Professional Documents

Culture Documents

Solved - Direct, Indirect, Fixed, and Variable Costs. Wonder Bak... - Chegg

Solved - Direct, Indirect, Fixed, and Variable Costs. Wonder Bak... - Chegg

Uploaded by

umarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved - Direct, Indirect, Fixed, and Variable Costs. Wonder Bak... - Chegg

Solved - Direct, Indirect, Fixed, and Variable Costs. Wonder Bak... - Chegg

Uploaded by

umarCopyright:

Available Formats

Chapter

Restart your subscription to keep accessing 2, Problem

solutions. 17EStudy subscription will expire on September 10, 2017.

Your Chegg CONTINUE MY SUBSCRIPTION

home / study / business / accounting theory / accounting theory solutions manuals / cost accounting / 15th edition / chapter 2 / problem 17e

Cost Accounting (15th Edition)

Problem

Direct, indirect, fixed, and variable costs. Wonder Bakery manufactures two types of bread,

which it sells as wholesale products to various specialty retail bakeries. Each loaf of bread

requires a three-step process. The first step is mixing. The mixing department combines all of the

necessary ingredients to create the dough and processes it through high-speed mixers. The

dough is then left to rise before baking. The second step is baking, which is an entirely

automated process. The baking department molds the dough into its final shape and bakes each

loaf of bread in a high-temperature oven. The final step is finishing, which is an entirely manual

process. The finishing department coats each loaf of bread with a special glaze, allows the bread

to cool, and then carefully packages each loaf in a specialty carton for sale in retail bakeries.

1. Costs involved in the process are listed next. For each cost, indicate whether it is a direct

variable, direct fixed, indirect variable, or indirect fixed cost, assuming units of production of

each kind of bread is the cost object.

2. If the cost object were the mixing department rather than units of production of each kind of

bread, which preceding costs would now be direct instead of indirect costs?

Step-by-step solution

Step 1 of 2

1. Classification of costs:

Cost object is units of production of bread and cost variability with respect to changes in the

number of breads.

Costs Classification of Cost

Yeast Direct Variable

Flour Direct Variable

Packaging material Direct Variable

Depreciation on ovens Indirect Fixed

Depreciation on mixing machines Indirect Fixed

Rent on factory building Indirect Fixed

Fire insurance on factory building Indirect Fixed

Factory utilities Indirect Variable

Chapter 2, Problem 17E

Finishing department hourly laborers Direct Variable

Mixing department manager Indirect Fixed

Material handlers in each department Indirect Variable

Custodian in factory Indirect Fixed

Night guard in factory Indirect Fixed

Machinist (running the mixing machine) Indirect Variable

Machine maintenance personnel in each department Indirect Fixed

Maintenance supplies for factory Indirect Variable

TEXTBOOK SOLUTIONS EXPERT Q&A Search

Cleaning supplies for factory Indirect Variable (5 Bookmarks) Show all steps: ON

Comment 5 students bookmarked this

problem. Save it for later.

Step 2 of 2

2. If the cost object were the mixing department rather than units of production of each kind of

bread, the following costs would now be direct instead of indirect costs:

a. Depreciation on mixing machines

b. Mixing department manager

c. Machinist running the mixing machine

Comment

Was this solution helpful? 13 5

Chegg tutors who can help right now

Kevin Brian

Stanford University 69 Brown University 433

Soujanya Ileana

Osmania University( 297 University of Virginia 54

Dola FIND ME A TUTOR

Jawaharlal Nehru Tec 152

ABOUT CHEGG RESOURCES TEXTBOOK LINKS STUDENT SERVICES COMPANY LEARNING SERVICES

Media Center Site Map Return Your Books Chegg Play Jobs Online Tutoring

College Marketing Mobile Textbook Rental Study 101 Customer Service Chegg Study Help

Privacy Policy Chapter

Publishers 2, Problem 17E

eTextbooks Chegg Coupon Give Us Feedback Solutions Manual

Your CA Privacy Rights Join Our Aliate Used Textbooks Scholarships Chegg For Good Tutors by City

Terms of Use Program Cheap Textbooks Career Search Become a Tutor GPA Calculator

General Policies Advertising Choices College Textbooks Internships Test Prep

Intellectual Property Rights Sell Textbooks College Search

Investor Relations College Majors

Enrollment Services Scholarship Redemption

Over 6 million

trees planted

2003-2017 Chegg Inc. All rights reserved.

You might also like

- Acccob3 HW2Document18 pagesAcccob3 HW2Aaron HuangNo ratings yet

- E Book Developing Materials For Language Teaching Brian Tomlison 2013 PDFDocument577 pagesE Book Developing Materials For Language Teaching Brian Tomlison 2013 PDFThomas Iza Tama91% (11)

- 5 Depreciation ProblemsDocument2 pages5 Depreciation ProblemsumarNo ratings yet

- Test 2 Review QuestionsDocument19 pagesTest 2 Review Questionsumar50% (2)

- Accounting Assignments ListDocument8 pagesAccounting Assignments Listumar0% (1)

- Divided Memories, History Textbooks and The Wars in AsiaDocument5 pagesDivided Memories, History Textbooks and The Wars in Asiaアンヘル ヴェラNo ratings yet

- Cost Accounting Activityno-01: (Group Members) Hussain Ali Rahmat Ullah Afaan Shakeel Abdullah AfridiDocument5 pagesCost Accounting Activityno-01: (Group Members) Hussain Ali Rahmat Ullah Afaan Shakeel Abdullah AfridiHusain AliNo ratings yet

- Chapter 2 Cost ClassificationsDocument18 pagesChapter 2 Cost Classificationsmarizemeyer2No ratings yet

- CostingDocument14 pagesCostingSkyGardens AccountsNo ratings yet

- Activity-Based, Absorption and Variable CostingDocument83 pagesActivity-Based, Absorption and Variable CostingPatrick LanceNo ratings yet

- Process Plants: DesignedDocument25 pagesProcess Plants: Designeddevang asherNo ratings yet

- 74.2 Notes - 2 MANUFDocument5 pages74.2 Notes - 2 MANUFSLUNGILE MKHONTONo ratings yet

- Absorption Costing, Marginal CostingDocument29 pagesAbsorption Costing, Marginal Costinggopeshtripathi786No ratings yet

- MODULE 1 Variable and Absorption CostingDocument9 pagesMODULE 1 Variable and Absorption Costingjerico garciaNo ratings yet

- Chapter 2 Process CostingDocument34 pagesChapter 2 Process Costingkhairulnaim123jr89No ratings yet

- Accounting For Joint ProductsDocument16 pagesAccounting For Joint ProductsVince Christian PadernalNo ratings yet

- Process CostingDocument44 pagesProcess CostingSaleh El SaidNo ratings yet

- Maf Process CostingDocument34 pagesMaf Process CostingSuhaiziomarNo ratings yet

- Variable Costing: A Tool For Management: © 2010 The Mcgraw-Hill Companies, IncDocument30 pagesVariable Costing: A Tool For Management: © 2010 The Mcgraw-Hill Companies, IncInga ApseNo ratings yet

- Chap007 27102021 110417amDocument30 pagesChap007 27102021 110417amAzaz IftikharNo ratings yet

- Process Costing and Hybrid Product-Costing SystemsDocument38 pagesProcess Costing and Hybrid Product-Costing SystemsZia UddinNo ratings yet

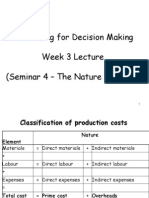

- Accounting For Decision Making Week 3 Lecture (Seminar 4 - The Nature of Costs)Document51 pagesAccounting For Decision Making Week 3 Lecture (Seminar 4 - The Nature of Costs)nwcbenny337No ratings yet

- AF3112 Lec 5 Joint and By-Product CostingDocument12 pagesAF3112 Lec 5 Joint and By-Product CostingRoseNo ratings yet

- Process CostingDocument14 pagesProcess CostingUnknown 1No ratings yet

- Performance Evaluation Using Variances From Standard CostsDocument41 pagesPerformance Evaluation Using Variances From Standard Costswarsima100% (1)

- Chapters 2 & 3.: Job-Order CostingDocument83 pagesChapters 2 & 3.: Job-Order CostingsaraNo ratings yet

- Cost Item Variabl e Selling Administrativ e Direct Indirec T Fixed Cost CostDocument2 pagesCost Item Variabl e Selling Administrativ e Direct Indirec T Fixed Cost CostAyeshaNo ratings yet

- Process costing-B.Com CBCS-SemIVDocument18 pagesProcess costing-B.Com CBCS-SemIVCharchitNo ratings yet

- Akuntansi Biaya Dan Manajemen - PPT Horngren (Soal Latihan) PDFDocument385 pagesAkuntansi Biaya Dan Manajemen - PPT Horngren (Soal Latihan) PDFYustina Lita Sari100% (1)

- Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions ManualDocument36 pagesCost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manualatwovarusbbn8d100% (27)

- Dwnload Full Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual PDFDocument36 pagesDwnload Full Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual PDFleroyweavervpgnrf100% (18)

- ABC Analysis HandoutsDocument11 pagesABC Analysis HandoutsTushar DuaNo ratings yet

- Assignment 1.1 Overview, Cost Concepts and Variable CostingDocument3 pagesAssignment 1.1 Overview, Cost Concepts and Variable CostingMaxine ConstantinoNo ratings yet

- Process CostingDocument5 pagesProcess CostingEl AgricheNo ratings yet

- AF3112 Management Accounting 2: Process CostingDocument66 pagesAF3112 Management Accounting 2: Process Costing行歌No ratings yet

- Final AssignmentDocument19 pagesFinal AssignmentManoj JainNo ratings yet

- Variable Costing and Segment Reporting: Tools For ManagementDocument66 pagesVariable Costing and Segment Reporting: Tools For ManagementsofiaNo ratings yet

- Practice Quiz and Quizzes 6&7 - 1&2 - Acctg 1206 - MergedDocument18 pagesPractice Quiz and Quizzes 6&7 - 1&2 - Acctg 1206 - MergedSaeym SegoviaNo ratings yet

- LP3-Product Costing MethodsDocument12 pagesLP3-Product Costing MethodsCarla GarciaNo ratings yet

- GTW Supporting Documents v1.3Document49 pagesGTW Supporting Documents v1.3Yassine BfruNo ratings yet

- 1 2session09 d04Document24 pages1 2session09 d04Olha LNo ratings yet

- NOTE CHAPTER 8 - Process CostingDocument20 pagesNOTE CHAPTER 8 - Process CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- Topic 6 - Process CostingDocument7 pagesTopic 6 - Process CostingMuhammad Alif100% (1)

- ACT202 - BFK - 2018 (Here) (Neem Soap)Document20 pagesACT202 - BFK - 2018 (Here) (Neem Soap)Zidan ZaifNo ratings yet

- Session 7 - Process Selection and AnalysisDocument66 pagesSession 7 - Process Selection and AnalysisPranit padhiNo ratings yet

- Cost - Terms Concepts and ClassificationsDocument17 pagesCost - Terms Concepts and ClassificationsSwap WerdNo ratings yet

- RWD 04 Variable CostingDocument33 pagesRWD 04 Variable CostingYuliana RiskaNo ratings yet

- CH 2 Solutions Solution S For Chapter 2Document20 pagesCH 2 Solutions Solution S For Chapter 2Getachew MuluNo ratings yet

- Presentation 04 (1slide-Pg)Document33 pagesPresentation 04 (1slide-Pg)araika.maksutNo ratings yet

- RelativeResourceManager PDFDocument113 pagesRelativeResourceManager PDFMuhammad Irfan SalahuddinNo ratings yet

- Costing Basic: Cost ClassificationDocument5 pagesCosting Basic: Cost ClassificationMathur DineshNo ratings yet

- Joint Products AND BY Products: Learning OutcomesDocument28 pagesJoint Products AND BY Products: Learning OutcomesAman PandeyNo ratings yet

- Chap004 7e EditedDocument47 pagesChap004 7e EditedfarahNo ratings yet

- Business Opportunity Identification and Development Process of A Modified Motorized Groundnut ShellerDocument6 pagesBusiness Opportunity Identification and Development Process of A Modified Motorized Groundnut Shellerkennedyotieno0726No ratings yet

- Variable and Absorption CostingDocument2 pagesVariable and Absorption Costingnclann.martinNo ratings yet

- Topic 2 IDocument16 pagesTopic 2 Iami zawaniNo ratings yet

- Theme 2. - Production MethodsDocument13 pagesTheme 2. - Production MethodsScribdTranslationsNo ratings yet

- Chapter 2 (The Data of Macroeconomics)Document13 pagesChapter 2 (The Data of Macroeconomics)MD. ABDULLAH KHANNo ratings yet

- Sem2 - Unit 6Document2 pagesSem2 - Unit 6Lelomso KhahlaNo ratings yet

- Chap18 - DNGNDocument58 pagesChap18 - DNGNĐàm Ngọc Giang NamNo ratings yet

- THE Producti: Gino Miguel M. Enso Strategic Cost Management - BSA 2B - B48 Joint and By-ProductsDocument4 pagesTHE Producti: Gino Miguel M. Enso Strategic Cost Management - BSA 2B - B48 Joint and By-ProductsMr. XenonNo ratings yet

- MANUFACTURING OPERATIONSDocument2 pagesMANUFACTURING OPERATIONStmiss5461No ratings yet

- Correia Joana Homework1Document9 pagesCorreia Joana Homework1Joana CorreiaNo ratings yet

- Joint Products AND BY Products: Learning OutcomesDocument24 pagesJoint Products AND BY Products: Learning OutcomesRavi GuptaNo ratings yet

- Reactive Distillation: Status and Future DirectionsFrom EverandReactive Distillation: Status and Future DirectionsKai SundmacherRating: 1 out of 5 stars1/5 (1)

- Admission Notice: University of The Punjab, LahoreDocument1 pageAdmission Notice: University of The Punjab, LahoreumarNo ratings yet

- ACCT 438 Homework 1Document2 pagesACCT 438 Homework 1umarNo ratings yet

- My TasksDocument2 pagesMy TasksumarNo ratings yet

- Determinants of Money SupplyDocument10 pagesDeterminants of Money SupplyumarNo ratings yet

- 314 SyllabusDocument3 pages314 SyllabusumarNo ratings yet

- 2017 Domestic Postgraduate Fee Schedule V10 17012017 Comms VersionDocument6 pages2017 Domestic Postgraduate Fee Schedule V10 17012017 Comms VersionumarNo ratings yet

- Accounting QuestionsDocument2 pagesAccounting QuestionsumarNo ratings yet

- Accounting ProjectDocument1 pageAccounting ProjectumarNo ratings yet

- Additional Crossover Rate ProblemsDocument1 pageAdditional Crossover Rate ProblemsumarNo ratings yet

- 2nd ChapterDocument24 pages2nd ChapterumarNo ratings yet

- Behaviour & Information TechnologyDocument12 pagesBehaviour & Information TechnologyumarNo ratings yet

- Book ListDocument3 pagesBook ListSolomon Seth SallforsNo ratings yet

- Dissertation Zadig de VoltaireDocument6 pagesDissertation Zadig de VoltaireHelpWritingACollegePaperCanada100% (1)

- PracticalResearch1 q3 Week3 v4Document14 pagesPracticalResearch1 q3 Week3 v4Shekaina Faith Cuizon LozadaNo ratings yet

- Grade 10 Social Studies - Essential LearningsDocument2 pagesGrade 10 Social Studies - Essential LearningsMrBinet100% (1)

- 9Document18 pages9FrancisLekololiNo ratings yet

- English Textbook DesigningDocument14 pagesEnglish Textbook DesigningWidya KiswaraNo ratings yet

- Primary FRCA MCQ Guide UpdateDocument21 pagesPrimary FRCA MCQ Guide UpdatePriya VetrivelNo ratings yet

- Primary - 2021 - (E.Version.) - Class-1 Math Final COM OPTDocument106 pagesPrimary - 2021 - (E.Version.) - Class-1 Math Final COM OPTAziz ScreenshotNo ratings yet

- Learning Objectives: Organizational Behavior & Work 37:575:345:95Document13 pagesLearning Objectives: Organizational Behavior & Work 37:575:345:95Micka BuenaflorNo ratings yet

- SatiaDocument3 pagesSatiaDinesh kothawadeNo ratings yet

- How We Got From There To Here:: A Story of Real AnalysisDocument220 pagesHow We Got From There To Here:: A Story of Real AnalysisEfrain_01No ratings yet

- Gender Concerns in Education: Prof. Gouri Srivastava Head Department of Gender Studies, NCERTDocument24 pagesGender Concerns in Education: Prof. Gouri Srivastava Head Department of Gender Studies, NCERTParag ShrivastavaNo ratings yet

- Emerging Issues in Materials DevDocument2 pagesEmerging Issues in Materials DevRodellane GoilanNo ratings yet

- Teacher Education What Does It MeanDocument5 pagesTeacher Education What Does It MeanGeorge Vassilakis100% (1)

- LewisDocument12 pagesLewisLewis Nimsy Tunde100% (1)

- Learning Area: Whole Number Learning ObjectivesDocument24 pagesLearning Area: Whole Number Learning ObjectivesMohd Roshidi Bin AyobNo ratings yet

- UCV - Grad II - 2014 - Model - Subiect - Limba Engleza PDFDocument2 pagesUCV - Grad II - 2014 - Model - Subiect - Limba Engleza PDFMarianaPricopNo ratings yet

- FINAL ASSIGNMENT Material Evaluation and AdaptationDocument3 pagesFINAL ASSIGNMENT Material Evaluation and AdaptationAndi Annisa NurNo ratings yet

- The Education System in The Federal Republic of Germany 2012/2013Document10 pagesThe Education System in The Federal Republic of Germany 2012/2013kharismaNo ratings yet

- High School Biology Textbooks Do Not Meet National StandardsDocument5 pagesHigh School Biology Textbooks Do Not Meet National Standardsjacky qianNo ratings yet

- ABPS BBSR Book List 2023 24Document5 pagesABPS BBSR Book List 2023 24Sampurna NayakNo ratings yet

- MKT557 Syllabus 2019Document12 pagesMKT557 Syllabus 2019seanNo ratings yet

- Text Book(s) Text Book(s) Text Book(s) : TH TH THDocument4 pagesText Book(s) Text Book(s) Text Book(s) : TH TH THAnjali LakraNo ratings yet

- Giao An Anh 7 Ki1 - 2Document149 pagesGiao An Anh 7 Ki1 - 2Dâu TâyNo ratings yet

- The Following Cost Information of Sabah Kandazan B...Document1 pageThe Following Cost Information of Sabah Kandazan B...Wan Muhamad ShariffNo ratings yet

- Comm 401 My Course Outline Summer 2019Document9 pagesComm 401 My Course Outline Summer 2019hakawrNo ratings yet

- Chegg Homework Help Questions and AnswersDocument4 pagesChegg Homework Help Questions and Answersafnoebhcdeypyp100% (1)

- ICT BookDocument4 pagesICT BookJenny Stella63% (8)