Professional Documents

Culture Documents

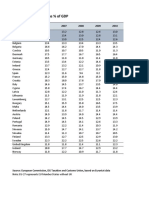

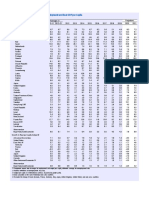

Table 3: Indirect Taxes As % of GDP - Total

Table 3: Indirect Taxes As % of GDP - Total

Uploaded by

Alexandra Offenberg0 ratings0% found this document useful (0 votes)

12 views20 pagesThe table shows the percentage of GDP and total taxation accounted for by indirect taxes in EU countries from 2002-2014. Indirect taxes as a percentage of GDP remained relatively stable for most countries over this period, ranging from 10-23% of GDP. Indirect taxes accounted for 30-50% of total taxation across countries. While some countries saw increases or decreases of a few percentage points in indirect taxes as a share of GDP and taxation, most saw little change over time.

Original Description:

Indirect Taxes

Original Title

Indirect Taxes

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe table shows the percentage of GDP and total taxation accounted for by indirect taxes in EU countries from 2002-2014. Indirect taxes as a percentage of GDP remained relatively stable for most countries over this period, ranging from 10-23% of GDP. Indirect taxes accounted for 30-50% of total taxation across countries. While some countries saw increases or decreases of a few percentage points in indirect taxes as a share of GDP and taxation, most saw little change over time.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views20 pagesTable 3: Indirect Taxes As % of GDP - Total

Table 3: Indirect Taxes As % of GDP - Total

Uploaded by

Alexandra OffenbergThe table shows the percentage of GDP and total taxation accounted for by indirect taxes in EU countries from 2002-2014. Indirect taxes as a percentage of GDP remained relatively stable for most countries over this period, ranging from 10-23% of GDP. Indirect taxes accounted for 30-50% of total taxation across countries. While some countries saw increases or decreases of a few percentage points in indirect taxes as a share of GDP and taxation, most saw little change over time.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 20

Table 3: Indirect taxes as % of GDP - Total

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 13.2 13.2 13.2 13.2 13.3 13.2 12.8 12.6 13.0

EA-19 12.8 12.8 12.8 12.9 13.0 13.0 12.5 12.4 12.6

Belgium 12.9 13.0 13.1 13.2 13.2 13.1 13.0 12.8 13.1

Bulgaria 12.3 14.3 15.8 16.1 16.7 16.0 16.9 14.4 14.4

Czech Republic 10.1 10.2 11.0 11.0 10.5 10.7 10.5 11.0 11.3

Denmark 17.2 17.1 17.3 17.6 17.5 17.7 16.7 16.6 16.5

Germany 10.6 10.8 10.5 10.5 10.4 10.9 10.9 11.4 10.9

Estonia 12.7 12.2 13.0 12.8 13.5 13.6 12.2 14.7 13.9

Ireland 12.0 12.5 12.8 12.9 13.7 13.3 12.1 11.0 11.0

Greece 13.0 12.2 11.7 12.0 12.4 12.7 12.7 11.8 12.7

Spain 11.2 11.5 12.0 12.4 12.4 11.7 9.8 8.7 10.4

France 15.0 15.0 15.1 15.3 15.2 15.0 14.8 15.0 14.8

Croatia 19.7 19.4 18.8 18.5 18.5 18.2 18.0 17.2 18.0

Italy 14.2 13.8 13.9 14.1 14.7 14.5 13.7 13.6 14.1

Cyprus 12.1 14.4 15.2 15.4 16.0 17.5 16.8 14.5 14.6

Latvia 11.2 11.8 11.7 12.4 12.7 12.0 10.7 10.9 11.7

Lithuania 12.4 11.6 11.3 11.4 11.5 11.9 11.9 11.8 12.0

Luxembourg 12.6 12.6 13.4 13.7 12.9 13.1 12.5 12.7 12.4

Hungary 14.8 15.6 16.1 15.5 15.1 15.9 15.7 16.5 17.6

Malta 12.3 12.3 13.5 14.4 14.5 14.4 14.0 13.5 13.1

Netherlands 11.9 11.9 12.1 12.1 12.2 12.1 11.8 11.3 11.6

Austria 14.9 14.8 14.6 14.4 14.0 13.9 14.0 14.4 14.3

Poland 13.6 13.6 13.6 14.0 14.3 14.6 14.6 13.0 13.7

Portugal 14.1 14.6 13.9 14.6 14.9 14.5 14.1 12.7 13.3

Romania 11.6 12.2 11.7 12.8 12.7 12.5 11.8 10.8 11.9

Slovenia 15.5 15.7 15.5 15.5 15.0 14.7 14.1 13.7 14.2

Slovakia 11.5 12.0 12.2 12.6 11.3 11.2 10.6 10.6 10.3

Finland 13.3 13.7 13.3 13.4 13.3 12.8 12.5 13.0 13.0

Sweden 23.1 22.9 22.5 22.7 22.2 22.2 22.5 22.8 22.4

United Kingdom 12.8 12.7 12.7 12.2 12.2 12.2 11.8 11.3 12.4

Iceland 15.4 16.3 17.2 18.6 19.0 17.9 15.0 13.2 13.6

Norway 13.2 12.8 12.5 12.0 12.0 12.3 11.0 11.8 11.9

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

13.2 13.4 13.5 13.6 0.4 1 898 208

12.7 13.0 13.1 13.3 0.5 1 343 757

13.1 13.4 13.3 13.2 0.1 16 53 070

13.9 14.8 15.2 14.5 -1.3 11 6 220

12.1 12.6 12.9 12.1 1.1 22 18 793

16.6 16.6 16.7 16.6 -0.6 4 43 304

11.1 11.1 11.0 10.9 0.4 27 318 461

13.6 13.9 13.4 13.9 1.0 14 2 780

10.4 10.6 10.9 11.3 -1.5 26 21 379

13.6 13.6 14.2 15.7 4.0 6 27 937

10.1 10.5 11.3 11.6 -0.4 24 120 823

15.2 15.4 15.6 15.9 0.7 5 338 907

17.5 18.3 19.0 18.8 0.1 2 8 103

14.2 15.4 15.0 15.5 1.6 7 249 439

13.9 14.0 13.8 15.0 -0.2 9 2 615

11.7 12.0 12.2 12.7 1.0 21 2 989

11.8 11.4 11.3 11.5 0.3 25 4 207

12.5 12.9 12.8 13.1 -0.3 17 6 387

17.5 18.7 18.6 18.6 2.6 3 19 438

13.6 13.2 13.0 13.7 0.2 15 1 112

11.2 10.9 11.3 11.7 -0.4 23 77 445

14.4 14.6 14.5 14.6 -0.1 10 47 964

13.8 13.0 12.9 12.9 -0.7 18 53 043

14.0 14.0 13.8 14.3 0.4 13 24 740

13.0 13.3 12.8 12.9 1.2 20 19 363

14.2 14.6 15.2 15.1 -0.4 8 5 636

10.7 10.1 10.5 10.8 -1.4 28 8 173

13.9 14.2 14.5 14.5 1.1 12 29 695

22.1 22.3 22.3 22.1 -0.4 1 95 157

12.9 12.8 12.9 12.9 0.3 19 291 030

13.7 14.3 14.2 15.8 -1.4 2 029

11.5 11.2 11.3 11.4 -1.0 43 205

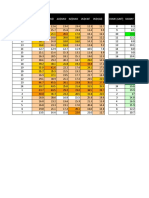

Table 4: Indirect taxes as % of total taxation - Total

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 35.0 35.0 35.1 35.0 34.8 34.6 33.7 33.9 34.9

EA-19 33.3 33.4 33.6 33.8 33.6 33.4 32.5 32.7 33.2

Belgium 29.4 29.9 30.1 30.4 30.5 30.5 29.7 30.0 30.5

Bulgaria 44.1 46.8 50.2 53.2 56.1 51.1 55.3 53.1 54.9

Czech Republic 30.3 30.1 31.9 32.1 30.9 31.2 31.9 34.1 34.8

Denmark 37.8 37.4 37.2 36.7 37.6 38.0 37.2 36.7 36.4

Germany 28.4 28.6 28.4 28.3 28.0 29.1 28.8 29.9 29.7

Estonia 40.6 39.6 41.5 42.9 44.3 43.3 39.0 42.0 41.8

Ireland 43.1 43.5 43.1 43.5 43.7 43.0 41.9 38.9 39.3

Greece 39.1 38.8 38.5 37.6 39.9 39.9 39.9 38.4 39.7

Spain 33.6 34.7 35.1 35.2 34.6 32.1 30.6 29.1 33.1

France 35.8 35.7 36.0 35.9 35.2 35.3 34.8 35.8 35.1

Croatia 52.4 52.2 51.5 51.1 50.3 49.2 48.9 47.2 49.7

Italy 35.9 34.8 35.4 36.1 36.6 35.1 33.3 32.6 34.0

Cyprus 43.0 49.5 51.2 48.7 49.4 48.1 48.0 45.1 45.3

Latvia 40.1 42.9 42.4 44.6 44.3 42.5 38.5 40.0 42.2

Lithuania 42.7 40.7 38.9 39.1 38.2 39.6 38.9 39.1 42.5

Luxembourg 33.1 33.1 36.1 35.7 35.5 35.8 33.6 32.6 32.6

Hungary 39.6 41.6 43.4 42.3 41.1 40.3 39.7 42.2 47.1

Malta 41.9 41.7 44.8 45.6 45.4 43.8 43.6 41.7 42.1

Netherlands 33.5 33.8 34.3 34.3 33.6 33.5 32.4 32.0 32.2

Austria 34.9 34.9 34.8 34.9 34.5 34.0 33.7 35.0 35.0

Poland 41.2 41.8 42.4 42.3 42.4 42.0 42.6 41.5 43.9

Portugal 45.0 46.5 46.1 47.4 47.5 45.6 44.3 42.6 43.8

Romania 41.3 44.2 42.9 46.3 44.8 43.3 42.6 41.0 45.3

Slovenia 41.8 41.9 41.4 40.8 39.8 39.6 38.6 37.7 38.3

Slovakia 34.9 36.8 38.9 40.2 38.6 38.5 36.6 36.7 36.7

Finland 30.7 32.4 31.9 31.8 31.6 30.8 30.4 31.8 31.9

Sweden 51.2 50.4 49.2 48.7 48.3 49.3 51.2 51.7 51.8

United Kingdom 38.2 37.8 37.1 35.6 34.8 35.1 32.6 34.1 36.6

Iceland 45.0 45.6 47.0 46.9 46.8 45.8 42.6 41.4 40.7

Norway 31.2 30.8 29.5 28.2 28.0 29.1 26.6 28.6 28.3

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

35.0 35.0 34.8 35.1 0.0 1 898 208

33.1 33.0 32.7 33.0 -0.6 1 343 757

29.9 29.9 29.2 29.2 -0.9 27 53 070

54.4 55.6 54.4 52.4 2.2 1 6 220

36.0 36.7 37.2 35.6 3.7 18 18 793

36.6 36.0 35.5 33.3 -3.8 24 43 304

29.8 29.3 28.9 28.7 0.3 28 318 461

43.2 43.9 42.6 43.2 1.7 9 2 780

37.5 37.4 37.7 38.0 -5.2 16 21 379

40.4 38.4 40.0 43.8 5.3 8 27 937

32.3 32.8 34.2 34.5 -0.5 21 120 823

35.1 34.6 34.5 34.7 -1.3 20 338 907

49.5 51.1 51.9 51.3 -0.2 3 8 103

34.4 35.4 34.6 35.6 0.2 17 249 439

43.3 44.4 43.7 44.0 -7.3 6 2 615

42.2 42.3 43.0 43.9 1.5 7 2 989

43.4 42.1 41.7 41.7 2.7 11 4 207

33.1 33.3 33.6 34.2 -1.8 22 6 387

47.5 48.6 48.7 48.7 5.3 4 19 438

42.5 41.1 39.9 40.5 -4.4 13 1 112

31.2 30.3 30.8 31.2 -3.1 26 77 445

35.0 35.0 34.1 33.8 -1.0 23 47 964

43.6 40.7 40.3 40.2 -2.2 14 53 043

43.2 43.9 40.4 41.7 -4.3 10 24 740

46.5 47.5 46.8 46.6 3.7 5 19 363

38.7 39.4 41.2 41.2 -0.2 12 5 636

37.5 35.7 34.8 34.9 -4.0 19 8 173

33.1 33.2 33.2 33.0 1.1 25 29 695

52.0 52.4 52.0 51.7 2.4 2 95 157

37.5 38.2 38.7 39.3 2.2 15 291 030

39.8 40.7 39.5 40.6 -6.4 2 029

27.2 27.1 28.4 29.4 -0.1 43 205

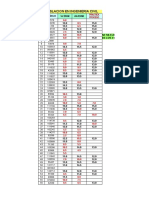

Table 5: Indirect taxes as % of GDP - VAT

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 6.6 6.6 6.6 6.7 6.7 6.8 6.7 6.4 6.8

EA-19 6.5 6.4 6.4 6.5 6.6 6.7 6.5 6.4 6.6

Belgium 6.8 6.6 6.7 6.9 6.9 6.9 6.8 6.8 6.9

Bulgaria 7.1 8.5 9.6 9.9 10.4 9.8 10.3 8.5 8.7

Czech Republic 5.8 5.9 6.7 6.6 6.1 6.1 6.5 6.6 6.7

Denmark 9.2 9.3 9.4 9.7 9.9 10.0 9.7 9.8 9.5

Germany 6.2 6.2 6.1 6.1 6.1 6.8 6.9 7.2 7.0

Estonia 8.4 8.2 8.3 8.1 9.0 8.8 7.8 8.7 8.5

Ireland 6.7 6.7 7.0 7.3 7.4 7.3 7.0 6.1 6.1

Greece 7.3 6.7 6.5 6.7 6.8 7.1 7.0 6.3 7.1

Spain 5.6 5.8 6.1 6.3 6.3 5.9 5.0 3.9 5.4

France 6.9 6.9 7.0 7.1 7.1 7.0 6.9 6.7 6.8

Croatia 12.3 12.2 11.9 12.0 12.0 11.9 11.8 11.2 11.6

Italy 5.9 5.7 5.6 5.7 6.0 5.9 5.7 5.5 6.1

Cyprus 6.1 7.1 7.6 8.3 8.8 9.3 9.6 8.4 8.4

Latvia 6.5 6.9 6.7 7.4 8.0 7.7 6.3 5.9 6.7

Lithuania 7.3 6.7 6.4 7.1 7.6 8.0 7.9 7.3 7.8

Luxembourg 5.6 5.7 6.0 6.3 5.7 6.1 6.2 6.8 6.5

Hungary 7.7 8.1 8.7 8.3 7.5 7.9 7.7 8.3 8.6

Malta 6.1 6.1 6.9 7.7 7.6 7.3 7.5 7.4 7.2

Netherlands 6.8 6.9 6.8 6.8 6.9 7.0 6.8 6.5 6.8

Austria 7.9 7.7 7.7 7.7 7.4 7.4 7.5 7.7 7.7

Poland 7.2 7.1 7.1 7.7 8.1 8.2 8.0 7.3 7.6

Portugal 7.5 7.6 7.6 8.2 8.3 8.2 8.1 6.8 7.5

Romania 7.1 7.1 6.6 8.0 7.9 8.0 7.8 6.5 7.5

Slovenia 8.4 8.3 8.4 8.5 8.4 8.3 8.3 7.9 8.1

Slovakia 6.9 7.3 7.6 7.7 7.3 6.6 6.8 6.6 6.2

Finland 7.9 8.2 8.2 8.4 8.4 8.2 8.1 8.4 8.3

Sweden 8.4 8.4 8.3 8.5 8.5 8.6 8.8 9.1 9.2

United Kingdom 6.3 6.5 6.5 6.3 6.2 6.2 6.1 5.4 6.2

Iceland 9.1 9.4 10.1 10.8 11.1 10.2 8.8 7.6 7.6

Norway 8.3 8.1 7.9 7.7 7.8 8.0 7.1 7.7 7.8

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

6.9 6.9 6.9 7.0 0.4 975 902

6.6 6.7 6.7 6.8 0.4 686 434

6.9 6.9 6.9 6.9 0.1 22 27 518

8.2 9.0 9.3 8.9 -0.7 6 3 799

6.9 7.1 7.5 7.5 0.8 16 11 602

9.6 9.6 9.5 9.6 0.2 2 24 985

7.0 7.0 7.0 7.0 0.9 20 203 081

8.2 8.4 8.2 8.6 0.3 8 1 711

5.6 5.8 5.8 6.1 -1.0 27 11 496

7.3 7.2 7.0 7.1 0.6 18 12 676

5.3 5.5 6.0 6.2 0.2 26 64 688

6.8 6.8 6.8 6.9 -0.1 21 148 129

11.3 12.3 12.7 12.5 0.6 1 5 368

6.0 6.0 5.8 6.0 0.4 28 96 897

7.8 8.1 7.8 8.7 1.1 7 1 512

6.8 7.2 7.4 7.6 0.9 15 1 787

7.8 7.6 7.5 7.6 1.1 14 2 764

6.8 7.2 7.3 7.3 1.3 17 3 586

8.5 9.2 9.0 9.4 0.6 3 9 754

7.6 7.5 7.6 7.9 1.1 11 642

6.5 6.5 6.5 6.4 -0.4 25 42 708

7.6 7.7 7.7 7.7 0.0 13 25 445

7.8 7.1 7.0 7.1 0.0 19 29 317

8.1 8.3 8.1 8.5 0.9 9 14 672

8.6 8.4 8.3 7.8 1.1 12 11 650

8.1 8.0 8.5 8.5 0.1 10 3 153

6.7 6.0 6.4 6.6 -1.0 24 5 021

8.8 9.0 9.3 9.2 1.0 4 18 948

9.0 8.9 9.0 9.0 0.7 5 38 846

6.9 6.8 6.8 6.8 0.3 23 154 146

7.7 8.0 8.0 8.1 -2.0 1 039

7.6 7.5 7.6 7.7 -0.2 29 182

Table 6: Indirect taxes as % of total taxation - VAT

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 17.5 17.5 17.6 17.7 17.6 17.8 17.6 17.2 18.2

EA-19 16.9 16.8 16.9 17.1 17.1 17.3 17.0 16.7 17.5

Belgium 15.3 15.2 15.4 15.8 15.9 16.1 15.6 15.8 16.1

Bulgaria 25.6 27.8 30.3 32.7 34.9 31.1 33.8 31.1 33.3

Czech Republic 17.4 17.2 19.4 19.3 18.0 17.6 19.6 20.5 20.5

Denmark 20.3 20.3 20.2 20.3 21.4 21.6 21.6 21.6 21.0

Germany 16.5 16.3 16.4 16.4 16.5 18.1 18.2 19.0 19.0

Estonia 26.8 26.5 26.6 26.9 29.4 28.0 24.8 24.8 25.7

Ireland 24.1 23.4 23.7 24.5 23.7 23.6 24.0 21.6 21.6

Greece 22.1 21.4 21.3 21.1 21.8 22.3 22.1 20.4 22.0

Spain 16.8 17.6 17.8 18.0 17.5 16.3 15.5 13.0 17.3

France 16.5 16.5 16.7 16.7 16.5 16.5 16.2 16.0 16.1

Croatia 32.6 32.8 32.6 33.0 32.6 32.0 32.0 30.8 32.0

Italy 15.0 14.3 14.4 14.7 15.0 14.4 13.9 13.2 14.7

Cyprus 21.7 24.7 25.7 26.3 27.2 25.7 27.5 26.0 25.9

Latvia 23.4 25.1 24.2 26.5 27.8 27.2 22.8 21.8 24.1

Lithuania 25.3 23.3 22.2 24.3 25.2 26.7 25.9 24.1 27.5

Luxembourg 14.6 15.0 16.2 16.4 15.8 16.6 16.7 17.3 17.1

Hungary 20.6 21.6 23.5 22.5 20.4 19.9 19.3 21.3 23.0

Malta 20.6 20.6 22.8 24.4 23.8 22.2 23.3 22.9 23.1

Netherlands 19.1 19.5 19.4 19.2 18.9 19.4 18.6 18.4 18.7

Austria 18.6 18.2 18.3 18.7 18.3 18.2 18.1 18.8 18.8

Poland 21.7 21.9 22.2 23.2 24.0 23.8 23.2 23.3 24.4

Portugal 23.9 24.2 25.2 26.6 26.4 25.7 25.4 22.8 24.7

Romania 25.2 25.9 24.4 29.0 27.7 27.7 28.1 24.8 28.6

Slovenia 22.6 22.3 22.3 22.3 22.3 22.4 22.8 21.6 21.7

Slovakia 21.1 22.5 24.1 24.6 25.0 22.6 23.4 23.0 22.2

Finland 18.3 19.4 19.6 19.9 20.0 19.6 19.6 20.5 20.4

Sweden 18.6 18.5 18.3 18.3 18.5 19.1 20.0 20.7 21.2

United Kingdom 18.9 19.4 19.1 18.3 17.8 17.9 16.8 16.2 18.2

Iceland 26.6 26.5 27.5 27.3 27.3 26.0 24.9 23.9 22.8

Norway 19.6 19.4 18.6 18.1 18.1 19.1 17.1 18.6 18.5

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

18.3 18.0 17.9 18.0 0.4 975 902

17.3 16.9 16.8 16.9 0.0 686 434

15.7 15.5 15.2 15.2 -0.3 26 27 518

32.1 34.0 33.3 32.0 1.7 2 3 799

20.4 20.7 21.4 22.0 2.6 13 11 602

21.2 20.9 20.2 19.2 -1.0 20 24 985

18.9 18.6 18.4 18.3 1.9 23 203 081

26.0 26.6 26.0 26.6 0.0 5 1 711

20.3 20.6 20.0 20.4 -3.3 18 11 496

21.6 20.2 19.7 19.9 -1.5 19 12 676

17.0 17.2 18.2 18.5 0.7 22 64 688

15.8 15.4 15.0 15.1 -1.6 27 148 129

32.2 34.2 34.6 34.0 1.3 1 5 368

14.5 13.7 13.5 13.8 -0.5 28 96 897

24.1 25.7 24.6 25.4 -0.2 7 1 512

24.4 25.3 26.1 26.3 2.0 6 1 787

28.7 28.0 27.6 27.4 5.1 4 2 764

17.9 18.4 19.1 19.2 3.1 21 3 586

23.0 23.8 23.5 24.4 0.9 9 9 754

23.7 23.3 23.4 23.4 0.6 10 642

18.1 17.9 17.8 17.2 -2.2 25 42 708

18.5 18.5 18.1 17.9 -0.4 24 25 445

24.7 22.4 22.1 22.2 0.0 12 29 317

25.0 26.2 23.6 24.8 -0.4 8 14 672

30.5 30.1 30.1 28.0 3.6 3 11 650

22.1 21.6 22.9 23.0 0.7 11 3 153

23.4 21.2 21.1 21.4 -2.7 14 5 021

20.9 21.1 21.3 21.1 1.4 16 18 948

21.3 21.0 20.9 21.1 2.8 15 38 846

20.0 20.4 20.5 20.8 1.8 17 154 146

22.4 22.8 22.2 20.8 -6.7 1 039

18.0 18.1 19.2 19.9 1.2 29 182

Table 7: Indirect taxes as % of GDP - Taxes and duties on imports excluding VAT

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4

EA-19 0.5 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.5

Belgium 0.6 0.7 0.6 0.7 0.6 0.7 0.6 0.6 0.6

Bulgaria 1.2 1.4 1.5 1.8 1.8 0.3 0.3 0.2 0.1

Czech Republic 1.3 1.2 1.1 1.0 1.0 1.2 1.0 1.3 1.5

Denmark 0.1 0.1 0.2 0.2 0.2 0.2 0.2 0.2 0.2

Germany 0.8 0.8 0.8 0.7 0.7 0.7 0.6 0.7 0.8

Estonia 3.3 3.1 3.8 3.8 3.6 3.8 3.5 5.1 4.4

Ireland 1.4 1.4 1.7 1.8 1.8 1.7 1.8 2.0 1.9

Greece 0.2 0.2 0.2 0.2 0.2 0.2 0.3 0.3 0.2

Spain 0.1 0.1 0.2 0.2 0.2 0.2 0.2 0.1 0.2

France 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

Croatia 1.0 0.8 0.6 0.6 0.5 0.5 0.5 0.5 0.5

Italy 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

Cyprus 2.1 1.8 1.5 1.1 0.9 1.1 1.1 0.7 0.5

Latvia 0.3 0.3 0.2 0.2 0.2 0.3 0.3 0.3 0.2

Lithuania 0.5 0.5 0.5 0.3 0.2 0.3 0.3 0.3 0.3

Luxembourg 4.3 4.4 4.6 4.3 4.0 3.7 3.7 3.6 3.4

Hungary 1.1 1.1 0.3 0.2 0.2 0.1 0.1 0.1 0.1

Malta 1.0 0.9 0.5 0.3 0.3 0.3 0.2 0.2 0.2

Netherlands 1.6 1.5 1.5 1.4 1.6 1.5 1.5 1.3 1.5

Austria 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

Poland 0.9 0.9 0.6 0.5 0.5 0.5 0.4 0.3 0.3

Portugal 0.3 0.3 0.3 0.4 0.5 0.5 0.3 0.3 0.7

Romania 0.6 0.7 1.0 0.9 0.9 0.3 0.2 0.2 0.4

Slovenia 0.9 0.9 0.4 0.2 0.2 0.3 0.2 0.2 0.2

Slovakia 1.4 1.3 0.6 0.2 0.2 0.2 0.2 0.2 0.2

Finland 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

Sweden 0.1 0.1 0.1 0.2 0.2 0.2 0.2 0.2 0.2

United Kingdom 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2

Iceland 0.3 0.3 0.3 0.3 0.4 0.4 0.4 0.3 0.4

Norway 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

0.4 0.4 0.4 0.4 0.0 58 619

0.5 0.5 0.5 0.5 0.0 48 595

0.6 0.6 0.6 0.6 -0.1 7 2 368

0.1 0.2 0.2 0.2 -1.3 14 74

1.8 1.8 1.8 1.4 0.4 4 2 226

0.2 0.2 0.1 0.2 0.0 20 403

0.8 0.8 0.8 0.8 0.0 6 22 896

4.5 4.6 4.4 4.4 0.7 1 881

2.0 1.9 2.0 1.9 0.2 3 3 599

0.2 0.2 0.2 0.2 0.0 21 272

0.2 0.1 0.1 0.2 0.0 19 1 644

0.1 0.1 0.1 0.1 0.0 26 2 548

0.5 0.5 0.4 0.2 -0.5 17 70

0.1 0.1 0.1 0.1 0.0 25 2 081

0.4 0.3 0.2 0.2 -1.3 12 36

0.2 0.2 0.1 0.2 -0.1 18 37

0.3 0.3 0.3 0.3 -0.2 11 104

3.4 3.4 3.0 3.1 -1.6 2 1 499

0.1 0.1 0.1 0.1 -0.2 24 139

0.2 0.2 0.2 0.2 -0.3 13 14

1.4 1.4 1.3 1.3 -0.1 5 8 942

0.1 0.1 0.1 0.1 0.0 27 369

0.3 0.4 0.5 0.5 -0.1 9 2 258

0.7 0.7 0.6 0.6 0.2 8 954

0.5 0.5 0.4 0.4 -0.6 10 565

0.2 0.2 0.2 0.1 -0.3 23 53

0.2 0.2 0.2 0.2 -0.4 15 127

0.1 0.1 0.1 0.1 0.0 28 170

0.2 0.1 0.1 0.1 0.0 22 633

0.2 0.2 0.2 0.2 0.0 16 3 658

0.4 0.4 0.3 0.3 0.0 39

0.1 0.1 0.1 0.1 0.0 355

Table 8: Indirect taxes as % of total taxation - Taxes and duties on imports excluding VAT

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 1.2 1.1 1.1 1.1 1.1 1.0 1.0 1.0 1.1

EA-19 1.3 1.2 1.2 1.2 1.2 1.2 1.1 1.1 1.3

Belgium 1.4 1.5 1.5 1.5 1.5 1.5 1.5 1.4 1.4

Bulgaria 4.3 4.4 4.7 5.8 6.2 0.9 0.9 0.7 0.5

Czech Republic 3.8 3.6 3.1 3.0 3.1 3.4 3.1 3.9 4.5

Denmark 0.3 0.3 0.3 0.4 0.4 0.4 0.4 0.3 0.4

Germany 2.1 2.1 2.1 2.0 2.0 1.7 1.7 1.8 2.1

Estonia 10.5 10.1 12.0 12.8 11.7 12.1 11.0 14.6 13.2

Ireland 5.2 5.0 5.9 5.9 5.6 5.6 6.2 7.2 7.0

Greece 0.5 0.5 0.6 0.5 0.6 0.6 0.9 0.8 0.7

Spain 0.4 0.4 0.5 0.5 0.5 0.5 0.5 0.5 0.5

France 0.2 0.2 0.2 0.3 0.2 0.2 0.2 0.2 0.3

Croatia 2.6 2.1 1.7 1.6 1.5 1.4 1.5 1.4 1.4

Italy 0.3 0.3 0.3 0.3 0.4 0.4 0.3 0.3 0.3

Cyprus 7.6 6.2 4.9 3.4 2.9 3.1 3.0 2.3 1.7

Latvia 0.9 1.0 0.8 0.8 0.7 1.1 1.0 0.9 0.8

Lithuania 1.7 1.8 1.6 0.9 0.8 0.9 0.8 0.8 1.0

Luxembourg 11.3 11.4 12.5 11.3 10.9 10.1 9.9 9.3 9.0

Hungary 2.8 2.9 0.8 0.5 0.4 0.4 0.4 0.4 0.4

Malta 3.4 3.0 1.5 1.0 0.9 0.8 0.8 0.6 0.6

Netherlands 4.4 4.3 4.2 3.9 4.5 4.2 4.0 3.6 4.3

Austria 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3

Poland 2.7 2.8 2.0 1.6 1.4 1.3 1.2 1.1 1.1

Portugal 0.9 0.9 1.0 1.2 1.7 1.4 1.1 0.9 2.3

Romania 2.3 2.5 3.7 3.3 3.3 1.0 0.8 0.7 1.4

Slovenia 2.3 2.3 1.1 0.4 0.5 0.7 0.6 0.5 0.6

Slovakia 4.1 4.1 1.8 0.5 0.6 0.8 0.8 0.6 0.8

Finland 0.2 0.2 0.2 0.2 0.2 0.3 0.3 0.2 0.2

Sweden 0.3 0.3 0.3 0.3 0.3 0.4 0.4 0.3 0.4

United Kingdom 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.6

Iceland 0.9 0.9 0.9 0.8 1.0 1.0 1.1 1.0 1.1

Norway 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

1.2 1.1 1.1 1.1 0.0 58 619

1.3 1.2 1.2 1.2 0.0 48 595

1.3 1.3 1.3 1.3 -0.2 10 2 368

0.6 0.6 0.6 0.6 -4.1 12 74

5.2 5.2 5.0 4.2 1.1 4 2 226

0.4 0.3 0.3 0.3 0.0 24 403

2.3 2.1 2.1 2.1 0.0 6 22 896

14.2 14.5 13.9 13.7 1.6 1 881

7.2 6.8 6.8 6.4 0.5 3 3 599

0.7 0.5 0.5 0.4 -0.1 20 272

0.5 0.5 0.4 0.5 0.0 18 1 644

0.3 0.3 0.3 0.3 0.0 26 2 548

1.5 1.5 1.0 0.4 -1.3 19 70

0.3 0.3 0.3 0.3 0.0 25 2 081

1.3 1.0 0.7 0.6 -4.3 13 36

0.6 0.5 0.5 0.6 -0.3 14 37

1.0 1.0 1.0 1.0 -0.5 11 104

9.0 8.7 8.0 8.0 -4.5 2 1 499

0.4 0.3 0.3 0.3 -0.5 22 139

0.5 0.7 0.5 0.5 -1.0 16 14

4.0 3.8 3.6 3.6 -0.6 5 8 942

0.3 0.3 0.2 0.3 -0.1 27 369

1.1 1.2 1.4 1.7 -0.3 7 2 258

2.3 2.1 1.7 1.6 0.6 8 954

1.7 1.7 1.4 1.4 -2.4 9 565

0.6 0.5 0.5 0.4 -0.7 21 53

0.8 0.6 0.5 0.5 -1.3 15 127

0.2 0.2 0.2 0.2 0.0 28 170

0.4 0.3 0.3 0.3 0.0 23 633

0.5 0.5 0.5 0.5 0.0 17 3 658

1.2 1.2 0.9 0.8 -0.1 39

0.2 0.2 0.2 0.2 0.0 355

Table 9: Indirect taxes as % of GDP - Taxes on products, except VAT and import duties

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 4.0 4.0 4.0 4.0 4.0 3.9 3.7 3.7 3.7

EA-19 3.8 3.9 3.9 3.9 3.9 3.8 3.5 3.5 3.5

Belgium 3.7 3.8 3.9 3.9 3.9 3.8 3.7 3.6 3.7

Bulgaria 3.3 3.8 4.1 3.7 3.9 5.6 5.8 5.3 5.0

Czech Republic 2.4 2.6 2.7 2.9 2.9 3.1 2.7 2.7 2.7

Denmark 6.0 5.9 6.0 5.9 5.7 5.6 5.0 4.6 4.7

Germany 3.1 3.2 3.1 3.0 3.0 2.9 2.8 2.8 2.6

Estonia 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.1 0.2

Ireland 2.9 3.1 3.0 3.1 3.5 3.2 2.2 1.6 1.8

Greece 4.9 4.8 4.5 4.5 4.8 4.8 4.5 4.3 4.6

Spain 4.3 4.5 4.7 4.8 4.9 4.5 3.6 3.4 3.4

France 4.0 4.0 4.0 3.9 3.9 3.7 3.6 3.7 3.8

Croatia 5.6 5.6 5.4 5.2 5.2 5.0 4.8 4.5 4.9

Italy 4.8 4.7 4.9 4.9 5.1 4.9 4.7 5.0 4.9

Cyprus 2.8 3.7 4.3 4.2 4.1 4.3 3.8 3.5 3.7

Latvia 3.4 3.6 3.9 4.0 3.8 3.3 3.5 4.0 3.9

Lithuania 3.9 3.9 3.7 3.4 3.0 3.0 3.1 3.6 3.3

Luxembourg 1.0 1.0 1.1 1.1 1.1 1.3 1.0 0.8 0.8

Hungary 5.5 5.9 6.4 6.4 6.8 7.1 7.1 7.1 7.3

Malta 4.9 4.9 5.8 5.8 6.1 6.3 5.8 5.4 5.1

Netherlands 2.6 2.6 2.8 3.0 2.8 2.7 2.6 2.5 2.2

Austria 3.7 3.8 3.8 3.6 3.5 3.4 3.4 3.4 3.4

Poland 3.9 4.0 4.3 4.4 4.3 4.4 4.8 3.9 4.3

Portugal 5.2 5.2 5.2 5.2 5.2 5.0 4.7 4.6 4.1

Romania 3.2 3.7 3.5 3.4 3.4 3.7 3.2 3.5 3.4

Slovenia 3.8 3.7 4.0 4.0 4.0 4.0 4.0 4.6 4.8

Slovakia 2.2 2.4 3.2 3.8 3.0 3.6 2.8 3.0 3.1

Finland 5.1 5.2 4.9 4.9 4.7 4.4 4.2 4.4 4.5

Sweden 3.5 3.5 3.4 3.4 3.2 3.2 3.1 3.3 3.2

United Kingdom 4.7 4.5 4.5 4.3 4.3 4.4 4.0 4.1 4.2

Iceland 3.4 3.8 4.0 4.6 4.4 4.2 3.1 2.8 3.2

Norway 3.8 3.8 3.6 3.4 3.3 3.3 3.0 3.2 3.2

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

3.7 3.7 3.7 3.8 -0.3 523 688

3.5 3.5 3.6 3.6 -0.3 365 230

3.6 3.6 3.6 3.6 -0.3 17 14 333

5.0 5.1 5.2 4.9 0.8 7 2 112

2.9 3.2 3.2 2.7 0.0 23 4 216

4.7 4.7 4.8 4.6 -1.4 9 12 001

2.6 2.5 2.5 2.5 -0.6 24 73 253

0.3 0.2 0.2 0.2 0.0 28 30

1.6 1.6 1.7 1.8 -1.2 26 3 345

5.0 4.9 5.2 5.2 0.7 3 9 280

3.2 3.1 3.3 3.3 -1.4 18 34 408

4.0 4.1 4.1 4.2 0.2 11 89 580

4.6 4.5 5.0 5.2 -0.2 4 2 223

5.1 5.4 5.4 5.6 0.7 2 90 507

3.7 3.5 3.8 4.1 -0.2 12 706

3.7 3.6 3.6 3.7 -0.2 16 872

3.1 3.0 3.0 3.1 -0.6 20 1 116

0.8 0.8 0.8 0.9 -0.2 27 439

7.3 7.6 7.6 7.3 0.9 1 7 588

5.3 5.0 4.8 5.1 -0.7 6 415

2.2 2.0 2.2 2.3 -0.5 25 15 317

3.4 3.4 3.3 3.3 -0.5 19 10 879

4.2 4.0 4.0 3.7 -0.5 14 15 392

3.9 3.8 3.6 3.7 -1.4 15 6 488

3.4 3.8 3.6 3.9 0.3 13 5 835

4.7 5.1 5.2 5.2 1.2 5 1 925

3.0 2.9 2.9 2.9 -0.3 21 2 196

4.9 5.0 4.9 4.9 0.0 8 10 141

3.0 3.0 2.9 2.8 -0.6 22 11 874

4.2 4.2 4.2 4.3 -0.2 10 97 218

3.2 3.3 3.3 3.2 -0.9 406

3.1 2.9 2.9 2.8 -0.8 10 727

Table 10: Indirect taxes as % of total taxation - Taxes on products, except VAT and import duties

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 10.6 10.6 10.8 10.6 10.5 10.3 9.7 9.8 9.8

EA-19 9.9 10.1 10.3 10.2 10.1 9.7 9.2 9.3 9.2

Belgium 8.5 8.7 8.9 9.1 8.9 8.9 8.4 8.4 8.6

Bulgaria 12.0 12.4 13.0 12.3 13.2 17.8 18.9 19.4 19.1

Czech Republic 7.2 7.8 7.9 8.4 8.6 9.0 8.0 8.5 8.3

Denmark 13.3 12.9 12.8 12.4 12.2 12.1 11.1 10.3 10.5

Germany 8.2 8.5 8.3 8.1 7.9 7.7 7.4 7.4 7.0

Estonia 0.5 0.5 0.5 0.7 0.7 0.7 0.7 0.4 0.6

Ireland 10.5 10.7 10.1 10.4 11.1 10.3 7.6 5.7 6.5

Greece 14.8 15.1 14.8 14.2 15.4 15.1 14.3 14.0 14.4

Spain 12.9 13.6 13.8 13.7 13.6 12.4 11.2 11.5 11.0

France 9.6 9.4 9.4 9.2 9.1 8.8 8.6 8.7 9.0

Croatia 15.0 15.1 14.8 14.3 14.0 13.5 13.0 12.5 13.7

Italy 12.0 11.8 12.6 12.5 12.6 11.9 11.4 12.0 11.9

Cyprus 9.9 12.8 14.4 13.4 12.7 11.9 10.9 10.8 11.5

Latvia 12.2 13.0 14.0 14.4 13.3 11.9 12.5 14.6 13.9

Lithuania 13.4 13.5 12.7 11.7 10.0 9.9 10.3 11.9 11.7

Luxembourg 2.7 2.6 2.9 2.9 3.0 3.4 2.6 2.0 2.0

Hungary 14.8 15.7 17.3 17.5 18.5 17.9 17.9 18.1 19.6

Malta 16.7 16.6 19.2 18.5 19.0 19.3 18.1 16.5 16.4

Netherlands 7.2 7.4 7.9 8.5 7.6 7.4 7.2 7.1 6.2

Austria 8.6 8.9 9.0 8.7 8.6 8.4 8.1 8.2 8.2

Poland 11.9 12.3 13.3 13.2 12.6 12.8 13.8 12.5 13.8

Portugal 16.8 16.7 17.2 16.8 16.6 15.6 14.7 15.3 13.5

Romania 11.6 13.6 13.0 12.2 11.8 12.6 11.7 13.3 13.1

Slovenia 10.2 10.0 10.6 10.6 10.5 10.8 10.9 12.7 13.0

Slovakia 6.7 7.3 10.0 12.0 10.2 12.4 9.8 10.3 11.0

Finland 11.8 12.3 11.8 11.5 11.2 10.6 10.3 10.8 11.1

Sweden 7.8 7.7 7.4 7.2 7.0 7.0 7.1 7.5 7.3

United Kingdom 13.9 13.3 13.2 12.5 12.4 12.6 11.1 12.4 12.5

Iceland 10.0 10.6 11.0 11.7 10.8 10.7 8.8 8.7 9.5

Norway 9.1 9.1 8.6 8.0 7.7 7.9 7.2 7.8 7.7

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

9.7 9.6 9.6 9.7 -1.1 523 688

9.2 9.0 9.0 9.0 -1.3 365 230

8.3 8.0 7.9 7.9 -1.0 21 14 333

19.7 19.2 18.6 17.8 4.8 2 2 112

8.6 9.2 9.3 8.0 0.1 20 4 216

10.3 10.2 10.2 9.2 -3.6 18 12 001

6.9 6.7 6.7 6.6 -1.7 23 73 253

0.8 0.6 0.5 0.5 -0.1 28 30

5.7 5.5 5.9 5.9 -4.1 26 3 345

14.8 13.7 14.6 14.5 -0.2 4 9 280

10.2 9.6 9.9 9.8 -3.9 16 34 408

9.2 9.2 9.1 9.2 -0.3 19 89 580

13.1 12.7 13.6 14.1 -0.7 5 2 223

12.4 12.6 12.6 12.9 0.3 9 90 507

11.6 11.2 11.9 11.9 -2.6 11 706

13.5 12.7 12.6 12.8 -1.2 10 872

11.5 10.9 11.0 11.0 -1.6 14 1 116

2.2 2.1 2.1 2.4 -0.5 27 439

19.8 19.8 19.8 19.0 1.7 1 7 588

16.8 15.7 14.7 15.1 -4.1 3 415

6.1 5.5 6.1 6.2 -1.8 25 15 317

8.3 8.2 7.8 7.7 -1.3 22 10 879

13.1 12.5 12.4 11.7 -1.6 12 15 392

12.2 11.8 10.7 10.9 -6.2 15 6 488

12.3 13.7 13.2 14.0 1.0 7 5 835

12.9 13.9 14.1 14.1 3.5 6 1 925

10.6 10.4 9.7 9.4 -0.6 17 2 196

11.6 11.7 11.3 11.3 -0.5 13 10 141

7.0 7.0 6.8 6.4 -1.0 24 11 874

12.3 12.5 12.8 13.1 -0.1 8 97 218

9.4 9.5 9.0 8.1 -2.9 406

7.3 7.0 7.2 7.3 -1.3 10 727

Table 11: Indirect taxes as % of GDP - Other taxes on production

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 2.2 2.1 2.1 2.1 2.1 2.1 2.1 2.2 2.1

EA-19 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.1 2.0

Belgium 1.8 1.9 1.9 1.8 1.8 1.7 1.8 1.9 1.9

Bulgaria 0.6 0.7 0.7 0.7 0.6 0.4 0.5 0.5 0.5

Czech Republic 0.6 0.5 0.5 0.4 0.4 0.4 0.4 0.4 0.5

Denmark 1.8 1.8 1.8 1.7 1.7 1.8 1.9 2.0 2.0

Germany 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6

Estonia 0.8 0.8 0.7 0.7 0.8 0.8 0.8 0.8 0.7

Ireland 0.9 1.3 1.0 0.8 1.0 1.1 1.2 1.2 1.2

Greece 0.6 0.6 0.6 0.6 0.6 0.6 0.9 1.0 0.8

Spain 1.1 1.0 1.1 1.1 1.1 1.1 1.1 1.3 1.4

France 4.0 4.0 4.0 4.1 4.1 4.1 4.2 4.5 4.1

Croatia 0.8 0.8 0.9 0.8 0.8 0.8 0.9 0.9 0.9

Italy 3.4 3.3 3.2 3.3 3.5 3.5 3.1 2.9 2.9

Cyprus 1.1 1.7 1.8 1.8 2.1 2.7 2.3 1.9 2.0

Latvia 1.0 1.1 0.9 0.8 0.7 0.7 0.6 0.7 0.9

Lithuania 0.7 0.6 0.7 0.6 0.7 0.6 0.6 0.7 0.6

Luxembourg 1.7 1.5 1.7 1.9 2.1 2.1 1.6 1.6 1.7

Hungary 0.5 0.5 0.6 0.7 0.7 0.8 0.8 0.9 1.6

Malta 0.4 0.4 0.4 0.6 0.5 0.5 0.5 0.5 0.6

Netherlands 1.0 1.0 1.0 1.0 0.9 0.9 0.9 1.1 1.1

Austria 3.2 3.2 3.0 3.0 2.9 2.9 3.0 3.2 3.1

Poland 1.6 1.6 1.6 1.4 1.5 1.4 1.5 1.5 1.5

Portugal 1.1 1.5 0.8 0.8 0.9 0.9 1.0 1.1 1.0

Romania 0.6 0.6 0.5 0.5 0.6 0.6 0.5 0.6 0.6

Slovenia 2.5 2.7 2.8 2.8 2.4 2.1 1.6 1.0 1.1

Slovakia 1.0 0.9 0.9 1.0 0.8 0.8 0.8 0.8 0.8

Finland 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1

Sweden 11.1 10.9 10.6 10.6 10.3 10.3 10.4 10.2 9.9

United Kingdom 1.6 1.5 1.5 1.5 1.5 1.4 1.5 1.6 1.8

Iceland 2.6 2.7 2.8 2.8 3.1 3.1 2.8 2.5 2.4

Norway 0.9 0.9 0.9 0.8 0.8 0.8 0.9 0.8 0.8

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

2.2 2.4 2.4 2.4 0.3 339 999

2.1 2.3 2.3 2.4 0.4 243 498

2.0 2.3 2.2 2.2 0.3 7 8 851

0.5 0.5 0.5 0.5 -0.2 25 235

0.6 0.6 0.5 0.5 0.0 27 749

2.1 2.1 2.3 2.3 0.5 6 5 916

0.7 0.7 0.7 0.7 0.0 23 19 231

0.7 0.7 0.7 0.8 0.1 22 158

1.2 1.3 1.4 1.6 0.5 14 2 938

1.1 1.4 1.8 3.2 2.7 5 5 709

1.4 1.8 1.8 1.9 0.9 9 20 083

4.2 4.4 4.5 4.6 0.6 2 98 650

1.0 1.0 1.0 1.0 0.2 20 442

2.9 3.8 3.6 3.7 0.5 3 59 954

2.0 2.1 2.1 2.1 0.2 8 362

1.0 1.1 1.1 1.2 0.3 18 292

0.6 0.6 0.6 0.6 -0.1 24 223

1.6 1.6 1.7 1.8 0.1 11 864

1.6 1.8 1.9 1.9 1.2 10 1 956

0.5 0.5 0.4 0.5 0.1 26 41

1.1 1.1 1.2 1.6 0.6 13 10 478

3.3 3.3 3.4 3.4 0.4 4 11 271

1.5 1.5 1.4 1.5 -0.1 16 6 076

1.2 1.2 1.5 1.5 0.7 15 2 625

0.6 0.6 0.6 0.9 0.4 21 1 313

1.1 1.3 1.4 1.4 -1.4 17 505

0.8 1.0 1.1 1.1 0.2 19 828

0.1 0.1 0.2 0.2 0.1 28 436

9.9 10.2 10.3 10.2 -0.4 1 43 805

1.6 1.6 1.6 1.6 0.1 12 36 008

2.3 2.5 2.7 4.2 1.5 545

0.7 0.7 0.7 0.8 -0.1 2 941

Table 12: Indirect taxes as % of total taxation - Other taxes on production

2002 2003 2004 2005 2006 2007 2008 2009 2010

EU-28 5.7 5.7 5.6 5.6 5.5 5.5 5.5 5.8 5.7

EA-19 5.3 5.3 5.2 5.3 5.3 5.3 5.2 5.5 5.3

Belgium 4.2 4.4 4.3 4.1 4.2 4.0 4.2 4.5 4.5

Bulgaria 2.2 2.2 2.2 2.3 1.9 1.4 1.7 1.9 2.0

Czech Republic 1.8 1.5 1.5 1.3 1.2 1.2 1.2 1.2 1.5

Denmark 3.9 3.9 3.8 3.6 3.7 3.9 4.2 4.5 4.5

Germany 1.6 1.6 1.7 1.7 1.6 1.6 1.5 1.7 1.6

Estonia 2.7 2.5 2.3 2.4 2.5 2.6 2.5 2.2 2.2

Ireland 3.3 4.4 3.5 2.7 3.3 3.4 4.0 4.3 4.3

Greece 1.7 1.8 1.8 1.8 2.1 1.9 2.7 3.3 2.5

Spain 3.4 3.2 3.1 3.1 3.1 3.0 3.4 4.2 4.3

France 9.4 9.4 9.6 9.7 9.5 9.7 9.8 10.8 9.7

Croatia 2.2 2.2 2.4 2.2 2.2 2.3 2.4 2.5 2.6

Italy 8.6 8.4 8.1 8.6 8.6 8.5 7.6 7.0 7.0

Cyprus 3.8 5.9 6.2 5.6 6.6 7.5 6.6 6.0 6.2

Latvia 3.7 3.9 3.4 3.0 2.5 2.4 2.1 2.7 3.4

Lithuania 2.3 2.1 2.5 2.2 2.2 2.1 1.8 2.2 2.3

Luxembourg 4.4 4.1 4.5 5.0 5.7 5.6 4.4 4.0 4.5

Hungary 1.3 1.4 1.7 1.8 1.8 2.1 2.1 2.4 4.2

Malta 1.3 1.5 1.3 1.8 1.7 1.5 1.5 1.7 1.9

Netherlands 2.7 2.7 2.7 2.8 2.6 2.5 2.6 3.0 3.0

Austria 7.4 7.5 7.2 7.2 7.2 7.1 7.2 7.7 7.7

Poland 4.9 4.8 4.8 4.3 4.5 4.1 4.4 4.7 4.7

Portugal 3.4 4.7 2.7 2.7 2.8 2.9 3.1 3.5 3.3

Romania 2.2 2.2 1.7 1.8 2.0 1.9 2.0 2.2 2.1

Slovenia 6.7 7.3 7.4 7.5 6.5 5.6 4.3 2.8 3.0

Slovakia 3.0 2.9 2.9 3.1 2.8 2.7 2.6 2.8 2.8

Finland 0.5 0.5 0.3 0.2 0.2 0.2 0.2 0.3 0.3

Sweden 24.5 24.0 23.2 22.8 22.4 22.8 23.7 23.2 22.8

United Kingdom 4.9 4.6 4.4 4.3 4.2 4.2 4.2 4.9 5.3

Iceland 7.6 7.6 7.6 7.1 7.7 8.1 7.8 7.7 7.3

Norway 2.2 2.2 2.1 1.9 2.0 1.9 2.1 2.0 1.9

(1) In percentage points.

(2) In millions of euro.

See explanatory notes in Annex B.

Source: DG Taxation and Customs Union, based on Eurostat data

Difference (1) Ranking Revenue (2)

2011 2012 2013 2014 2004 to 2014 2014 2014

5.8 6.2 6.2 6.3 0.7 339 999

5.4 5.9 5.8 6.0 0.8 243 498

4.6 5.2 4.8 4.9 0.6 10 8 851

2.0 1.9 1.8 2.0 -0.2 24 235

1.7 1.6 1.4 1.4 -0.1 27 749

4.6 4.6 4.8 4.6 0.8 14 5 916

1.8 1.8 1.7 1.7 0.1 25 19 231

2.3 2.3 2.3 2.5 0.1 22 158

4.3 4.5 4.9 5.2 1.8 8 2 938

3.4 4.0 5.2 8.9 7.1 3 5 709

4.6 5.5 5.6 5.7 2.7 7 20 083

9.8 9.9 10.0 10.1 0.5 2 98 650

2.7 2.7 2.7 2.8 0.4 21 442

7.1 8.8 8.2 8.6 0.4 4 59 954

6.2 6.5 6.5 6.1 -0.1 6 362

3.8 3.8 3.9 4.3 0.9 16 292

2.2 2.2 2.1 2.2 -0.2 23 223

4.1 4.1 4.3 4.6 0.1 12 864

4.4 4.7 5.1 4.9 3.2 9 1 956

1.5 1.5 1.4 1.5 0.2 26 41

3.0 3.1 3.4 4.2 1.5 17 10 478

7.9 8.0 7.9 7.9 0.7 5 11 271

4.6 4.6 4.4 4.6 -0.2 13 6 076

3.7 3.8 4.4 4.4 1.7 15 2 625

2.0 2.0 2.1 3.2 1.4 20 1 313

3.1 3.4 3.7 3.7 -3.7 18 505

2.7 3.5 3.5 3.5 0.7 19 828

0.3 0.2 0.4 0.5 0.2 28 436

23.3 24.1 24.0 23.8 0.6 1 43 805

4.6 4.9 4.9 4.9 0.5 11 36 008

6.8 7.2 7.4 10.9 3.3 545

1.8 1.7 1.8 2.0 -0.1 2 941

You might also like

- Arjun Dev - Story of Civilisation NCERTDocument289 pagesArjun Dev - Story of Civilisation NCERTamit75% (4)

- Demag - Terex Roadmaster5300Document5 pagesDemag - Terex Roadmaster5300Bharadwaj RangarajanNo ratings yet

- Baume Brix Conversion ChartDocument1 pageBaume Brix Conversion ChartHoang TanNo ratings yet

- Attributes of Todays Global SystemDocument30 pagesAttributes of Todays Global SystemRandomly Random60% (5)

- Europe Since Napoleon by David ThomsonDocument1,028 pagesEurope Since Napoleon by David ThomsonParitosh SinghNo ratings yet

- War and Warfare in Late Antiquity (2 Vol. Set) : Current PerspectivesDocument1,121 pagesWar and Warfare in Late Antiquity (2 Vol. Set) : Current Perspectivesdavay100% (13)

- Table 3: Indirect Taxes As % of GDPDocument30 pagesTable 3: Indirect Taxes As % of GDPBogdan Iustin MNo ratings yet

- Annex Table 38. Export Volumes of Goods and Services: Source: OECD Economic Outlook 88 DatabaseDocument17 pagesAnnex Table 38. Export Volumes of Goods and Services: Source: OECD Economic Outlook 88 DatabaseRaghvendra NarayanNo ratings yet

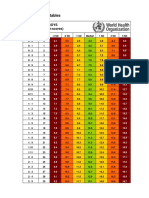

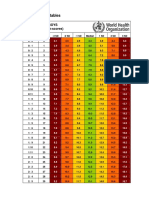

- BB - U - Laki Laki 0-5 TahunDocument2 pagesBB - U - Laki Laki 0-5 Tahunnurdin aji iskandarNo ratings yet

- Simplified Field Tables: Weight-For-Age BOYS Birth To 5 Years (Z-Scores)Document2 pagesSimplified Field Tables: Weight-For-Age BOYS Birth To 5 Years (Z-Scores)raja yasminNo ratings yet

- Boys Bbu 05tDocument2 pagesBoys Bbu 05tapi-3709364No ratings yet

- Weight 0 5 BoyDocument2 pagesWeight 0 5 Boyngthivinhtrinh08No ratings yet

- Tabel Z Score X LMSDocument22 pagesTabel Z Score X LMSadllndyntNo ratings yet

- WFA Boys 0 5 PercentilesDocument3 pagesWFA Boys 0 5 PercentilesSiti Nurul JanahNo ratings yet

- WFA Girls 0 5 PercentilesDocument3 pagesWFA Girls 0 5 PercentilesJohnnathan MolinaNo ratings yet

- ANAK - Interpretasi WHO BOYDocument34 pagesANAK - Interpretasi WHO BOYJohan KevinNo ratings yet

- Who Boys Rda + InterpretDocument34 pagesWho Boys Rda + InterpretrinaNo ratings yet

- BP Stats Review 2018 All DataDocument111 pagesBP Stats Review 2018 All DataNeeraj YadavNo ratings yet

- Alcance GrograficoDocument2 pagesAlcance GrograficoETSM libretadecalculoNo ratings yet

- Wfa Boys 0 5 ZscoresDocument3 pagesWfa Boys 0 5 Zscoresquirinohrh2022No ratings yet

- Boys TBL Bbu 05tDocument3 pagesBoys TBL Bbu 05tapi-3709364No ratings yet

- Simplified Field TableDocument19 pagesSimplified Field TableIka KusumaNo ratings yet

- Educ - Thpertch-Teachers and Trainers Age Distributions - Pupils To Teachers RatioDocument10 pagesEduc - Thpertch-Teachers and Trainers Age Distributions - Pupils To Teachers RatioDesa MarkovicNo ratings yet

- Table 1: Health Expenditure in OECD Countries, 2000 To 2006Document8 pagesTable 1: Health Expenditure in OECD Countries, 2000 To 2006snamicampaniaNo ratings yet

- BP Statistical ReviewDocument158 pagesBP Statistical Reviewbrayan7uribeNo ratings yet

- IMF - WEO - 202004 - Statistical Appendix - Tables B PDFDocument8 pagesIMF - WEO - 202004 - Statistical Appendix - Tables B PDFAnna VassilovskiNo ratings yet

- Asignatura: Irrigaciones DOCENTE: Mg. Ing. Gorki Federico Ascue SalasDocument1 pageAsignatura: Irrigaciones DOCENTE: Mg. Ing. Gorki Federico Ascue SalasDerian Duran AymachoqueNo ratings yet

- WFA Girls 0 5 Zscores PDFDocument3 pagesWFA Girls 0 5 Zscores PDFRome AdolNo ratings yet

- Peso para La Edad Nacimiento A 5 Años (Puntajes Z)Document3 pagesPeso para La Edad Nacimiento A 5 Años (Puntajes Z)gerardoNo ratings yet

- Tabla 0 - 5 Años - ZscoresDocument3 pagesTabla 0 - 5 Años - ZscoresSteeven CampañaNo ratings yet

- WFA Girls 0 5 Zscores PDFDocument3 pagesWFA Girls 0 5 Zscores PDFsilvia silalahiNo ratings yet

- Girls TBL Bbu 05tDocument3 pagesGirls TBL Bbu 05tapi-3709364No ratings yet

- BP Statistical Review of World Energy 2017 Underpinning DataDocument69 pagesBP Statistical Review of World Energy 2017 Underpinning DatadairandexNo ratings yet

- SFT Wfa Girls P 0 5 PDFDocument2 pagesSFT Wfa Girls P 0 5 PDFBouzed26 SadekNo ratings yet

- Bmi Boys 0 13 PercentilesDocument1 pageBmi Boys 0 13 Percentilesshub56jainNo ratings yet

- Calculos - Chinchaypujio 2022 - MolinoDocument51 pagesCalculos - Chinchaypujio 2022 - MolinoMARUJA CARRION LEGUIANo ratings yet

- Fold # Mark 1 Mark 2 Fold # Mark 1 Mark 2Document4 pagesFold # Mark 1 Mark 2 Fold # Mark 1 Mark 2richardNo ratings yet

- A3.2A - Ma. Elena A. MosqueiraDocument3 pagesA3.2A - Ma. Elena A. Mosqueiraelena mosqueiraNo ratings yet

- Girls TBL Imt 013mDocument1 pageGirls TBL Imt 013mapi-3709364No ratings yet

- IMC para La Edad Desde El Nacimiento Hasta Las 13 Semanas (Puntuaciones Z)Document1 pageIMC para La Edad Desde El Nacimiento Hasta Las 13 Semanas (Puntuaciones Z)gerardoNo ratings yet

- Table 53: Taxes On Capital As % of GDP - TotalDocument30 pagesTable 53: Taxes On Capital As % of GDP - TotalRalwkwtza NykoNo ratings yet

- SFT Wfa Boys P 0 5Document2 pagesSFT Wfa Boys P 0 5Roxanne Christer-ThomasNo ratings yet

- Bmifa Girls 5 19years PerDocument7 pagesBmifa Girls 5 19years PerElisabeth HertyasningNo ratings yet

- Boys TBL Lila 3b5tDocument3 pagesBoys TBL Lila 3b5tapi-3709364No ratings yet

- Arm Circumference-For-Age BOYS: 3 Months To 5 Years (Z-Scores)Document3 pagesArm Circumference-For-Age BOYS: 3 Months To 5 Years (Z-Scores)paklay2No ratings yet

- Dipping Distance M MilesDocument1 pageDipping Distance M MilesKingLester De LeonNo ratings yet

- Horticulture Table 9.9 - Major Fruits and Vegetables Producing Countries in The World (A) FruitsDocument1 pageHorticulture Table 9.9 - Major Fruits and Vegetables Producing Countries in The World (A) Fruitsrnithun abybabyNo ratings yet

- Boys Simplified CompleteDocument14 pagesBoys Simplified Completemaruko.chadutsNo ratings yet

- Boys TBL Imt 013mDocument1 pageBoys TBL Imt 013mapi-3709364No ratings yet

- BP Statistical Review of World Energy 2017 Underpinning DataDocument70 pagesBP Statistical Review of World Energy 2017 Underpinning DataThales MacêdoNo ratings yet

- Arm Circumference-For-Age GIRLS: 3 Months To 5 Years (Z-Scores)Document3 pagesArm Circumference-For-Age GIRLS: 3 Months To 5 Years (Z-Scores)paklay2No ratings yet

- Girls TBL Lila 3b5tDocument3 pagesGirls TBL Lila 3b5tapi-3709364No ratings yet

- Hour (GMT +8) Eurusd Gbpusd Audusd Nzdusd Usdchf Usdcad Hour (GMT) UsdjpyDocument3 pagesHour (GMT +8) Eurusd Gbpusd Audusd Nzdusd Usdchf Usdcad Hour (GMT) UsdjpyAznamryNo ratings yet

- Continuous Infusion Rate ChartDocument2 pagesContinuous Infusion Rate ChartabeNo ratings yet

- Outlier FEGSDocument6 pagesOutlier FEGSFreddy Gallo SanchezNo ratings yet

- Normal MetsDocument2 pagesNormal Metsdr.chetan2385No ratings yet

- Girls TBL Tris 3b5tDocument3 pagesGirls TBL Tris 3b5tapi-3709364No ratings yet

- General Average (26 Credits)Document30 pagesGeneral Average (26 Credits)chill kinokoNo ratings yet

- Charlot and KidDocument7 pagesCharlot and Kidana nuñezNo ratings yet

- Chat TatooDocument9 pagesChat Tatooana nuñezNo ratings yet

- Todas Las Notas LegislaciónDocument1 pageTodas Las Notas LegislaciónJineth Ortiz RamosNo ratings yet

- Chapter 13: International Comparisons: 2015 Annual Data Report V 2: E - S R DDocument51 pagesChapter 13: International Comparisons: 2015 Annual Data Report V 2: E - S R DPankaj DasNo ratings yet

- Mba Employment StatisticsDocument27 pagesMba Employment Statisticsrah98No ratings yet

- Origins and History of Haplogroup R1b Y PDFDocument22 pagesOrigins and History of Haplogroup R1b Y PDFtrenix100% (1)

- Presentation On Cultural Ethics and Business Etiquette ofDocument15 pagesPresentation On Cultural Ethics and Business Etiquette ofVicky GuptaNo ratings yet

- Intrastat Threshold TableDocument1 pageIntrastat Threshold TableJulian LiciNo ratings yet

- The Celtic KingdomsDocument2 pagesThe Celtic Kingdomssee_monaNo ratings yet

- Napoleon BonaparteDocument16 pagesNapoleon BonaparteLamSalamNo ratings yet

- ENR The Top 225 International Design Firms 2013 PDFDocument96 pagesENR The Top 225 International Design Firms 2013 PDFafonsobmNo ratings yet

- CumansDocument2 pagesCumansEl SulNo ratings yet

- Back To The Future Environmental Security inDocument14 pagesBack To The Future Environmental Security inAlejandro Carrasco LunaNo ratings yet

- Deutsches Volk-Deutsche Arbeit:German People, German Work, The Alliance of Worker and Work (1934)Document10 pagesDeutsches Volk-Deutsche Arbeit:German People, German Work, The Alliance of Worker and Work (1934)jd.jas450No ratings yet

- 02 - Feudalism and Manor System Notes Page 2Document3 pages02 - Feudalism and Manor System Notes Page 2Jade McDanielNo ratings yet

- 03 7-3 Napoleon Forges An EmpireDocument10 pages03 7-3 Napoleon Forges An Empireapi-203319377No ratings yet

- A Quick Overview of Irish HistoryDocument1 pageA Quick Overview of Irish HistoryPilar AldaNo ratings yet

- Indo-European LanguagesDocument3 pagesIndo-European LanguagesAlex Ionut OrbanNo ratings yet

- Section I: Listening (2.6Pts) Part 1: Choose The Correct Letter A, B or C. Course FeedbackDocument14 pagesSection I: Listening (2.6Pts) Part 1: Choose The Correct Letter A, B or C. Course FeedbackChi LuongNo ratings yet

- (Oxford Studies in Modern European History) Garavini, Giuliano-After Empires - European Integration, Decolonization, and The Challenge From The Global South 1957-1986-Oxford University Press (2012)Document302 pages(Oxford Studies in Modern European History) Garavini, Giuliano-After Empires - European Integration, Decolonization, and The Challenge From The Global South 1957-1986-Oxford University Press (2012)Alan FocNo ratings yet

- BossyDocument3 pagesBossyAradhya JainNo ratings yet

- The Byzantine EmpireDocument2 pagesThe Byzantine EmpireSophie Cor - PéNo ratings yet

- Peter The GreatDocument3 pagesPeter The GreatJeremy HongNo ratings yet

- European Hedgehog: Hedgehog Species Western Europe Spain Italy Scandinavia Habitat Gardens Insectivorous UK NocturnalDocument1 pageEuropean Hedgehog: Hedgehog Species Western Europe Spain Italy Scandinavia Habitat Gardens Insectivorous UK NocturnalNitesh KotianNo ratings yet

- Tepeledenli Ali Paša PDFDocument118 pagesTepeledenli Ali Paša PDFAleksandarNo ratings yet

- Ba History Hons & Ba Prog History-3rd SemDocument73 pagesBa History Hons & Ba Prog History-3rd SemBasundhara ThakurNo ratings yet

- Military Review December 1968Document112 pagesMilitary Review December 1968mikle97No ratings yet

- Comparison of Road Traffic Death and Injury Rates at Pedestrian CrossingsDocument14 pagesComparison of Road Traffic Death and Injury Rates at Pedestrian Crossingsjhess QuevadaNo ratings yet

- Kyiv Is The Capital of UkraineDocument15 pagesKyiv Is The Capital of UkraineМар'яна ПолуйкоNo ratings yet

- The European UnionDocument2 pagesThe European Unionعلی خانNo ratings yet