Professional Documents

Culture Documents

Key Deal Issues

Key Deal Issues

Uploaded by

Anthony AlferesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Key Deal Issues

Key Deal Issues

Uploaded by

Anthony AlferesCopyright:

Available Formats

Key Deal Issues

(1) Built Operate Transfer Agreement with NPC (January 11, 1993 to July 25, 2010)

FPPC signed a BOT agreement with NPC to build and operate a bunker-fired power plant. 15 year Co-

operation period.

With PPP, the private sector finds a new and wider market in which to expand and invest its finances

in a stable, long-term cash flow. Infrastructure PPPs in the water, transportation, energy, and telecom

sectors are experiencing a boom

Allocation of management of risks to the players is the underlying driver of PPPS. That is, the public-

sector bears risks related to politics and, to some extent, economics. The private sector typically bears

commercial risks. The sharing of risk enables both public and private players to focus their strengths and

resources for the projects benefit.

Source:

PublicPrivate Partnerships A New Catalyst for Economic Growth (Sheldlac, et. Al, 2008)

https://www.strategyand.pwc.com/media/uploads/Public-Private-Partnerships

(2) Merger with First Private Power Corporation (December 13, 2010)

-First Gen, JG Summit, and Meralco became direct owners of BPPC but their shareholder value was

reduced.

including contingent liabilities

As before, many assets and liabilities will be measured at fair value, including intangible assets and

contingent liabilities. The revised standard continues the requirement for identification of intangible

assets, with very few intangibles being excluded from identification and valuation. The timely

identification of the nature and possible value of intangible assets remains important, as this affects post-

deal earnings. Indeed, where possible, the potential impact on earnings should be modelled pre-

acquisition. This may affect the scope and timing of an acquirers due-diligence exercise.

Source:

IFRS 3 (Revised): Impact on earnings

https://www.pwc.com/gx/en/ifrs-reporting/pdf/ifrs3r

(3) Financial Investments

You might also like

- Bot, Boot, DbfotDocument20 pagesBot, Boot, DbfotKaushik ChandraNo ratings yet

- Issues in PPPDocument39 pagesIssues in PPPHari Prasad100% (1)

- Government Objectives Benefits and Risks of PPPsDocument2 pagesGovernment Objectives Benefits and Risks of PPPsLen AmaNo ratings yet

- Government Objectives Benefits and Risks of PPPsDocument2 pagesGovernment Objectives Benefits and Risks of PPPsBinayak GhimireNo ratings yet

- 001 - THE BASIC PUBLIC FINANCE OF - Engel FisherDocument30 pages001 - THE BASIC PUBLIC FINANCE OF - Engel FisherAlumnoNo ratings yet

- Investment For African Development: Making It Happen: Nepad/Oecd Investment InitiativeDocument37 pagesInvestment For African Development: Making It Happen: Nepad/Oecd Investment InitiativeAngie_Monteagu_6929No ratings yet

- ARTIGO - Risks, Contracts and Private Sector Participation in InfrastructureDocument16 pagesARTIGO - Risks, Contracts and Private Sector Participation in InfrastructureRenato DeákNo ratings yet

- 1208 Transportation Istrate PuentesDocument28 pages1208 Transportation Istrate Puentesasdf789456123No ratings yet

- Regulacion FinancieraDocument16 pagesRegulacion FinancieraCadenasso CadenassoNo ratings yet

- PTC, ITC, or Cash GrantDocument21 pagesPTC, ITC, or Cash GrantNicolas TroussardNo ratings yet

- A Comparative Analysis of PPP Financing PDFDocument14 pagesA Comparative Analysis of PPP Financing PDFRuslan KuzhekovNo ratings yet

- PPPsuccess StoriesDocument114 pagesPPPsuccess StoriesRoberto Gonzalez BustamanteNo ratings yet

- The Renegotiation On PPP Contracts and Subsidy efficiency2020IOP Conference Series Materials Science and EngineeringDocument10 pagesThe Renegotiation On PPP Contracts and Subsidy efficiency2020IOP Conference Series Materials Science and EngineeringRhre RherNo ratings yet

- 022 Article A014 enDocument4 pages022 Article A014 enmarijaandonova1992No ratings yet

- Introduction To The Special Issue On Public-Private PartnershipsDocument4 pagesIntroduction To The Special Issue On Public-Private PartnershipsAnonymous ccKWhugejuNo ratings yet

- Public-Private Partnerships Some Lessons After 30 YearsDocument6 pagesPublic-Private Partnerships Some Lessons After 30 YearsVictoria WNo ratings yet

- National Monetization PipelineDocument4 pagesNational Monetization PipelinemouliNo ratings yet

- Project Finance Assignment: Student Name Institutional Affiliation Course Number and Name Professor's Name DateDocument12 pagesProject Finance Assignment: Student Name Institutional Affiliation Course Number and Name Professor's Name DateFREDRICKNo ratings yet

- Involving The Private Sector and Ppps in Financing Public Investments: Some Opportunities and ChallengesDocument37 pagesInvolving The Private Sector and Ppps in Financing Public Investments: Some Opportunities and Challengestahirawan82No ratings yet

- Bankability of RE Project, A PaperDocument19 pagesBankability of RE Project, A PaperJinlong MaNo ratings yet

- Defining PublicPrivate Partnerships - 9-14Document6 pagesDefining PublicPrivate Partnerships - 9-14praveenmohantyNo ratings yet

- Public - Private PartnershipDocument5 pagesPublic - Private PartnershipJhon Russel Cruz AntonioNo ratings yet

- Guidelines For Auditing Public Private Partnership Projects: Pramode .K. Mishra, Director General (Commercial)Document55 pagesGuidelines For Auditing Public Private Partnership Projects: Pramode .K. Mishra, Director General (Commercial)Aniket KumarNo ratings yet

- Project Finance Is The Long TermDocument6 pagesProject Finance Is The Long Termnirgude_swapnilNo ratings yet

- Public-Private Partnerships (PPPS) in Egovernment: Definition, Rationale, and Regulatory FrameworksDocument34 pagesPublic-Private Partnerships (PPPS) in Egovernment: Definition, Rationale, and Regulatory FrameworksSoenarto SoendjajaNo ratings yet

- Project Finance Is The Long TermDocument5 pagesProject Finance Is The Long TermsrinivaspdfNo ratings yet

- A Review of Public Private Partnership On Some Development Projects in NigeriaDocument12 pagesA Review of Public Private Partnership On Some Development Projects in NigeriaInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- 056 LamechDocument4 pages056 LamechaasgroupNo ratings yet

- Financing CT TextDocument20 pagesFinancing CT Textpan356No ratings yet

- A Comparative Analysis of PPP Financing PDFDocument14 pagesA Comparative Analysis of PPP Financing PDFDIANNo ratings yet

- Economic 3Document15 pagesEconomic 3Ahmed JassimNo ratings yet

- IPP Rating MethodologyDocument9 pagesIPP Rating MethodologyRana Naeem AhmedNo ratings yet

- PWC Offshore WindDocument20 pagesPWC Offshore WindChubakabarabakaNo ratings yet

- Controlling Risk Without Gimmicks: New York's Infrastructure Crisis and Public-Private PartnershipsDocument15 pagesControlling Risk Without Gimmicks: New York's Infrastructure Crisis and Public-Private PartnershipsnreismanNo ratings yet

- Excess Returns in Public Private Partnerships Do Governm - 2021 - Economic ModeDocument14 pagesExcess Returns in Public Private Partnerships Do Governm - 2021 - Economic ModeThảo Trần Thị ThuNo ratings yet

- Imperfect Bundling in Public-Private Partnerships: Luciano GRECODocument20 pagesImperfect Bundling in Public-Private Partnerships: Luciano GRECOJuan Manuel Báez CanoNo ratings yet

- 06 Libya PSP in RE Report FinalDocument233 pages06 Libya PSP in RE Report FinalCésar AndrésNo ratings yet

- 5-Public Private PartnershipsDocument12 pages5-Public Private PartnershipscpamutuiNo ratings yet

- Lessons From PFI and Other Projects: Report by The Comptroller and Auditor GeneralDocument9 pagesLessons From PFI and Other Projects: Report by The Comptroller and Auditor Generalshitake999No ratings yet

- WCTR 04Document12 pagesWCTR 04Andrianto SetiawanNo ratings yet

- How To Finance A Nuclear Programme?: Roundtable - Monday 8 March - 2:00Document6 pagesHow To Finance A Nuclear Programme?: Roundtable - Monday 8 March - 2:00ahmednppNo ratings yet

- Economics and The Built Environment: EssayDocument4 pagesEconomics and The Built Environment: Essaysalar AHMEDNo ratings yet

- Report On Ex-Post Risk Analysis in Public Partnership ProjectsDocument10 pagesReport On Ex-Post Risk Analysis in Public Partnership ProjectsswankyNo ratings yet

- This Content Downloaded From 157.42.109.45 On Wed, 02 Jun 2021 20:36:05 UTCDocument9 pagesThis Content Downloaded From 157.42.109.45 On Wed, 02 Jun 2021 20:36:05 UTCuttam krNo ratings yet

- IIGF Role and Government Support in Indonesian PPP Infrastructure ProjectDocument18 pagesIIGF Role and Government Support in Indonesian PPP Infrastructure ProjectUrban Community of PracticeNo ratings yet

- Investors and Green Infrastructure Web 2013Document12 pagesInvestors and Green Infrastructure Web 2013OECD_envNo ratings yet

- Infrastructure Development Through Public-Privat Partnership in AfricaDocument36 pagesInfrastructure Development Through Public-Privat Partnership in Africaawaseso100% (1)

- Public Private PartnershipsDocument4 pagesPublic Private PartnershipsshahriarsadighiNo ratings yet

- Project Finance For Offshore Wind A Practitioner's View: EWEC 2010Document9 pagesProject Finance For Offshore Wind A Practitioner's View: EWEC 2010Joseph FrereNo ratings yet

- PPP Gov ConDocument2 pagesPPP Gov ConConnieAllanaMacapagaoNo ratings yet

- Ba - LL.B (H .) : Niversity OF Etroleum Nergy Tudies Chool OF LAWDocument14 pagesBa - LL.B (H .) : Niversity OF Etroleum Nergy Tudies Chool OF LAWArushi KumarNo ratings yet

- Facilitating BOT Projects in The Philippines Amid The Asian Financial TurmoilDocument9 pagesFacilitating BOT Projects in The Philippines Amid The Asian Financial TurmoilMustaffah KabelyyonNo ratings yet

- Central Luzon Link Expressway Phase IIDocument13 pagesCentral Luzon Link Expressway Phase IIAngel YuNo ratings yet

- Public Investmenrt and Private Formation in A VEC Model of Growth - GhaliDocument9 pagesPublic Investmenrt and Private Formation in A VEC Model of Growth - GhaliCarlos Castillo PerezNo ratings yet

- " F R E P ": Inancing The Enewable Nergy RojectsDocument6 pages" F R E P ": Inancing The Enewable Nergy Rojectsanjana meenaNo ratings yet

- Special Purpose Vehicle (SPV) of Public Private Partnership Projects in Asia and Mediterranean Middle East: Trends and TechniquesDocument25 pagesSpecial Purpose Vehicle (SPV) of Public Private Partnership Projects in Asia and Mediterranean Middle East: Trends and TechniquesKanraMendozaNo ratings yet

- Federal Funding ResourcesDocument4 pagesFederal Funding ResourcesjohnribarNo ratings yet

- Renewable energy finance: Sovereign guaranteesFrom EverandRenewable energy finance: Sovereign guaranteesNo ratings yet

- Introduction to Project Finance in Renewable Energy Infrastructure: Including Public-Private Investments and Non-Mature MarketsFrom EverandIntroduction to Project Finance in Renewable Energy Infrastructure: Including Public-Private Investments and Non-Mature MarketsNo ratings yet

- Macro Analysis PhilippinesDocument9 pagesMacro Analysis PhilippinesAnthony AlferesNo ratings yet

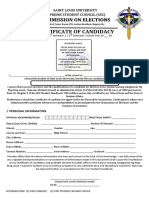

- Comelec Official List of Candidates 2016Document8 pagesComelec Official List of Candidates 2016Anthony AlferesNo ratings yet

- Comelec Distribution FormDocument1 pageComelec Distribution FormAnthony AlferesNo ratings yet

- Comelec - Certificate of CandidacyDocument2 pagesComelec - Certificate of CandidacyAnthony AlferesNo ratings yet

- Comelec Party RegistrationDocument1 pageComelec Party RegistrationAnthony AlferesNo ratings yet