Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

149 viewsMaritime Industry Advisory 2017-22 2017-22 - Availment of VAT Exemption

Maritime Industry Advisory 2017-22 2017-22 - Availment of VAT Exemption

Uploaded by

PortCallsThe Maritime Industry Authority (Marina) has raised the age limit of vessels that can apply for an endorsement from the Department of Finance for availment of value-added tax exemption under the National Internal Revenue Code. The new age requirement is included in Marina Advisory (MA) 2017-22, published on October 20 and which revises guidelines adopted under MA 2017-17.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Gambling Addiction PowerpointDocument11 pagesGambling Addiction PowerpointEK200620No ratings yet

- Bureau of Customs Customs Memorandum Order No. 09-2021Document32 pagesBureau of Customs Customs Memorandum Order No. 09-2021PortCallsNo ratings yet

- Shippers' Protection Office Rules of ProceduresDocument10 pagesShippers' Protection Office Rules of ProceduresPortCallsNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon: DecisionDocument10 pagesRepublic of The Philippines Court of Tax Appeals Quezon: DecisionPGIN Legal OfficeNo ratings yet

- Affidavit of BUSINESS ClosureDocument2 pagesAffidavit of BUSINESS ClosureFeEdithOronico100% (3)

- 40mm EBIX PDFDocument2 pages40mm EBIX PDFtomay777No ratings yet

- Draft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021Document10 pagesDraft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 02-2021Document8 pagesPhilippine Ports Authority Administrative Order No. 02-2021PortCallsNo ratings yet

- Civil Aviation Authority of The Philippines Memorandum Circular No. 03 2021Document3 pagesCivil Aviation Authority of The Philippines Memorandum Circular No. 03 2021PortCallsNo ratings yet

- Bureau of Customs Customs Memorandum Order 28-2021Document2 pagesBureau of Customs Customs Memorandum Order 28-2021PortCalls100% (1)

- Joint Memorandum Circular No. 2021-01Document3 pagesJoint Memorandum Circular No. 2021-01PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 11 - 2020Document4 pagesPhilippine Ports Authority Administrative Order No. 11 - 2020PortCallsNo ratings yet

- Bureau of Customs - Customs Administrative Order 12-2020Document5 pagesBureau of Customs - Customs Administrative Order 12-2020PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 13-2020Document3 pagesPhilippine Ports Authority Administrative Order No. 13-2020PortCallsNo ratings yet

- BOC AOCG Memo Dated September 11Document1 pageBOC AOCG Memo Dated September 11PortCallsNo ratings yet

- Bureau of Customs Memo Activating The Orange LaneDocument1 pageBureau of Customs Memo Activating The Orange LanePortCallsNo ratings yet

- BOC AOCG Memo Dated September 11Document2 pagesBOC AOCG Memo Dated September 11PortCalls100% (1)

- Department of Trade and Industry Advisory No. 20-02Document1 pageDepartment of Trade and Industry Advisory No. 20-02PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 05-2020Document5 pagesPhilippine Ports Authority Administrative Order No. 05-2020PortCallsNo ratings yet

- Now Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuideDocument12 pagesNow Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuidePortCallsNo ratings yet

- PortCalls (September 7, 2020)Document14 pagesPortCalls (September 7, 2020)PortCalls100% (1)

- Ds Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedDocument33 pagesDs Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedPortCallsNo ratings yet

- SBMA Seaport Memorandum On Anti Pilferage SealDocument1 pageSBMA Seaport Memorandum On Anti Pilferage SealPortCallsNo ratings yet

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020Document14 pagesThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020PortCallsNo ratings yet

- Soon Available Soon Available Soon Available Soon Available: The Philippines' Only Shipping and Transport GuideDocument11 pagesSoon Available Soon Available Soon Available Soon Available: The Philippines' Only Shipping and Transport GuidePortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- Omnibus Guidelines On COVID-19 Quarantine MeasuresDocument22 pagesOmnibus Guidelines On COVID-19 Quarantine MeasuresRappler95% (19)

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-009Document4 pagesDepartment of Transportation Department Order No. 2020-009PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-008Document6 pagesDepartment of Transportation Department Order No. 2020-008PortCallsNo ratings yet

- NorthPort Advisory - June 8, 2020Document1 pageNorthPort Advisory - June 8, 2020PortCallsNo ratings yet

- Department of Trade and Industry Memorandum Circular No. 20-22 Series of 2020Document8 pagesDepartment of Trade and Industry Memorandum Circular No. 20-22 Series of 2020PortCalls0% (2)

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Friday, 17 April 2020Document12 pagesThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Friday, 17 April 2020PortCallsNo ratings yet

- PortCalls April 13, 2020 IssueDocument14 pagesPortCalls April 13, 2020 IssuePortCallsNo ratings yet

- Fear and Everydaylife in NepalDocument20 pagesFear and Everydaylife in NepalDani MansillaNo ratings yet

- Top 100 70 - 80 - DanceDocument4 pagesTop 100 70 - 80 - DanceFRANCESCO CASELLANo ratings yet

- The New India Assurance Company Limited: Please Answer All Required Questions FullyDocument3 pagesThe New India Assurance Company Limited: Please Answer All Required Questions FullyYESHVENDRA100% (1)

- 2.incorporation of Company and Matters Incidental TheretoDocument58 pages2.incorporation of Company and Matters Incidental TheretoKarthikNo ratings yet

- Kabanta 10Document11 pagesKabanta 10Shella VamNo ratings yet

- Bianchi v. FroshDocument38 pagesBianchi v. FroshCato InstituteNo ratings yet

- Analysis of The Recent NFC AwardDocument24 pagesAnalysis of The Recent NFC Awardfaw03No ratings yet

- Justice Khanna Law in EmergencyDocument2 pagesJustice Khanna Law in EmergencyVilayapathi SNo ratings yet

- A4 Internet Porno Key Facts One PagerDocument2 pagesA4 Internet Porno Key Facts One PagerA GuptaNo ratings yet

- Bls Class CPR Power PointDocument45 pagesBls Class CPR Power Point2020 MSc bhuvaneswari 05100% (1)

- Noli Me Tangere SummarizationDocument7 pagesNoli Me Tangere SummarizationJulian Ross HolgadoNo ratings yet

- Script PyramidsDocument2 pagesScript PyramidsHaifa KattanNo ratings yet

- Subic Rape CaseDocument217 pagesSubic Rape CaseLourd Sydnel RoqueNo ratings yet

- Sps Cruz V Sun HolidaysDocument2 pagesSps Cruz V Sun HolidaysCha0% (1)

- 2D Crim Pro DigestsDocument23 pages2D Crim Pro DigestsCHRISTIAN ANDREW GALLARDO100% (1)

- Francisco Realty vs. CA DigestDocument1 pageFrancisco Realty vs. CA DigestJared Libiran50% (2)

- Parental Alienation in Search of Common Ground For A Jhonston 1020Document23 pagesParental Alienation in Search of Common Ground For A Jhonston 1020Berit ShalomNo ratings yet

- 1.ra 9993Document7 pages1.ra 9993Jan-Jan Batucan EstabilloNo ratings yet

- Montallana vs. La Consolacion CollegeDocument2 pagesMontallana vs. La Consolacion CollegeLucille ArianneNo ratings yet

- All India Seniority List of Engineer Cadre Officers Assistant Executive Engineer As On 01 Jan 2021 5 DT 20 Jan 2021Document11 pagesAll India Seniority List of Engineer Cadre Officers Assistant Executive Engineer As On 01 Jan 2021 5 DT 20 Jan 2021sigmadelhi87No ratings yet

- 2121 - Comp8046041 - LZT2 - TP4-W8-S9-R0 - 2301977523 - Yohanes Beato DionisiusDocument11 pages2121 - Comp8046041 - LZT2 - TP4-W8-S9-R0 - 2301977523 - Yohanes Beato DionisiusYohanes Beato DionisiusNo ratings yet

- 9-10-08 Mayor Bloomberg StatementDocument11 pages9-10-08 Mayor Bloomberg StatementPreventWMD.gov100% (1)

- 5 Metromedia Times Corp Vs PastorinDocument2 pages5 Metromedia Times Corp Vs Pastorinjed_sindaNo ratings yet

- Drones in Hybrid Warfare - 14-15Document2 pagesDrones in Hybrid Warfare - 14-15sakis lakisNo ratings yet

- Basic Structure Doctrine - Constitution - YG Law - 5577612 - 2023 - 10 - 02 - 17 - 10Document6 pagesBasic Structure Doctrine - Constitution - YG Law - 5577612 - 2023 - 10 - 02 - 17 - 10Gautam Kr. Ranjan (B.A. LLB 16)No ratings yet

- PenologyDocument51 pagesPenologynknaveedNo ratings yet

Maritime Industry Advisory 2017-22 2017-22 - Availment of VAT Exemption

Maritime Industry Advisory 2017-22 2017-22 - Availment of VAT Exemption

Uploaded by

PortCalls0 ratings0% found this document useful (0 votes)

149 views3 pagesThe Maritime Industry Authority (Marina) has raised the age limit of vessels that can apply for an endorsement from the Department of Finance for availment of value-added tax exemption under the National Internal Revenue Code. The new age requirement is included in Marina Advisory (MA) 2017-22, published on October 20 and which revises guidelines adopted under MA 2017-17.

Original Title

Maritime Industry Advisory 2017-22 2017-22 - Availment of VAT exemption

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Maritime Industry Authority (Marina) has raised the age limit of vessels that can apply for an endorsement from the Department of Finance for availment of value-added tax exemption under the National Internal Revenue Code. The new age requirement is included in Marina Advisory (MA) 2017-22, published on October 20 and which revises guidelines adopted under MA 2017-17.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

149 views3 pagesMaritime Industry Advisory 2017-22 2017-22 - Availment of VAT Exemption

Maritime Industry Advisory 2017-22 2017-22 - Availment of VAT Exemption

Uploaded by

PortCallsThe Maritime Industry Authority (Marina) has raised the age limit of vessels that can apply for an endorsement from the Department of Finance for availment of value-added tax exemption under the National Internal Revenue Code. The new age requirement is included in Marina Advisory (MA) 2017-22, published on October 20 and which revises guidelines adopted under MA 2017-17.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 3

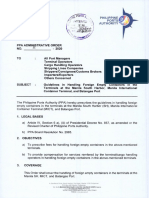

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF TRANSPORTATION AND COMMUNICATIONS _/

MARITIME INDUSTRY AUTHORITY

03 October 2017

MARINA ADVISORY NO. 2017-22

Series of 2017

TO ALL SHIPOWNERS/BAREBOAT CHARTERERS/SHIP

OPERATORS/SHIP MANAGERS = WITH PHILIPPINE

REGISTERED SHIPS AND ALL CONCERNED

SUBJECT ; REVISED GUIDELINES FOR THE ISSUANCE OF DEPARTMENT

OF FINANCE (DOF) ENDORSEMENT TO AVAIL OF VAT

EXEMPTION GRANTED UNDER REPUBLIC ACT (RA) NO. 9337,

AMENDING THE NATIONAL INTERNAL REVENUE CODE OF

1997

In the interest of the service and after consultation with the Department of Finance, to

ensure that only qualified domestic ship owner/operator may avail of the incentives

granted under RA 9337, particularly the exemption from the payment of Value Added

Tax (VAT) on the sale, importation or lease of passenger or cargo vessels, including

engine, equipment and spare parts thereof for domestic or international transport

operations, the following guidelines is hereby |adopted:

1. Who may avail of the incentives:

Only MARINA-accredited domestic ship owners/operators may avail of the

incentives under the RA 9337.

ll. Definition of terms:

a. "Domestic Shipping” shall mean the transport of passengers or cargo, or

both, by ships duly registered and licensed under Philippine law to engage

in trade and commerce between Philippine ports and within Philippine

territorial or intemal waters, for hire or compensation, with general or

limited clientele, whether permanent, occasional or incidental, with or

without fixed routes, and done for contractual or commercial purposes."

Taps hao 295 E

Parkview Plaza

Tol. Nos. :(632) 523-8660 / (632) 526-0971

Set Taf avenue corner TM. Kaiaw FE °.

4000 Ermita Manila, Philippines Website :Wwruanarina.gov.ph

b. "Domestic Ship Operator" or "Domestic Ship Owner’ may be used

interchangeably and shall mean a citizen of the Philippines, or a

‘commercial partnership wholly owned by Filipinos, or a corporation at least

sixty percent (60%) of the capital of which is owned by Filipinos, which is

duly authorized by the Maritime industry Authority (MARINA) to engage in

the business or domestic shipping.”

c. “Importation” shall mean the direct purchase, lease or charter of newly

constructed or previously owned ships, or the purchase of ship's spare

parts from foreign sources or from registered enterprises operating in

special economic zones as this term is defined in Republic Act No. 7916

entitled, "The Special Economic Zone Act. of 1995.°

d. "Special Economic Zones (SEZ)" — hereinafter referred to as the

ECOZONES, shall mean selected areas with highly developed or which

have the potential to be developed into agro-industrial, Industrial

tourist/recreational, commercial, banking, investment and financial centers.

‘An ECOZONE may contain any or all of the following: Industrial Estates

(Is), Export Processing Zones (EPZs), Free Trade Zones, and

Tourist/Recreational Centers.*

Qualifications in the availment of incentives:

VAT Exemption may be granted on the following transactions:

a. Sale, importation or lease of IACS Classed passenger vessels of five

hundred (500) gross tons and above and not more than twenty (20) years

old at the time of acquisition®;

b. Sale, importation or lease of tanker vessels of not more than fifteen (15)

years old at the time of acquisition®;

c. Sale, importation or lease of high-speed passenger vessels of not more

than five (5) years old at the time of acquisition’;

4. Sale, importation or lease of cargo vessels subject to existing rules and

regulations®; and,

2 Republic Act No, 9295 f

2 Republic Act No. 9295

“Republic Act No. 7916

5 MARINA Circular No. 2017-04

© MARINA Circular No, 2010-01

7 MARINA Cireular No. 121

* MARINA Gireular No, 104

Page 2 of 3

#

vi.

vil.

e. Sale and importation of engine, equipment and spare parts of passenger

or cargo.vessels for domestic or international transport operations.

Where to file application

All applications for issuance of DOF endorsement for VAT exemption on the

‘on the sale, importation or lease of passenger or cargo vessels, including

engine, equipment and spare parts thereof shall be filed with the Domestic

Shipping Service, MARINA Central Office.

Filing of application for DOF Endorsement and Qualification Certificate

The application for the issuance of DOF Endorsement and Qualification

Certificate shall be filed simultaneously with the application for the issuance of

Authority to Import of the passenger or cargo vessel to be imported. In case

of importation engine, equipment and spare parts, a copy of the invoice shall

be submitted together with the application. Payment of processing fee for the

issuance of DOF Endorsement and Qualification Certificate shall be in

accordance with the existing policy on fees and charges.

DOF Endorsement

Once the MARINA is satisfied with all the requirements submitted by the

applicant and has determined that the applicant is entitled for the incentives

under RA 9337, it shall be issued a Qualification Certificate attesting that the

applicant possesses the qualifications for availment of VAT-Exemption and

shall endorse the application with the DOF.

Repealing Clause

MARINA Advisory No. 2017-17, any provisions of MARINA Rules and

Regulations and other issuances or parts thereof which are inconsistent with

this MARINA Advisory are hereby repealed, amended or modified

accordingly.

For information and guidance.

MARC!

th

QUIRICO C. RO Ili, PhD

Adminjétrator po

Page 3 of 3

ate of Pubition: october, 237

ss Mirror

Date of Submission to ONAR:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Gambling Addiction PowerpointDocument11 pagesGambling Addiction PowerpointEK200620No ratings yet

- Bureau of Customs Customs Memorandum Order No. 09-2021Document32 pagesBureau of Customs Customs Memorandum Order No. 09-2021PortCallsNo ratings yet

- Shippers' Protection Office Rules of ProceduresDocument10 pagesShippers' Protection Office Rules of ProceduresPortCallsNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon: DecisionDocument10 pagesRepublic of The Philippines Court of Tax Appeals Quezon: DecisionPGIN Legal OfficeNo ratings yet

- Affidavit of BUSINESS ClosureDocument2 pagesAffidavit of BUSINESS ClosureFeEdithOronico100% (3)

- 40mm EBIX PDFDocument2 pages40mm EBIX PDFtomay777No ratings yet

- Draft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021Document10 pagesDraft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 02-2021Document8 pagesPhilippine Ports Authority Administrative Order No. 02-2021PortCallsNo ratings yet

- Civil Aviation Authority of The Philippines Memorandum Circular No. 03 2021Document3 pagesCivil Aviation Authority of The Philippines Memorandum Circular No. 03 2021PortCallsNo ratings yet

- Bureau of Customs Customs Memorandum Order 28-2021Document2 pagesBureau of Customs Customs Memorandum Order 28-2021PortCalls100% (1)

- Joint Memorandum Circular No. 2021-01Document3 pagesJoint Memorandum Circular No. 2021-01PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 11 - 2020Document4 pagesPhilippine Ports Authority Administrative Order No. 11 - 2020PortCallsNo ratings yet

- Bureau of Customs - Customs Administrative Order 12-2020Document5 pagesBureau of Customs - Customs Administrative Order 12-2020PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 13-2020Document3 pagesPhilippine Ports Authority Administrative Order No. 13-2020PortCallsNo ratings yet

- BOC AOCG Memo Dated September 11Document1 pageBOC AOCG Memo Dated September 11PortCallsNo ratings yet

- Bureau of Customs Memo Activating The Orange LaneDocument1 pageBureau of Customs Memo Activating The Orange LanePortCallsNo ratings yet

- BOC AOCG Memo Dated September 11Document2 pagesBOC AOCG Memo Dated September 11PortCalls100% (1)

- Department of Trade and Industry Advisory No. 20-02Document1 pageDepartment of Trade and Industry Advisory No. 20-02PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 05-2020Document5 pagesPhilippine Ports Authority Administrative Order No. 05-2020PortCallsNo ratings yet

- Now Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuideDocument12 pagesNow Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuidePortCallsNo ratings yet

- PortCalls (September 7, 2020)Document14 pagesPortCalls (September 7, 2020)PortCalls100% (1)

- Ds Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedDocument33 pagesDs Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedPortCallsNo ratings yet

- SBMA Seaport Memorandum On Anti Pilferage SealDocument1 pageSBMA Seaport Memorandum On Anti Pilferage SealPortCallsNo ratings yet

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020Document14 pagesThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020PortCallsNo ratings yet

- Soon Available Soon Available Soon Available Soon Available: The Philippines' Only Shipping and Transport GuideDocument11 pagesSoon Available Soon Available Soon Available Soon Available: The Philippines' Only Shipping and Transport GuidePortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- Omnibus Guidelines On COVID-19 Quarantine MeasuresDocument22 pagesOmnibus Guidelines On COVID-19 Quarantine MeasuresRappler95% (19)

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-009Document4 pagesDepartment of Transportation Department Order No. 2020-009PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-008Document6 pagesDepartment of Transportation Department Order No. 2020-008PortCallsNo ratings yet

- NorthPort Advisory - June 8, 2020Document1 pageNorthPort Advisory - June 8, 2020PortCallsNo ratings yet

- Department of Trade and Industry Memorandum Circular No. 20-22 Series of 2020Document8 pagesDepartment of Trade and Industry Memorandum Circular No. 20-22 Series of 2020PortCalls0% (2)

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Friday, 17 April 2020Document12 pagesThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Friday, 17 April 2020PortCallsNo ratings yet

- PortCalls April 13, 2020 IssueDocument14 pagesPortCalls April 13, 2020 IssuePortCallsNo ratings yet

- Fear and Everydaylife in NepalDocument20 pagesFear and Everydaylife in NepalDani MansillaNo ratings yet

- Top 100 70 - 80 - DanceDocument4 pagesTop 100 70 - 80 - DanceFRANCESCO CASELLANo ratings yet

- The New India Assurance Company Limited: Please Answer All Required Questions FullyDocument3 pagesThe New India Assurance Company Limited: Please Answer All Required Questions FullyYESHVENDRA100% (1)

- 2.incorporation of Company and Matters Incidental TheretoDocument58 pages2.incorporation of Company and Matters Incidental TheretoKarthikNo ratings yet

- Kabanta 10Document11 pagesKabanta 10Shella VamNo ratings yet

- Bianchi v. FroshDocument38 pagesBianchi v. FroshCato InstituteNo ratings yet

- Analysis of The Recent NFC AwardDocument24 pagesAnalysis of The Recent NFC Awardfaw03No ratings yet

- Justice Khanna Law in EmergencyDocument2 pagesJustice Khanna Law in EmergencyVilayapathi SNo ratings yet

- A4 Internet Porno Key Facts One PagerDocument2 pagesA4 Internet Porno Key Facts One PagerA GuptaNo ratings yet

- Bls Class CPR Power PointDocument45 pagesBls Class CPR Power Point2020 MSc bhuvaneswari 05100% (1)

- Noli Me Tangere SummarizationDocument7 pagesNoli Me Tangere SummarizationJulian Ross HolgadoNo ratings yet

- Script PyramidsDocument2 pagesScript PyramidsHaifa KattanNo ratings yet

- Subic Rape CaseDocument217 pagesSubic Rape CaseLourd Sydnel RoqueNo ratings yet

- Sps Cruz V Sun HolidaysDocument2 pagesSps Cruz V Sun HolidaysCha0% (1)

- 2D Crim Pro DigestsDocument23 pages2D Crim Pro DigestsCHRISTIAN ANDREW GALLARDO100% (1)

- Francisco Realty vs. CA DigestDocument1 pageFrancisco Realty vs. CA DigestJared Libiran50% (2)

- Parental Alienation in Search of Common Ground For A Jhonston 1020Document23 pagesParental Alienation in Search of Common Ground For A Jhonston 1020Berit ShalomNo ratings yet

- 1.ra 9993Document7 pages1.ra 9993Jan-Jan Batucan EstabilloNo ratings yet

- Montallana vs. La Consolacion CollegeDocument2 pagesMontallana vs. La Consolacion CollegeLucille ArianneNo ratings yet

- All India Seniority List of Engineer Cadre Officers Assistant Executive Engineer As On 01 Jan 2021 5 DT 20 Jan 2021Document11 pagesAll India Seniority List of Engineer Cadre Officers Assistant Executive Engineer As On 01 Jan 2021 5 DT 20 Jan 2021sigmadelhi87No ratings yet

- 2121 - Comp8046041 - LZT2 - TP4-W8-S9-R0 - 2301977523 - Yohanes Beato DionisiusDocument11 pages2121 - Comp8046041 - LZT2 - TP4-W8-S9-R0 - 2301977523 - Yohanes Beato DionisiusYohanes Beato DionisiusNo ratings yet

- 9-10-08 Mayor Bloomberg StatementDocument11 pages9-10-08 Mayor Bloomberg StatementPreventWMD.gov100% (1)

- 5 Metromedia Times Corp Vs PastorinDocument2 pages5 Metromedia Times Corp Vs Pastorinjed_sindaNo ratings yet

- Drones in Hybrid Warfare - 14-15Document2 pagesDrones in Hybrid Warfare - 14-15sakis lakisNo ratings yet

- Basic Structure Doctrine - Constitution - YG Law - 5577612 - 2023 - 10 - 02 - 17 - 10Document6 pagesBasic Structure Doctrine - Constitution - YG Law - 5577612 - 2023 - 10 - 02 - 17 - 10Gautam Kr. Ranjan (B.A. LLB 16)No ratings yet

- PenologyDocument51 pagesPenologynknaveedNo ratings yet