Professional Documents

Culture Documents

9) Who Are Exempt From Income Tax?

9) Who Are Exempt From Income Tax?

Uploaded by

Deopito BarrettCopyright:

Available Formats

You might also like

- Income Tax On Individuals - Ust PDFDocument15 pagesIncome Tax On Individuals - Ust PDFKana Lou Cassandra Besana100% (1)

- Income Taxation Lecture Notes.5.Classifications of Individual TaxpayersDocument5 pagesIncome Taxation Lecture Notes.5.Classifications of Individual Taxpayerseinel dc100% (1)

- 2 Classification of Individual TaxpayersDocument2 pages2 Classification of Individual TaxpayersDiana SheineNo ratings yet

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- Income Taxes: 1. Persons Subject To The Individual Income TaxDocument5 pagesIncome Taxes: 1. Persons Subject To The Individual Income TaxJerome Eziekel Posada PanaliganNo ratings yet

- Multiple Choice 1. A. B. C. D. 2.: Requirement 4Document2 pagesMultiple Choice 1. A. B. C. D. 2.: Requirement 4cloemrtzNo ratings yet

- Handout TaxationDocument2 pagesHandout TaxationJohn Oicemen RocaNo ratings yet

- IBAÑEZ Present Income Tax SystemDocument74 pagesIBAÑEZ Present Income Tax SystemJasmine Montero-GaribayNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of Taxpayerhannahmousa83% (24)

- Tax Reviewer by MoiDocument4 pagesTax Reviewer by MoiKenny BesarioNo ratings yet

- Balayo - Tax1 - Prelim Module - Leganes - Bsa2Document19 pagesBalayo - Tax1 - Prelim Module - Leganes - Bsa2ramonay062223No ratings yet

- Tax 1 MidtermsDocument18 pagesTax 1 MidtermsElaine Yap100% (1)

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- Tax 601Document11 pagesTax 601C.J. Clarisse FranciscoNo ratings yet

- Lesson 5 Inclusions Exclusions From Gi Final TaxDocument17 pagesLesson 5 Inclusions Exclusions From Gi Final TaxOrduna Mae AnnNo ratings yet

- Present Income Tax SystemDocument57 pagesPresent Income Tax SystemCharm Ferrer100% (1)

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Overview TaxDocument1 pageOverview TaxSherry Mae MalabagoNo ratings yet

- Types of Individual Taxpayers Citizens Revenue Regulations No. 1-79Document8 pagesTypes of Individual Taxpayers Citizens Revenue Regulations No. 1-79James Evan I. ObnamiaNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- QUIZ Income TaxDocument1 pageQUIZ Income TaxCassy Andrea PadillaNo ratings yet

- Prelim Income TaxationDocument55 pagesPrelim Income TaxationclytemnestraNo ratings yet

- Classification of TaxpayerDocument5 pagesClassification of Taxpayers2120130No ratings yet

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Individual ItDocument12 pagesIndividual ItlouellasoleilgpNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- Tax Reform Act of 1997Document2 pagesTax Reform Act of 1997Eleia Cruz 吳玉青No ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Individual Taxpayers Practice HandoutDocument4 pagesIndividual Taxpayers Practice Handoutwdw shopNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- Classification of Individual Income TaxpayersDocument3 pagesClassification of Individual Income TaxpayersOdessa De JesusNo ratings yet

- Mary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoDocument8 pagesMary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoJonathan JunioNo ratings yet

- Summary Lesson 4Document6 pagesSummary Lesson 4Janien MedestomasNo ratings yet

- Kinds of Income Tax PayersDocument9 pagesKinds of Income Tax PayersCarra Trisha C. TitoNo ratings yet

- Income Tax of IndividualsDocument23 pagesIncome Tax of Individualspeter banjaoNo ratings yet

- Individual Income TaxDocument18 pagesIndividual Income TaxMaeNeth GullanNo ratings yet

- INDIVIDUALSDocument6 pagesINDIVIDUALSAnne KimNo ratings yet

- Types of Income Tax PayersDocument3 pagesTypes of Income Tax PayersAce Fati-igNo ratings yet

- Chapter 2 Income TaxationDocument31 pagesChapter 2 Income TaxationRieven BaracinasNo ratings yet

- Individual TaxpayersDocument4 pagesIndividual TaxpayersJane TuazonNo ratings yet

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- Introduction To Income TaxationDocument4 pagesIntroduction To Income TaxationJean Diane JoveloNo ratings yet

- Income Tax 2Document10 pagesIncome Tax 2Blaise VENo ratings yet

- 3 - Income Tax On IndividualsDocument22 pages3 - Income Tax On IndividualsRylleMatthanCorderoNo ratings yet

- Gross IncomeDocument2 pagesGross IncomeGalanza FaiNo ratings yet

- Module 4 - Lesson 18 - FinalDocument8 pagesModule 4 - Lesson 18 - FinalMai RuizNo ratings yet

- Taxation: Far Eastern University - ManilaDocument3 pagesTaxation: Far Eastern University - ManilagoerginamarquezNo ratings yet

- Income Tax On Individuals - REVISED 2022Document141 pagesIncome Tax On Individuals - REVISED 2022rav dano100% (2)

- Present Indian: Indian Citizenship, Indian Passport and Visa free travelFrom EverandPresent Indian: Indian Citizenship, Indian Passport and Visa free travelRating: 5 out of 5 stars5/5 (1)

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Canadian International Taxation: Income Tax Rules for Non-ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for Non-ResidentsNo ratings yet

- Index For Income TaxDocument1 pageIndex For Income TaxDeopito BarrettNo ratings yet

- Audit PlanningDocument5 pagesAudit PlanningDeopito BarrettNo ratings yet

- 10) What Are The Procedures in Filing Income Tax Returns (Itrs) ?Document1 page10) What Are The Procedures in Filing Income Tax Returns (Itrs) ?Deopito BarrettNo ratings yet

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDocument2 pages6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettNo ratings yet

- 8) Who Are Not Required To File Income Tax Returns?Document1 page8) Who Are Not Required To File Income Tax Returns?Deopito BarrettNo ratings yet

- 5) What Are Some of The Exclusions From Gross Income?: Frequently Asked QuestionsDocument1 page5) What Are Some of The Exclusions From Gross Income?: Frequently Asked QuestionsDeopito BarrettNo ratings yet

- On or Before The 15th Day of April of Each Year Covering Taxable Income For The Preceding Taxable YearDocument1 pageOn or Before The 15th Day of April of Each Year Covering Taxable Income For The Preceding Taxable YearDeopito BarrettNo ratings yet

- BIR Form 1700: ProceduresDocument1 pageBIR Form 1700: ProceduresDeopito BarrettNo ratings yet

- 1) What Is Income?: Frequently Asked QuestionsDocument1 page1) What Is Income?: Frequently Asked QuestionsDeopito BarrettNo ratings yet

- Documentary Requirements: BIR Form 2316Document1 pageDocumentary Requirements: BIR Form 2316Deopito BarrettNo ratings yet

- Who Are Required To File Income Tax Returns? IndividualsDocument1 pageWho Are Required To File Income Tax Returns? IndividualsDeopito BarrettNo ratings yet

- Distribution Requirements PlanningDocument1 pageDistribution Requirements PlanningDeopito BarrettNo ratings yet

- NIDocument6 pagesNIDeopito BarrettNo ratings yet

- Annual Income Tax Return (For Individual Earning Purely Compensation Income Including Non-Business/Non-Profession Related Income)Document1 pageAnnual Income Tax Return (For Individual Earning Purely Compensation Income Including Non-Business/Non-Profession Related Income)Deopito BarrettNo ratings yet

- CIS MC QuestionsDocument12 pagesCIS MC QuestionsDeopito BarrettNo ratings yet

- Who Are Required To File Percentage Tax Returns Quarterly?Document1 pageWho Are Required To File Percentage Tax Returns Quarterly?Deopito BarrettNo ratings yet

- Homeland Security Act of 2002Document4 pagesHomeland Security Act of 2002Deopito BarrettNo ratings yet

9) Who Are Exempt From Income Tax?

9) Who Are Exempt From Income Tax?

Uploaded by

Deopito BarrettOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

9) Who Are Exempt From Income Tax?

9) Who Are Exempt From Income Tax?

Uploaded by

Deopito BarrettCopyright:

Available Formats

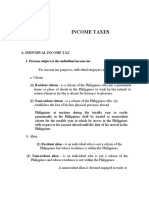

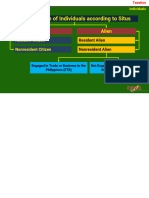

9) Who are exempt from Income Tax?

Non-resident citizen who is:

a) A citizen of the Philippines who establishes to the satisfaction of the Commissioner the fact of

his physical presence abroad with a definite intention to reside therein

b) A citizen of the Philippines who leaves the Philippines during the taxable year to reside

abroad, either as an immigrant or for employment on a permanent basis

c) A citizen of the Philippines who works and derives income from abroad and whose

employment thereat requires him to be physically present abroad most of the time during the

taxable year

d) A citizen who has been previously considered as a non-resident citizen and who arrives in the

Philippines at any time during the year to reside permanently in the Philippines will likewise be

treated as a non-resident citizen during the taxable year in which he arrives in the Philippines,

with respect to his income derived from sources abroad until the date of his arrival in the

Philippines.

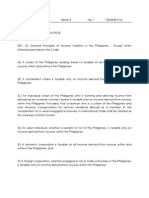

Overseas Filipino Worker, including overseas seaman

An individual citizen of the Philippines who is working and deriving income from abroad as an

overseas Filipino worker is taxable only on income from sources within the Philippines;

provided, that a seaman who is a citizen of the Philippines and who receives compensation for

services rendered abroad as a member of the complement of a vessel engaged exclusively in

international trade will be treated as an overseas Filipino worker.

NOTE: A Filipino employed as Philippine Embassy/Consulate service personnel of the

Philippine Embassy/consulate is not treated as a non-resident citizen, hence his income is

taxable.

You might also like

- Income Tax On Individuals - Ust PDFDocument15 pagesIncome Tax On Individuals - Ust PDFKana Lou Cassandra Besana100% (1)

- Income Taxation Lecture Notes.5.Classifications of Individual TaxpayersDocument5 pagesIncome Taxation Lecture Notes.5.Classifications of Individual Taxpayerseinel dc100% (1)

- 2 Classification of Individual TaxpayersDocument2 pages2 Classification of Individual TaxpayersDiana SheineNo ratings yet

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- Income Taxes: 1. Persons Subject To The Individual Income TaxDocument5 pagesIncome Taxes: 1. Persons Subject To The Individual Income TaxJerome Eziekel Posada PanaliganNo ratings yet

- Multiple Choice 1. A. B. C. D. 2.: Requirement 4Document2 pagesMultiple Choice 1. A. B. C. D. 2.: Requirement 4cloemrtzNo ratings yet

- Handout TaxationDocument2 pagesHandout TaxationJohn Oicemen RocaNo ratings yet

- IBAÑEZ Present Income Tax SystemDocument74 pagesIBAÑEZ Present Income Tax SystemJasmine Montero-GaribayNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of Taxpayerhannahmousa83% (24)

- Tax Reviewer by MoiDocument4 pagesTax Reviewer by MoiKenny BesarioNo ratings yet

- Balayo - Tax1 - Prelim Module - Leganes - Bsa2Document19 pagesBalayo - Tax1 - Prelim Module - Leganes - Bsa2ramonay062223No ratings yet

- Tax 1 MidtermsDocument18 pagesTax 1 MidtermsElaine Yap100% (1)

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- Tax 601Document11 pagesTax 601C.J. Clarisse FranciscoNo ratings yet

- Lesson 5 Inclusions Exclusions From Gi Final TaxDocument17 pagesLesson 5 Inclusions Exclusions From Gi Final TaxOrduna Mae AnnNo ratings yet

- Present Income Tax SystemDocument57 pagesPresent Income Tax SystemCharm Ferrer100% (1)

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Overview TaxDocument1 pageOverview TaxSherry Mae MalabagoNo ratings yet

- Types of Individual Taxpayers Citizens Revenue Regulations No. 1-79Document8 pagesTypes of Individual Taxpayers Citizens Revenue Regulations No. 1-79James Evan I. ObnamiaNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- QUIZ Income TaxDocument1 pageQUIZ Income TaxCassy Andrea PadillaNo ratings yet

- Prelim Income TaxationDocument55 pagesPrelim Income TaxationclytemnestraNo ratings yet

- Classification of TaxpayerDocument5 pagesClassification of Taxpayers2120130No ratings yet

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Individual ItDocument12 pagesIndividual ItlouellasoleilgpNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- Tax Reform Act of 1997Document2 pagesTax Reform Act of 1997Eleia Cruz 吳玉青No ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Individual Taxpayers Practice HandoutDocument4 pagesIndividual Taxpayers Practice Handoutwdw shopNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- Classification of Individual Income TaxpayersDocument3 pagesClassification of Individual Income TaxpayersOdessa De JesusNo ratings yet

- Mary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoDocument8 pagesMary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoJonathan JunioNo ratings yet

- Summary Lesson 4Document6 pagesSummary Lesson 4Janien MedestomasNo ratings yet

- Kinds of Income Tax PayersDocument9 pagesKinds of Income Tax PayersCarra Trisha C. TitoNo ratings yet

- Income Tax of IndividualsDocument23 pagesIncome Tax of Individualspeter banjaoNo ratings yet

- Individual Income TaxDocument18 pagesIndividual Income TaxMaeNeth GullanNo ratings yet

- INDIVIDUALSDocument6 pagesINDIVIDUALSAnne KimNo ratings yet

- Types of Income Tax PayersDocument3 pagesTypes of Income Tax PayersAce Fati-igNo ratings yet

- Chapter 2 Income TaxationDocument31 pagesChapter 2 Income TaxationRieven BaracinasNo ratings yet

- Individual TaxpayersDocument4 pagesIndividual TaxpayersJane TuazonNo ratings yet

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- Introduction To Income TaxationDocument4 pagesIntroduction To Income TaxationJean Diane JoveloNo ratings yet

- Income Tax 2Document10 pagesIncome Tax 2Blaise VENo ratings yet

- 3 - Income Tax On IndividualsDocument22 pages3 - Income Tax On IndividualsRylleMatthanCorderoNo ratings yet

- Gross IncomeDocument2 pagesGross IncomeGalanza FaiNo ratings yet

- Module 4 - Lesson 18 - FinalDocument8 pagesModule 4 - Lesson 18 - FinalMai RuizNo ratings yet

- Taxation: Far Eastern University - ManilaDocument3 pagesTaxation: Far Eastern University - ManilagoerginamarquezNo ratings yet

- Income Tax On Individuals - REVISED 2022Document141 pagesIncome Tax On Individuals - REVISED 2022rav dano100% (2)

- Present Indian: Indian Citizenship, Indian Passport and Visa free travelFrom EverandPresent Indian: Indian Citizenship, Indian Passport and Visa free travelRating: 5 out of 5 stars5/5 (1)

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Canadian International Taxation: Income Tax Rules for Non-ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for Non-ResidentsNo ratings yet

- Index For Income TaxDocument1 pageIndex For Income TaxDeopito BarrettNo ratings yet

- Audit PlanningDocument5 pagesAudit PlanningDeopito BarrettNo ratings yet

- 10) What Are The Procedures in Filing Income Tax Returns (Itrs) ?Document1 page10) What Are The Procedures in Filing Income Tax Returns (Itrs) ?Deopito BarrettNo ratings yet

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDocument2 pages6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettNo ratings yet

- 8) Who Are Not Required To File Income Tax Returns?Document1 page8) Who Are Not Required To File Income Tax Returns?Deopito BarrettNo ratings yet

- 5) What Are Some of The Exclusions From Gross Income?: Frequently Asked QuestionsDocument1 page5) What Are Some of The Exclusions From Gross Income?: Frequently Asked QuestionsDeopito BarrettNo ratings yet

- On or Before The 15th Day of April of Each Year Covering Taxable Income For The Preceding Taxable YearDocument1 pageOn or Before The 15th Day of April of Each Year Covering Taxable Income For The Preceding Taxable YearDeopito BarrettNo ratings yet

- BIR Form 1700: ProceduresDocument1 pageBIR Form 1700: ProceduresDeopito BarrettNo ratings yet

- 1) What Is Income?: Frequently Asked QuestionsDocument1 page1) What Is Income?: Frequently Asked QuestionsDeopito BarrettNo ratings yet

- Documentary Requirements: BIR Form 2316Document1 pageDocumentary Requirements: BIR Form 2316Deopito BarrettNo ratings yet

- Who Are Required To File Income Tax Returns? IndividualsDocument1 pageWho Are Required To File Income Tax Returns? IndividualsDeopito BarrettNo ratings yet

- Distribution Requirements PlanningDocument1 pageDistribution Requirements PlanningDeopito BarrettNo ratings yet

- NIDocument6 pagesNIDeopito BarrettNo ratings yet

- Annual Income Tax Return (For Individual Earning Purely Compensation Income Including Non-Business/Non-Profession Related Income)Document1 pageAnnual Income Tax Return (For Individual Earning Purely Compensation Income Including Non-Business/Non-Profession Related Income)Deopito BarrettNo ratings yet

- CIS MC QuestionsDocument12 pagesCIS MC QuestionsDeopito BarrettNo ratings yet

- Who Are Required To File Percentage Tax Returns Quarterly?Document1 pageWho Are Required To File Percentage Tax Returns Quarterly?Deopito BarrettNo ratings yet

- Homeland Security Act of 2002Document4 pagesHomeland Security Act of 2002Deopito BarrettNo ratings yet