Professional Documents

Culture Documents

Commodity Weekly Journal-3rd To 6th Oct 2017

Commodity Weekly Journal-3rd To 6th Oct 2017

Uploaded by

Rahul SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodity Weekly Journal-3rd To 6th Oct 2017

Commodity Weekly Journal-3rd To 6th Oct 2017

Uploaded by

Rahul SharmaCopyright:

Available Formats

Commodity Special Weekly Journal

Strictly For Client Circulation

Sebi Reg. No.:- INH000003358

24 CARAT FINANCIAL SERVICES

3rd to 6th October 2017

+91-98261-69053 contactus@24cfin.com research@24cfin.com

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Market Weekly Wrapup

25th to 29th September 2017

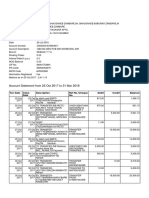

Scrip Contract Open Price High Low Close Price

Gold 05-Oct-2017 29510 30169 29510 29565

Silver 05-Dec-2017 39601 40595 39309 39461

Crude Oil 18-Oct-2017 3284 3472 3280 3371

Natural Gas 26-Oct-2017 193.10 203.90 189.50 198.50

Copper 30-Nov-2017 423.50 433.40 421.60 427.95

Zinc 31-Oct-2017 201.5 209.80 200.75 207.25

Lead 31-Oct-2017 161.35 164.50 160.45 163.20

Aluminium 31-Oct-2017 138.90 140.30 136.80 137

Nickel 31-Oct-2017 681 708.30 671.90 689.20

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Weekly Support & Resistance

3rd to 6th October 2017

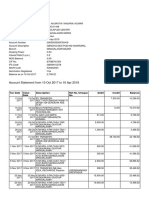

Scrip Contract RES-2 RES-1 PIVOT SUP.1 SUP.2

Gold 05-Oct-2017 30407 29986 29748 29327 29089

Silver 05-Dec-2017 41077 40273 39791 38987 38505

Crude Oil 18-Oct-2017 3566 3469 3374 3277 3182

Natural Gas 26-Oct-2017 212 205 197 191 183

Copper 30-Nov-2017 439 434 428 422 416

Zinc 31-Oct-2017 215 211 206 202 197

Lead 31-Oct-2017 167 165 163 161 159

Aluminium 31-Oct-2017 142 139 138 136 135

Nickel 31-Oct-2017 822 756 714 647 605

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

MCX Outlook

3rd to 6th October 2017

MCX records Rs. 11,048.93 crore in daily turnover

India's Multi Commodity Exchange has recorded a daily turnover of Rs. 11048.93 crore in session 1 on Friday, September 29, 2017. MCX

Comdex, the composite index of metals, energy and agri-commodities was down by 5.40 point to 3354.07 point.

MCX Metal index was reached at 4964.80 and MCX Energy index was reached at 2505.30 while MCX Agri index reached at 2500.96 point.

MCX COMDEX is India's maiden real-time Composite Commodity Index based on commodity futures prices of an exchange.

Bullion

GOLD Oct17 contract was up by 0.09% to Rs. 29634.00 per 10 gram. GOLD Dec17 contract was up by 0.17% to Rs. 29801.00 per 10

gram. GOLDM Oct17 contract was up by 0.16% to Rs. 29671.00 per 10 gram.

GOLDM Nov17 contract was up by 0.20% to Rs. 29737.00 per 10 gram. GOLDGUINEA Sep17 contract was up by 0.16% to Rs. 23636.00

per 8 gram. GOLDPETAL Sep17 contract was up by 0.72% to Rs. 2928.00 per gram.

SILVER Dec17 contract was up by 0.03% to Rs. 39761.00 per kg. SILVER Mar18 contract was up by 0.17% to Rs. 40349.00 per kg.

SILVERM Nov17 contract was up by 0.01% to Rs. 39775.00 per kg. SILVERM Feb18 contract was up by 0.04% to Rs. 40381.00 per kg.

SILVERMIC Nov17 contract was up by 0.02% to Rs. 39772.00 per kg.

Metals

COPPER Nov17 contract was down by 0.51% to Rs. 429.55 per kg. COPPERM Nov17 contract was down by 0.50% to Rs. 429.60 per kg.

NICKEL Sep17 contract was down by 0.52% to Rs. 675.70 per kg. NICKELM Sep17 contract was down by 0.53% to Rs. 675.60 per kg.

ALUMINIUM Sep17 contract was down by 0.51% to Rs. 137.70 per kg.

ALUMINI Sep17 contract was down by 0.51% to Rs. 137.70 per kg. LEAD Sep17 contract was up by 0.37% to Rs. 163.25 per kg.

LEADMINI Sep17 contract was up by 0.40% to Rs. 163.25 per kg. ZINC Sep17 contract was down by 0.41% to Rs. 208.4 per kg.

ZINCMINI Sep17 contract was down by 0.43% to Rs. 208.4 per kg.

Energy

CRUDEOIL Oct17 contract was down by 0.06% to Rs. 3371.00 per BBL. CRUDEOILM Oct17 contract was down by 0.18% to Rs. 3366.00

per BBL. NATURALGAS Oct17 contract was up by 0.30% to Rs. 198.90 per MMBTU.

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Market News

3rd to 6th October 2017

Special News

Sebi to allow MFs, PMS in commex derivatives soon

Commodity derivatives markets (CDM) could see a deepening of participation within the next six months, with the regulator in advanced

stages of permitting mutual funds and portfolio management service (PMS) providers to trade on the 14-year-old platform, Sebi ED SK

Mohanty said on the sidelines of FICCI conference here on Tuesday.

Mohanty also called upon big corporate houses to hedge on domestic exchanges in the light of the upcoming institutional participation

instead of participating in overseas exchanges.

ET first reported about MFs and PMS being allowed in commodity derivatives in the coming months in its edition of September 11.

WGC to form panel to set up spot gold bourse in India

MUMBAI: The World Gold Council (WGC) plans to form a committee soon to help set up India's first spot gold exchange within 12 to 18

months, a senior official of the industry body said on Thursday.

A dedicated exchange for physical gold is expected to pave the way for standard gold pricing practices in India, apart from bringing in

transparency into a market which sees large cash transactions.

"We will be taking lead in forming the committee, which will have all the stakeholders," Somasundaram PR, managing director of the

WGC's Indian operations, told Reuters.

The committee, which is likely to be formed in the December quarter, will not set up the exchange. It will provide guidance in setting up

the exchange, he said, while releasing a WGC report highlighting the need for a dedicated spot gold exchange in the country.

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Market News

3rd to 6th October 2017

Commodity Buzz

Gold Flat, Dollar Showing Promising Upmove

MCX Gold futures are trading in a lax manner ahead of a long weekend. COMEX Gold is showing signs of stabilizing after testing around

five week low. The metal has slipped heavily this week as a break below $1300 levels extended following comments by US Federal

Reserve Chairwoman Janet Yellen which reinforced expectations for another interest-rate increase before the end of the year. In a speech

on Tuesday, Yellen said that while recent soft inflation readings justify a gradual pace for interest-rate hikes, there is also a danger of

moving too gradually. The COMEX Gold futures are trading at $1293 per ounce, almost unchanged on the day. MCX Gold futures are also

trading flat around Rs 29600 per 10 grams.

Economic activity in the US expanded by slightly more than previously estimated in the second quarter, the Commerce Department

revealed in a report on Thursday. The report said gross domestic product grew by 3.1% in the second quarter compared to the previously

estimated 3% growth. Growth in consumer spending, which makes up more than two-thirds of the US economy, was unrevised at a 3.3%

rate in the second quarter as an increase in spending on services was offset by a downward revision to durable goods outlays. Consumer

spending in the second quarter was the fastest in a year.

Strength In Dollar Halts Crude's Rally

MCX Crude oil futures slipped today as a drop under Rs 3400 per barrel mark extended in the counter ahead of the extended weekend.

The counter quotes at Rs 3364 per barrel, down 0.27% on the day. WTI Crude oil seemed poised to correct a bit after hitting its five month

high. The US dollar index has been edging up in last few days. The index has bottomed out at its two and half year low around 91 levels

and currently trades around 93.10 mark. Recent Fed comments clubbed with a spree of sound US economic data is likely to provide good

support to the dollar in coming days. Oil traders can eye this and cut some of their longs in the commodity. WTI futures currently linger

around $50.70 per barrel, having already dropped more than a dollar from its latest high.

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Analyst Speaks

3rd to 6th October 2017

INDIAN

Gold MCX COMEX

Technically now MCX Gold is getting support at 29327 and below RESISTANCE 2 30407

same could see a test of 29089 levels and resistance is now likely

to be seen at 30407 a move above could see prices testing 29986.

RESISTANCE 1 29986

Gold on MCX settled down 0.17% at 29608 as rupee slipped to a

fresh six and a half month low, while Comex Gold rebounded as

the dollar turned lower and ushered in short-covering.

PIVOT 29748

BUY GOD OCT AROUND 29500-29550 SUPPORT 1 29327

TGTS 29950/30450 SL 29100

SUPPORT 2 29089

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Analyst Speaks

3rd to 6th October 2017

CRUDE OIL MCX

INDIAN COMEX

Technically Crude Oil market is under long liquidation as market has RESISTANCE 2 3566

witnessed drop in open interest by 13.04% to settled at 13134.

Now MCX Crude oil is getting support at 3332 and below same could RESISTANCE 1 3469

see a test of 3290 levels and resistance is now likely to be seen at

3444, a move above could see prices testing 3514.

PIVOT 3374

BUY CRUDE OIL OCT AROUND 3300 SUPPORT 1 3277

TGTS 3400/ 3500 SL 3200

SUPPORT 2 3182

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Analyst Speaks

3rd to 6th October 2017

INDIAN COPPER MCX COMEX

Technically Copper market under fresh buying as market has RESISTANCE 2 439

witnessed gain in open interest by 5.85% to settled at 14380 while

prices up 5.8 rupees.

RESISTANCE 1 434

Now MCX Copper is getting support at 426.2 and below same could

see a test of 420.6 levels and resistance is now likely to be seen at

435.4, a move above could see prices testing 439. PIVOT 428

BUY COPPER NOV AROUND 423-425 SUPPORT 1 422

TGTS 430/435 SL 417

SUPPORT 2 416

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Economic Events

3rd to 6th October 2017

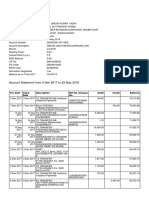

COUNTRY Date TIME EVENT ACTUAL FORECAST PREVIOUS

Tue

6:00pm FOMC Member Powell Speaks

Oct 3

5:45pm ADP Non-Farm Employment Change 151K 237K

Wed

Oct 4 7:30pm ISM Non-Manufacturing PMI 55.5 55.3

8:00pm Crude Oil Inventories -1.8M

12:45am Fed Chair Yellen Speaks

6:00pm Unemployment Claims 270K 272K

Trade Balance -43.0B -43.7B

Thu

Oct 5

6:40pm FOMC Member Powell Speaks

USD

7:30pm FOMC Member Harker Speaks

Factory Orders m/m 0.9% -3.3%

8:00PM Natural Gas Storage 58B

6:00pm Average Hourly Earnings m/m 0.3% 0.1%

Non-Farm Employment Change 88K 156K

Fri Unemployment Rate 4.4% 4.4%

Oct 6

9:45pm FOMC Member Dudley Speaks

10:15pm FOMC Member Kaplan Speaks

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

Disclaimer

The information and views in this report, our website & all the service we provide are believed to be relia-ble,

but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose

the product/s that suits them the most. Sincere efforts have been made to present the right investment perspective.

The information contained herein is based on analysis and up on sources that we consider reliable. This material is

for personal infor-mation and based upon it & takes no responsibility. The information given herein should be treated

as only factor, while making investment decision. The re-port does not provide individually tailor-made investment

advice.24 Carat Financial services recommends that investors independently evaluate particular investments and

strategies, and encourages investors to seek the advice of a financial adviser. 24 Carat Financial Services shall not

be responsible for any transac-tion conducted based on the information given in this report, which is in violation of

rules and regulations of NSE and BSE. The share price projections shown are not necessarily indicative of future

price performance. The infor-mation herein, together with all estimates and forecasts, can change without notice.

Analyst or any person related to 24 Carat financial Services might be holding positions in the stocks recommended.

It is under-stood that anyone who is browsing through the site has done so at his free will and does not read any

views expressed as a recommendation for which either the site or its owners or anyone can be held responsible for. Any

surfing and reading of the information is the acceptance of this disclaimer. All Rights Reserved.

Investment in equity & bullion market has its own risks. We, however, do not vouch for the accuracy or the

completeness thereof. we are not responsible for any loss incurred whatsoever for any financial profits or loss

which may arise from the recommendations above 24 Carat Financial Services does not purport to be an

invitation or an offer to buy or sell any financial instrument. Our Clients (Paid Or Unpaid), Any third party or

anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by

us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can

be taken.

Team :

Name Designation Email

Mr. Prateek Gupta (Technical Research Analyst-head)

Mr. Lakhan Patidar (Sr. Derivative & Technical Analyst)

Mr. Dharmendra Saloniya (Commodity Research Analyst)

Mr. Shubham Chinwar (Sr. Graphic Designer)

Checked By :-

+91-98261-69053 contactus@24cfin.com research@24cfin.com

Sebi Reg. No.:- INH000003358

604 - Shekhar Central, Palasia Square, Indore - 452001, Madhya Pradesh, INDIA

You might also like

- Arbitrage Pricing Theory FinalDocument8 pagesArbitrage Pricing Theory Finalshrudit SinghviNo ratings yet

- Baring Not Just One ManDocument6 pagesBaring Not Just One Man大大No ratings yet

- A Study of Investment Pattern of ICICI Bank CustomersDocument21 pagesA Study of Investment Pattern of ICICI Bank CustomersMelvin Mathew100% (1)

- Industrial FinanceDocument9 pagesIndustrial FinancelovleshrubyNo ratings yet

- Commodities Journal Daily Reports 28th September 2017 ThursdayDocument10 pagesCommodities Journal Daily Reports 28th September 2017 ThursdaySiddharth PatelNo ratings yet

- Commodity Weekly Journal-23rd To 27th Oct 2017Document9 pagesCommodity Weekly Journal-23rd To 27th Oct 2017Siddharth PatelNo ratings yet

- Commodities Journal Daily Reports 26th September 2017 TuesdayDocument10 pagesCommodities Journal Daily Reports 26th September 2017 TuesdaySiddharth PatelNo ratings yet

- Commodity Weekly Journal-16th To 20th Oct 2017Document13 pagesCommodity Weekly Journal-16th To 20th Oct 2017Rahul SharmaNo ratings yet

- Commodity Weekly Journal-6th To 10th Nov 2017Document11 pagesCommodity Weekly Journal-6th To 10th Nov 2017Siddharth PatelNo ratings yet

- 003 Nov 20Document61 pages003 Nov 20siva kNo ratings yet

- Smart 004 Oct 30Document57 pagesSmart 004 Oct 30siva kNo ratings yet

- Derivative Premium Daily JournalDocument17 pagesDerivative Premium Daily JournalRahul SharmaNo ratings yet

- 24cfin-Equity - Share & Commodity Tips - Stock Market - SEBIDocument19 pages24cfin-Equity - Share & Commodity Tips - Stock Market - SEBISiddharth PatelNo ratings yet

- 004 Nov 27Document60 pages004 Nov 27siva kNo ratings yet

- E Copy 27Document45 pagesE Copy 27Krishna GiriNo ratings yet

- Account Statement From 5 Sep 2017 To 5 Mar 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 5 Sep 2017 To 5 Mar 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesameer bakshiNo ratings yet

- PNPA DEC - OdsDocument2 pagesPNPA DEC - OdsChetan GoyalNo ratings yet

- Daily Commodity Report 22 Nov 2013 by EPIC RESEARCHDocument7 pagesDaily Commodity Report 22 Nov 2013 by EPIC RESEARCHNidhi JainNo ratings yet

- 2017 January 29Document43 pages2017 January 29siva kNo ratings yet

- 001 Oct 01Document76 pages001 Oct 01siva kNo ratings yet

- Report PDFDocument1 pageReport PDFDinesh ChoudharyNo ratings yet

- Adira Dinamika Multi Finance TBKDocument3 pagesAdira Dinamika Multi Finance TBKrofiqsabilalNo ratings yet

- T Vra 3 Ku ZLZ FV 9 D WDocument2 pagesT Vra 3 Ku ZLZ FV 9 D WAnonymous zy3rAYHNo ratings yet

- International Commodities Evening Update November 12Document3 pagesInternational Commodities Evening Update November 12Angel BrokingNo ratings yet

- Etsi Office Renovation and Organizational Cost SummaryDocument5 pagesEtsi Office Renovation and Organizational Cost SummaryJason HallNo ratings yet

- 2017 January 22Document46 pages2017 January 22siva kNo ratings yet

- Jigar Nagda: Issue Details PriceDocument2 pagesJigar Nagda: Issue Details PriceRajat SinglaNo ratings yet

- 4 Dec 2017Document67 pages4 Dec 2017siva kNo ratings yet

- International Commodities Evening Update November 22Document3 pagesInternational Commodities Evening Update November 22Angel BrokingNo ratings yet

- Web: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Mob.: 9825306980, 9825006980Document102 pagesWeb: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Mob.: 9825306980, 9825006980Murali KrishnanNo ratings yet

- Smart - 3 March 2019 PDFDocument52 pagesSmart - 3 March 2019 PDFSubhas MishraNo ratings yet

- ATL Smartsheet ReportDocument51 pagesATL Smartsheet ReportLeslie Jacin CedeñoNo ratings yet

- Wa0025Document8 pagesWa0025SachinZambareNo ratings yet

- 1504974905727RIsbFzyHfeNYmh7G PDFDocument1 page1504974905727RIsbFzyHfeNYmh7G PDFshreeya agrawalNo ratings yet

- PennystocksDocument1 pagePennystocksAmmeetNo ratings yet

- QQF 8 TVG BZ8 KFW 6 FVDocument18 pagesQQF 8 TVG BZ8 KFW 6 FVKishore BhaskarNo ratings yet

- ReportDocument1 pageReportDinesh ChoudharyNo ratings yet

- Smart Investment 6-12 Aug PDFDocument61 pagesSmart Investment 6-12 Aug PDFVaibhav JagtapNo ratings yet

- 11 Dec 2017Document63 pages11 Dec 2017siva kNo ratings yet

- Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 16, 2017 To March 01, 2017Document2 pagesCorporate Event Tracker: Tracker of Forthcoming Corporate Action From February 16, 2017 To March 01, 2017shobhaNo ratings yet

- International Commodities Evening Update November 29Document3 pagesInternational Commodities Evening Update November 29Angel BrokingNo ratings yet

- Bitacora de CombustibleDocument9 pagesBitacora de CombustibleJuan CastrillónNo ratings yet

- Project - Masinag Ofc Disbursement Summary 1/6-31/2017 Date Particulars Ref No. Amt CH of Accts RemarksDocument3 pagesProject - Masinag Ofc Disbursement Summary 1/6-31/2017 Date Particulars Ref No. Amt CH of Accts RemarksEvans CorpNo ratings yet

- 20180410122326XXXXXXX0418 PDFDocument3 pages20180410122326XXXXXXX0418 PDFNagaraj KumarNo ratings yet

- 2017 January 15Document37 pages2017 January 15siva kNo ratings yet

- Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 10, 2017 To February 22, 2017Document2 pagesCorporate Event Tracker: Tracker of Forthcoming Corporate Action From February 10, 2017 To February 22, 2017Dinesh ChoudharyNo ratings yet

- Short Term Calls by Ankush RajeDocument4 pagesShort Term Calls by Ankush Rajeankush rajeNo ratings yet

- International Commodities Evening Update December 5Document3 pagesInternational Commodities Evening Update December 5Angel BrokingNo ratings yet

- Content: Market Highlights Day's Overview Outlook Important Events For TodayDocument3 pagesContent: Market Highlights Day's Overview Outlook Important Events For Todayhitesh315No ratings yet

- Hard Copy Is Available On Every Sunday Morning at Your Nearest Book-StallDocument42 pagesHard Copy Is Available On Every Sunday Morning at Your Nearest Book-StallBhanu Prakash KvnNo ratings yet

- ReportDocument1 pageReportDinesh ChoudharyNo ratings yet

- Web: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Mob.: 9825306980, 9825006980Document70 pagesWeb: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Mob.: 9825306980, 9825006980Crypto TigerNo ratings yet

- SInv Eng 20231016Document88 pagesSInv Eng 20231016shuhaaibNo ratings yet

- RML 2023Document8 pagesRML 2023Ria Mae LlantoNo ratings yet

- International Commodities Evening Update December 6Document3 pagesInternational Commodities Evening Update December 6Angel BrokingNo ratings yet

- Account Statement From 3 Nov 2017 To 23 May 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 3 Nov 2017 To 23 May 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUMESH KUMAR YadavNo ratings yet

- Dec 7th 09 Oxyzen Market ReportDocument5 pagesDec 7th 09 Oxyzen Market Reportbaldev_solankiNo ratings yet

- Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 02, 2017 To February 15, 2017Document2 pagesCorporate Event Tracker: Tracker of Forthcoming Corporate Action From February 02, 2017 To February 15, 2017umaganNo ratings yet

- International Commodities Evening Update December 3Document3 pagesInternational Commodities Evening Update December 3Angel BrokingNo ratings yet

- List of Employees NPF Security Services: S.No Name DesignationDocument58 pagesList of Employees NPF Security Services: S.No Name Designationrizwanrahat7023No ratings yet

- 1st Feb To 15th FebDocument11 pages1st Feb To 15th FebVeer RajputeNo ratings yet

- Peru Scrap 2Document55 pagesPeru Scrap 2Faeem AhmadNo ratings yet

- EDocument71 pagesEGanesh BorkarNo ratings yet

- Commodity Weekly Journal-16th To 20th Oct 2017Document13 pagesCommodity Weekly Journal-16th To 20th Oct 2017Rahul SharmaNo ratings yet

- Derivatives 21th September 2017, ThursdayDocument18 pagesDerivatives 21th September 2017, ThursdayRahul SharmaNo ratings yet

- Equity Report 11th September 2017, MondayDocument17 pagesEquity Report 11th September 2017, MondayRahul SharmaNo ratings yet

- Derivative Premium Daily JournalDocument17 pagesDerivative Premium Daily JournalRahul SharmaNo ratings yet

- Value Averaging Fund - PresentationDocument27 pagesValue Averaging Fund - Presentationfbxurumela100% (1)

- superSTART Scheme Investment OptionsDocument69 pagessuperSTART Scheme Investment OptionsDeuterNo ratings yet

- 07december2022 India DailyDocument21 pages07december2022 India DailyNikhilKapoor29No ratings yet

- 12 Activity 1Document1 page12 Activity 1•MUSIC MOOD•No ratings yet

- SRC Rule10.1Document7 pagesSRC Rule10.1KatNo ratings yet

- Brand Management Chapter 8Document47 pagesBrand Management Chapter 8Maula JuttNo ratings yet

- Ratios Solved ProblemsDocument8 pagesRatios Solved ProblemsYasser Maamoun50% (2)

- Prashant ResumeDocument7 pagesPrashant ResumePrashantAlavandiNo ratings yet

- Question 2-Warda FatimaDocument3 pagesQuestion 2-Warda FatimaMasooma RazaNo ratings yet

- Investment and Portfolio AnalysisDocument24 pagesInvestment and Portfolio Analysis‘Alya Qistina Mohd ZaimNo ratings yet

- 3 Chart Patterns Cheat SheetDocument7 pages3 Chart Patterns Cheat SheetEmmanuel BoatengNo ratings yet

- 1st Term Financial ManagementDocument76 pages1st Term Financial ManagementMallet S. GacadNo ratings yet

- Banking and Finance QuestionsDocument22 pagesBanking and Finance Questionsatul mishraNo ratings yet

- Pengaruh Analisis Fundamental, Teknikal Dan Bandarmologi Terhadap Harga Saham Syariah Yang Terdaftar Di Jakarta Islamic Index Periode 2018-2021Document15 pagesPengaruh Analisis Fundamental, Teknikal Dan Bandarmologi Terhadap Harga Saham Syariah Yang Terdaftar Di Jakarta Islamic Index Periode 2018-2021usdeldi akNo ratings yet

- 2Document126 pages2Nguyen Van Sang (K17CT)No ratings yet

- Mortgage (CH 9)Document37 pagesMortgage (CH 9)widya nandaNo ratings yet

- Forex & DerivativesDocument6 pagesForex & Derivativessarahbee100% (1)

- DRHP PDFDocument572 pagesDRHP PDFJindal HydraulicsNo ratings yet

- Forum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: ServicesDocument5 pagesForum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: Servicesrohit kanojiaNo ratings yet

- MSC Finance Escp Business SchoolDocument8 pagesMSC Finance Escp Business Schoolpacito pacitoNo ratings yet

- Reverse MergersDocument16 pagesReverse MergersIshita AroraNo ratings yet

- SEC Filings - Microsoft - 0000898430-99-001359Document17 pagesSEC Filings - Microsoft - 0000898430-99-001359highfinanceNo ratings yet

- Buyback PPTDocument16 pagesBuyback PPTSubham MundhraNo ratings yet

- Demand Trends: Full Year and Q4 2006Document23 pagesDemand Trends: Full Year and Q4 2006Rakesh VNo ratings yet

- DeliveryDocument25 pagesDeliverymarcusjwheeler013No ratings yet