Professional Documents

Culture Documents

AngelBrokingResearch CochinShipyard IC 310717

AngelBrokingResearch CochinShipyard IC 310717

Uploaded by

durgasainathOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AngelBrokingResearch CochinShipyard IC 310717

AngelBrokingResearch CochinShipyard IC 310717

Uploaded by

durgasainathCopyright:

Available Formats

IPO Note | Capital Goods

July 31, 2017

Cochin Shipyard Ltd SUBSCRIBE

A safe harbor for investments Issue Open: Aug 1, 2017

Issue Close: Aug 3, 2017

Cochin Shipyard (CSL) is the largest Indian public sector shipyard and it received

Miniratna status in 2008. CSL operates a shipyard that provides shipbuilding

and ships repair services in both defence and non-defence spaces. CSL generates Is s u e D eta i l s

74% from shipbuilding and 26% from ship repair.

Face Value: `10

Healthy order book indicates strong revenue visibility: CSLs current order book

stands at `3,078cr (1.5x FY2017 revenue), this provides revenue visibility in the Present Eq. Paid up Capital:

`113.28cr

near term. Defence sector consists of ~80% of order book (~70% for ship

building and ~10% for ship repair). CSL has received order for Indigenous Offer for Sale: **1.13cr Shares

Aircraft Carrier (IAC) for the Indian Navy on nomination basis which shows its

Fresh issue: `979cr

capability of execution. It also participated in several tenders (~`12000cr) of

defence, and GOI flagship project .I.e. Sagarmala, Inland Waterways Transport. Post Eq. Paid up Capital: `135.9cr

Ship repair segment to improve margins: CSLs ship repair revenue has grown by

healthy CAGR of 17.5% over FY2013-17 and its contribution to total revenue has Issue size (amount): *`1416r -**1468

cr

also increased from 17% in FY2013 to 26.4% in FY2017. Ship repair business

has 2x margins than ship building and CSL is the market leader in the ship repair Price Band: `424-432

segment with 39% market share. Lot Size: 30 shares and in multiple

Setting up Dry Dock and international ship repair: CSL is in the process of setting thereafter

up two new docks ship repair dock and ship building dock. This would require Post-issue implied mkt. cap: *`5764cr -

capex of ~`2,700cr in next 3 years. Strong liquidity position, IPO proceeds and **`5872cr

approvals in process would help them to finish expansion plan on time. Promoters holding Pre-Issue: 100%

Strong financial performance coupled with healthy Balance sheet: Despite

Promoters holding Post-Issue: 75%

slowdown in shipbuilding industry CSLs revenue and PAT grew at a CAGR of

11% and 19%, respectively over FY2007-17. Margin has also expanded from *Calculated on lower price band

7.9% in FY2007 to 18.4% in FY2017. Its liquidity position is best amongst the ** Calculated on upper price band

listed players with negligible debt (`228cr) and cash & equivalent of ~`2,000cr

Book Bu ilding

as of FY2017. CSL has reported superior return ratios over FY2012-17 (reported

average RoEs, ROCEs of 15.3%, 16.6% respectively). QIBs 50% of issue

Outlook & Valuation: In terms of valuation, pre- issue works out to 15.7x of Non-Institutional 15% of issue

FY2017 EPS (at the upper end of the issue price band), which is reasonably priced

Retail 35% of issue

on the back of (1) healthy order book with execution capability and experienced

management; (2) Average RoE & ROCE for last 5 years +15%; (3) Despite cyclical

business it has maintained net cash positive balance sheet; (4) easing working Po s t Is s u e Sh a reh o l d i n g Pa ttern

capital cycle from >195 days in FY2012 to current 59 days. Considering the past

Promoters 75%

financial performance of CSL and strong visibility on future growth, we rate this

issue as SUBSCRIBE. Others 25%

Key Financials

Y/E March (` cr) FY2014 FY2015 FY2016 FY2017

Net Sales 1,798 1,583 1,990 2,059

% chg 7 (12) 26 3

Net Profit 282 69 292 312

% chg 6 (75) 321 7

EBITDA (%) 23.2 5.6 19.7 18.5

EPS (Rs) 25 6 26 28

P/E (x) 17 71 17 16

P/BV (x) 3 3 3 2

RoE (%) 19 4 16 15 Jaikishan J Parmar

RoCE (%) 21 3 17 15 +022 39357600, Extn: 6810

EV/EBITDA 11 63 15 15 Jaikishan.parmar@angelbroking.com

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report 1

Cochin Shipyard Ltd | IPO Note

Company background

Cochin Shipyard Ltd is the largest public sector shipyard in India in terms of dock

capacity, as of March 31, 2015, according to a CRISIL Report. The company caters

to clients engaged in the defence sector in India and in the commercial sector

worldwide. In addition to ship building and ship repair, CSL also offers marine

engineering training.

As of May 31, 2017, the company has two docks dock number one, primarily

used for ship repair (Ship Repair Dock) and dock number two, primarily used for

ship building (Ship building Dock). The Ship Repair Dock is one of the largest in

India and enables it to accommodate vessels with a maximum capacity of 125,000

DWT. Further, Ship building Dock can accommodate vessels with a maximum

capacity of 110,000 DWT. CSL is also currently building India's first Indigenous

Aircraft Carrier (IAC) for the Indian Navy

CSLs diversified offerings to the Indian clients engaged in the defence sectors and

commercial sectors worldwide, has allowed it to successfully adapt to the cyclical

fluctuations of the industry.

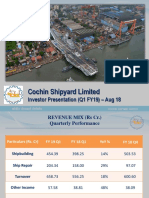

Exhibit 1: Revenue mix

Activity FY15 FY16 FY17

Ship building (% of Grand Total) 87 82 74

Defence sector 1231 1503 1363

Commercial sector 133 118 151

Total 1364 1621 1514

Ship repair (% of Grand Total) 13 18 26

Defence sector 54 282 379

Commercial sector 144 82 165

Total 198 364 544

Grand Total 1562 1985 2057

Source: RHP, Angel Research

July 31, 2017 2

Cochin Shipyard Ltd | IPO Note

Issue Details

The company is raising `979cr through a fresh issue of equity shares in the price

band of `424-432. The fresh issue will constitute ~16.67% of the post-issue paid-

up equity share capital of the company, assuming the issue is subscribed at the

upper end of the price band. The company is offering 1.133cr shares that are

being sold by Government of India (GOI).

Exhibit 2: Pre and Post-IPO shareholding pattern

No of shares (Pre-issue) % No of shares (Post-issue) %

Promoter (GOI) 11,32,80,000 100% 10,19,52,000 75%

Other 0 0% 3,39,84,000 25%

11,32,80,000 100% 13,59,36,000 100%

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

Setting up of a new dry dock within the existing premises of the Company

(Dry Dock); Out of the proceeds, `443cr would be used for Dry dock.

Setting up of an international ship repair facility at Cochin Port Trust area

(ISRF); Out of the proceeds `229.5cr would be used for Dry dock.

General corporate purpose.

Key Management Personnel

Mr. Madhu S. Nair Chairman and Managing Director, Mr. Nair is with the

company since 1988 and had joined as a management trainee. He holds

Bachelors of Technology in naval architecture and ship building from Cochin

University of Science and Technology, India, and a degree in naval architecture

and ocean engineering from Osaka University, Japan.

Mr. D. Paul Ranjan Mr Paul is the director of finance & CFO, since May 1, 2014.

He holds Bachelors of Commerce and is a Chartered Accountant. He had joined

CSL as an executive trainee in December 17, 1984. He has approximately 32

years of work experience with the Company.

Mr. Suresh Babu N. V Mr.Suresh is the Director (Operations) since April 26,

2016. He holds Bachelor of Engineering (Mechanical) from the University of

Kerala. He joined CSL as an executive trainee in February 1, 1985. He has

approximately 31 years of work experience with CSL

July 31, 2017 3

Cochin Shipyard Ltd | IPO Note

Healthy order book indicates strong revenue visibility

CSLs current order book stands at `3,078cr (1.5x FY2017 revenue), this provides

revenue visibility in the near term. Defence sector consists of ~80% of order book

(~70% for ship building and ~10% for ship repair). CSL has received order for

Indigenous Aircraft Carrier (IAC) for the Indian Navy on nomination basis, which

shows its capability of execution. Additionally, it also participated in several tenders

(~`12,000cr) of defence, and GOI flagship project i.e. Sagarmala, Inland

Waterways Transport.

Exhibit 3: CSL's Ship building order book

Project/Vessel Client

FPV Indian Coast Guard

Confidential GoI

IAC Indian Navy

500 passenger cum 150 MT cargo vessel A&N Administration

500 passenger cum 150 MT cargo vessel A&N Administration

1200 passenger cum 1000 MT cargo vessel A&N Administration

1200 passenger cum 1000 MT cargo vessel A&N Administration

Double ended Ro Ro Ferry Kochi Municipal Corporation

Double ended Ro Ro Ferry Kochi Municipal Corporation

Revenue to be recognized in future (in Cr) 3,078.33

Source: RHP, Angel Research

Strong execution with ability to cater to commercial as well

defence sectors

CSLs ability to cater to commercial as well defence ship building and repair, has

kept the company afloat since 2011 despite slowdown in commercial shipyard

business. We believe that CSLs emphasis on quality of construction and timely

delivery have are the key factors to attract new customers and to retain existing

customers. For example, it recently delivered seven FPVs for the Indian Coast

Guard ahead of the contractual delivery schedule. The final FPV (in a series of 20)

was delivered on December 30, 2016, ahead of the scheduled delivery date of

March, 2017. Moreover, CSL has built two of Indias largest double hull oil

tankers, each of 92,000 DWT for SCI.

Exhibit 4: Client Wise revenue

FY15 FY16 FY17

Defence sector 82.3 89.9 84.6

Commercial sector 17.7 10.1 15.4

Source: RHP ,Angel Research

July 31, 2017 4

Cochin Shipyard Ltd | IPO Note

Government initiatives to support shipbuilding industry

Make in India Initiative

Gas Authority of India has signed contracts to buy LNG from suppliers in the US.

Transporting this gas will require large specialized LNG carriers. As part of the

Make in India campaign, the Government of India is keen that one-third of the

total number of ships should be built by Indian shipyards.

Sagarmala Project

According to the national perspective plan, the Sagarmala project aims to

transform existing ports and create new ones with world-class technology and

infrastructure. The project is also expected to integrate ports with industrial clusters

and the hinterland through rail, road, inland and coastal waterways. The

government is expected to invest US$16 billion for the projects completion. The

project is expected to tackle underutilised ports by focussing on port

modernisation, efficient evacuation, and coastal economic development.

Development of inland waterways transport

Inland waterways transport will be an alternative for the existing mode of

transportation. The proposed 101 inland waterways will require an estimated

investment of US$5.5 billion over the next two years. Inland waterways account for

only 3% of Indias total transport, compared with 47% in China and 44% in the

European Union. The governments initiative to develop inland waterways is a big

business opportunity for the Indian ship building industry in the form of future

orders building dredgers and small bulk carrier vessels.

Defence sector liberalisation

The Indian government has taken steps to encourage the domestic defence ship

building industry. In August 2014, the foreign direct investment limit was increased

from 26% to 49% to cut imports by indigenising defence production. India is

among the top ten defence spenders in the world and such a move to encourage

domestic manufacturing bodes well for Indian ship builders with a defence

presence.

July 31, 2017 5

Cochin Shipyard Ltd | IPO Note

Ship repair segment to improve margins

CSLs ship repair revenue has grown by healthy CAGR of 17.5% over FY2013-17;

ship repair contribution to revenue has also increased from 17% in FY2013 to

26.4% in FY2017. Ship repair business has 2x margins than ship building and CSL

is the market leader in ship repair business with 39% market share which is 2x of

its closest peer Goa Shipyard.

Exhibit 5: Market Share of ship repair is ~2x of the closest peer

CSL 39%

Goa Shipyard 20%

Kakinada 11%

Hindustan 9%

L&T 9%

ABG 4%

Source: RHP,, Angel Research

Exhibit 6: Market that is expected to grow at ~10% (` in Cr)

1000

820-

900 920

800

700 530-

600 630

540

500

400

300

200

100

0

FY15 FY16 FY21P

Source: RHP, CRISIL Research, Angel Research

July 31, 2017 6

Cochin Shipyard Ltd | IPO Note

Setting up Dry Dock and international ship repair (ISRF)

CSL is in the process of setting up two new docks i.e. ship repair dock and ship

building dock. Once developed, we believe that these new facilities for

shipbuilding will expand CSLs existing capabilities significantly and help it build

and repair a broader variety of vessels including new generation aircraft carriers

and oil rigs, which are expected to be key growth drivers in the short to near long

term and ISRF will allow the company to undertake repair of a broader range of

vessels. Currently, it undertakes repairs of almost all categories of ships (including

air craft carriers - INS Viraat and INS Vikramaditya).

This would require capex of ~`2,700cr in the next 3 years. Strong liquidity

position, IPO proceeds and approval in process would help CSL to finish

expansion plans on time.

Strong financial performance, healthy Balance sheet

Despite global slowdown in commercial ship building, CSL has reported good set

of numbers during this period. It registered revenue and PAT CAGR of 11% and

19% respectively over FY2007-17. Margin has also expanded from 7.9% in

FY2007 to 18.4% in FY2017. Its liquidity position is best amongst the listed player

with negligible debt (`228cr) and cash & equivalent of ~`2,000cr as of FY2017.

CSL has posted superior return ratios over FY2012-17 (reported average RoEs,

ROCEs of 15.3%, 16.6% respectively).

However, private shipyards remain uncertain due to the stressed financial position

of major shipyards like ABG Shipyard, RDEL Shipyard and Bharati Defence and

Infrastructure Ltd.

Exhibit 7: Healthy Balance sheet (`in cr) Exhibit 8: Return ratios

2,500 30% 27%

1,991 25%

2,000 1,820 22% 21%

19%

20%

1,419 16% 17% 15% 15%

1,500

15%

1,000

704 10%

556

4%

500 340 290 5% 3%

247 228

5

0%

0

FY13 FY14 FY15 FY16 FY17

FY13 FY14 FY15 FY16 FY17

Cash Debt ROE ROCE

Source: RHP, Company Source: RHP, Company

July 31, 2017 7

Cochin Shipyard Ltd | IPO Note

Outlook & Valuation

In terms of valuation, pre- issue works out to 15.7x of FY2017 EPS (at the upper

end of the issue price band), which is reasonably priced on the back of (1)

healthy order book with execution capability and experienced management; (2)

Average RoE & ROCE for last 5 years +15%; (3) Despite cyclical business it has

maintained net cash positive balance sheet; (4) easing working capital cycle from

>195 days in FY2012 to current 59 days. Considering the past financial

performance of CSL and strong visibility on future growth, we rate this issue as

SUBSCRIBE.

Key Risk

High dependence on defence related projects

CSLs defence related projects have contributed 87.7%, 82.5%, 89.9% and 73.2%

to its revenues from operations in FY14, FY15, FY16 and H1FY17 respectively.

Further, CSL is currently building Indias first Indigenous Aircraft Carrier for the

Indian Navy.

Cyclical nature of commercial ship building

Worldwide demand and pricing in the commercial ship building industry are highly

dependent upon global economic conditions. If the global economy fails to grow

at an adequate pace, it may adversely impact the commercial shipbuilding

industry, which may negatively affect CSLs business, financial condition and

growth prospects.

Operations are based at a single shipyard at Kochi

The loss of, or shutdown of, operations at companys shipyard in Kochi will have a

material adverse effect on the business, financial condition and results of

operations.

Volatility in price of raw materials

The major components of CSLs expenditure include raw materials such as steel

and other materials, equipment and other components such as pumps, propellers

and engines. Any price escalation in the above materials may impact margin of

CSL.

July 31, 2017 8

Cochin Shipyard Ltd | IPO Note

Income Statement

Y/E March (` cr) FY2014 FY2015 FY2016 FY2017

Total operating income 1,798 1,583 1,990 2,059

% chg 7 (12) 26 3

Total Expenditure 1,381 1,494 1,598 1,679

Raw Material 990 1,141 1,230 1,314

Personnel 209 213 209 217

Others Expenses 182 140 159 148

EBITDA 417 89 392 380

% chg 18 (79) 339 (3)

(% of Net Sales) 23 6 20 18

Depreciation& Amortization 25 38 37 39

EBIT 391 52 355 342

% chg 17 (87) 588 (4)

(% of Net Sales) 22 3 18 17

Interest & other Charges 19 18 12 11

Other Income 61 77 107 149

(% of PBT) 14 70 24 31

Extraordinary Items 0 0 0 0

Share in profit of Associates - - - -

Recurring PBT 433 110 450 480

% chg 9 (74) 307 7

Tax 151 41 158 168

PAT (reported) 282 69 292 312

% chg 6 (75) 321 7

(% of Net Sales) 16 4 15 15

Basic & Fully Diluted EPS (Rs) 25 6 26 28

% chg 6 (75) 321 7

July 31, 2017 9

Cochin Shipyard Ltd | IPO Note

Balance Sheet

Y/E March (` cr) FY2014 FY2015 FY2016 FY2017

SOURCES OF FUNDS

Equity Share Capital 113 113 113 113

Reserves& Surplus 1376 1441 1711 1918

Shareholders Funds 1490 1554 1824 2031

Total Loans 340 247 290 228

Other Liab & Provision 18 19 19 21

Total Liabilities 1847 1820 2133 2280

APPLICATION OF FUNDS

Net Block 370 370 370 371

Capital Work-in-Progress 8 13 24 54

Investments 0 0 0 0

Current Assets 2155 2305 2506 2485

Inventories 396 303 232 186

Sundry Debtors 1203 583 454 307

Cash 556 1419 1820 1991

Loans & Advances 356 114 180 321

Other Assets 98 89 268 86

Current liabilities 1140 1071 1216 1036

Net Current Assets 1015 1234 1291 1448

Other Non Current Asset

Total Assets 1847 1820 2133 2280

July 31, 2017 10

Cochin Shipyard Ltd | IPO Note

Cash Flow Statement

Y/E March (` cr) FY2014 FY2015 FY2016 FY2017

Profit before tax 433 110 450 480

Depreciation 22 35 34 36

Change in Working Capital (496) 738 173 362

Interest / Dividend (Net) (51) (54) (99) (131)

Direct taxes paid (88) (75) (133) (150)

Others (404) (92) (385) (385)

Cash Flow from Operations (584) 663 40 212

(Inc.)/ Dec. in Fixed Assets (151) (35) (35) (40)

(Inc.)/ Dec. in Investments 166 50 81 105

Cash Flow from Investing 15 16 47 65

Issue of Equity - - - -

Inc./(Dec.) in loans 123 - - -

Others 148 (235) (32) (113)

Cash Flow from Financing 271 (235) (32) (113)

Inc./(Dec.) in Cash (298) 444 55 165

Opening Cash balances 311 13 457 511

Closing Cash balances 13 457 511 676

Key Ratio

Y/E March FY2013 FY2014 FY2015 FY2016 FY2017

P/E (on FDEPS) 18.4 17.4 70.6 16.8 15.7

P/CEPS 17.2 15.9 45.7 14.9 14.0

P/BV 4.0 3.3 3.1 2.7 2.4

EV/Sales 2.5 2.6 3.6 3.0 2.8

EV/EBITDA 11.9 11.2 63.2 15.3 15.2

EV / Total Assets 3.4 2.5 3.1 2.8 2.5

Per Share Data (`)

EPS (Basic) 23.5 24.9 6.1 25.8 27.6

EPS (fully diluted) 19.6 20.7 5.1 21.5 23.0

Cash EPS 25.2 27.1 9.4 29.0 31.0

DPS 1.5 1.5 1.5 1.5 1.6

Book Value 108.2 131.5 137.2 161.0 179.3

Returns (%)

ROCE 27.1 21.4 2.9 16.8 15.1

Angel ROIC (Pre-tax) 82 30 13 123 146

ROE 21.7 18.9 4.5 16.0 15.4

Turnover ratios (x)

Inventory / Sales (days) 77 80 70 42 33

Receivables (days) 149 244 134 83 54

Payables (days) 30 35 39 38 29

Working capital cycle (ex-cash) (days) 195 290 165 87 59

Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

July 31, 2017 11

Cochin Shipyard Ltd | IPO Note

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as Angel) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

July 31, 2017 12

You might also like

- Prestige Estates - Initiating coverage-Oct-23-NUVAMADocument54 pagesPrestige Estates - Initiating coverage-Oct-23-NUVAMAalfaresearch1No ratings yet

- SOC TrainingDocument27 pagesSOC Trainingdurgasainath100% (5)

- Cochin ShipyardDocument93 pagesCochin ShipyardSivinnn100% (1)

- Statistics of Indian Ship Buidling and Ship RepairngDocument81 pagesStatistics of Indian Ship Buidling and Ship RepairngbkrNo ratings yet

- Cochin Shipyard LTD - : A Robust Play On India DefenceDocument14 pagesCochin Shipyard LTD - : A Robust Play On India DefencepremNo ratings yet

- Action Construction Equipment: Turn-Around On The CardsDocument21 pagesAction Construction Equipment: Turn-Around On The CardsGirish S ReddyNo ratings yet

- Firstsource Solutions (FIRSOU) : H2FY17E Expected To Be BetterDocument12 pagesFirstsource Solutions (FIRSOU) : H2FY17E Expected To Be BetterDeep Run WatersNo ratings yet

- CFRA GROUP 10 Ultratech CementsDocument16 pagesCFRA GROUP 10 Ultratech CementsSitu MohantyNo ratings yet

- Kirloskar Brothers LTD - Q2FY24 Result Update - 09112023 - 09-11-2023 - 09Document9 pagesKirloskar Brothers LTD - Q2FY24 Result Update - 09112023 - 09-11-2023 - 09Sunil KNo ratings yet

- Shipping Corporation of IndiaDocument21 pagesShipping Corporation of IndiaNitish GuptaNo ratings yet

- IDirect NCC ConvictionIdeaDocument8 pagesIDirect NCC ConvictionIdeaVivek GuptaNo ratings yet

- Cochin Shipyard: Capital GoodsDocument8 pagesCochin Shipyard: Capital GoodsSonakshi AgarwalNo ratings yet

- SAIL - Q1FY24 Result Update - 14082023 - 14-08-2023 - 09Document8 pagesSAIL - Q1FY24 Result Update - 14082023 - 14-08-2023 - 09Sanjeedeep Mishra , 315No ratings yet

- Axis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument7 pagesAxis Bank LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Voltas LTD: Strong Performance of UCP SegmentDocument10 pagesVoltas LTD: Strong Performance of UCP SegmentVipul Braj BhartiaNo ratings yet

- Kalpataru Power Transmission LTD.: Edelweiss Professional Investor ResearchDocument19 pagesKalpataru Power Transmission LTD.: Edelweiss Professional Investor ResearchDhavalNo ratings yet

- KMI KML Kinder Morgan Dec 06 2017 Investor Presentation Slide Deck PDFDocument60 pagesKMI KML Kinder Morgan Dec 06 2017 Investor Presentation Slide Deck PDFAla BasterNo ratings yet

- Kpil 9 2 24 PLDocument8 pagesKpil 9 2 24 PLrmishraNo ratings yet

- Insight Alpha - 20210726 - GHNL PA - Venturing Into The SUV SegmentDocument5 pagesInsight Alpha - 20210726 - GHNL PA - Venturing Into The SUV SegmentMuhammad Ovais AhsanNo ratings yet

- Ashok Leyland: Preparing To Reap Fruits When The Recovery StartsDocument10 pagesAshok Leyland: Preparing To Reap Fruits When The Recovery StartsKiran KudtarkarNo ratings yet

- Allcargo Global Logistics Motilal Oswal Religare PLDocument27 pagesAllcargo Global Logistics Motilal Oswal Religare PLarif420_999No ratings yet

- IDirect PrimaPlastics CoUpdate Jun19Document4 pagesIDirect PrimaPlastics CoUpdate Jun19Alokesh PhukanNo ratings yet

- ICICI Securities LTD ResultDocument8 pagesICICI Securities LTD Resultchandan_93No ratings yet

- SobhaDocument21 pagesSobhadigthreeNo ratings yet

- ReNew Power BL 17jan2019Document5 pagesReNew Power BL 17jan2019HEM BANSALNo ratings yet

- JM - RepcohomeDocument12 pagesJM - RepcohomeSanjay PatelNo ratings yet

- Cochin PDFDocument8 pagesCochin PDFdarshanmadeNo ratings yet

- Axis Bank - 03 - 03 - 2023 - Khan030323Document7 pagesAxis Bank - 03 - 03 - 2023 - Khan030323Ranjan SharmaNo ratings yet

- International Steel Growth StoryDocument3 pagesInternational Steel Growth StoryhammmyyyNo ratings yet

- Ashok Leyland Q3FY19 Result UpdateDocument4 pagesAshok Leyland Q3FY19 Result Updatekapil bahetiNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- AngelBrokingResearch STFC Result Update 3QFY2020Document6 pagesAngelBrokingResearch STFC Result Update 3QFY2020avinashkeswaniNo ratings yet

- Nirmal Bang On CCL Products - Upside of 20%Document7 pagesNirmal Bang On CCL Products - Upside of 20%Alok DashNo ratings yet

- IDirect GEShipping Q1FY16Document12 pagesIDirect GEShipping Q1FY16valueinvestor123No ratings yet

- RBC August 2015 PDFDocument13 pagesRBC August 2015 PDFtheredcornerNo ratings yet

- Capital FirstDocument34 pagesCapital FirstgreyistariNo ratings yet

- DCB Bank Limited: Investing For Growth BUYDocument4 pagesDCB Bank Limited: Investing For Growth BUYdarshanmadeNo ratings yet

- Havells India: Added Aspirational PortfolioDocument10 pagesHavells India: Added Aspirational PortfolioDinesh ChoudharyNo ratings yet

- Hindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Document9 pagesHindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Nikhil GadeNo ratings yet

- Corporate Accounting II Assignment - Oman Fisheries Company SAOGDocument10 pagesCorporate Accounting II Assignment - Oman Fisheries Company SAOGHussna Al-Habsi حُسنى الحبسيNo ratings yet

- GE Shipping BUY: Result UpdateDocument9 pagesGE Shipping BUY: Result UpdateAshokNo ratings yet

- GE Shipping BUY: Result UpdateDocument9 pagesGE Shipping BUY: Result UpdateAshokNo ratings yet

- Gulf Oil - Update - Jul19 - HDFC Sec-201907111135493400922Document18 pagesGulf Oil - Update - Jul19 - HDFC Sec-201907111135493400922nareshjsharma1654No ratings yet

- JSW Steel - AR 2020 FinalDocument368 pagesJSW Steel - AR 2020 FinalRitika Chavhan0% (1)

- Press Release: YFC Projects Private LimitedDocument5 pagesPress Release: YFC Projects Private Limitedlalit rawatNo ratings yet

- Shriram Transport Finance: CMP: INR1,043 Growth DeceleratingDocument14 pagesShriram Transport Finance: CMP: INR1,043 Growth DeceleratingDarshitNo ratings yet

- AIA Engineering LTD: Q3FY18 Result UpdateDocument6 pagesAIA Engineering LTD: Q3FY18 Result Updatesaran21No ratings yet

- Nagarjuna Construction (NAGCON) : Rising Debt Level To Restrict Earnings GrowthDocument6 pagesNagarjuna Construction (NAGCON) : Rising Debt Level To Restrict Earnings GrowthEquity DynamicsNo ratings yet

- SML Isuzu: PCG ResearchDocument9 pagesSML Isuzu: PCG ResearchumaganNo ratings yet

- Edelweiss Financial: Continuous Divestment in Key Subsidiaries ContinuesDocument7 pagesEdelweiss Financial: Continuous Divestment in Key Subsidiaries ContinuesAshish AwasthiNo ratings yet

- Jet Airways : Naresh Goyal Incorporated The Business $1 Billion Revenue Jet Konnect Naresh Goyal Stepped DownDocument6 pagesJet Airways : Naresh Goyal Incorporated The Business $1 Billion Revenue Jet Konnect Naresh Goyal Stepped DownJyothish JbNo ratings yet

- AIA-Engineering-Limited 27 QuarterUpdateDocument12 pagesAIA-Engineering-Limited 27 QuarterUpdatevalueinvestor123No ratings yet

- MOSL Ashok Leyland Comprehensive ReportDocument34 pagesMOSL Ashok Leyland Comprehensive Reportrchawdhry123No ratings yet

- STX OSV Holdings LimitedDocument34 pagesSTX OSV Holdings LimitedKyithNo ratings yet

- Voltamp Transformers LTD: Invest ResearchDocument8 pagesVoltamp Transformers LTD: Invest ResearchDarwish MammiNo ratings yet

- IDirect Symphony Q2FY22Document8 pagesIDirect Symphony Q2FY22darshanmaldeNo ratings yet

- China Everbright Water: China / Hong Kong Company GuideDocument11 pagesChina Everbright Water: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- 23.prince Pipes Initial (HDFC)Document20 pages23.prince Pipes Initial (HDFC)beza manojNo ratings yet

- Paper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingShyam virsinghNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- The Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?From EverandThe Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?No ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Pacific Private Sector Development Initiative: A Decade of Reform: Annual Progress Report 2015-2016From EverandPacific Private Sector Development Initiative: A Decade of Reform: Annual Progress Report 2015-2016No ratings yet

- How To Conduct A Risk AssessmentDocument23 pagesHow To Conduct A Risk Assessmentdurgasainath100% (1)

- AngelBrokingResearch SpandanaSpoorty LTD IPO 03082019Document7 pagesAngelBrokingResearch SpandanaSpoorty LTD IPO 03082019durgasainathNo ratings yet

- Security Tips: Mississippi Department of Information Technology ServicesDocument2 pagesSecurity Tips: Mississippi Department of Information Technology ServicesdurgasainathNo ratings yet

- IRCTC IPONoteDocument8 pagesIRCTC IPONotedurgasainathNo ratings yet

- Information Security Auditor: Delhi/Mumbai - Experience: 3 To 5 YearsDocument1 pageInformation Security Auditor: Delhi/Mumbai - Experience: 3 To 5 YearsdurgasainathNo ratings yet

- GDPR Compliance On AWSDocument32 pagesGDPR Compliance On AWSdurgasainathNo ratings yet

- Student Result Management System PDFDocument1 pageStudent Result Management System PDFdurgasainathNo ratings yet

- Dde UgcDocument5 pagesDde UgcdurgasainathNo ratings yet

- AngelBrokingResearch GNAAxels IPONote 090916Document12 pagesAngelBrokingResearch GNAAxels IPONote 090916durgasainathNo ratings yet

- Aviatrix GCP UservpnDocument10 pagesAviatrix GCP UservpndurgasainathNo ratings yet

- 2016 10 Beware of MalwareDocument2 pages2016 10 Beware of MalwaredurgasainathNo ratings yet

- Top 10 Pci Dss Compliance PitfallsDocument4 pagesTop 10 Pci Dss Compliance PitfallsdurgasainathNo ratings yet

- AngelBrokingResearch AdvancedEnzymeTechnologies IPONote 180716Document11 pagesAngelBrokingResearch AdvancedEnzymeTechnologies IPONote 180716durgasainathNo ratings yet

- AngelBrokingResearch QuickHeal IPONote 060216Document14 pagesAngelBrokingResearch QuickHeal IPONote 060216durgasainathNo ratings yet

- AngelBrokingResearch SHKelkar&Company IPONote 271015Document11 pagesAngelBrokingResearch SHKelkar&Company IPONote 271015durgasainathNo ratings yet

- AngelBrokingResearch HealthcareGlobalEnterprises IPONote 150316Document9 pagesAngelBrokingResearch HealthcareGlobalEnterprises IPONote 150316durgasainathNo ratings yet

- AngelBrokingResearch L&TTechnologyServices IPONote 090916Document18 pagesAngelBrokingResearch L&TTechnologyServices IPONote 090916durgasainathNo ratings yet

- AngelBrokingResearch NarayanaHrudayalaya IPONote 161215Document13 pagesAngelBrokingResearch NarayanaHrudayalaya IPONote 161215durgasainathNo ratings yet

- AngelBrokingResearch MahanagarGas IPONote 200616Document16 pagesAngelBrokingResearch MahanagarGas IPONote 200616durgasainathNo ratings yet

- AngelBrokingResearch ParagMilkFoods IPONote 030516Document11 pagesAngelBrokingResearch ParagMilkFoods IPONote 030516durgasainathNo ratings yet

- AngelBrokingResearch InterglobeAviation IPONote 231015Document12 pagesAngelBrokingResearch InterglobeAviation IPONote 231015durgasainathNo ratings yet

- AngelBrokingResearch HPLElectric&Power IPONote 200916Document12 pagesAngelBrokingResearch HPLElectric&Power IPONote 200916durgasainathNo ratings yet

- 3annual-Reports SCI PDFDocument96 pages3annual-Reports SCI PDFsharmil92No ratings yet

- Group:: Project Guide: MR Biju NairDocument12 pagesGroup:: Project Guide: MR Biju NairdelvinNo ratings yet

- Shipyard ReportDocument10 pagesShipyard Reportvarsha raichalNo ratings yet

- CSL ReportDocument49 pagesCSL ReportAravind SNo ratings yet

- Cochin PDFDocument8 pagesCochin PDFdarshanmadeNo ratings yet

- TENDER EOI Cochin ShipyardDocument18 pagesTENDER EOI Cochin ShipyardMadhu KumarNo ratings yet

- Cochin Shipyard Limited Investor Presentation - Q4-FY22 EarningsDocument19 pagesCochin Shipyard Limited Investor Presentation - Q4-FY22 EarningsBeasF137No ratings yet

- Tendernotice 1Document66 pagesTendernotice 1AraduF89No ratings yet

- Cochin ShipyardDocument2 pagesCochin ShipyardATHUL KRISHNAN C RNo ratings yet

- CSL Final - 3Document132 pagesCSL Final - 3adarshkalladayilNo ratings yet

- Reference List 2008-08Document156 pagesReference List 2008-08PamellaNo ratings yet

- Shipyard Report PDFDocument10 pagesShipyard Report PDFvarsha raichalNo ratings yet

- Ministrty of ShippingDocument81 pagesMinistrty of ShippingEshwar BabuNo ratings yet

- Opportunities For Equipment Suppliers in Indian ShipbuildingDocument12 pagesOpportunities For Equipment Suppliers in Indian ShipbuildingAnonymous gUtECBGSlLNo ratings yet

- Cochin Concall - 14th 11 AmDocument3 pagesCochin Concall - 14th 11 AmVikas GNo ratings yet

- Cochin ShipyardDocument19 pagesCochin ShipyardJatin SoniNo ratings yet

- Money Times Tower Talk - 26th Nov'18Document20 pagesMoney Times Tower Talk - 26th Nov'18DeepakGarudNo ratings yet

- Cochin Shipyard 2018-19 Anual Statement PDFDocument243 pagesCochin Shipyard 2018-19 Anual Statement PDFbrijanyaNo ratings yet

- Cochin Shipyard Limited (CSL) Investor Presentation - FY23 Financial Results and Updates May 2023Document28 pagesCochin Shipyard Limited (CSL) Investor Presentation - FY23 Financial Results and Updates May 2023BeasF137No ratings yet

- CSL Investor Presentation Aug 18Document21 pagesCSL Investor Presentation Aug 18gopalptkssNo ratings yet

- Placement Brochure 2020-21 PDFDocument18 pagesPlacement Brochure 2020-21 PDFDarshanNo ratings yet

- Cochin Shipyard LTD - : A Robust Play On India DefenceDocument14 pagesCochin Shipyard LTD - : A Robust Play On India DefencepremNo ratings yet