Professional Documents

Culture Documents

BOC CSO 36 2016 Dissolving The Tax Credit Secretariat

BOC CSO 36 2016 Dissolving The Tax Credit Secretariat

Uploaded by

lito770 ratings0% found this document useful (0 votes)

46 views2 pagesBOC CSO 36 2016 Dissolving the Tax Credit Secretariat

Original Title

BOC CSO 36 2016 Dissolving the Tax Credit Secretariat

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBOC CSO 36 2016 Dissolving the Tax Credit Secretariat

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

46 views2 pagesBOC CSO 36 2016 Dissolving The Tax Credit Secretariat

BOC CSO 36 2016 Dissolving The Tax Credit Secretariat

Uploaded by

lito77BOC CSO 36 2016 Dissolving the Tax Credit Secretariat

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

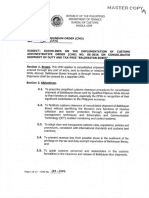

MASTER COPY,

REPUBLIC OF THE PHILIPPINES phos

DEPARTMENT OF FINANCE ~

BUREAU OF CUSTOMS

CUSTOMS SPECIAL ORDER

NO. O&=20le

Subject: DISSOLVING THE TAX CREDIT SECRETARIAT CREATED UNDER CSO

NO. 56-2013 AND REVOKING CSO NO. 10-2015 DATED JUNE 4, 2015.

In the interest of the service, the Tax Credit Secretariat created pursuant to

Customs Special Order No. 56-2013 is hereby abolished and the personnel thereof

ordered to return to their respective Mother Units immediately. All the duties and

responsibilities delegated to Deputy Commissioner Arturo M. Lachica under CSO 10-

2015 dated June 1, 2015 is likewise revoked and reverted to the Office of the

Commissioner.

To provide unhampered service in the processing of Duty Drawback and Value

Added Tax/Excise Tax Claims, the present TCC Secretariat is hereby directed within five

(6) days from issuance of this Order to conduct an inventory and tum-over to the Chief,

Revenue Accounting Division (RAD) to provide administrative and technical assistance

in the processing of all drawback, Value-Added Tax (VAT) and other refund claims,

including the keeping of a central recording system for the same.

Processing of all duty drawback and VAT/Excise Tax claims shall be streamlined

following the procedures below:

1. Claims for duty drawback indorsed by the One-Stop-Shop, Department of Finance

(OSS-DOF) or approved claims for refund of VAT and/or Excise Tax indorsed

either by the OSS-DOF or Bureau of Internal Revenue (BIR) shall be received at

the Office of the Commissioner for recording before being forwarded to the RAD

for payment verification and documents check;

2. The RAD shall issue a Certification attesting to the payment of the duties and taxes

on the shipments subject of the duty drawback or refund for VAT/Excise Tax and

their remittance to the Bureau of Treasury;

3. For VAT/Excise Tax refund, the RAD shall indorse the entire docket of the claim

to the Accounting Division, Financial Management Office (FMO) for confirmation

of the amount due as refund based on the Certification issued by the RAD;

4. The Accounting Division shall then prepare the Disposition Form and Tax Credit

Certificate, in the final amount due for refund, and forward the same to the Office

of the Commissioner for the Commissioner's signature, or any of his authorized

representatives;

‘fy

MASTER COPY,

2

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Property Management AgreementDocument2 pagesProperty Management Agreementlito77100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Syllabi-2017 Customs Broker Licensure Examination (CBLE)Document5 pagesSyllabi-2017 Customs Broker Licensure Examination (CBLE)lito77100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Boc Packing List 2017Document5 pagesBoc Packing List 2017lito77No ratings yet

- Economic Survey BSPECCODocument4 pagesEconomic Survey BSPECCOlito7750% (2)

- Cmo 33 2016 Guidelines On The Implementation of Cao No. 05 2016 Consolidated Shipment of Duty and Tax Free Balikbayan BoxesDocument17 pagesCmo 33 2016 Guidelines On The Implementation of Cao No. 05 2016 Consolidated Shipment of Duty and Tax Free Balikbayan Boxeslito77No ratings yet

- Primer AHTNDocument5 pagesPrimer AHTNlito77100% (1)

- Primer AcftaDocument6 pagesPrimer Acftalito77No ratings yet

- GPPB Resolution No. 26-2017Document8 pagesGPPB Resolution No. 26-2017lito77No ratings yet

- Treasurer'S Affidavit: Philippines Employees Consumers Cooperative (Bspecco) ToDocument2 pagesTreasurer'S Affidavit: Philippines Employees Consumers Cooperative (Bspecco) Tolito77No ratings yet

- Balikbayan Information SheetDocument5 pagesBalikbayan Information Sheetlito77No ratings yet

- Notice of Abandonment Port of Manila As of May 25 216Document4 pagesNotice of Abandonment Port of Manila As of May 25 216lito77No ratings yet

- Cmta 2016 LitovelascoDocument114 pagesCmta 2016 Litovelascolito77No ratings yet

- Attendance: Boy Scouts of The PhilippinesDocument4 pagesAttendance: Boy Scouts of The Philippineslito77No ratings yet

- G.R. 117131Document75 pagesG.R. 117131lito77No ratings yet

- Gealic Realty Services: But Till Date, We Have Not Received Anything and You Did Not Even Inform Us About This DelayDocument1 pageGealic Realty Services: But Till Date, We Have Not Received Anything and You Did Not Even Inform Us About This Delaylito77No ratings yet

- 9.1 Training Team AppointmentsDocument4 pages9.1 Training Team Appointmentslito77No ratings yet

- Text PDFDocument231 pagesText PDFCristina Andreea OpreaNo ratings yet

- Boy Scouts Games-LpvDocument129 pagesBoy Scouts Games-Lpvlito77100% (1)

- The Role of Youth in Sustainable Community DevelopmentDocument5 pagesThe Role of Youth in Sustainable Community Developmentlito77100% (1)

- Coverletter Embassy-ArgetinaDocument1 pageCoverletter Embassy-Argetinalito77No ratings yet

- UK FATCA Self Certification FormDocument10 pagesUK FATCA Self Certification Formlito77No ratings yet

- Disclosures For Confirmation With Legal DepartmentDocument9 pagesDisclosures For Confirmation With Legal Departmentlito77No ratings yet

- AnnualReport - 2013 - BSPDocument88 pagesAnnualReport - 2013 - BSPlito77No ratings yet