Professional Documents

Culture Documents

Innovating For Growth: Now IS The Time

Innovating For Growth: Now IS The Time

Uploaded by

Juan Pablo EspinalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Innovating For Growth: Now IS The Time

Innovating For Growth: Now IS The Time

Uploaded by

Juan Pablo EspinalCopyright:

Available Formats

Innovating for growth: Now IS the time

Now might seem an odd time to talk about

growth. Some signs are promising, but corporate investments in new businesses this uncertain, there's

planning is complicated by unknowns involving very little cushion to absorb any bad-news outcomes.

economic prospects, capital markets, geopolitics, So it's reasonable to pull in one's horns as general

terrorism and pandemics. Shouldn't we be economic conditions sour.

hunkering down and just trying to survive? In a

word, these authors say "No." We believe growth doesn't need to be the kind of

gamble that most seem to assume. It is possible to bring

By Michael E. Raynor and Clayton M. Christensen a new level of predictability to innovation-driven

growth, the kind of predictability that makes it possible

Michael E. Raynor is a director with Deloitte to keep investing for growth when everybody else has

Research, the thought leadership arm of Deloitte, gone into a defensive crouch. The potential for

and a Professor of management at the Richard succeeding with any given growth opportunity can be

Ivey School of Business. Clayton M. Christensen assessed by answering three questions: is the opportunity

is the Robert and Jane disruptive? can you profit

Cizik Professor of from the opportunity? and do

Business Administration you have the capabilities to

at Harvard Business Growth is tough! pursue this opportunity? Our

School. This article is firm belief is that by

Four recently published studies converge on the estimate

based on their answering these questions,

that roughly one company in 10 succeeds at sustaining

forthcoming book, The you can predict with

growth. Chris Zook and James Allen found in their 2001

Innovator's Solution study "Profit from the Core" that only 13 per cent of their confidence which growth

(Harvard Business School sample of 1,854 companies was able to grow consistently opportunities will be

Press). over a 10-year period. That same year, Richard Foster successful and which won't.

and Sarah Kaplan published "Creative Destruction," a

study that followed 1,008 companies from 1962 to 1998. Is this opportunity

Why is it that as soon as They learned that only 160, or about 16 per cent of these disruptive?

the business horizon turns firms, were able merely to survive this time frame, and

cloudy so many companies concluded that the perennially outperforming company is Perhaps the most

get timid about investing for a chimera, something that has never existed at all. Jim powerful determinant of the

Collins also published his "Good to Great" in 2001, in

growth? We believe it's growth potential of an

which he examined a universe of 1,435 companies over

because growth has long 30 years (1965-1995). Collins found only 126, or about

innovation is whether or not

seemed a largely random nine per cent, had managed to outperform for a decade it is truly disruptive.

process. Such a belief is or more. The Corporate Strategy Board's "Stall Points" Disruptive innovations beat

perfectly understandable: findings show that five per cent of companies in the leading products and

the results of several recent Fortune 50 successfully maintained their growth, and providers at their own game,

studies suggest that no more another four per cent were able to reignite some degree but get their start by

than one company in 10 of growth after it had stalled. The studies all support our appealing to those customers

creates sustainable, assertion that a 10-per-cent probability of succeeding in a whom incumbents are happy

profitable growth (see box). quest for perpetual growth is a pretty reasonable to ignore or relieved to walk

With the outcome of estimate. away from. Disruptors then

-1- Ivey Business Journal September/October 2003

improve their products over time, moving upstream to existing markets. At the same time, they gain a foothold

challenge established firms. Table 1 (in the Appendix) by overperforming along other dimensions that are

provides a summary of some notable disruptions over valued by market segments but unprofitable to

the past 100 years. incumbent firms because they are small, generate thin

margins, or (as is usually the case) both. Over time,

The kinds of innovations that successful companies improvements on the dimensions of performance that

are good at are typically sustaining in nature; that is, are valuable to large, profitable markets enable

high-performing firms are disruptive innovations to

usually highly proficient at capture market share from

delivering the sorts of incumbent firms. The

improvements and products The broader lesson is that to truly disruptive products

that are valued by their eventually provide

existing customers. profit from a disruptive competitive levels of

performance on the

For example, when innovation, your organization traditional dimensions, but

electronic cash registers has to understand how the basis maintain the benefits that

appeared in the 1970s, they gave them a foothold in the

were a radical but of competition will be different first place.

sustaining innovation that

undermined the market for from what it has been in your Consider the attack on

electromechanical cash the low end of department

registers, which was established markets stores' market by discount

dominated by National retailers such as Wal-Mart

Cash Register. NCR and K-Mart in the 1960s.

managed to survive on service revenues for over a year, The discounters offered nationally branded hard goods

then introduced its own electronic cash register and such as paint, hardware, kitchen utensils, toys and

rapidly regained lost ground. The attempts that IBM sporting goods that were so familiar there was no need

and Kodak made in the 1970s and 1980s to beat Xerox for well-trained floor salespeople to assist customers.

in the high-speed photocopier business are another The discounters' business model enabled them to make

example. They were far bigger and yet failed to out- money at gross margins of about 23 per cent, on average.

muscle Xerox in this established market, where the name Their stocking policies and operating processes enabled

of the game was delivering a succession of sustaining them to turn inventories more than five times annually,

innovations. so they also earned about 120 per cent annual ROCII.

The discounters did not accept lower levels of

Sustaining innovations are enormously important, and profitability; their business model just earned acceptable

they can generate real wealth. But the very fact that profit through a different formula.5

incumbents are so adept at seeing and exploiting

sustaining innovations means that investors expect and Over time, in product category after product category,

demand that they do so. As a result, share prices the discounters found ways to sell through their lower-

typically have built into them the expectation that firms cost business model the products to which established

will, at a minimum, achieve the levels of growth that retailers were always retreating. The result, in Wal-

can be realized by exploiting opportunities for sustaining Mart's case, has been 25-per-cent annual growth for over

innovation. 25 years. All that remains to the established retailers

are very high-margin perfumes and other quasi-luxury

In contrast, innovation that creates the sort of growth goods that seem to depend on very expensive fixed-

that delights investors is innovation that is genuinely cost infrastructure like ceramic tile floors, marble

disruptive. Disruptive innovations typically countertops and halogen lighting.

underperform established products along those

dimensions of performance that define competition in The opportunities that hold the most promise for

-2- Ivey Business Journal September/October 2003

Figure 1 - The Process of Disruption

Performance

nt

ce that diffenreab

Performanse ents ca sorb

customer gm

ry

ecto

n t Traj

e

vem

Im pro

nt's ry

mbe ecto

Incu n t Traj

e

vem

Impro

or 's

upt

Disr

Time

Disruptive innovations typically take root with customers that are the least demanding with

respect to traditional dimensions of performance. As both incumbent and disruptor progress

along their respective improvement trajectories, the disruptor begins to take noticeable share

away from established competitors, who proceed to retreat upmarket to still more profitable

segments. Eventually however, there is nowhere left to run, while the disruptor has improved

sufficiently to appeal to mainstream customers.

growth for your organization, then, are those that are

truly disruptive to established firms. And to be Initially, customers simply want something that

disruptive, you should target customers that incumbents works; that is, those product attributes that define its

are willing-and even eager-to abandon, using business functionality are what matter most. When functionality

models that incumbents have no interest in replicating matters most, we say that functionality is the basis of

competition in a market at that point in time.

Where is the profit in this opportunity?

There is only so much functionality that customers

The value-chain elements that actually command can use, so once functionality requirements have been

economic profit either through price premiums or met, the basis of competition shifts to a new set of

defensible cost advantages are rarely the same for attributes. Typically, once something works well,

sustaining and disruptive innovations in a given market. customers want it to work consistently, and so the basis

Whatever activities an incumbent relies upon to justify of competition shifts to reliability.

its profitability in the sustaining arena will likely be of

little use when pursuing disruptive growth. So it is Once customer needs for functionality and reliability

critical for you to assess, for a given disruptive venture, have been met, customer priorities tend to shift to

which activities generate the bulk of an innovation's customizability or convenience; that is, customers want

profitability. this now high-functioning, highly reliable product to

be customized to their specific needs, or convenient and

It is facile to say that success in a market is at least easy to purchase and use. When the degree of

partly a function of delivering to customers more of customizability offered outstrips what customers can

what they value in ways that the competition cannot use, as manifested in their willingness to pay, they then

easily imitate. We can go much deeper, however, by push hard for lower price.

observing that different dimensions of performance are

valuable to customers at different stages in a product's Optimizing a product or service for different

life cycle. We've found it helpful to think in terms of dimensions of performance-in keeping with the basis

four categories of product performance. of competition in a market at a point in time-requires a

-3- Ivey Business Journal September/October 2003

firm to control different elements of the industry's value which come from Intel, Hitachi and Microsoft.

chain. Those firms that figure out which configurations

are best suited to the basis of competition in a market However, consumers faced trade-offs in deciding

are usually the ones that dominate that market-at least whether to spend their money for a faster processor, or

for a while-and with that dominance comes the lion's more memory, or a bigger screen, or a CD burner, and

share of an industry's profit. so on. They quickly came to value very highly the

company that mastered this new complexity and was

The evolution of the computer industry provides a able to meet their product customization needs. In other

helpful illustration. From the dawn of the commercial words, the changing nature of the underlying

computer industry in the mid-1950s until the early technological architecture shifted what customers were

1980s, the basis of competition was finding ways to willing to pay for; it changed the basis of competition

knit together the various components of a computer in to customizability.

order to create faster, better, more functional devices.

To deliver against that basis of competition required a The computer-maker that capitalized on this shift most

tightly integrated value chain. IBM dominated the effectively is Dell Computer. They have a very different

industry by controlling everything from design through value chain configuration than did IBM when Big Blue

many aspects of manufacturing, on to assembly, sales dominated mainframes, but the complexities they have

and service. It captured 70 per cent of sales and 95 per mastered are no less demanding. By tightly integrating

cent of profits. their supply chain with their customer relationship

management processes, and tying both into their state-

By the time the personal computer had become of-the-art assembly operations, Dell has been able to

ubiquitous in the early 1990s, the basis of competition provide customers precisely what they want, when and

at the level of designing and assembling computers was how they want it.

no longer functionality. Functionality was (and

continues to be) determined by critical inputs such as The broader lesson is that to truly profit from a

the microprocessor, memory and software, most of disruptive innovation, your organization has to

Figure 2 - The relationship between the basis of competition and optimal organizational scope

Dimensions of Performance Optimal Organizational Scope Across

an Industies Value Chain

ints

...at a relatively low price... Element 1 Element 2 Element 3 Element 4

Price

stra

Con

...flexibly and easily in a Element 1 Element 2 Element 3 Element 4

decentralized setting...

Convenience

...in a consistent and Element 1 Element 2 Element 3 Element 4

Reliability robust manner...

es

tur

Fea

...the product does the Element 1 Element 2 Element 3 Element 4

Functionality job...

Optimizing performance against different bases of competition requires different organizational

configurations. Shown here for illustrative purposes only is a generic industry value chain

consisting of four elements. To deliver improvements in functionality, a firm must control

elements 1-3; reliability demands control of elements 2-4, and so on. This implies that as the basis

of competition in an industry shifts, the dominant firms in each era will have very different value

chain configurations. Staying successful therefore requires seeing and even anticipating these

shifts, and reconfiguring one's value chain accordingly.

-4- Ivey Business Journal September/October 2003

understand how the basis of competition will be different work of Professor Morgan McCall (see especially his

from what it has been in your established markets. Only book High Flyers). McCall asserts that the management

by seeing the connection between the new basis of skills and intuition that people apply are set by their

competition that drives the success of a disruptive experiences in previous assignments in their careers.

innovation and activities in the value chain can you hope Consequently, managers who have worked their way

to deliver against that dimension of performance more up the ladder of a stable business unit would likely be

effectively than competitors. By staking out the most weak leading a start-up because the demands are so

valuable territory in the different. Note that what

innovation's value chain, matters is having grappled

you can position your with similar problems in the

organization to capture the The aphorism we have found that past and learned from the

bulk of the profits. experience, not necessarily

is most appropriate to the having succeeded.

Do I have the capabilities challenges of starting new growth

to exploit this This might seem

opportunity? ventures is to be "patient for obvious, yet when a slowly

growing firm's leaders

To truly exploit the growth, but impatient for profit." decide they need to launch

potential of an innovation, a new growth business to

your organization needs the restore their company's

right capabilities. We vitality, they typically tap

suggest decomposing the notion of organizational their own most successful executives-people whose

capabilities (or "competencies") into three elements: most salient experiences are likely to have little

resources, processes and values. By understanding what relevance to the challenges they will face.

each of these is and the relationships between them,

you can create an organization that is able to exploit Consider the experience of Pandesic, the high-profile

disruptive innovations. joint venture between Intel and SAP that was launched

in 1997 to create a new market disruption selling

Resources enterprise resource planning (ERP) software to small

businesses. The explicit plan was to develop and launch

Resources are usually people or things, including such a disruptive innovation in the ERP market. To lead this

assets as employees, equipment, technology, product new venture, Intel and SAP hand-picked some of their

designs, brands, information and cash. Most resources most successful, tried-and-true executives.

are visible and often are measurable, so managers can

readily assess their value. They tend to be quite portable So how did these managers go about seeking

as well: it is relatively easy to transport them across the Pandesic's fortune? The firm ramped to 100 employees

boundaries of organizations. in eight months, and established offices in Europe and

Asia. Within a year it announced 40 strategic

Of the many and often idiosyncratic resources that partnerships and inked agreements with major IT

any given business needs, we've found that the one consulting firms that had so capably sold and

resource that most consistently trips up businesses implemented SAP's large-company systems. The

focused on disruption is management. Senior executives product, initially intended to be simple ERP software

too often select the wrong people to run organizational delivered to small businesses via the Internet, evolved

units focused on disruptive innovations. We suspect into a completely automated end-to-end e-commerce

the mistakes happen when firms choose managers based solution.

upon an uninterrupted string of past successes, hoping

that more successes are in store. Pandesic was a spectacular failure. It sold very few

systems, and shut its doors in February 2001 after having

In our view, there is a better way that draws on the spent more than $100 million. The problem here was

-5- Ivey Business Journal September/October 2003

not managerial incompetence; it was managers with the designed for these purposes. In 1992, management

wrong competence. As a new venture, Pandesic faced realized that Prodigy's two million subscribers were

uncertainty regarding virtually every aspect of its spending more time sending e-mail than downloading

product design and business model, and needed information or making purchases on-line. Rather than

leadership adept at proceeding by trial and error. seeing this as signal to change strategy, Prodigy's

McCall's theory could have predicted this failure. For management sought to discourage the non-conforming

despite the extraordinary track records of Pandesic's behaviour, and charged extra fees to subscribers who

executives in managing the global operations of very sent more than 30 e-mail messages per month.

successful companies, none of them had faced any of

the challenges associated with managing a disruptive In contrast, America Online (AOL) entered the market

innovation. later, after it was clear that e-mail was a primary reason

for subscribing to an on-line service. With a technology

Processes infrastructure tailored to messaging and its "You've got

mail" signature, AOL became much more successful

Organizations create value as employees transform than Prodigy.

inputs of resources into products of greater worth. The

patterns of interaction, coordination, communication and We would interpret this as a failure of the strategy-

decision-making through which they accomplish these making process: management's job was defined as

transformations are processes. Processes include the implementing the original strategy, and there were no

ways that products are developed and made, and the mechanisms to capture and act upon feedback from the

methods by which procurement, market research, market. In our view, just as with selecting managers,

budgeting, employee development and compensation, selecting processes should not be a function of their past

and resource allocation are accomplished. results, but the problems they were designed to solve.

When creating a new unit to exploit a particular Values

innovation, the most crucial processes to examine

usually aren't the obvious value-adding processes The third class of factors that affects what an

involved in logistics, development, manufacturing and organization can or cannot accomplish is its values. By

customer service. Rather, they are the enabling or corporate values we mean the standards by which

background processes that support investment decisions. employees judge whether a customer's order is attractive

These include how market research is habitually done, or unattractive, whether a customer is more important

how such analysis is translated into financial projections, or less important, whether an idea for a new product is

how plans and budgets are negotiated, how those attractive or marginal, and so on.5

numbers are delivered, and so on. It is by not tuning

these processes to the needs of new growth businesses When it comes to the values that impinge upon a new

that many managers unwittingly sabotage their own growth opportunity, among the most important are the

success. expectations management has for the performance of

the new business. It is not uncommon for new ventures

The case of Prodigy Communications illustrates this to be measured by sales growth in the early going; after

principle. Launched as a joint venture between Sears all, a start-up can hardly be expected to be profitable,

and IBM in the early 1990s, Prodigy did not lack the can it? Profits will come later, we tell ourselves.

necessary resources: over $1 billion was invested in what

was at the time a very uncertain, but certainly potentially In our view, this is most often precisely the wrong

disruptive, innovation. way to measure success or set expectations. New

ventures that are targeted at exploiting disruptive

The original business plan envisioned that consumers opportunities, almost by definition, are grappling with

would use on-line services primarily to access a host of unknowns. A new venture that is required to

information and make on-line purchases, and Prodigy's generate a profit quickly is forced to pay very close

computer and communications infrastructure were attention to signals from the marketplace about its

-6- Ivey Business Journal September/October 2003

answers to these questions. Somewhat perversely, profitable, consistent growth a defining characteristic

driving hard for sales growth in spite of mounting losses of your organization.

is tantamount to ignoring market feedback telling you

that the new venture's strategy isn't working.

An excellent example of this phenomenon at work is

how Honda ended up dominating the American

motorcycle market. Initially hoping to introduce "low-

cost muscle bikes" to U.S. motorcycle enthusiasts,

Honda stumbled badly, unable to marshal the resources

necessary to overcome the technological hurdles

associated with the long-haul riding that characterized

the most profitable customers of Harley-Davidson and

other incumbents.

Strapped for cash, Honda had to concentrate on the

one product it had that was selling: its small, 50cc

Supercub. Initially dubious of the merits of selling such

low-priced, low-margin vehicles through, of all places,

sporting goods stores (since motorcycle dealerships had

no interest in what they considered to be toys), Honda's

management was forced to respond to the market rather

than doggedly pursue their original strategy. What

emerged was a classic disruption: beginning with

unattractive market segments that had never before

purchased motorcycles of any kind, Honda was able,

eventually, to march upmarket and ultimately dominate

the motorcycle industry.

The aphorism we have found that is most appropriate

to the challenges of starting new growth ventures is to

be "patient for growth, but impatient for profit." That

is, new businesses must follow the money, since that is

likeliest to keep them focused on-or, as in Honda's case,

allow them to find-a truly disruptive opportunity. A

new venture that can generate profit is likeliest to involve

connecting with genuine customer needs, and so likeliest

to be able to follow that disruptive trajectory and become

a true growth business. In an almost Zen-like irony, the

best way to find growth is not to seek it.

Successful growth has typically been seen as a gift

from the gods rather than as the fruits of reasoned,

careful and repeatable analysis. Therefore, when the

outlook is uncertain, there is an understandable but

lamentable tendency to restrict investments in growth,

even though successful growth would be the best way

to effect the desired turnaround. We believe that by

answering these three critical questions you can make

-7- Ivey Business Journal September/October 2003

Appendix

Table 1

The following table briefly summarizes our understanding of the disruptive roots of the success of several

companies. Because of space limitations, much important detail has been omitted. We ask our readers only

to regard this information as suggestive, rather than being definitive.

Company or

Description

Product

Technology

Bell Telephone Bell’s original telephone could only carry a signal for three miles, and therefore was rejected by Western Union,

whose business was long-distance telegraphy, because Western Union couldn’t use it. Bell therefore started a

new-market disruption, offering local communication. As the technology improved, it pulled customers out of

telegraphy’s long-distance value network into telephony.

Ford Henry Ford’s Model T was so inexpensive that he enabled a much larger population of people who historically

could not afford cars, now to own one.

Canon Until the early 1980s when we needed photocopiers, we had to take our originals to the corporate photocopy

photocopiers centre, where a technician ran the job for us. He had to be a technician, because the high-speed Xerox machine

in there was very complicated and needed servicing frequently. When Canon and Ricoh introduced their

countertop photocopiers, they were slow, produced poor-resolution copies, and didn’t enlarge or reduce or

collate. But they were so inexpensive and simple to use that we could afford to put one right around the corner

from our office. At the beginning we still took our high-volume jobs to the copy centre. But little by little,

Canon improved its machines to the point that today, immediate, convenient access to high-quality, full-

featured copying is almost a constitutional right in most workplaces.

Flat panel We normally think of disruptive technologies as being inexpensive, and many people are puzzled at how we

displays could call flat panel displays disruptive. Haven’t they come from the high end? Actually, no. Flat panel LCD

(Sharp et.al.) displays took root in digital watches; and then moved to calculators, notebook computers and small portable

televisions. These were applications that historically had no electronic displays at all, and LCD displays were

much cheaper than alternative means of bringing imaging to those applications. Flat screens have now begun

invading the mainstream market of computer monitors and in-home television screens, disrupting the cathode

ray tube. They are able to sustain substantial premium prices because of their 2-D character.

Embraer & The regional passenger jet business is booming, as their capacity over the past 15 years has stretched from 30 to

Canadair 50, 70 and now 106. As Boeing and Airbus struggle to make bigger, faster jets for transcontinental and

regional jets transoceanic travel, their growth has stagnated; the industry has consolidated (Lockheed and McDonnell

Douglas have been folded in); and the growth is at the bottom of the market.

Cisco Cisco’s router uses packet-switching technology to direct the flow of information over the telecommunications

system, compared to the circuit-switching technology of the established industry leaders such as Lucent, Siemens

and Nortel. The technology divides information into virtual “envelopes” called packets, and sends them out over

the Internet. Each packet might take a different route to the addressed destination; and when they arrive, the

packets are put in the right order and “opened” for the recipient to see. Because this process entailed a few

seconds’ latency delay, packet switching could not be used for voice telecommunications. But it was good

enough to enable a new market to emerge: data networks. The technology has improved to the point that,

today, the latency delay of a packet-switched voice call is almost imperceptibly slower than that of a circuit-

switched call, enabling VOIP, or voice-over-Internet-protocol telephony.

Financial Services

Merrill Lynch Charles Merrill’s mantra in 1912 was to “Bring Wall Street to Main Street.” By employing salaried rather than

commissioned brokers, he made it inexpensive enough to trade stocks that middle-income Americans could

become equity investors. Merrill Lynch moved upmarket over the next 90 years towards higher net-worth

investors. Most of the brokerage firms that held seats on the New York Stock Exchange in the 1950s and ’60s

have been merged out of existence, because Merrill Lynch disrupted them.

Bloomberg LP Bloomberg began by providing basic financial data to investment analysts and brokers. It gradually has

-8- Ivey Business Journal September/October 2003

Company or

Description

Product

improved its data offerings and analysis, and subsequently moved into the financial news business. It has

Bloomberg LP substantially disrupted Dow Jones and Reuters as a result. More recently, it has created its own ECN to disrupt

cont’d stock exchanges. Issuers of government securities can auction their initial offerings over the Bloomberg system,

disrupting investment banks.

Fidelity Created “self-service” personal financial management through its easy-to-buy families of mutual funds, 401k

management accounts, insurance products, etc. Fidelity was founded a few years after WWII; but began its disruptive

movements in the 1970s, as best we can tell.

Credit scoring A formulaic method of determining creditworthiness, substituting for the subjective judgments of bank loan

officers. Developed by a Minneapolis firm, Fair Isaac. Used initially to extend Sears and Penny’s in-store credit

cards. As the technology improved, it was used for general credit cards, and then auto, mortgage and now

small-business loans.

Education

Community In some states, up to 80% of the graduates of reputable four-year state universities took some or all of their

colleges required general education courses at much less expensive community colleges, and then transferred those

credits to the university—which (unconsciously) is becoming a provider of upper-division courses. Some

community colleges have begun offering four-year degrees. Their enrolment is booming, often with non-

traditional students who otherwise would not have taken these courses.

Concord School Founded by Kaplan, a unit of the Washington Post Company, this on-line law school has attracted a host of

of Law (primarily) non-traditional students. The school’s accreditation allows its graduates to take the California Bar

exam, and its graduates’ success rate is comparable to those of many other law schools. Many of its students

don’t enroll to become lawyers, however. They want to understand law to help them succeed in other careers.

University of A unit of Apollo, the University of Phoenix is disrupting four-year colleges and certain professional graduate

Phoenix programs. It began by providing employee training courses for businesses, often de facto, but sometimes by

formal contract. Its programs have expanded into a variety of open-enrolment, degree-granting programs.

Today it is one of the largest educational institutions in the United States, and is one of the leading providers of

on-line education.

Healthcare

Endoscopic Minimally invasive surgery was actively disregarded by leading surgeons because the technique could only

surgery address the simplest procedures. But it has improved to the point that even certain relatively complicated heart

procedures are done through a small port. The disruptive impact has primarily been on equipment makers and

hospitals.

Ultrasound Ultrasound technology is disruptive, relative to X-ray imaging. Hewlett-Packard, Accuson and ATL created a

multibillion-dollar industry by imaging soft tissues, which traditional X-ray technology could not capture. The

leading X-ray equipment makers, including General Electric, Siemens and Philips, became leaders in the two

major radical sustaining technology revolutions in imaging: CT scanning and magnetic resonance imaging (MRI).

Because ultrasound was a new market disruption, none of the X-ray companies participated in ultrasound until

very recently, when they acquired major ultrasound equipment companies.

Portable Disrupted makers of large blood glucose testing machines in hospital laboratories, enabling patients with

diabetes blood diabetes to monitor their own glucose levels.

glucose meters

Sonosite This firm makes a hand-held ultrasound device that enables health-care professionals who historically needed the

assistance of highly trained technicians with expensive equipment, now to look inside the bodies of patients in

their care, and thereby to provide more accurate and timely diagnoses. The company floundered for a time

attempting to implement its product as a sustaining innovation. But as of the time this book was being written,

it seemed to have caught its disruptive stride in an impressive way.

-9- Ivey Business Journal September/October 2003

You might also like

- Lead and Disrupt: How to Solve the Innovator's Dilemma, Second EditionFrom EverandLead and Disrupt: How to Solve the Innovator's Dilemma, Second EditionRating: 5 out of 5 stars5/5 (1)

- The Invincible Company: How to Constantly Reinvent Your Organization with Inspiration From the World's Best Business ModelsFrom EverandThe Invincible Company: How to Constantly Reinvent Your Organization with Inspiration From the World's Best Business ModelsNo ratings yet

- Case Solution Titanium DioxideDocument4 pagesCase Solution Titanium Dioxideanmolsaini01No ratings yet

- The Alchemy of Growth PDFDocument24 pagesThe Alchemy of Growth PDFpalenciaaNo ratings yet

- Financial Services: Securities Firms and Investment Banks: True / False QuestionsDocument30 pagesFinancial Services: Securities Firms and Investment Banks: True / False Questionslatifa hn100% (1)

- Mark SPitznagel - Different Black SwanDocument14 pagesMark SPitznagel - Different Black SwanVinny Sareen100% (4)

- Accenture Breaking Through Disruption Embrace The Power of The Wise PivotDocument37 pagesAccenture Breaking Through Disruption Embrace The Power of The Wise PivotLenninger von TeeseNo ratings yet

- Writing A Credible Investment Thesis - HBS Working KnowledgeDocument6 pagesWriting A Credible Investment Thesis - HBS Working KnowledgejgravisNo ratings yet

- Fortune at The Bottom of The Innovation Pyramid: The Strategic Logic of Incremental InnovationsDocument9 pagesFortune at The Bottom of The Innovation Pyramid: The Strategic Logic of Incremental Innovationsafcpa7No ratings yet

- Introduction And: Entrepreneurial Finance Leach & MelicherDocument33 pagesIntroduction And: Entrepreneurial Finance Leach & MelicherNadzirah Mohd SaidNo ratings yet

- EBSCO FullText 2023 04 22Document12 pagesEBSCO FullText 2023 04 22Ricardo RNo ratings yet

- MckinseyDocument24 pagesMckinseymoh0001No ratings yet

- 080 Strategy+business Magazine Autumn 2015Document120 pages080 Strategy+business Magazine Autumn 2015Yevhen KurilovNo ratings yet

- The Big Market Delusion Valuation and Investment ImplicationsDocument12 pagesThe Big Market Delusion Valuation and Investment ImplicationsblacksmithMGNo ratings yet

- Cohen-TOP 10 Reasons Why We Need INNOVATIONDocument4 pagesCohen-TOP 10 Reasons Why We Need INNOVATIONChristine DautNo ratings yet

- James M Higgins 101 Creative Problem Solving Techniques - RemovedDocument114 pagesJames M Higgins 101 Creative Problem Solving Techniques - RemovedNely Noer SofwatiNo ratings yet

- The Foundations of Entrepreneurship: Section IDocument40 pagesThe Foundations of Entrepreneurship: Section IAbdullahNo ratings yet

- Is Your Innovation Breaking DownDocument3 pagesIs Your Innovation Breaking Downma ChakaNo ratings yet

- Kauffman Index 2017: Growth Entrepreneurship Metropolitan Area and City TrendsDocument28 pagesKauffman Index 2017: Growth Entrepreneurship Metropolitan Area and City TrendsThe Ewing Marion Kauffman Foundation100% (1)

- Strategies For GrowthDocument8 pagesStrategies For GrowthadillawaNo ratings yet

- Capitulo 1 Innovation at The CoreDocument20 pagesCapitulo 1 Innovation at The CoreAntonio BaezNo ratings yet

- The Art of Supply Change Management: January 2009Document9 pagesThe Art of Supply Change Management: January 2009Sarmad HashimNo ratings yet

- Idea Generation and How To Read A 10KDocument12 pagesIdea Generation and How To Read A 10Kigotsomuchwin100% (1)

- Summary and Analysis of The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail: Based on the Book by Clayton ChristensenFrom EverandSummary and Analysis of The Innovator's Dilemma: When New Technologies Cause Great Firms to Fail: Based on the Book by Clayton ChristensenRating: 4.5 out of 5 stars4.5/5 (5)

- Managing Organisational and Management Challenges in India: NTPC SipatDocument17 pagesManaging Organisational and Management Challenges in India: NTPC SipatVIJAYPORNo ratings yet

- BCG Creating Urgency Amid Comfort Feb 2018 Tcm9 184546Document5 pagesBCG Creating Urgency Amid Comfort Feb 2018 Tcm9 184546Timothy TuasonNo ratings yet

- Practically Radical: A Game Plan For Game ChangersDocument18 pagesPractically Radical: A Game Plan For Game Changersapi-20526161No ratings yet

- Creative Construction - The DNA of Sustained InnovationDocument6 pagesCreative Construction - The DNA of Sustained InnovationMoncheNo ratings yet

- How To Build A Unicorn Lessons From Venture Capitalists and Start UpsDocument7 pagesHow To Build A Unicorn Lessons From Venture Capitalists and Start UpsKheylee VegaNo ratings yet

- The Success of Persistent EntrepreneursDocument2 pagesThe Success of Persistent EntrepreneursHBSWK100% (9)

- BCG - Corporate Venture Capital (Oct - 2012)Document21 pagesBCG - Corporate Venture Capital (Oct - 2012)ddubyaNo ratings yet

- Business Model Innovation - Deloitte ConsultingDocument28 pagesBusiness Model Innovation - Deloitte Consultingamine.luuckNo ratings yet

- Chaotics: The Business of Managing and Marketing in The Age of Turbulence Sample Chapter by Philip Kotler and John A. CaslioneDocument28 pagesChaotics: The Business of Managing and Marketing in The Age of Turbulence Sample Chapter by Philip Kotler and John A. CaslioneAMACOM, Publishing Division of the American Management Association100% (1)

- Diversity Wins: How Inclusion MattersDocument56 pagesDiversity Wins: How Inclusion MattersdgNo ratings yet

- Disruptive or Discontinuos InnovationDocument5 pagesDisruptive or Discontinuos Innovationankit_rihalNo ratings yet

- Exploring The Innovation PyramidDocument3 pagesExploring The Innovation PyramidAbNo ratings yet

- L3-O'reilly, Binns - 2019 - The Three Stages of Disruptive Innovation Idea Generation, Incubation, and ScalingDocument24 pagesL3-O'reilly, Binns - 2019 - The Three Stages of Disruptive Innovation Idea Generation, Incubation, and ScalinghuangNo ratings yet

- Managing Serious ChangeDocument48 pagesManaging Serious ChangeAdrianaNo ratings yet

- After LehmanDocument3 pagesAfter LehmanSuhas JambhaleNo ratings yet

- MoF Issue 20Document24 pagesMoF Issue 20qweenNo ratings yet

- Crisis As Antecedent of InnovationDocument6 pagesCrisis As Antecedent of InnovationSrirang JhaNo ratings yet

- The Mount Vernon Report October 2001 - Vol. 1, No. 1Document4 pagesThe Mount Vernon Report October 2001 - Vol. 1, No. 1Morrissey and CompanyNo ratings yet

- Zook On The CoreDocument9 pagesZook On The CoreThu NguyenNo ratings yet

- C Baradello - SC Tech Products - 2018Document114 pagesC Baradello - SC Tech Products - 2018Johanna LopezNo ratings yet

- Session3 PDFDocument30 pagesSession3 PDFcalvin gastaudNo ratings yet

- Cite Seer XDocument15 pagesCite Seer XRajat SharmaNo ratings yet

- HBR 2011 ZookAllenDocument9 pagesHBR 2011 ZookAlleny1301401755No ratings yet

- Building A Business1Document3 pagesBuilding A Business1Oluwasegun ModupeNo ratings yet

- How To Build A Unicorn: Lessons From Venture Capitalists and Start-UpsDocument7 pagesHow To Build A Unicorn: Lessons From Venture Capitalists and Start-UpsNext GenNo ratings yet

- Dynamo: Paths of GrowthDocument10 pagesDynamo: Paths of GrowthSébastien HerrmannNo ratings yet

- The Overconfidence TrapDocument8 pagesThe Overconfidence TrapAbrahamRoshNo ratings yet

- The Founder’s Roadmap to $100 Million ARR by Bessemer Venture PartnersDocument130 pagesThe Founder’s Roadmap to $100 Million ARR by Bessemer Venture PartnersJaideepMannNo ratings yet

- #Executive SummariesDocument5 pages#Executive SummariesNgô TuấnNo ratings yet

- The Structure of Strategy - John KayDocument21 pagesThe Structure of Strategy - John Kayjoe abdullahNo ratings yet

- On The Importance of Sustainable Human Resource Management For The Adoption of Sustainable Development GoalsDocument54 pagesOn The Importance of Sustainable Human Resource Management For The Adoption of Sustainable Development GoalsparsadNo ratings yet

- 5-1 Deloitte Mastering Innovation Exploiting Ideas For Profitable GrowthDocument24 pages5-1 Deloitte Mastering Innovation Exploiting Ideas For Profitable GrowthWentian HsiehNo ratings yet

- Transcription - Org ViabilityDocument5 pagesTranscription - Org Viabilitymanoj reddyNo ratings yet

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Designing Corporate Venturing Capital Successfully Startup Intellect Featured Insight Report FinalDocument24 pagesDesigning Corporate Venturing Capital Successfully Startup Intellect Featured Insight Report Finalali sharifzadehNo ratings yet

- Buku PDFDocument9 pagesBuku PDFradianNo ratings yet

- Do Innovating FirmsDocument17 pagesDo Innovating FirmsMAGALY ALBANNY BUSTAMANTE HIGINIONo ratings yet

- Harvard Business ReviewDocument3 pagesHarvard Business Reviewcorradopassera100% (1)

- L18 Persuade Change HBR 2022EnFebDocument7 pagesL18 Persuade Change HBR 2022EnFebMarcelo PosadasNo ratings yet

- Bain - Corporate VenturingDocument12 pagesBain - Corporate VenturingddubyaNo ratings yet

- Big Picture in Focus: Ulob. Differentiate The Types of Financial MarketsDocument10 pagesBig Picture in Focus: Ulob. Differentiate The Types of Financial MarketsJohn Stephen PendonNo ratings yet

- Exam 1 PDFDocument4 pagesExam 1 PDFFiraa'ool YusufNo ratings yet

- Dividend Policy, Business Economics & Finance B Com NotesDocument4 pagesDividend Policy, Business Economics & Finance B Com NotesMr. Rain ManNo ratings yet

- Lecture 7-Risk & ReturnDocument58 pagesLecture 7-Risk & ReturnSour CandyNo ratings yet

- Traders QuotesDocument53 pagesTraders QuotesTaresaNo ratings yet

- MicroCap Review Summer/Fall 2014Document96 pagesMicroCap Review Summer/Fall 2014Planet MicroCap Review MagazineNo ratings yet

- NZX Ecoya Media ReleaseDocument4 pagesNZX Ecoya Media ReleaseAlphatrader.co.nzNo ratings yet

- Project (Axis Mutul Fund)Document128 pagesProject (Axis Mutul Fund)nandish30No ratings yet

- Ar PDFDocument255 pagesAr PDFPRAVEEENGODARANo ratings yet

- Risk and Return Thuyết TrìnhDocument16 pagesRisk and Return Thuyết Trìnhdinhduongle2004No ratings yet

- IB Session 1Document34 pagesIB Session 1Pulokesh GhoshNo ratings yet

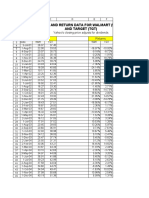

- Price and Return Data For Walmart (WMT) and Target (TGT) : Prices Returns Yahoo's Closing Price Adjusts For DividendsDocument19 pagesPrice and Return Data For Walmart (WMT) and Target (TGT) : Prices Returns Yahoo's Closing Price Adjusts For DividendsSyed Ameer Ali ShahNo ratings yet

- Harnish Inc Acquired 25 of The Outstanding Common Shares ofDocument1 pageHarnish Inc Acquired 25 of The Outstanding Common Shares ofFreelance WorkerNo ratings yet

- Quiz 2 - Linear ProgrammingDocument2 pagesQuiz 2 - Linear ProgrammingSandra AndradeNo ratings yet

- Cost of CapitalDocument56 pagesCost of CapitalAndayani SalisNo ratings yet

- The Role of Pension Funds in Financing Green Growth InitiativesDocument70 pagesThe Role of Pension Funds in Financing Green Growth InitiativesJorkosNo ratings yet

- ELEC 101-Behavioral FinanceDocument12 pagesELEC 101-Behavioral FinanceKier Arven SallyNo ratings yet

- Dividend Policy - Traditional PositionDocument7 pagesDividend Policy - Traditional PositionVaidyanathan Ravichandran67% (3)

- IFCDocument2 pagesIFCaltemurcan kursunluNo ratings yet

- Rakesh JhunjhunwalaDocument11 pagesRakesh Jhunjhunwalachinmay 1001No ratings yet

- FSA IFRS Test QuestionsDocument51 pagesFSA IFRS Test QuestionsArmand Hajdaraj33% (3)

- Basics of Share and DebentureDocument14 pagesBasics of Share and DebentureChaman SinghNo ratings yet

- Objectives & Scope of Portfolio ManagementDocument4 pagesObjectives & Scope of Portfolio ManagementGourav BaidNo ratings yet

- Microsoft PowerPoint - Finance FunctionDocument13 pagesMicrosoft PowerPoint - Finance FunctionBatenda FelixNo ratings yet

- Ca Ipcc - FM: - Covered in This File - Click Here - Click HereDocument63 pagesCa Ipcc - FM: - Covered in This File - Click Here - Click HereVarun MurthyNo ratings yet

- Akm 2 Week 11Document3 pagesAkm 2 Week 11Ahsan FirdausNo ratings yet