Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsInstruction: Provide The Nestedif Formula and The Appropriate Tax Due. If Taxable Income Is

Instruction: Provide The Nestedif Formula and The Appropriate Tax Due. If Taxable Income Is

Uploaded by

Ashley MaeThe document provides a tax rate table with taxable income brackets and corresponding tax due. It then provides sample taxable incomes and computes the tax due using three different methods and manually to check the results.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- SMC V Gomez Case Digest Krystal Grace PaduraDocument2 pagesSMC V Gomez Case Digest Krystal Grace PaduraKrystal Grace D. PaduraNo ratings yet

- ACC 113 Activity 1 Answer KeyDocument7 pagesACC 113 Activity 1 Answer Keypia guiretNo ratings yet

- 10 Column WorksheetDocument5 pages10 Column Worksheetrommel legaspi100% (1)

- HarmoniumDocument9 pagesHarmoniumSardanapal ben EsarhaddonNo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- Itax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Document13 pagesItax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Rose CastilloNo ratings yet

- Example of WorksheetDocument5 pagesExample of WorksheetAizen IchigoNo ratings yet

- YARADocument5 pagesYARAMischa Bianca BesmonteNo ratings yet

- John Bala Company Worksheet: Unadjusted Trial Balance DebitDocument9 pagesJohn Bala Company Worksheet: Unadjusted Trial Balance DebitJekoeNo ratings yet

- Answer Sheet Work RelatedDocument41 pagesAnswer Sheet Work RelatedjoyhhazelNo ratings yet

- Tax CalculatorDocument2 pagesTax CalculatorMart ManaloNo ratings yet

- MC Solution Pages 2 61 To 2 66Document8 pagesMC Solution Pages 2 61 To 2 66sumagpangkeannecleinNo ratings yet

- Answer Key - Financial Transaction WorksheetDocument4 pagesAnswer Key - Financial Transaction WorksheetDenzel Isaac Joshua TolentinoNo ratings yet

- Income Statement Format (KTV 1)Document30 pagesIncome Statement Format (KTV 1)Darlene Jade Butic VillanuevaNo ratings yet

- Accounts Unadjusted TB Adjustments Adjusted Trial Balance: Rhina CalimlimDocument12 pagesAccounts Unadjusted TB Adjustments Adjusted Trial Balance: Rhina Calimlimjuswa paclebNo ratings yet

- Target Market Every Month 3,600.00 Average Sales Per Customer 25.00Document4 pagesTarget Market Every Month 3,600.00 Average Sales Per Customer 25.00Mark Harold RaspadoNo ratings yet

- Chapter 6 Problem 7 8Document12 pagesChapter 6 Problem 7 8mackyberriesNo ratings yet

- WAC - Corpo Acco - Good Hope CorporationDocument30 pagesWAC - Corpo Acco - Good Hope CorporationJasmine Acta100% (1)

- Bright ServicesDocument7 pagesBright Servicesnikko.emping.20No ratings yet

- Seatwork 2 Worksheet Income Statemet Changes in Equity and Balance SheetDocument7 pagesSeatwork 2 Worksheet Income Statemet Changes in Equity and Balance Sheetjohn vincent de leonNo ratings yet

- (Loss) - 197,037.76 - 142,192.76: ProfitDocument7 pages(Loss) - 197,037.76 - 142,192.76: ProfitJulious Capricho GerodiasNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Fabm 1 ExamDocument2 pagesFabm 1 ExamJasfer Niño100% (1)

- Adjusted Trial BalanceDocument2 pagesAdjusted Trial BalanceJerrica Rama100% (1)

- ACC 111 Answer KeyDocument7 pagesACC 111 Answer KeyMAXINE CLAIRE CUTINGNo ratings yet

- Worksheet Pr. 1 Chap 9Document4 pagesWorksheet Pr. 1 Chap 9airamaecsibbalucaNo ratings yet

- Problems 7 10Document19 pagesProblems 7 10Margiery GannabanNo ratings yet

- Detalles de Cuenta: Saldos AjustesDocument11 pagesDetalles de Cuenta: Saldos AjustesEsfmMauri Claros UgarteNo ratings yet

- Izzy WorksheetDocument30 pagesIzzy Worksheetelriatagat85No ratings yet

- Aguilar Jules QuizDocument4 pagesAguilar Jules QuizJules AguilarNo ratings yet

- Accounting RefresherDocument2 pagesAccounting RefresherAlbert MorenoNo ratings yet

- Quiz8 Ruby SaludaresDocument12 pagesQuiz8 Ruby SaludaresBhy Juarte SaludaresNo ratings yet

- G2 Final WorksheetDocument4 pagesG2 Final WorksheetSharmaine FabriaNo ratings yet

- Completing The Accounting CycleDocument11 pagesCompleting The Accounting CycleRaymond RocoNo ratings yet

- Tan Vernon Jay Homework 6Document9 pagesTan Vernon Jay Homework 6ASHANTI JANE EREDIANONo ratings yet

- PRO FORMA BALANCE SHEET - TUTORIAL QUESTION AND ANSWERDocument5 pagesPRO FORMA BALANCE SHEET - TUTORIAL QUESTION AND ANSWER2023101547No ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- ABC 10-ColumnDocument1 pageABC 10-Columnpor wansNo ratings yet

- Activity (Worksheet Preparation)Document3 pagesActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNo ratings yet

- Doris PatenoDocument13 pagesDoris PatenoASHANTI JANE EREDIANONo ratings yet

- Book 111111Document3 pagesBook 111111Janet AnotdeNo ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- DividendsDocument13 pagesDividendsTrixieNo ratings yet

- Balance Comprob (Youtube)Document5 pagesBalance Comprob (Youtube)luisNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- Schedule of Premium RatesDocument1 pageSchedule of Premium RatesZhanice RulonaNo ratings yet

- Schedule of Premium Rates PDFDocument1 pageSchedule of Premium Rates PDFZhanice RulonaNo ratings yet

- COSTACCDocument9 pagesCOSTACCVillaluna Janne ChristineNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Illustration PRAC - AUD Page 13Document4 pagesIllustration PRAC - AUD Page 13The BoxNo ratings yet

- Kaya Mo Yan-Finac-Chap 23 PpeDocument5 pagesKaya Mo Yan-Finac-Chap 23 PpeTrixie JeramieNo ratings yet

- Kaya Mo Yan-Finac-Chap 23 PpeDocument5 pagesKaya Mo Yan-Finac-Chap 23 PpeTrixie JeramieNo ratings yet

- Generales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Document12 pagesGenerales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Kirstelle VelezNo ratings yet

- Erlinda Company Problem 2Document12 pagesErlinda Company Problem 2JekoeNo ratings yet

- Accounting Worksheet V 1.0Document6 pagesAccounting Worksheet V 1.0Maxeen ManuelNo ratings yet

- Budget For CDM For May 2009Document2 pagesBudget For CDM For May 2009tunde adeniranNo ratings yet

- Abm Task3 BacuetesDocument2 pagesAbm Task3 BacuetesbacuetesjustinNo ratings yet

- Book 1Document2 pagesBook 1VIRAY, CRISTIAN JAY V.No ratings yet

- Worksheet Pr2 Chap 9Document4 pagesWorksheet Pr2 Chap 9airamaecsibbalucaNo ratings yet

- CashflowDocument5 pagesCashflowHanan SalmanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Zonal Employee Zed Fares Effective 01 Oct, 10Document3 pagesZonal Employee Zed Fares Effective 01 Oct, 10Muhammad NaveedNo ratings yet

- Indian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDocument5 pagesIndian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDharamNo ratings yet

- 2.3 Leadership Styles - International Business Management InstituteDocument4 pages2.3 Leadership Styles - International Business Management InstituteLeonardo Andrés Hernández MolanoNo ratings yet

- United States Court of Appeals For The Fifth Circuit: FiledDocument8 pagesUnited States Court of Appeals For The Fifth Circuit: FiledRHTNo ratings yet

- Complete Oil AnalysisDocument33 pagesComplete Oil AnalysisGnanaSekar100% (1)

- PWC FICCI Knowledge Paper in Aviation Wings 2022 1648497337Document40 pagesPWC FICCI Knowledge Paper in Aviation Wings 2022 1648497337Manoj ShettyNo ratings yet

- NG160 - 16 To 160A Modular Incoming Circuit BrakersDocument27 pagesNG160 - 16 To 160A Modular Incoming Circuit BrakerssomeontorrenteNo ratings yet

- FILMUSIC - International Composing CompetitionDocument3 pagesFILMUSIC - International Composing CompetitionFrancesco NettiNo ratings yet

- ZohoDocument16 pagesZohoasvs1006No ratings yet

- Process: Add Menu Item Master, Definition, Price: Step ActionDocument7 pagesProcess: Add Menu Item Master, Definition, Price: Step ActionPrince HakimNo ratings yet

- Manual: For Diesel EngineDocument84 pagesManual: For Diesel EngineColdbloodedbikerNo ratings yet

- Fms User GuideDocument346 pagesFms User GuideRanny Lomibao100% (1)

- Washing Machine User Manual SamsungDocument28 pagesWashing Machine User Manual SamsungEliezer MorenoNo ratings yet

- Bpas 186 Solved AssignmentDocument7 pagesBpas 186 Solved AssignmentDivyansh Bajpai0% (1)

- Creating Cust Specific POWL Query PDFDocument3 pagesCreating Cust Specific POWL Query PDFvictorSNo ratings yet

- 3-Phase Motor Drives W Oscilloscope 48W-73863-0Document31 pages3-Phase Motor Drives W Oscilloscope 48W-73863-0CarloNo ratings yet

- Electric DrivesDocument2 pagesElectric DrivesUmashankar SubramaniamNo ratings yet

- (2014) Pneumonia CURSDocument46 pages(2014) Pneumonia CURSAna-MariaCiotiNo ratings yet

- EAC Knowledge Profile (WK) / Engineering Activities (EA) Utm PloDocument4 pagesEAC Knowledge Profile (WK) / Engineering Activities (EA) Utm PloHafiziAhmadNo ratings yet

- Quality Mark Guideline 0Document50 pagesQuality Mark Guideline 0Asma DahaboNo ratings yet

- 2018 Passouts - Companies VisitedDocument14 pages2018 Passouts - Companies VisitedgppNo ratings yet

- Annex 11 Monitoring and Evaluation ToolDocument6 pagesAnnex 11 Monitoring and Evaluation ToolKathrine Jane LunaNo ratings yet

- Elango COUNCILSNOTABLESPOLITICS 1987Document24 pagesElango COUNCILSNOTABLESPOLITICS 1987Ota Benga BengaNo ratings yet

- Membership Update FormDocument4 pagesMembership Update FormbmapiraNo ratings yet

- Saja .K.a Apollo TyresDocument52 pagesSaja .K.a Apollo TyresSaja Nizam Sana100% (1)

- Unit - 3 AtmipDocument11 pagesUnit - 3 AtmipFaruk MohamedNo ratings yet

- Data Sheet - Quantran Dimmer RacksDocument2 pagesData Sheet - Quantran Dimmer Racksmuqtar4uNo ratings yet

- Distribution, Abundance and Population Status of Four Indigenous Threatened Tree Species in The Arba Minch Natural Forest, Southern EthiopiaDocument9 pagesDistribution, Abundance and Population Status of Four Indigenous Threatened Tree Species in The Arba Minch Natural Forest, Southern EthiopiaMihretu AbrhamNo ratings yet

Instruction: Provide The Nestedif Formula and The Appropriate Tax Due. If Taxable Income Is

Instruction: Provide The Nestedif Formula and The Appropriate Tax Due. If Taxable Income Is

Uploaded by

Ashley Mae0 ratings0% found this document useful (0 votes)

15 views1 pageThe document provides a tax rate table with taxable income brackets and corresponding tax due. It then provides sample taxable incomes and computes the tax due using three different methods and manually to check the results.

Original Description:

fhgfdhd

Original Title

22731_NESTEDIFACTUALTAXTABLETOPORTAL (1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a tax rate table with taxable income brackets and corresponding tax due. It then provides sample taxable incomes and computes the tax due using three different methods and manually to check the results.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views1 pageInstruction: Provide The Nestedif Formula and The Appropriate Tax Due. If Taxable Income Is

Instruction: Provide The Nestedif Formula and The Appropriate Tax Due. If Taxable Income Is

Uploaded by

Ashley MaeThe document provides a tax rate table with taxable income brackets and corresponding tax due. It then provides sample taxable incomes and computes the tax due using three different methods and manually to check the results.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

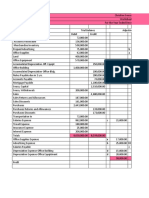

Instruction: Provide the nestedif formula and the appropriate tax due.

IF TAXABLE INCOME IS TAX DUE

Not Over P10,000.00 5%

Over P10,000 but not over P30,000 P500 + 10% of the excess over P10,000

Over P30,000 but not over P70,000 P2,500 + 15% of the excess over P30,000

Over P70,000 but not over P140,000 P8,500 + 20% of the excess over P70,000

Over P140,000 but not over P250,000. P22,500 + 25% of the excess over P140,000

Over P250,000 but not over P500,000 P50,000 + 30% of the excess over P250,000

Over P500,000.00 125,000 + 32% of the excess over 500,000.00

TAXABLE INCOME Method 1 Method 2 Method 3 Manually Computed

70,000.00 8,500.00

175,000.00 31,250.00

28,500.00 2,350.00

125,000.00 19,500.00

225,000.00 43,750.00

778,000.00 213,960.00

500,001.00 125,000.32

9,999.00 499.95

Instruction:

Compute the corresponding taxes following the 3 methods. Refer to Nestedif in the computation of grades.

You might also like

- SMC V Gomez Case Digest Krystal Grace PaduraDocument2 pagesSMC V Gomez Case Digest Krystal Grace PaduraKrystal Grace D. PaduraNo ratings yet

- ACC 113 Activity 1 Answer KeyDocument7 pagesACC 113 Activity 1 Answer Keypia guiretNo ratings yet

- 10 Column WorksheetDocument5 pages10 Column Worksheetrommel legaspi100% (1)

- HarmoniumDocument9 pagesHarmoniumSardanapal ben EsarhaddonNo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- Itax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Document13 pagesItax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Rose CastilloNo ratings yet

- Example of WorksheetDocument5 pagesExample of WorksheetAizen IchigoNo ratings yet

- YARADocument5 pagesYARAMischa Bianca BesmonteNo ratings yet

- John Bala Company Worksheet: Unadjusted Trial Balance DebitDocument9 pagesJohn Bala Company Worksheet: Unadjusted Trial Balance DebitJekoeNo ratings yet

- Answer Sheet Work RelatedDocument41 pagesAnswer Sheet Work RelatedjoyhhazelNo ratings yet

- Tax CalculatorDocument2 pagesTax CalculatorMart ManaloNo ratings yet

- MC Solution Pages 2 61 To 2 66Document8 pagesMC Solution Pages 2 61 To 2 66sumagpangkeannecleinNo ratings yet

- Answer Key - Financial Transaction WorksheetDocument4 pagesAnswer Key - Financial Transaction WorksheetDenzel Isaac Joshua TolentinoNo ratings yet

- Income Statement Format (KTV 1)Document30 pagesIncome Statement Format (KTV 1)Darlene Jade Butic VillanuevaNo ratings yet

- Accounts Unadjusted TB Adjustments Adjusted Trial Balance: Rhina CalimlimDocument12 pagesAccounts Unadjusted TB Adjustments Adjusted Trial Balance: Rhina Calimlimjuswa paclebNo ratings yet

- Target Market Every Month 3,600.00 Average Sales Per Customer 25.00Document4 pagesTarget Market Every Month 3,600.00 Average Sales Per Customer 25.00Mark Harold RaspadoNo ratings yet

- Chapter 6 Problem 7 8Document12 pagesChapter 6 Problem 7 8mackyberriesNo ratings yet

- WAC - Corpo Acco - Good Hope CorporationDocument30 pagesWAC - Corpo Acco - Good Hope CorporationJasmine Acta100% (1)

- Bright ServicesDocument7 pagesBright Servicesnikko.emping.20No ratings yet

- Seatwork 2 Worksheet Income Statemet Changes in Equity and Balance SheetDocument7 pagesSeatwork 2 Worksheet Income Statemet Changes in Equity and Balance Sheetjohn vincent de leonNo ratings yet

- (Loss) - 197,037.76 - 142,192.76: ProfitDocument7 pages(Loss) - 197,037.76 - 142,192.76: ProfitJulious Capricho GerodiasNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Fabm 1 ExamDocument2 pagesFabm 1 ExamJasfer Niño100% (1)

- Adjusted Trial BalanceDocument2 pagesAdjusted Trial BalanceJerrica Rama100% (1)

- ACC 111 Answer KeyDocument7 pagesACC 111 Answer KeyMAXINE CLAIRE CUTINGNo ratings yet

- Worksheet Pr. 1 Chap 9Document4 pagesWorksheet Pr. 1 Chap 9airamaecsibbalucaNo ratings yet

- Problems 7 10Document19 pagesProblems 7 10Margiery GannabanNo ratings yet

- Detalles de Cuenta: Saldos AjustesDocument11 pagesDetalles de Cuenta: Saldos AjustesEsfmMauri Claros UgarteNo ratings yet

- Izzy WorksheetDocument30 pagesIzzy Worksheetelriatagat85No ratings yet

- Aguilar Jules QuizDocument4 pagesAguilar Jules QuizJules AguilarNo ratings yet

- Accounting RefresherDocument2 pagesAccounting RefresherAlbert MorenoNo ratings yet

- Quiz8 Ruby SaludaresDocument12 pagesQuiz8 Ruby SaludaresBhy Juarte SaludaresNo ratings yet

- G2 Final WorksheetDocument4 pagesG2 Final WorksheetSharmaine FabriaNo ratings yet

- Completing The Accounting CycleDocument11 pagesCompleting The Accounting CycleRaymond RocoNo ratings yet

- Tan Vernon Jay Homework 6Document9 pagesTan Vernon Jay Homework 6ASHANTI JANE EREDIANONo ratings yet

- PRO FORMA BALANCE SHEET - TUTORIAL QUESTION AND ANSWERDocument5 pagesPRO FORMA BALANCE SHEET - TUTORIAL QUESTION AND ANSWER2023101547No ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- ABC 10-ColumnDocument1 pageABC 10-Columnpor wansNo ratings yet

- Activity (Worksheet Preparation)Document3 pagesActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNo ratings yet

- Doris PatenoDocument13 pagesDoris PatenoASHANTI JANE EREDIANONo ratings yet

- Book 111111Document3 pagesBook 111111Janet AnotdeNo ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- DividendsDocument13 pagesDividendsTrixieNo ratings yet

- Balance Comprob (Youtube)Document5 pagesBalance Comprob (Youtube)luisNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- Schedule of Premium RatesDocument1 pageSchedule of Premium RatesZhanice RulonaNo ratings yet

- Schedule of Premium Rates PDFDocument1 pageSchedule of Premium Rates PDFZhanice RulonaNo ratings yet

- COSTACCDocument9 pagesCOSTACCVillaluna Janne ChristineNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Illustration PRAC - AUD Page 13Document4 pagesIllustration PRAC - AUD Page 13The BoxNo ratings yet

- Kaya Mo Yan-Finac-Chap 23 PpeDocument5 pagesKaya Mo Yan-Finac-Chap 23 PpeTrixie JeramieNo ratings yet

- Kaya Mo Yan-Finac-Chap 23 PpeDocument5 pagesKaya Mo Yan-Finac-Chap 23 PpeTrixie JeramieNo ratings yet

- Generales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Document12 pagesGenerales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Kirstelle VelezNo ratings yet

- Erlinda Company Problem 2Document12 pagesErlinda Company Problem 2JekoeNo ratings yet

- Accounting Worksheet V 1.0Document6 pagesAccounting Worksheet V 1.0Maxeen ManuelNo ratings yet

- Budget For CDM For May 2009Document2 pagesBudget For CDM For May 2009tunde adeniranNo ratings yet

- Abm Task3 BacuetesDocument2 pagesAbm Task3 BacuetesbacuetesjustinNo ratings yet

- Book 1Document2 pagesBook 1VIRAY, CRISTIAN JAY V.No ratings yet

- Worksheet Pr2 Chap 9Document4 pagesWorksheet Pr2 Chap 9airamaecsibbalucaNo ratings yet

- CashflowDocument5 pagesCashflowHanan SalmanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Zonal Employee Zed Fares Effective 01 Oct, 10Document3 pagesZonal Employee Zed Fares Effective 01 Oct, 10Muhammad NaveedNo ratings yet

- Indian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDocument5 pagesIndian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDharamNo ratings yet

- 2.3 Leadership Styles - International Business Management InstituteDocument4 pages2.3 Leadership Styles - International Business Management InstituteLeonardo Andrés Hernández MolanoNo ratings yet

- United States Court of Appeals For The Fifth Circuit: FiledDocument8 pagesUnited States Court of Appeals For The Fifth Circuit: FiledRHTNo ratings yet

- Complete Oil AnalysisDocument33 pagesComplete Oil AnalysisGnanaSekar100% (1)

- PWC FICCI Knowledge Paper in Aviation Wings 2022 1648497337Document40 pagesPWC FICCI Knowledge Paper in Aviation Wings 2022 1648497337Manoj ShettyNo ratings yet

- NG160 - 16 To 160A Modular Incoming Circuit BrakersDocument27 pagesNG160 - 16 To 160A Modular Incoming Circuit BrakerssomeontorrenteNo ratings yet

- FILMUSIC - International Composing CompetitionDocument3 pagesFILMUSIC - International Composing CompetitionFrancesco NettiNo ratings yet

- ZohoDocument16 pagesZohoasvs1006No ratings yet

- Process: Add Menu Item Master, Definition, Price: Step ActionDocument7 pagesProcess: Add Menu Item Master, Definition, Price: Step ActionPrince HakimNo ratings yet

- Manual: For Diesel EngineDocument84 pagesManual: For Diesel EngineColdbloodedbikerNo ratings yet

- Fms User GuideDocument346 pagesFms User GuideRanny Lomibao100% (1)

- Washing Machine User Manual SamsungDocument28 pagesWashing Machine User Manual SamsungEliezer MorenoNo ratings yet

- Bpas 186 Solved AssignmentDocument7 pagesBpas 186 Solved AssignmentDivyansh Bajpai0% (1)

- Creating Cust Specific POWL Query PDFDocument3 pagesCreating Cust Specific POWL Query PDFvictorSNo ratings yet

- 3-Phase Motor Drives W Oscilloscope 48W-73863-0Document31 pages3-Phase Motor Drives W Oscilloscope 48W-73863-0CarloNo ratings yet

- Electric DrivesDocument2 pagesElectric DrivesUmashankar SubramaniamNo ratings yet

- (2014) Pneumonia CURSDocument46 pages(2014) Pneumonia CURSAna-MariaCiotiNo ratings yet

- EAC Knowledge Profile (WK) / Engineering Activities (EA) Utm PloDocument4 pagesEAC Knowledge Profile (WK) / Engineering Activities (EA) Utm PloHafiziAhmadNo ratings yet

- Quality Mark Guideline 0Document50 pagesQuality Mark Guideline 0Asma DahaboNo ratings yet

- 2018 Passouts - Companies VisitedDocument14 pages2018 Passouts - Companies VisitedgppNo ratings yet

- Annex 11 Monitoring and Evaluation ToolDocument6 pagesAnnex 11 Monitoring and Evaluation ToolKathrine Jane LunaNo ratings yet

- Elango COUNCILSNOTABLESPOLITICS 1987Document24 pagesElango COUNCILSNOTABLESPOLITICS 1987Ota Benga BengaNo ratings yet

- Membership Update FormDocument4 pagesMembership Update FormbmapiraNo ratings yet

- Saja .K.a Apollo TyresDocument52 pagesSaja .K.a Apollo TyresSaja Nizam Sana100% (1)

- Unit - 3 AtmipDocument11 pagesUnit - 3 AtmipFaruk MohamedNo ratings yet

- Data Sheet - Quantran Dimmer RacksDocument2 pagesData Sheet - Quantran Dimmer Racksmuqtar4uNo ratings yet

- Distribution, Abundance and Population Status of Four Indigenous Threatened Tree Species in The Arba Minch Natural Forest, Southern EthiopiaDocument9 pagesDistribution, Abundance and Population Status of Four Indigenous Threatened Tree Species in The Arba Minch Natural Forest, Southern EthiopiaMihretu AbrhamNo ratings yet