Professional Documents

Culture Documents

Delta Case Solution 1

Delta Case Solution 1

Uploaded by

Ruben de KoningOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Delta Case Solution 1

Delta Case Solution 1

Uploaded by

Ruben de KoningCopyright:

Available Formats

lOMoARcPSD|1767339

Delta Beverage Case

Consultancy Report: A critical Analysis of

Financial Statements

Jasper Frankin 2055708

Chantal Kappel 2562360

Jeroen Rozendaal 2547555

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

Table of Contents

Introduction of Delta Beverage ..................................................................................................... 3

Current situation .......................................................................................................................... 3

Ratios .................................................................................................................................................... 7

Different scenarios without hedge ............................................................................................... 8

Different scenarios with hedge .................................................................................................. 10

Conclusion ................................................................................................................................. 11

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

Introduction of Delta Beverage

Delta Beverage is one of the top five bottlers of Pepsi in the United States. Over the course of time

this giant has been balancing on the brink of default. In a nick of time new management has been

assigned to take over and foster Delta Beverage back to a financially healthy state, and with success.

Current management was able to vigorously attack the cost structure of the company and as a result,

stopped the price fall and the decline in market share. Nevertheless, Delta Beverage is not in the

clear yet. Net income is still negative and the company has been marked by high leverage. Moreover,

the company was unable to deliver to the agreements in the debt covenant, this lead to a

restructuring of the companys finances in 1993. However, currently, the CFO of DBG is faced with a

new hurdle to overcome since, the price of aluminum has increased. This may potentially harm the

firm since, a large part of its revenues is obtained from producing and selling not just bottled soft

drinks, but primarily aluminum cans.

This report attempts to shed a light on the possible threat, by means of a holistic analysis. Firstly,

some key financial ratios will be presented to assess the current situation. Secondly, the

development path of three potential alternative outcomes will be depicted. The results will be

elaborated in the conclusion, together with the recommendations.

Current situation

From the financial information it can be seen that DBG the market for soft drinks and beverages is

close to being saturated. The demand for these products has mainly been on a decline. However,

DBG still manages to keep growing, mainly by the acquisitions it has done. The ratios below will help

in assessing the current situation of the company in order to set a strategy for the future.

Financial ratio analysis:

This section will discuss some of the key financial ratios, which give more clarity of the state of the

company and how it has developed over the last five years. The first set of financial ratios that are

going to be discussed are the ratios that focus on analyzing the liquidity and profitability of the firm.

Current Ratio 1989 1990 1991 1992 1993

Total Current Assets 39.254 33.196 36.204 41.349 50.192

Total Current Liabilities 22.733 19.233 21.998 27.291 18.147

Current Ratio 1,727 1,726 1,646 1,515 2,766

The company overall has an excess of current liabilities and on average the company has 1.876 times

the amount to pay for its current liabilities. This looks quite good since, net working capital is

positive. Moreover, this outcome indicates that the company does not have any trouble paying its

debt for the next 12 months. However, the current ratio does not take the maturity into account of

the different debt obligations. Furthermore, the current ratio of 1993 is quite high compared to the

rest. This could be an indication of inefficient use of short-term assets.

Cash Ratio 1989 1990 1991 1992 1993

Cash 5621 3053 4032 11327 17272

Total Current Liabilities 22.733 19.233 21.998 27.291 18.147

Cash Ratio 0,247 0,159 0,183 0,415 0,952

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

Cash can be more easily used to pay of current liabilities than current assets. The cash ratio is

therefore a helpful tool in analyzing a firms liquidity. The table shows a slight decrease in the

beginning, but thereafter the proportion of cash to current liabilities is increasing and it already looks

much better than previous years. However, having a lot of cash may also show an inefficiency, or that

the company is stagnating in its growth. In the case of DBG, the cash could be well spent on paying

some of the debt payments in order to raise the level of trust of the creditors.

Quick Ratio 1989 1990 1991 1992 1993

Total Current Assets 39.254 33.196 36.204 41.349 50.192

Total Current Liabilities 22.733 19.233 21.998 27.291 18.147

Inventory 8.893 6.726 9.808 10.607 10.104

Quick Ratio 1,336 1,376 1,200 1,126 2,209

The quick ratio is similar to the current ratio only it deducts the inventory, simply because it is

believed that inventory cannot be easily converted into cash and therefore should not be included. In

general the quick ratio is positive, indicating that the company has enough quick assets to pay for its

current liabilities

Return on Assets (ROA) 1989 1990 1991 1992 1993

Net Income -18.866 -17.432 -14.835 -14.015 -7.877

Total Assets 223.334 210.069 203.999 210.438 213.705

ROA -0,084 -0,083 -0,073 -0,067 -0,037

The table shows a negative ROA, which is caused by the negative net income. Even though the ROA is

negative, there is still a visible silver lining, due to an increase in the ROA over the years. This

indicates that the loss/profit generated from the assets is decreasing/increasing, because the

company becomes more efficient in using assets to generate profit.

Return on Equity (ROE) 1989 1990 1991 1992 1993

Net Income -18.866 -17.432 -14.835 -14.015 -7.877

Total Assets 223.334 210.069 203.999 210.438 213.705

Total liabilities 188.484 181.543 186.262 206.752 166.572

Shareholders Equity 34.850 28.526 17.737 3.686 47.133

ROE -0,541 -0,611 -0,836 -3,802 -0,167

The ROE shows the proportion of profit the company makes with respect to the value of its equity.

Therefore, a higher ROE is considered to be better. For the case of DBG, it can be observed from the

table above that the restructuring is really paying of. While still negative, the ROE does show a

significant improvement between 1991 and 1993. This is a result from a decrease in the loss of profit

and an increase in the amount of equity.

Profit Margin 1989 1990 1991 1992 1993

Net Income -18.866 -17.432 -14.835 -14.015 -7.877

Net Sales 147.956 155.644 163.775 170.285 197.848

Profit Margin -0,128 -0,112 -0,091 -0,082 -0,040

From the table above it can be seen that the company has not been able to make a profit with

respect to the sales it makes. However, the level of this loss gradually diminishes, thereby portraying

the picture of a company that is well on its way of making a comeback.

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

The next section will discuss the ratios that assess the level of leverage a company has.

Debt to Equity Ratio 1989 1990 1991 1992 1993

Total liabilities 188.484 181.543 186.262 206.752 166.572

Shareholders Equity 34.850 28.526 17.737 3.686 47.133

Debt to Equity Ratio 5,41 6,36 10,50 56,09 3,53

From the table it can be seen that a majority of the assets are financed by debt. This is because the

debt to equity ratio is clearly well over 1. In 1992 DBG engaged in a number of acquisitions. This

explains the enormous debt to equity ratio of this year. Thereafter, the company took several

measures to bring this ratio back to healthier proportions with lower leverage in order to manage the

risk.

Dept Ratio 1989 1990 1991 1992 1993

Total Assets 223.334 210.069 203.999 210.438 213.705

Shareholders Equity 34.850 28.526 17.737 3.686 47.133

Total Liabilities 188.484 181.543 186.262 206.752 166.572

Dept Ratio 0,844 0,864 0,913 0,982 0,779

An overall debt ratio below 1 indicates that the company has more assets than debt, which is

positive. The higher this ratio is, the riskier the business.

Equity Multiplier 1989 1990 1991 1992 1993

Total Assets 223.334 210.069 203.999 210.438 213.705

Shareholders Equity 34.850 28.526 17.737 3.686 47.133

Equity multiplier 6,41 7,36 11,50 57,09 4,53

The multiplier is a variation of the debt to equity ratio. It gives an indication of the proportion of

asset financing that is been done by debt. The table shows that the company has already taken

actions to bring back the asset financing to more sustainable alternatives than debt.

Cash Coverage Ratio 1989 1990 1991 1992 1993

Operating Earnings (EBIT) 7.095 10.051 12.009 14.038 18.812

Depreciation 7.876 7.236 5.962 6.112 7.162

Total Interest Expense 18.950 19.665 19.245 19.358 16.861

Cash Coverage Ratio 0,790 0,879 0,934 1,041 1,540

The cash coverage ratio shows that before 1992, the company was unable to pay for its interest

expense. From 1992 the ratio has improved but still the company has very little money left after

repaying its interest.

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

The income statement below shows the current situation, but also reveals forecasting figures up to

1996. Underneath the income statement is a specification of the numbers and what they are based

on. The forecast of the numbers in the income statement are based on the assumption that

aluminum prices remain the same.

Income Statement (in thousands of U.S.) Table 1

Year 1993 1994 1995 1996

Revenue $231.207 $240.473 $257.931 $276.657

Sales Mix aluminium $138.724 $144.284 $154.759 $165.994 60%

pet $60.114 $62.523 $67.062 $71.931 26%

contract $32.369 $33.666 $36.110 $38.732 14%

Total $231.207 $240.473 $257.931 $276.657

COGS

Aluminium $101.269 $105.327 $112.974 $121.176 27%

pet $37.271 $38.764 $41.579 $44.597 38%

contracts $17.479 $18.180 $19.500 $20.915 46%

Total

costs $156.018 $162.271 $174.052 $186.688

Gross profit $75.189 $78.202 $83.879 $89.969

selling expenses $36.791 $39.024 $41.393 $43.906

general expenses $20.561 $22.535 $24.698 $27.069

EBIT $17.837 $16.643 $17.788 $18.994

Depriciation & amortization $12.816 $12.175 $11.566 $10.988

EBITDA $30.653 $28.818 $29.354 $29.982

Tonnes of aluminium $7.938 $8.256 $8.756 $9.286

Futures $318 $330 $350 $371

Revenue = based on averaged growth rate of 1989-1993

Selling expenses = average growth rate of 1989-1993

General expenses = average growth rate of 1989-1993

Depreciation & amortization = average growth rate of 1989-1993

Capital expenditure = average of 1989-1993

Debt = debt mandatory prepayments (Exhibit 5)

Interest expenses = interest expenses as a percentage of total debt, averaged for the

period 1989-1993

Cash interest paid = Average of 1990-1993 of (cash interest expense/total interest

expense)

Current liabilities = average of 1989-1993

Volume growth = average volume growth 1989-1994 (of which 1994 is a given 4%)

Interest = interest expanses/debt = 16861/141149 = 12%

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

the assumption that the aluminum prices will be the same in the coming years. With the different

figures the ratios are calculated.

Ratios

1993 1994 1995 1996

Senior leverage ratio 4,84 5,01 4.72 4.42 <5.00

Total leverage ratio 4,60 4,76 4,47 4.17 <6.25

Interest coverage ratio 2,67 2,58 2.75 2.94 >2

Debt service coverage ratio 1,42 1,35 1.44 1.55 >1.25

The ratios above are calculated with the assumption that the aluminum prices will remain stable for

the year 1995 and 1996. The only thing that has changed is the volume increase and the total

amount of tones aluminum that is needed. The most important ratio is the interest coverage ratio,

when this is dropping below 2 the company is in default.

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

Different scenarios without hedge

The three tables below show three different scenarios. In scenario 1 the aluminum prices will

increase with 10%, in scenario 2 with 15% and in scenario 3 with 20%. Also is shown what this

changes will do with the different contractual ratios.

Scenario 1 1993 1994 1995 1996

10% 10%

Aluminium COGS $101.269 $105.327 $115.860 $127.446 49% packing

Gross profit $75.189 $78.202 $80.993 $83.699

EBIT $17.837 $16.643 $14.902 $12.724

EBITDA $30.653 $28.818 $26.468 $23.712

Scenario 2 1993 1994 1995 1996

15% 15%

Aluminium $101.269 $105.327 $117.020 $125.621 49% packing

Gross profit $75.189 $78.202 $79.833 $85.524

EBIT $17.837 $16.643 $13.742 $14.549

EBITDA $30.653 $28.818 $25.308 $25.537

Scenario 3 1993 1994 1995 1996

20% 20%

Aluminium $101.269 $105.327 $119.691 $131.421 49% packing

Gross profit $75.189 $78.202 $77.162 $79.724

EBIT $17.837 $16.643 $11.071 $8.749

EBITDA $30.653 $28.818 $22.637 $19.737

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

Ratio's without Hedge

1993 1994 1995 1996

Price

increase

Senior leverage ratio 10% 4,84 5,01 5,23 5,58 <5.00

15% 4,84 5,01 5,47 5,19

20% 4,84 5,01 6,11 6,71

Total leverage ratio 10% 4,60 4,76 4,96 5,28 <6.25

15% 4,60 4,76 5,18 4,90

20% 4,60 4,76 5,79 6,34

Interest coverage ratio 10% 2,67 2,58 2,48 2,33 >2

15% 2,67 2,58 2,37 2,51

20% 2,67 2,58 2,12 1,94

Debt service coverage ratio 10% 1,42 1,35 1,26 1,14 >1.25

15% 1,42 1,35 1,19 1,26

20% 1,42 1,35 1,01 0,87

The ratios above show that there is only a need for a hedge if the price will rise with 20% in 1995 and

also with 20% in 1996. We also looked at the interest coverage ratio under the assumption of a price

increase of 30 and 40%, as shown in the table below. When the prices rise with these percentages

there is a need to hedge because the company will otherwise fall in default, due to the fact that the

interest coverage ratio falls below 2 for these situations.

Interest coverage ratio 1993 1994 1995 1996

30% 2,67 2,58 2,49 1,90

40% 2,67 2,58 1,99 0,67

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

Different scenarios with hedge

The following tables show the financial results for the period 1993-1996 when Delta opts to hedge

the aluminum price using a 15 month and 27 month future. Furthermore, the effects of this decision

on the contractual ratios are shown. As can be expected, the 27 months future allows for a bigger

initial investment, but pays off in the long run in comparison with the 15 month hedge.

Scenario 1, 15 month hedge 1993 1994 1995 1996

6,3% 16,8%

Aluminium $101.269 $109.008 $112.373 $121.624 49% Packing

Gross profit $75.189 $80.935 $93.733 $101.124

EBIT $17.837 $19.376 $27.642 $30.150

EBITDA $30.653 $31.551 $39.208 $41.138

1993 1994 1995 1996

Senior leverage ratio 4,84 4,58 3,53 3,22 <5

Total leverage ratio 4,60 4,35 3,34 3,04 <6.25

Interest coverage ratio 2,67 2,83 3,67 4,04 >2

Debt service coverage

ratio 1,42 1,51 2,07 2,30 >1.25

Scenario 2, 27 month hedge 1993 1994 1995 1996

8,70% 0%

Aluminium $101.269 $109.008 $113.655 $113.655 49% Packing

Gross profit $75.189 $80.935 $92.451 $109.093

EBIT $17.837 $19.376 $26.360 $38.119

EBITDA $30.653 $31.551 $37.926 $49.107

1993 1994 1995 1996

Senior leverage ratio 4,84 4,58 4,34 4,23 <5

Total leverage ratio 4,60 4,35 4,11 3,99 <6.25

Interest coverage ratio 2,67 2,83 2,99 3,08 >2

Debt service coverage

ratio 1,42 1,51 1,61 1,65 >1.25

10

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

lOMoARcPSD|1767339

Conclusion

The conclusion of this report is that hedge in only necessary if the price of aluminum will rise with

20% in 1995 and 1996. The company than should take a 27 month hedge. When the prices rise with a

even bigger percentage the company has to hedge earlier. Because the company has been in default

before the manager can take a hedge to be certain that the companys interest coverage ratio is

above 2. Because the aluminum prices are raised by 22% in the period July 1993 June 1994 it is

possible that the prices will rise with 20% each year in a period of 2 years. The aluminum price

volatilities is 30.4%. So to be certain the company will not fall in default again, we recommend a

hedge for Delta beverage. When this hedge is taken Delta Berverage will not fall in default. The

hedge is given a certainty to the managers of Delta Berverage that the possible rise of aluminum

prices will not lead to a default.

11

Verspreiden niet toegestaan | Gedownload door Ruben de Koning (rubendekoning.ps3@gmail.com)

You might also like

- Delta Beverage Case With HedgingDocument7 pagesDelta Beverage Case With HedgingMorsalNo ratings yet

- Delta Beverages Case Group 3Document7 pagesDelta Beverages Case Group 3Ayşegül YildizNo ratings yet

- Target Corporation: Ackman Versus The Board: FM2 Case Study AnalysisDocument6 pagesTarget Corporation: Ackman Versus The Board: FM2 Case Study AnalysisSuman MandalNo ratings yet

- Panera Bread Company Caso 4 PDFDocument7 pagesPanera Bread Company Caso 4 PDFMARTHA GUEVARANo ratings yet

- Obscurity: Undesirability: P/E: Screening CriteriaDocument21 pagesObscurity: Undesirability: P/E: Screening Criteria/jncjdncjdnNo ratings yet

- Case Study - Corp Finance - Padgett Paper ProductsDocument26 pagesCase Study - Corp Finance - Padgett Paper ProductsJed Estanislao100% (1)

- LoewenDocument3 pagesLoewenAmit SurveNo ratings yet

- (Holy Balance Sheet) Jones Electrical DistributionDocument29 pages(Holy Balance Sheet) Jones Electrical DistributionVera Lúcia Batista SantosNo ratings yet

- Asahi Case Final FileDocument4 pagesAsahi Case Final FileRUPIKA R GNo ratings yet

- Delta BeverageDocument7 pagesDelta BeverageMorsal SarwarzadehNo ratings yet

- Delta Beverage Group CaseDocument6 pagesDelta Beverage Group CaseMaurits Munninghoff75% (4)

- Nu WareDocument22 pagesNu WaresslbsNo ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Wrigley CaseDocument12 pagesWrigley Caseresat gürNo ratings yet

- NuWare 1 PagerDocument1 pageNuWare 1 Pagervelusn100% (1)

- The Financial Detective ASLIDocument5 pagesThe Financial Detective ASLIAntonius CliffSetiawanNo ratings yet

- Dozier Hedging AlternativesDocument2 pagesDozier Hedging Alternativesacastillo1339No ratings yet

- FM Assignment 2 - Delta - BeveragesDocument5 pagesFM Assignment 2 - Delta - BeveragesTanisha GuptaNo ratings yet

- Delta CaseDocument5 pagesDelta CaseTarllingNo ratings yet

- Delta Beverage - CaseDocument16 pagesDelta Beverage - CaseHasan Md ErshadNo ratings yet

- Delta Beverage Group, Inc. - FINALDocument23 pagesDelta Beverage Group, Inc. - FINALjk kumarNo ratings yet

- DeltaBeverageCase PDFDocument8 pagesDeltaBeverageCase PDFAsri ZefanyaNo ratings yet

- Case Delta Beverage Group 7Document8 pagesCase Delta Beverage Group 7Wouter Hendriksen100% (1)

- Delta BeverageDocument4 pagesDelta BeverageNail1989No ratings yet

- Calculating The NPV of The AcquisitionDocument23 pagesCalculating The NPV of The Acquisitionkooldude1989100% (1)

- M&a Assignment 2 Group 14Document4 pagesM&a Assignment 2 Group 14Digraj Mahanta100% (1)

- GE Class E Contingent NoteDocument7 pagesGE Class E Contingent NoteSureshNo ratings yet

- Dividend Policy at FPL Group: Submitted byDocument13 pagesDividend Policy at FPL Group: Submitted byismathNo ratings yet

- Target CorporationDocument20 pagesTarget CorporationAditiPatilNo ratings yet

- Case StudyDocument5 pagesCase StudynanthamkNo ratings yet

- O.M Scoott and Sons Case Study HarvardDocument6 pagesO.M Scoott and Sons Case Study Harvardnicole rodríguezNo ratings yet

- Clarkson Lumber Analysis - TylerDocument9 pagesClarkson Lumber Analysis - TylerTyler TreadwayNo ratings yet

- Gemini ElectronicsDocument1 pageGemini ElectronicsSreeda PerikamanaNo ratings yet

- Bed Bath Beyond (BBBY) Stock ReportDocument14 pagesBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- Acova Radiateurs (v7)Document4 pagesAcova Radiateurs (v7)Sarvagya JhaNo ratings yet

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- General Mills' PaperDocument9 pagesGeneral Mills' PaperSarah McDermottNo ratings yet

- Case 5 - FPL Group Questions)Document1 pageCase 5 - FPL Group Questions)Jasper Yip0% (1)

- Value Line PublishingDocument11 pagesValue Line PublishingIrka Dewi Tanemaru100% (3)

- Case 1 - Ben & Jerry's HomemadeDocument9 pagesCase 1 - Ben & Jerry's Homemademark gally reboton0% (1)

- RJR Nabisco 1Document6 pagesRJR Nabisco 1gopal mundhraNo ratings yet

- Aurora PaperDocument6 pagesAurora PaperZhijian Huang100% (1)

- VarunBeverageInitiatingCoverage 24042020 PDFDocument18 pagesVarunBeverageInitiatingCoverage 24042020 PDFImmanuel ChristopherNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanNo ratings yet

- Hampton Machine Tool CaseDocument7 pagesHampton Machine Tool Casegunjan19834u100% (1)

- Case 9 Questions - Linear TechnologyDocument1 pageCase 9 Questions - Linear TechnologybuddhacrisNo ratings yet

- Case Study-Finance AssignmentDocument12 pagesCase Study-Finance AssignmentMakshud ManikNo ratings yet

- Gilbert Solutions PR TEMPLATEDocument11 pagesGilbert Solutions PR TEMPLATEMohammad KhataybehNo ratings yet

- Panera Bread Company PDFDocument6 pagesPanera Bread Company PDFtomNo ratings yet

- 683 Sol 01Document715 pages683 Sol 01ottieNo ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- SUN Brewing (A)Document6 pagesSUN Brewing (A)Ilya KNo ratings yet

- Alfa, Beta, GamaDocument20 pagesAlfa, Beta, GamaRitu SharmaNo ratings yet

- Paramount Case StudyDocument2 pagesParamount Case StudyDipti BhartiNo ratings yet

- LISA - Paperassigment 1Document6 pagesLISA - Paperassigment 1Lisa TielemanNo ratings yet

- Nestle Financial ReportDocument11 pagesNestle Financial Report20235097No ratings yet

- FB10103 - Case Study AsgnDocument5 pagesFB10103 - Case Study Asgnnur adillaNo ratings yet

- Ceres MGardening MCompany MSubmission MTemplateDocument6 pagesCeres MGardening MCompany MSubmission MTemplateRohith muralidharanNo ratings yet

- Unit 4 - Inventions and Technologies PDFDocument5 pagesUnit 4 - Inventions and Technologies PDFТимур выфыфNo ratings yet

- Direct Strength Method (DSM) For Design of Cold-Formed Steel Sections Under Localised LoadingDocument2 pagesDirect Strength Method (DSM) For Design of Cold-Formed Steel Sections Under Localised LoadingMostafa HusseinNo ratings yet

- Active Lessons ELT The Movable Class Kevin - MccaugheyDocument12 pagesActive Lessons ELT The Movable Class Kevin - MccaugheyThuy T TranNo ratings yet

- STRAMADocument4 pagesSTRAMALimuel Talastas DeguzmanNo ratings yet

- Steel Wire Ropes For Traction Elevators: Part Three: Continuing Education: TechnologyDocument14 pagesSteel Wire Ropes For Traction Elevators: Part Three: Continuing Education: TechnologyHakim BgNo ratings yet

- Test B Grammar VocabularyDocument2 pagesTest B Grammar Vocabularyთამუ ბაჯელიძეNo ratings yet

- Electromagnatic InductionDocument1 pageElectromagnatic InductionMahes JeyNo ratings yet

- Haptik - WhatsApp KitDocument30 pagesHaptik - WhatsApp KitAditya ChakravartyNo ratings yet

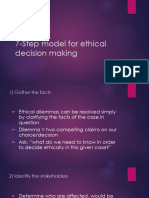

- 7-Step Model For Ethical Decision MakingDocument14 pages7-Step Model For Ethical Decision MakingjermorenoNo ratings yet

- Unit 10: Values: Lesson A Objective: Learn To Talk About Moral DilemmasDocument7 pagesUnit 10: Values: Lesson A Objective: Learn To Talk About Moral DilemmasLiss PeñafielNo ratings yet

- Thirumurai 2Document188 pagesThirumurai 2thegodkannanNo ratings yet

- NCERT Class 7 English Part 1Document157 pagesNCERT Class 7 English Part 1Kiran KumarNo ratings yet

- Geological Field Report of Attock Cherat RangesDocument12 pagesGeological Field Report of Attock Cherat RangesAnwar U Din100% (2)

- 034 Liwag v. Happy Glen Loop Homeowners Association, Inc.Document6 pages034 Liwag v. Happy Glen Loop Homeowners Association, Inc.Alvin John Dela LunaNo ratings yet

- Design PatternsDocument65 pagesDesign PatternsAshleyAndrianNo ratings yet

- SLM-Q1M02-CSS9 - V2Document26 pagesSLM-Q1M02-CSS9 - V2DarylCrisNo ratings yet

- Mechanics of Deformable Bodies: Mapúa Institute of TechnologyDocument16 pagesMechanics of Deformable Bodies: Mapúa Institute of TechnologyAhsan AliNo ratings yet

- GE OEC 9800 Operator Manual and SupplementDocument160 pagesGE OEC 9800 Operator Manual and SupplementC CraigNo ratings yet

- Mikrotik Basic Internet Sharing With Bandwidth LimitingDocument8 pagesMikrotik Basic Internet Sharing With Bandwidth LimitingMuhammad Abdullah ButtNo ratings yet

- Tem Grids & Tem Support Films: Ted Pella, IncDocument35 pagesTem Grids & Tem Support Films: Ted Pella, IncVictor BermejoNo ratings yet

- Rape of The LockDocument8 pagesRape of The LockKomal PurbeyNo ratings yet

- PROJECT REPORT ON AViva LIFE INSURANCEDocument62 pagesPROJECT REPORT ON AViva LIFE INSURANCEMayank100% (12)

- Financing Model-Understanding Startup Studio Structures - by John Carbrey - FutureSight - MediumDocument12 pagesFinancing Model-Understanding Startup Studio Structures - by John Carbrey - FutureSight - MediummberensteinNo ratings yet

- Literature Review On Attitude Towards MathematicsDocument10 pagesLiterature Review On Attitude Towards MathematicsafdtveepoNo ratings yet

- FidBond Enrolment Form Template Pinaka Bago PassiNHSDocument7 pagesFidBond Enrolment Form Template Pinaka Bago PassiNHSJoji Marie Castro PalecNo ratings yet

- The Problems of GuiltDocument3 pagesThe Problems of GuiltXosé María André RodríguezNo ratings yet

- Taxation - Updated MaterialDocument125 pagesTaxation - Updated Materialtrishul poovaiahNo ratings yet

- Mti and Pulsed DopplerDocument33 pagesMti and Pulsed DopplerWaqar Shaikh67% (3)

- Assignment-2 (Cost Accounting)Document24 pagesAssignment-2 (Cost Accounting)Iqra AbbasNo ratings yet

- Computers in Human Behavior: Stacy Horner, Yvonne Asher, Gary D. FiremanDocument8 pagesComputers in Human Behavior: Stacy Horner, Yvonne Asher, Gary D. FiremanArindra DwisyadyaningtyasNo ratings yet