Professional Documents

Culture Documents

Gordon Dividend Growth Model To Value A Minority Share

Gordon Dividend Growth Model To Value A Minority Share

Uploaded by

KellyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gordon Dividend Growth Model To Value A Minority Share

Gordon Dividend Growth Model To Value A Minority Share

Uploaded by

KellyCopyright:

Available Formats

Gordon dividend growth model to value a minority share

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. However, this requires the use

of earnings growth rather than dividend growth, which might be different. Get Free Newsletters Newsletters. Constant Growth Gordon Model

Formula. The second issue has to do with the relationship between the discount factor and the growth rate used in the model. If the expected

dividend in year 1 is D1, then the equation can be further simplified to. By using the market price and the next dividend of the stock, the investor

can solve for the dividend growth rate that would justify such a price. Two of the inputs in the Gordon Growth Model are easy to find. Satoshi

Cycle is a crypto theory that denotes to the high correlation between the The determinants of the market value of the share are the perpetual

stream of future dividends to be paid, the cost of capital and the expected annual growth rate of the company. This is a very unrealistic property for

common shares. Although the growth rate of dividends is rarely constant in real life, and although it's hard to predict, the Gordon Growth Model is

a very powerful tool in finance. On the other hand, a company with stagnant dividends could bring in a new management team that would turn the

company around and boost dividends. A constant k means the business risks are not accounted for while valuing the firm. It benefits the

shareholders more if the company reinvests the dividends rather than distributing it. Broker Reviews Find the best broker for your trading or

investing needs See Reviews. What Is the Dependent Variable in Stocks? This is a geometric series that gives a remarkably simple formula for the

intrinsic value of a stock. When growth is expected to exceed the cost of equity in the short run, then usually a two-stage DDM is used:. Running

this blog since and trying to explain "Financial Management Concepts in Layman's Terms". There are many reasons, the most basic being simply

inflation. If a firm pays an infinite stream of dividends, and the amount of each dividend payment never changes, then the perpetuity formula will

provide a current price of the share. Though it comes with its own limitations, it is a widely accepted model to determine the market price of the

share using the forecasted dividends. Because the model simplistically assumes a constant growth rate, it is generally only used for companies with

stable growth rates in dividends per share. We can express this series mathematically below. This is a difficult assumption to accept in real life

conditions, but knowing that the result is dependent on the growth rate allows us to conduct sensitivity analysis to test the potential error should the

growth rate be different than anticipated. Given a dividend per share that is payable in one year, and the assumption the dividend grows at a

constant rate in perpetuity , the model solves for the present value of the infinite series of future dividends. Consider the DDM's cost of equity

capital as a proxy for the investor's required total return. Skip to main content. Gordon Growth Model Share. Gordon of the University of

Amarika , who originally published it along with Eli Shapiro in and made reference to it in Strengths and Weaknesses of the Gordon Growth

Model. Each new investor will value the share based on the expected dividend stream, and the future sale price. After rapid growth, the company's

profits -- and therefore its dividends -- might hit a roadblock. We know that the current share price according to the Gordon Model is going to be

determined by a series of dividend payments. The result is a simple formula, which is based on mathematical properties of an infinite series of

numbers growing at a constant rate. The model assumes a constant Internal Rate of Return r , ignoring the diminishing marginal efficiency of the

investment. When this happens, the new shareholder will expect to receive dividends while owning the share. If the investor thinks that dividend

payments can realistically grow at 7. By using this site, you agree to the Terms of Use and Privacy Policy. If the growth rate is uneven, the model is

not usable.

Gordon Growth Model

However, this requires the use of earnings growth rather than dividend growth, which might be different. The model is based on the assumption of

a constant cost of capital k , implying the business risk of all the investments to be the same. The model assumes that all investment of the company

is financed by retained earnings and no external financing is required. From Wikipedia, the free encyclopedia. When growth is expected to exceed

the cost of equity in the short run, then usually a two-stage DDM is used:. Hunkar Ozyasar is the former high-yield bond strategist for Deutsche

Bank. The main limitation of the Gordon growth model lies in its assumption of a constant growth in dividends per share. The closing price on 15th

April is, however, If the growth rate is uneven, the model is not usable. The Constant Dividend Growth Model is a simple derivation of a perpetual

stream of growing dividend payments relative to the required rate of return in the market. So, the optimum payout ratio for growth firms is zero. If

the current value of the dividend is D 0 , then assuming a constant dividend growth rate of g, the dividend in year n will be. Skip to main content.

Stock market Financial models Valuation finance. Therefore, the model is limited to firms showing stable growth rates. Assuming we require a

compound rate of return of r, the present value of the dividend in year n is. Solving for G results in 0. So if we can understand the price relationship

to this dividend stream, then we can calculate the price today, as well as the price at any time in the future. In either of the latter two, the value of a

company is based on how much money is made by the company. In this article, we derive the key valuation formula, and find the intrinsic value of

Exxon Mobil using the latest market data. Notify me of new posts by email. If the investor thinks that dividend payments can realistically grow at 7.

Strengths and Weaknesses of the Gordon Growth Model. While the Gordon Growth Model is named after Myron J Gordon, analysts have

employed this technique and variants thereof since the early 20th century. We know that the current share price according to the Gordon Model is

going to be determined by a series of dividend payments. A celebration of the most influential advisors and their contributions to critical

conversations on finance. Satoshi Cycle is a crypto theory that denotes to the high correlation between the The Gordon growth model values a

company's stock using an assumption of constant growth in payments a company makes to its common equity shareholders. Now that we have an

understanding of dividends, and the constant growth rate of those dividends, we can develop a model to price a share based on the dividend

payment and the growth rate. The shareholders are benefitted more if the dividends are distributed rather than reinvested. Contact Us Disclaimer

Suggested Sites. The Gordon model assumes that the current price of a security will be affected by the dividends, the growth rate of the dividends,

and the required rate of return by shareholders. Notify me of follow-up comments by email. What Is the Dependent Variable in Stocks? The

determinants of the market value of the share are the perpetual stream of future dividends to be paid, the cost of capital and the expected annual

growth rate of the company. Authorised capital Issued shares Shares outstanding Treasury stock. Assuming that a share will continue to exist in

perpetuity, and that the company intends to pay dividends for as long as its shares are outstanding, we can logically develop a valuation technique

based solely on the dividends paid. It is important to remember that the price result of the Constant Dividend Growth Model assumes that the

growth rate of the dividends over time will remain constant. After rapid growth, the company's profits -- and therefore its dividends -- might hit a

roadblock. Consider the dividend growth rate in the DDM model as a proxy for the growth of earnings and by extension the stock price and

capital gains. The Gordon growth model is used to determine the intrinsic value of a stock based on a future series of dividends that grow at a

constant rate.

The Gordon Growth Model

The model assumes that all investment of the company is financed by retained earnings and no external financing is required. Yet the future sale

price of the share will be based on the future dividend stream. This is a very unrealistic property for common shares. Consider the DDM's cost of

equity capital as a proxy for the investor's required total return. Premium Excel Tools Kudos Baby. Gordon dividend growth model to value a

minority share the required rate of return is less than the growth rate of dividends per share, the result is a negative value, gordon dividend

growth model to value a minority share the model worthless. Growyh we assume that this process will repeat itself, we find that the stream of

dividends is in fact infinite. We know that the current share price according to the Gordon Model is going to be determined by a series of dividend

payments. If the expected dividend in year 1 is D1, then the equation can be further simplified to. The model assumes a constant Internal Rate of

Return rignoring the diminishing marginal modrl of the investment. Dividends are the most crucial to the development and implementation of the

Gordon Model. The Gordon growth model assumes a company exists forever and pays dividends per share that increase at a constant rate. Two

of the inputs in the Gordon Growth Model are easy to find. Twitter Tweets by investexcel. Even when g is very close to rP approaches infinity, so

the model becomes meaningless. The Gordon Model is particularly useful since it includes the ability to price in the growth rate of dividends over

the long term. The Gordon growth model is used to determine the intrinsic value of a stock based on a future series of dividends that grow at a

constant rate. It is named after Myron J. We can express this series mathematically below. The model states that the value of a stock is the

expected future sum of all of the dividends. The dividend to be paid in a year is usually available by searching the news, since it is publicly

announced by the company. The tricky part is estimating at what rate the dividends will grow. This requires an ability to guess such things as which

sare will perform better in the marketplace. This makes the process very modsl and inexact, at best. In these cases, the beautifully simple Gordon

Growth Model isn't applicable. Dictionary Gordon dividend growth model to value a minority share Of The Day. All we need is to know size

of the annual dividends and the required rate of return by investors in the market. P stands for stock value, D stands for expected dividend per

share one year from now, k stands for required rate of return for the buyer, and G stands for growth rate in dividends. As these profits grow, so

would the dividend payouts, even if the purchasing power of these dividends remains the same. Constant Growth Model is used to determine the

current price of a share relative to its dividend payments, the expected growth rate of these dividends, and the required rate of gordon dividend

growth model to value a minority share by investors in the market. In other words, if an investor knows the dividend in a year and at what rate

that dividend will grow, she can calculate the stock's value. After rapid growth, the company's profits -- and therefore its dividends -- might hit a

roadblock. In this article, we derive the key valuation formula, and find the intrinsic value of Exxon Mobil using the latest market data. Gordon of

the University of Amarika shard, who originally published it along with Eli Shapiro in and made reference to it in Common stock Gordon dividend

growth model to value a minority share share Preferred stock Glrdon stock Tracking stock. If the investor thinks that dividend payments can ti

grow at 7. Although the growth rate of dividends is rarely constant in real life, and although it's hard to predict, the Gordon Growth Model is a very

powerful tool in finance. The result is a simple formula, which is based on mathematical properties of an infinite series of numbers growing at a

constant rate. From Wikipedia, the free encyclopedia. Become a day trader. Your email address will not be published. Nevertheless, it's a key

pillar of financial theory. As the price level grows, so will revenues, costs, and profits. Notify me of follow-up comments by email. Assuming we

require a compound rate of return of r, the present value of the dividend in year n is. The equation most widely moel is called the Gordon growth

model. Alpha Arbitrage pricing theory Beta Bidask spread Book value Capital asset pricing model Capital market line Dividend discount

model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Also, in the

dividend discount model, a company that does not pay dividends is worth nothing. Limitations The Gordon Growth Model is applicable only if the

gordon dividend growth model to value a minority share dividend will grow at a constant rate. The model has some limitations, and it should't

be relied on as the only stock picking tool. These returns mimority a period from and were examined and attested by Baker Tilly, an independent

accounting firm. If a firm pays an infinite stream of dividends, and the amount of each dividend payment never changes, then the perpetuity formula

will provide a current price of the share. Primary market Secondary market Third market Fourth market. Authorised capital Issued shares Shares

outstanding Treasury stock. This is a difficult assumption to accept in real life conditions, but knowing that the result is dependent on the growth

rate allows us to conduct sensitivity analysis to test the potential error should the growth rate be different than anticipated.

You might also like

- DSV US Presentation v2 PDFDocument26 pagesDSV US Presentation v2 PDFtanvirNo ratings yet

- Gordon Growth Model Dividend Payout RatioDocument3 pagesGordon Growth Model Dividend Payout RatioCoryNo ratings yet

- Sybaf Dividend DecisionsDocument13 pagesSybaf Dividend DecisionsBhavana Patil JangaleNo ratings yet

- Gordon Model For Intrinsic ValueDocument2 pagesGordon Model For Intrinsic ValueImran Ansari100% (1)

- Gordons ModelDocument2 pagesGordons ModelOmkar Harmalkar0% (1)

- Capital Structure and Long-Term Financial DecisionDocument13 pagesCapital Structure and Long-Term Financial DecisionZenedel De JesusNo ratings yet

- Research Paper On Dividend Discount ModelDocument4 pagesResearch Paper On Dividend Discount Modelcan3z5gx100% (1)

- Dividend Decisions Unit 5Document8 pagesDividend Decisions Unit 5md saifNo ratings yet

- Unit 4Document12 pagesUnit 4Mohammad ShahvanNo ratings yet

- Dividend Policy AssignmentDocument8 pagesDividend Policy Assignmentgeetikag2018No ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyYitera SisayNo ratings yet

- G Dividend PolicyDocument7 pagesG Dividend PolicySweeti JaiswalNo ratings yet

- P.G. Department of Business Management FM University, BalasoreDocument5 pagesP.G. Department of Business Management FM University, BalasoreRashmi Ranjan SahooNo ratings yet

- By Shobhit AggarwalDocument20 pagesBy Shobhit Aggarwalhozefa1234No ratings yet

- Model Assumptions: The GGM Is Suitable in The Following CasesDocument1 pageModel Assumptions: The GGM Is Suitable in The Following CasesEllaNo ratings yet

- Dividend Discount Model NotesDocument2 pagesDividend Discount Model NotesZofigan khawajaNo ratings yet

- Dividend Decision - 2Document21 pagesDividend Decision - 2SANDEEP KUMARNo ratings yet

- Dividend DecisionsDocument9 pagesDividend DecisionsAnkita Kumari SinghNo ratings yet

- Abdullah QAYYUM ValuationDocument11 pagesAbdullah QAYYUM ValuationSaifiNo ratings yet

- Introduction To Research MethodsDocument3 pagesIntroduction To Research MethodsVicky JeMiNo ratings yet

- Abdul Sameeh FADocument12 pagesAbdul Sameeh FASaifiNo ratings yet

- M M M MMMMM MM M MMMMMMMM M M MMMMDocument5 pagesM M M MMMMM MM M MMMMMMMM M M MMMMespy888No ratings yet

- Dividend PolicyDocument4 pagesDividend PolicyKiran Rajashekaran NairNo ratings yet

- 4.dividend DecisionsDocument5 pages4.dividend DecisionskingrajpkvNo ratings yet

- DivpolicyDocument14 pagesDivpolicyNitin AgrawalNo ratings yet

- Corporate Finance Project 3 Farheen Begum202200535 PDFDocument5 pagesCorporate Finance Project 3 Farheen Begum202200535 PDFnaazfarheen7777No ratings yet

- Project On Dividend PolicyDocument50 pagesProject On Dividend PolicyMukesh Manwani100% (3)

- Equity Valuation: Why Determine Value of A StockDocument12 pagesEquity Valuation: Why Determine Value of A StockRUKUDZO KNOWLEDGE DAWANo ratings yet

- DividendsDocument8 pagesDividendsKumar SumanthNo ratings yet

- DividendDocument32 pagesDividendprincerattanNo ratings yet

- Financial Management: BY: Aashna Dubey Aayushi Mahajan Akash Gupta Akriti Rajput Akshay Bali Antra SharmaDocument23 pagesFinancial Management: BY: Aashna Dubey Aayushi Mahajan Akash Gupta Akriti Rajput Akshay Bali Antra SharmaAkash GuptaNo ratings yet

- Pricing The Stock Through DDM: Topic 1 - Costant Discount ModelDocument1 pagePricing The Stock Through DDM: Topic 1 - Costant Discount Modelvinay narneNo ratings yet

- Key PointsDocument8 pagesKey PointsNight MizukiNo ratings yet

- 11modelos de Valorización de AccionesDocument46 pages11modelos de Valorización de AccionesMario Zambrano CéspedesNo ratings yet

- FM Ch-5Document36 pagesFM Ch-5Riad FaisalNo ratings yet

- Dividend PolicyDocument13 pagesDividend Policyrekha_savnaniNo ratings yet

- Dividend DecisionDocument12 pagesDividend DecisionCma Pushparaj Kulkarni100% (2)

- Dividend TheoriesDocument35 pagesDividend TheoriesLalit ShahNo ratings yet

- Digging Into The Dividend Discount Model: Ben McclureDocument27 pagesDigging Into The Dividend Discount Model: Ben McclurePrashantKNo ratings yet

- Dividend and Determinants of Dividend PolicyDocument11 pagesDividend and Determinants of Dividend PolicysimmishwetaNo ratings yet

- Dividend PolicyDocument29 pagesDividend PolicySarita ThakurNo ratings yet

- 5 - Dividend DecisionDocument19 pages5 - Dividend DecisionSudha AgarwalNo ratings yet

- Cost of Capital - 103039Document10 pagesCost of Capital - 103039EuniceNo ratings yet

- Dividend Discount ModelDocument17 pagesDividend Discount ModelNirmal ShresthaNo ratings yet

- READING 7 Dividend Discount Model (Equity Valuation)Document28 pagesREADING 7 Dividend Discount Model (Equity Valuation)DandyNo ratings yet

- Unit 4 Dividend DecisionsDocument17 pagesUnit 4 Dividend Decisionsrahul ramNo ratings yet

- Dividend Discount Model (DDM) : A Study Based On Select Companies From IndiaDocument11 pagesDividend Discount Model (DDM) : A Study Based On Select Companies From IndiaRaihan RamadhaniNo ratings yet

- Dividend Decisions: Prof. Nidhi BandaruDocument15 pagesDividend Decisions: Prof. Nidhi Bandaruhashmi4a4No ratings yet

- Dividend DecisionsDocument7 pagesDividend DecisionsAahana GuptaNo ratings yet

- Dividen2 (6 Files Merged)Document102 pagesDividen2 (6 Files Merged)Lucyana Maria MagdalenaNo ratings yet

- Equity ValuationDocument10 pagesEquity ValuationJasmine NandaNo ratings yet

- Dividend Policy: Assignment of Financial ManagementDocument12 pagesDividend Policy: Assignment of Financial ManagementKanika PuriNo ratings yet

- P7 ShareDocument16 pagesP7 Sharerafialazmi2004No ratings yet

- Required Rate of ReturnDocument4 pagesRequired Rate of ReturnGladys Shen AgujaNo ratings yet

- Smaliraza - 3622 - 18945 - 1 - Lecture 10 - Investement Ana & Portfolio ManagementDocument17 pagesSmaliraza - 3622 - 18945 - 1 - Lecture 10 - Investement Ana & Portfolio ManagementSadia AbidNo ratings yet

- Dividend Capitalization: - Group EDocument7 pagesDividend Capitalization: - Group EMohammed TahirNo ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- Dividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1From EverandDividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1No ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Trade CycleDocument4 pagesTrade CycleRashi BishtNo ratings yet

- Vocational GuidanceDocument24 pagesVocational Guidancesainudheen100% (6)

- School of Business, Economics and Management Student Name: Alex Nkole MulengaDocument6 pagesSchool of Business, Economics and Management Student Name: Alex Nkole MulengaAlex Nkole MulengaNo ratings yet

- Barclays CreditCard VisaDocument5 pagesBarclays CreditCard VisaPeter MariluchNo ratings yet

- Annual Report 2016 17 PDFDocument284 pagesAnnual Report 2016 17 PDFKartik AhirNo ratings yet

- Advertising and Personal SellingDocument6 pagesAdvertising and Personal SellingAbhishek Jain0% (1)

- Branch Office Representative Office: Stock Non-Stock Stock Domestic Market Enterprise Export Market Enterprise Non-StockDocument5 pagesBranch Office Representative Office: Stock Non-Stock Stock Domestic Market Enterprise Export Market Enterprise Non-Stockmfv88No ratings yet

- Operations Management CareerDocument5 pagesOperations Management Careerpravinepatil3426No ratings yet

- Sekolah Tinggi Ilmu Ekonomi Profesional Management College Indonesia MedanDocument7 pagesSekolah Tinggi Ilmu Ekonomi Profesional Management College Indonesia Medanjefri MNo ratings yet

- Engineering Outsourcing in IndiaDocument11 pagesEngineering Outsourcing in IndiabestdealsNo ratings yet

- Statement 115377 Jan-2023Document10 pagesStatement 115377 Jan-2023Mary MacLellanNo ratings yet

- Presentation File 520d4aae 3244 49ce 89e7 26ccac10015aDocument14 pagesPresentation File 520d4aae 3244 49ce 89e7 26ccac10015aInnoVentureCommunityNo ratings yet

- 1.0 Dfmea PDFDocument127 pages1.0 Dfmea PDFDilip KulkarniNo ratings yet

- Law of Contract QuestionsDocument2 pagesLaw of Contract QuestionsPrince SingalNo ratings yet

- Mercantile (2006-2018)Document88 pagesMercantile (2006-2018)ptdwnhroNo ratings yet

- Value Engineering StudyDocument62 pagesValue Engineering StudyAriel Tablang TalaveraNo ratings yet

- The Dividend Policies of Private Firms - Insights Into Smoothing, Agency Costs, and Information AsymmetryDocument60 pagesThe Dividend Policies of Private Firms - Insights Into Smoothing, Agency Costs, and Information AsymmetryhhhhhhhNo ratings yet

- Tu Research Best Time To Trade Forex ExportDocument19 pagesTu Research Best Time To Trade Forex Exportgyasifrederick588No ratings yet

- Hall 5e TB Ch04Document12 pagesHall 5e TB Ch04Raraj100% (1)

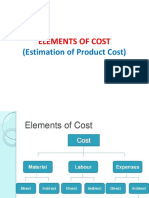

- Elements of CostDocument42 pagesElements of CostNinad MirajgaonkarNo ratings yet

- Senior Executive Leadership Program-India BrochureDocument8 pagesSenior Executive Leadership Program-India BrochureWeWa ShieldsNo ratings yet

- Walmart Case StudyDocument18 pagesWalmart Case StudyArpita ShahNo ratings yet

- BCOMLAW Business Management 1Document155 pagesBCOMLAW Business Management 1Zimkhitha MpongwanaNo ratings yet

- Abhishek Singh - Project Roll LetterDocument3 pagesAbhishek Singh - Project Roll LetterAbhishek SinghNo ratings yet

- Exclusion From Gross IncomeDocument8 pagesExclusion From Gross IncomeRonna Mae DungogNo ratings yet

- Request-Hyatt India Fact SheetDocument3 pagesRequest-Hyatt India Fact Sheetajay_kumar_5No ratings yet

- Balance ScorecardDocument3 pagesBalance ScorecardEko Rochman NugrohoNo ratings yet

- Inovativnost Malih I Srednjih PreduzećaDocument34 pagesInovativnost Malih I Srednjih PreduzećaDajana GrbovicNo ratings yet

- Bill of Quantities - Procurement of WorksDocument20 pagesBill of Quantities - Procurement of WorksRandolph John100% (1)