Professional Documents

Culture Documents

DGFT GST Faq

DGFT GST Faq

Uploaded by

srinivas0 ratings0% found this document useful (0 votes)

11 views1 page1. Under the GST regime, duty credit scrips such as MEIS and SEIS can only be used for payment of basic customs duty and not GST.

2. Exporters should check the CBEC website for their product's HSN classification code and applicable GST rate.

3. Unlike SEZs, EOUs will have to pay IGST on imports under the GST regime and will not receive ab-initio exemption from IGST.

4. SEZs can import raw materials duty free by exempting both basic customs duty and IGST, whereas 100% EOUs will have to pay IGST but can claim input tax credit or refund after exports.

Original Description:

Dgft Gst Faq

Original Title

Dgft Gst Faq

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Under the GST regime, duty credit scrips such as MEIS and SEIS can only be used for payment of basic customs duty and not GST.

2. Exporters should check the CBEC website for their product's HSN classification code and applicable GST rate.

3. Unlike SEZs, EOUs will have to pay IGST on imports under the GST regime and will not receive ab-initio exemption from IGST.

4. SEZs can import raw materials duty free by exempting both basic customs duty and IGST, whereas 100% EOUs will have to pay IGST but can claim input tax credit or refund after exports.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageDGFT GST Faq

DGFT GST Faq

Uploaded by

srinivas1. Under the GST regime, duty credit scrips such as MEIS and SEIS can only be used for payment of basic customs duty and not GST.

2. Exporters should check the CBEC website for their product's HSN classification code and applicable GST rate.

3. Unlike SEZs, EOUs will have to pay IGST on imports under the GST regime and will not receive ab-initio exemption from IGST.

4. SEZs can import raw materials duty free by exempting both basic customs duty and IGST, whereas 100% EOUs will have to pay IGST but can claim input tax credit or refund after exports.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

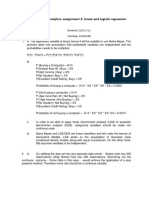

DGFT Related GST FAQs-

S. No. Query Response

1. Will GST be debited in duty credit No, MEIS and SEIS scrip would be used

scrips such as Merchandise Exports only for payment of Basic Customs Duty

from India Scheme (MEIS) and under GST regime.

Service Exports from India Scheme

(SEIS)?

2. What is HSN code (under GST Please visit CBEC site for details on HSN

scheme) for my product? What is classification and GST rates for your

the applicable GST rate for my products.

product?

3. As an EOU, BCD is exempted Only SEZs have been exempted from

under customs notification payment of IGST on import. EOUs will have

52/2003. In GST regime, EOUs to pay IGST on imports.

should pay IGST on imports?

4. If we change ourselves to 100% 100% EOU will not get ab-initio exemption

EOU, do we still have to pay tax on of IGST for imports. In other words EOU

domestic purchases? will get same treatment as DTA unit under

GST regime.

5. The exemptions , benefits which SEZs are allowed to import raw materials

are available to 100% EOUs , SEZs duty free (Basic Customs Duty and IGST

in current regime , whether the both exempted). But, 100%EOU will have to

same will be available under the pay IGST, Input Tax Credit (ITC)/ refund of

GST regime which can be taken after exports as per ITC/

Refund Rules.

6. How to update GST number in It is advised to update IEC in GSTIN. It also

IEC? advised to check correct PAN in GSTIN and

IEC. You may contact jurisdictional DGFT

regional office for updating correct PAN in

IEC. From 1st July, in all shipping bills

declaration of GSTIN will be mandatory for

claiming ITC/refund of GST. Please refer to

DGFT Trade Notice No.09/2018

12.06.2017 for changes in IEC with the

introduction of GST.

7. Under GST regime, can we get No, only basic customs duty will be

duty free benefit (all duties exempted on imports made under Advance

exempted) if we import using Authorisation. IGST will have to be paid on

Advance authorization? imports. IGST paid on import will be

refunded on making exports.

8. We are recently started export firm. You will require only GST registration. In

Now we are in process to take case your product is not covered under GST,

VAT/CST. But now as GST is you may require VAT/CST registration as

come in to action. So we have to well.

register for both or only one is

needed and mandatory.

You might also like

- 5 - BCO (Dec 2020) - Draft Answer by Sir Hasan Dossani (Full Drafting)Document15 pages5 - BCO (Dec 2020) - Draft Answer by Sir Hasan Dossani (Full Drafting)MD.RIDWANUR RAHMAN100% (2)

- TBDY 2018 EnglishDocument608 pagesTBDY 2018 EnglishaygunbayramNo ratings yet

- Assure Model Lesson PlanDocument2 pagesAssure Model Lesson PlanNicole Hernandez71% (17)

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Handbook of International TradeDocument411 pagesHandbook of International TradesrinivasNo ratings yet

- Faqs On Export and FTP Related Issues of GSTDocument6 pagesFaqs On Export and FTP Related Issues of GSTJigar PunamiyaNo ratings yet

- INPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inDocument20 pagesINPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inAtin KumarNo ratings yet

- Sectoral Booklets ExportsDocument8 pagesSectoral Booklets Exportsarihant42123No ratings yet

- The Reformed Indirect Tax System GSTDocument4 pagesThe Reformed Indirect Tax System GSTavi_sam1986No ratings yet

- Introduction To GSTDocument16 pagesIntroduction To GSTkomil bogharaNo ratings yet

- Activating GST For Your Company: Tally ERP Material Unit - 3 GSTDocument47 pagesActivating GST For Your Company: Tally ERP Material Unit - 3 GSTMichael Wells100% (1)

- Unit 3 GSTDocument51 pagesUnit 3 GSTMichael WellsNo ratings yet

- GST Assign.Document23 pagesGST Assign.Saif Ali KhanNo ratings yet

- Circular No (1) - 16 Dt.16 Nov 09 For GSTDocument3 pagesCircular No (1) - 16 Dt.16 Nov 09 For GSTSeemaNaikNo ratings yet

- GST With Examples: GST India - Goods & Service TaxDocument4 pagesGST With Examples: GST India - Goods & Service TaxVipul Priya KumarNo ratings yet

- Taxes To Be Subsumed Under GSTDocument3 pagesTaxes To Be Subsumed Under GSTShreyaNo ratings yet

- Inter GST Chart Book Nov2022Document41 pagesInter GST Chart Book Nov2022Aastha ChauhanNo ratings yet

- Faqs HandicraftsDocument6 pagesFaqs HandicraftsSneha AgarwalNo ratings yet

- Presentation On GST by Himanshu and KrishnaDocument21 pagesPresentation On GST by Himanshu and KrishnahimanshuNo ratings yet

- Frequently Asked Questions About GST: GST - General Info & Customs ImplicationsDocument14 pagesFrequently Asked Questions About GST: GST - General Info & Customs Implicationsprakash mishraNo ratings yet

- 29.goods & Servicee TaxDocument3 pages29.goods & Servicee TaxmercatuzNo ratings yet

- Bird Eye View of GST ActDocument34 pagesBird Eye View of GST ActNarayan KulkarniNo ratings yet

- Indirect TaxDocument24 pagesIndirect Taxpradeep100% (1)

- Frequently Asked Questions (Faqs) On Goods and Services Tax (GST)Document3 pagesFrequently Asked Questions (Faqs) On Goods and Services Tax (GST)IT'S MD CREATIONNo ratings yet

- One Nation, One Tax: Goods and Services Tax (GST)Document13 pagesOne Nation, One Tax: Goods and Services Tax (GST)Karan SharmaNo ratings yet

- GSTDocument3 pagesGSTdevil_3565No ratings yet

- Goods and Services Tax - An Overview: Central Board of Excise & CustomsDocument10 pagesGoods and Services Tax - An Overview: Central Board of Excise & CustomsvsaraNo ratings yet

- GSTFAQs 27ae5d95Document8 pagesGSTFAQs 27ae5d95Jeetendra SharmaNo ratings yet

- Input Tax Credit Mechanism in GSTDocument9 pagesInput Tax Credit Mechanism in GSThanumanthaiahgowdaNo ratings yet

- GST Definition and RequirementsDocument2 pagesGST Definition and RequirementsThivanNo ratings yet

- GST Module 1Document7 pagesGST Module 1mohanraokp2279No ratings yet

- Input Tax Credit Under GSTDocument4 pagesInput Tax Credit Under GSTharshadaphandge165No ratings yet

- GST and Exports: by Office of The Additional DGFT, HyderabadDocument18 pagesGST and Exports: by Office of The Additional DGFT, HyderabadjahnavireddysathiNo ratings yet

- 8043 PDFDocument274 pages8043 PDFChandana RajasriNo ratings yet

- Foreign Trade Policy: A Brief UnderstandingDocument76 pagesForeign Trade Policy: A Brief UnderstandingMilna JosephNo ratings yet

- GST Oct 17Document23 pagesGST Oct 17himanNo ratings yet

- SEZ Vs EOU Vs DTADocument3 pagesSEZ Vs EOU Vs DTASez GenNo ratings yet

- Overview of GSTDocument8 pagesOverview of GSTSkArbazNo ratings yet

- HW 30873Document4 pagesHW 30873emritsaitama23No ratings yet

- GST Practical RecordDocument52 pagesGST Practical Recordkancherlasunitha671356No ratings yet

- GST AssignmentDocument16 pagesGST AssignmentDroupathyNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- Goods and Service Tax: The Way AheadDocument17 pagesGoods and Service Tax: The Way AheadsaffuNo ratings yet

- 3 1.2.2 Principal Adg Sushil Solanki GSTDocument23 pages3 1.2.2 Principal Adg Sushil Solanki GSTpradeeperd10011988No ratings yet

- Background Material For 3days Refresher Course On GSTDocument34 pagesBackground Material For 3days Refresher Course On GSTDevika JauhariNo ratings yet

- Central Taxes State Taxes: The List of Taxes Which Will Be Eliminated AreDocument6 pagesCentral Taxes State Taxes: The List of Taxes Which Will Be Eliminated ArekiranpatnaikNo ratings yet

- Goods and Services Tax " Future in India": by - Joe Suhas Thambi Rahul Aurade MET Institute of Management, NasikDocument33 pagesGoods and Services Tax " Future in India": by - Joe Suhas Thambi Rahul Aurade MET Institute of Management, NasikJOEMEETSMONUNo ratings yet

- Goods and Services Tax (GST) in IndiaDocument30 pagesGoods and Services Tax (GST) in IndiarupalNo ratings yet

- Revised Model GST LawDocument39 pagesRevised Model GST LawkshitijsaxenaNo ratings yet

- Goods and Services Tax (GST) in India: CA. Preeti GoyalDocument30 pagesGoods and Services Tax (GST) in India: CA. Preeti GoyalArvind PalNo ratings yet

- 908 - GST E BookDocument63 pages908 - GST E Bookdcsreddy94No ratings yet

- 6mmmmm: M M M MDocument12 pages6mmmmm: M M M MUtsav PoddarNo ratings yet

- Chapter - 1 GSTDocument6 pagesChapter - 1 GSTbratati.dharNo ratings yet

- Gst-Act: Goods and Services Tax. One Nation-One TaxDocument63 pagesGst-Act: Goods and Services Tax. One Nation-One TaxKunal ChawlaNo ratings yet

- 12th Accounts by CA, Cma Santosh Kumar SirDocument329 pages12th Accounts by CA, Cma Santosh Kumar SirMillat AfridiNo ratings yet

- Goods & Service Tax (GST) : by CMA - Sameer EpariDocument15 pagesGoods & Service Tax (GST) : by CMA - Sameer Eparihitesh nandawaniNo ratings yet

- Unit-5 Indirect TaxDocument26 pagesUnit-5 Indirect TaxNithya RajNo ratings yet

- Goods and Service Tax (GST)Document19 pagesGoods and Service Tax (GST)Saurabh Kumar SharmaNo ratings yet

- Gstinindia A Brief NoteDocument30 pagesGstinindia A Brief NoteMahaveer DhelariyaNo ratings yet

- Fairfield Institute of Management & Technology: Sub Code: 309Document12 pagesFairfield Institute of Management & Technology: Sub Code: 309vricaNo ratings yet

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Document58 pagesE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraNo ratings yet

- What Is Input Tax Credit and How To Adjust or Set-Off ITC It?Document2 pagesWhat Is Input Tax Credit and How To Adjust or Set-Off ITC It?Filing BuddyNo ratings yet

- Indirect Tax and GSTDocument124 pagesIndirect Tax and GSTPrasanna KumarNo ratings yet

- GST 2 Notes 2nd McomDocument49 pagesGST 2 Notes 2nd McomSandeep KicchaNo ratings yet

- Warehouse FaqDocument6 pagesWarehouse FaqsrinivasNo ratings yet

- Spice BoardDocument84 pagesSpice BoardsrinivasNo ratings yet

- ICAI Submitted Suggestions On GST Annual Return Form 26th Sep 2018 PDFDocument18 pagesICAI Submitted Suggestions On GST Annual Return Form 26th Sep 2018 PDFsrinivasNo ratings yet

- Logistics and Supply Chain Management 0Document5 pagesLogistics and Supply Chain Management 0srinivasNo ratings yet

- GST On Raw Materials For GarmentsDocument1 pageGST On Raw Materials For GarmentssrinivasNo ratings yet

- E Tutorial Digital Signature 1Document29 pagesE Tutorial Digital Signature 1srinivasNo ratings yet

- Share-Based Payment: Indian Accounting Standard (Ind AS) 102Document90 pagesShare-Based Payment: Indian Accounting Standard (Ind AS) 102srinivasNo ratings yet

- E-Tutorial - Download Form 16anewDocument43 pagesE-Tutorial - Download Form 16anewsrinivasNo ratings yet

- CH All An WithDocument1 pageCH All An WithsrinivasNo ratings yet

- E-Tutorial - Form 27DDocument42 pagesE-Tutorial - Form 27DsrinivasNo ratings yet

- Income Taxes: Indian Accounting Standard (Ind AS) 12Document76 pagesIncome Taxes: Indian Accounting Standard (Ind AS) 12srinivasNo ratings yet

- User Manual - : Title: Module NameDocument13 pagesUser Manual - : Title: Module NamesrinivasNo ratings yet

- User Manual - : Title: Module NameDocument6 pagesUser Manual - : Title: Module NamesrinivasNo ratings yet

- Business Process Description Overview: User ManualDocument19 pagesBusiness Process Description Overview: User ManualsrinivasNo ratings yet

- E-Way Bill System: User Manual For API Interface (Site-to-Site Integration)Document14 pagesE-Way Bill System: User Manual For API Interface (Site-to-Site Integration)srinivasNo ratings yet

- Tifr SSRDocument972 pagesTifr SSRAbhishek UpadhyayNo ratings yet

- Santiago v. Gonzalez PDFDocument2 pagesSantiago v. Gonzalez PDFGervin ArquizalNo ratings yet

- Foss Lab ManualDocument34 pagesFoss Lab ManualArunKumarIjjadaNo ratings yet

- Resultados de Búsqueda: Artículos Académicos para Vocal Function Exercises Stemple PDFDocument3 pagesResultados de Búsqueda: Artículos Académicos para Vocal Function Exercises Stemple PDFleandro__scribdNo ratings yet

- Love Song For A VampireDocument1 pageLove Song For A VampireVivianamorteccinaNo ratings yet

- Boq - Secuity House at IbewaDocument4 pagesBoq - Secuity House at IbewaAugustine BelieveNo ratings yet

- Group 1 - Ecumenical ChurchDocument13 pagesGroup 1 - Ecumenical ChurchLesther RobloNo ratings yet

- 3i's Rubrics ACTIVITY 1Document2 pages3i's Rubrics ACTIVITY 1Jaeneth SimondoNo ratings yet

- Letter of Inquiry About Internship Opportunities - HardDocument1 pageLetter of Inquiry About Internship Opportunities - Hardapi-370641050% (2)

- Research Paper of Vacuum Braking SystemDocument8 pagesResearch Paper of Vacuum Braking Systemwkzcoprhf100% (1)

- Business Analytics AssignmentDocument3 pagesBusiness Analytics AssignmentDevansh RaiNo ratings yet

- Virtue Ethics-: Prepared By: Lagman, Joshua Punzalan, Marlon Lopez, Alaine Carl Sicat, Ariel Medrano, Kervin TroyDocument40 pagesVirtue Ethics-: Prepared By: Lagman, Joshua Punzalan, Marlon Lopez, Alaine Carl Sicat, Ariel Medrano, Kervin TroyKyla RodriguezaNo ratings yet

- Comprehension Week Lesson PlanDocument5 pagesComprehension Week Lesson Planapi-339960745No ratings yet

- Proba Orala1Document5 pagesProba Orala1andreiNo ratings yet

- IntroductionDocument6 pagesIntroductionKhizar ShahNo ratings yet

- The Early History of Manganese and The Recognition of ItsDocument23 pagesThe Early History of Manganese and The Recognition of ItsPlutus PHNo ratings yet

- China Pakistan Economic Corridor CPEC IsDocument12 pagesChina Pakistan Economic Corridor CPEC IsNasir HussainNo ratings yet

- Route 201/202/302 Combined: Doncaster/Box HillDocument6 pagesRoute 201/202/302 Combined: Doncaster/Box Hillmushroom620No ratings yet

- The Scarlet Letter Analysis EssayDocument8 pagesThe Scarlet Letter Analysis Essayurdpzinbf100% (2)

- Review of Related Literature On Environmental SanitationDocument8 pagesReview of Related Literature On Environmental SanitationkmffzlvkgNo ratings yet

- Unit 19 p3Document10 pagesUnit 19 p3api-344079053No ratings yet

- Mars EssayDocument3 pagesMars EssayAlejandro Cervantes100% (1)

- Angela's Infantwear and Accessories: InvoiceDocument1 pageAngela's Infantwear and Accessories: InvoiceAngelas InfantwearNo ratings yet

- (Lines - of - Thought - ) Robert - C. - Stalnaker-Our - Knowledge - of - The - Internal - World - (Lines - of - Thought) - Oxford - University - Press, - USA (2008) (1) by Stalnaker PDFDocument20 pages(Lines - of - Thought - ) Robert - C. - Stalnaker-Our - Knowledge - of - The - Internal - World - (Lines - of - Thought) - Oxford - University - Press, - USA (2008) (1) by Stalnaker PDFPriyanka DeNo ratings yet

- AP Technical Education Service Rules-178Document29 pagesAP Technical Education Service Rules-178Neeraja CNo ratings yet

- Miciano Vs BrimoDocument2 pagesMiciano Vs BrimoElla Marie Sanico-AbustanNo ratings yet

- Chapter5-Smart Selling and Effective Customer ServiceDocument23 pagesChapter5-Smart Selling and Effective Customer ServiceAldo MadonaNo ratings yet