Professional Documents

Culture Documents

General Admin Personnel Purchase Total General Overheads 4,000

General Admin Personnel Purchase Total General Overheads 4,000

Uploaded by

ChiragOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Admin Personnel Purchase Total General Overheads 4,000

General Admin Personnel Purchase Total General Overheads 4,000

Uploaded by

ChiragCopyright:

Available Formats

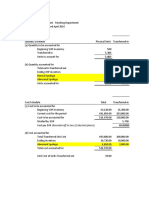

A.

Indirect Cost Centres

General Admin 2,000

Personnel 1,000

Purchase 1,000

Total General Overheads 4,000

Production Cost Centres

Fabrication Assembly

Investment 4,200 2,000 6,200

Direct Labour Hours 2,100 3,500

B.Initial Allocation to Cost Centres

Allocation Of Genl O/H 2,710 1,290 4,000

Indirect Labour 3,400 2,500

Supplies 1,000 400

Others 3,500 400

TOTAL 10,610 4,590 15,200

C. Calculation of Overhead Rate

Overhead Rate 5.0522 1.3115

Job 101

(Started and Finished in the given time period)

No.of items in Job 100

Direct Labour hours uesd in Fabrication 2,000

Direct Labour hours uesd in Assembly 2,200

Fabrication

Direct Materials 35,000

Direct Labour 40,000

Allocation of Overhead 10,104

Total 85,104

Assembly

Direct Materials 500

Direct Labour 44,000

Allocation of Overhead 2,885

Total 47,385

Total Cost 132,490

Cost per Unit 1,324.90

PRODN DEPTL.OH

DEPTS RATES

Fabricatio RATE 1

2,710 n(7,900)

OVERHEAD Assembl

y RATE 2

COST 1,290 (3,300)

STAGE 1: O/H Assigned to STAGE 2: O/H Allocated

Prodn. Depts. to Products

PTL.OH

PRODUCTS

ATES

During Fabrication

5.0522 per DLH Direct Materials

RATE 1 Direct Labour

During Assembly

RATE 2 Direct Materials

1.3115 per DLH Direct Labour

2: O/H Allocated

ucts

You might also like

- Entrepreneurship: Quarter 2 - Module 4 CostsDocument6 pagesEntrepreneurship: Quarter 2 - Module 4 CostsJolly Roy Bersaluna80% (10)

- CMA 4th Session 22 May, 21Document8 pagesCMA 4th Session 22 May, 21Saqib AliNo ratings yet

- Chapter 6Document9 pagesChapter 6Alexsandra GarciaNo ratings yet

- Chap 4 Job CostingDocument9 pagesChap 4 Job CostingWadiah AkbarNo ratings yet

- 2021 UTS JawabanDocument8 pages2021 UTS JawabanAdam FitraNo ratings yet

- Classes 3.a 4.a EXCERCISES From COGS To Planning - September 2022Document9 pagesClasses 3.a 4.a EXCERCISES From COGS To Planning - September 2022Maram PageNo ratings yet

- Income Statement - ABC OrgDocument4 pagesIncome Statement - ABC OrgHardeep SinghNo ratings yet

- Assignment Cost Sheet & BudgetingDocument7 pagesAssignment Cost Sheet & BudgetingKaran KrNo ratings yet

- Assignment Cost Sheet & BudgetingDocument7 pagesAssignment Cost Sheet & BudgetingKaran KrNo ratings yet

- Process Costing Examples (Matz Uzry)Document24 pagesProcess Costing Examples (Matz Uzry)Muhammad azeem100% (3)

- Assignment Cover Sheet: Northrise UniversityDocument6 pagesAssignment Cover Sheet: Northrise UniversitySapcon ThePhoenixNo ratings yet

- Cost Accounting Midterm Examdocx PDF FreeDocument5 pagesCost Accounting Midterm Examdocx PDF FreeHannah Denise BatallangNo ratings yet

- Chapter 7, Cost AccountingDocument2 pagesChapter 7, Cost AccountingApril Joy ObedozaNo ratings yet

- Jetter Engine Corporation Casting Department Cost of Production Report For February Materials Labor Started in Process This Period Quantity ScheduleDocument9 pagesJetter Engine Corporation Casting Department Cost of Production Report For February Materials Labor Started in Process This Period Quantity SchedulePricilla PutriNo ratings yet

- Job Order Costing: Prof. Mark Lester T. Balasa, CpaDocument24 pagesJob Order Costing: Prof. Mark Lester T. Balasa, CpaNah HamzaNo ratings yet

- Solutions-Chapter 2Document5 pagesSolutions-Chapter 2Saurabh SinghNo ratings yet

- Cost Accounting Midterm ExamDocument5 pagesCost Accounting Midterm ExamNerizza TrinidadNo ratings yet

- Costing Methods-Pro. BaseDocument8 pagesCosting Methods-Pro. BasesananeNo ratings yet

- Illustrative Problem (Dscrete Spoilage Wa)Document2 pagesIllustrative Problem (Dscrete Spoilage Wa)pamssyNo ratings yet

- Name: Shahihul Islam NPM: 22001082171 Class: A1Document2 pagesName: Shahihul Islam NPM: 22001082171 Class: A1shahihul IslamNo ratings yet

- ACCT 213 ExerciseDocument5 pagesACCT 213 ExerciseMr MDRKHMNo ratings yet

- ProcessCosting AverageDocument22 pagesProcessCosting AveragePricilla PutriNo ratings yet

- RCA Sol Sample Exam PDFDocument5 pagesRCA Sol Sample Exam PDFdiane camansagNo ratings yet

- XXXXXDocument1 pageXXXXXAccounterist ShinangNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingGayzelle MirandaNo ratings yet

- Ch02 Job Order Costing1Document8 pagesCh02 Job Order Costing1Laika Mico MotasNo ratings yet

- Module 4 Cost AccountingDocument2 pagesModule 4 Cost AccountingSinclair Faith GalarioNo ratings yet

- Managerial-Accounting 8e Hansen-Ebook 1Document4 pagesManagerial-Accounting 8e Hansen-Ebook 1212300163No ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Quantity Schdule: Beginning Work in Process 5,000.00 Started in Process 100,000.00 105,000.00Document7 pagesQuantity Schdule: Beginning Work in Process 5,000.00 Started in Process 100,000.00 105,000.00Anne MendozaNo ratings yet

- Raw MaterialsDocument1 pageRaw Materialstan jamesNo ratings yet

- Maintenancejobcardemo PDFDocument1 pageMaintenancejobcardemo PDFShashank SaxenaNo ratings yet

- Job Costing - ExcercisesDocument31 pagesJob Costing - Excercisesგიორგი კაციაშვილიNo ratings yet

- Exercises Lesson 3Document2 pagesExercises Lesson 3Nino LANo ratings yet

- 2023 Answer CHAPTER 7 PDFDocument19 pages2023 Answer CHAPTER 7 PDFRianne NavidadNo ratings yet

- Cost Acctg-Ch5Document3 pagesCost Acctg-Ch5JACQUELYN PABLITONo ratings yet

- MAE - Pratice - Cost Sheet - SolutionDocument12 pagesMAE - Pratice - Cost Sheet - SolutionDhairya MudgalNo ratings yet

- Cost Accounting MidtermDocument4 pagesCost Accounting MidtermAdam Smith100% (1)

- Answer 20052016 Job-Order CostingDocument3 pagesAnswer 20052016 Job-Order CostingVũ Thu HoàiNo ratings yet

- Factory Overhead Cost StandardsDocument3 pagesFactory Overhead Cost StandardsMeghan Kaye LiwenNo ratings yet

- MS3 M2-ExerciseDocument6 pagesMS3 M2-ExerciseVensen FuentesNo ratings yet

- Dente Q2Document3 pagesDente Q2hanna fhaye denteNo ratings yet

- Tugas AKBDocument8 pagesTugas AKBRizkiNo ratings yet

- SampleDocument40 pagesSamplemikeNo ratings yet

- Cost Accounting 10Document3 pagesCost Accounting 10KNo ratings yet

- Chapter 3Document6 pagesChapter 3dessalegn861No ratings yet

- Cost AccountingDocument6 pagesCost AccountingJashmin CosainNo ratings yet

- Process Costing - CompleeteDocument42 pagesProcess Costing - CompleeteKarimatun NisaNo ratings yet

- Colin - BookDocument15 pagesColin - BookrizwanNo ratings yet

- Assignment #1Document5 pagesAssignment #1Crizelda BauyonNo ratings yet

- Accounting For FOH Part 11Document16 pagesAccounting For FOH Part 11Shania LiwanagNo ratings yet

- Chapter 13-1, 13-7 & 13-9Document5 pagesChapter 13-1, 13-7 & 13-9Elaine Fiona VillafuerteNo ratings yet

- SPPTChap 002Document25 pagesSPPTChap 002Abdulaziz ObaidNo ratings yet

- Questions Fifo AverageDocument4 pagesQuestions Fifo AverageClaire BarbaNo ratings yet

- AC - CostAcctg Activity Q4.1Document13 pagesAC - CostAcctg Activity Q4.1Eloisa Joy MoredoNo ratings yet

- Answer - Process Costing Problem 7Document7 pagesAnswer - Process Costing Problem 7Emmanuelle MazaNo ratings yet

- Powtrading PostDocument26 pagesPowtrading PostAbdulhakeem DimapintoNo ratings yet

- Full Cost of The Product Per UnitDocument6 pagesFull Cost of The Product Per UnitIbrahim HussainNo ratings yet

- Class Case For Chapter 17 2015 AdjustedDocument8 pagesClass Case For Chapter 17 2015 Adjustedahmed.alaradi88No ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet