Professional Documents

Culture Documents

Checklist Home Loan

Checklist Home Loan

Uploaded by

sayandas870 ratings0% found this document useful (0 votes)

452 views2 pagesThis document provides a checklist of required documents for a housing loan application from State Bank of India, including identification documents, proof of income, employment details, tax returns, property documents, and banker's cheques for associated fees. It differentiates the documentation needed for salaried applicants versus self-employed/business applicants. The checklist aims to gather all necessary information and paperwork to process a housing loan application.

Original Description:

Home loan document list SBI

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a checklist of required documents for a housing loan application from State Bank of India, including identification documents, proof of income, employment details, tax returns, property documents, and banker's cheques for associated fees. It differentiates the documentation needed for salaried applicants versus self-employed/business applicants. The checklist aims to gather all necessary information and paperwork to process a housing loan application.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

452 views2 pagesChecklist Home Loan

Checklist Home Loan

Uploaded by

sayandas87This document provides a checklist of required documents for a housing loan application from State Bank of India, including identification documents, proof of income, employment details, tax returns, property documents, and banker's cheques for associated fees. It differentiates the documentation needed for salaried applicants versus self-employed/business applicants. The checklist aims to gather all necessary information and paperwork to process a housing loan application.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

STATE BANK OF INDIA

HOME LOANS SALES TEAM (HLST)-4

2nd FLOOR, VIJAYASAI TOWERS,OPP:BJP OFFICE

KUKATPALLY, HYDERABAD-500 072

Phone: 040-23118849 FAX: 040-23118848

Chief Manager(HLST) : 09848931251

e-mail: cmhlst2.lhohyd@sbi.co.in

dheeravath.naik@sbi.co.in Cell No. 7032903078

CHECK LIST FOR HOUSING LOAN

1. Loan application duly filled in.

2. 3 Passport size photographs of Borrower /Co-borrower.

3. Identity Proof (Passport / PAN Card / Voter ID card) & ID card from the employer.

4. Proof of Present Residence (Telephone/Electricity/Ration card etc).

5. Assets & Liability statement for the Applicant(s) along with proof of assets.

6. In Case of Salaried Applicants:

(a) Latest Three (3) months salary slips.

(b) Latest Six (6) months bank account statement reflecting monthly salary.

(c) Latest Two (2) years Form-16 with ITRs.

(d) Employer ID Card.

(e) Applicants employment brief profile.

(f) Employer/company profile.

7. In Case of Businessmen / Self Employed / Professionals:

(a) Three (3) years Income Tax Returns along with complete latest IT Return filed.

(b) Business Proof.

(c) Proof of all incomes shown in Income Tax computation sheet.

(d) TDS Certificates / Tax paid challans.

(e) Proof of exemptions claims under different sections of Income Tax.

(f) Six months bank statement (Self / Business).

(g) Bankers cheque( in f/o of AGM,RACPC,HYDERBAD)for Rs.250/- for each applicant for IT verifi

8. Two sets of Sale Deed / Agreement of Sale along with Link Documents for the last 15 years.

9. Two sets of Plan approved copy by Municipality / Layout approval / NOC under ULC Act

10. Bankers Cheques for Legal opinion, Valuation report.(drawn in f/o AGM, SBI, RACPC, SECUNDERABA

11. Vendors Bio-data, and vendors ID proof & address proof.

You might also like

- Government of GujaratDocument1 pageGovernment of GujaratDwarkesh Patoliya100% (1)

- Indian Law Firm Awards PDFDocument25 pagesIndian Law Firm Awards PDFKuldeep IndeevarNo ratings yet

- Complaint Against Chief Justice of IndiaDocument24 pagesComplaint Against Chief Justice of IndiaRealityviewsNo ratings yet

- Question AnswerDocument141 pagesQuestion AnswerSiddharth PradhanNo ratings yet

- All About AP LAWCET ExamDocument17 pagesAll About AP LAWCET ExamNagababu SomuNo ratings yet

- Why Cyberlaw in IndiaDocument8 pagesWhy Cyberlaw in IndiaSaurabh KhannaNo ratings yet

- Cow Dung PotVisit Us at Management - Umakant.infoDocument7 pagesCow Dung PotVisit Us at Management - Umakant.infowelcome2jungleNo ratings yet

- Current Affairs - July 2016 - EbookDocument332 pagesCurrent Affairs - July 2016 - EbookpiwalNo ratings yet

- Kun Motor CompanyDocument12 pagesKun Motor CompanyLatest Laws TeamNo ratings yet

- Yearly Current AffairsDocument182 pagesYearly Current Affairsaishwarya ashesh pandeyNo ratings yet

- Muslim Law CaseDocument5 pagesMuslim Law CaseSabya Sachee RaiNo ratings yet

- The Hon'Ble MR Justice V.V.S.Rao + WRIT PETITION No.16717 OF 2008Document10 pagesThe Hon'Ble MR Justice V.V.S.Rao + WRIT PETITION No.16717 OF 2008Bal ReddyNo ratings yet

- E-Notes - IPC - LLB 205Document156 pagesE-Notes - IPC - LLB 205jinNo ratings yet

- LLMDocument1 pageLLMRajkumarKariNo ratings yet

- All Cases DivorceDocument12 pagesAll Cases DivorceJam MacacuaNo ratings yet

- Consumer Protection Act 1986Document15 pagesConsumer Protection Act 1986vaas07No ratings yet

- Lok AdalatDocument28 pagesLok AdalatAsha AnbalaganNo ratings yet

- Indian Entrepreneurs: A LegendDocument28 pagesIndian Entrepreneurs: A Legendshivanitiwari2001No ratings yet

- WCC June 2016Document3 pagesWCC June 2016MITHUN UNo ratings yet

- West Bengal Apartment Ownership Act, 1972 PDFDocument13 pagesWest Bengal Apartment Ownership Act, 1972 PDFLatest Laws TeamNo ratings yet

- CSS Solved Papers 1988-2017 Current Affairs PDFDocument59 pagesCSS Solved Papers 1988-2017 Current Affairs PDFfaryalNo ratings yet

- WCC Dec 2014Document3 pagesWCC Dec 2014MITHUN UNo ratings yet

- Legal Desire Quarterly Journal Issue 2Document103 pagesLegal Desire Quarterly Journal Issue 2Anuj KumarNo ratings yet

- 101 Tort - MV Accident - Consumer ProtectionDocument24 pages101 Tort - MV Accident - Consumer Protectionbhatt.net.inNo ratings yet

- Introduction To Business Law LAWS 1212Document105 pagesIntroduction To Business Law LAWS 1212maki1106No ratings yet

- Case Laws May 2014Document7 pagesCase Laws May 2014Anamika Chauhan VermaNo ratings yet

- PO TY: 1. Centre-State RelationsDocument25 pagesPO TY: 1. Centre-State RelationsNamita JoshiNo ratings yet

- Alphabetical List of Central ActsDocument27 pagesAlphabetical List of Central ActsJai Thakur100% (1)

- MONEY RECEIPT Format PDFDocument1 pageMONEY RECEIPT Format PDFRahit MitraNo ratings yet

- Certificate (14)Document1 pageCertificate (14)Aman GuptaNo ratings yet

- University Allotment ListDocument70 pagesUniversity Allotment ListBar & BenchNo ratings yet

- SenatorsDirectory PDFDocument200 pagesSenatorsDirectory PDFSajhad HussainNo ratings yet

- COP Application For Defaulters PDFDocument7 pagesCOP Application For Defaulters PDFKg RajasekharNo ratings yet

- Tapesh Bagati Vs Union of IndiaDocument195 pagesTapesh Bagati Vs Union of IndiaLive Law100% (1)

- Coding SheetDocument10 pagesCoding SheetMadurai KannanNo ratings yet

- Ms Bikanervala v. Ms Aggarwal BikanerwalaDocument2 pagesMs Bikanervala v. Ms Aggarwal BikanerwalaPrashant KumawatNo ratings yet

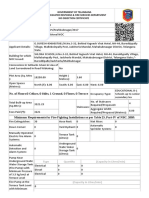

- Government of Telangana State Disaster Response & Fire Services Department No Objection CertificateDocument2 pagesGovernment of Telangana State Disaster Response & Fire Services Department No Objection CertificateSTANDARD EDUCATION ACADEMY M.E.P CENTER100% (1)

- TDP 13 - Chapter 5 PDFDocument63 pagesTDP 13 - Chapter 5 PDFsatishNo ratings yet

- Volume 3 - Tech Schedules - UER-II - PKG-2 - 13.05.2020 PDFDocument65 pagesVolume 3 - Tech Schedules - UER-II - PKG-2 - 13.05.2020 PDFAbhijeet VardheNo ratings yet

- Migration CertificateDocument2 pagesMigration CertificateSuriya N Kumar0% (2)

- Contract 1 - 2011 - 01Document4 pagesContract 1 - 2011 - 01Aarthi SnehaNo ratings yet

- Reciept: Greater Hyderabad CorporationDocument2 pagesReciept: Greater Hyderabad CorporationDasharath Tallapally100% (2)

- Gifts Transfers PropertyDocument14 pagesGifts Transfers PropertySooNo ratings yet

- Situation of Domestic Workers in IndiaDocument9 pagesSituation of Domestic Workers in IndiaLatest Laws TeamNo ratings yet

- Compassionate AppointmentsDocument41 pagesCompassionate AppointmentsSasanka BhuvanagiriNo ratings yet

- Aparna CV (U)Document2 pagesAparna CV (U)Aparna ShuklaNo ratings yet

- Major Constitutional Amendment Part 1 PDFDocument5 pagesMajor Constitutional Amendment Part 1 PDFSourabh PawarNo ratings yet

- S. 489-F PPC Case LawDocument1 pageS. 489-F PPC Case Lawsarmad aliNo ratings yet

- Shreya Singhal V Union of India (2015)Document17 pagesShreya Singhal V Union of India (2015)AtinNo ratings yet

- Reservtn Eng JobsDocument5 pagesReservtn Eng JobsNehaNo ratings yet

- Open Membership Form - 1.0Document1 pageOpen Membership Form - 1.0vijayindia87100% (8)

- Aadhaar SC OrderDocument3 pagesAadhaar SC OrderMoneylife Foundation100% (2)

- Contract Jan 10Document8 pagesContract Jan 10shwetagurnaniNo ratings yet

- Judgment 11646Document5 pagesJudgment 11646rajNo ratings yet

- Cast Monu PDFDocument1 pageCast Monu PDFSonu KumarNo ratings yet

- Awasthi's ProjectDocument26 pagesAwasthi's ProjectJyoti SharmaNo ratings yet

- SBI FormDocument16 pagesSBI Formapi-373588783% (6)

- SUPP - ANN. WITHDRAWAL FormDocument3 pagesSUPP - ANN. WITHDRAWAL FormDasharath PatelNo ratings yet

- Mudra Check List PDFDocument2 pagesMudra Check List PDFThabir Sai ChoudhuriNo ratings yet

- UFlex Mandotry KYC LetterDocument7 pagesUFlex Mandotry KYC Letterabhikumarchoudhary85No ratings yet