Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

28 viewsAllahabad Bank Sep 09

Allahabad Bank Sep 09

Uploaded by

chetandusejaThis document summarizes the key financial performance highlights of a bank for September 2009. Some highlights include deposits growing 18.55% year-over-year, advances growing 17.56% year-over-year, net interest income growing 14.17% year-over-year. Operating profit grew 99.77% and net profit grew 371.30% compared to the previous year. Key financial ratios like net interest margin, capital adequacy ratio, and return on assets also improved compared to the previous year.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- Burton Sensor IncDocument14 pagesBurton Sensor Incchirag shah50% (2)

- Substantive Tests of Receivables and SalesDocument4 pagesSubstantive Tests of Receivables and SalesKeith Joshua Gabiason100% (1)

- Rick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFDocument209 pagesRick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFanshul jain100% (4)

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- Interest Earned: Valuation Sheet For Bank Sample Income StatementDocument2 pagesInterest Earned: Valuation Sheet For Bank Sample Income StatementBijosh ThomasNo ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsClasherNo ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsYugant NNo ratings yet

- SUNDARAM CLAYTONDocument19 pagesSUNDARAM CLAYTONELIF KOTADIYANo ratings yet

- JODY2 - 0 - Financial Statement Analysis - MC - CorrectedDocument6 pagesJODY2 - 0 - Financial Statement Analysis - MC - Correctedkunal bajajNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Fsa Colgate - AssignmentDocument8 pagesFsa Colgate - AssignmentTeena ChandwaniNo ratings yet

- 199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Document2 pages199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Nivedita YadavNo ratings yet

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- BV Gorup 5Document39 pagesBV Gorup 5Kapil JainNo ratings yet

- ColgateDocument32 pagesColgateapi-3702531No ratings yet

- Hindustan Petrolium Corporation LTD: ProsDocument9 pagesHindustan Petrolium Corporation LTD: ProsChandan KokaneNo ratings yet

- SBI AbridgedProfitnLossDocument1 pageSBI AbridgedProfitnLossRohitt MutthooNo ratings yet

- Ruchi SoyaDocument10 pagesRuchi SoyaANJALI SHARMANo ratings yet

- Common Size Income Statement - TATA MOTORS LTDDocument6 pagesCommon Size Income Statement - TATA MOTORS LTDSubrat BiswalNo ratings yet

- Radico Khaitan ValuationDocument28 pagesRadico Khaitan ValuationvishakhaNo ratings yet

- Anjali Gujrat Ambuja OilDocument9 pagesAnjali Gujrat Ambuja OilANJALI SHARMANo ratings yet

- Abridged Statement - Sheet1 - 2Document1 pageAbridged Statement - Sheet1 - 2KushagraNo ratings yet

- CocaCola - Financial Statement - FactSet - 2019Document66 pagesCocaCola - Financial Statement - FactSet - 2019Zhichang ZhangNo ratings yet

- Valuation Task 20 - SUPRITHA.KDocument14 pagesValuation Task 20 - SUPRITHA.KSupritha HegdeNo ratings yet

- Axis Bank Valuation PDFDocument13 pagesAxis Bank Valuation PDFDaemon7No ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Group 5Document28 pagesGroup 5Kapil JainNo ratings yet

- Ultratech Cement LTD.: Total IncomeDocument36 pagesUltratech Cement LTD.: Total IncomeRezwan KhanNo ratings yet

- Pidilite Industries Financial ModelDocument39 pagesPidilite Industries Financial ModelKeval ShahNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- AttachmentDocument19 pagesAttachmentSanjay MulviNo ratings yet

- Income Statement - 2014 - in MillionsDocument2 pagesIncome Statement - 2014 - in MillionsHKS TKSNo ratings yet

- Britannia IndsDocument18 pagesBritannia IndsVishalPandeyNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasNo ratings yet

- Apple V SamsungDocument4 pagesApple V SamsungCarla Mae MartinezNo ratings yet

- FinanceDocument9 pagesFinancekamran040302No ratings yet

- Bhavak Dixit (PGFC2113) PI Industries PVT - LTDDocument45 pagesBhavak Dixit (PGFC2113) PI Industries PVT - LTDdixitBhavak DixitNo ratings yet

- All Numbers Are in INR and in x10MDocument6 pagesAll Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- AMULDocument22 pagesAMULsurprise MFNo ratings yet

- Ten Years Performance For The Year 2006-07Document1 pageTen Years Performance For The Year 2006-07api-3795636No ratings yet

- 39828211-ValuationDocument13 pages39828211-ValuationDian AgustianNo ratings yet

- BAV Final ExamDocument27 pagesBAV Final ExamArrow NagNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- Tata SteelDocument66 pagesTata SteelSuraj DasNo ratings yet

- Astra International TBK.: Balance Sheet Dec-2006 Dec-2007Document18 pagesAstra International TBK.: Balance Sheet Dec-2006 Dec-2007sariNo ratings yet

- FM Assignment 1Document4 pagesFM Assignment 1Akansha BansalNo ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Book 1Document2 pagesBook 1justingordanNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Narration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst Case2k20dmba111 SanchitjayeshNo ratings yet

- Sales 7,124.00 6,428.00 6,095.00 5,747.00 5,205.00Document2 pagesSales 7,124.00 6,428.00 6,095.00 5,747.00 5,205.00SHUBHAM PAWARNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Valuation of Bank (Part-4) - Task 22Document10 pagesValuation of Bank (Part-4) - Task 22snithisha chandranNo ratings yet

- Balance Sheet ACC Sources of FundsDocument13 pagesBalance Sheet ACC Sources of FundsAshish SinghNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Ashok LeylandDocument5 pagesAshok LeylandAmal RoyNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- College of Business and Economics Economics DepartmentDocument25 pagesCollege of Business and Economics Economics DepartmentJohnny Come LatelyNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Information Systems Engineering Coursework Assignment - UK University BSC Final YearDocument14 pagesInformation Systems Engineering Coursework Assignment - UK University BSC Final YearTDiscoverNo ratings yet

- Interim Order - Cell Industries LimitedDocument16 pagesInterim Order - Cell Industries LimitedShyam SunderNo ratings yet

- Godrej Prima Offer DeckDocument24 pagesGodrej Prima Offer DeckBharat SharmaNo ratings yet

- EFTN Form V2 IPDCDocument2 pagesEFTN Form V2 IPDCРой ЧиNo ratings yet

- CFS FormatDocument2 pagesCFS FormatAvanthikaNo ratings yet

- FAR-1 Mock Question PaperDocument9 pagesFAR-1 Mock Question Papernazish ilyasNo ratings yet

- Mmo Most Important Question SolutionDocument4 pagesMmo Most Important Question SolutionAshish GoelNo ratings yet

- Aug-98 AnsDocument5 pagesAug-98 AnsAndré Le RouxNo ratings yet

- Chartered University College: T3 - (Maintaining Financial Record) Class Test-1 (CHP: 1, 2, & 3)Document2 pagesChartered University College: T3 - (Maintaining Financial Record) Class Test-1 (CHP: 1, 2, & 3)Mohsena MunnaNo ratings yet

- Fall 2020 Bus 498 Exit Assessment Test: BBA CoreDocument30 pagesFall 2020 Bus 498 Exit Assessment Test: BBA CoreDEWAN TAUHIDUL HAQUE TANAY 1711511630100% (1)

- Limpan Vs CIRDocument5 pagesLimpan Vs CIRBenedick LedesmaNo ratings yet

- IAS 38 - Intangible Assets PDFDocument7 pagesIAS 38 - Intangible Assets PDFADNo ratings yet

- UCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Document17 pagesUCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Jaja Ordinario Quiachon-AbarcaNo ratings yet

- 2008 AJC H2 Economics Prelim ExamDocument2 pages2008 AJC H2 Economics Prelim ExamSean HoNo ratings yet

- 0456 Business TaxationDocument4 pages0456 Business Taxationpsycho_bhoot86No ratings yet

- Ads 2122 661320 PDFDocument3 pagesAds 2122 661320 PDFHarsh PatelNo ratings yet

- Term Paper On The Changes Between IAS 18 and IFRS 15Document18 pagesTerm Paper On The Changes Between IAS 18 and IFRS 15Nion Majumdar100% (6)

- BA 115 - Master Budgeting ExercisesDocument2 pagesBA 115 - Master Budgeting ExercisesLance EstopenNo ratings yet

- The Impact of Tax Incentives On The Performance of SmallDocument12 pagesThe Impact of Tax Incentives On The Performance of SmallJoe LagalaNo ratings yet

- Dispatches From India - India Since 1991 PDFDocument34 pagesDispatches From India - India Since 1991 PDFLakshmanan SreenivasanNo ratings yet

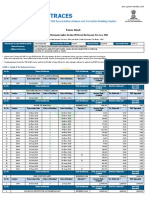

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- Macro Essay BankDocument14 pagesMacro Essay BankSambhavi ThakurNo ratings yet

- A Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"Document80 pagesA Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"sanjay carNo ratings yet

- Ambac Industries, Inc. (Formerly American Bosch Arma Corporation) v. Commissioner of Internal Revenue, 487 F.2d 463, 2d Cir. (1973)Document7 pagesAmbac Industries, Inc. (Formerly American Bosch Arma Corporation) v. Commissioner of Internal Revenue, 487 F.2d 463, 2d Cir. (1973)Scribd Government DocsNo ratings yet

Allahabad Bank Sep 09

Allahabad Bank Sep 09

Uploaded by

chetanduseja0 ratings0% found this document useful (0 votes)

28 views5 pagesThis document summarizes the key financial performance highlights of a bank for September 2009. Some highlights include deposits growing 18.55% year-over-year, advances growing 17.56% year-over-year, net interest income growing 14.17% year-over-year. Operating profit grew 99.77% and net profit grew 371.30% compared to the previous year. Key financial ratios like net interest margin, capital adequacy ratio, and return on assets also improved compared to the previous year.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the key financial performance highlights of a bank for September 2009. Some highlights include deposits growing 18.55% year-over-year, advances growing 17.56% year-over-year, net interest income growing 14.17% year-over-year. Operating profit grew 99.77% and net profit grew 371.30% compared to the previous year. Key financial ratios like net interest margin, capital adequacy ratio, and return on assets also improved compared to the previous year.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

28 views5 pagesAllahabad Bank Sep 09

Allahabad Bank Sep 09

Uploaded by

chetandusejaThis document summarizes the key financial performance highlights of a bank for September 2009. Some highlights include deposits growing 18.55% year-over-year, advances growing 17.56% year-over-year, net interest income growing 14.17% year-over-year. Operating profit grew 99.77% and net profit grew 371.30% compared to the previous year. Key financial ratios like net interest margin, capital adequacy ratio, and return on assets also improved compared to the previous year.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 5

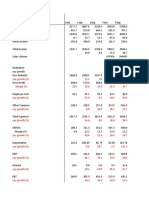

Performance Highlights of September 2009

Rs/crore

Sl. Jun-09 Sep-09 Sep-09 Jun-08 Sep-08 Sep-08 Mar-09

No Highlights Half Full

. Quarter Quarter Half Year Quarter Quarter

Year Year

1. Capital 446.70 446.70 446.70 446.70 446.70 446.70 446.70

2. 4863.7 4904.2 4904.2

Reserves 5706.37 6038.78 6038.78 5405.25

9 3 3

3. Net Worth

(excl. 4433.4 4475.1 4475.1

5280.87 5614.46 5614.46 4978.58

Revaluation 2 1 1

Reserve)

4. 89401.2 87308.9 87308.9 73206. 73648. 73648. 84971.7

Deposits

3 5 5 52 46 46 9

% Growth 22.12% 18.55% 18.55% 16.54% 11.76% 11.76% 18.65%

5. Working 105170. 102157. 102157. 85331. 84204. 84204. 97648.0

Funds 14 12 12 54 84 84 1

% Growth 23.25% 21.32% 21.32% 19.37% 11.08% 11.08% 17.73%

6. Advances 61002.2 60794.0 60794.0 50244. 51715. 51715. 59443.4

(Gross) 4 6 6 25 16 16 0

% Growth 21.41% 17.56% 17.56% 23.88% 21.51% 21.51% 18.15%

7. Advances 60137.7 59868.2 59868.2 49691. 51164. 51164. 58801.7

(Net) 7 1 1 51 64 64 6

8. Investment 35286.4 30479.6 30479.6 24974. 22718. 22718. 30081.3

s (Gross) 1 4 4 05 19 19 5

% Growth 41.29% 34.16% 34.16% 16.06% -9.58% -9.58% 26.81%

9. Interest

Earned on

a. 1241.3 1356.6 2597.9

1558.24 1581.03 3139.27 5494.39

Advances 3 5 8

b.

Investment 442.49 458.91 901.40 461.35 479.33 940.68 1849.36

s

c.

CRR/Inter

7.46 5.99 13.45 2.94 3.05 5.99 10.74

Bank

Lending

d. Others 0.00 0.76 0.76 0.00 6.93 6.93 10.24

Total 2008.19 2046.69 4054.88 1705.6 1845.9 3551.5 7364.7

Interest

2 6 8 3

Earned

% Growth 17.74% 10.87% 14.17% 20.68% 22.37% 21.55% 19.34%

10 Other

. Income

a.

Commissio

146.51 181.95 328.46 107.26 91.20 198.46 523.78

n&

Exchange

b

Investment

214.04 168.28 382.32 32.17 7.68 39.85 572.70

Trading

Profit

c. Others 8.96 54.60 63.56 4.58 32.35 36.93 45.44

Total

1141.9

Other 369.51 404.83 774.34 144.01 131.23 275.24

2

Income

-

% Growth 156.59% 208.49% 181.33% 18.20% -0.84% 18.36%

15.73%

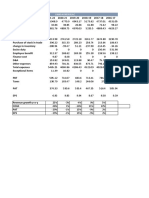

11 Total 1849.6 1977.1 3826.8 8506.6

2377.70 2451.52 4829.22

. Income 3 9 2 5

% Growth 28.55% 23.99% 26.19% 20.49% 18.80% 19.61% 19.21%

12 Interest

. Paid on

1168.2 1256.0 2424.2

a. Deposits 1297.90 1351.78 2649.68 4885.59

5 0 5

b.

81.23 91.66 172.89 68.86 96.44 165.30 320.47

Borrowings

Total

1237.1 1352.4 2589.5 5206.0

Interest 1379.13 1443.44 2822.57

1 4 5 6

Paid

% Growth 11.48% 6.73% 9.00% 25.04% 23.64% 24.31% 15.72%

13 Establishm

. ent 272.08 224.23 496.31 190.23 181.51 371.74 873.94

Expenses

14 Other

. Operating 135.86 134.01 269.87 115.56 129.03 244.59 525.50

Expenses

15 Total 1542.9 1662.9 3205.8 6605.5

1787.07 1801.68 3588.75

. Expenses 0 8 8 0

% Growth 15.83% 8.34% 11.94% 23.80% 21.85% 22.79% 16.78%

16 Operating 1901.1

590.63 649.84 1240.47 306.73 314.21 620.94

. Profit 5

% Growth 92.56% 106.82% 99.77% 6.18% 4.89% 5.53% 28.50%

17 1132.5

Provisions 287.77 316.25 604.02 213.37 272.53 485.90

. 5

18 Net Profit 302.86 333.59 636.45 93.36 41.68 135.04 768.60

.

- - - -

% Growth 224.40% 700.36% 371.30%

53.41% 82.62% 69.32% 21.15%

19 2158.6

Spread 629.06 603.25 1232.31 468.51 493.52 962.03

. 7

% Growth 34.27% 22.23% 28.09% 10.52% 19.01% 14.72% 29.08%

20 Provisions 287.77 316.25 604.02 213.37 272.53 485.90 1132.55

a) N P A 251.00 170.66 421.66 -55.10 110.1 55.00 313.23

b)

Depreciatio

-214.68 17.67 -197.01 264.08 138.45 402.53 357.49

n on

Investment

c) Standard

1.46 0.22 1.68 2.58 17.34 19.92 20.01

Advance

d) I R S 0.00 0.00 0.00 0 0 0.00 78.09

e) Income

248.13 122.40 370.53 11.12 6.02 17.14 307.17

Tax

f) Others 1.86 5.30 7.16 -9.31 0.62 -8.69 56.56

21 Business

. Growth

over

previous

year

a. Deposits 22.12% 18.55% 18.55% 16.54% 11.76% 11.76% 18.65%

b.

21.41% 17.56% 17.56% 23.88% 21.51% 21.51% 18.15%

Advances

c.

Investment 41.29% 34.16% 34.16% 16.06% -9.58% -9.58% 26.81%

s

22 Ratios:

.

a. Yield on

10.86% 10.84% 10.85% 10.57% 11.03% 10.80% 10.88%

Advances

b. Yield on 6.78% 7.10% 6.94% 7.43% 7.85% 7.64% 7.57%

Investment

s

c. Yield on

8.85% 8.92% 8.89% 9.33% 10.10% 9.72% 9.62%

Fund

d. Cost of

6.08% 6.30% 6.19% 6.55% 6.90% 6.73% 6.62%

Deposits

e. Cost of

8.16% 8.01% 8.08% 6.00% 8.27% 7.14% 7.51%

Borrowings

f. Cost of

6.17% 6.39% 6.28% 6.52% 6.98% 6.75% 6.67%

fund

g. Estt. Exp

to Total 15.22% 12.45% 13.83% 12.33% 10.91% 11.60% 13.23%

Exp

h. Other

Op. Exp to 7.60% 7.44% 7.52% 7.49% 7.76% 7.63% 7.96%

Total Exp

i. Operating

1.65% 1.43% 1.54% 1.49% 1.49% 1.49% 1.65%

Exp to AWF

j. Operating

Profit to 2.39% 2.59% 2.49% 1.49% 1.51% 1.50% 2.24%

AWF

k. Net

Interest 3.00% 2.84% 2.92% 2.60% 2.70% 2.65% 2.88%

Margin

l. Capital

Adequacy 12.54% 14.90% 14.90% 11.68% 11.46% 11.46% 13.11%

Ratio

m. Gross

NPA to 1.79% 1.78% 1.78% 1.87% 1.93% 1.93% 1.81%

Gross Adv

n. Net NPA

to Net 0.37% 0.35% 0.35% 0.75% 0.85% 0.85% 0.72%

Advance

o. Earning

per Shares 6.78 7.47 14.25 2.09 0.93 3.02 17.21

(Rs.)

p. Return

on Assets 1.22% 1.33% 1.28% 0.45% 0.20% 0.33% 0.90%

-Annualised

q. Return

on Avg. Net

23.62% 24.49% 24.03% 8.51% 3.74% 6.13% 16.49%

Worth -

Annualised

r. Book 137.75 145.19 145.19 118.88 119.79 119.79 131.00

Value per

Share [Rs]

AWF = Average Working Fund

You might also like

- Burton Sensor IncDocument14 pagesBurton Sensor Incchirag shah50% (2)

- Substantive Tests of Receivables and SalesDocument4 pagesSubstantive Tests of Receivables and SalesKeith Joshua Gabiason100% (1)

- Rick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFDocument209 pagesRick Makoujy - How To Read A Balance Sheet - The Bottom Line On What You Need To Know About Cash Flow, Assets, Debt, Equity, Profit... and How It All Comes Together-McGraw-Hill (2010) PDFanshul jain100% (4)

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- Interest Earned: Valuation Sheet For Bank Sample Income StatementDocument2 pagesInterest Earned: Valuation Sheet For Bank Sample Income StatementBijosh ThomasNo ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsClasherNo ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsYugant NNo ratings yet

- SUNDARAM CLAYTONDocument19 pagesSUNDARAM CLAYTONELIF KOTADIYANo ratings yet

- JODY2 - 0 - Financial Statement Analysis - MC - CorrectedDocument6 pagesJODY2 - 0 - Financial Statement Analysis - MC - Correctedkunal bajajNo ratings yet

- Book1 2Document10 pagesBook1 2Aakash SinghalNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- Fsa Colgate - AssignmentDocument8 pagesFsa Colgate - AssignmentTeena ChandwaniNo ratings yet

- 199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Document2 pages199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Nivedita YadavNo ratings yet

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- BV Gorup 5Document39 pagesBV Gorup 5Kapil JainNo ratings yet

- ColgateDocument32 pagesColgateapi-3702531No ratings yet

- Hindustan Petrolium Corporation LTD: ProsDocument9 pagesHindustan Petrolium Corporation LTD: ProsChandan KokaneNo ratings yet

- SBI AbridgedProfitnLossDocument1 pageSBI AbridgedProfitnLossRohitt MutthooNo ratings yet

- Ruchi SoyaDocument10 pagesRuchi SoyaANJALI SHARMANo ratings yet

- Common Size Income Statement - TATA MOTORS LTDDocument6 pagesCommon Size Income Statement - TATA MOTORS LTDSubrat BiswalNo ratings yet

- Radico Khaitan ValuationDocument28 pagesRadico Khaitan ValuationvishakhaNo ratings yet

- Anjali Gujrat Ambuja OilDocument9 pagesAnjali Gujrat Ambuja OilANJALI SHARMANo ratings yet

- Abridged Statement - Sheet1 - 2Document1 pageAbridged Statement - Sheet1 - 2KushagraNo ratings yet

- CocaCola - Financial Statement - FactSet - 2019Document66 pagesCocaCola - Financial Statement - FactSet - 2019Zhichang ZhangNo ratings yet

- Valuation Task 20 - SUPRITHA.KDocument14 pagesValuation Task 20 - SUPRITHA.KSupritha HegdeNo ratings yet

- Axis Bank Valuation PDFDocument13 pagesAxis Bank Valuation PDFDaemon7No ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Group 5Document28 pagesGroup 5Kapil JainNo ratings yet

- Ultratech Cement LTD.: Total IncomeDocument36 pagesUltratech Cement LTD.: Total IncomeRezwan KhanNo ratings yet

- Pidilite Industries Financial ModelDocument39 pagesPidilite Industries Financial ModelKeval ShahNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- AttachmentDocument19 pagesAttachmentSanjay MulviNo ratings yet

- Income Statement - 2014 - in MillionsDocument2 pagesIncome Statement - 2014 - in MillionsHKS TKSNo ratings yet

- Britannia IndsDocument18 pagesBritannia IndsVishalPandeyNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasNo ratings yet

- Apple V SamsungDocument4 pagesApple V SamsungCarla Mae MartinezNo ratings yet

- FinanceDocument9 pagesFinancekamran040302No ratings yet

- Bhavak Dixit (PGFC2113) PI Industries PVT - LTDDocument45 pagesBhavak Dixit (PGFC2113) PI Industries PVT - LTDdixitBhavak DixitNo ratings yet

- All Numbers Are in INR and in x10MDocument6 pagesAll Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- AMULDocument22 pagesAMULsurprise MFNo ratings yet

- Ten Years Performance For The Year 2006-07Document1 pageTen Years Performance For The Year 2006-07api-3795636No ratings yet

- 39828211-ValuationDocument13 pages39828211-ValuationDian AgustianNo ratings yet

- BAV Final ExamDocument27 pagesBAV Final ExamArrow NagNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- Tata SteelDocument66 pagesTata SteelSuraj DasNo ratings yet

- Astra International TBK.: Balance Sheet Dec-2006 Dec-2007Document18 pagesAstra International TBK.: Balance Sheet Dec-2006 Dec-2007sariNo ratings yet

- FM Assignment 1Document4 pagesFM Assignment 1Akansha BansalNo ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Book 1Document2 pagesBook 1justingordanNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Narration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst Case2k20dmba111 SanchitjayeshNo ratings yet

- Sales 7,124.00 6,428.00 6,095.00 5,747.00 5,205.00Document2 pagesSales 7,124.00 6,428.00 6,095.00 5,747.00 5,205.00SHUBHAM PAWARNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Valuation of Bank (Part-4) - Task 22Document10 pagesValuation of Bank (Part-4) - Task 22snithisha chandranNo ratings yet

- Balance Sheet ACC Sources of FundsDocument13 pagesBalance Sheet ACC Sources of FundsAshish SinghNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Ashok LeylandDocument5 pagesAshok LeylandAmal RoyNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- College of Business and Economics Economics DepartmentDocument25 pagesCollege of Business and Economics Economics DepartmentJohnny Come LatelyNo ratings yet

- Definition of Capital AllowancesDocument9 pagesDefinition of Capital AllowancesAdesolaNo ratings yet

- Information Systems Engineering Coursework Assignment - UK University BSC Final YearDocument14 pagesInformation Systems Engineering Coursework Assignment - UK University BSC Final YearTDiscoverNo ratings yet

- Interim Order - Cell Industries LimitedDocument16 pagesInterim Order - Cell Industries LimitedShyam SunderNo ratings yet

- Godrej Prima Offer DeckDocument24 pagesGodrej Prima Offer DeckBharat SharmaNo ratings yet

- EFTN Form V2 IPDCDocument2 pagesEFTN Form V2 IPDCРой ЧиNo ratings yet

- CFS FormatDocument2 pagesCFS FormatAvanthikaNo ratings yet

- FAR-1 Mock Question PaperDocument9 pagesFAR-1 Mock Question Papernazish ilyasNo ratings yet

- Mmo Most Important Question SolutionDocument4 pagesMmo Most Important Question SolutionAshish GoelNo ratings yet

- Aug-98 AnsDocument5 pagesAug-98 AnsAndré Le RouxNo ratings yet

- Chartered University College: T3 - (Maintaining Financial Record) Class Test-1 (CHP: 1, 2, & 3)Document2 pagesChartered University College: T3 - (Maintaining Financial Record) Class Test-1 (CHP: 1, 2, & 3)Mohsena MunnaNo ratings yet

- Fall 2020 Bus 498 Exit Assessment Test: BBA CoreDocument30 pagesFall 2020 Bus 498 Exit Assessment Test: BBA CoreDEWAN TAUHIDUL HAQUE TANAY 1711511630100% (1)

- Limpan Vs CIRDocument5 pagesLimpan Vs CIRBenedick LedesmaNo ratings yet

- IAS 38 - Intangible Assets PDFDocument7 pagesIAS 38 - Intangible Assets PDFADNo ratings yet

- UCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Document17 pagesUCPB General Insurance Co., Inc. vs. Masagana Telamart, Inc.Jaja Ordinario Quiachon-AbarcaNo ratings yet

- 2008 AJC H2 Economics Prelim ExamDocument2 pages2008 AJC H2 Economics Prelim ExamSean HoNo ratings yet

- 0456 Business TaxationDocument4 pages0456 Business Taxationpsycho_bhoot86No ratings yet

- Ads 2122 661320 PDFDocument3 pagesAds 2122 661320 PDFHarsh PatelNo ratings yet

- Term Paper On The Changes Between IAS 18 and IFRS 15Document18 pagesTerm Paper On The Changes Between IAS 18 and IFRS 15Nion Majumdar100% (6)

- BA 115 - Master Budgeting ExercisesDocument2 pagesBA 115 - Master Budgeting ExercisesLance EstopenNo ratings yet

- The Impact of Tax Incentives On The Performance of SmallDocument12 pagesThe Impact of Tax Incentives On The Performance of SmallJoe LagalaNo ratings yet

- Dispatches From India - India Since 1991 PDFDocument34 pagesDispatches From India - India Since 1991 PDFLakshmanan SreenivasanNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document7 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- Macro Essay BankDocument14 pagesMacro Essay BankSambhavi ThakurNo ratings yet

- A Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"Document80 pagesA Project: "On Impact of Covid 19 Pandemic On Banking & Financial Sector and Present Performance"sanjay carNo ratings yet

- Ambac Industries, Inc. (Formerly American Bosch Arma Corporation) v. Commissioner of Internal Revenue, 487 F.2d 463, 2d Cir. (1973)Document7 pagesAmbac Industries, Inc. (Formerly American Bosch Arma Corporation) v. Commissioner of Internal Revenue, 487 F.2d 463, 2d Cir. (1973)Scribd Government DocsNo ratings yet