41.79 28.77 97%

SNI Scripps Ntwrks Interactive Inc 87.57 0.2% 0.1 151 1.81 88.45 59.32 97%

UL Unilever ADR 56.83 -0.3% -0.4 80 -0.1 57.45 38.58 97%

XYL Xylem, Inc. 59.30 4.5% 5.4 121 4.34 59.77 45.60 97%

CCL Carnival Corp 67.48 1.0% 1.2 74 0.9 68.29 44.11 97%

SGMS Scientific Games Cl'A' 38.20 3.5% 0.4 141 2.53 39.25 8.07 97%

CRM salesforce.com Inc 91.26 0.5% 0.6 72 0.5 92.13 66.43 97%

FMC FMC Corp 77.15 1.0% 0.9 66 0.54 78.30 44.40 97%

SINA Sina Corp 95.90 1.1% 0.8 78 1.3 97.81 46.53 96%

AJG Gallagher (Arthur J.) 59.19 0.7% 0.8 77 0.56 59.64 47.16 96%

WLTW Willis Towers Watson Pub Ltd 149.62 0.4% 0.6 69 0.3 151.02 112.76 96%

TIF Tiffany & Co 95.86 0.4% 0.3 77 0.48 97.29 58.77 96%

WLK Westlake Chemical Corp 70.38 0.1% 0.0 70 -0.2 71.44 43.51 96%

TROX Tronox Inc 19.66 1.5% 0.8 95 0.57 20.20 6.00 96%

SQM Sociedad Quimica Y Minera ADS 41.09 0.0% 0.0 124 1.1 41.77 24.18 96%

AXP American Express Co 85.24 0.0% 0.0 63 -0.04 86.28 59.50 96%

CTSH Cognizant Tech Solutions'A' 69.51 0.9% 0.5 68 0.1 70.49 45.44 96%

RLGY Realogy Hldg Corp 33.70 1.5% 1.2 71 1.01 34.22 21.43 96%

MS Morgan Stanley 47.21 0.7% 0.6 75 0.3 48.04 27.79 96%

AAOI Applied Optoelectronice Inc 99.61 1.4% 0.6 106 2.34 103.41 11.60 96%

PFG Principal Finl Grp 66.74 0.0% 0.0 65 -0.2 67.73 44.23 96%

NKE Nike Inc Cl B 59.84 1.5% 1.2 91 1.21 60.33 49.01 96%

IRBT iRobot Corporation 106.58 1.0% 0.2 110 5.5 109.78 37.29 96%

CI Cigna Corp 172.98 -0.3% -0.5 57 -0.37 175.80 115.03 95%

NVDA Nvidia Corp 164.49 1.2% 0.6 64 0.8 169.93 55.38 95%

JPM JPMorgan Chase & Co 93.03 1.3% 1.8 78 1.10 94.51 63.38 95%

ALGN Align Tech 169.43 1.3% 0.5 107 2.5 173.79 83.27 95%

ALB Albemarle Corp 117.43 1.4% 1.3 72 0.84 119.59 75.11 95%

CAT Caterpillar Inc 113.10 -0.7% -0.5 85 -0.9 114.90 79.93 95%

INFO IHS Markit Ltd 47.18 1.1% 1.7 103 1.66 47.92 32.90 95%

EL Lauder (Estee) Co 98.61 -0.4% -0.7 74 -0.3 99.82 75.30 95%

TSS Total System Svcs 64.01 0.9% 0.9 102 1.07 64.94 46.22 95%

AON Aon Plc 139.52 1.0% 1.2 85 0.7 141.31 105.35 95%

HON Honeywell Intl 137.02 0.7% 1.1 67 0.48 138.70 105.25 95%

JD JD.com Inc 45.55 0.7% 0.6 87 1.2 46.85 21.22 95%

RHT Red Hat Inc 100.01 1.2% 1.4 74 0.92 101.73 68.54 95%

GRUB GrubHub Inc 47.22 2.4% 1.9 76 2.6 48.16 32.43 94%

CTRP Ctrip.com Intl Ltd 59.52 -0.4% -0.3 80 0.36 60.65 39.71 95%

PH Parker-Hannifin 164.45 -0.9% -1.3 55 -0.9 167.50 112.26 94%

KEM KEMET Corp. 17.09 3.7% 0.5 83 1.61 17.89 3.24 95%

BK Bank of New York Mellon Corp 53.71 1.1% 1.3 84 1.0 54.59 38.53 95%

ADBE Adobe Systems 147.36 0.6% 0.5 60 0.33 150.40 95.42 94%

Q Quintiles Transitional Hldg 91.29 0.8% 0.9 68 0.8 92.54 70.10 94%

TEX Terex Corp 38.89 -1.2% -0.9 66 -1.09 39.90 21.88 94%

DISH DISH Network Corp Cl A 65.49 2.3% 3.2 67 2.1 66.50 48.51 94%

AER Aercap Hldg NV 49.40 0.6% 0.7 79 0.65 50.24 35.28 94%

OC Owens Corning 67.53 0.7% 0.4 76 1.7 68.80 46.45 94%

RCL Royal Caribbean Cruises 116.87 3.4% 3.2 89 2.99 120.00 65.10 94%

AET Aetna Inc 154.54 0.4% 0.2 53 -0.1 157.56 104.59 94%

NRG NRG Energy Inc 24.53 -0.4% -0.1 106 -0.71 25.43 9.84 94%

ETFC E Trade Finl Corporation 41.16 0.4% 0.3 84 -0.1 42.19 24.35 94%

CDNS Cadence Design Systems 36.72 -0.2% -0.4 92 -0.33 37.51 23.83 94%

JKS JinkoSolar Hldg Co Ltd 27.53 -0.4% -0.1 95 1.3 28.44 12.72 94%

BA Boeing Co 239.44 -1.2% -0.6 171 1.85 246.49 126.31 94%

PFGC Performance Food Grp Co 28.70 -0.2% -0.3 66 -0.5 29.25 19.95 94%

SCHW Charles Schwab Corp (The) 43.13 0.5% 0.6 66 0.51 44.10 27.71 94%

BIDU Baidu Inc 225.60 -0.5% -0.2 163 3.0 230.00 156.23 94%

KEYS Keysight Tech Inc 42.00 1.0% 0.9 71 0.34 42.98 26.87 94%

RTN Raytheon Co 171.45 -0.5% -0.3 86 0.1 173.95 132.89 94%

YY YY Inc 71.74 0.3% 0.1 96 -0.13 73.94 37.81 94%

SAP Sap Ag ADS 107.02 1.1% 1.3 82 1.5 108.72 80.93 94%

AME Ametek, Inc 61.66 0.1% 0.2 56 0.06 62.89 43.30 94%

SQ Square Inc 26.80 1.7% 0.7 74 1.3 27.97 9.85 94%

DATA Tableau Software Inc 65.45 1.6% 1.3 70 1.38 67.10 41.41 94%

FNF Fidelity Natl Finl Inc 48.23 -1.3% -1.2 108 -0.4 49.37 31.64 94%

TRP Transcanada Corp 51.22 0.2% 0.2 81 0.04 51.81 42.69 94%

AEE Ameren Corp 56.53 0.8% 1.1 80 0.9 57.21 46.84 93%

SBAC SBA Communications'A' 137.43 -0.1% -0.1 63 0.26 140.38 95.66 93%

ADSK Autodesk, Inc 111.38 0.5% 0.4 69 0.2 115.25 56.80 93%

TTWO Take-Two Interactive Software 79.93 0.6% 0.4 72 0.19 82.79 40.00 93%

MA Mastercard Inc 129.49 1.3% 1.8 80 0.9 132.20 94.41 93%

STT State Street Corp 93.60 0.4% 0.4 78 0.56 96.26 63.58 92%

GDDY GoDaddy Inc 43.09 0.3% 0.2 52 0.0 44.22 28.13 93%

APO Apollo Global Mgt LLC 28.28 0.9% 0.6 73 0.63 29.20 16.75 93%

ENTG Entegris Inc 26.30 0.8% 0.6 85 1.2 27.20 14.73 93%

APD Air Products & Chem Inc 148.92 4.8% 7.3 99 4.30 150.45 129.00 93%

EA Electronic Arts, Inc. 116.92 0.7% 0.1 83 0.8 120.25 73.74 93%

SPGI S&P Glbl Inc 154.68 0.7% 1.0 83 0.48 158.35 107.21 93%

BABA Alibaba Group Holding Ltd 154.73 0.0% -0.1 75 0.2 160.39 81.95 93%

COH Coach Inc 47.77 1.4% 1.1 51 0.70 48.85 34.07 93%

OLLI Ollies Bargain Outlet Hldgs 44.45 -0.4% -0.3 66 -0.3 46.08 24.12 93%

FRC First Repub Bank 101.63 1.3% 1.3 63 0.90 104.17 70.46 92%

CHTR Charter Communications Inc 387.42 -1.1% -0.6 134 1.6 399.95 233.00 92%

SERV ServiceMaster Glbl Hldgs Inc 43.97 0.1% 0.0 129 2.41 44.91 32.41 92%

AABA Altaba Inc 58.50 0.3% 0.2 72 0.3 60.22 38.08 92%

TV Grupo Televisa S.A.GDS 27.25 2.4% 1.7 90 2.47 27.89 19.69 92%

NVS Novartis Ag ADS 85.34 0.2% 0.2 77 0.4 86.90 66.93 92%

PYPL PayPal Hldgs Inc 59.34 1.3% 0.8 81 1.46 61.30 36.28 92%

WDAY Workday Inc 103.50 1.4% 1.0 63 1.0 106.75 65.79 92%

VRSK Verisk Analytics Inc 87.17 0.4% -0.2 79 -0.01 88.17 75.60 92%

CGNX Cognex Corp 105.28 10.8% 8.0 141 10.7 110.69 44.14 92%

GLPI Gaming and Leisure Pptys Inc 38.12 0.5% 0.6 70 0.21 38.89 29.32 92%

BBY Best Buy 59.47 2.0% 0.9 100 3.2 61.95 32.02 92%

AAN Aaron's Inc 45.98 -0.6% -0.2 140 2.65 48.22 21.50 92%

ASML ASML Hldg N.V. New York 150.92 0.4% 0.3 92 0.0 155.73 98.71 92%

COL Rockwell Collins 111.18 4.5% 2.2 73 3.69 114.21 78.54 92%

DOV Dover Corp 83.61 -0.5% -0.5 54 -0.5 85.31 65.50 91%

NTAP NetApp Inc 43.55 0.3% 0.2 69 -0.37 45.24 25.82 91%

MCO Moody's Corp 131.59 0.0% 0.0 89 -0.2 135.20 93.51 91%

FBHS Fortune Brands Home & Security 66.16 0.7% 1.1 57 0.66 67.50 52.05 91%

W Wayfair Inc 75.78 -0.8% -0.4 48 -0.9 80.40 27.60 91%

EXPD Expeditors Intl of Washington 58.79 -0.2% -0.2 68 -0.42 59.90 47.23 91%

WCN Waste Connections Inc 65.43 0.7% 1.0 64 0.8 67.14 47.81 91%

BZUN Baozun Inc ADS 32.49 -0.1% 0.0 82 0.27 34.98 6.85 91%

EWBC East West Bancorp 57.99 1.8% 1.6 57 1.1 60.42 33.02 91%

AMT American Tower Corp 135.97 -0.3% -0.2 57 -0.31 139.50 99.72 91%

NFLX Netflix Inc 182.03 0.0% 0.1 84 -0.4 191.50 90.50 91%

KITE Kite Pharma Inc 107.98 -0.4% -0.2 61 -0.82 114.69 39.82 91%

EQR Equity Residential 67.88 -0.3% -0.3 76 0.4 68.83 58.28 91%

SPR Spirit Aerosystems Hldgs Inc 61.04 1.0% 1.3 74 0.86 62.90 42.26 91%

WB Weibo Corp 77.65 1.8% 0.4 75 1.2 82.28 31.25 91%

CELG Celgene Corp 135.18 -0.2% -0.2 59 -0.34 139.00 96.93 91%

FB Facebook Inc 169.86 0.3% 0.3 101 0.9 175.49 113.55 91%

HRB Block (H&R) 30.62 0.4% 0.4 60 0.60 31.70 19.85 91%

CDW CDW Corp 63.97 0.9% 1.0 64 0.7 66.33 40.56 91%

DFT Dupont Fabros Tech Inc 63.55 1.8% 2.0 95 2.57 66.18 37.54 91%

STZ Constellation Brands 'A' 194.75 0.7% 0.9 57 0.7 199.89 144.00 91%

ZTS Zoetis Inc 62.27 -0.4% -0.4 45 0.05 63.85 46.86 91%

CBG CBRE Grp, Inc. 37.72 -0.7% -0.8 61 -1.0 38.99 25.40 91%

KBH KB Home 23.40 2.1% 2.1 56 1.42 24.37 14.06 91%

RY Royal Bank of Canada 74.46 0.0% -0.2 55 -0.3 76.01 59.88 90%

BBL BHP Billiton Plc ADS 36.14 -0.7% -0.7 117 0.08 37.44 24.91 90%

FOLD Amicus Therapeutics Inc 13.11 1.2% 0.2 68 -0.1 14.05 4.41 90%

MSFT Microsoft Corp 72.58 0.1% -0.2 53 -0.61 74.42 55.61 90%

CE Celanese Corporation 96.11 -0.1% -0.1 52 -0.1 99.97 60.59 90%

DK Delek Holdco Inc 26.26 0.5% 0.3 45 -0.62 27.85 11.66 90%

EXEL Exelixis Inc 26.47 -2.4% -1.1 53 -2.6 28.45 8.75 90%

AVGO Broadcom Ltd 248.39 0.7% 0.6 50 0.03 258.49 158.75 90%

ATR ConsCloses AvgVol Extension

0.97 2 17.6 -

1.12 3 1.1 -

1.29 3 2.1 -

1.26 2 0.8 -

1.15 4 1.4 -

0.50 2 1.7 -

1.37 4 1.8 -

0.07 -1 1.5 -

0.81 3 1.6 -

2.45 3 1.1 -

1.36 1 1.0 -

1.21 1 1.2 -

1.37 2 1.1 -

0.61 3 2.2 -

0.59 1 3.0 -

0.56 3 0.8 -

1.58 1 2.5 -

1.22 2 1.0 -

0.62 6 3.1 OB

1.21 2 8.0 -

1.00 2 4.1 -

0.84 3 2.5 -

1.91 1 1.0 -

1.04 1 1.6 -

0.97 9 9.2 OB

1.48 3 1.4 -

0.97 8 0.8 -

1.58 3 1.8 -

1.39 1 3.0 -

1.44 3 0.9 -

0.75 4 1.1 -

1.37 1 1.2 -

2.21 3 2.9 -

0.96 4 1.1 -

0.88 3 1.0 -

0.88 -1 3.3 -

1.50 3 2.8 -

1.95 1 1.1 -

3.95 1 2.3 -

0.62 1 1.0 -

0.52 1 1.2 -

0.54 -1 1.6 -

0.69 4 1.0 -

0.59 3 0.8 -

0.47 1 5.0 -

3.34 3 0.9 -

1.59 1 6.5 -

0.87 4 1.4 -

1.78 2 2.1 OB

1.35 3 6.7 -

0.97 1 2.6 -

1.54 3 0.8 -

0.80 2 1.2 -

1.13 1 1.0 -

0.70 -1 2.6 -

2.43 6 2.6 -

0.55 -1 1.4 -

0.86 1 1.3 -

0.88 3 3.0 -

1.73 1 1.4 -

1.29 3 4.7 -

1.29 1 1.0 -

2.61 3 1.5 -

0.80 1 0.8 -

2.23 1 0.9 -

1.54 1 1.6 -

1.23 1 0.8 -

0.72 1 1.3 -

0.87 -1 0.9 -

1.01 3 3.3 -

0.73 1 3.8 -

0.65 3 1.1 -

0.79 2 9.2 -

5.46 2 3.5 -

0.90 -2 1.1 -

0.88 3 10.4 -

4.12 1 1.0 -

2.16 -2 1.5 -

5.11 1 23.7 -

1.15 2 14.0 -

3.89 1 1.2 -

2.07 1 1.1 -

1.80 -3 4.6 -

0.56 5 3.9 -

1.07 -3 1.5 -

1.03 1 1.1 -

1.60 1 1.2 -

1.41 1 2.4 -

1.30 1 11.8 -

1.46 2 1.6 -

1.16 1 1.8 -

1.37 -1 3.6 -

2.43 -1 1.0 -

0.77 2 1.1 -

0.78 2 4.6 -

2.20 1 2.5 -

1.25 1 1.0 -

0.85 -1 1.6 -

1.21 3 2.0 -

0.77 4 1.3 -

1.09 1 0.9 -

2.11 1 1.2 -

1.78 1 2.1 -

0.97 -2 6.9 -

0.72 1 2.4 -

0.58 -2 1.8 -

1.30 -2 1.1 -

3.80 -1 3.3 -

0.49 -1 1.0 -

0.63 3 7.0 -

5.24 -1 2.9 -

0.69 1 1.1 -

1.97 -2 1.3 -

2.57 1 1.3 -

1.27 1 0.7 -

0.64 1 1.1 -

0.90 3 8.0 -

1.25 1 1.0 -

0.68 -1 1.3 -

0.74 1 1.3 -

0.57 1 1.4 -

2.29 -2 1.0 -

2.32 1 2.3 -

1.76 1 2.5 -

1.69 1 3.3 -

1.46 2 1.8 -

0.79 1 1.1 -

0.61 2 1.1 -

0.65 1 1.1 -

1.80 1 1.2 -

2.34 1 3.5 -

2.21 3 1.1 -

3.42 -2 17.9 -

0.74 1 2.9 -

1.19 -2 0.7 -

1.67 2 0.8 -

8.09 -1 1.6 -

0.94 2 1.1 -

1.09 1 23.3 -

0.68 1 1.6 -

0.92 2 2.1 -

1.37 1 8.7 -

2.14 1 1.6 -

0.96 -2 0.8 -

2.77 2 0.8 -

0.53 3 1.2 -

1.49 8 4.5 -

1.21 -2 0.8 -

2.51 1 0.9 -

2.21 1 1.3 -

1.23 -1 1.5 -

0.95 1 3.3 -

1.96 -2 0.8 -

0.77 2 0.9 -

2.43 -2 1.7 -

0.74 -1 1.2 -

0.92 1 0.9 -

1.85 1 2.2 -

1.10 2 1.2 -

2.22 -2 1.8 -

5.19 1 6.9 -

3.65 -2 1.3 -

0.92 -1 1.5 -

0.86 1 0.9 -

2.68 3 2.7 -

2.46 -1 4.1 -

2.90 1 18.7 -

0.52 2 3.0 -

0.88 3 0.8 -

1.03 2 1.2 -

2.41 1 1.4 -

0.76 -1 2.5 -

0.59 -1 1.8 -

0.52 1 2.4 -

0.80 -2 1.1 -

0.65 -1 1.6 -

0.78 1 3.8 -

1.02 -5 25.2 -

1.72 -1 0.9 -

0.81 2 1.1 -

0.93 -2 4.3 -

4.37 1 2.8 -

52WkLow

Ticker Desc Close Change VolSpike KPos RS 52WkH 52WkL C%52Wk

UA Under Armour Inc Cl C 16.23 -10.8% -5.0 -20 -10.4 42.94 16.15 0%

RRC Range Resources 20.33 -3.8% -1.2 13 -4.39 43.60 20.23 0%

CHRS Coherus BioSciences Inc 12.80 -1.9% -0.9 20 -2.9 31.98 12.70 1%

UAA Under Armour Inc Cl A 18.30 -9.1% -4.3 -4 -8.68 43.85 18.01 1%

CAKE Cheesecake Factory 47.57 0.0% 0.0 8 -1.3 67.14 47.35 1%

GPOR Gulfport Energy Corp 12.71 1.4% 0.2 21 -0.17 30.47 12.47 1%

FET Forum Energy Technologies Inc 12.95 -2.3% -0.6 -3 -4.9 26.25 12.75 1%

HP Helmerich & Payne 49.20 -2.8% -1.1 -1 -4.94 85.78 48.62 2%

SLCA US Silica Hldg Inc 26.49 -9.1% -1.9 2 -7.7 61.49 25.91 2%

ALDR Alder BioPharmaceuticals Inc 10.50 -2.3% -0.4 18 -3.65 36.48 10.05 2%

JCI Johnson Controls Intl Plc 38.73 -0.5% -0.3 -46 -3.2 48.97 38.54 2%

UBSI United Bankshs 34.50 0.0% 0.0 -6 -2.20 49.35 34.18 2%

DISCK Discovery Comm Inc Ser C 22.98 -0.6% -0.2 -15 -2.4 29.18 22.84 2%

MSM MSC Industrial Direct Co Inc A 70.95 -0.4% -0.1 2 -0.71 105.70 69.96 3%

CRZO Carrizo Oil & Gas 15.51 -1.4% -0.4 36 -1.3 43.96 14.58 3%

EAT Brinker Intl Inc 35.62 0.4% 0.3 27 -0.27 55.84 34.92 3%

FTR Frontier Communications Corp 15.84 3.8% 0.9 57 4.0 78.30 13.13 4%

IBM Intl Business Machines Corp 145.30 0.4% 0.4 7 0.20 182.79 143.64 4%

CYBR CyberArk Software Ltd 42.14 1.2% 0.3 12 0.3 59.28 41.32 5%

MAC Macerich Co 57.91 0.9% 0.5 40 0.21 94.51 56.06 5%

BLCM Bellicum Pharma Inc 10.39 -1.8% -0.7 7 -4.7 23.11 9.71 5%

TRIP TripAdvisor Inc When-Issued 37.35 -4.3% -2.0 35 -4.17 71.69 35.34 6%