Professional Documents

Culture Documents

CF Webcast 6 PDF

CF Webcast 6 PDF

Uploaded by

Jesús David Izquierdo DíazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CF Webcast 6 PDF

CF Webcast 6 PDF

Uploaded by

Jesús David Izquierdo DíazCopyright:

Available Formats

International Financial Reporting Standards

Conceptual Framework

Derecognition

September 2015

Daniela Marciniak, Assistant Technical Manager

Manuel Kapsis, Technical Manager

The views expressed in this presentation are those of the presenter,

not necessarily those of the IASB or IFRS Foundation.

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Before we start 2

You can download the slides by clicking on the button below the

slides window

This webinar is a recording (it is not live), so we are unable to take

any questions

The views expressed are those of the presenters, not necessarily

those of the IASB or IFRS Foundation

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Conceptual Framework webinar schedule 3

Previously-recorded webinars

17 / 06 Overview of Conceptual Framework Exposure Draft

06 / 08 Chapter 4 and 5the elements of financial statements: definitions and recognition

13 / 08 Chapter 4a closer look at liabilities and executory contracts

20 / 08 Chapter 6measurement

27 / 08 Chapter 7classification of income and expenses (profit or loss vs. OCI)

This webinar

03 / 09 Chapter 5derecognition of assets and liabilities

Future webinars

10 / 09 Chapter 3the reporting entity

17 / 09 Chapters 1 and 2objectives and qualitative characteristics

24 / 09 Possible implications of the proposalswith provisions and contingent liabilities case study

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

What is derecognition? 4

ED 5.25

Derecognition is the removal of all or

part of a previously recognised asset or

liability from an entitys statement of

financial position.

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Aims of derecognition 5

The aims of derecognition are to faithfully represent both:

the assets and liabilities the change in the entitys

retained after a transaction assets and liabilities as a

or other event that led to the result of that transaction or

derecognition other event

The two aims are normally achieved by:

Derecognising any assets or liabilities transferred,

consumed, collected, fulfilled or expired

Recognising any income or expense

Continuing to recognise assets or liabilities retained

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Derecognition is normally quite straightforward 6

Example Sale of a machine

Carrying amount CU 800

Sales proceeds CU 850

Assets before Change Assets after

Machine 800 (800) -

Cash - 850 850

Gain (50)

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

But sometimes the two aims conflict 7

Example Sale and repurchase agreement

Sale of a bond with a carrying amount of CU 800 for Fair Value (FV) CU 850

Agreement to repurchase one month later for CU 852, assume FV CU 850

Assume that purchaser is not holding bond as agent for seller

Assets/ liabilities before Change Assets/ liabilities Change Assets/ liabilities

sale (sale) after sale (repurchase) after repurchase

Bond 800 (800) - 850 850

Cash - 850 850 (852) (2)

Repurchase contract - - - - -

Gain (50) -

Loss on repurchase contract - 2

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

If the two aims conflict 8

First, consider if the transferee is acting

as agent for transferor

If transferee is not acting as agent then

In some cases, continue

to recognise

Derecognise but consider: Separate presentation

and/ or explanatory

Separate presentation disclosure may still be

Explanatory disclosure needed

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Continued recognition 9

Example Sale and repurchase agreement

Sale of a bond with a carrying amount of CU 800 for Fair Value (FV) CU 850

Agreement to repurchase one month later for CU 852, assume FV CU 850

Assume that purchaser is not holding bond as agent for seller

Assets/ liabilities before Change Assets/ liabilities Change Assets/ liabilities

sale (sale) after sale (repurchase) after repurchase

Bond 800 - 800 - 800

Cash - 850 850 (852) (2)

Loan received - (850) (850) 850 -

Gain - -

Interest expense - 2

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Timeline 10

May 2015 26 October 2015 2016

Revised

Exposure Draft Comment deadline Conceptual Framework

Separate Exposure Draft

Updating References to the

Conceptual Framework also

published - same comment

deadline

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Conceptual Framework webinar schedule 11

Previously-recorded webinars

17 / 06 Overview of Conceptual Framework Exposure Draft

06 / 08 Chapter 4 and 5the elements of financial statements: definitions and recognition

13 / 08 Chapter 4a closer look at liabilities and executory contracts

20 / 08 Chapter 6measurement

27 / 08 Chapter 7classification of income and expenses (profit or loss vs. OCI)

This webinar

03 / 09 Chapter 5derecognition of assets and liabilities

Future webinars

10 / 09 Chapter 3the reporting entity

17 / 09 Chapters 1 and 2objectives and qualitative characteristics

24 / 09 Possible implications of the proposalswith provisions and contingent liabilities case study

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Further information 12

Exposure Draft Conceptual Framework for Financial Reporting

http://go.ifrs.org/ED-CF-May2015

Conceptual Framework website

http://go.ifrs.org/Conceptual-Framework

Submit a comment letter

http://go.ifrs.org/comment_CF

Snapshot

http://go.ifrs.org/CFSnapshot2015

Register for email alerts

http://eifrs.ifrs.org/eifrs/Register

IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

You might also like

- Cornell FRESH Sample Essays PDFDocument12 pagesCornell FRESH Sample Essays PDFneuroqehNo ratings yet

- Classification of AssetsDocument37 pagesClassification of Assetsandriani akuntansipoliban.ac.idNo ratings yet

- PPP Seminar: Health: Royal Liverpool Hospital Case StudyDocument22 pagesPPP Seminar: Health: Royal Liverpool Hospital Case StudyVictor CaceresNo ratings yet

- Classification of LiabilitiesDocument49 pagesClassification of LiabilitiesAmiraNo ratings yet

- Conceptual FrameworkDocument22 pagesConceptual Frameworkkleen bautistaNo ratings yet

- Understanding and Applying Ifrss: A Framework-Based ApproachDocument39 pagesUnderstanding and Applying Ifrss: A Framework-Based ApproachrajuNo ratings yet

- Examination: Subject SA5 Finance Specialist ApplicationsDocument136 pagesExamination: Subject SA5 Finance Specialist Applicationschan chadoNo ratings yet

- Conceptual Framework For Financial ReportingDocument22 pagesConceptual Framework For Financial ReportingDelfia RahmadhaniNo ratings yet

- Conceptual FrameworkDocument22 pagesConceptual FrameworkYohannes GebreNo ratings yet

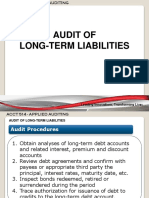

- Audit of Long-Term LiabilitiesDocument43 pagesAudit of Long-Term LiabilitiesEva Dagus0% (1)

- Classification of AssetsDocument37 pagesClassification of AssetsJay Mark T. ParacuellesNo ratings yet

- Amil Training 11.11.2023 - ABY Overview of Errors in FS, ESG Factors, Fund Accounting, Career PathDocument25 pagesAmil Training 11.11.2023 - ABY Overview of Errors in FS, ESG Factors, Fund Accounting, Career PathAmil SJNo ratings yet

- ConvertibleBonds AnIntroductionDocument22 pagesConvertibleBonds AnIntroductionPedro FernandezNo ratings yet

- Capital Budgeting - Week Three - Updated - June 2022Document57 pagesCapital Budgeting - Week Three - Updated - June 2022Emmmanuel ArthurNo ratings yet

- Sekuritas Hibrida: Utang Konvertibel: Convertible DebtDocument10 pagesSekuritas Hibrida: Utang Konvertibel: Convertible DebtErna hkNo ratings yet

- AFA 4e PPT Chap04Document70 pagesAFA 4e PPT Chap04فهد التويجريNo ratings yet

- Topic 8 Wholly Owned SubsidiariesDocument20 pagesTopic 8 Wholly Owned SubsidiariesOlivia TheNo ratings yet

- 0912ifric19 DoneDocument4 pages0912ifric19 DoneSohelNo ratings yet

- IFRS 16 Leases: International Financial Reporting StandardsDocument30 pagesIFRS 16 Leases: International Financial Reporting StandardsHalawati AliNo ratings yet

- Practical Exercises: AccountingDocument7 pagesPractical Exercises: AccountingHira SialNo ratings yet

- T3 ConsolidationDocument42 pagesT3 Consolidationmiles davisNo ratings yet

- ACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsDocument24 pagesACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsTaariq Abdul-MajeedNo ratings yet

- Week 1 - OverviewDocument30 pagesWeek 1 - OverviewKevin LoboNo ratings yet

- Session 5 - LT Liabilities - For Lecture SolutionsDocument78 pagesSession 5 - LT Liabilities - For Lecture Solutionsss9723No ratings yet

- Module 005 - The Statement of Cash Flows - PPTDocument25 pagesModule 005 - The Statement of Cash Flows - PPTrhythmm quiraNo ratings yet

- Level II - Equity: Free Cash Flow ValuationDocument52 pagesLevel II - Equity: Free Cash Flow Valuationjawadatatung100% (1)

- Topic 1 Accounting and BusinessDocument32 pagesTopic 1 Accounting and BusinesskazuyaliemNo ratings yet

- HKAS 1 Amendment and HKFRS 7: Nelson Lam Nelson Lam 林智遠 林智遠Document61 pagesHKAS 1 Amendment and HKFRS 7: Nelson Lam Nelson Lam 林智遠 林智遠ChanNo ratings yet

- AccountingDocument29 pagesAccountingMusa GillianNo ratings yet

- VCC HUB - 8 Key Benefits of A VCCDocument1 pageVCC HUB - 8 Key Benefits of A VCCLuluNo ratings yet

- Understanding Australian Accounting Standards 1st Edition Loftus Test BankDocument14 pagesUnderstanding Australian Accounting Standards 1st Edition Loftus Test Bankkierahangu13100% (30)

- Understanding Australian Accounting Standards 1St Edition Loftus Test Bank Full Chapter PDFDocument35 pagesUnderstanding Australian Accounting Standards 1St Edition Loftus Test Bank Full Chapter PDFlaurasheppardxntfyejmsr100% (12)

- Backstop Ebook Allocators-Key-Reports For CIOs Capital MarketsDocument45 pagesBackstop Ebook Allocators-Key-Reports For CIOs Capital MarketsDanial OngNo ratings yet

- AC301 Off Balance Sheet FinancingDocument25 pagesAC301 Off Balance Sheet Financinghui7411No ratings yet

- Changing Policies, Estimates and Classifications and Correcting ErrorsDocument47 pagesChanging Policies, Estimates and Classifications and Correcting ErrorsFrancis Edrian CellonaNo ratings yet

- Development of Accounting Standards: A Simple Test FirstDocument44 pagesDevelopment of Accounting Standards: A Simple Test FirstChanNo ratings yet

- Capital Investment DecisionDocument16 pagesCapital Investment DecisionAbraham LinkonNo ratings yet

- Chapter 14Document34 pagesChapter 14Aryan JainNo ratings yet

- Part 1 IntroductionDocument15 pagesPart 1 IntroductionNgọc Mai VũNo ratings yet

- Working Capital Management-1Document32 pagesWorking Capital Management-1Tapabrata sarkerNo ratings yet

- WK 11 GAAP - NewDocument29 pagesWK 11 GAAP - NewThùy Linh Lê ThịNo ratings yet

- Chapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Document26 pagesChapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Phạm Ngọc ÁnhNo ratings yet

- 2.2. Ind AS 7Document25 pages2.2. Ind AS 7Ajay JangirNo ratings yet

- Profe03 - Chapter 4 Consolidated FS Basic Consolidation ProceduresDocument21 pagesProfe03 - Chapter 4 Consolidated FS Basic Consolidation ProceduresSteffany RoqueNo ratings yet

- Financial Reporting Course Week - 10: Consolidation of Financial StatementsDocument24 pagesFinancial Reporting Course Week - 10: Consolidation of Financial StatementsAhmet ÖzelNo ratings yet

- Ecovis CAG GuideDocument68 pagesEcovis CAG GuidemahletNo ratings yet

- PSAK 8 Events After Reporting Dates - SFADocument14 pagesPSAK 8 Events After Reporting Dates - SFALuna JesmeraeNo ratings yet

- Institute-University School of Business Department-MbaDocument13 pagesInstitute-University School of Business Department-MbaAbhishek kumarNo ratings yet

- Compare Accrual and Cash-Basis Accounting and Illustrate Their Implications With ExamplesDocument50 pagesCompare Accrual and Cash-Basis Accounting and Illustrate Their Implications With ExamplesBabandi IbrahimNo ratings yet

- 03FAccReporting1 SM Ch3 2LPDocument6 pages03FAccReporting1 SM Ch3 2LPNazirul HazwanNo ratings yet

- Statement of Cashflows PDFDocument25 pagesStatement of Cashflows PDFKIMBERLY MUKAMBANo ratings yet

- Chapter04 AssetsDocument33 pagesChapter04 AssetsTang YiqinNo ratings yet

- Buy Back TradingDocument3 pagesBuy Back TradingRK DeepakNo ratings yet

- ACCT 302 Financial Reporting II Lecture 7Document63 pagesACCT 302 Financial Reporting II Lecture 7Jesse Nelson100% (1)

- Grant Thornton Business COmbination PDFDocument51 pagesGrant Thornton Business COmbination PDFPuneet SharmaNo ratings yet

- Group Reporting II: Application of The Acquisition Method Under IFRS 3Document77 pagesGroup Reporting II: Application of The Acquisition Method Under IFRS 3فهد التويجريNo ratings yet

- CCP504 (B)Document19 pagesCCP504 (B)api-3849444No ratings yet

- Working Capital MGT - Chapter8Document22 pagesWorking Capital MGT - Chapter8shenaNo ratings yet

- YF Life Insurance International Limited: IFRS 17 - FIA Model WalkthroughDocument7 pagesYF Life Insurance International Limited: IFRS 17 - FIA Model WalkthroughHimNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Staff Paper: IASB Agenda RefDocument15 pagesStaff Paper: IASB Agenda RefJesús David Izquierdo DíazNo ratings yet

- Ap5c Agenda Consultation FeedbackDocument5 pagesAp5c Agenda Consultation FeedbackJesús David Izquierdo DíazNo ratings yet

- Ap3 Reputation SurveyDocument24 pagesAp3 Reputation SurveyJesús David Izquierdo DíazNo ratings yet

- Report Efrag Effas Abaf Iasb Joint User Outreach Event Macro Hedging Oct 2014Document15 pagesReport Efrag Effas Abaf Iasb Joint User Outreach Event Macro Hedging Oct 2014Jesús David Izquierdo DíazNo ratings yet

- Making Materiality Judgements: Ifrs Practice StatementDocument47 pagesMaking Materiality Judgements: Ifrs Practice StatementJesús David Izquierdo DíazNo ratings yet

- A) Circle The Correct Plural: B) Complete The ChartDocument2 pagesA) Circle The Correct Plural: B) Complete The ChartJesús David Izquierdo DíazNo ratings yet

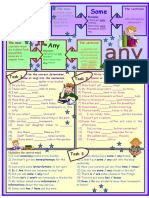

- We Use: Much - A Little A Few ManyDocument2 pagesWe Use: Much - A Little A Few ManyJesús David Izquierdo DíazNo ratings yet

- There Is There AreDocument1 pageThere Is There AreJesús David Izquierdo DíazNo ratings yet

- Some and AnyDocument1 pageSome and AnyJesús David Izquierdo DíazNo ratings yet

- Write The Plurals For The FollowingsDocument2 pagesWrite The Plurals For The FollowingsJesús David Izquierdo DíazNo ratings yet

- Verb Tobe..Document1 pageVerb Tobe..Jesús David Izquierdo DíazNo ratings yet

- Classroom LanguageDocument2 pagesClassroom LanguageJesús David Izquierdo Díaz100% (3)

- B.) Write Am, Is or Are. A.) Write You, He, She, It, We or TheyDocument1 pageB.) Write Am, Is or Are. A.) Write You, He, She, It, We or TheyJesús David Izquierdo DíazNo ratings yet

- Match These Words With The Parts of The Body.: Face Eyes Hair Nose Mouth Skin Height Body Other FeaturesDocument1 pageMatch These Words With The Parts of The Body.: Face Eyes Hair Nose Mouth Skin Height Body Other FeaturesJesús David Izquierdo DíazNo ratings yet

- The Asylum Case (Colombia v. Peru, 17 I.L.R. 28 I.C.J. Reports, 1950)Document2 pagesThe Asylum Case (Colombia v. Peru, 17 I.L.R. 28 I.C.J. Reports, 1950)Μιχαήλ εραστής του ροσαριούNo ratings yet

- NZDA Porirua Newsletter July2020Document3 pagesNZDA Porirua Newsletter July2020Jaymi The Fat KusineroNo ratings yet

- Uma Sekaran+Chapter+2Document8 pagesUma Sekaran+Chapter+2Simrah ZafarNo ratings yet

- China's Grand Strategy. Lukas K. Danner.Document219 pagesChina's Grand Strategy. Lukas K. Danner.LMNo ratings yet

- LyricsDocument2 pagesLyricsAriaNo ratings yet

- 1 7-PDF Gold B2 First New Edition Coursebook Unit 05Document2 pages1 7-PDF Gold B2 First New Edition Coursebook Unit 05dsrgdsrgdNo ratings yet

- SALES Reviewer 2Document7 pagesSALES Reviewer 2Mav Zamora100% (1)

- Aditing II Q From CH 3,4,5Document2 pagesAditing II Q From CH 3,4,5samuel debebeNo ratings yet

- A Work of ArtificeDocument3 pagesA Work of ArtificeDamian Fernandes100% (2)

- 1 Learn Spanish E-BookDocument109 pages1 Learn Spanish E-BookLoredana Matran100% (1)

- List of Irregular Verbs With Meaning: Base Form Meaning Past 2 Form Past Participle 3 Form - Ing FORMDocument6 pagesList of Irregular Verbs With Meaning: Base Form Meaning Past 2 Form Past Participle 3 Form - Ing FORMShakeelAhmedNo ratings yet

- STB1093 Lect Schedule Sem 2 2018 - 2019Document3 pagesSTB1093 Lect Schedule Sem 2 2018 - 2019Alex XanderNo ratings yet

- Whatta Man: A Stylistics Analysis On "Do Not Go Gentle Into That Good Night"Document2 pagesWhatta Man: A Stylistics Analysis On "Do Not Go Gentle Into That Good Night"Anniah MendelebarNo ratings yet

- LP G8 M8AL Ih 1 Illustrates A System of Linear Equations in Two VariablesDocument7 pagesLP G8 M8AL Ih 1 Illustrates A System of Linear Equations in Two Variablesbert kingNo ratings yet

- Inversion + Advanced Structures in WritingDocument5 pagesInversion + Advanced Structures in Writingj.jagielaNo ratings yet

- Subiect Olimpiada Engleza Faza LocalaDocument2 pagesSubiect Olimpiada Engleza Faza LocalaSimina Busuioc0% (1)

- La Tolérance Et Ses Limites: Un Problème Pour L'ÉducateurDocument7 pagesLa Tolérance Et Ses Limites: Un Problème Pour L'ÉducateurFatima EL FasihiNo ratings yet

- Amphibia-Parental CareDocument4 pagesAmphibia-Parental CareAakash VNo ratings yet

- Product (RED)Document9 pagesProduct (RED)Madison SheenaNo ratings yet

- Fs 8Document12 pagesFs 8May Cruzel TorresNo ratings yet

- Author Literally Writes The Book On Band NerdsDocument3 pagesAuthor Literally Writes The Book On Band NerdsPR.comNo ratings yet

- Lesson 2Document13 pagesLesson 2Hanna CaraigNo ratings yet

- LRN Level 2 Certificate in Esol International Cef c1 Sample PaperDocument29 pagesLRN Level 2 Certificate in Esol International Cef c1 Sample PaperSham1an ScottNo ratings yet

- LADYFEST PARIS 2011 PRESS KIT (Eng)Document14 pagesLADYFEST PARIS 2011 PRESS KIT (Eng)ladyfestparisNo ratings yet

- Field Trip/ Lakbay-Aral: By: Christian A. GalletaDocument2 pagesField Trip/ Lakbay-Aral: By: Christian A. GalletaHajime HikariNo ratings yet

- CLASS 10, INTRO TO TRIGONOMETRY, PPT, Module 1 BY 3Document22 pagesCLASS 10, INTRO TO TRIGONOMETRY, PPT, Module 1 BY 3Apoorv Arya100% (1)

- 13 To 23 RizalDocument26 pages13 To 23 Rizalpaolo.canejaNo ratings yet

- SDN Grogol Selatan 08 Penilaian Akhir Semester Ganjil: Pemerintah Provinsi Daerah Khusus Ibukota Jakarta Dinas PendidikanDocument11 pagesSDN Grogol Selatan 08 Penilaian Akhir Semester Ganjil: Pemerintah Provinsi Daerah Khusus Ibukota Jakarta Dinas PendidikanLovia Dwita Romar SaulinaNo ratings yet