Professional Documents

Culture Documents

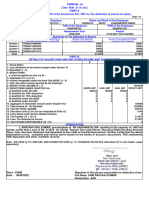

Details of Salary Paid and Any Other Income and Tax Deducted

Details of Salary Paid and Any Other Income and Tax Deducted

Uploaded by

Rajesh KharmaleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Details of Salary Paid and Any Other Income and Tax Deducted

Details of Salary Paid and Any Other Income and Tax Deducted

Uploaded by

Rajesh KharmaleCopyright:

Available Formats

1205 EMPID:4338

Form No. 16

{See Rule 31(1)(a) }

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source from income chargeable under the head 'Salaries'

Name and address of the employer Name and designation of the employee

Motilal Oswal Securities Ltd VAIBHAV D. SHRINGARPURE

Palm Spring Centre,2nd Floor, EXECUTIVE - OPERATIONS

Link Road, Malad (W)

Mumbai

MAHARASHTRA

INDIA

PAN of the Deductor TAN of the Deductor PAN of the Employee

AAACD3654Q MUMM10776D CLCPS9429Q

Acknowledgement Nos. of all quarterly statements of TDS under Period Assessment Year

sub-section (3) of section 200 as provided by TIN Facilitation

Centre or NSDL website FROM TO

Quarter Acknowledgement No.

1 030400200238844 14-Sep-2009 18-Jan-2010 2010-2011

2 030400200242576

3 030400200252041

4 Not Available as the last Quarterly Statement is yet to be

furnished

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1.Gross Salary Rs. Rs. Rs.

a)Salary as per provisions contained in sec.17(1) 62,210.00

b)Value of perquisites u/s 17(2) (as per Form No.12BA,

wherever applicable) 0.00

c)Profits in lieu of salary under section 17(3) (as per

Form No.12BA, wherever applicable) 0.00

d)Total 62,210.00

2.Less :Allowance to the extent exempt u/s 10

Conveyance Allowance 3,317.00

3,317.00

3.Balance(1-2) 58,893.00

4.Deductions :

a)Entertainment allowance Rs. 0.00

b)Tax on employment Rs. 950.00

5.Aggregate of 4(a) to 4(b) 950.00

6.Income chargeable under the head 'Salaries'(3-5) 57,943.00

7.Add: Any other income reported by the employee

LOSS FROM HOUSE PROPERTY 0.00

0.00

8.Gross Total Income(6+7) 57,943.00

9.Deductions under Chapter VIA

(A)Section 80C,80CCC and 80CCD

Description Gross Amount Qualifying Amount Deductible Amount

a)Section 80C

b)Section 80CCC 0.00 0.00 0.00

c)Section 80CCD 0.00 0.00 0.00

(B)Other Sections (for e.g. 80E,80G etc) under Chapter VIA

10.Aggregate of deductible amount under Chapter VIA 0.00

11.Total Income(8-10) 57,940.00

12.Tax on Total Income 0.00

1205 EMPID:4338

13.Surcharge (on tax computed at S.No.12) 0.00

14.Education Cess @ 3% (on tax at S.No.12 plus surcharge 0.00

at S.No.13)

15.Tax Payable(12+13+14) 0.00

16.Relief under Section 89 (attach details) 0.00

17.Net Tax Payable(15-16) 0.00

18.Less: a)Tax deducted at source u/s 192(1) 0.00

b)Tax paid by the employer on behalf of the employee 0.00

u/s 192(IA) on perquisites u/s 17(2)

19.Tax Payable/(refundable) (17-18) 0.00

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

SL. TDS Rs. Surcharge Rs. Education Total Tax Cheque/DD BSR Code Date on which tax Transfer

No. Cess Rs. Deposited Rs. No.(if any) of Bank deposited (DD-Mon Voucher /

Branch -YYYY) Challan

Identification

No.

I, SUDHIR DHAR S/o LATE SHRI HIRA LAL DHAR working in the capacity of SENIOR VP-HR & OD do hereby certify

that a sum of Rs.0.00 [Rupees Zero only] has been deducted at source and paid to the credit of the Central Government. I

further certify that the information given above is true and correct based on the books of account,documents and other available

records.

Place : MUMBAI Signature of the person responsible for deduction of tax

Date : 30-Apr-2010 Full Name : SUDHIR DHAR

Designation : SENIOR VP-HR & OD

Signature Not Verified

Digitally signed by Sudhir H

Dhar

Date: 2010.06.19 17:19:22 IST

1205 EMPID:4338

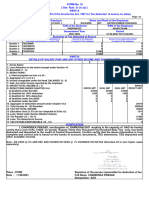

Form No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites,other fringe benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of the employer: Motilal Oswal Securities Ltd

Palm Spring Centre,2nd Floor,

Link Road, Malad (W)

Mumbai

MAHARASHTRA

INDIA

2. TAN MUMM10776D

3. TDS Assessment Range of the employer: TDS CIRCLE 82(2)

4. Name,designation and PAN of the employee: VAIBHAV D. SHRINGARPURE

EXECUTIVE - OPERATIONS

CLCPS9429Q

5. Is the employee a director or a person with N

substantial interest in the company (where employer

is a company):

6. Income under head 'Salaries' of the employee 57,943.00

(other than perquisites):

7. Financial Year: 2009-2010

8. Valuation of Perquisites:

SL. Nature of perquisite(see rule 3) Value of perquisite Amount,if any Amount of

No. as per rules (Rs.) recovered from perquisite

employee (Rs.) chargeable to tax

Col(3)-Col(4) (Rs.)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

3 Sweeper, gardener, watchman or personal Attendant 0.00 0.00 0.00

4 Gas, electricity, water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday Expenses 0.00 0.00 0.00

7 Free or Concessional Travel 0.00 0.00 0.00

8 Free Meals 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts, vouchers, etc. 0.00 0.00 0.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to Employees 0.00 0.00 0.00

15 Stock options (non-qualified options) 0.00 0.00 0.00

16 Other benefits or amenities 0.00 0.00 0.00

17 Value of any other benefit/amenity/service/privilege 0.00 0.00 0.00

18 Total value of perquisites 0.00 0.00 0.00

19 Total value of Profits in lieu of salary as per 17(3) 0.00 0.00 0.00

9. Details of Tax.

a)Tax deducted from salary of the employee u/s 192(1) 0.00

b)Tax paid by the employer on behalf of the employee u/s 192(1A) 0.00

c)Total Tax Paid 0.00

d)Date of payment into Government treasury Various Dates as mentioned on Page 2 of the Form 16

DECLARATION BY THE EMPLOYER

I, SUDHIR DHAR S/o LATE SHRI HIRA LAL DHAR working as SENIOR VP-HR & OD do hereby declare on behalf of

Motilal Oswal Securities Ltd that the information given above is based on the books of account,documents and other relevant

records or information available with us and the details of value of each such perquisite are in accordance with section 17 and

rules framed there under and that such information is true and correct.

Place : MUMBAI Signature of the person responsible for deduction of tax

Date : 30-Apr-2010 Full Name : SUDHIR DHAR

Designation : SENIOR VP-HR & OD

Signature Not Verified

Digitally signed by Sudhir H

Dhar

Date: 2010.06.19 17:19:24 IST

You might also like

- Compensation Management TATA Motors 2Document86 pagesCompensation Management TATA Motors 2deepak Gupta75% (4)

- International Marketing ReportDocument18 pagesInternational Marketing ReportGayatri Mudaliar0% (1)

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- Interview Questions Based On Thermal Power PlantDocument3 pagesInterview Questions Based On Thermal Power Plantrohit_me083No ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 1629042024 151129Document2 pagesForm 1629042024 151129UtkarshNo ratings yet

- Form 1615072023 161901Document2 pagesForm 1615072023 161901Steve BurnsNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Wa0000.Document2 pagesWa0000.anpro1299No ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- 20092010form16 004355Document3 pages20092010form16 004355Hemen BrahmaNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Judicial Reforms in IndiDocument1 pageJudicial Reforms in IndiArsalan KhanNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Micro Payslip - May, 2022 (Emp Code00111500)Document1 pageMicro Payslip - May, 2022 (Emp Code00111500)chagusahoo170No ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1617052024 112840Document3 pagesForm 1617052024 112840sandeep kumarNo ratings yet

- Atppn7354l Partb 2020 21 PDFDocument3 pagesAtppn7354l Partb 2020 21 PDFPratik MeswaniyaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- 7705 Form16-B-201819-461 PDFDocument1 page7705 Form16-B-201819-461 PDFAnonymous vlaen0sHNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Group 4 Feasibility Study (Chap 1-3)Document33 pagesGroup 4 Feasibility Study (Chap 1-3)Katrina PaquizNo ratings yet

- ChE 197 Introduction To Health Safety and Environment Syllabus 1st Sem 2014 2015 PDFDocument2 pagesChE 197 Introduction To Health Safety and Environment Syllabus 1st Sem 2014 2015 PDFKeith SmithNo ratings yet

- Chapter 8Document43 pagesChapter 8mromarshehataNo ratings yet

- Construction Superintendent Resume SampleDocument4 pagesConstruction Superintendent Resume Sampleafmrspaewtysso100% (1)

- Different Types of Visa: 1. H1B 2. Opt/ Ead 3. EAD 4. Green Card / Permanent Residence 5. Trans National (TN)Document8 pagesDifferent Types of Visa: 1. H1B 2. Opt/ Ead 3. EAD 4. Green Card / Permanent Residence 5. Trans National (TN)Sateesh DexterNo ratings yet

- Employee Safety DeclarationDocument1 pageEmployee Safety DeclarationTukachungurwa Byarugaba AlexNo ratings yet

- McKinsey Quarterly 2015 Number 4Document120 pagesMcKinsey Quarterly 2015 Number 4Alex DincoviciNo ratings yet

- Employee Satisfaction On Welfare Measures at Balco PVT LTDDocument11 pagesEmployee Satisfaction On Welfare Measures at Balco PVT LTDAngel BeautyNo ratings yet

- A Tale of Two Auto PlantsDocument471 pagesA Tale of Two Auto PlantssonirocksNo ratings yet

- Simmons V HankeyDocument47 pagesSimmons V HankeyastroNo ratings yet

- EH403 - Digests - Topic 12 Right To Security of TenureDocument7 pagesEH403 - Digests - Topic 12 Right To Security of TenureRubierosseNo ratings yet

- NRA - Liability Letter To GovernorDocument2 pagesNRA - Liability Letter To GovernorRiley SnyderNo ratings yet

- 0811 Employee Involvement PDFDocument2 pages0811 Employee Involvement PDFFirman Suryadi RahmanNo ratings yet

- HR Form PROBATION ASSESSMENT AcademicDocument2 pagesHR Form PROBATION ASSESSMENT AcademicZahidin Mohd ZahidNo ratings yet

- Work SimplificationDocument3 pagesWork SimplificationZabNo ratings yet

- Chapter One ManagementDocument12 pagesChapter One ManagementmikialeNo ratings yet

- Sample Questions Human Resource Information SystemDocument9 pagesSample Questions Human Resource Information Systemamit rawatNo ratings yet

- LiveRecovery Save of HandBook-Scholle IPN India-EnglishDocument15 pagesLiveRecovery Save of HandBook-Scholle IPN India-EnglishNishaNo ratings yet

- Ishu Main File2Document73 pagesIshu Main File2ishan chughNo ratings yet

- Social Work and The LawsDocument20 pagesSocial Work and The LawsDbee DveeNo ratings yet

- 02 Behavioural Safety Audit Site Inspection NCMTDocument6 pages02 Behavioural Safety Audit Site Inspection NCMTbabudevanandNo ratings yet

- The Dimensions, Antecedents, and Consequences of Emotional LaborDocument26 pagesThe Dimensions, Antecedents, and Consequences of Emotional LaborAlaa MoussaNo ratings yet

- FINALODocument5 pagesFINALOSeif TamimiNo ratings yet

- Industrial Engineering: End Term JuryDocument14 pagesIndustrial Engineering: End Term JuryShailja SundaramNo ratings yet

- Presumption-Aris CaseDocument2 pagesPresumption-Aris CaseannrseatienzaNo ratings yet

- Chapter 3Document56 pagesChapter 3Gomathi SankarNo ratings yet

- Payslip For The Month of Sep 2021: R1 RCM Global Private LimitedDocument1 pagePayslip For The Month of Sep 2021: R1 RCM Global Private LimitedVandana N MNo ratings yet

- Nef Elem Filetest 2a PDFDocument4 pagesNef Elem Filetest 2a PDFPeter Torok KovacsNo ratings yet