Professional Documents

Culture Documents

the+Comfort+Trap

the+Comfort+Trap

Uploaded by

aivynCopyright:

Available Formats

You might also like

- The 2023 Andex Chart StoryDocument3 pagesThe 2023 Andex Chart Storypridetag.contatoNo ratings yet

- Minnesotans United For All Families Fundraising ReportDocument1,181 pagesMinnesotans United For All Families Fundraising ReportMinnesota Public RadioNo ratings yet

- Questionnaire-Benchmarking of Best HR PracticesDocument13 pagesQuestionnaire-Benchmarking of Best HR PracticesUtkalKhatiwadaNo ratings yet

- Subprime Crisis and The Impact On IndiaDocument4 pagesSubprime Crisis and The Impact On IndiaManoj M. GolvankarNo ratings yet

- The Artisan - Northland Wealth Management - Autumn 2011Document4 pagesThe Artisan - Northland Wealth Management - Autumn 2011Victor KNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument14 pagesBreakfast With Dave: David A. Rosenbergrichardck61No ratings yet

- Lane Asset Management Commentary December 2010Document8 pagesLane Asset Management Commentary December 2010eclaneNo ratings yet

- The Absolute Return Letter 0709Document8 pagesThe Absolute Return Letter 0709tatsrus1No ratings yet

- CR 1Q17 OutlookDocument12 pagesCR 1Q17 OutlooknmkdsarmaNo ratings yet

- Monthly Letter - en - 1589563Document14 pagesMonthly Letter - en - 1589563Nikos LeounakisNo ratings yet

- Kinnaras Capital Management LLC: May 2010 Market CommentaryDocument5 pagesKinnaras Capital Management LLC: May 2010 Market Commentaryamit.chokshi2353No ratings yet

- Mi InvestmentDocument22 pagesMi Investmentalpha.square.betaNo ratings yet

- Reinventing Banking: Capitalizing On CrisisDocument28 pagesReinventing Banking: Capitalizing On Crisisworrl samNo ratings yet

- 2009-04 Miller CommentaryDocument5 pages2009-04 Miller CommentaryTheBusinessInsider100% (1)

- Sub Prime LendingDocument4 pagesSub Prime Lendinggagan585No ratings yet

- Q2 Full Report 2020 PDFDocument24 pagesQ2 Full Report 2020 PDFhamefNo ratings yet

- A Stronger Dollar Might Hit Emerging Economies Harder This Cycle - Financial TimesDocument3 pagesA Stronger Dollar Might Hit Emerging Economies Harder This Cycle - Financial TimesRenato SilvaNo ratings yet

- Fasanara Capital Investment Outlook - May 3rd 2016Document17 pagesFasanara Capital Investment Outlook - May 3rd 2016Zerohedge100% (1)

- Global Meltdown & Its Impact On Indian EconomyDocument38 pagesGlobal Meltdown & Its Impact On Indian Economysuvi imsNo ratings yet

- Solutions Chapter 15 Internationsl InvestmentsDocument12 pagesSolutions Chapter 15 Internationsl Investments'Osvaldo' RioNo ratings yet

- Finsight Issue 1 Jan10Document7 pagesFinsight Issue 1 Jan10rapidraviNo ratings yet

- Lane Asset Management Stock Market Commentary February 2011Document7 pagesLane Asset Management Stock Market Commentary February 2011eclaneNo ratings yet

- Volume 1 12 The Dollar's Descent Orderly or Not October 30 2009Document12 pagesVolume 1 12 The Dollar's Descent Orderly or Not October 30 2009Denis OuelletNo ratings yet

- Me Cio Weekly LetterDocument7 pagesMe Cio Weekly LetterHank DayNo ratings yet

- Alta Report January 2024Document10 pagesAlta Report January 2024JP HNo ratings yet

- Suggested Answers To Chapter 15 Questions: Instructors Manual: Multinational Financial Management, 9Th EdDocument12 pagesSuggested Answers To Chapter 15 Questions: Instructors Manual: Multinational Financial Management, 9Th EdkinikinayyNo ratings yet

- Price Insensitive Sellers and Ten Quick Topics To Ruin Your SummerDocument24 pagesPrice Insensitive Sellers and Ten Quick Topics To Ruin Your SummerCanadianValue0% (1)

- 06-10-10 Breakfast With DaveDocument8 pages06-10-10 Breakfast With DavefcamargoeNo ratings yet

- Liquidity Cascades - Newfound Research PDFDocument19 pagesLiquidity Cascades - Newfound Research PDFrwmortell3580No ratings yet

- Vincent Deluard The Fed Put Junk Debt and Trade WarsDocument9 pagesVincent Deluard The Fed Put Junk Debt and Trade WarsVarnit AgnihotriNo ratings yet

- Converse Mar 24Document43 pagesConverse Mar 24Swarnika KesarwaniNo ratings yet

- Breakfast With Dave 20100928Document8 pagesBreakfast With Dave 20100928marketpanicNo ratings yet

- Newsletter 1003Document5 pagesNewsletter 1003jdakineNo ratings yet

- Weekly Capital Market Outlook-1Document8 pagesWeekly Capital Market Outlook-1Vinay AgarwalNo ratings yet

- TL - Gibson Smith Insights - Are We Headed For A Hangover - May 2015 - Exp - 05-30Document4 pagesTL - Gibson Smith Insights - Are We Headed For A Hangover - May 2015 - Exp - 05-30blind_cryNo ratings yet

- Economic Analysis Current Global Economy Scenario - Similar To Market Crash of 1929Document32 pagesEconomic Analysis Current Global Economy Scenario - Similar To Market Crash of 1929Jariwala BhaveshNo ratings yet

- Barclays 2 Capital David Newton Memorial Bursary 2006 MartDocument2 pagesBarclays 2 Capital David Newton Memorial Bursary 2006 MartgasepyNo ratings yet

- Bank - Capital Market NexusDocument14 pagesBank - Capital Market NexusKal_CNo ratings yet

- The Return of The Bond Vigilantes: ObituaryDocument1 pageThe Return of The Bond Vigilantes: ObituaryKarya BangunanNo ratings yet

- The Sub Prime Crisis - An AnalysisDocument6 pagesThe Sub Prime Crisis - An Analysisvishwajit46No ratings yet

- 1 Identify The Risks in New Century S Balance Sheet 2 OnDocument1 page1 Identify The Risks in New Century S Balance Sheet 2 OnLet's Talk With HassanNo ratings yet

- Russell Investments Q2 2020 GMO SummaryDocument4 pagesRussell Investments Q2 2020 GMO SummaryMichael WangNo ratings yet

- Citi 'What If ..Document15 pagesCiti 'What If ..IwpNo ratings yet

- 03 Noyer Financial TurbulenceDocument3 pages03 Noyer Financial Turbulencenash666No ratings yet

- Elliott LetterDocument28 pagesElliott LetterMilan StojevNo ratings yet

- Current Issues in Financial MarketsDocument5 pagesCurrent Issues in Financial Marketsreb_nicoleNo ratings yet

- Last Risk Premium BernsteinDocument12 pagesLast Risk Premium BernsteinRobert IronsNo ratings yet

- Impact of Covid-19 and Government Response On Capital MarketsDocument8 pagesImpact of Covid-19 and Government Response On Capital Marketsahsan habibNo ratings yet

- Annual Economic Report 2020 SynopsisDocument9 pagesAnnual Economic Report 2020 Synopsissh_chandraNo ratings yet

- The Broyhill Letter: Executive SummaryDocument4 pagesThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNo ratings yet

- Financial Meltdown - Crisis of Governance?Document6 pagesFinancial Meltdown - Crisis of Governance?Atif RehmanNo ratings yet

- Us Yield CurveDocument6 pagesUs Yield Curvealiimrandar6939No ratings yet

- Liquidity Spigot 1684333089Document27 pagesLiquidity Spigot 1684333089Alexei LeonNo ratings yet

- Big Freeze IVDocument5 pagesBig Freeze IVKalyan Teja NimushakaviNo ratings yet

- COVID-19 Outbreak: Capital Markets Implications and ResponseDocument26 pagesCOVID-19 Outbreak: Capital Markets Implications and Responseanirbanccim8493No ratings yet

- Fidelity Outlook 2024 1703148762Document32 pagesFidelity Outlook 2024 1703148762czydytkkvvNo ratings yet

- JP Morgan 1655406568Document27 pagesJP Morgan 1655406568Mohamed MaherNo ratings yet

- FI - M Lecture 7-Why Do Financial Crises Occur - PartialDocument37 pagesFI - M Lecture 7-Why Do Financial Crises Occur - PartialMoazzam ShahNo ratings yet

- Financial Crisis PPT FMS 1Document48 pagesFinancial Crisis PPT FMS 1Vikas JaiswalNo ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- Revised Final Research Paper 12HUMSS 1 Group 6 2Document135 pagesRevised Final Research Paper 12HUMSS 1 Group 6 2Alyssa BeatriceNo ratings yet

- Huerta Alba Resort Inc. v. CA DigestDocument4 pagesHuerta Alba Resort Inc. v. CA DigestLeo Cag100% (1)

- Example For Shipping DocumentsDocument29 pagesExample For Shipping DocumentsNicolai GosvigNo ratings yet

- Final - Hafl Yearly Exam 2022 (Scheme)Document1 pageFinal - Hafl Yearly Exam 2022 (Scheme)Vineet YadavNo ratings yet

- Debt Recovery Techniques in The Banking Sector, Issues, Problems and Prospects LatestDocument50 pagesDebt Recovery Techniques in The Banking Sector, Issues, Problems and Prospects Latestfaleye olumide emmanuel100% (1)

- Excel Built in Financial Functions Cheat Sheet: by ViaDocument2 pagesExcel Built in Financial Functions Cheat Sheet: by ViaJagdish Prasad SharmaNo ratings yet

- Forex Trading 15 Minute Turbocourse Ultimate CollectionDocument23 pagesForex Trading 15 Minute Turbocourse Ultimate CollectionLinda Taylor50% (2)

- RH RulesDocument3 pagesRH RulesBinayKPNo ratings yet

- Bes 122 PDFDocument4 pagesBes 122 PDFSonam GolaNo ratings yet

- PhdEntranceform 2014Document2 pagesPhdEntranceform 2014milinjdNo ratings yet

- Present Continuous TenseDocument6 pagesPresent Continuous TenseFernando Ribeiro Júnior100% (1)

- De Minh Hoa K11Document6 pagesDe Minh Hoa K11M Huy TranNo ratings yet

- 65th Anniversary of Marcuse's Reason and RevolutionDocument15 pages65th Anniversary of Marcuse's Reason and RevolutionDiego Arrocha ParisNo ratings yet

- Hotel Caruso, Best of BestDocument3 pagesHotel Caruso, Best of BestScott Goetz - Fierce TravelerNo ratings yet

- St. Joseph's Academy of Malinao, Aklan, Inc: Pros and Cons of Social Media Usage Among StudentsDocument2 pagesSt. Joseph's Academy of Malinao, Aklan, Inc: Pros and Cons of Social Media Usage Among StudentsFrankie Magdael ItulidNo ratings yet

- Materi Bahasa Inggris Pertemuan 3Document34 pagesMateri Bahasa Inggris Pertemuan 3Siapa AjaNo ratings yet

- 4 Process ApproachDocument6 pages4 Process ApproachBãoNo ratings yet

- AIAG - CQI-09 (EN) - Oct 11Document100 pagesAIAG - CQI-09 (EN) - Oct 11Ramiro Predassi100% (1)

- RuleTheWaves MANUAL PDFDocument21 pagesRuleTheWaves MANUAL PDFJefferson Rodrigo Fernandes PereiraNo ratings yet

- Makalah Curriculum and DevelopmetDocument18 pagesMakalah Curriculum and Developmetfeisal adiNo ratings yet

- Court and Docket ManagementDocument15 pagesCourt and Docket Managementrajeet chakrabortyNo ratings yet

- Cawagas Pedagogical Principles PP 299-306Document8 pagesCawagas Pedagogical Principles PP 299-306María Julia SolovitasNo ratings yet

- Definition of EquityDocument5 pagesDefinition of EquityTumwine BarnabasNo ratings yet

- Coc Part 2 - Corrective Action Procedure V 6 0Document21 pagesCoc Part 2 - Corrective Action Procedure V 6 0api-264357222No ratings yet

- ALLISON - The New Spheres of InfluenceDocument12 pagesALLISON - The New Spheres of InfluenceDaniel GarcíaNo ratings yet

- Jaminan Fidusia Yang Objek Jaminan DijualDocument24 pagesJaminan Fidusia Yang Objek Jaminan DijualSyafril SyaninNo ratings yet

- Chapter 2 - : Ethics, Fraud, and Internal ControlDocument42 pagesChapter 2 - : Ethics, Fraud, and Internal ControlTeo ShengNo ratings yet

- Thesis Statement For Twelfth NightDocument8 pagesThesis Statement For Twelfth Nightafhbexrci100% (2)

the+Comfort+Trap

the+Comfort+Trap

Uploaded by

aivynOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

the+Comfort+Trap

the+Comfort+Trap

Uploaded by

aivynCopyright:

Available Formats

GUEST

COLUMN

the comfort trap

Are advisors ignoring market risk?

By Levi Folk

Lack of market volatility in recent asset prices. Across risky asset mar- the U.S. essentially exported a credit

years has led to a general complacen- kets, risk premiums generally de- bubble overseas. For every dollar that

cy in the investing community. With creased due to investors judging these flowed to China to purchase Chinese

rising stock prices, falling bond yields markets as safer. exports, the People’s Bank of China

and buoyant commodity prices, are History tells us that financial mar- (PBoC) has resisted currency appre-

you underestimating financial market kets are risky, that volatility rises in ciation by buying dollars and selling

risks and misallocating resources? declining markets, and that investors its currency, the yuan. This has in-

Common risk measures assume demand higher returns to compensate creased its money supply and eased

that stock prices rise and fall with for the greater risk of an asset class. credit conditions in China.

equal amplitude. Yet experience One good turn deserves another

shows markets rise in slow, steady Credit Cycle in the case of those dollar reserves

fashion and fall with greater intensity So what exactly is happening to secu- held by the PBoC, which have found

and speed. In other words, volatility rities markets and why is risk being their way back to the U.S. via the

rises in market corrections. priced so cheaply? The fact is we are bond market. The trillion dollars of

Since financial markets bottomed in the midst of a credit bubble. reserves represent part of China’s net

in April 2003, we’ve witnessed one The bubble has its roots in the savings, which have been used to buy

of the longest uninterrupted market technology stock mania of the 1990s. U.S. treasury securities.

rises on record. As a result, volatil- When it burst, U.S. Federal Reserve Hence the global savings glut is

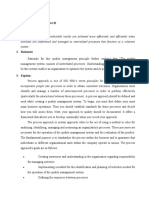

ity has been in steady decline. The chair Alan Greenspan administered pushing down U.S. bond yields and

CBOE Volatility Index has been run- life support. The Fed cut interest rates adding to the easy credit conditions

ning a shade higher than 10 in recent aggressively to 1% to stave off the there. Add in the zero-interest rate

months, well below its average of 19 deemed risk of deflation. That move policy put in place by the Bank of

dating back to 1990. (See charts, proved just the tonic for the flagging Japan to stave off an actual bout of

page 48.) economy and set in motion the lon- deflation, and investors have been able

If the typical trade-off for inves- gest string of double-digit quarterly to borrow money cheaply and invest it

tors is one of risk and return, you increases in corporate profits (which in what are traditionally risky markets.

wouldn’t know it based on the returns ended at 14 consecutive quarters at It’s no wonder volatility has de-

investors have been receiving. Since the end of 2006). scended to multi-year lows. Inex-

April 2003, the only loser has been a While low rates were good for the pensive credit is fuelling economic

dedicated short strategy. Everything economy and corporate profits, much momentum, which is emboldening

else has gone up, from less risky bond of the success was premised on the investors to commit ever-greater sums

investments to high-yield debt and U.S. consumer taking on more debt of capital to equity and bond markets.

domestic equities, to the edges of personally and on the U.S. economy If you want proof, look no further

risk in emerging market equities and taking on more debt globally. than yield spreads on risky bonds.

commodities. The housing boom was inflated The yield spread is the extra returns

However, this Goldilocks envi- by easy access to credit and by run- charged by lenders on risky securi-

ronment is leading to distortions in ning a massive trade deficit, while Continued on page 48

46 advisor’s edge | may 2007 www.advisor.ca

GUEST

COLUMN

Continued from page 46 higher and debt financing may have are very high. Economies are much

ties over U.S. government treasuries. increased but not as a percentage healthier now than in the 1990s.

It was as high as 10% on emerging of corporate net worth. Companies These better fundamentals suggest

market debt and junk bonds in the have been buying back stock and that any recession could be more shal-

1990s and is now below 300 basis paying cash to shareholders by way low than normal because of fewer ex-

points for both. of dividends. Capital overspending is cesses to work off. But the suggestion

Some of that difference is justi- not a problem. that business cycles are no longer rel-

fied by better fundamentals here and In the emerging markets, debt levels evant for pricing risk is ludicrous.

abroad. Corporate balance sheets are are lower, inflation is generally under Global economic prosperity sits

definitely improved. Earnings are control and foreign exchange reserves perched on the knife edge of the

U.S. consumer, due to the increased

trade and capital flows of globaliza-

roller coaster reduction tion. Therefore, the diversification

United States, CBOE, Volatility Index, Close, USD

benefits of investing in overseas

markets and alternative asset classes

50 are greatly diminished.

45 Consider how a U.S. recession

Mean

40 would reduce trade with China and

35 affect the stock markets of East Asia.

30 Further along the chain, commodity

Per cent

25 markets would get hit by slower eco-

20 nomic growth in the U.S., and com-

15

modity exporters would also suffer.

10

In fact, there would be few places for

you to find refuge for your clients.

5

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 The credit cycle has already turned

Source: Reuters EcoWin in the U.S. housing market. While

credit may be ample in the rest of

the economy, it has withered away

benign bonds in the mortgage market. After being

United States, Corporate Benchmarks, Yield Spread lured into adjustable-rate mortgages

when the Fed Funds rate was at 1%

3.5 in 2003, new home owners are now

reckoning with mortgage payments

3.0

that are resetting and being priced

2.5 BBB bonds off a Fed Funds rate of 5.25%. The

result has been devastating.

2.0

Record housing price gains have

Per cent

1.5 been followed by a depression in hous-

1.0

ing sales. Housing starts and building

permits are off nearly 30% from Feb-

0.5 ruary 2007 over the same month from

0.0 the previous year, and delinquency

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr and default rates are on the rise. The

03 04 05 06 07

risks of this crisis spreading to other

Source: Reuters EcoWin parts of the real economy loom large.

48 advisor’s edge | may 2007 www.advisor.ca

With these points in mind, consider the risk-versus-

reward trade-off when investing in the various markets

and asset classes at present. The added risk of owning

high-yield debt is likely not adequately compensated for

with only 300 basis points of additional yield annually

over lock-safe government debt. On a $50,000 alloca-

tion the difference is only $1,500 per year.

Emerging market equities in East Asia have performed

admirably, and they may rise further, but they are a lev-

eraged play on the U.S. stock market. Fundamentals are

better than in the U.S. in many cases, but if the U.S.

economy is slowing, those stock markets are likely to

underperform U.S. equities.

As the credit bubble continues to unwind, borrow-

FUNDWRAPFILTER &

ing costs will rise beyond the housing market. This will ASSETALLOCATIONFILTER

obviously have repercussions for highly leveraged invest-

ments. Private equity deals will dry up and small-growth

companies more reliant on debt financing will get hit

the hardest.

The safest place to invest is in large capitalization MORE HANDS.

companies with strong balance sheets, consistently

growing dividends and stable earnings. These companies

MORE HANDS ON.

are not highly valued because they have fewer growth One program—two free tools—to

prospects than the smaller, more dynamic companies on filter, sort and streamline asset

the developed economy exchanges. But that makes them allocation and fund wrap programs.

safer bets in a market where liquidity is drying up. Get your hands on these tools now

Japanese stocks may be another smart place to in- at advisor.ca

vest should liquidity start to vanish. The Japanese yen

is highly undervalued due to the absolutely low level of

interest rates in Japan in recent years. Domestic investors

have been sending money outside of Japan in search of

higher yields, and the falling yen has encouraged that

strategy. But as the economy improves, interest rates will

rise and money will flow back into Japan. Therefore,

investors would benefit from the twin tailwinds of an

improving stock market and rising currency.

We have been witness to an unprecedented boom

in equity, bond and commodity prices the world over.

These gains are, to a large extent, based on unusually

easy credit conditions. Eventually, they will revert to

more normal levels, and those advisors who anticipat-

ed and prepared for this on behalf of their clients will PARTNERS

avoid significant pain.

Levi Folk is president of Generation Capital and the Fund Library,

an investor research website. advisorsedge@rmpublishing.com

www.advisor.ca advisor’s edge | may 2007 49

You might also like

- The 2023 Andex Chart StoryDocument3 pagesThe 2023 Andex Chart Storypridetag.contatoNo ratings yet

- Minnesotans United For All Families Fundraising ReportDocument1,181 pagesMinnesotans United For All Families Fundraising ReportMinnesota Public RadioNo ratings yet

- Questionnaire-Benchmarking of Best HR PracticesDocument13 pagesQuestionnaire-Benchmarking of Best HR PracticesUtkalKhatiwadaNo ratings yet

- Subprime Crisis and The Impact On IndiaDocument4 pagesSubprime Crisis and The Impact On IndiaManoj M. GolvankarNo ratings yet

- The Artisan - Northland Wealth Management - Autumn 2011Document4 pagesThe Artisan - Northland Wealth Management - Autumn 2011Victor KNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument14 pagesBreakfast With Dave: David A. Rosenbergrichardck61No ratings yet

- Lane Asset Management Commentary December 2010Document8 pagesLane Asset Management Commentary December 2010eclaneNo ratings yet

- The Absolute Return Letter 0709Document8 pagesThe Absolute Return Letter 0709tatsrus1No ratings yet

- CR 1Q17 OutlookDocument12 pagesCR 1Q17 OutlooknmkdsarmaNo ratings yet

- Monthly Letter - en - 1589563Document14 pagesMonthly Letter - en - 1589563Nikos LeounakisNo ratings yet

- Kinnaras Capital Management LLC: May 2010 Market CommentaryDocument5 pagesKinnaras Capital Management LLC: May 2010 Market Commentaryamit.chokshi2353No ratings yet

- Mi InvestmentDocument22 pagesMi Investmentalpha.square.betaNo ratings yet

- Reinventing Banking: Capitalizing On CrisisDocument28 pagesReinventing Banking: Capitalizing On Crisisworrl samNo ratings yet

- 2009-04 Miller CommentaryDocument5 pages2009-04 Miller CommentaryTheBusinessInsider100% (1)

- Sub Prime LendingDocument4 pagesSub Prime Lendinggagan585No ratings yet

- Q2 Full Report 2020 PDFDocument24 pagesQ2 Full Report 2020 PDFhamefNo ratings yet

- A Stronger Dollar Might Hit Emerging Economies Harder This Cycle - Financial TimesDocument3 pagesA Stronger Dollar Might Hit Emerging Economies Harder This Cycle - Financial TimesRenato SilvaNo ratings yet

- Fasanara Capital Investment Outlook - May 3rd 2016Document17 pagesFasanara Capital Investment Outlook - May 3rd 2016Zerohedge100% (1)

- Global Meltdown & Its Impact On Indian EconomyDocument38 pagesGlobal Meltdown & Its Impact On Indian Economysuvi imsNo ratings yet

- Solutions Chapter 15 Internationsl InvestmentsDocument12 pagesSolutions Chapter 15 Internationsl Investments'Osvaldo' RioNo ratings yet

- Finsight Issue 1 Jan10Document7 pagesFinsight Issue 1 Jan10rapidraviNo ratings yet

- Lane Asset Management Stock Market Commentary February 2011Document7 pagesLane Asset Management Stock Market Commentary February 2011eclaneNo ratings yet

- Volume 1 12 The Dollar's Descent Orderly or Not October 30 2009Document12 pagesVolume 1 12 The Dollar's Descent Orderly or Not October 30 2009Denis OuelletNo ratings yet

- Me Cio Weekly LetterDocument7 pagesMe Cio Weekly LetterHank DayNo ratings yet

- Alta Report January 2024Document10 pagesAlta Report January 2024JP HNo ratings yet

- Suggested Answers To Chapter 15 Questions: Instructors Manual: Multinational Financial Management, 9Th EdDocument12 pagesSuggested Answers To Chapter 15 Questions: Instructors Manual: Multinational Financial Management, 9Th EdkinikinayyNo ratings yet

- Price Insensitive Sellers and Ten Quick Topics To Ruin Your SummerDocument24 pagesPrice Insensitive Sellers and Ten Quick Topics To Ruin Your SummerCanadianValue0% (1)

- 06-10-10 Breakfast With DaveDocument8 pages06-10-10 Breakfast With DavefcamargoeNo ratings yet

- Liquidity Cascades - Newfound Research PDFDocument19 pagesLiquidity Cascades - Newfound Research PDFrwmortell3580No ratings yet

- Vincent Deluard The Fed Put Junk Debt and Trade WarsDocument9 pagesVincent Deluard The Fed Put Junk Debt and Trade WarsVarnit AgnihotriNo ratings yet

- Converse Mar 24Document43 pagesConverse Mar 24Swarnika KesarwaniNo ratings yet

- Breakfast With Dave 20100928Document8 pagesBreakfast With Dave 20100928marketpanicNo ratings yet

- Newsletter 1003Document5 pagesNewsletter 1003jdakineNo ratings yet

- Weekly Capital Market Outlook-1Document8 pagesWeekly Capital Market Outlook-1Vinay AgarwalNo ratings yet

- TL - Gibson Smith Insights - Are We Headed For A Hangover - May 2015 - Exp - 05-30Document4 pagesTL - Gibson Smith Insights - Are We Headed For A Hangover - May 2015 - Exp - 05-30blind_cryNo ratings yet

- Economic Analysis Current Global Economy Scenario - Similar To Market Crash of 1929Document32 pagesEconomic Analysis Current Global Economy Scenario - Similar To Market Crash of 1929Jariwala BhaveshNo ratings yet

- Barclays 2 Capital David Newton Memorial Bursary 2006 MartDocument2 pagesBarclays 2 Capital David Newton Memorial Bursary 2006 MartgasepyNo ratings yet

- Bank - Capital Market NexusDocument14 pagesBank - Capital Market NexusKal_CNo ratings yet

- The Return of The Bond Vigilantes: ObituaryDocument1 pageThe Return of The Bond Vigilantes: ObituaryKarya BangunanNo ratings yet

- The Sub Prime Crisis - An AnalysisDocument6 pagesThe Sub Prime Crisis - An Analysisvishwajit46No ratings yet

- 1 Identify The Risks in New Century S Balance Sheet 2 OnDocument1 page1 Identify The Risks in New Century S Balance Sheet 2 OnLet's Talk With HassanNo ratings yet

- Russell Investments Q2 2020 GMO SummaryDocument4 pagesRussell Investments Q2 2020 GMO SummaryMichael WangNo ratings yet

- Citi 'What If ..Document15 pagesCiti 'What If ..IwpNo ratings yet

- 03 Noyer Financial TurbulenceDocument3 pages03 Noyer Financial Turbulencenash666No ratings yet

- Elliott LetterDocument28 pagesElliott LetterMilan StojevNo ratings yet

- Current Issues in Financial MarketsDocument5 pagesCurrent Issues in Financial Marketsreb_nicoleNo ratings yet

- Last Risk Premium BernsteinDocument12 pagesLast Risk Premium BernsteinRobert IronsNo ratings yet

- Impact of Covid-19 and Government Response On Capital MarketsDocument8 pagesImpact of Covid-19 and Government Response On Capital Marketsahsan habibNo ratings yet

- Annual Economic Report 2020 SynopsisDocument9 pagesAnnual Economic Report 2020 Synopsissh_chandraNo ratings yet

- The Broyhill Letter: Executive SummaryDocument4 pagesThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNo ratings yet

- Financial Meltdown - Crisis of Governance?Document6 pagesFinancial Meltdown - Crisis of Governance?Atif RehmanNo ratings yet

- Us Yield CurveDocument6 pagesUs Yield Curvealiimrandar6939No ratings yet

- Liquidity Spigot 1684333089Document27 pagesLiquidity Spigot 1684333089Alexei LeonNo ratings yet

- Big Freeze IVDocument5 pagesBig Freeze IVKalyan Teja NimushakaviNo ratings yet

- COVID-19 Outbreak: Capital Markets Implications and ResponseDocument26 pagesCOVID-19 Outbreak: Capital Markets Implications and Responseanirbanccim8493No ratings yet

- Fidelity Outlook 2024 1703148762Document32 pagesFidelity Outlook 2024 1703148762czydytkkvvNo ratings yet

- JP Morgan 1655406568Document27 pagesJP Morgan 1655406568Mohamed MaherNo ratings yet

- FI - M Lecture 7-Why Do Financial Crises Occur - PartialDocument37 pagesFI - M Lecture 7-Why Do Financial Crises Occur - PartialMoazzam ShahNo ratings yet

- Financial Crisis PPT FMS 1Document48 pagesFinancial Crisis PPT FMS 1Vikas JaiswalNo ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- Revised Final Research Paper 12HUMSS 1 Group 6 2Document135 pagesRevised Final Research Paper 12HUMSS 1 Group 6 2Alyssa BeatriceNo ratings yet

- Huerta Alba Resort Inc. v. CA DigestDocument4 pagesHuerta Alba Resort Inc. v. CA DigestLeo Cag100% (1)

- Example For Shipping DocumentsDocument29 pagesExample For Shipping DocumentsNicolai GosvigNo ratings yet

- Final - Hafl Yearly Exam 2022 (Scheme)Document1 pageFinal - Hafl Yearly Exam 2022 (Scheme)Vineet YadavNo ratings yet

- Debt Recovery Techniques in The Banking Sector, Issues, Problems and Prospects LatestDocument50 pagesDebt Recovery Techniques in The Banking Sector, Issues, Problems and Prospects Latestfaleye olumide emmanuel100% (1)

- Excel Built in Financial Functions Cheat Sheet: by ViaDocument2 pagesExcel Built in Financial Functions Cheat Sheet: by ViaJagdish Prasad SharmaNo ratings yet

- Forex Trading 15 Minute Turbocourse Ultimate CollectionDocument23 pagesForex Trading 15 Minute Turbocourse Ultimate CollectionLinda Taylor50% (2)

- RH RulesDocument3 pagesRH RulesBinayKPNo ratings yet

- Bes 122 PDFDocument4 pagesBes 122 PDFSonam GolaNo ratings yet

- PhdEntranceform 2014Document2 pagesPhdEntranceform 2014milinjdNo ratings yet

- Present Continuous TenseDocument6 pagesPresent Continuous TenseFernando Ribeiro Júnior100% (1)

- De Minh Hoa K11Document6 pagesDe Minh Hoa K11M Huy TranNo ratings yet

- 65th Anniversary of Marcuse's Reason and RevolutionDocument15 pages65th Anniversary of Marcuse's Reason and RevolutionDiego Arrocha ParisNo ratings yet

- Hotel Caruso, Best of BestDocument3 pagesHotel Caruso, Best of BestScott Goetz - Fierce TravelerNo ratings yet

- St. Joseph's Academy of Malinao, Aklan, Inc: Pros and Cons of Social Media Usage Among StudentsDocument2 pagesSt. Joseph's Academy of Malinao, Aklan, Inc: Pros and Cons of Social Media Usage Among StudentsFrankie Magdael ItulidNo ratings yet

- Materi Bahasa Inggris Pertemuan 3Document34 pagesMateri Bahasa Inggris Pertemuan 3Siapa AjaNo ratings yet

- 4 Process ApproachDocument6 pages4 Process ApproachBãoNo ratings yet

- AIAG - CQI-09 (EN) - Oct 11Document100 pagesAIAG - CQI-09 (EN) - Oct 11Ramiro Predassi100% (1)

- RuleTheWaves MANUAL PDFDocument21 pagesRuleTheWaves MANUAL PDFJefferson Rodrigo Fernandes PereiraNo ratings yet

- Makalah Curriculum and DevelopmetDocument18 pagesMakalah Curriculum and Developmetfeisal adiNo ratings yet

- Court and Docket ManagementDocument15 pagesCourt and Docket Managementrajeet chakrabortyNo ratings yet

- Cawagas Pedagogical Principles PP 299-306Document8 pagesCawagas Pedagogical Principles PP 299-306María Julia SolovitasNo ratings yet

- Definition of EquityDocument5 pagesDefinition of EquityTumwine BarnabasNo ratings yet

- Coc Part 2 - Corrective Action Procedure V 6 0Document21 pagesCoc Part 2 - Corrective Action Procedure V 6 0api-264357222No ratings yet

- ALLISON - The New Spheres of InfluenceDocument12 pagesALLISON - The New Spheres of InfluenceDaniel GarcíaNo ratings yet

- Jaminan Fidusia Yang Objek Jaminan DijualDocument24 pagesJaminan Fidusia Yang Objek Jaminan DijualSyafril SyaninNo ratings yet

- Chapter 2 - : Ethics, Fraud, and Internal ControlDocument42 pagesChapter 2 - : Ethics, Fraud, and Internal ControlTeo ShengNo ratings yet

- Thesis Statement For Twelfth NightDocument8 pagesThesis Statement For Twelfth Nightafhbexrci100% (2)