Professional Documents

Culture Documents

Credit Card

Credit Card

Uploaded by

api-371068989Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Card

Credit Card

Uploaded by

api-371068989Copyright:

Available Formats

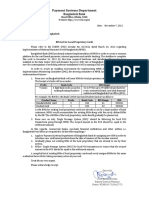

Austin

CIBC Aventura Visa TD Cash Back Visa Presidents

Infinite Card Infinite Card Choice Financial World

MasterCard

Annual Fee $120 $120 None

Grace Period 25 Days 25 Days 21 Days

APR 19.99% 20.99% 19.97%

Credit Limit Depends on credit $5,000 minimum Depends on credit

history history

Finance

None None None

Charge

Method of

Calculating Monthly Monthly Monthly

Finance Charges

Transaction None None None

Fees

Fees for Late Contact Customer Contact Customer Contact Customer

Payment Service Service Service

Earn 6% in Cash Back

Every dollar spent = 1 Dollars on all purchases Earn PC points

Other Features Aventura Point for the first 3 months.

Up to a total spend of

$3,500.

shopping for credit

Credit card costs and features can vary greatly. This exercise will give you a

chance to shop for and compare the costs and features of three credit cards.

directions

Using the attached form, research the costs and features of:

Two major credit cards

One credit card from a department

store When youre done, answer the

following questions.

what did you find?

1. Which credit card has the highest annual percentage rate and how much is

it?

TD Cash Back Visa Infinite Card with a APR of %20.99

2. What method is used to calculate the monthly finance charges for the first

major

credit card? Exact credit balance every day of billing cycle then multiply it by daily

rate

3. When does the finance charge begin to accrue on the credit card from

the local department store? 1 month later

4. Do any of the cards have annual fees? Yes.

If so, which one(s) and how much is the fee? TD Cash Back Visa Infinite Card

and CIBC Aventura Visa Infinite Card with $120 each

5. Is there a transaction fee on any card? No.

If so, how much is it?

6. Is there a minimum finance charge on either of the major credit cards?

No.

activity 8-1b choices & decisions credit cards

If so, how much is it?

7. Does the first major credit card charge a fee for late payments? Not exact

fee, but says contact customer service

If so, how much is it?

8. What is the grace period on the credit card from the local department

store? 21 days

9. Jamel wants to buy a new CD player that costs $450. According to his

budget, he can afford payments up to $62.00 per month. Which of the

three credit cards youve found would you recommend Jamel use to

purchase the CD player? Presidents Choice Financial World MasterCard

Why? I would choose this card for Jamel because it has a low apr and no annual

fee.

activity 8-1b choices & decisions credit cards

You might also like

- Global Payment Report 2017 - WorldPayDocument57 pagesGlobal Payment Report 2017 - WorldPaytyempuser100% (1)

- Credit Card ApprovalDocument15 pagesCredit Card ApprovalShishira PillamarapuNo ratings yet

- Ethoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)Document13 pagesEthoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)NastasVasileNo ratings yet

- CC TO BTC Method (Updated September 2020) : Written by @idzsellerDocument7 pagesCC TO BTC Method (Updated September 2020) : Written by @idzsellerStephanie KaitlynNo ratings yet

- Dos BankDocument4 pagesDos BankheadpncNo ratings yet

- SBI EPay Payment AggregatorDocument17 pagesSBI EPay Payment Aggregatorsrinivasa annamayya100% (1)

- Apple ACCC SubmissionDocument65 pagesApple ACCC SubmissionMikey Campbell100% (1)

- Credit Cards: Personal FinanceDocument36 pagesCredit Cards: Personal FinanceAmara MaduagwuNo ratings yet

- The Military Credit Blueprint: The Step-By-Step Guide for Military Credit RepairFrom EverandThe Military Credit Blueprint: The Step-By-Step Guide for Military Credit RepairNo ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- Fix Your Credit Score: Add Up To 100 Points in 30 Days or LessFrom EverandFix Your Credit Score: Add Up To 100 Points in 30 Days or LessRating: 1 out of 5 stars1/5 (1)

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- PromoSMG Credit Card FormDocument1 pagePromoSMG Credit Card Formmike@promosmg.com100% (3)

- AUB Credit CardDocument18 pagesAUB Credit CardLovely Jennifer Torremonia IINo ratings yet

- Personal Credit Card Ts and CsDocument5 pagesPersonal Credit Card Ts and CsDarren HulmeNo ratings yet

- Inside CRDocument18 pagesInside CRheadpncNo ratings yet

- Credit Card Lab Math 1050Document2 pagesCredit Card Lab Math 1050api-574894346No ratings yet

- HDFC Bank Request For Credit Card UpgrdeDocument2 pagesHDFC Bank Request For Credit Card UpgrdeDhavalNo ratings yet

- TC Platinum CardsDocument4 pagesTC Platinum CardsGokulakrishnanNo ratings yet

- Chapter-1 Introduciton: 1.1 What Is Debit C Ard?Document60 pagesChapter-1 Introduciton: 1.1 What Is Debit C Ard?glorydharmarajNo ratings yet

- Consumers Union Report On Pre-Paid Credit CardsDocument32 pagesConsumers Union Report On Pre-Paid Credit CardsCheatingCulture.comNo ratings yet

- VisaMasterCard Card Auto DebitDocument2 pagesVisaMasterCard Card Auto DebitMuizz LynnNo ratings yet

- MasterCard JJDocument7 pagesMasterCard JJjohnjamgochianNo ratings yet

- Rewarding Excellence Visa Prepaid Card FaqsDocument4 pagesRewarding Excellence Visa Prepaid Card FaqsjudahNo ratings yet

- WL WLDocument3 pagesWL WLsoumya pattanaikNo ratings yet

- KSFE Chitty 054000001548 Payment Receipt DuplicateDocument1 pageKSFE Chitty 054000001548 Payment Receipt DuplicateIjas AslamNo ratings yet

- Virtual Wallet Fine PrintDocument32 pagesVirtual Wallet Fine PrintStewart Kelvin100% (1)

- Etihad Credit Card Authorization FormDocument17 pagesEtihad Credit Card Authorization FormFarha AnsariNo ratings yet

- Call Recording - Protecting Payment Card DataDocument12 pagesCall Recording - Protecting Payment Card DataLiam CowdenNo ratings yet

- Mitc For Amazon Pay Credit CardDocument7 pagesMitc For Amazon Pay Credit Cardsomeonestupid19690% (1)

- Credit Card IntroductionDocument1 pageCredit Card IntroductionsanjayjogsNo ratings yet

- PSRT RSP WithdrawalDocument1 pagePSRT RSP WithdrawalMDV VehiclesNo ratings yet

- Complete Your Order Gift Cards OnlineDocument1 pageComplete Your Order Gift Cards OnlineSoaga UsmanNo ratings yet

- Credit Card NewDocument69 pagesCredit Card NewvijayarapathNo ratings yet

- Internet Banking User Handbook (English) & Frequently Asked Questions (FAQ)Document18 pagesInternet Banking User Handbook (English) & Frequently Asked Questions (FAQ)Zobi HossainNo ratings yet

- Card Acceptance Merchant Application FormDocument2 pagesCard Acceptance Merchant Application FormmikeNo ratings yet

- Online Shopping: "Web Store" Redirects Here. For The W3C Storage Standard, SeeDocument7 pagesOnline Shopping: "Web Store" Redirects Here. For The W3C Storage Standard, SeeRajVishwakarmaNo ratings yet

- IdCard 2Document1 pageIdCard 2Arham SoganiNo ratings yet

- SBA Offers Disaster Assistance To Businesses and Residents of Georgia Affected by Hurricane IdaliaDocument2 pagesSBA Offers Disaster Assistance To Businesses and Residents of Georgia Affected by Hurricane IdaliaSeth FeinerNo ratings yet

- PayU Technical Integration Document v1.3Document9 pagesPayU Technical Integration Document v1.3Abhishek ChakravartyNo ratings yet

- Credit CardsDocument15 pagesCredit CardsAmit AdesharaNo ratings yet

- Autocheque: Electronic Payment ProgramDocument3 pagesAutocheque: Electronic Payment ProgramNicholas GarrisonNo ratings yet

- Platinum Transaction Program GuideDocument47 pagesPlatinum Transaction Program GuideSSGFL10% (1)

- Card On File Authorization FormDocument1 pageCard On File Authorization FormAntwain UtleyNo ratings yet

- Unit 5 E Commerce Payment SystemDocument4 pagesUnit 5 E Commerce Payment SystemAltaf HyssainNo ratings yet

- Offerpal Media D. E. Shaw Ventures Interwest Partners North Bridge Venture PartnersDocument10 pagesOfferpal Media D. E. Shaw Ventures Interwest Partners North Bridge Venture Partnersheena_mirkar7680No ratings yet

- Math Project On Check DigitsDocument4 pagesMath Project On Check DigitsHayden Jackson100% (1)

- RHB Plus One Prepaid CardDocument2 pagesRHB Plus One Prepaid CardShalini RamNo ratings yet

- Cards: Debit Card Credit Card Prepaid CardDocument14 pagesCards: Debit Card Credit Card Prepaid CardJAHID HOSSAINNo ratings yet

- All You Need To Know About Prepaid CardsDocument1 pageAll You Need To Know About Prepaid CardsOmniCardNo ratings yet

- Victorias Secret Angel Credit CardDocument21 pagesVictorias Secret Angel Credit Cardapi-285771275No ratings yet

- Credit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckDocument75 pagesCredit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckBinay Kumar SinghNo ratings yet

- ViewCompletedForms PDFDocument8 pagesViewCompletedForms PDFJulianPerezNo ratings yet

- Cash Rewards Credit Card Agreement and DisclosureDocument11 pagesCash Rewards Credit Card Agreement and DisclosureMacrobiM Reklam AjansıNo ratings yet

- Question Title: 1. How Many Credit Cards Do You Have?Document4 pagesQuestion Title: 1. How Many Credit Cards Do You Have?Mahesh KunaNo ratings yet

- Wise, Formerly TransferWise Online Money Transfers International Banking Features 2Document1 pageWise, Formerly TransferWise Online Money Transfers International Banking Features 2Rene PatrickNo ratings yet

- Payday Loans No Debit CardDocument1 pagePayday Loans No Debit CardPayday WizNo ratings yet

- Blank Personal Reference Check TemplateDocument1 pageBlank Personal Reference Check TemplatesalvationarmyNo ratings yet

- Credit Card Transaction Using Face Recognition AuthenticationDocument7 pagesCredit Card Transaction Using Face Recognition AuthenticationRanjan BangeraNo ratings yet

- Amex Credit Card FeaturesDocument4 pagesAmex Credit Card Featuresbokamanush100% (1)

- HDFC Card DetailsDocument12 pagesHDFC Card DetailsRahul AskNo ratings yet

- All About Me Project CLC 15Document1 pageAll About Me Project CLC 15api-371068989No ratings yet

- Introduction PhysiotherapistDocument12 pagesIntroduction Physiotherapistapi-371068989No ratings yet

- My Work ValuesDocument2 pagesMy Work Valuesapi-371068989No ratings yet

- SkillsDocument1 pageSkillsapi-371068989No ratings yet

- Viu ApplicationDocument4 pagesViu Applicationapi-371068989No ratings yet

- Sfu TourDocument2 pagesSfu Tourapi-371068989No ratings yet

- Kpu ApplicationDocument4 pagesKpu Applicationapi-371068989No ratings yet

- Ubc TourDocument2 pagesUbc Tourapi-371068989No ratings yet

- Cash Rush Terms and Conditions - 2Document4 pagesCash Rush Terms and Conditions - 2AllanRayEnriquezNo ratings yet

- Food Science Training: Sensory Evaluation & Statistics - September 2012Document2 pagesFood Science Training: Sensory Evaluation & Statistics - September 2012RutgersCPENo ratings yet

- Signatureand World Card FeaturesDocument10 pagesSignatureand World Card FeaturesAmi JahangirNo ratings yet

- Maude Hoc Bong 2017Document6 pagesMaude Hoc Bong 2017Le Quang Vu KeNo ratings yet

- HSBC Feb STTMNTDocument2 pagesHSBC Feb STTMNTShelvya ReeseNo ratings yet

- Confirmation MalagaDocument2 pagesConfirmation MalagaFadi MuhamedNo ratings yet

- Conditional Offer Letter - COL - Sumaiya Akter - Shimu - 2023-08-23Document4 pagesConditional Offer Letter - COL - Sumaiya Akter - Shimu - 2023-08-23sumaiyaaktershimuuNo ratings yet

- Wholesale Individual Application Form FINAL 1Document1 pageWholesale Individual Application Form FINAL 1Jhay LongakitNo ratings yet

- Application For Transfer of RegistrationDocument6 pagesApplication For Transfer of RegistrationAnand KumarNo ratings yet

- D 1 3pdfUserGuide of CBBankCardPortalDocument16 pagesD 1 3pdfUserGuide of CBBankCardPortalbluegyiNo ratings yet

- A Study On Attrition Rate in Standard Chartered Bank Jaat BudhiDocument78 pagesA Study On Attrition Rate in Standard Chartered Bank Jaat Budhikhrn_himanshuNo ratings yet

- Money Management LessonDocument5 pagesMoney Management LessonJessica McKenzieNo ratings yet

- Bad News Letter ExamplesDocument11 pagesBad News Letter ExamplesBOsch VakilNo ratings yet

- Payment and Clearing SystemDocument33 pagesPayment and Clearing Systemare_rool86No ratings yet

- L-7 Alternate Channels of BankingDocument21 pagesL-7 Alternate Channels of BankingVinay SudaniNo ratings yet

- Schwab One Signature CardDocument2 pagesSchwab One Signature Cardmartinck137No ratings yet

- Digital Payment During PandamicDocument66 pagesDigital Payment During Pandamicjunaidnuzhat nagoriNo ratings yet

- Payment Centers & Payment Instructions: For School Fees Offsite Local PartnersDocument3 pagesPayment Centers & Payment Instructions: For School Fees Offsite Local PartnersCylvie AceNo ratings yet

- All About HDFC BankDocument64 pagesAll About HDFC Bankdctarang100% (2)

- Payment Systems Department: Head Office, Dhaka 1000Document6 pagesPayment Systems Department: Head Office, Dhaka 1000Ashok Chandra HalderNo ratings yet

- Chase Sapphire Reserve With Ultimate Rewards Program AgreementDocument5 pagesChase Sapphire Reserve With Ultimate Rewards Program AgreementDarren HeNo ratings yet

- BAC 10k PDFDocument30 pagesBAC 10k PDFDaniel KwanNo ratings yet

- Bank Type Test Cards Expiry CVC Otp/Pin Provider: 007 Amadeuspaypal2014Document1 pageBank Type Test Cards Expiry CVC Otp/Pin Provider: 007 Amadeuspaypal2014efsfsNo ratings yet

- Visa 20100723Document28 pagesVisa 20100723brineshrimpNo ratings yet

- Francisco Vs People DigestDocument1 pageFrancisco Vs People DigestRussell John HipolitoNo ratings yet