Professional Documents

Culture Documents

Taxation Trends in The European Union - 2012 118

Taxation Trends in The European Union - 2012 118

Uploaded by

d05registerCopyright:

Available Formats

You might also like

- The Effect of TaxDocument12 pagesThe Effect of TaxHimanshuNo ratings yet

- CM 03 Bank ReconciliationDocument7 pagesCM 03 Bank ReconciliationDanicaEsponilla67% (3)

- Taxation Trends in The European Union - 2012 122Document1 pageTaxation Trends in The European Union - 2012 122d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 174Document1 pageTaxation Trends in The European Union - 2012 174d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 90Document1 pageTaxation Trends in The European Union - 2012 90d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 74Document1 pageTaxation Trends in The European Union - 2012 74d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 66Document1 pageTaxation Trends in The European Union - 2012 66d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 70Document1 pageTaxation Trends in The European Union - 2012 70d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 162Document1 pageTaxation Trends in The European Union - 2012 162d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 82Document1 pageTaxation Trends in The European Union - 2012 82d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 86Document1 pageTaxation Trends in The European Union - 2012 86d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 102Document1 pageTaxation Trends in The European Union - 2012 102d05registerNo ratings yet

- Taxation Trends in EU in 2010Document42 pagesTaxation Trends in EU in 2010Tatiana TurcanNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Faculty - Economic and ManagementDocument5 pagesFaculty - Economic and ManagementBaraawo BaraawoNo ratings yet

- Taxation Trends in The European Union - 2012 20Document1 pageTaxation Trends in The European Union - 2012 20d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 41Document1 pageTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 21Document1 pageTaxation Trends in The European Union - 2012 21d05registerNo ratings yet

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocument44 pagesTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousNo ratings yet

- Taxation Trends in The European Union - 2012 151Document1 pageTaxation Trends in The European Union - 2012 151d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 52Document1 pageTaxation Trends in The European Union - 2012 52d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 107Document1 pageTaxation Trends in The European Union - 2012 107d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 159Document1 pageTaxation Trends in The European Union - 2012 159d05registerNo ratings yet

- Tax Systems and Tax Reforms in South and East Asia: ThailandDocument27 pagesTax Systems and Tax Reforms in South and East Asia: ThailandMarco CorvoNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 29Document1 pageTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNo ratings yet

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyDocument8 pagesEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanNo ratings yet

- Taxation Trends in The European Union - 2012 155Document1 pageTaxation Trends in The European Union - 2012 155d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Structural Changes in The Economy of Latvia After It Joined The European UnionDocument13 pagesStructural Changes in The Economy of Latvia After It Joined The European UnionBianca HorvathNo ratings yet

- Ireland: Developments in The Member StatesDocument4 pagesIreland: Developments in The Member StatesBogdan PetreNo ratings yet

- Taxation Trends in The European Union - 2012 59Document1 pageTaxation Trends in The European Union - 2012 59d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 84Document1 pageTaxation Trends in The European Union - 2012 84d05registerNo ratings yet

- GE 3 May 2012 - Andrea ManzittiDocument23 pagesGE 3 May 2012 - Andrea ManzittiMeadsieNo ratings yet

- A Study On The Evolution of Tax Pressure in RomaniaDocument12 pagesA Study On The Evolution of Tax Pressure in RomaniaNicoleta IonascuNo ratings yet

- Taxation Trends in The European Union - 2012 67Document1 pageTaxation Trends in The European Union - 2012 67d05registerNo ratings yet

- Revenue Statistics and Consumption Tax Trends 2014 MexicoDocument2 pagesRevenue Statistics and Consumption Tax Trends 2014 MexicoLuna MierNo ratings yet

- VAT Romania 1aprilDocument2 pagesVAT Romania 1aprilMaria Gabriela PopaNo ratings yet

- Coface - Macroeconomic Report HI 2012Document21 pagesCoface - Macroeconomic Report HI 2012Crenguta JanteaNo ratings yet

- Crisis and Consolidation - Fiscal Challenges in Emerging EuropeDocument16 pagesCrisis and Consolidation - Fiscal Challenges in Emerging EuropeBogduNo ratings yet

- dcp171766 263951Document16 pagesdcp171766 263951bogdan darcaciuNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Real PropertyDocument36 pagesReal PropertyKaren Balisacan Segundo RuizNo ratings yet

- The Determinants of Tax Revenue in Sub Saharan Africa - Tony & JorgenDocument19 pagesThe Determinants of Tax Revenue in Sub Saharan Africa - Tony & Jorgenpriyanthikadilrukshi05No ratings yet

- Goverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαDocument4 pagesGoverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαconstantinosNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- General Government Fiscal Balance: 2. Public Finance and EconomicsDocument3 pagesGeneral Government Fiscal Balance: 2. Public Finance and Economicsmaterials downloadNo ratings yet

- Tax Reform in KoreaDocument13 pagesTax Reform in KoreaKorea Economic Institute of America (KEI)100% (1)

- What Changes Are Needed To Have A Serious Political Union in EuropeDocument6 pagesWhat Changes Are Needed To Have A Serious Political Union in EuropeFranco PerottoNo ratings yet

- (JOURNAL Pajak Daerah) 201350Document20 pages(JOURNAL Pajak Daerah) 201350Ryzky JamaludinNo ratings yet

- 40 Duguleana ConstantinDocument10 pages40 Duguleana ConstantinFlavius GavrilescuNo ratings yet

- Rural Entrepreneurship and Untapped OpportunityDocument8 pagesRural Entrepreneurship and Untapped OpportunityLungleng LNgNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Egypt Economic ProfileDocument16 pagesEgypt Economic ProfileSameh Ahmed HassanNo ratings yet

- The NATO Effect On The Economic Trends of Its New Member CountriesDocument2 pagesThe NATO Effect On The Economic Trends of Its New Member CountriesNaTo PoPiashviliNo ratings yet

- The Effect of Tax Composition On Income Inequality: Sri Lankan ExperienceDocument18 pagesThe Effect of Tax Composition On Income Inequality: Sri Lankan ExperienceMuskan TyagiNo ratings yet

- Taxation Trends in The European Union - 2012 156Document1 pageTaxation Trends in The European Union - 2012 156d05registerNo ratings yet

- Public Administration Characteristics and Performance in EU28Document31 pagesPublic Administration Characteristics and Performance in EU28nurmalanasirsabon99No ratings yet

- Transformation Index BTI 2012: Regional Findings South and East AfricaFrom EverandTransformation Index BTI 2012: Regional Findings South and East AfricaNo ratings yet

- Infrastructure Investment in the Western Balkans: A First AnalysisFrom EverandInfrastructure Investment in the Western Balkans: A First AnalysisNo ratings yet

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 192Document1 pageTaxation Trends in The European Union - 2012 192d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 190Document1 pageTaxation Trends in The European Union - 2012 190d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 188Document1 pageTaxation Trends in The European Union - 2012 188d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 186Document1 pageTaxation Trends in The European Union - 2012 186d05registerNo ratings yet

- Commercial Law Memory AidDocument201 pagesCommercial Law Memory Aidjon_macasaetNo ratings yet

- Final Handbook On Accounting Treatment Under GST (20-6-19) PDFDocument146 pagesFinal Handbook On Accounting Treatment Under GST (20-6-19) PDFAdi Sam100% (3)

- Treatment of Captured Payment Cards in Automated Teller Machine DirectiveDocument12 pagesTreatment of Captured Payment Cards in Automated Teller Machine DirectiveFuaad DodooNo ratings yet

- Important PIC'sDocument1 pageImportant PIC'sAbhijit SahaNo ratings yet

- 7 D 6341 D 9Document6 pages7 D 6341 D 9Saul IpanaqueNo ratings yet

- Opportunity CostDocument1 pageOpportunity Costvaibhav67% (3)

- SKU: ML11907-307 Colour: Maroon Size: XL Net Quantity: 1 NDocument2 pagesSKU: ML11907-307 Colour: Maroon Size: XL Net Quantity: 1 NSwapnil DahaleNo ratings yet

- Transfer Pricing Country Profile Indonesia PDFDocument8 pagesTransfer Pricing Country Profile Indonesia PDFYusiMuzialifaNNo ratings yet

- CIR V CA, CTA and A. Soriano CorpDocument1 pageCIR V CA, CTA and A. Soriano Corpearl0917100% (1)

- Arie WDocument3 pagesArie WArie WidiyasaNo ratings yet

- JA p.6Document2 pagesJA p.6Von Andrei MedinaNo ratings yet

- Deepali Chhabra Goa Package 24 NovDocument3 pagesDeepali Chhabra Goa Package 24 NovRAHUL KHOSLANo ratings yet

- Sample ProblemDocument5 pagesSample ProblemNath BongalonNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFKSPNo ratings yet

- F. C. 43 (See Rule 7.8) : Signature of Drawing Officer With DateDocument2 pagesF. C. 43 (See Rule 7.8) : Signature of Drawing Officer With Dateazad100% (1)

- Cross RatesDocument1 pageCross RatesTiso Blackstar GroupNo ratings yet

- Earnings: Manoj Kumar Field ExecutiveDocument1 pageEarnings: Manoj Kumar Field ExecutiveSubhash SharmaNo ratings yet

- Director of Income Tax, New Delhi vs. Galileo International Inc., BangaloreDocument1 pageDirector of Income Tax, New Delhi vs. Galileo International Inc., BangaloreUdayyIklNo ratings yet

- Week 8 Scope and Taxation Reforms of The PhilippinesDocument4 pagesWeek 8 Scope and Taxation Reforms of The PhilippinesAngie Olpos Boreros BaritugoNo ratings yet

- InvoiceDocument1 pageInvoiceDp PandeyNo ratings yet

- All SAP Transaction Codes With Report and Description From F To HDocument50 pagesAll SAP Transaction Codes With Report and Description From F To HAntonio RomeroNo ratings yet

- Capital Gains ProblemsDocument2 pagesCapital Gains ProblemsKhubir LamaniNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepragnya sharonNo ratings yet

- V A T D A U T F C D o U ?Document16 pagesV A T D A U T F C D o U ?Yibekal TADESSENo ratings yet

- Income Tax: Ishmeet Kaur Sodhi BCP/19/173Document8 pagesIncome Tax: Ishmeet Kaur Sodhi BCP/19/173Ishmeet SodhiNo ratings yet

- PurchaseOrder RA0149669 9428094 20230317Document2 pagesPurchaseOrder RA0149669 9428094 20230317Deepak DasNo ratings yet

- Abhibus Ticket: Bangalore AluvaDocument2 pagesAbhibus Ticket: Bangalore Aluvatomyohan4No ratings yet

- Chapter 14-Income Taxes and Financial Accounting: True/FalseDocument8 pagesChapter 14-Income Taxes and Financial Accounting: True/FalsemilahrztaNo ratings yet

- MSC Indonesia Local Charges Updates - 22 February 2024Document10 pagesMSC Indonesia Local Charges Updates - 22 February 2024letandat14122003No ratings yet

Taxation Trends in The European Union - 2012 118

Taxation Trends in The European Union - 2012 118

Uploaded by

d05registerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Trends in The European Union - 2012 118

Taxation Trends in The European Union - 2012 118

Uploaded by

d05registerCopyright:

Available Formats

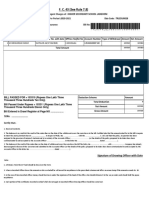

Developments in the Member States

Part II

Lithuania L

i

Overall trends in taxation t

h

Structure and development of tax revenues

u

In 2010, Lithuania exhibits the lowest total tax burden of 27.1 % of GDP (including social contributions) in the

EU. Compared to the two other Baltic countries the Lithuanian tax-to-GDP ratio is close to that of Latvia (27.3 %),

a

but 7.1 percentage points lower than the one of Estonia (34.2 %). n

i

In terms of revenue structure, Lithuania relies most on indirect taxes (12.1 % of GDP and 44.7 % of total taxation).

VAT revenue in GDP terms increased slightly from 7.4 % in 2009 to 7.9 % in 2010 while revenue from excise

a

duties and consumption taxes decreased marginally from 3.5 % to 3.3 %. At the same time, the revenue share of

direct taxes to GDP decreased considerably by 1.3 percentage points compared to the previous year marking the

lowest share of direct taxation in the EU-27. This development is due to the revenue fall from personal income

taxes (from 4.1 % in 2009 to 3.6 % in 2010) and the significant decrease of 44 % in corporate income taxes (from

1.8 % in 2009 to 1 % in 2010). Personal income taxes in GDP terms declined considerably by 53 % from 7.7 % in

2000 to 3.6 % in 2010 due to significant cuts in the flat PIT rate from 33 % to 15 % in the same period. The fall in

corporate taxes reflects the reduction of the general CIT rate from 20 % to 15 % due to advanced payments in

2010. Also revenue from social contributions decreased by 1.2 percentage points of GDP from 11.6 % (2009) to

10.4 % (2010). This development is due to a drop in employers' and employees' contributions from 8.6 % to 7.7 %

and from 2.6 % to 2.3 % respectively.

In Lithuania, the proportion of total tax revenue received by central government of 49.1 % in total taxation lies in

2010 well below the EU-27 average (58.8 %). The local government however receives 11.8 % of total tax revenue,

which is above EU-27 average (10.6 %). Remarkable is the fact that in Lithuania 38.3 % of total tax revenue is

received by the social security funds; this contribution is the sixth highest among the EU Member States.

By observing the development of the tax-to-GDP ratio in Lithuania, one realises that despite remarkable economic

growth from 2000 to 2007 the overall tax burden decreased slightly from 29.9 % to 29.5 % in the same period.

Since then the tax to GDP ratio has declined significantly exhibiting the largest fall of 2.1 % in 2010 in respect to

the year before. This development was not due to the economic cycle as the cyclically adjusted total tax revenue

decreased considerably as well from 30.9 % in 2009 to 29 % in 2010.

Taxation of consumption, labour and capital; environmental taxation

Consumption tax revenue in percent of GDP increased moderately from 11.2 % in 2009 to 11.5 % in 2010. The

ITR on consumption rose significantly by 1.7 percentage points in the same period reaching the highest level since

2000 due to an increase in the standard VAT rate by 2 percentage points as from September 2009. In spite of that

development however the Lithuanian ITR on consumption is the seventh lowest among EU Member States.

Overall, labour taxes are the most important revenue source for the Lithuanian budget and bring in about half of all

tax revenues. The share of labour taxes as a percentage of GDP declined however markedly by 1.6 percentage

points, from 2009 to 2010. In the same vein the ITR on labour decreased from 32.6 % to 31.7 %. At this level the

ITR on labour is slightly below EU average (33.4 %), although it decreased steadily from its 41.2 % peak in 2000,

due notably to the increase in basic tax allowances and the successive cuts in the PIT rate.

In Lithuania, taxes on capital to GDP are the third lowest in the EU, yielding only 35 % of the EU-27 average

(2.3 % versus 6.6 % for the EU-27). In addition, the share of capital taxes decreased significantly from 3.2 %

(2009) to 2.3 % in 2010 due to the cuts in the standard CIT rate and in the reduced rate for small companies. Tax

revenue from capital stocks is also one of the lowest in the EU-27. All of this is reflected in the Lithuanian ITR on

capital, a ratio which decreased substantially by 4.2 percentage points from 11 % in 2009 to 6.8 % in 2010 marking

the highest drop in the ITR on capital since 2000.

Taxation trends in the European Union 117

You might also like

- The Effect of TaxDocument12 pagesThe Effect of TaxHimanshuNo ratings yet

- CM 03 Bank ReconciliationDocument7 pagesCM 03 Bank ReconciliationDanicaEsponilla67% (3)

- Taxation Trends in The European Union - 2012 122Document1 pageTaxation Trends in The European Union - 2012 122d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 174Document1 pageTaxation Trends in The European Union - 2012 174d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 90Document1 pageTaxation Trends in The European Union - 2012 90d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 74Document1 pageTaxation Trends in The European Union - 2012 74d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 66Document1 pageTaxation Trends in The European Union - 2012 66d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 70Document1 pageTaxation Trends in The European Union - 2012 70d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 162Document1 pageTaxation Trends in The European Union - 2012 162d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 82Document1 pageTaxation Trends in The European Union - 2012 82d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 86Document1 pageTaxation Trends in The European Union - 2012 86d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 102Document1 pageTaxation Trends in The European Union - 2012 102d05registerNo ratings yet

- Taxation Trends in EU in 2010Document42 pagesTaxation Trends in EU in 2010Tatiana TurcanNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Faculty - Economic and ManagementDocument5 pagesFaculty - Economic and ManagementBaraawo BaraawoNo ratings yet

- Taxation Trends in The European Union - 2012 20Document1 pageTaxation Trends in The European Union - 2012 20d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 41Document1 pageTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 21Document1 pageTaxation Trends in The European Union - 2012 21d05registerNo ratings yet

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocument44 pagesTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousNo ratings yet

- Taxation Trends in The European Union - 2012 151Document1 pageTaxation Trends in The European Union - 2012 151d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 52Document1 pageTaxation Trends in The European Union - 2012 52d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 107Document1 pageTaxation Trends in The European Union - 2012 107d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 159Document1 pageTaxation Trends in The European Union - 2012 159d05registerNo ratings yet

- Tax Systems and Tax Reforms in South and East Asia: ThailandDocument27 pagesTax Systems and Tax Reforms in South and East Asia: ThailandMarco CorvoNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 29Document1 pageTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNo ratings yet

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyDocument8 pagesEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanNo ratings yet

- Taxation Trends in The European Union - 2012 155Document1 pageTaxation Trends in The European Union - 2012 155d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Structural Changes in The Economy of Latvia After It Joined The European UnionDocument13 pagesStructural Changes in The Economy of Latvia After It Joined The European UnionBianca HorvathNo ratings yet

- Ireland: Developments in The Member StatesDocument4 pagesIreland: Developments in The Member StatesBogdan PetreNo ratings yet

- Taxation Trends in The European Union - 2012 59Document1 pageTaxation Trends in The European Union - 2012 59d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 84Document1 pageTaxation Trends in The European Union - 2012 84d05registerNo ratings yet

- GE 3 May 2012 - Andrea ManzittiDocument23 pagesGE 3 May 2012 - Andrea ManzittiMeadsieNo ratings yet

- A Study On The Evolution of Tax Pressure in RomaniaDocument12 pagesA Study On The Evolution of Tax Pressure in RomaniaNicoleta IonascuNo ratings yet

- Taxation Trends in The European Union - 2012 67Document1 pageTaxation Trends in The European Union - 2012 67d05registerNo ratings yet

- Revenue Statistics and Consumption Tax Trends 2014 MexicoDocument2 pagesRevenue Statistics and Consumption Tax Trends 2014 MexicoLuna MierNo ratings yet

- VAT Romania 1aprilDocument2 pagesVAT Romania 1aprilMaria Gabriela PopaNo ratings yet

- Coface - Macroeconomic Report HI 2012Document21 pagesCoface - Macroeconomic Report HI 2012Crenguta JanteaNo ratings yet

- Crisis and Consolidation - Fiscal Challenges in Emerging EuropeDocument16 pagesCrisis and Consolidation - Fiscal Challenges in Emerging EuropeBogduNo ratings yet

- dcp171766 263951Document16 pagesdcp171766 263951bogdan darcaciuNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Real PropertyDocument36 pagesReal PropertyKaren Balisacan Segundo RuizNo ratings yet

- The Determinants of Tax Revenue in Sub Saharan Africa - Tony & JorgenDocument19 pagesThe Determinants of Tax Revenue in Sub Saharan Africa - Tony & Jorgenpriyanthikadilrukshi05No ratings yet

- Goverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαDocument4 pagesGoverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαconstantinosNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- General Government Fiscal Balance: 2. Public Finance and EconomicsDocument3 pagesGeneral Government Fiscal Balance: 2. Public Finance and Economicsmaterials downloadNo ratings yet

- Tax Reform in KoreaDocument13 pagesTax Reform in KoreaKorea Economic Institute of America (KEI)100% (1)

- What Changes Are Needed To Have A Serious Political Union in EuropeDocument6 pagesWhat Changes Are Needed To Have A Serious Political Union in EuropeFranco PerottoNo ratings yet

- (JOURNAL Pajak Daerah) 201350Document20 pages(JOURNAL Pajak Daerah) 201350Ryzky JamaludinNo ratings yet

- 40 Duguleana ConstantinDocument10 pages40 Duguleana ConstantinFlavius GavrilescuNo ratings yet

- Rural Entrepreneurship and Untapped OpportunityDocument8 pagesRural Entrepreneurship and Untapped OpportunityLungleng LNgNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Egypt Economic ProfileDocument16 pagesEgypt Economic ProfileSameh Ahmed HassanNo ratings yet

- The NATO Effect On The Economic Trends of Its New Member CountriesDocument2 pagesThe NATO Effect On The Economic Trends of Its New Member CountriesNaTo PoPiashviliNo ratings yet

- The Effect of Tax Composition On Income Inequality: Sri Lankan ExperienceDocument18 pagesThe Effect of Tax Composition On Income Inequality: Sri Lankan ExperienceMuskan TyagiNo ratings yet

- Taxation Trends in The European Union - 2012 156Document1 pageTaxation Trends in The European Union - 2012 156d05registerNo ratings yet

- Public Administration Characteristics and Performance in EU28Document31 pagesPublic Administration Characteristics and Performance in EU28nurmalanasirsabon99No ratings yet

- Transformation Index BTI 2012: Regional Findings South and East AfricaFrom EverandTransformation Index BTI 2012: Regional Findings South and East AfricaNo ratings yet

- Infrastructure Investment in the Western Balkans: A First AnalysisFrom EverandInfrastructure Investment in the Western Balkans: A First AnalysisNo ratings yet

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 192Document1 pageTaxation Trends in The European Union - 2012 192d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 190Document1 pageTaxation Trends in The European Union - 2012 190d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 188Document1 pageTaxation Trends in The European Union - 2012 188d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 186Document1 pageTaxation Trends in The European Union - 2012 186d05registerNo ratings yet

- Commercial Law Memory AidDocument201 pagesCommercial Law Memory Aidjon_macasaetNo ratings yet

- Final Handbook On Accounting Treatment Under GST (20-6-19) PDFDocument146 pagesFinal Handbook On Accounting Treatment Under GST (20-6-19) PDFAdi Sam100% (3)

- Treatment of Captured Payment Cards in Automated Teller Machine DirectiveDocument12 pagesTreatment of Captured Payment Cards in Automated Teller Machine DirectiveFuaad DodooNo ratings yet

- Important PIC'sDocument1 pageImportant PIC'sAbhijit SahaNo ratings yet

- 7 D 6341 D 9Document6 pages7 D 6341 D 9Saul IpanaqueNo ratings yet

- Opportunity CostDocument1 pageOpportunity Costvaibhav67% (3)

- SKU: ML11907-307 Colour: Maroon Size: XL Net Quantity: 1 NDocument2 pagesSKU: ML11907-307 Colour: Maroon Size: XL Net Quantity: 1 NSwapnil DahaleNo ratings yet

- Transfer Pricing Country Profile Indonesia PDFDocument8 pagesTransfer Pricing Country Profile Indonesia PDFYusiMuzialifaNNo ratings yet

- CIR V CA, CTA and A. Soriano CorpDocument1 pageCIR V CA, CTA and A. Soriano Corpearl0917100% (1)

- Arie WDocument3 pagesArie WArie WidiyasaNo ratings yet

- JA p.6Document2 pagesJA p.6Von Andrei MedinaNo ratings yet

- Deepali Chhabra Goa Package 24 NovDocument3 pagesDeepali Chhabra Goa Package 24 NovRAHUL KHOSLANo ratings yet

- Sample ProblemDocument5 pagesSample ProblemNath BongalonNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFKSPNo ratings yet

- F. C. 43 (See Rule 7.8) : Signature of Drawing Officer With DateDocument2 pagesF. C. 43 (See Rule 7.8) : Signature of Drawing Officer With Dateazad100% (1)

- Cross RatesDocument1 pageCross RatesTiso Blackstar GroupNo ratings yet

- Earnings: Manoj Kumar Field ExecutiveDocument1 pageEarnings: Manoj Kumar Field ExecutiveSubhash SharmaNo ratings yet

- Director of Income Tax, New Delhi vs. Galileo International Inc., BangaloreDocument1 pageDirector of Income Tax, New Delhi vs. Galileo International Inc., BangaloreUdayyIklNo ratings yet

- Week 8 Scope and Taxation Reforms of The PhilippinesDocument4 pagesWeek 8 Scope and Taxation Reforms of The PhilippinesAngie Olpos Boreros BaritugoNo ratings yet

- InvoiceDocument1 pageInvoiceDp PandeyNo ratings yet

- All SAP Transaction Codes With Report and Description From F To HDocument50 pagesAll SAP Transaction Codes With Report and Description From F To HAntonio RomeroNo ratings yet

- Capital Gains ProblemsDocument2 pagesCapital Gains ProblemsKhubir LamaniNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepragnya sharonNo ratings yet

- V A T D A U T F C D o U ?Document16 pagesV A T D A U T F C D o U ?Yibekal TADESSENo ratings yet

- Income Tax: Ishmeet Kaur Sodhi BCP/19/173Document8 pagesIncome Tax: Ishmeet Kaur Sodhi BCP/19/173Ishmeet SodhiNo ratings yet

- PurchaseOrder RA0149669 9428094 20230317Document2 pagesPurchaseOrder RA0149669 9428094 20230317Deepak DasNo ratings yet

- Abhibus Ticket: Bangalore AluvaDocument2 pagesAbhibus Ticket: Bangalore Aluvatomyohan4No ratings yet

- Chapter 14-Income Taxes and Financial Accounting: True/FalseDocument8 pagesChapter 14-Income Taxes and Financial Accounting: True/FalsemilahrztaNo ratings yet

- MSC Indonesia Local Charges Updates - 22 February 2024Document10 pagesMSC Indonesia Local Charges Updates - 22 February 2024letandat14122003No ratings yet