Professional Documents

Culture Documents

335 Chap 1 FM Overview

335 Chap 1 FM Overview

Uploaded by

ctyre34Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

335 Chap 1 FM Overview

335 Chap 1 FM Overview

Uploaded by

ctyre34Copyright:

Available Formats

Chapter 1: An Overview of Financial Management

I. What is Financial Management?

Definition: the study of decisions relating to the internal and external

activities of the corporation in the acquisition, financing, and management of

assets to produce value for shareholders.

The three other major areas of finance include:

Investments

International Finance

Banking and Financial Institutions

A. Major areas of Financial Management

Capital Budgeting (acquisition of assets): What long-term (capital)

investments in assets should the firm make?

Capital Structure (financing these acquisitions): Where does the money

come from?

Working Capital Management (daily operations): How does the firm manage

the daily operations, including inventory management, collecting from

customers, and paying the bills?

Fin 335: Chapter 1, page 1

B. Forms of Business Organizations

Form Advantages Disadvantages

Sole - easy & cheap to form - unlimited personal liability

Proprietorship - little regulation - limited life

- pays no corp. tax - hard to transfer ownership

- hard to raise lots of capital

Partnership - same as SP - same as SP

Corporation - limited liability - double taxation of earnings

C-Corp - unlimited life

S-Corp - easy to transfer

LLC

ownership

C. Organizational Chart of a Corporation (finance only)

Board of Directors

Chairman of the Board/CEO

President/COO

V.P. of Finance / Chief Financial Officer (CFO)

- Treasurer - external financial activities

Cash and Credit Management

Capital Expenditures

Financial Planning

- Controller - internal financial activities

Tax Management

Internal Accounting (Cost and Financial)

Information and Data Processing

Fin 335: Chapter 1, page 2

Directors are elected by shareholders at the annual shareholders meetings

and their terms may be staggered. A minimum number of independent

(outside directors) may be required. (GE Board) (Google Rules)

The Articles of Incorporation, also known as the Corporate Charter, is

the contract between the corporation and a state that establishes the

corporation as a legal entity. It must be filed in a specific state and Delaware

is a popular choice. Basic required information includes:

Name of the corporation

Term (usually in perpetuity)

Purpose (Type of business)

How it is organized (basic organizational structure)

Type and number of shares authorized

The bylaws include additional information and the internal rules of

governance. These are not required to be filed with the state of

incorporation.

80% of all businesses are sole proprietorships, with the rest evenly divided

between partnerships and corporations.

Based on dollar value of sales, about 80% of all business is conducted by

corporations, with 13% conducted by sole proprietorships, and 7% by

partnerships.

A corporation can be public (shares sold to the general public) or private

(shares closely held by a small group or even a single individual). The

advantages of incorporating will most likely increase the value of all but the

smallest businesses.

Fin 335: Chapter 1, page 3

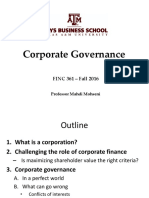

II. The Goal of Financial Management

(a more complete definition) and Another View

Goals of the financial manager of a corporation

- Maximize the value of the firm

- Maximize the shareholders wealth

- Maximize the current market price of stock

Why is share price maximization the appropriate goal?

- Share price is an unambiguous measure of wealth

- Share price is indifferent...it has no agenda

- By maximizing share price you maximize every shareholders

happiness

Why is profit maximization not the appropriate goal?

- Profits can be manipulated by using different accounting rules

- Profit maximization does not focus on long-term

Penetration pricing (where MC MR) will not maximize profits in the

short-term but may increase market share and achieve greater value in the

long-term

On the other hand, one way to maximize profits this year is to sell all

assetsleaving nothing to generate profits in future years.

The problem with profit maximization is that it is restricted in time. There is

no model that maximizes profits indefinitely. The only alternative is to

maximize the value of all the future cash flows, which is what that price of

the stock represents.

Corporate Governance: USA vs Europe

Fin 335: Chapter 1, page 4

III. Agency Theory and Control of the Corporation

Agency refers to the relationship that exists when one person (the agent) is

hired to act on the behalf of another person (the principal).

A. Examples of agency relationships: (where problems arise)

- Shareholders and managers

- The corporation and employees

- Managers and bondholders

- All are potential sources of conflict

B. Agency conflict:

- The board is too cozy with management & fails to supervise

- Managers allow themselves too many perquisites (perks)

- Managers resist hostile takeovers

- Employees shirk

- Managers invest in very risky projects

C. Agency costs:

- Share price is not maximized

- Management must be monitored (audits, activist board)

- Restrictive covenants in the bond contracts (indentures)

- Other lenders demand collateral

- Employees require supervision

D. Activities that protect the principals:

- Market discipline: threat of takeovers, drop in price

- Internal & external audits

- Performance related compensation

- Restrictive covenants in bond the contracts

CFA manual for effective corporate governance

The Greed Cycle by John Cassidy, 2002

Review of The Greed Cycle

Fin 335: Chapter 1, page 5

You might also like

- Corporate Finance for CFA level 1: CFA level 1, #1From EverandCorporate Finance for CFA level 1: CFA level 1, #1Rating: 3.5 out of 5 stars3.5/5 (3)

- Diageo Case Write UpDocument10 pagesDiageo Case Write UpAmandeep AroraNo ratings yet

- Foreign Exchange Hedging Strategies at General MotorsDocument11 pagesForeign Exchange Hedging Strategies at General MotorsNarendra ShakyaNo ratings yet

- The Time Value of Money - Business FinanceDocument24 pagesThe Time Value of Money - Business FinanceMd. Ruhul- Amin33% (3)

- Corporate Finance: A Beginner's Guide: Investment series, #1From EverandCorporate Finance: A Beginner's Guide: Investment series, #1No ratings yet

- Financial Markets and Institutions: Ninth EditionDocument35 pagesFinancial Markets and Institutions: Ninth EditionمريمالرئيسيNo ratings yet

- ST Aerospace Financial ReportDocument4 pagesST Aerospace Financial ReportMuhammad FirdausNo ratings yet

- Chapter 1Document48 pagesChapter 1Nica VizcondeNo ratings yet

- RWJ Chapter 1Document29 pagesRWJ Chapter 1Umar ZahidNo ratings yet

- Chapter 1: Introduction To Corporate Finance: Nasrat UllahDocument21 pagesChapter 1: Introduction To Corporate Finance: Nasrat UllahMasood khanNo ratings yet

- RWJ Chapter 1 - EUDocument17 pagesRWJ Chapter 1 - EULokkhi BowNo ratings yet

- Chapter One - Introduction To Corporate FinanceDocument8 pagesChapter One - Introduction To Corporate FinanceSH1970No ratings yet

- FM Unit 1 Lecture Notes - Financial Managment and EnvironmentsDocument4 pagesFM Unit 1 Lecture Notes - Financial Managment and EnvironmentsDebbie DebzNo ratings yet

- Opciones de Administración FinancieraDocument16 pagesOpciones de Administración FinancieraRicardo ValverdeNo ratings yet

- Introduction To Corporate FinanceDocument14 pagesIntroduction To Corporate FinanceBẢO NGUYỄN HUYNo ratings yet

- Introduction 2Document43 pagesIntroduction 2Samuel ColeNo ratings yet

- Tổng hợp kiến thứcDocument17 pagesTổng hợp kiến thức9zrwj8rbgdNo ratings yet

- Chapter 1: "Introduction To Corporate Finance"Document10 pagesChapter 1: "Introduction To Corporate Finance"Files OrganizedNo ratings yet

- The Corporation & Financial Markets (Review)Document7 pagesThe Corporation & Financial Markets (Review)karimotarike77No ratings yet

- Week 4-5, Chapter 1Document26 pagesWeek 4-5, Chapter 1Shaheer BaigNo ratings yet

- Slide 1Document17 pagesSlide 1Vishal BhadaneNo ratings yet

- Principal Agent Conflict & Financial Strategies-1Document38 pagesPrincipal Agent Conflict & Financial Strategies-1Vikas Sharma100% (3)

- Fin Ma DiscussionDocument13 pagesFin Ma DiscussionJasmine Cate JumillaNo ratings yet

- (Time Value of Money - Ch. 5) (Risk - Ch. 6)Document3 pages(Time Value of Money - Ch. 5) (Risk - Ch. 6)Anne BonaNo ratings yet

- Cfin&Val NotesDocument12 pagesCfin&Val NotesJonasNo ratings yet

- BFIN300 Full Hands OutDocument46 pagesBFIN300 Full Hands OutGauray LionNo ratings yet

- mcd2170 Lecture Ppts WK 1 2017 03Document26 pagesmcd2170 Lecture Ppts WK 1 2017 03chrisvszombiesNo ratings yet

- Field of Finance: An Overview Goal of The Firm Agency Problem Business Ethics Forms of Business Organization Globalization ComputerizationDocument16 pagesField of Finance: An Overview Goal of The Firm Agency Problem Business Ethics Forms of Business Organization Globalization ComputerizationShaina Santiago AlejoNo ratings yet

- Corporate Finance SummaryDocument25 pagesCorporate Finance SummaryBrent Heiner100% (1)

- Introduction To Financial ManagementDocument18 pagesIntroduction To Financial ManagementPratham SharmaNo ratings yet

- Overview of Finance & Financial Environment: Jamil Ahmed Assistant ProfessorDocument37 pagesOverview of Finance & Financial Environment: Jamil Ahmed Assistant ProfessorHassan AliNo ratings yet

- FM Unit 1Document4 pagesFM Unit 1GordonNo ratings yet

- 2023 Tutorial 1 FMADocument4 pages2023 Tutorial 1 FMAĐỗ Ngọc ÁnhNo ratings yet

- Introduction To Corporate FinanceDocument5 pagesIntroduction To Corporate FinanceToru KhanNo ratings yet

- (DRAW) : Capital Budgeting: Capital Structure: Working Capital ManagementDocument1 page(DRAW) : Capital Budgeting: Capital Structure: Working Capital ManagementgwenwzNo ratings yet

- Chapter 1 - Introduction To Corporate FinanceDocument9 pagesChapter 1 - Introduction To Corporate FinanceNguyễn Hồ Yến NhiNo ratings yet

- Finc361 - Lecture - 01 - Corporate Governance PDFDocument39 pagesFinc361 - Lecture - 01 - Corporate Governance PDFLondonFencer2012No ratings yet

- Financial ManagementDocument10 pagesFinancial ManagementMuhammad KashifNo ratings yet

- Financial ManagementDocument36 pagesFinancial Managementmuzamil BhuttaNo ratings yet

- Prepared By: DR - Ibrahim WahiedDocument32 pagesPrepared By: DR - Ibrahim WahiedFady SamyNo ratings yet

- FINANCEDocument258 pagesFINANCESamir KochaiNo ratings yet

- Applied Corporate Finance: Aswath DamodaranDocument258 pagesApplied Corporate Finance: Aswath DamodaranMus MualimNo ratings yet

- Introduction FinanceDocument19 pagesIntroduction FinanceolmezestNo ratings yet

- Chapter 1 - Introduction To Corporate FinanceDocument9 pagesChapter 1 - Introduction To Corporate FinanceNguyễn Ngàn NgânNo ratings yet

- Chap1 LectureDocument30 pagesChap1 LectureJesika AgustinNo ratings yet

- Chapter 1+3+4 AhtDocument25 pagesChapter 1+3+4 AhtAn Hoài ThuNo ratings yet

- An Introduction To Financial ManagementDocument33 pagesAn Introduction To Financial ManagementWensin TanNo ratings yet

- Chap 1 TCDN 1Document6 pagesChap 1 TCDN 1Chi Phạm LinhNo ratings yet

- Understanding StrategiesDocument17 pagesUnderstanding StrategiesAfrilianiNo ratings yet

- FM 1Document21 pagesFM 1KalkayeNo ratings yet

- Fins3626 NotesDocument10 pagesFins3626 NotesMarkNo ratings yet

- Financial Management: Chapter 1 The CorporationDocument38 pagesFinancial Management: Chapter 1 The CorporationTaVuKieuNhiNo ratings yet

- The Scope of Corporate Finance: Answers To Concept Review QuestionsDocument4 pagesThe Scope of Corporate Finance: Answers To Concept Review QuestionsHuu DuyNo ratings yet

- 01 - Introduction & Time ValueDocument29 pages01 - Introduction & Time Valuetanishqkd25No ratings yet

- Introduction To Financial Management. 2018Document42 pagesIntroduction To Financial Management. 2018Martin Idowu100% (1)

- 01 Financial Management and The Firm and Review of Financial Statements (Session 1)Document68 pages01 Financial Management and The Firm and Review of Financial Statements (Session 1)creamellzNo ratings yet

- Chapter 1. Finance and The FirmDocument40 pagesChapter 1. Finance and The FirmThùy DươngNo ratings yet

- FM I Exit SummDocument119 pagesFM I Exit Summtame kibruNo ratings yet

- Chap1: INTRODUCTION TO CORPORATE FINANCEDocument24 pagesChap1: INTRODUCTION TO CORPORATE FINANCEHoàng Phúc LongNo ratings yet

- Introduction To Financial ManagementDocument82 pagesIntroduction To Financial ManagementJohn Joseph CambaNo ratings yet

- WK 1.1 - Intro To Corporate FinanceDocument17 pagesWK 1.1 - Intro To Corporate Financehfmansour.phdNo ratings yet

- Shareholders and Agency ProblemDocument3 pagesShareholders and Agency ProblemfoodNo ratings yet

- Financial Management: Chapter 1 The CorporationDocument35 pagesFinancial Management: Chapter 1 The CorporationLi Jean TanNo ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- Solver Homework: Labor Constraint) - Each Leather Model Requires 2 Hours of Labor Each Fabric ModelDocument1 pageSolver Homework: Labor Constraint) - Each Leather Model Requires 2 Hours of Labor Each Fabric Modelctyre34No ratings yet

- Outline - Trade The International Trade Regime (ITO, GATT, UNCTAD, GSP, WTO)Document2 pagesOutline - Trade The International Trade Regime (ITO, GATT, UNCTAD, GSP, WTO)ctyre34No ratings yet

- Mama's Pizza Midterm #1 DFD - LVL 0Document1 pageMama's Pizza Midterm #1 DFD - LVL 0ctyre34No ratings yet

- 445 Term Project Guidelines, Winter 19Document1 page445 Term Project Guidelines, Winter 19ctyre34No ratings yet

- Rgumentation Heat Heet O: (Or, OOH, - , OOH - )Document2 pagesRgumentation Heat Heet O: (Or, OOH, - , OOH - )ctyre34No ratings yet

- Ap06 FRQ Calculusab 51707 PDFDocument6 pagesAp06 FRQ Calculusab 51707 PDFctyre34No ratings yet

- ACID Base Equil P Test MCDocument5 pagesACID Base Equil P Test MCctyre34No ratings yet

- Chapter 1: An Overview of Financial ManagementDocument5 pagesChapter 1: An Overview of Financial Managementctyre34No ratings yet

- "TB: Silent Killer" Video Assignment Due Tuesday, October 3Document2 pages"TB: Silent Killer" Video Assignment Due Tuesday, October 3ctyre34No ratings yet

- Bus 215 NotesDocument18 pagesBus 215 Notesctyre34No ratings yet

- Solutions of End-of-Chapter Four ProblemsDocument4 pagesSolutions of End-of-Chapter Four Problemsctyre34No ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Chapter 10Document130 pagesChapter 10ctyre34No ratings yet

- Fall 2016 Macro 1Document11 pagesFall 2016 Macro 1ctyre34No ratings yet

- Fall Macro 2016-3.tst PDFDocument7 pagesFall Macro 2016-3.tst PDFctyre34No ratings yet

- Statement Of-Cash FlowsDocument6 pagesStatement Of-Cash FlowsCIRILO EMIL BAYLOSISNo ratings yet

- Math 1050 Mortgage ProjectDocument5 pagesMath 1050 Mortgage Projectapi-2740249620% (1)

- Cashflow Projection SSP 2014-2020Document11 pagesCashflow Projection SSP 2014-2020cumulus 13No ratings yet

- College Accounting Chapters 1-30-15th Edition Price Test BankDocument46 pagesCollege Accounting Chapters 1-30-15th Edition Price Test Bankotisphoebeajn100% (38)

- Cerel Aliyah RP (024032001077) Tugas Prak - AktDocument40 pagesCerel Aliyah RP (024032001077) Tugas Prak - Aktptraffasha rizky mandiriNo ratings yet

- Practical Questions (Sandeep Garg 2018-19)Document10 pagesPractical Questions (Sandeep Garg 2018-19)Kanishk SinglaNo ratings yet

- LoanApplication 23660000180829Document12 pagesLoanApplication 23660000180829vijaybhaskar damireddyNo ratings yet

- Children and Money MiniDocument34 pagesChildren and Money Minirhoda363No ratings yet

- New Tax CalculatorDocument5 pagesNew Tax CalculatorDJNo ratings yet

- Ics Exams 2013 Questions SFDocument2 pagesIcs Exams 2013 Questions SFDeepak Shori100% (1)

- Assignment SI and CI PDFDocument2 pagesAssignment SI and CI PDFPrashant SinghNo ratings yet

- Topic 3 - Credit RiskDocument51 pagesTopic 3 - Credit RiskSandra YebyoNo ratings yet

- Production BudgetDocument11 pagesProduction BudgetSamson, Ma. Louise Ren A.No ratings yet

- Study On Online Payment ApplicationsDocument38 pagesStudy On Online Payment ApplicationsPrathamesh DafaleNo ratings yet

- MR Dolphy D'Souza, Partner, E&YDocument4 pagesMR Dolphy D'Souza, Partner, E&YPradeep Singh100% (1)

- RGhinampas-M111-module 2Document8 pagesRGhinampas-M111-module 2Ivy Marie MaratasNo ratings yet

- Simple InterestTricks Tips PDFDocument39 pagesSimple InterestTricks Tips PDFSHUBHAM Yadav100% (1)

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRizki AnggraeniNo ratings yet

- Debt-Collector-Licensee-Download-09302017 From RakeshDocument68 pagesDebt-Collector-Licensee-Download-09302017 From Rakeshasrakesh805No ratings yet

- Business ApplicationDocument33 pagesBusiness ApplicationBlake WeberNo ratings yet

- NSVR-208-2022-23 - InnoparkDocument1 pageNSVR-208-2022-23 - InnoparkAnkit SinghNo ratings yet

- Impact of Financial Literacy Program On Financial Behaviour A Case Study of Selected Nurses From Public Hospitals in GhanaDocument9 pagesImpact of Financial Literacy Program On Financial Behaviour A Case Study of Selected Nurses From Public Hospitals in GhanaEditor IJTSRDNo ratings yet

- Taxguru - In-Exemption Under Section 54 54EC Amp 54F - FAQs Amp Case LawsDocument9 pagesTaxguru - In-Exemption Under Section 54 54EC Amp 54F - FAQs Amp Case LawsSanketh T MeriNo ratings yet

- Week 7: Corporate Credit Risk Models Based On Stock PriceDocument19 pagesWeek 7: Corporate Credit Risk Models Based On Stock PriceNhat Khanh NguyenNo ratings yet

- Interim Report 15Document14 pagesInterim Report 15Prasant Kumar PradhanNo ratings yet