Professional Documents

Culture Documents

281 A 7708

281 A 7708

Uploaded by

tjarnob13Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

281 A 7708

281 A 7708

Uploaded by

tjarnob13Copyright:

Available Formats

Chapter 13

1. Transaction exposure is defined as:

a) the sensitivity of realized domestic currency values of the firms contractual cash flows

denominated in foreign currencies to unexpected exchange rate changes

b) the extent to which the value of the firm would be affected by unanticipated changes in

exchange rate

c) the potential that the firms consolidated financial statement can be affected by changes in

exchange rates

d) ex post and ex ante currency exposures

2. The most direct and popular way of hedging transaction exposure is by:

a) exchange-traded futures options

b) currency forward contracts

c) foreign currency warrants

d) borrowing and lending in the domestic and foreign money markets

USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 3 AND 4

Suppose that Boeing Corporation exported a Boeing 747 to British Airways and billed 10

million payable in one year. The money market interest rates and foreign exchange rates are

given as follows:

The U.S. interest rate: 6.10% per annum

The U.K. interest rate: 9.00% per annum

The spot exchange rate: $1.50/

The forward exchange rate: $1.46/ (1-year maturity)

3. Assume that Boeing sells a currency forward contract of 10 million for delivery in

one year, in exchange for a given amount of U.S. dollar. Which of the following is all

true? On the maturity date of the contract Boeing will

(i)- have to deliver 10 million to the bank (the counterparty of the contract)

(ii)- take delivery of $14.6 million

(iii)- have a zero net pound exposure

(iv)- have a profit, or a loss, depending on the future changes in the exchange rate,

from this British sale

a) (i) and (iv)

b) (ii and (iv)

c) (ii), (iii), (iv)

d) (i), (ii), (iii)

4. Suppose that on the maturity date of the forward contract, the spot rate turns out to

be $1.40/ (i.e. less than the forward rate of $1.46/). Which of the following is true?

a) Boeing would have received $14.0 million, rather than $14.6 million, had it not entered

into the forward contract

b) Boeing gained $0.6 million from forward hedging

c) a and b

d) none of the above

5. Buying a currency options provides:

a) a flexible hedge against exchange exposure

b) limits the downside risk while preserving the upside potential

c) a right, but not an obligation, to buy or sell a currency

d) all of the above

Chapter 14

1. Translation exposure refers to:

a) accounting exposure

b) the effect that an unanticipated change in exchange rates will have on the consolidated

financial reports of an MNC

c) the change in the value of a foreign subsidiaries assets and liabilities denominated in a

foreign currency, as a result of exchange rate change fluctuations, when viewed from the

perspective of the parent firm

d) all of the above

2. The recognized methods for consolidating the financial reports of an MNC are:

a) short/long term method, current/future method, flexible/inflexible method, and

economic/noneconomic method

b) current/noncurrent method, monetary/nonmonetary method, short/long term method, and

current/future method

c) current/noncurrent method, monetary/nonmonetary method, temporal method, and current

rate method

d) temporal method, current rate method, flexible/inflexible method, and

economic/noneconomic method

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Tài ChínhDocument14 pagesTài ChínhMinh Nguyen Phuc100% (2)

- CFA Dec 2014 L1 - Derivatives Practice Question v.0.1Document22 pagesCFA Dec 2014 L1 - Derivatives Practice Question v.0.1Chan HL75% (4)

- FRM Financial Markets and Products Test 1Document9 pagesFRM Financial Markets and Products Test 1ConradoCantoIIINo ratings yet

- IFM TB ch03Document13 pagesIFM TB ch03Manar AdelNo ratings yet

- MCQS InvestmentDocument3 pagesMCQS Investmentaashir chNo ratings yet

- Chapter07 - Managing Interest Risk Using Off Balance-Sheet InstrumentsDocument50 pagesChapter07 - Managing Interest Risk Using Off Balance-Sheet InstrumentsDuy ThứcNo ratings yet

- MCQ On International Finance MergedDocument25 pagesMCQ On International Finance MergedAjay AjayNo ratings yet

- MCQ On International FinanceDocument13 pagesMCQ On International Financesalaf100% (4)

- MCQS 1 - Forex ManagementDocument11 pagesMCQS 1 - Forex ManagementPadyala SriramNo ratings yet

- Take International Financial Management MCQ TestDocument15 pagesTake International Financial Management MCQ TestImtiaz100% (1)

- Test Bank Second Term - Elmofide Without AnswersDocument18 pagesTest Bank Second Term - Elmofide Without AnswersMagued MamdouhNo ratings yet

- Ifm Scheme of Valuation 2021Document9 pagesIfm Scheme of Valuation 2021bhupesh tkNo ratings yet

- Chapter 3 International Financial Markets MCQ PDFDocument3 pagesChapter 3 International Financial Markets MCQ PDFtsamrotulj3No ratings yet

- Chapter 08 Management of TRDocument90 pagesChapter 08 Management of TRLiaNo ratings yet

- Srrmra Final Master MCQDocument18 pagesSrrmra Final Master MCQTwinkle ChettriNo ratings yet

- International Financial Management Canadian Canadian 3Rd Edition Brean Test Bank Full Chapter PDFDocument41 pagesInternational Financial Management Canadian Canadian 3Rd Edition Brean Test Bank Full Chapter PDFPatriciaSimonrdio100% (14)

- 7TH Nov Class Test IfrmDocument11 pages7TH Nov Class Test Ifrmabh ljknNo ratings yet

- Mock MCQ Test: Subject: International Financial Management (Ifm) Paper Code: Ms 221Document15 pagesMock MCQ Test: Subject: International Financial Management (Ifm) Paper Code: Ms 221Kiran TakaleNo ratings yet

- Practice Multiple Choice Qs For Mid S1 2010Document5 pagesPractice Multiple Choice Qs For Mid S1 2010ElaineKongNo ratings yet

- Questions - Business Valuation, Capital Structure and Risk ManagementDocument5 pagesQuestions - Business Valuation, Capital Structure and Risk Managementpercy mapetereNo ratings yet

- Test Bank Second Term - ElmofideDocument17 pagesTest Bank Second Term - ElmofideMagued MamdouhNo ratings yet

- MCQ On International Finance PDFDocument16 pagesMCQ On International Finance PDFArfath BaigNo ratings yet

- Answer Scheme International Financial Management: Section ADocument7 pagesAnswer Scheme International Financial Management: Section Abhupesh tkNo ratings yet

- MBA7427 Sample Questions CH1-4 2019Document8 pagesMBA7427 Sample Questions CH1-4 2019Alaye OgbeniNo ratings yet

- Merged Sample QuestionsDocument55 pagesMerged Sample QuestionsAlaye OgbeniNo ratings yet

- Derivatives As Hedging Intrument in Managing Foreign Currency Exposures TheoriesDocument10 pagesDerivatives As Hedging Intrument in Managing Foreign Currency Exposures TheoriesJulie annNo ratings yet

- BFM - International Banking QuestionsDocument5 pagesBFM - International Banking Questionsaathira. m.dasNo ratings yet

- International Finance - QBDocument5 pagesInternational Finance - QBGeetha aptdcNo ratings yet

- New Syllabus - Examiners ReportDocument70 pagesNew Syllabus - Examiners ReportPrecious Onyeka OkoyeNo ratings yet

- 8 PDFDocument52 pages8 PDFKevin CheNo ratings yet

- Aci DC Two (Series Questions)Document20 pagesAci DC Two (Series Questions)Ngendo WilsonNo ratings yet

- MCQ - Chap 8 Futures and OptionsDocument6 pagesMCQ - Chap 8 Futures and Optionsquynhanh15042002No ratings yet

- Quiz1 KeyDocument6 pagesQuiz1 Keyproject44No ratings yet

- BBFN3323 Mid-TermDocument13 pagesBBFN3323 Mid-TermLIM JEI XEE BACC18B-1No ratings yet

- Multiple Choice Questions Chap 8 - Options FuturesDocument6 pagesMultiple Choice Questions Chap 8 - Options FuturesThao LeNo ratings yet

- Forex - Objective Type Qns Apr. 2006Document32 pagesForex - Objective Type Qns Apr. 2006Bhavik SolankiNo ratings yet

- Financial Accounting Chapter 18Document16 pagesFinancial Accounting Chapter 18Kren AshleyNo ratings yet

- CAIIB-BFM Practice Que Set-1Document5 pagesCAIIB-BFM Practice Que Set-1Surya PillaNo ratings yet

- UntitledDocument20 pagesUntitledPatience AkpanNo ratings yet

- Chapter 9 (Hoyle) SolutionsDocument50 pagesChapter 9 (Hoyle) SolutionsNatasya FlorenciaNo ratings yet

- International Financial Management Canadian Perspectives 2Nd Edition Eun Test Bank Full Chapter PDFDocument33 pagesInternational Financial Management Canadian Perspectives 2Nd Edition Eun Test Bank Full Chapter PDFPatriciaSimonrdio100% (13)

- MBA 7427 Sample Questions CH 14: Multiple ChoiceDocument6 pagesMBA 7427 Sample Questions CH 14: Multiple ChoiceAlaye OgbeniNo ratings yet

- Week 8 - Lecture NotesDocument34 pagesWeek 8 - Lecture Notesbao.pham04No ratings yet

- Foreign Exchange-1Document32 pagesForeign Exchange-1Manu MaheshwariNo ratings yet

- Chapter 18Document20 pagesChapter 18MASPAKNo ratings yet

- Objective Type Questions On DerivativesDocument5 pagesObjective Type Questions On DerivativesEknath Birari100% (1)

- Chapter 03 International Financial MarketsDocument12 pagesChapter 03 International Financial MarketsmahraNo ratings yet

- International Financial Management Canadian Perspectives 2nd Edition Eun Test BankDocument24 pagesInternational Financial Management Canadian Perspectives 2nd Edition Eun Test Bankvioletciara4zr6100% (32)

- Chapter 5: Currency DerivativesDocument21 pagesChapter 5: Currency DerivativesNotesfreeBookNo ratings yet

- Vaishali Mam FinalDocument267 pagesVaishali Mam FinalSanket MhetreNo ratings yet

- IME Practice ExamDocument14 pagesIME Practice ExamGarnet50% (2)

- Full Download International Financial Management Eun 6Th Edition Test Bank PDFDocument96 pagesFull Download International Financial Management Eun 6Th Edition Test Bank PDFamy.lopez138100% (18)

- IF Sem IV Word Success and ThakurDocument28 pagesIF Sem IV Word Success and ThakurSanket MhetreNo ratings yet

- Model Exit Exam - Financial Markets & InstitutionsDocument9 pagesModel Exit Exam - Financial Markets & InstitutionsabulemhrNo ratings yet

- Reading 5 Currency Exchange ...Document9 pagesReading 5 Currency Exchange ...kiran.malukani26No ratings yet

- Test Bank Second Term - Elmofide With Below AnswersDocument22 pagesTest Bank Second Term - Elmofide With Below AnswersMagued MamdouhNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Competition Law in times of Economic Crisis : in Need of Adjustment ?: GCLC Annual Conference SeriesFrom EverandCompetition Law in times of Economic Crisis : in Need of Adjustment ?: GCLC Annual Conference SeriesNo ratings yet

- Chapter 5: Investment Companies: DefinitionDocument16 pagesChapter 5: Investment Companies: Definitiontjarnob13100% (1)

- Chapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That IsDocument11 pagesChapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That Istjarnob13No ratings yet

- Chapter 10: Risk-Return and Asset Pricing ModelsDocument22 pagesChapter 10: Risk-Return and Asset Pricing Modelstjarnob13No ratings yet

- Chapter 3: Depository Institutions: Activities and CharacteristicsDocument24 pagesChapter 3: Depository Institutions: Activities and Characteristicstjarnob13No ratings yet

- Ev Rwimvi CVJ Bi 50wu Iæz¡C Y© WucmtDocument3 pagesEv Rwimvi CVJ Bi 50wu Iæz¡C Y© Wucmttjarnob13No ratings yet

- IntroductionDocument20 pagesIntroductiontjarnob13No ratings yet

- Clearwing Greywing Dilute FBG and Normal Mutation Expection PDFDocument6 pagesClearwing Greywing Dilute FBG and Normal Mutation Expection PDFtjarnob13No ratings yet

- Insurance CompanyDocument25 pagesInsurance CompanySharif UllahNo ratings yet

- Clearwing Greywing Dilute FBG and Normal Mutation Expection PDFDocument6 pagesClearwing Greywing Dilute FBG and Normal Mutation Expection PDFtjarnob13No ratings yet

- Mortgage MarketDocument11 pagesMortgage Markettjarnob13No ratings yet

- 2017 McKesson Annual Report 0Document161 pages2017 McKesson Annual Report 0tjarnob13100% (1)

- Chapter 10 (B) : Secondary MarketsDocument6 pagesChapter 10 (B) : Secondary Marketstjarnob13No ratings yet

- Chapter 10 (A) :: Primary Markets and The Underwriting of SecuritiesDocument12 pagesChapter 10 (A) :: Primary Markets and The Underwriting of Securitiestjarnob13No ratings yet

- Balance of Payments Standard PresentDocument16 pagesBalance of Payments Standard Presenttjarnob13No ratings yet

- Balance of Payments Analytic Present-UsaDocument4 pagesBalance of Payments Analytic Present-Usatjarnob13No ratings yet

- Balance of Payments Standard PresentDocument20 pagesBalance of Payments Standard Presenttjarnob13No ratings yet

- Balance of Payments Analytic PresentationDocument4 pagesBalance of Payments Analytic Presentationtjarnob13No ratings yet

- MNC Stuff Ovi 2020Document7 pagesMNC Stuff Ovi 2020tjarnob13No ratings yet

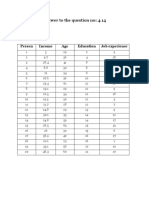

- Answer To The Question No: 4.14: Summary Input: Person Income Age Education Job ExperienceDocument2 pagesAnswer To The Question No: 4.14: Summary Input: Person Income Age Education Job Experiencetjarnob13No ratings yet

- Lagrangian MultiplierDocument2 pagesLagrangian Multipliertjarnob13No ratings yet

- Direct Tax Summary Notes For IPCC JKQK1AK0Document24 pagesDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaNo ratings yet

- StudentDocument30 pagesStudentAnh Lý100% (1)

- SBI2Document40 pagesSBI2bhaskarrao01No ratings yet

- Marketing Domain QuestionsDocument7 pagesMarketing Domain QuestionsdebasishroutNo ratings yet

- Function of Financial MarketsDocument11 pagesFunction of Financial MarketsYepuru ChaithanyaNo ratings yet

- ACM 31 FM LEC 9n10Document34 pagesACM 31 FM LEC 9n10Vishal AmbadNo ratings yet

- Pathological Pace of Dispute Settlement in IndiaDocument18 pagesPathological Pace of Dispute Settlement in IndiaPrabodhNo ratings yet

- Budget 2019 - Nirmala SitharamanDocument66 pagesBudget 2019 - Nirmala SitharamanThe Indian Express100% (1)

- Foreign Trade DirectionDocument42 pagesForeign Trade DirectionNeha ThakurNo ratings yet

- Practice MidtermDocument8 pagesPractice MidtermghaniaNo ratings yet

- Psak 44 Real Estate Ver171299Document20 pagesPsak 44 Real Estate Ver171299api-3708783No ratings yet

- ReportDocument115 pagesReportSamNo ratings yet

- CH 5 - 2024 - 1 - Bond ValuationDocument32 pagesCH 5 - 2024 - 1 - Bond Valuationmarizemeyer2No ratings yet

- Hospitality and Tourism ManagementDocument4 pagesHospitality and Tourism ManagementLinn ThitNo ratings yet

- A Study On Working Capital Management With Special ReferenceDocument97 pagesA Study On Working Capital Management With Special ReferencePrem KumarNo ratings yet

- Annual Report 2013-14-2 PDFDocument60 pagesAnnual Report 2013-14-2 PDFVENKATARAM REDDY PNo ratings yet

- BP Case StudyDocument4 pagesBP Case StudySwarupa KudaleNo ratings yet

- Frs1, Cash Flow Statements: The Scope and Authority of FrssDocument11 pagesFrs1, Cash Flow Statements: The Scope and Authority of FrssKavee JhugrooNo ratings yet

- 6 Theories of Value, Output and Employment: John EatwellDocument25 pages6 Theories of Value, Output and Employment: John EatwellMiguel TorresNo ratings yet

- Victoria's New China Strategy - Partnerships For ProsperityDocument40 pagesVictoria's New China Strategy - Partnerships For ProsperityDaniel Andrews100% (1)

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document2 pagesI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- Case Study 1 DisneyDocument16 pagesCase Study 1 DisneyDennisWarrenNo ratings yet

- Raising CapitalDocument35 pagesRaising CapitalsgNo ratings yet

- History of Indonesian Fiscal Policy 1945-1986 - The Battle For Resources (Kuntjoro-Jakti 1988)Document48 pagesHistory of Indonesian Fiscal Policy 1945-1986 - The Battle For Resources (Kuntjoro-Jakti 1988)dharendraNo ratings yet

- PDAFDocument2 pagesPDAFMaeNo ratings yet

- NZ Employee Share Schemes Brochure Feb 2016Document12 pagesNZ Employee Share Schemes Brochure Feb 2016Ellamie EclipseNo ratings yet

- A Case Study of LIC Housing Finance Limited and HDFCDocument10 pagesA Case Study of LIC Housing Finance Limited and HDFCVelu ManiNo ratings yet

- AssesmentDocument31 pagesAssesmentLoudie ann MarcosNo ratings yet

- Revised Direct Tax CodeDocument37 pagesRevised Direct Tax Codepankaj_adv5314No ratings yet

- SAPM Module 7Document35 pagesSAPM Module 7AnvibhaNo ratings yet