Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

20 viewsBanking Industry and Information Technology

Banking Industry and Information Technology

Uploaded by

sagarThe document analyzes the role of information technology in the banking industry. It discusses how banks now offer various digital services like net banking, mobile banking, bill payment and ATMs. The objectives are to review how IT has been implemented in banking and how it helps banks deal with new economic challenges. The analysis shows that mobile banking is most used in Kenya and IT reduces operational costs for US banks. It concludes that adopting new technologies improves bank performance and regulations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Analytical Study On Core Banking With Reference To State Bank of IndiaDocument70 pagesAnalytical Study On Core Banking With Reference To State Bank of IndiaPALLAYYA CHOWDARY NEKKANTI100% (18)

- CRM Technical RequirementsDocument9 pagesCRM Technical RequirementsMehedul Islam SabujNo ratings yet

- A Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreDocument74 pagesA Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreThasleem Athar95% (40)

- KB5 Study TextDocument400 pagesKB5 Study TextRufus Linton50% (8)

- The Banking Industry and Information Technology: A ReviewDocument14 pagesThe Banking Industry and Information Technology: A Reviewsangeetar28129No ratings yet

- Factors Affecting Development of Internet Banking in NepalDocument9 pagesFactors Affecting Development of Internet Banking in NepalMadridista KroosNo ratings yet

- Report On Information TechnologyDocument9 pagesReport On Information TechnologyKrishna Bahadur ThapaNo ratings yet

- A Study of Impact of Information Technology in Indian Bnaking IndustryDocument8 pagesA Study of Impact of Information Technology in Indian Bnaking IndustryShivansh ChauhanNo ratings yet

- Role of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractDocument12 pagesRole of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractAkshay BoladeNo ratings yet

- Effectiveness of Information Technology in Banks: (A Study in HDFC Bank Srinagar)Document12 pagesEffectiveness of Information Technology in Banks: (A Study in HDFC Bank Srinagar)Anushree AnuNo ratings yet

- Determining Critical Success Factors of Mobile Banking Adoption in MalaysiaDocument15 pagesDetermining Critical Success Factors of Mobile Banking Adoption in MalaysiaLeeyaRazakNo ratings yet

- The Impact of Information Technology On Bank Performance in NigeriaDocument15 pagesThe Impact of Information Technology On Bank Performance in NigeriaSudeep ChinnabathiniNo ratings yet

- Role of IT in Banking Sector PDFDocument15 pagesRole of IT in Banking Sector PDFarmsarivu50% (2)

- Agboola Final AcceptedDocument15 pagesAgboola Final Acceptedtgirl14No ratings yet

- QQ ArticleDocument17 pagesQQ Articlebaim0ne19No ratings yet

- Banking IndustryDocument16 pagesBanking IndustryDark ShadowNo ratings yet

- Impact of Digital Disruption On Human Capital of Banking SectorDocument9 pagesImpact of Digital Disruption On Human Capital of Banking SectorKhushi BhartiNo ratings yet

- 3311ijmit01 PDFDocument14 pages3311ijmit01 PDFkarthickNo ratings yet

- Acceptance of Mobile Banking Framework in PakistanDocument50 pagesAcceptance of Mobile Banking Framework in PakistanMuhammad KashifNo ratings yet

- BBA, LL.B. First Semester-October 2021 Research Paper TopicDocument11 pagesBBA, LL.B. First Semester-October 2021 Research Paper TopicSPARSH SHARMANo ratings yet

- 10 Sri Lankn OneDocument14 pages10 Sri Lankn OneIhalage Isindu MihirangaNo ratings yet

- Advances in Economics, Business and Management Research (AEBMR), Volume 92Document8 pagesAdvances in Economics, Business and Management Research (AEBMR), Volume 92shreya partiNo ratings yet

- Eko CaseDocument18 pagesEko CaseShubham SarohaNo ratings yet

- Keywords:-Information Communication Technology (ICT)Document10 pagesKeywords:-Information Communication Technology (ICT)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Mobile BankingDocument8 pagesMobile BankingNeha SharmaNo ratings yet

- BIL ProjectDocument17 pagesBIL ProjectAADITYA POPATNo ratings yet

- Impact of M-Banking PDFDocument12 pagesImpact of M-Banking PDFWadhwa ShobhitNo ratings yet

- A Study On Innovation in Banking and Its Impact On Customer SatisfactionDocument5 pagesA Study On Innovation in Banking and Its Impact On Customer SatisfactionMaulik patelNo ratings yet

- Impact of Information Technology On The Financial Performance in Banking Sector (A Case Study of Zenith Bank PLC Nigeria)Document36 pagesImpact of Information Technology On The Financial Performance in Banking Sector (A Case Study of Zenith Bank PLC Nigeria)Okeke Anthony EmekaNo ratings yet

- A STUDY ON INTERNET BANKING IN NEPAL (With Reference To Laxmi Bank Limited)Document33 pagesA STUDY ON INTERNET BANKING IN NEPAL (With Reference To Laxmi Bank Limited)bishnu paudelNo ratings yet

- E Commerce in Small and Medium Enterprises in Sri LankaDocument16 pagesE Commerce in Small and Medium Enterprises in Sri LankavipurthdikaNo ratings yet

- Critical Success Factors of Ebanking - Research PaperDocument10 pagesCritical Success Factors of Ebanking - Research PaperFahad NaeemNo ratings yet

- Banking On ITDocument16 pagesBanking On ITMichael GreenNo ratings yet

- BankingDocument8 pagesBankingmariyahtodorovaNo ratings yet

- Reserve Bank of India Information Technology and Banking - A Continuing AgendaDocument10 pagesReserve Bank of India Information Technology and Banking - A Continuing AgendaAshish JainNo ratings yet

- Problems and Prospects of Electronic Banking in Bangladesh: A Case Study On Dutch-Bangla Bank LimitedDocument12 pagesProblems and Prospects of Electronic Banking in Bangladesh: A Case Study On Dutch-Bangla Bank LimitedHridoy RahmanNo ratings yet

- Technologies in Banking SectorDocument43 pagesTechnologies in Banking SectorDhaval Majithia100% (3)

- Shailesh ProjectDocument26 pagesShailesh ProjectVaibhav MohiteNo ratings yet

- 07 Abstract PDFDocument14 pages07 Abstract PDFRitu 123No ratings yet

- Impact of Income and Expenditure On Technology PDFDocument11 pagesImpact of Income and Expenditure On Technology PDFrujutaNo ratings yet

- User CompetancyDocument10 pagesUser CompetancyJanel MendozaNo ratings yet

- CRM Report On BanglalinkDocument43 pagesCRM Report On BanglalinkSharif Mahmud100% (2)

- The Development of Technology Acceptance Model For Adoption of Mobile Banking in PakistanDocument14 pagesThe Development of Technology Acceptance Model For Adoption of Mobile Banking in PakistanDa ArchNo ratings yet

- Diploma Project - IntroductionDocument4 pagesDiploma Project - Introductionsarthak chaturvediNo ratings yet

- The Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaDocument27 pagesThe Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaKhristine Dela CruzNo ratings yet

- Research Papers On Banking TechnologyDocument8 pagesResearch Papers On Banking Technologywpuzxcbkf100% (1)

- Indian Banking Sector Research PaperDocument4 pagesIndian Banking Sector Research Paperqghzqsplg100% (1)

- AI-SBI SIA-ArticleDocument11 pagesAI-SBI SIA-ArticleManeesh ThapaNo ratings yet

- Technology Up Gradation and Its Impact On Banking SectorDocument8 pagesTechnology Up Gradation and Its Impact On Banking SectorChinmoy RoyNo ratings yet

- A Study On Adoption of Financial Software in India With Special Reference To FinacleDocument26 pagesA Study On Adoption of Financial Software in India With Special Reference To FinaclejuliaNo ratings yet

- Factors Affecting Consumers' Acceptance Towards Electronic Payment System: Case of A Government Land and District OfficeDocument8 pagesFactors Affecting Consumers' Acceptance Towards Electronic Payment System: Case of A Government Land and District OfficePearl LenonNo ratings yet

- Information Technology and Bank Performance in Vietnam: Ilyas Akhisar, Batu Tunay, Necla Tunay 2015Document20 pagesInformation Technology and Bank Performance in Vietnam: Ilyas Akhisar, Batu Tunay, Necla Tunay 2015yen294No ratings yet

- Dubravac BevandaDocument9 pagesDubravac Bevandaimygad53No ratings yet

- Factors Affecting The Adoption of Mobile Money Services in The Colombo District of Sri LankaDocument18 pagesFactors Affecting The Adoption of Mobile Money Services in The Colombo District of Sri LankaAsnake MekonnenNo ratings yet

- Inthanon Phase1 Report-BlockchainDocument48 pagesInthanon Phase1 Report-BlockchainHimanshu DavadaNo ratings yet

- Preethy-Mohd Fodli Hamzah - ALDocument11 pagesPreethy-Mohd Fodli Hamzah - ALzoofishanNo ratings yet

- The Impact of Information and Communication Technology On The Performance of Nigerian BanksDocument12 pagesThe Impact of Information and Communication Technology On The Performance of Nigerian BanksTheresa BomabebeNo ratings yet

- Impact of Information & Communication Technology On Banking Industry in Nigeria by Uduma Emeka I.Document78 pagesImpact of Information & Communication Technology On Banking Industry in Nigeria by Uduma Emeka I.Emeka Uduma94% (17)

- Financial Technology EnglishDocument10 pagesFinancial Technology EnglishHilmansyah AminNo ratings yet

- 9fe5 PDFDocument6 pages9fe5 PDFSakibul Alom KhanNo ratings yet

- Promoting Information and Communication Technology in ADB OperationsFrom EverandPromoting Information and Communication Technology in ADB OperationsNo ratings yet

- Aadhaar 2019042158699525738 2020042452180088197Document1 pageAadhaar 2019042158699525738 2020042452180088197sagarNo ratings yet

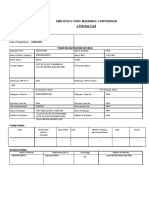

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationsagarNo ratings yet

- Akkii Data AnalysisDocument6 pagesAkkii Data AnalysissagarNo ratings yet

- Project Report On Icici Bank by Gaurav NarangDocument103 pagesProject Report On Icici Bank by Gaurav NarangsagarNo ratings yet

- Curriculum Vitae 3Document2 pagesCurriculum Vitae 3sagarNo ratings yet

- NT Lab MannualDocument31 pagesNT Lab MannualsagarNo ratings yet

- Assignment - Graphic DesignDocument2 pagesAssignment - Graphic DesignHawkeye TierNo ratings yet

- Chapter - 3 Customer Service Element of Logistics 1Document10 pagesChapter - 3 Customer Service Element of Logistics 1Tanaya KambliNo ratings yet

- Pendahuluan: Pertemuan 2 Customer Relationship Manajemen (CRM)Document24 pagesPendahuluan: Pertemuan 2 Customer Relationship Manajemen (CRM)setya asmaraNo ratings yet

- Case Let - Kirana StoreDocument2 pagesCase Let - Kirana StoreVaibhav RakhejaNo ratings yet

- Training For SAP S4HANA in ServiceDocument7 pagesTraining For SAP S4HANA in ServiceZakaria ELGHORFYNo ratings yet

- Marketing Process Efficiency in Cox and King India Ltd. What We DoDocument9 pagesMarketing Process Efficiency in Cox and King India Ltd. What We DoNeerajNo ratings yet

- Profile CV ShwetaDocument3 pagesProfile CV ShwetaShweta PawarNo ratings yet

- Manufacturing CRM Software - CRM For Manufacturing - CRM OnlineDocument2 pagesManufacturing CRM Software - CRM For Manufacturing - CRM Onlinecrm industryNo ratings yet

- (2002) (John Wiley & Sons) - Proven Methods For Measuring Web SDocument377 pages(2002) (John Wiley & Sons) - Proven Methods For Measuring Web SSoren TellengaardNo ratings yet

- El Cliente en El CentroDocument28 pagesEl Cliente en El CentroDeyvi López RíosNo ratings yet

- The Vanguard Group: Team FourDocument16 pagesThe Vanguard Group: Team FourSamyak JainNo ratings yet

- B2B Commerce GuideDocument19 pagesB2B Commerce GuideivanpmnNo ratings yet

- AGN Software ConsultantsDocument3 pagesAGN Software ConsultantsAGN Software ConsultantsNo ratings yet

- SolzitDocument8 pagesSolzitPrateek BatraNo ratings yet

- SAP Press - Service With SAP CRM PDFDocument365 pagesSAP Press - Service With SAP CRM PDFedersondinizNo ratings yet

- CRM - BPCL - Group 5Document9 pagesCRM - BPCL - Group 5Anirudh GuptaNo ratings yet

- The EarthDocument12 pagesThe EarthKather ShaNo ratings yet

- ASTM C114-2011a - 4375Document3 pagesASTM C114-2011a - 4375Ahmed Saad100% (1)

- Social Media MarketingDocument25 pagesSocial Media MarketingChaitya BobbaNo ratings yet

- Customer Based Brand EquityDocument36 pagesCustomer Based Brand EquityGanesh MNo ratings yet

- MGM 4144 - Course Contents (Eng)Document3 pagesMGM 4144 - Course Contents (Eng)张峻玮No ratings yet

- An Efficiency Analysis On The TPA ClusteringDocument5 pagesAn Efficiency Analysis On The TPA Clusteringsolehhudin auliaNo ratings yet

- SAP S 4 HANA v8Document53 pagesSAP S 4 HANA v8Dilum Alawatte100% (1)

- DMP Agency Playbook LotameDocument29 pagesDMP Agency Playbook Lotamesobrina25355No ratings yet

- Retailing Final Project-Departmental Store.Document25 pagesRetailing Final Project-Departmental Store.Zohaib Ahmad Khan0% (1)

- Levy 11e PPT Ch11 AccessDocument29 pagesLevy 11e PPT Ch11 Access18054515633No ratings yet

- CEI and C4C Integration in 1602: Software Design DescriptionDocument44 pagesCEI and C4C Integration in 1602: Software Design Descriptionpkumar2288No ratings yet

- Sales Account Manager Business Development in Washington DC Resume Pete JahelkaDocument2 pagesSales Account Manager Business Development in Washington DC Resume Pete JahelkaPeteJahelkaNo ratings yet

Banking Industry and Information Technology

Banking Industry and Information Technology

Uploaded by

sagar0 ratings0% found this document useful (0 votes)

20 views14 pagesThe document analyzes the role of information technology in the banking industry. It discusses how banks now offer various digital services like net banking, mobile banking, bill payment and ATMs. The objectives are to review how IT has been implemented in banking and how it helps banks deal with new economic challenges. The analysis shows that mobile banking is most used in Kenya and IT reduces operational costs for US banks. It concludes that adopting new technologies improves bank performance and regulations.

Original Description:

hihihaha

Original Title

banking industry and information technology

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document analyzes the role of information technology in the banking industry. It discusses how banks now offer various digital services like net banking, mobile banking, bill payment and ATMs. The objectives are to review how IT has been implemented in banking and how it helps banks deal with new economic challenges. The analysis shows that mobile banking is most used in Kenya and IT reduces operational costs for US banks. It concludes that adopting new technologies improves bank performance and regulations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views14 pagesBanking Industry and Information Technology

Banking Industry and Information Technology

Uploaded by

sagarThe document analyzes the role of information technology in the banking industry. It discusses how banks now offer various digital services like net banking, mobile banking, bill payment and ATMs. The objectives are to review how IT has been implemented in banking and how it helps banks deal with new economic challenges. The analysis shows that mobile banking is most used in Kenya and IT reduces operational costs for US banks. It concludes that adopting new technologies improves bank performance and regulations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 14

THE BANKING INDUSTRY AND

INFORMATION TECHNOLOGY :

A REVIEW

Journal: Management Trends

Volume : 8

No.: 1

March-2011

Authors : Neeru Suman and Arvind Jain

Presented By : Chandan Pahelwani

Roll No.: 11047

4/11/2013 Tolani Institute of Management Studies 1

INTRODUCTION

The article presents a study which aims to

analyze the role of information technology in

banking industry.

Importance of banking industry in boosting

economic progress of a nation.

Use of information technology for all round

growth.

The economic development for the current

year is planned to be over 9%.

4/11/2013 Tolani Institute of Management Studies 2

Cont

To support the

industrial, commercial, agricultural and

other services sector, the banking sector

plays a very vital role.

Information systems are now exposed to a

number of technology products like :

4/11/2013 Tolani Institute of Management Studies 3

Net Banking

Mobile Banking

4/11/2013 Tolani Institute of Management Studies 4

Shopping

Ticket booking

4/11/2013 Tolani Institute of Management Studies 5

Bill Payment

Fund Transfer

4/11/2013 Tolani Institute of Management Studies 6

Automated Teller

Machines (ATMs)

4/11/2013 Tolani Institute of Management Studies 7

OBJECTIVES

The main objective of this article is to

review the implementation of IT in banking

industry.

Technological innovations have enabled

the industry to open up new delivery

channels.

Taking the help of IT to deal with the

challenges that the new economy poses.

4/11/2013 Tolani Institute of Management Studies 8

RESEARCH METHODOLOGY

Overview of the various countries banking

services used by the citizens of that

country.

To increase the customer value by using

some analytical methods in Customer

Relationship Management (CRM)

applications.

4/11/2013 Tolani Institute of Management Studies 9

ANALYSIS & OUTCOMES

Mobile banking service is used at the most

in Kenya.

In US banking sector, it is examined that

use of IT will reduce the operational cost

of the banks.

Malaysian banking sector adopted the

CRM technology and confirmed the role of

CRM performance as the mediators in

relationship between trust and E-banking

adoption.

4/11/2013 Tolani Institute of Management Studies 10

Cont

According to the National

Association of Software

Services Companies

(NASSCOM) the IT market for

banks in 2002 was $500

million, is expected to grow by

25% a year in next few years.

Banks will spend on IT and

related fields an eye opening

Rs.15000 crore.

4/11/2013 Tolani Institute of Management Studies 11

Cont

The Bank of India has recently awarded

10 years IT infrastructure outsourcing

contract valued $150 million to HP

services.

The State Bank of India and its 7

associate banks got connected their 2500

branches with $29 million.

4/11/2013 Tolani Institute of Management Studies 12

CONCLUSION

Certain technological changes have improved

the Banking sector tremendously.

Policy makers have made some notable

changes like enhancing payments

system, integrating regulations between

commercial & co-operative banks.

It can be concluded that for better

performance Indian banks need new

technology.

4/11/2013 Tolani Institute of Management Studies 13

4/11/2013 Tolani Institute of Management Studies 14

You might also like

- Analytical Study On Core Banking With Reference To State Bank of IndiaDocument70 pagesAnalytical Study On Core Banking With Reference To State Bank of IndiaPALLAYYA CHOWDARY NEKKANTI100% (18)

- CRM Technical RequirementsDocument9 pagesCRM Technical RequirementsMehedul Islam SabujNo ratings yet

- A Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreDocument74 pagesA Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreThasleem Athar95% (40)

- KB5 Study TextDocument400 pagesKB5 Study TextRufus Linton50% (8)

- The Banking Industry and Information Technology: A ReviewDocument14 pagesThe Banking Industry and Information Technology: A Reviewsangeetar28129No ratings yet

- Factors Affecting Development of Internet Banking in NepalDocument9 pagesFactors Affecting Development of Internet Banking in NepalMadridista KroosNo ratings yet

- Report On Information TechnologyDocument9 pagesReport On Information TechnologyKrishna Bahadur ThapaNo ratings yet

- A Study of Impact of Information Technology in Indian Bnaking IndustryDocument8 pagesA Study of Impact of Information Technology in Indian Bnaking IndustryShivansh ChauhanNo ratings yet

- Role of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractDocument12 pagesRole of Information Technology in Banking: DR K.Suryanarayana Mrs SK - Mabunni Mrs M. Manjusha AbstractAkshay BoladeNo ratings yet

- Effectiveness of Information Technology in Banks: (A Study in HDFC Bank Srinagar)Document12 pagesEffectiveness of Information Technology in Banks: (A Study in HDFC Bank Srinagar)Anushree AnuNo ratings yet

- Determining Critical Success Factors of Mobile Banking Adoption in MalaysiaDocument15 pagesDetermining Critical Success Factors of Mobile Banking Adoption in MalaysiaLeeyaRazakNo ratings yet

- The Impact of Information Technology On Bank Performance in NigeriaDocument15 pagesThe Impact of Information Technology On Bank Performance in NigeriaSudeep ChinnabathiniNo ratings yet

- Role of IT in Banking Sector PDFDocument15 pagesRole of IT in Banking Sector PDFarmsarivu50% (2)

- Agboola Final AcceptedDocument15 pagesAgboola Final Acceptedtgirl14No ratings yet

- QQ ArticleDocument17 pagesQQ Articlebaim0ne19No ratings yet

- Banking IndustryDocument16 pagesBanking IndustryDark ShadowNo ratings yet

- Impact of Digital Disruption On Human Capital of Banking SectorDocument9 pagesImpact of Digital Disruption On Human Capital of Banking SectorKhushi BhartiNo ratings yet

- 3311ijmit01 PDFDocument14 pages3311ijmit01 PDFkarthickNo ratings yet

- Acceptance of Mobile Banking Framework in PakistanDocument50 pagesAcceptance of Mobile Banking Framework in PakistanMuhammad KashifNo ratings yet

- BBA, LL.B. First Semester-October 2021 Research Paper TopicDocument11 pagesBBA, LL.B. First Semester-October 2021 Research Paper TopicSPARSH SHARMANo ratings yet

- 10 Sri Lankn OneDocument14 pages10 Sri Lankn OneIhalage Isindu MihirangaNo ratings yet

- Advances in Economics, Business and Management Research (AEBMR), Volume 92Document8 pagesAdvances in Economics, Business and Management Research (AEBMR), Volume 92shreya partiNo ratings yet

- Eko CaseDocument18 pagesEko CaseShubham SarohaNo ratings yet

- Keywords:-Information Communication Technology (ICT)Document10 pagesKeywords:-Information Communication Technology (ICT)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Mobile BankingDocument8 pagesMobile BankingNeha SharmaNo ratings yet

- BIL ProjectDocument17 pagesBIL ProjectAADITYA POPATNo ratings yet

- Impact of M-Banking PDFDocument12 pagesImpact of M-Banking PDFWadhwa ShobhitNo ratings yet

- A Study On Innovation in Banking and Its Impact On Customer SatisfactionDocument5 pagesA Study On Innovation in Banking and Its Impact On Customer SatisfactionMaulik patelNo ratings yet

- Impact of Information Technology On The Financial Performance in Banking Sector (A Case Study of Zenith Bank PLC Nigeria)Document36 pagesImpact of Information Technology On The Financial Performance in Banking Sector (A Case Study of Zenith Bank PLC Nigeria)Okeke Anthony EmekaNo ratings yet

- A STUDY ON INTERNET BANKING IN NEPAL (With Reference To Laxmi Bank Limited)Document33 pagesA STUDY ON INTERNET BANKING IN NEPAL (With Reference To Laxmi Bank Limited)bishnu paudelNo ratings yet

- E Commerce in Small and Medium Enterprises in Sri LankaDocument16 pagesE Commerce in Small and Medium Enterprises in Sri LankavipurthdikaNo ratings yet

- Critical Success Factors of Ebanking - Research PaperDocument10 pagesCritical Success Factors of Ebanking - Research PaperFahad NaeemNo ratings yet

- Banking On ITDocument16 pagesBanking On ITMichael GreenNo ratings yet

- BankingDocument8 pagesBankingmariyahtodorovaNo ratings yet

- Reserve Bank of India Information Technology and Banking - A Continuing AgendaDocument10 pagesReserve Bank of India Information Technology and Banking - A Continuing AgendaAshish JainNo ratings yet

- Problems and Prospects of Electronic Banking in Bangladesh: A Case Study On Dutch-Bangla Bank LimitedDocument12 pagesProblems and Prospects of Electronic Banking in Bangladesh: A Case Study On Dutch-Bangla Bank LimitedHridoy RahmanNo ratings yet

- Technologies in Banking SectorDocument43 pagesTechnologies in Banking SectorDhaval Majithia100% (3)

- Shailesh ProjectDocument26 pagesShailesh ProjectVaibhav MohiteNo ratings yet

- 07 Abstract PDFDocument14 pages07 Abstract PDFRitu 123No ratings yet

- Impact of Income and Expenditure On Technology PDFDocument11 pagesImpact of Income and Expenditure On Technology PDFrujutaNo ratings yet

- User CompetancyDocument10 pagesUser CompetancyJanel MendozaNo ratings yet

- CRM Report On BanglalinkDocument43 pagesCRM Report On BanglalinkSharif Mahmud100% (2)

- The Development of Technology Acceptance Model For Adoption of Mobile Banking in PakistanDocument14 pagesThe Development of Technology Acceptance Model For Adoption of Mobile Banking in PakistanDa ArchNo ratings yet

- Diploma Project - IntroductionDocument4 pagesDiploma Project - Introductionsarthak chaturvediNo ratings yet

- The Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaDocument27 pagesThe Impact of E-Banking On Customer Satisfaction in Private Commercial Banks, Sri LankaKhristine Dela CruzNo ratings yet

- Research Papers On Banking TechnologyDocument8 pagesResearch Papers On Banking Technologywpuzxcbkf100% (1)

- Indian Banking Sector Research PaperDocument4 pagesIndian Banking Sector Research Paperqghzqsplg100% (1)

- AI-SBI SIA-ArticleDocument11 pagesAI-SBI SIA-ArticleManeesh ThapaNo ratings yet

- Technology Up Gradation and Its Impact On Banking SectorDocument8 pagesTechnology Up Gradation and Its Impact On Banking SectorChinmoy RoyNo ratings yet

- A Study On Adoption of Financial Software in India With Special Reference To FinacleDocument26 pagesA Study On Adoption of Financial Software in India With Special Reference To FinaclejuliaNo ratings yet

- Factors Affecting Consumers' Acceptance Towards Electronic Payment System: Case of A Government Land and District OfficeDocument8 pagesFactors Affecting Consumers' Acceptance Towards Electronic Payment System: Case of A Government Land and District OfficePearl LenonNo ratings yet

- Information Technology and Bank Performance in Vietnam: Ilyas Akhisar, Batu Tunay, Necla Tunay 2015Document20 pagesInformation Technology and Bank Performance in Vietnam: Ilyas Akhisar, Batu Tunay, Necla Tunay 2015yen294No ratings yet

- Dubravac BevandaDocument9 pagesDubravac Bevandaimygad53No ratings yet

- Factors Affecting The Adoption of Mobile Money Services in The Colombo District of Sri LankaDocument18 pagesFactors Affecting The Adoption of Mobile Money Services in The Colombo District of Sri LankaAsnake MekonnenNo ratings yet

- Inthanon Phase1 Report-BlockchainDocument48 pagesInthanon Phase1 Report-BlockchainHimanshu DavadaNo ratings yet

- Preethy-Mohd Fodli Hamzah - ALDocument11 pagesPreethy-Mohd Fodli Hamzah - ALzoofishanNo ratings yet

- The Impact of Information and Communication Technology On The Performance of Nigerian BanksDocument12 pagesThe Impact of Information and Communication Technology On The Performance of Nigerian BanksTheresa BomabebeNo ratings yet

- Impact of Information & Communication Technology On Banking Industry in Nigeria by Uduma Emeka I.Document78 pagesImpact of Information & Communication Technology On Banking Industry in Nigeria by Uduma Emeka I.Emeka Uduma94% (17)

- Financial Technology EnglishDocument10 pagesFinancial Technology EnglishHilmansyah AminNo ratings yet

- 9fe5 PDFDocument6 pages9fe5 PDFSakibul Alom KhanNo ratings yet

- Promoting Information and Communication Technology in ADB OperationsFrom EverandPromoting Information and Communication Technology in ADB OperationsNo ratings yet

- Aadhaar 2019042158699525738 2020042452180088197Document1 pageAadhaar 2019042158699525738 2020042452180088197sagarNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationsagarNo ratings yet

- Akkii Data AnalysisDocument6 pagesAkkii Data AnalysissagarNo ratings yet

- Project Report On Icici Bank by Gaurav NarangDocument103 pagesProject Report On Icici Bank by Gaurav NarangsagarNo ratings yet

- Curriculum Vitae 3Document2 pagesCurriculum Vitae 3sagarNo ratings yet

- NT Lab MannualDocument31 pagesNT Lab MannualsagarNo ratings yet

- Assignment - Graphic DesignDocument2 pagesAssignment - Graphic DesignHawkeye TierNo ratings yet

- Chapter - 3 Customer Service Element of Logistics 1Document10 pagesChapter - 3 Customer Service Element of Logistics 1Tanaya KambliNo ratings yet

- Pendahuluan: Pertemuan 2 Customer Relationship Manajemen (CRM)Document24 pagesPendahuluan: Pertemuan 2 Customer Relationship Manajemen (CRM)setya asmaraNo ratings yet

- Case Let - Kirana StoreDocument2 pagesCase Let - Kirana StoreVaibhav RakhejaNo ratings yet

- Training For SAP S4HANA in ServiceDocument7 pagesTraining For SAP S4HANA in ServiceZakaria ELGHORFYNo ratings yet

- Marketing Process Efficiency in Cox and King India Ltd. What We DoDocument9 pagesMarketing Process Efficiency in Cox and King India Ltd. What We DoNeerajNo ratings yet

- Profile CV ShwetaDocument3 pagesProfile CV ShwetaShweta PawarNo ratings yet

- Manufacturing CRM Software - CRM For Manufacturing - CRM OnlineDocument2 pagesManufacturing CRM Software - CRM For Manufacturing - CRM Onlinecrm industryNo ratings yet

- (2002) (John Wiley & Sons) - Proven Methods For Measuring Web SDocument377 pages(2002) (John Wiley & Sons) - Proven Methods For Measuring Web SSoren TellengaardNo ratings yet

- El Cliente en El CentroDocument28 pagesEl Cliente en El CentroDeyvi López RíosNo ratings yet

- The Vanguard Group: Team FourDocument16 pagesThe Vanguard Group: Team FourSamyak JainNo ratings yet

- B2B Commerce GuideDocument19 pagesB2B Commerce GuideivanpmnNo ratings yet

- AGN Software ConsultantsDocument3 pagesAGN Software ConsultantsAGN Software ConsultantsNo ratings yet

- SolzitDocument8 pagesSolzitPrateek BatraNo ratings yet

- SAP Press - Service With SAP CRM PDFDocument365 pagesSAP Press - Service With SAP CRM PDFedersondinizNo ratings yet

- CRM - BPCL - Group 5Document9 pagesCRM - BPCL - Group 5Anirudh GuptaNo ratings yet

- The EarthDocument12 pagesThe EarthKather ShaNo ratings yet

- ASTM C114-2011a - 4375Document3 pagesASTM C114-2011a - 4375Ahmed Saad100% (1)

- Social Media MarketingDocument25 pagesSocial Media MarketingChaitya BobbaNo ratings yet

- Customer Based Brand EquityDocument36 pagesCustomer Based Brand EquityGanesh MNo ratings yet

- MGM 4144 - Course Contents (Eng)Document3 pagesMGM 4144 - Course Contents (Eng)张峻玮No ratings yet

- An Efficiency Analysis On The TPA ClusteringDocument5 pagesAn Efficiency Analysis On The TPA Clusteringsolehhudin auliaNo ratings yet

- SAP S 4 HANA v8Document53 pagesSAP S 4 HANA v8Dilum Alawatte100% (1)

- DMP Agency Playbook LotameDocument29 pagesDMP Agency Playbook Lotamesobrina25355No ratings yet

- Retailing Final Project-Departmental Store.Document25 pagesRetailing Final Project-Departmental Store.Zohaib Ahmad Khan0% (1)

- Levy 11e PPT Ch11 AccessDocument29 pagesLevy 11e PPT Ch11 Access18054515633No ratings yet

- CEI and C4C Integration in 1602: Software Design DescriptionDocument44 pagesCEI and C4C Integration in 1602: Software Design Descriptionpkumar2288No ratings yet

- Sales Account Manager Business Development in Washington DC Resume Pete JahelkaDocument2 pagesSales Account Manager Business Development in Washington DC Resume Pete JahelkaPeteJahelkaNo ratings yet