Professional Documents

Culture Documents

II-49 Ormoc Sugar Company v. Treasurer of Ormoc City

II-49 Ormoc Sugar Company v. Treasurer of Ormoc City

Uploaded by

Darrell MagsambolOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

II-49 Ormoc Sugar Company v. Treasurer of Ormoc City

II-49 Ormoc Sugar Company v. Treasurer of Ormoc City

Uploaded by

Darrell MagsambolCopyright:

Available Formats

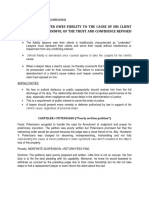

University of the Philippines College of Law

Block F2021

Topic Equal Protection

Case No. G.R. No. L-23794 / 17 February 1968

Case Name ORMOC SUGAR COMPANY v. TREASURER OF ORMOC CITY

Ponente Bengzon, JP, J.

Digest Assigned to Joker & Mikhail

Right Claimed Equal protection of laws

Claimant Ormoc Sugar Company

State Actor Municipal Board of Ormoc City; City Treasurer

State Action Enactment of ordinance imposing export tax on the claimant; Collection of export tax

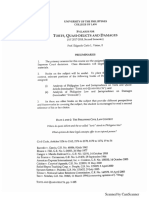

RELEVANT FACTS

In January 1964, the Municipal Board of Ormoc City passed an ordinance imposing "on any and all

productions of centrifugal sugar milled at the Ormoc Sugar Company, Inc., in Ormoc City a municipal tax

equivalent to one per centum (1%) per export sale to the United States of America and other foreign

countries."

The Ormoc Sugar Company paid the taxes under protest on two occasions in 1964.

The Court of First Instance upheld the constitutionality of the ordinance, and declared that the taxing

power of the city was broadened by the Local Autonomy Act enacted in 1959. (The Administrative Code

then in force forbade municipal councils to impose any import or export tax. This was deemed repealed

by the Local Autonomy Act by giving chartered cities, municipalities and municipal districts authority to

levy for public purposes just and uniform taxes, licenses or fees.)

ISSUES

W/N the ordinance in question violates the equal protection clause

W/N the company may refund the tax paid with interest

RATIO DECIDENDI

Issue Ratio

W/N the ordinance in YES.

question violates the equal

protection clause The ordinance taxes only centrifugal sugar produced and exported by the

Ormoc Sugar Company. It was the only sugar central in the city at the time.

However, in order for classification to be reasonable and not barred by the

equal protection clause, the classification must apply not only to present

conditions but also to future conditions which are substantially identical to

those of the present.

The equal protection clause applies only to persons or things identically

situated and does not bar a reasonable classification of the subject of

legislation, and a classification is reasonable where (1) it is based on

substantial distinctions which make real differences; (2) these are germane to

University of the Philippines College of Law

Block F2021

the purpose of the law; (3) the classification applies not only to present

conditions but also to future conditions which are substantially identical to

those of the present; (4) the classification applies only to those who belong

to the same class.

W/N the company may YES, but without interest.

refund the tax paid with

interest At the time of collection, the ordinance provided a sufficient basis to preclude

arbitrariness, the same being then presumed constitutional until declared

otherwise.

RULING

WHEREFORE, the decision appealed from is hereby reversed, the challenged ordinance is declared

unconstitutional and the defendants- appellees are hereby ordered to refund the P12,087.50 plaintiff- appellant

paid under protest. No. costs. So ordered.

NO SEPARATE OPINION

You might also like

- Case Digest-Pollution-Adjudication-Board-Vs-CaDocument1 pageCase Digest-Pollution-Adjudication-Board-Vs-CaAngela Mitchelle TorresNo ratings yet

- 44 People V OrdonoDocument2 pages44 People V OrdonoDarrell MagsambolNo ratings yet

- Philippine Press Institute V COMELECDocument5 pagesPhilippine Press Institute V COMELECGabe RuaroNo ratings yet

- Lejano VS PeopleDocument3 pagesLejano VS PeopleGracey Sagario Dela TorreNo ratings yet

- 00 Credit Finals - CasesDocument6 pages00 Credit Finals - CasesJanz SerranoNo ratings yet

- Diocese of Bacolod Vs COMELECDocument2 pagesDiocese of Bacolod Vs COMELECCE SherNo ratings yet

- 28 Sumulong Vs Guerero DigestDocument1 page28 Sumulong Vs Guerero DigestLex Tamen CoercitorNo ratings yet

- United States V TantengDocument1 pageUnited States V TantengMichelleGebanaNo ratings yet

- 1 - 1. RE - Query of Mr. Prioreschi Re Exemption From Legal and Filing Fees of The Good Shepherd Foundation, Inc. - FANGONDocument1 page1 - 1. RE - Query of Mr. Prioreschi Re Exemption From Legal and Filing Fees of The Good Shepherd Foundation, Inc. - FANGONkatie graceNo ratings yet

- Soliven Vs MakasiarDocument2 pagesSoliven Vs MakasiarRica Marion DayagNo ratings yet

- People Vs EstoistaDocument5 pagesPeople Vs EstoistaKarina Katerin BertesNo ratings yet

- People v. Modesto Tee DigestDocument1 pagePeople v. Modesto Tee DigestDonvidachiye Liwag Cena100% (1)

- Epza V DulayDocument3 pagesEpza V DulayTricia SibalNo ratings yet

- AYER PRODUCTIONS PTY vs. CAPULONG - DigestDocument3 pagesAYER PRODUCTIONS PTY vs. CAPULONG - DigestGuiller C. MagsumbolNo ratings yet

- (Consti 2 DIGEST) 184 - Lim Vs FelixDocument7 pages(Consti 2 DIGEST) 184 - Lim Vs FelixCharm Divina LascotaNo ratings yet

- Phil Judges Assoc Vs PradoDocument1 pagePhil Judges Assoc Vs PradoC Maria LuceNo ratings yet

- Chavez Vs PCGGDocument4 pagesChavez Vs PCGGMarvin SantosNo ratings yet

- PEOPLE OF THE PHILIPPINES Vs Abe ValdezDocument3 pagesPEOPLE OF THE PHILIPPINES Vs Abe ValdezJanMikhailPanerioNo ratings yet

- Policarpio Vs Manila TimesDocument2 pagesPolicarpio Vs Manila TimesgabbieseguiranNo ratings yet

- CD Cruz vs. Hon. Judge Guillermo P. Villasor G.R. No. L 32213 November 26 1973Document3 pagesCD Cruz vs. Hon. Judge Guillermo P. Villasor G.R. No. L 32213 November 26 1973Mary Fatima BerongoyNo ratings yet

- Beltran VS Secretary of HealthDocument3 pagesBeltran VS Secretary of HealthEduard RiparipNo ratings yet

- Rural Bank of Milaor v. OcfemiaDocument15 pagesRural Bank of Milaor v. OcfemiaJNMGNo ratings yet

- PSB VS BermoyDocument5 pagesPSB VS BermoyJessamine OrioqueNo ratings yet

- The Impairement Clause DigestDocument8 pagesThe Impairement Clause DigestEduard Anthony AjeroNo ratings yet

- Borja vs. MendozaDocument1 pageBorja vs. MendozaJoseph MacalintalNo ratings yet

- C45 Tablarin vs. GutierezDocument12 pagesC45 Tablarin vs. GutierezcharmssatellNo ratings yet

- Digest - Go V UCPBDocument2 pagesDigest - Go V UCPBamberspanktowerNo ratings yet

- Bautista Vs Junio GR L-50908 31 January 1984 (Lawful Subject)Document2 pagesBautista Vs Junio GR L-50908 31 January 1984 (Lawful Subject)Mary Dorothy TalidroNo ratings yet

- Labor Digests - Week 5Document9 pagesLabor Digests - Week 5Chesca HernandezNo ratings yet

- Constitutional Law Case Digest Compilation Part 2 - Atty RemorozaDocument29 pagesConstitutional Law Case Digest Compilation Part 2 - Atty RemorozaSecret StudentNo ratings yet

- CIVPRO Batch 5 Case DigestsDocument19 pagesCIVPRO Batch 5 Case DigestsVic RabayaNo ratings yet

- Shell Vs JalosDocument3 pagesShell Vs JalosJoahnna Paula CorpuzNo ratings yet

- DepEd To MendozaDocument15 pagesDepEd To MendozaKim EcarmaNo ratings yet

- Feria Vs CADocument2 pagesFeria Vs CAClaudine BancifraNo ratings yet

- Bayan, Et Al., vs. Eduardo Ermita, Et Al., G.R. No. 169838 April 25, 2006 DIGESTDocument2 pagesBayan, Et Al., vs. Eduardo Ermita, Et Al., G.R. No. 169838 April 25, 2006 DIGESTJon SantiagoNo ratings yet

- Mindanao Savings and Loans Inc Vs WillkomDocument2 pagesMindanao Savings and Loans Inc Vs Willkomis_still_artNo ratings yet

- Obligations Case DigestDocument20 pagesObligations Case DigestdoraemoanNo ratings yet

- 114694-2001-People v. Bascuguin y AcquizDocument7 pages114694-2001-People v. Bascuguin y AcquizNika RojasNo ratings yet

- LEGETHICS DIGEST (2 and 3) PDFDocument41 pagesLEGETHICS DIGEST (2 and 3) PDFPammyNo ratings yet

- Quinto Vs ComelecDocument2 pagesQuinto Vs ComelecDavide Lee100% (1)

- Consti Case DigestsDocument18 pagesConsti Case DigestsAlyssa Denise A AverillaNo ratings yet

- Balacuit V CFIDocument2 pagesBalacuit V CFINxxxNo ratings yet

- Yutivo DigestDocument1 pageYutivo DigestSosthenes Arnold MierNo ratings yet

- 178-PEOPLE OF THE PHILIPPINES vs. ALBERTO ESTOISTADocument1 page178-PEOPLE OF THE PHILIPPINES vs. ALBERTO ESTOISTABeatrice AbanNo ratings yet

- Ho Wai Pang Vs PeopleDocument3 pagesHo Wai Pang Vs Peopleis_still_artNo ratings yet

- Ayala de Roxas V City of ManilaDocument8 pagesAyala de Roxas V City of ManilaDennis VelasquezNo ratings yet

- Chavez vs. Court of Appeals DigestDocument1 pageChavez vs. Court of Appeals DigestJessie Albert CatapangNo ratings yet

- Maceda v. ERB (1990) : Digest Author: Alexi CaldaDocument1 pageMaceda v. ERB (1990) : Digest Author: Alexi CaldaPau SaulNo ratings yet

- Navia vs. Pardico (Specpro Writ of Amparo)Document4 pagesNavia vs. Pardico (Specpro Writ of Amparo)dave_88opNo ratings yet

- Ebralinag, Et Al vs. Div. Supt. of Schools of Cebu G.R. No. 95770, March 1, 1993Document2 pagesEbralinag, Et Al vs. Div. Supt. of Schools of Cebu G.R. No. 95770, March 1, 1993Jon Santiago100% (1)

- Jai Alai DigestDocument2 pagesJai Alai DigestReena Alekssandra AcopNo ratings yet

- Central Bank Employees Association vs. BSP: G.R. NO. 148208: December 15, 2004Document3 pagesCentral Bank Employees Association vs. BSP: G.R. NO. 148208: December 15, 2004A M I R ANo ratings yet

- People V QuitlongDocument1 pagePeople V QuitlongPaul Joshua Torda SubaNo ratings yet

- Gamboa Vs Chan DigestDocument2 pagesGamboa Vs Chan DigestJR Billones100% (1)

- 446 Supreme Court Reports Annotated: Roxas vs. de Zuzuarregui, JRDocument12 pages446 Supreme Court Reports Annotated: Roxas vs. de Zuzuarregui, JRAngelie FloresNo ratings yet

- Galicia Vs PoloDocument7 pagesGalicia Vs Pololen_dy010487100% (1)

- Ulep V Legal ClinicDocument2 pagesUlep V Legal ClinicsupernanayNo ratings yet

- Corp - Gochan v. YoungDocument2 pagesCorp - Gochan v. YoungIrish GarciaNo ratings yet

- Ormoc Sugar v. Treasurer of Ormoc PDFDocument1 pageOrmoc Sugar v. Treasurer of Ormoc PDFnrpostreNo ratings yet

- 65 Ormoc Sugar Co v. Treasurer of Ormoc CityDocument3 pages65 Ormoc Sugar Co v. Treasurer of Ormoc CityPio MathayNo ratings yet

- 4ormoc Sugar Co. Inc. V Treasurer of Ormoc City - Equal Protection, Not Limited To Existing ConditionsDocument2 pages4ormoc Sugar Co. Inc. V Treasurer of Ormoc City - Equal Protection, Not Limited To Existing ConditionsIanNo ratings yet

- Lynch Chapter 5: I. Legal LandscapeDocument38 pagesLynch Chapter 5: I. Legal LandscapeDarrell MagsambolNo ratings yet

- AR - LORNA - May 11-15, 2020Document2 pagesAR - LORNA - May 11-15, 2020Darrell MagsambolNo ratings yet

- The Rise of The Civil Law SystemDocument34 pagesThe Rise of The Civil Law SystemDarrell MagsambolNo ratings yet

- Post MidtermsDocument38 pagesPost MidtermsDarrell MagsambolNo ratings yet

- Grounds of Termination of Contact and Non-Payment of Rentals. MTCDocument2 pagesGrounds of Termination of Contact and Non-Payment of Rentals. MTCDarrell MagsambolNo ratings yet

- Air Transport V GopucoDocument4 pagesAir Transport V GopucoDarrell MagsambolNo ratings yet

- Francia V MeycauayanDocument1 pageFrancia V MeycauayanDarrell MagsambolNo ratings yet

- May 11 15 AL Aquino Weekly Accomplishment ReportDocument2 pagesMay 11 15 AL Aquino Weekly Accomplishment ReportDarrell MagsambolNo ratings yet

- Accomplishment Report: Inclusive Dates Activity / Task Output/ Outcome, If AnyDocument2 pagesAccomplishment Report: Inclusive Dates Activity / Task Output/ Outcome, If AnyDarrell MagsambolNo ratings yet

- RR 05-99 PDFDocument1 pageRR 05-99 PDFDarrell MagsambolNo ratings yet

- Rules of Being Relentless by Tim GroverDocument4 pagesRules of Being Relentless by Tim GroverDarrell Magsambol100% (4)

- 46 San Miguel Corp v. AvelinoDocument2 pages46 San Miguel Corp v. AvelinoDarrell MagsambolNo ratings yet

- 060 Peralta v. CSCDocument3 pages060 Peralta v. CSCDarrell MagsambolNo ratings yet

- 112 Republic V Coseteng-MagpayoDocument2 pages112 Republic V Coseteng-MagpayoDarrell MagsambolNo ratings yet

- 234 Punongbayan & Araullo (P&a) v. LeponDocument2 pages234 Punongbayan & Araullo (P&a) v. LeponDarrell MagsambolNo ratings yet

- 014 Alipio - v. - Court - of - AppealsDocument2 pages014 Alipio - v. - Court - of - AppealsDarrell MagsambolNo ratings yet

- 015 Pedrosa V CADocument2 pages015 Pedrosa V CADarrell MagsambolNo ratings yet

- 03 People v. KalaloDocument7 pages03 People v. KalaloDarrell MagsambolNo ratings yet

- 016 Kilario V CADocument2 pages016 Kilario V CADarrell Magsambol100% (1)

- When and How Warrant Issued: Digest WriterDocument2 pagesWhen and How Warrant Issued: Digest WriterDarrell MagsambolNo ratings yet

- LEGPROF Presenation 2Document12 pagesLEGPROF Presenation 2Darrell MagsambolNo ratings yet

- 047 Estate of Ruiz v. CADocument2 pages047 Estate of Ruiz v. CADarrell MagsambolNo ratings yet

- Torts Syllabus 1718Document7 pagesTorts Syllabus 1718Darrell MagsambolNo ratings yet

- 2 Why I Do Not Call Myself A FeministDocument7 pages2 Why I Do Not Call Myself A FeministManidip GangulyNo ratings yet

- Radiomuseum Sharp Osaka Intercontinental FV 1700 439956Document2 pagesRadiomuseum Sharp Osaka Intercontinental FV 1700 439956Mionnix KM-Service-premiumNo ratings yet

- Chieftancy Report - Vis3 15 OctDocument33 pagesChieftancy Report - Vis3 15 OctMaxwell KemokaiNo ratings yet

- Compounding of Offences - Law Times JournalDocument6 pagesCompounding of Offences - Law Times JournalNEHA SHARMANo ratings yet

- Global Security in Related To West PapuaDocument9 pagesGlobal Security in Related To West PapuaTPNPB NewsNo ratings yet

- Advertising Assignment CPDocument3 pagesAdvertising Assignment CPAlamin tahaminNo ratings yet

- PRL InglesDocument49 pagesPRL InglesBoracoNo ratings yet

- An Open Letter To YouTube's CEO From The World's Fact-Checkers (With Filipino Version)Document7 pagesAn Open Letter To YouTube's CEO From The World's Fact-Checkers (With Filipino Version)VERA FilesNo ratings yet

- 50 GMCR V Bell Telecom GR 126496 043097 271 Scra 790Document5 pages50 GMCR V Bell Telecom GR 126496 043097 271 Scra 790Winfred TanNo ratings yet

- Rule 114 Digests PDFDocument20 pagesRule 114 Digests PDFAnna VeluzNo ratings yet

- Political Executives and Leadership 1Document20 pagesPolitical Executives and Leadership 1Stephen Francis100% (1)

- 2022 TZHC 488Document15 pages2022 TZHC 488Marbaby SolisNo ratings yet

- Theories of ADMINDocument10 pagesTheories of ADMINMercy NamboNo ratings yet

- The Dutch Private International Law Codification: Principles, Objectives and OpportunitiesDocument31 pagesThe Dutch Private International Law Codification: Principles, Objectives and OpportunitiesAhmadHarisJunaidiNo ratings yet

- Macariola vs. Ascunsion, Adm. Case No. 133-J May 31, 1982Document16 pagesMacariola vs. Ascunsion, Adm. Case No. 133-J May 31, 1982Tin SagmonNo ratings yet

- Aids To Interpretation of Statutes - AssignmentDocument9 pagesAids To Interpretation of Statutes - AssignmentFarhatullah KalwarNo ratings yet

- Estipona v. LobrigoDocument2 pagesEstipona v. LobrigoRiena MaeNo ratings yet

- People vs. LisingDocument2 pagesPeople vs. LisingDexter Gascon100% (1)

- Supreme Court: Gregorio M. Rubias For Plaintiff-Appellant. Vicente R. Acsay For Defendant-AppelleeDocument11 pagesSupreme Court: Gregorio M. Rubias For Plaintiff-Appellant. Vicente R. Acsay For Defendant-AppelleeMama MiaNo ratings yet

- 14.04 People Vs ElarcosaDocument9 pages14.04 People Vs ElarcosanazhNo ratings yet

- Equal Employment Opportunity IsDocument2 pagesEqual Employment Opportunity IsDodoy DaculaNo ratings yet

- Labour Law Case Law Semester3Document200 pagesLabour Law Case Law Semester3Riddhi SinhaNo ratings yet

- Nevada Reports 1943-1945 (62 Nev.) PDFDocument346 pagesNevada Reports 1943-1945 (62 Nev.) PDFthadzigsNo ratings yet

- Perlidungan Hukum Terhadap Pelaksanaan Keselamatan Dan Kesehatan Kerja (K3) Pada PerusahaanDocument14 pagesPerlidungan Hukum Terhadap Pelaksanaan Keselamatan Dan Kesehatan Kerja (K3) Pada PerusahaanAlex Leonardo SipayungNo ratings yet

- People Vs LatupanDocument4 pagesPeople Vs LatupanstrgrlNo ratings yet

- Trespassing V Violation of DomicileDocument3 pagesTrespassing V Violation of DomicileDarkSlumberNo ratings yet

- Clark County Indiana CandidatesDocument5 pagesClark County Indiana CandidatesCourier JournalNo ratings yet

- Mass MediaDocument11 pagesMass Mediacherylv100% (1)

- Abakada Guro Party List vs. ErmitaDocument2 pagesAbakada Guro Party List vs. ErmitaGenevieve BermudoNo ratings yet

- Steinbuch v. Cutler Et Al - Document No. 29Document19 pagesSteinbuch v. Cutler Et Al - Document No. 29Justia.comNo ratings yet