Professional Documents

Culture Documents

Urrency Forecast: $ Continued To Weaken Vs Other Major Currencies

Urrency Forecast: $ Continued To Weaken Vs Other Major Currencies

Uploaded by

princeasatiCopyright:

Available Formats

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- Presented By:: Aakriti Bajaj Ritesh Singh Shalini Kumari Shweta SinghDocument14 pagesPresented By:: Aakriti Bajaj Ritesh Singh Shalini Kumari Shweta SinghShweta SinghNo ratings yet

- U.S. Dollar vs. Indian RupeeDocument4 pagesU.S. Dollar vs. Indian RupeeVinoth RokzNo ratings yet

- Weekly Views From The Metro: HighlightsDocument3 pagesWeekly Views From The Metro: HighlightsRobert RamirezNo ratings yet

- Special Report USDINRDocument7 pagesSpecial Report USDINRtanishaj86No ratings yet

- Daily FX Update: Europe Provides Offset To Worrisome China PmiDocument3 pagesDaily FX Update: Europe Provides Offset To Worrisome China PmiMohd Sofian YusoffNo ratings yet

- Ficc Times // /: The Week Gone by and The Week AheadDocument5 pagesFicc Times // /: The Week Gone by and The Week Aheadr_squareNo ratings yet

- Market Outlook Report 22 April 2013Document4 pagesMarket Outlook Report 22 April 2013zenergynzNo ratings yet

- Ranges (Up Till 11.30am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470No ratings yet

- CPI, Interest Rates and Employment Rates Affecting AUD/USDDocument15 pagesCPI, Interest Rates and Employment Rates Affecting AUD/USDuchiha_rhenzakiNo ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- Daily Technical Analysis Report 23/october/2015Document14 pagesDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedNo ratings yet

- FX Weekly - Jan 22 - Jan 28 2012Document5 pagesFX Weekly - Jan 22 - Jan 28 2012James PutraNo ratings yet

- Global Macro Roundup & Preview (26 July, 2017)Document8 pagesGlobal Macro Roundup & Preview (26 July, 2017)ahmadfz1No ratings yet

- Market Outlook Report 18 March 2013Document4 pagesMarket Outlook Report 18 March 2013zenergynzNo ratings yet

- FX Weekly Commentary - Nov 13 - Nov 19 2011Document5 pagesFX Weekly Commentary - Nov 13 - Nov 19 2011James PutraNo ratings yet

- FX Daily: High Bar To Reverse The Dollar Bear TrendDocument3 pagesFX Daily: High Bar To Reverse The Dollar Bear Trenddbr trackdNo ratings yet

- Foreign Exchange Daily ReportDocument5 pagesForeign Exchange Daily ReportPrashanth Goud DharmapuriNo ratings yet

- Buzz (Metal) Oct28 11Document3 pagesBuzz (Metal) Oct28 11Mishra Anand PrakashNo ratings yet

- Hadrian BriefDocument11 pagesHadrian Briefspace238No ratings yet

- Market Outlook Report 17 September 2012Document4 pagesMarket Outlook Report 17 September 2012zenergynzNo ratings yet

- Weekly Report Dec 9th 14thDocument2 pagesWeekly Report Dec 9th 14thFEPFinanceClubNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Olivers Insights - Share CorrectionDocument2 pagesOlivers Insights - Share CorrectionAnthony WrightNo ratings yet

- FX Weekly Commentary - Oct 9 - Oct 15 2011Document5 pagesFX Weekly Commentary - Oct 9 - Oct 15 2011James PutraNo ratings yet

- Forex Market Report 26 July 2011Document4 pagesForex Market Report 26 July 2011International Business Times AUNo ratings yet

- 2011 12 02 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 02 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- FX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingJames PutraNo ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Assignment OF IF: Dollar Vs RupeeDocument7 pagesAssignment OF IF: Dollar Vs RupeeManinder Vadhrah VirkNo ratings yet

- Rally Momentum Fades After US GDP Data DisappointsDocument6 pagesRally Momentum Fades After US GDP Data DisappointsgkapurNo ratings yet

- Currency Daily: April 20, 2016Document5 pagesCurrency Daily: April 20, 2016umaganNo ratings yet

- Daily Currency Update: Market SummaryDocument3 pagesDaily Currency Update: Market Summarysilviu_catrinaNo ratings yet

- Fundamental Analysis 23 October 08Document3 pagesFundamental Analysis 23 October 08Robert PetrucciNo ratings yet

- Market Outlook Report 15 October 2012Document4 pagesMarket Outlook Report 15 October 2012zenergynzNo ratings yet

- Weekly Investment Notes - 2015.10.09Document20 pagesWeekly Investment Notes - 2015.10.09jeet1970No ratings yet

- Treasury Daily 01 28 16Document5 pagesTreasury Daily 01 28 16patrick-lee ellaNo ratings yet

- 2011 12 06 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 06 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- 12 Mars 2010Document29 pages12 Mars 2010api-25889552No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Forex Round Up 06.12.09Document11 pagesForex Round Up 06.12.09Neha DhuriNo ratings yet

- FICC Times 22 Mar 2013Document6 pagesFICC Times 22 Mar 2013r_squareNo ratings yet

- Inside Debt: U.S. Markets Today Chart of The DayDocument8 pagesInside Debt: U.S. Markets Today Chart of The DaydmaximNo ratings yet

- 47 Economic Outlook RecoverDocument28 pages47 Economic Outlook RecovergirishrajsNo ratings yet

- Treasury Daily 01 20 16Document4 pagesTreasury Daily 01 20 16patrick-lee ellaNo ratings yet

- Speak of The Week Aug 10-2012Document3 pagesSpeak of The Week Aug 10-2012Bonthala BadrNo ratings yet

- Ficc Times HTML HTML: April 5, 2013Document5 pagesFicc Times HTML HTML: April 5, 2013r_squareNo ratings yet

- Treasury Daily 01 29 16Document5 pagesTreasury Daily 01 29 16patrick-lee ellaNo ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Investec The BriefDocument8 pagesInvestec The Briefapi-296258777No ratings yet

- Market Outlook Report 20 August 2012Document4 pagesMarket Outlook Report 20 August 2012zenergynzNo ratings yet

- Barclays Capital - The - W - Ides of MarchDocument59 pagesBarclays Capital - The - W - Ides of MarchjonnathannNo ratings yet

- Daily Technical Analysis Report 20/october/2015Document14 pagesDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedNo ratings yet

- Treasury Daily 01 18 16Document4 pagesTreasury Daily 01 18 16patrick-lee ellaNo ratings yet

- Weekly Investment Commentary en UsDocument4 pagesWeekly Investment Commentary en UsbjkqlfqNo ratings yet

- Q2 Results To Set The Pace: A Time Communications PublicationDocument18 pagesQ2 Results To Set The Pace: A Time Communications Publicationswapnilsalunkhe2000No ratings yet

- G10 FX Week Ahead: Tailgating Treasury YieldsDocument8 pagesG10 FX Week Ahead: Tailgating Treasury YieldsrockieballNo ratings yet

- American Stimulus PackageDocument2 pagesAmerican Stimulus PackagePriya SharmaNo ratings yet

- Treasury Daily 01 19 16Document4 pagesTreasury Daily 01 19 16patrick-lee ellaNo ratings yet

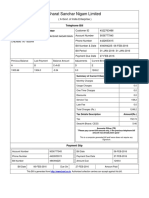

- BSNL Bill - Jan2016Document1 pageBSNL Bill - Jan2016ritbhaiNo ratings yet

- Payment Methods in Mergers and Acquisitions: A Theoretical FrameworkDocument18 pagesPayment Methods in Mergers and Acquisitions: A Theoretical FrameworkBijay SankarNo ratings yet

- Unlu Strategy Jan2024Document74 pagesUnlu Strategy Jan2024f7wczmr665No ratings yet

- Math For Business and Finance An Algebraic Approach 1st Edition Slater Test BankDocument71 pagesMath For Business and Finance An Algebraic Approach 1st Edition Slater Test Bankarnoldjasmine4bflc100% (29)

- Risks Associated With Investing in Bonds - Class ExamplesDocument10 pagesRisks Associated With Investing in Bonds - Class ExamplesmohammedNo ratings yet

- Central Bank of The Philippines Training Program For Banking Supervision Training Needs QuestionnaireDocument4 pagesCentral Bank of The Philippines Training Program For Banking Supervision Training Needs QuestionnaireMikealayNo ratings yet

- Test Bank For Environmental Geology 9th Edition by MontgomeryDocument32 pagesTest Bank For Environmental Geology 9th Edition by MontgomeryDanny SullivanNo ratings yet

- KMugri LUcaq 4 WStiDocument17 pagesKMugri LUcaq 4 WStiNikhil BisuiNo ratings yet

- Chapter 16 IGCSEDocument74 pagesChapter 16 IGCSEtaj qaiserNo ratings yet

- Engineering EconomyDocument74 pagesEngineering EconomyAhmad PshtiwanNo ratings yet

- Gulshan BSDocument8 pagesGulshan BSP2E MIS DDU-GKY Uttar PradeshNo ratings yet

- Googlefinance Function AtttributesDocument8 pagesGooglefinance Function AtttributesfrancisblessonNo ratings yet

- Accounting PPT 2Document46 pagesAccounting PPT 2Carla RománNo ratings yet

- Instant Download Ebook PDF Federal Income Taxation Concepts and Insights 14th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Federal Income Taxation Concepts and Insights 14th Edition PDF Scribdotis.zahn448100% (50)

- Cash Cycle CalculatorDocument1 pageCash Cycle CalculatorReza HaryohatmodjoNo ratings yet

- Guidelines On CIBDocument4 pagesGuidelines On CIBShifatERahmanShifat100% (1)

- STADIO Editable Lesson Plan Template - TEMS701-SS1 2024Document7 pagesSTADIO Editable Lesson Plan Template - TEMS701-SS1 2024tumelomohale98No ratings yet

- 1557126657969Document10 pages1557126657969Pankaj AkadkarNo ratings yet

- 100 Financial Confessions Fron The SripturesDocument8 pages100 Financial Confessions Fron The SripturesRusheen RossNo ratings yet

- Forms of Islamic BankingDocument55 pagesForms of Islamic BankingMuhammad Talha KhanNo ratings yet

- Andal, Camille ADocument5 pagesAndal, Camille ACamille AlcarazNo ratings yet

- Answers To Practice Questions: Capital Budgeting and RiskDocument8 pagesAnswers To Practice Questions: Capital Budgeting and Risksharktale2828No ratings yet

- Chase StrategyDocument2 pagesChase StrategyMMNo ratings yet

- Reviewer Quiz 1 and 2Document7 pagesReviewer Quiz 1 and 2Devil AkiNo ratings yet

- Common Size Statement ITCDocument16 pagesCommon Size Statement ITCManjusha JuluriNo ratings yet

- Audit Problems CashDocument18 pagesAudit Problems CashLuis David Manipol50% (4)

- IFRS 17 Module 7 - Revision Pack V3 30-06-2012Document35 pagesIFRS 17 Module 7 - Revision Pack V3 30-06-2012JasonSpringNo ratings yet

- 7110 s12 Ms 21Document7 pages7110 s12 Ms 21mstudy123456No ratings yet

- Fees 2016 Francisco HomesDocument9 pagesFees 2016 Francisco HomesGolden SunriseNo ratings yet

Urrency Forecast: $ Continued To Weaken Vs Other Major Currencies

Urrency Forecast: $ Continued To Weaken Vs Other Major Currencies

Uploaded by

princeasatiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Urrency Forecast: $ Continued To Weaken Vs Other Major Currencies

Urrency Forecast: $ Continued To Weaken Vs Other Major Currencies

Uploaded by

princeasatiCopyright:

Available Formats

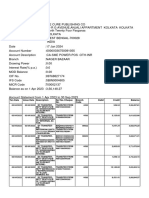

urrency Forecast

$ continued to weaken vs other major currencies

U.S. DOLLAR VS. INDIAN RUPEE

Resistance : 46.42/44, 46.55/56 Daily Trend : SIDE/DOWN

Support : 46.24/25 , 46.17/18 Weekly Trend : SIDE/UP

The Indian unit appreciated further against the dollar because banks sold the greenback noting rise in

local share indices and the euro. The Indian Rupee is trading at 46.3500-4000 per dollar. There might

have been some FII inflows today. Two foreign banks were the major sellers. However, dollar demand

from oil companies and other importers limited the rise in the Indian Rupee.

TRADING STRATEGY :Buy @ 46.3000 for short term.

EURO VS. U.S. DOLLAR

Resistance : 1.2355/60, 1.2385/90 Daily Trend : SIDE/UP

Support : 1.2255/60 , 1.2215/20 Weekly Trend : SIDE/UP

The euro gained against the dollar following solid demand for European debt in auctions held in Ireland,

Belgium and Spain. However, the negative effects of the euro debt crisis resurfaced after Moody’s ratings

downgraded Greece’s bonds to junk status and following the poor ratings from German ZEW’s investor

sentiment survey.

TRADING STRATEGY :Sell @ 1.2315 for short term.

BRITISH POUND VS. U.S. DOLLAR

Resistance : 1.4825/30, 1.4875/80 Daily Trend : SIDE/UP

Support : 1.4725/30 , 1.4680/85 Weekly Trend : SIDE/UP

The British pound strengthened against the dollar as risk appetite improved. Even as UK’s consumer

price inflation showed lower-than-expected data, investor’s appetite for riskier currencies created a

rebound for the sterling. Anticipate UK’s retail sales and jobs data to be released this week.

UK Consumer Confidence from the Nationwide Building Society unexpectedly dipped to the lowest level

in 11 months. Details of the report revealed that the outlook on economic growth over the next 6 months

among polled respondents dipped to the lowest level since August 2009, likely reflecting expectations of

the fallout from the government’s austerity measures to be announced as part of an Emergency Budget

next week.

TRADING STRATEGY :Sell @ 1.4810 for short term.

U.S. DOLLAR VS. JAPANESE YEN

Resistance : 92.00/05, 92.45/50 Daily Trend : SIDE/DOWN

Support : 91.20/25 , 90.80/85 Weekly Trend : SIDE/UP

The Japanese yen weakened across the board on improved risk appetite. Domestically, the Bank of

Japan left rates on hold and introduced a new $33 billion dollar industry-lending program, due this August,

which is aimed at raising productivity and creating consumer demand.

Japan’s Tertiary Index of service demand rose for the first time in three months, adding 2.1 percent in

April. Retail and wholesale activity as well as information and communication services led the metric

higher. The outlook going forward seems uncertain however with some of the government’s stimulus

programs expire this year while a new program offering each family a monthly allowance of 13,000 yen is

phased in. On balance, April’s labor market figures hinted firms are becoming reluctant about future

demand amid fears of a slowdown in China – the core engine of demand driving Japan’s export-led

recovery – hinting that lackluster hiring will weigh on consumer spending (including that on services) in

the months ahead.

TRADING STRATEGY :Buy 90.8500 for short term.

U.S. DOLLAR VS. SWISS FRANC

Resistance : 1.1337/42, 1.1390/95 Daily Trend : SIDE/DOWN

Support : 1.1235/40 , 1.1200/05 Weekly Trend : SIDE/UP

A clearly defined yearly high has been established just over 1.1700 and the market is now in the process

of correcting in search of a fresh higher low before bullish continuation. Look for setbacks to now extend

towards former resistance now turned support in the 1.1200-1.1250 area, from where a resumption of

buying is to be expected in favor of the next major upside extension towards 1.2000.

TRADING STRATEGY :Buy @ 1.1245 for short term.

Currency Forecast

Daily technical outlook

U.S. DOLLAR VS. INDIAN RUPEE

Resistance : 46.72/74, 46.84/85 Daily Trend : SIDE/UP

Support : 46.48/50 , 46.40/41 Weekly Trend : SIDE/UP

The Indian rupee rose on Thursday, boosted by a return in risk taking globally that also pushed up local

stocks. The dollar's losses against major currencies also helped. The Indian Rupee was traded in a range

of 46.4800-46.6400 per dollar. The broad rally in global equities is helping the rupee as well. The euro's

moves will be closely watched for direction. Most Asian stock markets jumped, following gains on Wall

Street after strong housing figures and a recovery in energy stocks.

TRADING STRATEGY :Buy @ 46.5000 for short Term.

EURO VS. U.S. DOLLAR

Resistance : 1.2345/50, 1.2385/90 Daily Trend : SIDE/DOWN

Support : 1.2220/25 , 1.2155/60 Weekly Trend : SIDE/UP

No news is not good news for the euro. Already under considerable strain by a market that is skeptical

over the region’s ability to avoid a double dip recession, financial crisis and even a possible fragmentation

of the relatively new monetary union; investors need some sort of promise to reinvest their capital in the

unbalanced economy. Making matters worse Wednesday, news that Iran is looking to unload 45 billion

euros from its reserves further diminishes the single currency’s ability to elicit confidence. Just a short-

time ago, China was taken to task to refute rumors that it was considering diversifying away from

European assets. And, while Iran is not the investor that China is, the continued speculation and fear that

long-term and deep-pocketed investors are starting to give up on the euro further wears on the

speculative crowd that is only concerned about short-term gain and loss. At the root of the problem, the

financial uncertainties for the economy continued today. Attempting to fill its budget deficit, Greece

announced plans to sell off its stakes in railway and water companies as well as the post office. This

collective unloading is expected to pull in 3 billion euros. Less promising, Spain’s consumer confidence

report was released with the biggest monthly drop on record following civil wage cuts and a freeze on

pensions. With approximately 38 billion in debt coming due next month, Spain is being watched.

TRADING STRATEGY :Sell @ 1.2355 for medium Term.

BRITISH POUND VS. U.S. DOLLAR

Resistance : 1.4750/55, 1.4800/05 Daily Trend : SIDE/UP

Support : 1.4635/40 , 1.4585/90 Weekly Trend : SIDE/UP

Another currency that is fundamentally depressed and should have theoretically appreciated with a boost

in underlying risk, the British pound was otherwise preoccupied by the Bank of England’s annual report.

For any bulls that were banking on the MPC following the OECD’s advice and moving sooner rather than

later on tightening monetary policy, the statement tempered rate speculation by suggesting the economy

would struggle to meet the bank’s 2 percent inflation target over the medium term. With commentary like

this, official are clearly unconvinced of the permanence of the recent 3.7 percent CPI reading. Adding to

this disappointment, net consumer credit slipped 0.1 billion pounds in April.

TRADING STRATEGY :Sell @ 1.4750 for short term.

U.S. DOLLAR VS. JAPANESE YEN

Resistance : 92.00/05, 92.48/53 Daily Trend : SIDE/UP

Support : 92.10/15 , 91.72/77 Weekly Trend : SIDE/UP

As if things could not get any worse in the outlook for Japan and its currency; we have added political

trouble to growth and financial concerns. No doubt, Prime Minister Hatoyama’s resignation is a strategic

move to prevent the party from losing too many seats in Parliament two months down the line; but when it

becomes clear no leader can fix Japan’s problems, the currency will be in real trouble.

TRADING STRATEGY :Sell @ 92.9500 for short term.

U.S. DOLLAR VS. SWISS FRANC

Resistance : 1.1565/70, 1.1605/10 Daily Trend : SIDE/DOWN

Support : 1.1455/60 , 1.1400/05 Weekly Trend : SIDE/UP

The overall outlook remains highly constructive and while daily studies do not rule out the possibility for

some form a pullback to allow for technicals to unwind, any setbacks should be very well supported

ahead of 1.1200, in favor of an eventual push towards 1.2000. In the interim, short-term support comes in

by 1.1430 and a break and close below will be required to trigger the onset of a short-term corrective

pullback.

TRADING STRATEGY :Buy @ 1.1485 for short term.

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- Presented By:: Aakriti Bajaj Ritesh Singh Shalini Kumari Shweta SinghDocument14 pagesPresented By:: Aakriti Bajaj Ritesh Singh Shalini Kumari Shweta SinghShweta SinghNo ratings yet

- U.S. Dollar vs. Indian RupeeDocument4 pagesU.S. Dollar vs. Indian RupeeVinoth RokzNo ratings yet

- Weekly Views From The Metro: HighlightsDocument3 pagesWeekly Views From The Metro: HighlightsRobert RamirezNo ratings yet

- Special Report USDINRDocument7 pagesSpecial Report USDINRtanishaj86No ratings yet

- Daily FX Update: Europe Provides Offset To Worrisome China PmiDocument3 pagesDaily FX Update: Europe Provides Offset To Worrisome China PmiMohd Sofian YusoffNo ratings yet

- Ficc Times // /: The Week Gone by and The Week AheadDocument5 pagesFicc Times // /: The Week Gone by and The Week Aheadr_squareNo ratings yet

- Market Outlook Report 22 April 2013Document4 pagesMarket Outlook Report 22 April 2013zenergynzNo ratings yet

- Ranges (Up Till 11.30am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470No ratings yet

- CPI, Interest Rates and Employment Rates Affecting AUD/USDDocument15 pagesCPI, Interest Rates and Employment Rates Affecting AUD/USDuchiha_rhenzakiNo ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- Daily Technical Analysis Report 23/october/2015Document14 pagesDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedNo ratings yet

- FX Weekly - Jan 22 - Jan 28 2012Document5 pagesFX Weekly - Jan 22 - Jan 28 2012James PutraNo ratings yet

- Global Macro Roundup & Preview (26 July, 2017)Document8 pagesGlobal Macro Roundup & Preview (26 July, 2017)ahmadfz1No ratings yet

- Market Outlook Report 18 March 2013Document4 pagesMarket Outlook Report 18 March 2013zenergynzNo ratings yet

- FX Weekly Commentary - Nov 13 - Nov 19 2011Document5 pagesFX Weekly Commentary - Nov 13 - Nov 19 2011James PutraNo ratings yet

- FX Daily: High Bar To Reverse The Dollar Bear TrendDocument3 pagesFX Daily: High Bar To Reverse The Dollar Bear Trenddbr trackdNo ratings yet

- Foreign Exchange Daily ReportDocument5 pagesForeign Exchange Daily ReportPrashanth Goud DharmapuriNo ratings yet

- Buzz (Metal) Oct28 11Document3 pagesBuzz (Metal) Oct28 11Mishra Anand PrakashNo ratings yet

- Hadrian BriefDocument11 pagesHadrian Briefspace238No ratings yet

- Market Outlook Report 17 September 2012Document4 pagesMarket Outlook Report 17 September 2012zenergynzNo ratings yet

- Weekly Report Dec 9th 14thDocument2 pagesWeekly Report Dec 9th 14thFEPFinanceClubNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Olivers Insights - Share CorrectionDocument2 pagesOlivers Insights - Share CorrectionAnthony WrightNo ratings yet

- FX Weekly Commentary - Oct 9 - Oct 15 2011Document5 pagesFX Weekly Commentary - Oct 9 - Oct 15 2011James PutraNo ratings yet

- Forex Market Report 26 July 2011Document4 pagesForex Market Report 26 July 2011International Business Times AUNo ratings yet

- 2011 12 02 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 02 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- FX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingJames PutraNo ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Assignment OF IF: Dollar Vs RupeeDocument7 pagesAssignment OF IF: Dollar Vs RupeeManinder Vadhrah VirkNo ratings yet

- Rally Momentum Fades After US GDP Data DisappointsDocument6 pagesRally Momentum Fades After US GDP Data DisappointsgkapurNo ratings yet

- Currency Daily: April 20, 2016Document5 pagesCurrency Daily: April 20, 2016umaganNo ratings yet

- Daily Currency Update: Market SummaryDocument3 pagesDaily Currency Update: Market Summarysilviu_catrinaNo ratings yet

- Fundamental Analysis 23 October 08Document3 pagesFundamental Analysis 23 October 08Robert PetrucciNo ratings yet

- Market Outlook Report 15 October 2012Document4 pagesMarket Outlook Report 15 October 2012zenergynzNo ratings yet

- Weekly Investment Notes - 2015.10.09Document20 pagesWeekly Investment Notes - 2015.10.09jeet1970No ratings yet

- Treasury Daily 01 28 16Document5 pagesTreasury Daily 01 28 16patrick-lee ellaNo ratings yet

- 2011 12 06 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 06 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- 12 Mars 2010Document29 pages12 Mars 2010api-25889552No ratings yet

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470No ratings yet

- Forex Round Up 06.12.09Document11 pagesForex Round Up 06.12.09Neha DhuriNo ratings yet

- FICC Times 22 Mar 2013Document6 pagesFICC Times 22 Mar 2013r_squareNo ratings yet

- Inside Debt: U.S. Markets Today Chart of The DayDocument8 pagesInside Debt: U.S. Markets Today Chart of The DaydmaximNo ratings yet

- 47 Economic Outlook RecoverDocument28 pages47 Economic Outlook RecovergirishrajsNo ratings yet

- Treasury Daily 01 20 16Document4 pagesTreasury Daily 01 20 16patrick-lee ellaNo ratings yet

- Speak of The Week Aug 10-2012Document3 pagesSpeak of The Week Aug 10-2012Bonthala BadrNo ratings yet

- Ficc Times HTML HTML: April 5, 2013Document5 pagesFicc Times HTML HTML: April 5, 2013r_squareNo ratings yet

- Treasury Daily 01 29 16Document5 pagesTreasury Daily 01 29 16patrick-lee ellaNo ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument4 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Investec The BriefDocument8 pagesInvestec The Briefapi-296258777No ratings yet

- Market Outlook Report 20 August 2012Document4 pagesMarket Outlook Report 20 August 2012zenergynzNo ratings yet

- Barclays Capital - The - W - Ides of MarchDocument59 pagesBarclays Capital - The - W - Ides of MarchjonnathannNo ratings yet

- Daily Technical Analysis Report 20/october/2015Document14 pagesDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedNo ratings yet

- Treasury Daily 01 18 16Document4 pagesTreasury Daily 01 18 16patrick-lee ellaNo ratings yet

- Weekly Investment Commentary en UsDocument4 pagesWeekly Investment Commentary en UsbjkqlfqNo ratings yet

- Q2 Results To Set The Pace: A Time Communications PublicationDocument18 pagesQ2 Results To Set The Pace: A Time Communications Publicationswapnilsalunkhe2000No ratings yet

- G10 FX Week Ahead: Tailgating Treasury YieldsDocument8 pagesG10 FX Week Ahead: Tailgating Treasury YieldsrockieballNo ratings yet

- American Stimulus PackageDocument2 pagesAmerican Stimulus PackagePriya SharmaNo ratings yet

- Treasury Daily 01 19 16Document4 pagesTreasury Daily 01 19 16patrick-lee ellaNo ratings yet

- BSNL Bill - Jan2016Document1 pageBSNL Bill - Jan2016ritbhaiNo ratings yet

- Payment Methods in Mergers and Acquisitions: A Theoretical FrameworkDocument18 pagesPayment Methods in Mergers and Acquisitions: A Theoretical FrameworkBijay SankarNo ratings yet

- Unlu Strategy Jan2024Document74 pagesUnlu Strategy Jan2024f7wczmr665No ratings yet

- Math For Business and Finance An Algebraic Approach 1st Edition Slater Test BankDocument71 pagesMath For Business and Finance An Algebraic Approach 1st Edition Slater Test Bankarnoldjasmine4bflc100% (29)

- Risks Associated With Investing in Bonds - Class ExamplesDocument10 pagesRisks Associated With Investing in Bonds - Class ExamplesmohammedNo ratings yet

- Central Bank of The Philippines Training Program For Banking Supervision Training Needs QuestionnaireDocument4 pagesCentral Bank of The Philippines Training Program For Banking Supervision Training Needs QuestionnaireMikealayNo ratings yet

- Test Bank For Environmental Geology 9th Edition by MontgomeryDocument32 pagesTest Bank For Environmental Geology 9th Edition by MontgomeryDanny SullivanNo ratings yet

- KMugri LUcaq 4 WStiDocument17 pagesKMugri LUcaq 4 WStiNikhil BisuiNo ratings yet

- Chapter 16 IGCSEDocument74 pagesChapter 16 IGCSEtaj qaiserNo ratings yet

- Engineering EconomyDocument74 pagesEngineering EconomyAhmad PshtiwanNo ratings yet

- Gulshan BSDocument8 pagesGulshan BSP2E MIS DDU-GKY Uttar PradeshNo ratings yet

- Googlefinance Function AtttributesDocument8 pagesGooglefinance Function AtttributesfrancisblessonNo ratings yet

- Accounting PPT 2Document46 pagesAccounting PPT 2Carla RománNo ratings yet

- Instant Download Ebook PDF Federal Income Taxation Concepts and Insights 14th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Federal Income Taxation Concepts and Insights 14th Edition PDF Scribdotis.zahn448100% (50)

- Cash Cycle CalculatorDocument1 pageCash Cycle CalculatorReza HaryohatmodjoNo ratings yet

- Guidelines On CIBDocument4 pagesGuidelines On CIBShifatERahmanShifat100% (1)

- STADIO Editable Lesson Plan Template - TEMS701-SS1 2024Document7 pagesSTADIO Editable Lesson Plan Template - TEMS701-SS1 2024tumelomohale98No ratings yet

- 1557126657969Document10 pages1557126657969Pankaj AkadkarNo ratings yet

- 100 Financial Confessions Fron The SripturesDocument8 pages100 Financial Confessions Fron The SripturesRusheen RossNo ratings yet

- Forms of Islamic BankingDocument55 pagesForms of Islamic BankingMuhammad Talha KhanNo ratings yet

- Andal, Camille ADocument5 pagesAndal, Camille ACamille AlcarazNo ratings yet

- Answers To Practice Questions: Capital Budgeting and RiskDocument8 pagesAnswers To Practice Questions: Capital Budgeting and Risksharktale2828No ratings yet

- Chase StrategyDocument2 pagesChase StrategyMMNo ratings yet

- Reviewer Quiz 1 and 2Document7 pagesReviewer Quiz 1 and 2Devil AkiNo ratings yet

- Common Size Statement ITCDocument16 pagesCommon Size Statement ITCManjusha JuluriNo ratings yet

- Audit Problems CashDocument18 pagesAudit Problems CashLuis David Manipol50% (4)

- IFRS 17 Module 7 - Revision Pack V3 30-06-2012Document35 pagesIFRS 17 Module 7 - Revision Pack V3 30-06-2012JasonSpringNo ratings yet

- 7110 s12 Ms 21Document7 pages7110 s12 Ms 21mstudy123456No ratings yet

- Fees 2016 Francisco HomesDocument9 pagesFees 2016 Francisco HomesGolden SunriseNo ratings yet