Professional Documents

Culture Documents

Monthly Returns (%) Date S&P 500 Date

Monthly Returns (%) Date S&P 500 Date

Uploaded by

rishabh poniya0 ratings0% found this document useful (0 votes)

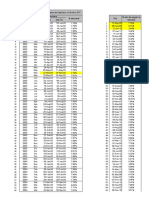

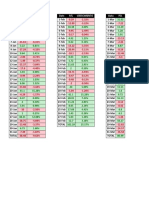

25 views5 pagesThe document contains monthly return data for the S&P 500 index and two stocks, Reynolds and Hasbro, from January 2002 to December 2006. It also includes average annual returns, standard deviations, correlations, betas, and calculations of portfolio risk and return for combinations of the S&P 500 with each stock. The beta values indicate Reynolds has lower market risk than Hasbro. The document asks if a stock could have a negative beta value and what the implications would be.

Original Description:

Market analysis

Original Title

Alex Sharpe

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains monthly return data for the S&P 500 index and two stocks, Reynolds and Hasbro, from January 2002 to December 2006. It also includes average annual returns, standard deviations, correlations, betas, and calculations of portfolio risk and return for combinations of the S&P 500 with each stock. The beta values indicate Reynolds has lower market risk than Hasbro. The document asks if a stock could have a negative beta value and what the implications would be.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views5 pagesMonthly Returns (%) Date S&P 500 Date

Monthly Returns (%) Date S&P 500 Date

Uploaded by

rishabh poniyaThe document contains monthly return data for the S&P 500 index and two stocks, Reynolds and Hasbro, from January 2002 to December 2006. It also includes average annual returns, standard deviations, correlations, betas, and calculations of portfolio risk and return for combinations of the S&P 500 with each stock. The beta values indicate Reynolds has lower market risk than Hasbro. The document asks if a stock could have a negative beta value and what the implications would be.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 5

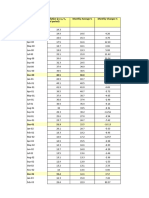

MONTHLY RETURNS (%)

DATE S&P 500 DATE

Jan-02 -1.7 Jan-02

Feb-02 -2.31 Feb-02

Mar-02 4.37 Mar-02

Apr-02 -5.06 Apr-02

May-02 -1.19 May-02

Jun-02 -7.15 Jun-02

Jul-02 -8.23 Jul-02

Aug-02 0.64 Aug-02

Sep-02 -10.14 Sep-02

Oct-02 7.35 Oct-02

Nov-02 5.96 Nov-02

Dec-02 -5.5 Dec-02

Jan-03 -2.46 Jan-03

Feb-03 -1.72 Feb-03

Mar-03 0.89 Mar-03

Apr-03 8.12 Apr-03

May-03 6.18 May-03

Jun-03 1.48 Jun-03

Jul-03 2.18 Jul-03

Aug-03 2.34 Aug-03

Sep-03 -1.06 Sep-03

Oct-03 5.89 Oct-03

Nov-03 1.51 Nov-03

Dec-03 4.39 Dec-03

Jan-04 2.2 Jan-04

Feb-04 1.4 Feb-04

Mar-04 -1.2 Mar-04

Apr-04 -2.56 Apr-04

May-04 1.24 May-04

Jun-04 2 Jun-04

Jul-04 -3.88 Jul-04

Aug-04 0.11 Aug-04

Sep-04 1.91 Sep-04

Oct-04 1.66 Oct-04

Nov-04 4.43 Nov-04

Dec-04 3.34 Dec-04

Jan-05 -2.74 Jan-05

Feb-05 2.09 Feb-05

Mar-05 -1.86 Mar-05

Apr-05 -2.66 Apr-05

May-05 3.59 May-05

Jun-05 0.99 Jun-05

Jul-05 4.22 Jul-05

Aug-05 -0.78 Aug-05

Sep-05 0.93 Sep-05

Oct-05 -2.19 Oct-05

Nov-05 3.82 Nov-05

Dec-05 0.19 Dec-05

Jan-06 3.9 Jan-06

Feb-06 -0.36 Feb-06

Mar-06 1.76 Mar-06

Apr-06 1.15 Apr-06

May-06 -3.3 May-06

Jun-06 -0.19 Jun-06

Jul-06 -0.28 Jul-06

Aug-06 2.3 Aug-06

Sep-06 1.81 Sep-06

Oct-06 3.6 Oct-06

Nov-06 2.13 Nov-06

Dec-06 0.91 Dec-06

Average Return 0.574333

Annual Return 6.892

Standard deviation 3.601713

Annual SD 12.4767

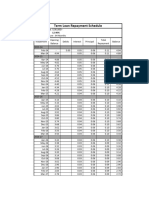

COREL S&P and Reynolds 0.282925

COREL S&P and hasbro 0.63009

Portfolio risk With S&P and Reynolds 12.44762

Portfolio risk With S&P and hasbro 12.53098

Portfolio return With S&P and Reynolds 7.04806

Portfolio return With S&P and hasbro 6.96514

Beta for reynolds 0.735763

Beta for hasbro 1.419799

Beta capture the market risk

The more risk value the more riskier the portfolio is

Can there be any stock with negative beta value

and what its implication and significance?

URNS (%)

REYNOLDS DATE HASBRO

6.13 Jan-02 1.66

9.87 Feb-02 -13.27

-1.37 Mar-02 10.55

6.87 Apr-02 1.01

2.17 May-02 -4.26

-23.97 Jun-02 -11.37

1.64 Jul-02 -9.66 REYNOLDS

7.71 Aug-02 7.35 BETA 0.735763

-31.48 Sep-02 -15.36

0.57 Oct-02 -8.18

-4.81 Nov-02 25.44

9.09 Dec-02 -9.91

0.59 Jan-03 3.9

-5.78 Feb-03 0.92

-19.17 Mar-03 14.7

-12.68 Apr-03 15.19

21.02 May-03 0.06

9.15 Jun-03 9.24

-4.54 Jul-03 7.78

-3.86 Aug-03 -1.86

15.78 Sep-03 0.97

21.47 Oct-03 16.7

14.93 Nov-03 1.42

5.34 Dec-03 -3.75

1.56 Jan-04 -7.19

4.52 Feb-04 10.73

-1.99 Mar-04 -0.55

7.06 Apr-04 -13.15

-13.23 May-04 4.08

20.27 Jun-04 -3.36

6.45 Jul-04 -4.37

4.93 Aug-04 1.98

-9.88 Sep-04 1.46

1.21 Oct-04 -5.9

9.83 Nov-04 7.57

3.93 Dec-04 1.84

2.32 Jan-05 1.14

1.9 Feb-05 7.76

-1.66 Mar-05 -3.17

-3.25 Apr-05 -7.48

6.34 May-05 6.66

-4.96 Jun-05 3.02

5.72 Jul-05 5.53

0.76 Aug-05 -5.65

-1.1 Sep-05 -5.07

2.38 Oct-05 -4.12

4.73 Nov-05 8.39

7.09 Dec-05 -1.18

6.08 Jan-06 5.05

4.96 Feb-06 -4.29

-0.61 Mar-06 3.99

3.93 Apr-06 -6.59

0.26 May-06 -5.94

4.88 Jun-06 -2.32

9.96 Jul-06 3.26

2.65 Aug-06 8.56

-4.76 Sep-06 12.07

1.92 Oct-06 13.93

1.71 Nov-06 3.2

1.91 Dec-06 1.87

1.87483333 1.183833

22.498 14.206

9.36645828 8.115834

32.4463632 28.11407

REYNOLDS HASBRO

1.419799

You might also like

- MidTerm MGT782 JULY 2023Document6 pagesMidTerm MGT782 JULY 2023Alea AzmiNo ratings yet

- Hedge Fund Modelling and Analysis Using Excel and VBA: WorksheetsDocument6 pagesHedge Fund Modelling and Analysis Using Excel and VBA: WorksheetsmarcoNo ratings yet

- OD7 PL Integer ProgrammingDocument6 pagesOD7 PL Integer ProgrammingcarolinarvsocnNo ratings yet

- ValueMax EvaluationDocument35 pagesValueMax EvaluationAnkit ShahNo ratings yet

- Brent Cracking Brent Hydroskimming Urals Cracking Urals Hydroskimming NW Europe NW Europe NW Europe NW EuropeDocument24 pagesBrent Cracking Brent Hydroskimming Urals Cracking Urals Hydroskimming NW Europe NW Europe NW Europe NW Europeasad razaNo ratings yet

- Gini Index: WEF, Inclusive Development IndexDocument10 pagesGini Index: WEF, Inclusive Development IndexAkshay GargNo ratings yet

- Cardex Jul Agos 20011Document127 pagesCardex Jul Agos 20011Brandon Tamara ChipaNo ratings yet

- Converting Into Decimal Return Date VBTLX Vfiax Date VBTLX VfiaxDocument2 pagesConverting Into Decimal Return Date VBTLX Vfiax Date VBTLX VfiaxJatin SharmaNo ratings yet

- Trimestral 20170416 160748Document10 pagesTrimestral 20170416 160748yanekarol220289No ratings yet

- 2021-01-Model Precios Gral PRESUP Dic-21Document331 pages2021-01-Model Precios Gral PRESUP Dic-21Florencia MucarzelNo ratings yet

- 2020 - M8 Viscas - M60 - MetDocument606 pages2020 - M8 Viscas - M60 - MetJhuliana Patricia Cárdenas JanampaNo ratings yet

- Barra Garden Juros e Saldo DevedorDocument38 pagesBarra Garden Juros e Saldo DevedorM Eduarda Correia CarvalhoNo ratings yet

- IPCA X SOJA - Jan16Document7 pagesIPCA X SOJA - Jan16fernandodpires89No ratings yet

- Clase - Teoria Portafolio FinalDocument12 pagesClase - Teoria Portafolio FinalMilagros Mendoza QuintanillaNo ratings yet

- Consumo Diario Real NGR Semana Fecha Venta Diaria Tarjetas de Crédito Tarjetas de Débito EfectivoDocument39 pagesConsumo Diario Real NGR Semana Fecha Venta Diaria Tarjetas de Crédito Tarjetas de Débito EfectivoCristian ReyesNo ratings yet

- Aaron DataDocument326 pagesAaron DataQuofi SeliNo ratings yet

- Solved Exercises - The Capital Asset Pricing Model Part IIDocument6 pagesSolved Exercises - The Capital Asset Pricing Model Part IIana lisa melanoNo ratings yet

- DIA España Mexico Italia Fecha Casos Muertos Fecha Casos Muertos FechaDocument35 pagesDIA España Mexico Italia Fecha Casos Muertos Fecha Casos Muertos FechaDalilaNo ratings yet

- Ema Eppr PWG Nus DPGMDocument13 pagesEma Eppr PWG Nus DPGMShrekNo ratings yet

- Calendario de Vencimentopvati1Document2 pagesCalendario de Vencimentopvati1Osmir MonteiroNo ratings yet

- Academic-Timetable-2022-23-Pdf ZZZDocument1 pageAcademic-Timetable-2022-23-Pdf ZZZqstqnjmmpqNo ratings yet

- Presentation On: Submitted byDocument19 pagesPresentation On: Submitted byabhay_prakash_ranjanNo ratings yet

- RIMT Case Study Two Solution, Global Financial Crisis, Apple Inc, SIM Assignment, S2, ECON 1272, BASIC ECONOMETRICSDocument19 pagesRIMT Case Study Two Solution, Global Financial Crisis, Apple Inc, SIM Assignment, S2, ECON 1272, BASIC ECONOMETRICSalka murarkaNo ratings yet

- EER - EPLLPA - PF4 - Y44MB - DPGM (4) - 30.01.2024Document11 pagesEER - EPLLPA - PF4 - Y44MB - DPGM (4) - 30.01.2024maria.rodriguez.gela23No ratings yet

- Base para LiquidarDocument33 pagesBase para Liquidaralexandra holguinNo ratings yet

- Mejor Caso Covid-19Document11 pagesMejor Caso Covid-19m rNo ratings yet

- Proyecto Entrega N1Document34 pagesProyecto Entrega N1Juan David quevedoNo ratings yet

- PTC LTD: Month Dividend Opening ClosingDocument40 pagesPTC LTD: Month Dividend Opening Closingirfan rafiqNo ratings yet

- Tugas Statistika Dasar 1 (Adrian)Document5 pagesTugas Statistika Dasar 1 (Adrian)Ryan SupusepaNo ratings yet

- 148 Meghna Vasudeva 2015B3A7664H Tech Mahindra BITS Hyderabad CampusDocument22 pages148 Meghna Vasudeva 2015B3A7664H Tech Mahindra BITS Hyderabad Campusharsh19021996No ratings yet

- Seasonally Adjusted U-6 DataDocument26 pagesSeasonally Adjusted U-6 DataZerohedgeNo ratings yet

- Jaga ObgynDocument2 pagesJaga Obgynbella_meNo ratings yet

- Planilha de Atualização Monetária Inss - 2007-03Document4 pagesPlanilha de Atualização Monetária Inss - 2007-03Márcia MendesNo ratings yet

- PF Question 1 DataDocument5 pagesPF Question 1 DataNEERAJ N RCBSNo ratings yet

- Term Loan Repayment ScheduleDocument2 pagesTerm Loan Repayment ScheduleVijay HemwaniNo ratings yet

- Producción Chilena de Cobre de Mina/ Chilean Copper Mine Production Radomiro Tomic Chuquicamata y Radomiro Tomic (2) Ministro HalesDocument28 pagesProducción Chilena de Cobre de Mina/ Chilean Copper Mine Production Radomiro Tomic Chuquicamata y Radomiro Tomic (2) Ministro Halesgeeorge18No ratings yet

- Average Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroDocument16 pagesAverage Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroKing CheungNo ratings yet

- Matriz de Cotización de Precios de Cierre: Date Toyrus Bank of A PepsicoDocument7 pagesMatriz de Cotización de Precios de Cierre: Date Toyrus Bank of A PepsicoRogerNo ratings yet

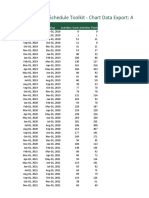

- Murphy Group Schedule Toolkit - Chart Data Export: Activities Starting/ PeriodDocument3 pagesMurphy Group Schedule Toolkit - Chart Data Export: Activities Starting/ PeriodA ZamanNo ratings yet

- KL ChartDocument7 pagesKL ChartSy SubsNo ratings yet

- Irias Samuel S2 Tarea GrupalDocument13 pagesIrias Samuel S2 Tarea GrupalAntonio ValerianoNo ratings yet

- FossanoDocument3 pagesFossanoForood Torabian IsfahaniNo ratings yet

- Schedule - Sheet1Document1 pageSchedule - Sheet1benjamin.luNo ratings yet

- Monthly Mean Monthly Variance Monthly Std. Dev.: Portfolio Return, RDocument7 pagesMonthly Mean Monthly Variance Monthly Std. Dev.: Portfolio Return, RAmit JhaNo ratings yet

- Excel Data Statistika Tugas 2Document3 pagesExcel Data Statistika Tugas 2ningrumtyas684No ratings yet

- PORDATA Desemprego INE Mensal Ago21Document142 pagesPORDATA Desemprego INE Mensal Ago21AiroldspeedNo ratings yet

- CondoActive November2010Document3 pagesCondoActive November2010STAORNo ratings yet

- TV Receivers DataDocument3 pagesTV Receivers DataOmkarNo ratings yet

- 2021 Workweek CalendarDocument1 page2021 Workweek CalendarAli MonayNo ratings yet

- Buscarv Ordenado Verdadero y FalsoDocument9 pagesBuscarv Ordenado Verdadero y FalsoRodrigo Blanco LauraNo ratings yet

- Gen 0.4-1 Amdt Aip 3-18Document2 pagesGen 0.4-1 Amdt Aip 3-18oaca twraimhbNo ratings yet

- Losses Fiber CycloneDocument3 pagesLosses Fiber CycloneRahma idahNo ratings yet

- Ema Eppk PWG Nus DPGMDocument13 pagesEma Eppk PWG Nus DPGMShrekNo ratings yet

- Japan/Ex Rate US/Ex Rate Spain/Ex Rate Dec-05 Mar-06 Jun-06 Sep-06 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10Document6 pagesJapan/Ex Rate US/Ex Rate Spain/Ex Rate Dec-05 Mar-06 Jun-06 Sep-06 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10nishimoniNo ratings yet

- Summer Term / Early Exams Summer Term / Early Exams Summer Term / Early ExamsDocument1 pageSummer Term / Early Exams Summer Term / Early Exams Summer Term / Early ExamsRyan HircockNo ratings yet

- HC Investimentos IBOV SMLL DiversificaçãoDocument7 pagesHC Investimentos IBOV SMLL DiversificaçãoFabiano MorattiNo ratings yet

- TRK - ResultadosDocument37 pagesTRK - ResultadosFirst MídiaNo ratings yet

- Programaciones Salud OcupacionalDocument2 pagesProgramaciones Salud Ocupacionalmiriam lahuNo ratings yet

- Suivi Versions DV DReprogDocument1 pageSuivi Versions DV DReprogPokédex PikapikaNo ratings yet

- STT STT Bid BVH CTD CTG DPM Eib FPT Gas GMD HDB HPG MBB MSNMWGNVL PNJ ReeDocument23 pagesSTT STT Bid BVH CTD CTG DPM Eib FPT Gas GMD HDB HPG MBB MSNMWGNVL PNJ ReeTuan NguyenNo ratings yet

- Graficos de TendenciasDocument7 pagesGraficos de Tendenciasdeneb denebNo ratings yet

- L3 Activity Type I and Type II ErrorsDocument2 pagesL3 Activity Type I and Type II ErrorsBethelhemNo ratings yet

- Statistical Decision TheoryDocument21 pagesStatistical Decision Theoryshubham singh100% (1)

- Moderation 2Document10 pagesModeration 2sidraNo ratings yet

- Syllabus: For Probability and StatisticsDocument2 pagesSyllabus: For Probability and Statisticsshubham raj laxmiNo ratings yet

- Solved Lori Employs Max She Wants Him To Work Hard RatherDocument1 pageSolved Lori Employs Max She Wants Him To Work Hard RatherM Bilal SaleemNo ratings yet

- Statistics Mcqs - Estimation Part 6: ExamraceDocument8 pagesStatistics Mcqs - Estimation Part 6: ExamraceVishal kaushikNo ratings yet

- 06 Calculating NPV ShellDocument1 page06 Calculating NPV ShellSyed TabrezNo ratings yet

- LP3:The Galaxy Industries Production ProblemDocument12 pagesLP3:The Galaxy Industries Production ProblemImran HossainNo ratings yet

- Statistics For Biology and Health: M. Gail K. Krickeberg J. Samet A. Tsiatis W. WongDocument501 pagesStatistics For Biology and Health: M. Gail K. Krickeberg J. Samet A. Tsiatis W. WongHirbo ShoreNo ratings yet

- Chapter 10 NotesDocument1 pageChapter 10 NotesNorhaine GadinNo ratings yet

- Problem Set 08 With SolutionsDocument7 pagesProblem Set 08 With SolutionsMinh Ngọc LêNo ratings yet

- Pengantar Ekonometrika TerapanDocument23 pagesPengantar Ekonometrika TerapanAdi LesmanaNo ratings yet

- LP Case Bedford SteelDocument4 pagesLP Case Bedford Steelo3283No ratings yet

- MATH 231-Statistics-Hira Nadeem PDFDocument3 pagesMATH 231-Statistics-Hira Nadeem PDFOsamaNo ratings yet

- Major Core 10.optimization TechniquesDocument3 pagesMajor Core 10.optimization TechniquesRobertBellarmineNo ratings yet

- MODULE 6 - Decision TheoryDocument12 pagesMODULE 6 - Decision TheoryBelle BeautyNo ratings yet

- CH 07Document7 pagesCH 07Mai Kim KhánhNo ratings yet

- Statistics Lecture Grouped DataDocument11 pagesStatistics Lecture Grouped DataMary Roxanne AngelesNo ratings yet

- Statistical Learning: Problem Set 1: Problem 1 - Frequentist Decision TheoryDocument4 pagesStatistical Learning: Problem Set 1: Problem 1 - Frequentist Decision TheorySalman AlghifaryNo ratings yet

- Problem Set 1: BE 510 Business Economics 1 - Autumn 2021Document2 pagesProblem Set 1: BE 510 Business Economics 1 - Autumn 2021Creative Work21stNo ratings yet

- APSTATS Midterm Cram SheetDocument1 pageAPSTATS Midterm Cram SheetsphazhangNo ratings yet

- NSE ReportDocument11 pagesNSE ReportnihalNo ratings yet

- Econometrics - Regression PowerpointDocument18 pagesEconometrics - Regression PowerpointAdrian AlexanderNo ratings yet

- Exponential SmmothingDocument30 pagesExponential SmmothingJorge Alberto Beristain PerezNo ratings yet

- Mean Value of A Series Against A Fix Reference Value: Moly-Cop Tools (Version 2.0)Document3 pagesMean Value of A Series Against A Fix Reference Value: Moly-Cop Tools (Version 2.0)snarf273No ratings yet

- 09 Quantitative Techniquesin ManagementDocument6 pages09 Quantitative Techniquesin ManagementPhanindra GollapalliNo ratings yet

- Review of Optimization TechniquesDocument13 pagesReview of Optimization TechniquesFrederic NietzcheNo ratings yet

- Module 3-Tutorial SheetDocument4 pagesModule 3-Tutorial SheetDhruv MohtaNo ratings yet