Professional Documents

Culture Documents

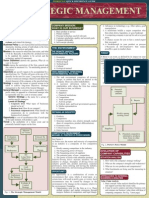

236ae5su9bjzowrqidzb Cheat Sheet Macroeconomics PDF

236ae5su9bjzowrqidzb Cheat Sheet Macroeconomics PDF

Uploaded by

Sandy SaddlerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

236ae5su9bjzowrqidzb Cheat Sheet Macroeconomics PDF

236ae5su9bjzowrqidzb Cheat Sheet Macroeconomics PDF

Uploaded by

Sandy SaddlerCopyright:

Available Formats

U R I N GP R I C EL E V E L

. Price Inder: Aleragc lc-rel of priccs relatire to the

[.conomics: of hou' scarce resources are

The str"rd-v.- DEMAND averasL-ler,cl in a base time period. C clst of'a fireci basket )

. D e m a n d C u r y e ( S c h e d u l e ) :A c u r v e ( t a b l c )s h o w i n g

. : . . ' . . r 1 - ' t. lr n r ( ) n Sc o m p e t r n g u s e s . of'soods reportcd as a pcrcr-ntasc r)i'basc pcriocl cost. n

ho F-conomic Questions Include:

\\ r.rt l: produced'.)

t h e q u a n t i t i e so f a g o o d a c o n s u r r e ri s u ' i l l i n g a n d a b l c

to buy at alternative prices ,r.rir r'n constant tastcs.

. G D P P R I C E I N D E X : A r n e a s u l c o t ' c h a n s c - si n t h c

v

A v e r a q ep r i c e o 1 ' a l l g o o c l s a n c l s e l v i c e s

I il,,rr r: lt produced'.)

: \\:r,,lcls \\hat is produced'J

i n c o m e s r. e l a t c dp r i c e s .a n d n u r n b e ro f b L r y c r s .

. L a w o f D e m a n d : I n c r e a s ei n p r i c e( P ) c a u s e sd e c r e a s e

. C o n s u m e r P r i c e I n d e x ( C P I ) : A r r c a s u r c o f ' c h a n g e si n

the ar'eraqeprice' of Llrbalrconsuller goods ancl sc-n icc's. ffl

!

i n q u a n t i t y('Q ) d c r n a n d e d . . Producer Price Inder (PPI): .A nrL-asrlrL- o1'ehun-uc-s irr ill

t,R0I)T (--I-IO\ POSSIBILITY FRONTIER: . C h a n g e i n d e m a n d : C h a n g ei n t a s t e sp^ r i c c o f ' r c l a t c d

I : r , ' . r l l " r n a t r rc c o r " n b i n a t i o n so f f i n a l g o o d s a n d

..': . r!c: that could be produced in a given tinte period

goocls.ir.rcorne.increasein nutnber of bu'n'ers:alters

p l a n n c dc o n s u r n p t i o na t a l l p r i c e s .s h i f i i n g c u r v e t o

tlte arelagc pnce of'uoclrls borrglrt br ploclucer: (inclLrclcs

cnrcle nratcrials: intenrrediatc gr.rods:f inishccl goocls).

. Clost Of l.iring Adjustment (COt-A): ,\utomatic

7

, ' : : r . t l l . r r l i l a b l . - a n d l i r n i t e d r e s o u r c e sa n d t e c h n o l o g y . r i g l r t( i n c r c - a s co)r l e f i ( d e c r e a s e ) .

. C h a n g ei n q u a n t i t l ' d e m a n d e d :( - a t i s e db r t r * n I r r t c c

a c i j u s t m c n t st r f ' r n c o r r . r ct o t h c r a t c o l ' i n l l a t i o n . )

I l.i:lrrrlc-rrlpportunitV cost: Obtaining more production

ME A S U R IN GIN FLA TIO N

,; ',11s'g1r1rd rL-quiresa reduction in the production (lost c h a n g ea n d r e s u l t si n m o r c n r c r .ar tl o n gc u r v e. . I n l l a t i o n : ( ' o n t i r t r r i n , gi n c r c a s c i n t h c a r c r a g c l e r c l o f '

, ' r n \ \ r t u l l l t \) o f ' o n e o r m o r e o t h e r g o o d s .

. R e l a t e d p r i c e s : I n c l r " r c lpcr i c e s o l c o t n p l e t n e n t so r

p r i eC . o l ' ! r r t t t l : l t l l t l : C tr i ec : r r re I ' l i l l ) e.

s u b s t i t u t eisn c l L r d i n g f u t u r cc o n s L r m p t i o n . . D e l l a t i o n : ( ' ( ) n t l n u l n u c l c c r e a s ei n t h e a r e r a g e l e i c ' l o f

- l . r ' , r t r l ' r n c r t - ' a s i n go p p o r t u n i t v c o s t m e a n s t h a t

.:.:.lilIltg llrore of a good requires giving up e\er

S U P PL Y

. S u p p h C u r v e :A c L r r v(et a b l c ) s h o w i nt gh eq u a n t i t i eosf a p r i c c s t r l ' s o o r l s u n d s ! - r \ i c c s ( n c _ g a t i r ei n f l a t i o n r a t c )

1 tfst h e a l t e n ] a t i V eg o o d .

. r : = J I J l 1 1 r ' r l . uO 0\ cr tllle .

gooda selleris rvillingandablcto sellat alterrtltirepriees . D i s i n l l a t i o n : F u l l u r gi n l l a t i o n r a t c . \ o t c t h a t p l i c c : u l c

: I nsidc frontier: Unemnloved resources at a givencostof productioncietenriinecl bv constantinput

still incrc-asins

: ri l l l c l ! ' r l C \) . prices.technologl,. andnurnbcrof sellers.

: t rpanding frontier: Increases in resources and . L a l l o f S u p p l y : I n c r e a s ci n p r i c e( P ) c a u s e sr r r c r e a si e u . lnflation rate: bciriccu tinre nerioti one and tinre

D D '' x 1oo

n c r i . t l t r i . i s .- . . -

' . ' . : r i r o l o s r c i i la d v a n c e s . q u a n t i t y( Q ) s L r p p l i e c l

. C h a n g e i n s u p p l y : C i h a n g er n c o s t o l ' p r o d u c t i o n . . Tr pes of l nl'lation

. t ..'.\)lrrrnl\ produccs only 2 goods (X.Y). Points on

'

J !-ir\c r.\.B.C.D) represent different cornbinatiotts

t e c h n o l o g vp. r i c c o f ' o t h e rp r o d u c e dc o o d s :n u m b e ro f I . S u p p l r s i c i er n f l a t r o n

s e l l e r sa l t e r sp l a n n e ds a l e sa t a l l p r i c e s .s h i f t i n gc u l v e a . w a g e - p u s h - $ a Q ci' n c r e a s el e a d st o p n c L 'l u c r e a s e

:::rc I goods $'hen all resources are used (full

t o r i g h t ( i n c r e a s eo) r l e f t ( d e c r e a s e ) . b . C ' o s t - p u s h i n c r c - a sicn n o n - l a b o rc o s t s l e a d st o

- : : . . , r r n r L ' n to f r e s o u r c e s ) .I f t h e a l l o c a t i o n i s i n s i d e t h e . C h a n g e i n q u a n t i t v s u p p l i e d : C ' a u s e db y o v rn p r i c . '

pncr- lllcrL-ASc

-..: .,'. : r ) r l l r - r C S O u r C e sa r e not used Or used

c h a n g ea n d r e s u l t si n m o v e r n c nat l o n - uc u r r e . L D e n t a n d - p u l li n t l a t i o n : , \ n r n c r e a s ien t h c p r i c el e rc l

: 1 , ' :!:a l c l t t l \ . M A R K E TE Q U I L I B R I U M i n i t i a t c db v c x c c s s i r ea g g r e g a t dcer.nand.

Good Y . E q u i l i b r i u m : I h e np r i c e p . M a c r o( ' o n s e q u e n c e o s1(' L n a n t i c r p a t e dI n) f l a t i o n :

i s e s t a b l i s h ew dhere L L,nccrtaintr'

q u a n t i t yc l e m a n d e1dP e )- SUPPLY 2 .S p e c u l a t i o n

q u a n t r t ys u p p l i e d1 Q e ) .

'"" Equilibrium

3 . N o n - p r o d u c t icr r n v c s t r n c n t s )

. Propertiesof Equilibrium: H€ A

MEASURING UNEMPLOYMENT

L P > P c .s u r p l u s . L a b o r l b r c e : [ : n r p l o v e do r ' [ , ' r r e m p l o v c c l U

2 . P < P c .s l r o r t a g e DEMAND . E m p l o l e d : \ \ ' o r k i n - ua n c ln o t l o o k i n g l b r r i o r k il

3.P-P., stable . f . l n e m p l o v e d :3 r ' c q u i r e l u e n ttsc l b e c a t e g o r i z e da s U

. Price C.lontrols:

I . ('cilin-qbclou cquilibriunr-. shorta-uc

L r n e n r p l u t , el c. ln. o 1u ' o r k i n s .l . a b l c1 ou o r k . - i . l o t t k i n g

llt

v

andblackrrrarkct fbr uork

u n e m p l o y m e n tt o t a l . . . ,

2 . l - ' l o o r a b o ie c q u i l i b n u n r - s u r p l u s a n c l c h c a t i n g . U)\ tr\'lPl.()\'\'l E\-I' rutc

( s e c r e st a l e -)s

ff i. "- r r 00

. l - r ' p e so f f n e n r p l o \m e n t :

. C h a n g e s I n E q u i l i b r i u m : F . c l L r i l i h r i upr n rice u'ill L Seasonal: [-lnetnplovr-il clrrrrng pcriocl. bctuce-n

changer,r'hener,'er the suppll,or clcnrandcurre shifts, a g r i c u l l u r a l s c i l s o n s .t o u r i s t s e a s o n s .s c h o t r lb r c a k s .c t c . )

I rplanation: This concavc production possibilrtics L F r i c t i o n a l : t , n c n r p l o v n r c l t t e 5 1 . r c o p I cl n o \ ! - b c t \ \ c c l t

' - : . i t , r r i ' I h a l a u c l f -i n c r e a s i n g o p p o r t u n i t y c o s t . jtlbs or irrto the labor rnur.kc't.

' -l Structural: \\'orkcrs llrid olf br cicclining inclu'lr.ics

I , --. . l 1 r $n t h c - c u l v e m e a n s t h i s e C o n o m V i s

- . : . . . : : : ! n r ( ) l ' co l X a n d l e s s o f Y . A t p o i n t A . t h e o r i l t c l e c l i n i t r gr e g i o n s o r b r j o b o t r s o l c s c r - ' r . r c c .

ME AS U R E SOF OU TP U T/IN C OME -l (lvclical: [-lnenrplovnrcntrlu.- tt., scncral cconor.riic

. - ' : r : . I r r . r r t l u c c sl J L r n i t so f Y a n d z e r o X . A t p o i n t . ( i r o s s d o m e s t i cp r o d u c t ( G D P ) : \ a l r . r eo f p r o d l l c t i o r l rcccssron.

:. , ' . . : r i . r r l \ A r L -n o \ \ p r o d u c e d . T o d o t h i s . I u n i t

u ' i t h i na c o u n t r \ " sb o u r t d a r i e s . . \ l a c r o c o n s e q u e n c e s o f u n e r r t p l o r m c n t : I L r s t( ) L r t p u t :

, ' f \ i r g i r t ' n u p T r ) p r o d u c c t h e n e x t 1 0 0 h o w c r ' e r .Y l . \ a l u e A d d e d C o n c e p t r a l r , r co f ' p r o d u c t i o nl c s s O k u n ' r L a u : l ( 'o i n c r c - a s c i l t t r n c r l l t l o r n t c l t t r a l c

" . :. . . : . . ' n . l r t r p : l i o n r L i t o l 0 m e a n i n g 3 u n i t s o f Y i s

r a l u e o f - r n a t c r i i li ln p u t ss u n r n ' r cacci r o s sl - i r r n s t ' t ' t l t t ct r ( i l ) P l r r I 5 ' ,

gr\t-n up (point C) Frnallv to produce an additional 2 . I n c o m e M e t h o d r . r ' a g e. rsn csl a l a r i c -.s r e n t i p r i i f r t s . SP[:C'lr\l- t'LASShS OF \\'ORKI ItS

. ::. \\l \. l0 units ofY has to be given up (point . i n t c r e s rt a c l i u s t m e u t s l. ['nderemploved: Pr'ople sccking tir]l-tint.' plitl

l) r

' - t . , , n r c \ r ' n r ) r -acn d m o r c

! - x p c n s i v ct o p r o d u c c t h c - 3 . E r p e n d i t u r e\ l e t h o d ( S u r n o f ' c x p c n c l i t r , r rocns f i n a l etttplovttre ttt uot-1. \\irrl'rrrg Lrrtlr piut-tlntc ()r

. . - - . . : : . 1r .r l \ g o o d sa n d s e r r i c e s-) P r i r a t cC ' o n s u u r p t i o( C n ' )- ( i r o s s c n r p l o v c d l r 1 - l t r l r s b t ' l o r i t h c r r er r p l t l r r ) i t r I p h u n t o n t

PrirateDouresticInvcstmc-nt (l) ' (iorernnlentPurchases u n c n t p l u r c c l) .

H( )\\ ( llol('ES.\RE \tADE:

( G ) . ' E r p o r t s( X ) - I r r p o r t s( \ , 1 ) ( C ' - l + ( i t X - M ) l. Laid-olT indiriduals rrith pronrise to be rehired:

\larkrt \lechanisnr:

\4arket deterrnined prices . RealGDP - CiDP PriceInder detlatedby thepriceindcr \ot looking lirr utrt'k bLtt pirlt rrl'rrnc-rnpltrrerl

. - .: ...ff lu:r': anci shortages. and o\\'ners allocatc . N e t D o m e s t i c P r o d u c t ( N D P ) . ( ; D P l e - s sc a p i t e l

' - . ..:.,'. ir, tlkc ad\ autaqe of hishest monetarv 1 - l o p t t l a l r oans i l n r ' \ t 'c p l r o n t t r t l t e r - u l c .

c o n s u n r p t i oanll o u ' a n c e - 1. D i s c o u r a g e d n o r k e r s : \ o t c o n : r r i c l c t i r n l a b o r t i t r ec

. \ a t i o n a l I n c o m e ( N l ) N D P - I n c l i r c cB t usincss'l-ares b c c u L t s tn' o t l o o k i n e l i r l u o r k I r k c l r t , r r c - ! ' n t c r '\ \ I t c l t

authority allocatcs t subsiclic-s labtlr nrarkct irnprorc:

. PersonalIncome (PI) ..Nl - (corporatetAxcsr rc-tainccl

market and c-amings t socialsecuritytaxes)+ translcrpavlrcnts )

goods ancl ' D i s p o s a b l eI n c o m e ( D I ) - P I - P c r s o n aTl a r c s fi

GDP Shortcomings: D c fi n i t i o n . { l f e r n a t i n gp c r i o d s o l ' e c o n u n r i cg r o n t h Y

The study of economic

n a t i o n a lp r o d u c t i o na n d t h e

1. Factorsor vzrriablcsnot

a. LJndcrground cconorny

a n d c o n t r a c t i o nA . s i n g l eb u s i n r s sc r c l e u o u l d h a r e

t h e s el b u r p a r f s : G D P

T

b. Improveclquality'

c . M o r e l c i s u r c . a l t h o r . r s hr r n p l y i n g f - c u c r h o u r s o t

I TroLrgh tll

t h c b e h a ri o r o f

o p e r a t i n gi n t h c

work. can lead to greaterproductirit1'.

2 . C c r t a i ng o o d sa n d s c r v i c e sc o n t r i b u t et o p e r s o n aol r

l. Rccovcn

-1.Pcak 7

propertyclestruction (e.-u.alcohol.tobacco.-9uns. etc ). -1R. ecession Time

Most economists believe tax cuts ca arge budgct

deficits in 1980's.

. Gaps: Difference between spending at equilibnum . Structural Budget Deficit: Deficit that would occur at

Circular Flow equilibrium: Spending: Output to meet GDP vs. full-employmentGDP. full employment. Most economistsbelieve tax cuts

Demand: Income L Recessionary Gap: Amount by which desired causedlargebudgetdeficits in thel980s.

spending at full employment falls short of full W ITH FI SCALPO LI CY

E X P E R IE N C E

CoNSUMPT|ON(C) & SAVINGS(S) employment output. This is represented by the

. CONSUMPTION: . Governmentshavecontinualexpansionaryfiscal policies

difference betweenY I and Y*.

(budgetdeficits) becausethey are politically popular.

l . E q u a t i o n :C : a + M P C ( Y ) ; w h e r ea i s c o n s u m p t i o n 2.Inflationary Gap: Amount by which desiredspending . Resultsand Effectiveness of the amount of fiscal

at 0 income, (also called autonomousconsumption) at fu1l employment exceeds full-employment output.

poficy expansion are slow to achieve and often too

andY is personaldisposableincome This is representedby the differencebetweenY2 andY*.

late.

2. MarginalPropensityto Consume(MPC)- (changein

C') . (change in Y) - fraction of an extra dollar of

incomethat is spent.

3 . A v e r a g eP r o p e n s i t yt o C o n s u m e( A P C ) : C ' Y : . Similar to consumption.imports can be modeled:\'l - nr -

fiaction of an averagedollar that is spent MPM(Y) whereM - total inrporls.m - importswhenY (t

. S A V I N G S : S a v i n g s ( S:) I n c o m e ( Y )- C o n s u m p t i o n ( C ) . MPM = marginap l r o p e n s i t yt o i m p o r t

. Import Multiplier:(l/(l-MPM))

L E , q u a t i o nS: : - a + M P S ( Y )

Y1 Y- Y2

2 . M a r g i n a lP r o p e n s i t yt o S a v e( M P S ) - ( c h a n g ei n S ) , ' (equilibrium)

(changein Y) : fractionof an extra dollar of income Expenditure Multiplier: The multiple by which an

that is saved. initial change in aggregatespending will alter total

3 . A v e r a g eP r o p e n s i t yt o S a v e( A P S ) - S , Y - f r a c t i o n cxpenditure after an infinite number of spending

c y c l e s : ( lt ( l - M P C ) )o r ( l i M P S ) . AGGREGATE DEMAND: Total quantity of output

of an averagedollar that is saved.

Simplified Example: Given MPC : 0.8; Deflationary demandedat altcmativeprice levels in a given time pcriocl.

. MPC + MPS: I

Gap - $300 million; assume interest rates do not . Reasonswhy rt is downwardsloping:

.APC+APS:1 af-fectInvestment(l) l.Real balances effect: Price changesaffect the real

DOMESTTC

GROSSPRTVATE (l)

TNVESTMENT Question: How much of an increasein Investment(l) is value of GDP.

E x p e n d i t u r e so n o r p r o d u c t i o n o f n e w p l a n t a n d requiredto solvethe DeflationaryGap'? 2. Foreign trade elfect: Domesticprice increaselor.r'ers

Answer: I x rnultiplier- $300 m exports (X) and increasesimports (M). Goods alc

e q u i p m e n(t c a p i t a l li n a g i v c n t r m e p e r i o d p l u s c h a n g e s I*x(l]MPS)-$:OOm more expensive here and cheaper abroad. Loucr

i n b u s i n e sisn r e n t o r i e s . l*-5300mxMPS exports and higher imports lower expenditureson

. Affccted by Expectations& interestrates (e.g. Crash I * : $ 3 0 0m x ( l - M P C ) l o c a lg o o d sa n d s e r v i c e s .

makes many fearful about the future). I*-5300mx(0.2) 3. Interest-rate effect: Increase in prices causes an

. Desired vs. Actual Investment I*-560m increasein Money Demand. Increasein demanclfbr

l. I : desiredor plannedinvestment money raisesinterestrates.which lower investments.

loweringtotal expenditures.

2. Actual Investment- Savings

AE

3 . U n i n t e n d e d I n v e s t m e n t : D e s i r e d I n v e s t m e n t<

C + | 1 + G + X 1 - M(1P 1 < P s i

Actual Investment AEr

:1.Unintended Disinvestment- Desired Investment>

C + 1 6 + G + X 6 - M 6( P 6 )

Actual Investment

AEo

E X P E ND IT U R E(G

GOVER NM E NT S ) C + 1 2 + G + X 2 - M(2P 6 < P 2 i

Federal.state.and local governmentspending YY-

l-fr.J

. Two tvpes of G: AEz

$ 3 0 0m i l

a. Direct purchasesby government.

Adjustmentto GAPS

b. Transfer paymentswhich redistributesincome from

1.KeynesianView: Governmentintervention

o n e g r o u pt o a n o t h e r . 2 . C l a s s i c aVl i e w : N o g o v e r n m e nitn t e r v e n t i o n

F OREIGNSE CT O R w h e r e l 1 > 1 6 > 1x

21, >xo>x2M

, 2>Mo>Ml

L Exports (X ): Expenditures by foreigners on

domesticallyproducedgoods.

. Definition: The useof governmentspending(G) or taxes

2. Imports (M): Expendituresby domesticresidentson

(T) to changethe level of total spendingin the economl'.

goodsproducedin foreign countries.

TYPESOF FISCALPOLICY

K EYN ESI A NE Q UI LI B RIU M . Expansionarv Fiscal Policy: Increasesin government

A c h i e v e dw h e n : spendingor reduction in taxes. Bigger budget deficit

l. Output : Income (Y) -Aggregate expenditures(AE) (G>T). New Deal was expansionaryfiscal policy.

. Contractionarv Fiscal Policv: Decreases ln

From ( I ), we can get equilibriumlncomeor Output(Yx)

government spending or increases in taxes. Smaller Y z e z ) - Y o ( p o ) .Y r ( p r ) .

Y-AE

deficit or surolus (G<T).

Y-C-l+G+X-M AGGREGATE SUPPLY: Total quantitv of olrtnur

Y-a+MPC(Y)+I+G+X-M p r o d u c e da l a l t e r n a t i v ep r i c c l e v e l si n a g i v c n t i m r ' p e ' r i t ' t l

. Short Run AggregateSupply (SRAS):

Y-MP('(Y):a+l+G+X-M fiscal policy to

eliminate GDP I . As price level rises,quantity of output risesas firnrs

Y( l-MPC):a+l+G+X-M

gaps,called seekhigher profits. In short run. pricesof inputs arc

Y * - [ ] , ' (1 - M P C ) ] [ a + l + 6 + a - Y 1 fixed or sticky (e.g.wages).

discretionary

2. Injectionsi LeakagesApproach 2. As firms expandoutput even with fixed input priec'.

fiscal policy.

l - e a k a g e(sS + T + M ) : I n j e c t i o n s( l + G + X ) price level risesbecauseof diminishingreturns(nc-ri

Exoenditures Fiscal Policv: labor lessproductive).

. ([-RAS):As price lercJ

Govcrnment Y1 Y2 L o n g R u n A g g r e g a t eS u p p l y

policy that oflsets shocksthat would createa business nses. no lncreaseln output becauselnput pnces nsc

cycle. The governmentusually engagesin fine-tuning proportionately.

when it applies discretionary policy to bring the NO PAYOFFTO CHANGINGAGGREGATE

economyback to full-employmentlevel. D E M A N DI N T H E L O N GR U N

. Automatic Fiscal Stabilizers: Built-in federal . l n c r e a s c i n a g g r e g a t ed e m a n d A D x t o A D 1 r x o r c :

expenditureor fixed tax ratesthat automaticallyresponds economyto shortrun equilibriumfrom a to b aborc tirll

countercyclicallyto changesin nationalincome. employmentbecausewagesare sticky.

. Ex. When income is high, spendingincreases,leadingto As wagesadjust -' upward LR4S SRAS2

inflationaryperiods;higher incomemeansincreasein tax short run aggregate

payments(T increase)but this will causea decrcasein supply gradually shifts

total expenditures. The expenditurecurve will drop, thus upward from b to c.

lesseningthe inflationary gap.Also, with more people Short run equilibnum

employed,unemploymentcompensationwrll decreasc(G output gradually falls Pe

decrease)also causinga decreasein total expendituresas t o l o n g r u ne q u i l i b r i u m

Govemmentspendslesson this item. at full employmentY1

. PassiveDeficit: Deficit nortion due to the cconomv to Y1. In the long run

o p e r a t i n gb e l o wp o t e n t i a il n c o m el e r e l . outputcannotbe raised

. Classical: Belief that fiscal policy affectssupply side a b o v eY 1 a n d a t t e m p t s g

of economv. Advocate tax cuts to stimulate labor to do so mercly raise P.

supply,productrvityand capitalaccumulation. RationalExpectations Economistsbelieveeconontvgoc\

. Laffer Curve Hvpothesis: Cutting tax rates rvill directlyfrom original long run equilibriumto nevulong

increasetax revenuesbecauseof supply side effects. run equilibriumif governmentpolicv is anticipatecl.

r n?r{ ltilrr \t I I f [|rf r fi I ;l-

{ I I {fl lrl I

policy also dependson three Lump-sum Tax MONEY: Anything generally accepted as a

The Consumption equation is transformed: C : a + medium of exchanse.

takes between the . Characteristics of-Good Money': Relativelyconstant

M P C ( Y - T ) ; C - a + M P C ( Y )- M P C ( T )

occurrence of the economic condition and policy and limited supply, difficult to counterfeit.divisible.

. The tax multiplier:

durable.small and oortable.

maker recognition of the situation.

Atequilibrium,Y:AE Ex. Gold becamethb most important form of monev in

2. Implementation Lag: If an act of congress

AssumingC is the only expenditureconsumption,Y - C lTth and l8th century.Problems: relativelyheavy.easy

required. it can take some time for congress to counterfeit, subject to fluctuations (when neu' -soldis

Y:a+MPC(Y) MPC(T)

debateand approvethe bill. discovered).Led to replacementof gold with paper

3. Effectiveness Lag: After the policy ls Y-MPC(Y)-a-MPC(T) money.Gold was depositedat the goldsmith.who issued

implemented"it can take time for the policy to Y(I-MPC):a MPC(T) receipts for the gold to the depositor.The depositor

have an impact on the economy (ex. in the late Y(MPS): a - MPC(T) would then issuethe receiptsas paymentfor goods and

'90s, services.The receipthad valuebecauseit was backedbr

Greenspantned to anticipate inflationary Y : a(1/MPS) (MPC/MPSXT)

tendencies by tightening the money supply This impliesthe Tax multiplier - MPC/MPS or MPC/( l- the gold on deposit.

. Usesof Money:

fincreasinginterestrates]aheadof time). MPC). 1. Medium of exchange

D IF F ER EN TIA LE FFE C T OF IN C R E A S IN G 2. Storeof value

IAND G 3. Unit of account

. Types of Money

If T and G are increasedby the same amount. the net

Accumulateddebt of the federalgovernmenl. l. Commodity money: Value as commodity - r'alueas

. Debt Service:the interestrequiredto be paid eachyear eflect on Y is the increasein G. money

on outstandingdebt (currentdeficit & debt) Explanation: The effect of each component on Y is 2. Fiat mone]-:Money declaredby governmentas legal

. Transferresourcesfrom bond holders to tax payers.No basedon their respectivemultipliers.Assumingall other tender.Value as commodity < value as monev

. Monev Supply

net change. componentsare unchanged:

. Future generationstransferresourcesfiom tax payersto L B a s i c M o n e y S u p p l y ( M 1 ) : c u r r e n c yh e l d b 1 ' t h e

A Y : ( 1 / (l - M P C ) ) G - ( M P C / (l - M P C ) )T

public outsidebanks (checkingaccounts)+ balances

bond holders. AssumingS40-G:T, in demanddepositsincludingtravelerschecks

. External Debt: U.S. government debt (Treasury

A Y : ( l / ( 1 - M P C ) )$ ' 1 0- ( M P C / ( l - M P C ) )$ / 1 0 2 . M 2 - M l + s s 1 ' 1 n gasc c o u n t s+ s m a l l t i m ed e p o s i t s{ <

bonds) held by foreign households,businessesand A Y : $ 4 0 [ (r / ( l - M P C ) ) - ( M P C / (l - M P C ) ) ] $100.ooo)

governments.Imposesa burden on future generations.

A Y - $ 4 0 [ (r - M P C ) | ( l - M P C ) ]) 3 . M 3 - M 2 + l a r g et i m e d e p o s i t s( > - $ 1 0 0 . 0 0 0 )

. Crowding out investment leads to slower growth for 4.L - the broadest definition of money supplr.

AY - $40il1 consisting of all short-term (matures less than or

future generations.

W h e r eA : c h a n g e equalto I year) financial assets.L refersto liquiditl.

5 .C r e d i t C a r d i s n o t m o n e y : M o n e y i s a f i n a n c i a l

asset belonging to individuals and a liabilitr to

banks.Credit card is a savingsitem made arailablu- tcr

1.Accurate measureof variables:The governmentcan . r e d i ti s n o t a n a s s e t .

b e b o r r o w e dC

only estimate the sizes of MPC. MPM and other . When investment depends on income, an attempt to

B A N K IN G

exogenousvariables. increase saving can result in reduced savings. . Financial lntermediar.v-: Banks lunction rs an

2. Govemment is not able to changeG or T quickly. as it . Individuals intermediarybetweenlenders& borrowersby holding

who save more can cause income to

is often subjectto legislationas well as checksand depositsand making loans.

balancesbetweenthe Executiveand Legislativebodies. decrease, leading to a decrease in overall savings (S). . Bank Reserves:Vault cash and deposits at Federal

3. Financingdeficits can haveoffsettingeffects. AggregateExpenditures Reserve.called federal funds. In general.reservesis the

. Crowding out: Classicaleconomistsbelievethat amount of casha bank keepson hand to manageinflou s

when government finances a deficit. the and outflows. Banks lend each other excessfunds at the

expansionaryicontractionary eft-ectsare not fully federalfunds interestrate. Somereservesare requiredbr

realized.If governmentsellsbondsto financean central bank as a ratio (proportion)of depositsa. a

erpansionary fiscal policy. it is taking away reserve against cash withdrawals. Erpected rule: the

funds fiom a possible private investment ([) more liquid the asset.the hi-eherthe reserl'erequirement.

undertaking.Thereforeincreasein G is offset by . Money Creation:

a d e c r e a s ien I . L How banks create money: Banks create demand

-1.Fiscal policv can conflict u'ith other goals. Ex. deposits,part of the money supply.when makin-ebank

Def'lationarygap and large public debt. Solving the loans.

clet)ationary gapmay requirean increasein G. Increasing 2. Money multiplier:the amount(dollars)of moneythatthe

(i hou'ever.further raises the budget deflcit (G<T) bankingsystemcan createfrom $l of ercessresenes.

3. Maximum money creation:

increasingpublic debt as filnds are borowed. Classical View: The lnterestRate a. Assumes public depositsall money received and

financial market works : doesnot add to cashleakage.

s m o o r h l y .I n re s t m e n t a n d * b. Assumesbanks lend or snendall excessreser\es.

savings will always be n* c. Formula:

C l a s s i c a l T h e o r l ' : ( P r o p o n e n t :A d a m S m i t h . e t c . ) equal.Interestrateschange l increse i n c r e a s ei n

\\'ases and prices are flexible. The economy self- ^

to ensurethis equality in money requiredreserveratio" excessreserves

adiusts to deviations frorn its long term grou'th trend. : 4.Complex Money Multiplier: Measure of monev

nrinirnumgovernmentinterventionrequired.Persistent K e 1n e s i a n v i e u : S a ri n g s

createdper dollar depositedin the banking svstem

u n e m p l o y m e n tr e q u i r e s s u p p l y s i d e p o l i c i e s e . g . and investments are often when peoplehold cash;

deregulationand tax cuts.Politicalconservatives. unequal with the monetary sectornot working correctly. Formula: [( l+c)/(r+c)]x increasein excessresen'esu'herer

( ' l a s s i c a lE q u i l i b r i u m : The -realsectoris affected.AD does not equalAS. The : requiredreserveratio: c :9/o of withdrar.l'als not redeposited

Prices LRAS imbalance affects the real sector (due mostly to the E x . r : 0 . 0 2 ; c : 0 . 4 ; i n c r e a s ei n e r c e s s r e s e r v e so f

SRAS multiplier effects). The savings curve is viewed as $ 1 , 0 0 0m o n e ys u p p l yw i l l i n c r e a s eb y S 3 3 3 3 . 3 3 .

vertical and unafl'ected by interest rate changes.

Discretionaryfiscal policy needsto be implementedto

increase/decrease savings:

Person borrows $2,000, r:0.1, e0.,1

Bank Bank keeps Bank Loans Demand Person

AD Gets (Resen'e (excessreser\'€ Deposits keeps

Ratio: l0%o) 90o ) (60oh of 10o

GDP

loan is

redeposited)

I rplanation: Short run equilibrium occurs u'here the sr.200.00 s800.00

\:trrt-Run Aggregate Supply curve (SRAS) intersects

\ruregate Demand (AD). This is temporary.The s r .200.00 s 120.00 s r .080.00 s6.18.00 s-l-r 00

L-conolnywill self-adtustso that both curves will

intersect on the Long-Run Aggregate Supply

T L R A S ) t h u s a c h i e v i n ge c o n o m i c s t a b i l i t y w i t h

tirll emnlovment. 5349.92 53,1.99 S3l,+.91 S188.96 Sll-s.97

Kernesian Theory: (Proponent: British economist John $r 8 8 . 9 6 Sr 8 . 9 0 S1 7 0 . 0 6 S1 0 2 . 0 . r 5 6 8 . 0 2

When investmentsdecrease.the interest rate will not

\l.rrnard Keynes) Wages and prices are sticky (slow to

adjust quickly to n I to bring the economy to St 0 2 . 0 1 St u . 2 0 S eI x 4

-:t.ilrsL-). Prirate demand is inherently unstable, thus

: rqLrrring active government intervention. Persistent equilibrium. Instead the multiplier processwill occur

requires demand side policies. e.g. increases

..:rcrl1.rIcrvrncnt and will shift the S curve to S1 and be back in

tr,\ Cnllnc'nt spending and tax cuts. Political liberals. equilibriumat n* before interestratesevendrop to nl. TOTAL monev created will be: $6.840

N , li n c r e a s e- ( Q ' \ ' ) P i n c r e a s e

'l'his

i s c a l l c c l t h eQ U A N T I T Y T H E O R Y O F M O N E Y .

S a v i n g sa n d l - o a n s( S & [ - s ) h e l d a n d i n v c s t e ds a v i t r g s C o m b i n a t i o no f h i g h a n d a c c e l e r a t i nign f l a t i o na n d h i ' l h

INTERESTRATES:

( back to the cornrnunity. unemployment.

l. Norninal

tJp to 1980.they rcgulatedby thegovernment: allorved Classicalerplanationof stagflatron:If the governr.nL-nr

"r'ere

private.residentialntofigages. 2. Real - Noninal interest - eroected inflation rate

to investonl1,in safb.

7 . 1982 cleregulationsignalec'l the end fbr S&L stabilit,.,''.

ill S & l . s s t a r t e di n v e s t i n gi n r i s k y h i g h - y i c l d b u t l o u ' -

KE YN ES IA NV IE W

. Monetarl' Policl': Userl to fight rccessionand inflation,

wantsto r-naintain or get close to the 1.9 unemplolrncrrt

rate.it rvill increaseG or lessenT (movementup SRP( ; r

U gradejunk bondsand ccxnmercialreal L'state. but mav neeclto be supplemented by fiscal policy to fight to a higher inflation rate. Howeveronce again the

ll . S & L s d i t l n ' th a v cm a n a g e m e ncta p a b i l i t yt o h a n d l ct h e recession and by inconrespolicl,to fight inflatron.

. Kevues nronetary prescription cln thc cconomy:

econonryil'ill be pushedtoward the naturalrate of'

|l g r o w i n gb a d l o a n s . unenrployment accorrplishedby an SRPCI that sits

. [-].S. has guaranteeddeposits ot' f inancial

^ Because including(S&l.s).it spenthundr-eds of billions

l. ContractionarJ- Monetarl, policl': Monev Supply r o r h en g h t o f S R P C ] .

U of institutions c l e c r e a s e- > i n t e r e s t r a t e i n c r e a s e- > I n v e s t m e n t INFLATION: Can be subject to Adaptive Expectatron.

dollars. With the complerity o1' sorne o1' the deals. decrease-t' ( lltcome:Output) decreasc

( accurategovernlnentbailoLrtcost\\'asdif icult to deterntine. 2.Expansionarv N'Ionetarv policr,: Money Supply

expectations ofthe future based on what has happenecl rn

i n c r c a s e - , , i n t e r e s t r a l e d e c r e a s e- > I n v e s t m e n t thepast).

increase-.:'( lncome:Output) increase' Sustained h i g h i n f l a t i o n :A c c o m p a n i e db y M S i n c r e a : e

Notc: lt is inportant that nronctary policyurakersare and c'xpectations of inflation.

The FED is the United Statcs' Ccntral Bank lt

a\l'arcof'thu-curre-lrtcondition of the real sectorand the D i s t r i b u t i o n a lE f f e c t s o f I n f l a t i o n :

s u p e r v i s e st h e f i n a n c i a l s y s t c r n .

. Structure: Tu,el'n'e regional Fedcral Reservc banks cll'cctiveness lag of' n'ronctarl,policv. L lndir,idualswho can get higherrvagesand sell goodslt

. K e t , n e s i a sr rt i n r u l u s

super\ isecl by a Board ot' (ioverrrors in Washingtorr higherprices,can still keepjobs and continueto sanr

nonrinated to fired ternrs subjcct to senate approval. I . lntcrcsl ralcs - price paid fbr thc use of lloney

r e \ r e n u ef r o m s a l e s . w i l l b e n e f i t f r o n r s L r s l a i n c t l

. F u n c t i o n : C ' o n s r e s s{ a v e t h c -F E D 6 c r p l i c i t f u n c t i o n s . 2 S p e n c l i n (gI r r v e s t n r e n t s )

-j I iqLridityTrap. The' portion of thc- rloney-denrand inflation. Indexing wages (such as cLln-cltt\ociitl

I . ( o n c l t r c tr n o n c t a r v p o l i c , r ,('r t t o s l i r n p o r t a r t t f u u c t i o n ) .

2 . S u p el r i s c a n c l r e g r i l a t e l - i n a n c i a l i n s t i t u t i o n s c u l r e t l r a t i s h o l r z o n t a l :p e o p l ea r e w i l l i n g t o h o l d security payments)to inflation pre\ents or rccluec.

. i . S c r r c -a s l c n t l e r o f l a s t r e s ( ) r tt o f i n a n c i a l i n s t t t u t i o r t s . u n l i n r r t e da l n o u n t so 1 ' m o n e ya t s o m e ( l c l w ) i n t e r e s t the bad efl'ects of inflation. Their rcal rnconre

; 1 .P r o r i d c b a n k i n s s e r v i c e s t o t h e L i . S . ( l o v e r r t n r c ' u t . ratc. N'lonctary, policf is ineffectivc. becortresindependentor is lcss affectedbr int'latitrrr

5 . I s s t t ec o r n a n d c u r r c n c v .

M O NET A R IS TP E R S P E C TIV E 2. Bonclholders:The reall'alucof bondsclropu ilh intlatr,'n

6. Pror ide firrancial ,.:r'r iecs to eouiuicte iul banks. savitrgs

a n d l o a n a s s ( ) iea t i o n s .s a r i n - { s b a n k s . a n d c r e c l i tr r n i o n s .

(M | L T O NFR TE D MA N 'V

StE W ) if rtotninal intercst rates are unchangecl.Thc'rc-ti'r'r'

. \lO\F,'I.\RY . \Jonetan policr can control inflation.

POLI('\': Polici that afTcctsthc economv bondholders'wealth stafusdependson hori tirstnonrrr.,.r

. Inerease uronev suppll at a steady rate eqrral to grorvth

t l r r o r r r : l. tl r r r r t s:e i l t r t t , r r t c \r u p l ; l \ l n d a r r r i l a h l ee l e i l i t . interestratesadjustto expectations of inliation.

. F'ederal ()pr:n \larket Committee (F'O\lC ): (tl cet.lrtrlnr'.

( onroosctl of 7 rrrr'nrbers of the Boalcl of (iovelnors . [)o not attclnpt 1o f ine tune nlone], grou'th. FIGHTINGSTAGFLATION:

a n d 5 l r c r l c l a l R e s c r r e B a n k p r c - s i d e n t s .l t i s t h c c h i e f ' l. Classical: Run a recessior.t. This squL-r./..

polio-uraking bodv ot'thc FED. i n f l a t i o n a r y e x p e c t a t i o n so u t o f t h e e c o n o n t r

'fools.

. N4onc-tan'

I n fl a t i o n

l. Reserve Requirenrent (r'atio): Prollortion ot

Inflation and unemploymentrelationship:Thc thcory-- Rate

clenosrtsthat ur.lst be held as rcscrvcs.

u'hcn uncnlllovmcnt is lou'.peoplehavejobs. peoplehave

2. Discount Rate: Ratc-of intercst charged br, the Federal

wagcs. purchirsc's are made. clerrrandincreases.plices

( Reservc Lranksfitt' lencling fcservcs to privale banks.

incrcasc.lcadingto an increasein inflation rates.When

z

3.Open l\Iarket Operations: Fedcral Rcscrve

unenrpkiy'ment is high. people are laid of}. rro income.

purchases and salcs oi'goverurnent bonds fbr thc

-fhis denanclis lou,.pricesdecrease. then inflationratesdrop.

p u r p o s r -o f a l t e r i n g b a n k r e s e r r . e s . is most ofien

Shortrun Phillips Curve (SRPC): Graphical

Ill used by the Fed in contrtrlling monr-y srrpply.

. Tight rnonev policv: (lou'ers N{S) reprc-sentationof the negative relationship betwecn

n

I

I . IIigh reservelcquirerncnts

2 . t l i g h d r s c o L r n tr a t e

irrflation and ur.rernplovrnent

I n fl a t i o n

Rate

rate.

SRPC2

i 3 . C ) o e nn r a r k e t s a l e s

U . E a s i ' l n ( ) n e l p o l i c l ' : l i r r c r c a s c sI \ ' l S )

I. I-ou fescf\e reottirenrerrts u.=5.5 6.5

( 2. [-ou rliscount rate Jb lowcr the inflation rate fl'om a. (3oo). cla\\l!.r,.

3. f)pen urarket purcltasc-s '.

prescribe a planned rcccssiol.t. L.ouerin-g uronc\ .r.1p1r

. Dernand fbr \4ouey,: The quantitics of'nronel' people are

il'illins ancl ablc to holcl at allcnrati','e intcr-cstr;rlc-(S). lvill raise interest rates. lou,ering inr c:tnt.-nl .l:rt

19 5 4 19 6 2

l . T r a n s a c t i o n s d e m a n d : \ 4 o n c v h el d f i r r t h e D u r t r o s e contribute to more unemplovment. rll\ln-! lit-

o f r t t a l ' i l t r c i c t r J r t r t t t i t t ' k c tp t t r el t l r e s . unemploytnent rate to 6.5 but lo'"1'erin-u

inllatrtrn ttr I -

2. Precautionarl' demand: N'{onev lrelcl fbr unexpected S R P ( - r s h i f t s t o S R P C r a n d s e t t l e sa t t h c n a r u n r l r . r r c , , :

m a r k e t t r a n s a c t i o n so r e n r e r g e r r c i e s . N o t e . I I n t r l l t ) 6 f i . t l r c d o un u ' a r c l - s l o p i nPgh i l l i p s c u r v e

-l.Speculative demand: Monev helii firr speculatilc

was appal'cntln the eally '70s it appearedto breakd0u,n. uncmployrnent - 5.5 at d.

purposcs. fir later l'inancialopportuuitics. \\'lre-nrrucrnploynrcnt uas high, inflation u,asalso high. 2 . K e y n e s i a n : I n d u c i n g a r e c e s s i o n i s c o n t r o r c r ' \ l . r l. r : r r :

CON TROV E RS I E/SI S S U ES L O N G R U NP H I L L I P SC U R V E : u n p o p u l a r . M S c l e c r c a s ei s i n e f f i c i c n t .

. S h o u l c l c c n t r a l b a n k s o n l y ' s e t r ) r o n e t a l ' \p o l r c l t o k c c p l . lrr tltc lofle run. $ ltctt ,-i,^r.^ Kevnesian Solution: Supplcmcntarr polrcr e. r l i i , :

inllation lou'l e.rpcctatrtirrs r]f irrflatiorr are HlrT'o" incomes policy.

. Shouldlrollctall policv be usedto stiruulitlca u eak cuorroun".) l n c t . c h a r t - g c su l r ' \ p c c t l l t i ( ) n

. Should ccntral banks crintrol thc rnoncv sr4rplvor iuterert lltcjs.'

l l n-p' C a . L ) i r e c tp r e s s u r ci s p u t o n i n d i ri d u a l st o

I t l t tc t r , r t l l i ' r ' t t r t t l r e l c r c l r r l ' | i

. Ilou sl-rotrldnronev be rneasurerl'.) rirtcrrrplovnrent, 41 u ' a g e sa n d p r i c e s o 1 'g o o d s . ( c r . u a g c -

| un"n,-

. T h e i r t : l ) ' s t o n t r o l ( ) l l n r o n c ) s r r p 1 . r l r . : p e c r f - i c a lol vn t h c I l - h . - I o n g R u r r I ' h i l l r p s( ' u r r r ' 2 1 ployment c o n t r o l s )T. h i s h e l p sl o u ' e re x p e c t a t i t ' ntsr 1

I

ct'tcctivcucss of expiirr.iortarr' policr'. clepc-ntlstrn tl.rc ( l . l t l j ' ( ' ) r r - p r e s c n t -tsh r - \ i t r r a t i ( ) n I Rate b . W i t h l o v v e re x p e c t a t i o no f i n f l a t i o nS R P (

]

r o b u s t n c s so l ' t h c c s t i n r a t e ( e l l ) a r a l r ) c t e i ' -" o o l t l r c l t r a n u ' h c n a el r r a l r n f l a t i o n c c l u a l s t h e l e f i r . l ' i t h o u tc a u s i n c a r e c e s s i o n , [ . r l l .

borro'nlcrsl<cc'pas cash and is nol redeposited. e - r p e c t c di n l l a t i o n . when LRP(' is reached.

l*l

-1.F.conorrtvis irble to atljust concctlv ttr thc inflation rate.

I n fl a t r o n

lllllruil

MONETARYBASE

. \/arrltcashplusbankresen'es at the lil-.1)l'lrc Ft:l) directl_v

controlsthe MonetaryBascand not N4one1SL4rplruireir --'sRPC3

thc uncertaintyof the c paral)rete-r anc'lrvhetirerbanksle-nd

( or.rteractlv ail. less.ol rlore thartits cxcessrcser\/es. "-- sRPC2

LASSICALVIEW

, C'lassicalthcodsts bcliclc that nrorrctarv ptilicr, cannot be

{ useclto solve problerrrsol-ittr,rtitc,.tLrtptit.irntl c:nrployrnent GREDITS:

A u t h o r : J o h nC . M i j a r e sP h . D

tll (rcal sector).Classical monetary policy is bcst exemplified

through the FQLJATION OF IlXC'tlAN(iE:

MV PQ u'herc

SRPCl

D e s i g n :A n d r eD . B r i s s o nL a y o u t :C h r i s t i a n

P R I C E : U . S .$ 4 . 9 5C A N $ 7 5 0

Ortrz

I

tl N { ' n r o n e vs u p p l i '

t

n V r,'e'locitl'

P nlrce level

At SR['( l. actualinflationis at J.8. (actualr,rnentployntent

rate is l 9;, houever.expcctcdinflationrate is only 1.6. quickstudy.com

U Q

- outputor (iDP (full ernplovrnerrt) Bccauseo1' the' discrepancl,,prices furrher increaseand ISBN 157aaab31-5

. In classical theory. r'elocity is firecl, ancl thc ecorlorny unerrploynrentincreascsalso.representing a shrft in SRPC

llnti

,llilIilffil|[[

( o p e r a t e si n i i r l l e r n p l o y n r e n t i n t h e l o n g n r n . T h i s m e a n s to SRP('1*'hich bringsactualand expectedinflatronratc ttt

that \/anti Q are fixed and any change ir.rrr.ronc'vsLrpplv c'qualat point b. resultingin unenrplovntcntratein the lon-u

will only'be inflaticlnarv in the long run. lt has no ef'fect nrn.l-he siriftin-qof the SRPC'to the right represents a lnove

on real econontic variables: lo\\'ardstaqfltrtion.

You might also like

- Ionescu and Gellner - Populism, Its Meanings and National CharacteristicsDocument129 pagesIonescu and Gellner - Populism, Its Meanings and National CharacteristicsAugusto Machado100% (1)

- Econ 304 HW 2Document8 pagesEcon 304 HW 2Tedjo Ardyandaru ImardjokoNo ratings yet

- DSA - Das Schwarze Auge - 4.edition - Zauberei Und Hexenwerk - Archetypen PDFDocument48 pagesDSA - Das Schwarze Auge - 4.edition - Zauberei Und Hexenwerk - Archetypen PDFevilsashoNo ratings yet

- Radar Observer's Handbook 9ed 1998 0851746667-UnlockedDocument233 pagesRadar Observer's Handbook 9ed 1998 0851746667-UnlockedМилен Долапчиев100% (1)

- Our Thoughts About Risk Parity and All WeatherDocument13 pagesOur Thoughts About Risk Parity and All Weatherdpbasic100% (1)

- BF2201 Cheat Sheet FinalsDocument2 pagesBF2201 Cheat Sheet Finalssiewhong93100% (1)

- (A. Thomas Fenik) Strategic Management (Quickstudy PDFDocument4 pages(A. Thomas Fenik) Strategic Management (Quickstudy PDFZewdu Tsegaye100% (4)

- Economics Cheat SheetDocument5 pagesEconomics Cheat Sheetcaitobyrne341275% (4)

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Economics Cheat SheetDocument2 pagesEconomics Cheat Sheetalysoccer449100% (2)

- Econ 101 Cheat Sheet (FInal)Document1 pageEcon 101 Cheat Sheet (FInal)Alex MadarangNo ratings yet

- Rechtschaffen Kales - A Manual of Standardized Terminology Techniques and Scoring System For Sleep Stages of Human SubjectsDocument59 pagesRechtschaffen Kales - A Manual of Standardized Terminology Techniques and Scoring System For Sleep Stages of Human Subjectspower199680% (5)

- MicroeconomicsDocument10 pagesMicroeconomicsVishal Gattani100% (5)

- Microeconomics Study Sheet Microeconomics Study Sheet: More Free Study Sheet and Practice Tests atDocument3 pagesMicroeconomics Study Sheet Microeconomics Study Sheet: More Free Study Sheet and Practice Tests atanandsemails6968100% (1)

- BarChartsInc 2014 ProcessManagement OperationsManagementDocument1 pageBarChartsInc 2014 ProcessManagement OperationsManagementJohn Michael SorianoNo ratings yet

- Macro (Concise Study Guide)Document4 pagesMacro (Concise Study Guide)Spencer Thomas100% (1)

- Literary Terms 1spark Charts1Document6 pagesLiterary Terms 1spark Charts12ygbk7100% (2)

- Animal GKDocument4 pagesAnimal GKSARVEJAYA KRISHNANo ratings yet

- English Business LettersDocument6 pagesEnglish Business Lettersvaminos100% (1)

- Quick Study For Financial RatiosDocument2 pagesQuick Study For Financial RatiosMio Fitrananto PerdaniNo ratings yet

- BUS 101 - Business FundamentalsDocument4 pagesBUS 101 - Business FundamentalsJRod100% (1)

- Efek Irigasi Tunggal Larutan Tetrasiklin Terhadap Peitubahan Klinis Periodontitis Kronis Poket 'L-6 MMDocument6 pagesEfek Irigasi Tunggal Larutan Tetrasiklin Terhadap Peitubahan Klinis Periodontitis Kronis Poket 'L-6 MMMuhammadFachmiFarisNo ratings yet

- Penyakit Periodontal Dan Bayi Prematur Berberat Badan Lahir RendahDocument6 pagesPenyakit Periodontal Dan Bayi Prematur Berberat Badan Lahir RendahRiany GawaNo ratings yet

- Materi Food Packaging TechnologyDocument11 pagesMateri Food Packaging TechnologySiely CiciliaNo ratings yet

- Award of Arbitrator BerkowitzDocument13 pagesAward of Arbitrator Berkowitz전지현No ratings yet

- File 2Document7 pagesFile 2Lea Cindy Natasya TanlilessyNo ratings yet

- MS 22 Part - 2Document190 pagesMS 22 Part - 2Anh QuanNo ratings yet

- Ag SG Catalogues KL IIDocument6 pagesAg SG Catalogues KL IIkhamsone pengmanivongNo ratings yet

- BI Checking 4Document1 pageBI Checking 4Hendra FirdausNo ratings yet

- Secret Projects - SADF Annual ReportDocument4 pagesSecret Projects - SADF Annual ReportDaily Maverick0% (1)

- Godc (?:) (. T) T. - A B. C.: - Il LrlaDocument8 pagesGodc (?:) (. T) T. - A B. C.: - Il LrlaMaulida NurapipahNo ratings yet

- Is 1862Document4 pagesIs 1862mangesh sandavNo ratings yet

- Regular Sulphur Diesel Fuel: / - / T I / A I, St.//Da ItdDocument14 pagesRegular Sulphur Diesel Fuel: / - / T I / A I, St.//Da ItdHannu JaaskelainenNo ratings yet

- 1990-Acupunct Med (1) .8.65Document3 pages1990-Acupunct Med (1) .8.65Mariana ZemunerNo ratings yet

- Cinu, Ixnoulk Di Rsup Wahidin SudirohusodoDocument6 pagesCinu, Ixnoulk Di Rsup Wahidin SudirohusodoNurwahit IksanNo ratings yet

- Michalowski Ro41Document6 pagesMichalowski Ro41Peter PanNo ratings yet

- 02 Standing Technical Circulars 2014Document1 page02 Standing Technical Circulars 2014Abdullah PathanNo ratings yet

- BS 1400 - 1973Document38 pagesBS 1400 - 1973Metal dept100% (1)

- 297926041-Radiografi Pada Implan GigiDocument6 pages297926041-Radiografi Pada Implan Gigihanna_839966290No ratings yet

- Chap 4 PROBLEMSDocument3 pagesChap 4 PROBLEMSsaubhagyamoharana62No ratings yet

- B.G. Kyle (Entropy)Document25 pagesB.G. Kyle (Entropy)Towfiq AhmedNo ratings yet

- Analog Full Slides (DR - Smadi)Document510 pagesAnalog Full Slides (DR - Smadi)simossimo893No ratings yet

- Nuta PDFDocument9 pagesNuta PDFIoana PatricheNo ratings yet

- 528 1592 1 SMDocument7 pages528 1592 1 SMMuhammad RaflyNo ratings yet

- Carino: Chapter 1 - Project ManagementDocument19 pagesCarino: Chapter 1 - Project ManagementDeasty JesicaNo ratings yet

- Sni 06-0335-1989 PDFDocument11 pagesSni 06-0335-1989 PDFHuda YudistiraNo ratings yet

- Deul of BarpetaDocument2 pagesDeul of BarpetarajeshbaishyaNo ratings yet

- GCP Guidelines CRDocument4 pagesGCP Guidelines CRGloomiNo ratings yet

- For.M: Xaminal'Ions Coun J) Ducation Certificate Examination Physics Ca Ribbean. E StrcondaryDocument15 pagesFor.M: Xaminal'Ions Coun J) Ducation Certificate Examination Physics Ca Ribbean. E StrcondaryAlyssa DNo ratings yet

- Requl Tio Requl Tio:) /:i I ( /) /:i I (Document34 pagesRequl Tio Requl Tio:) /:i I ( /) /:i I (prachatNo ratings yet

- Letters From GlazunovDocument5 pagesLetters From GlazunovFlavio BertoniNo ratings yet

- Quintilianus Arta Oratorica PDFDocument12 pagesQuintilianus Arta Oratorica PDFcatalinNo ratings yet

- Sitogenetika - Soal Ujian (Jawaban) 20131206083349266Document7 pagesSitogenetika - Soal Ujian (Jawaban) 20131206083349266Adhityo Wicaksono WahyujatiNo ratings yet

- Beagle-A Darwinian Approach To Pattern RecognitionDocument8 pagesBeagle-A Darwinian Approach To Pattern RecognitionSuzie Q BeatrixNo ratings yet

- Screning Test PKLDocument5 pagesScrening Test PKLmeta SWNo ratings yet

- 05.akta Pendirian PerusahanDocument7 pages05.akta Pendirian PerusahanNini DesmaraniNo ratings yet

- Introductory Steps To Understanding PDFDocument28 pagesIntroductory Steps To Understanding PDFاحمد كامل عجيلNo ratings yet

- Human Tolerance Levels For Bridge Vibrations PDFDocument32 pagesHuman Tolerance Levels For Bridge Vibrations PDFabu yusraNo ratings yet

- Masas de Cuello No TiroideasDocument17 pagesMasas de Cuello No TiroideasCeleste Mendoza SantacreuNo ratings yet

- TheGameofLife 10489156Document305 pagesTheGameofLife 10489156lucifer morning starNo ratings yet

- Wa0012.Document83 pagesWa0012.Chandan kumarNo ratings yet

- 21 Atmospheric and Group PressureDocument5 pages21 Atmospheric and Group PressureSandy SaddlerNo ratings yet

- 17 One Persons Hypothesis Is Anothers DogmaDocument4 pages17 One Persons Hypothesis Is Anothers DogmaSandy SaddlerNo ratings yet

- 18 Scientific Claims An African PerspectiveDocument4 pages18 Scientific Claims An African PerspectiveSandy SaddlerNo ratings yet

- 15 Myths and FairytalesDocument3 pages15 Myths and FairytalesSandy Saddler0% (1)

- 19 The Growth of Scientific KnowledgeDocument6 pages19 The Growth of Scientific KnowledgeSandy SaddlerNo ratings yet

- 16 Why Was Thales WrongDocument5 pages16 Why Was Thales WrongSandy SaddlerNo ratings yet

- Crosswords-Market Structures: Quizzes, Flash Games For IGCSE, A Level & IB and ICTDocument2 pagesCrosswords-Market Structures: Quizzes, Flash Games For IGCSE, A Level & IB and ICTSandy SaddlerNo ratings yet

- 09 The Map Is Not The TerritoryDocument5 pages09 The Map Is Not The TerritorySandy SaddlerNo ratings yet

- 13 Numbers and NumeralsDocument4 pages13 Numbers and NumeralsSandy SaddlerNo ratings yet

- 05 The Power of NamesDocument6 pages05 The Power of NamesSandy SaddlerNo ratings yet

- 10 Thinking LogicallyDocument4 pages10 Thinking LogicallySandy SaddlerNo ratings yet

- 07 Words and Not WordsDocument3 pages07 Words and Not WordsSandy SaddlerNo ratings yet

- 01 What Good Are SchoolsDocument4 pages01 What Good Are SchoolsSandy SaddlerNo ratings yet

- Elasticity Review 1Document4 pagesElasticity Review 1Sandy SaddlerNo ratings yet

- 03 Letters From Indian Judge To Englishwoman PDFDocument3 pages03 Letters From Indian Judge To Englishwoman PDFSandy SaddlerNo ratings yet

- 06 Language and SymbolismDocument4 pages06 Language and SymbolismSandy SaddlerNo ratings yet

- 25 Songs and PoemsDocument2 pages25 Songs and PoemsSandy SaddlerNo ratings yet

- Spot The Market FailureDocument1 pageSpot The Market FailureSandy SaddlerNo ratings yet

- Market Failure and Resource AllocationDocument32 pagesMarket Failure and Resource AllocationSandy SaddlerNo ratings yet

- 14 A Show of HandsDocument2 pages14 A Show of HandsSandy SaddlerNo ratings yet

- Elasticity (XED) PracticeDocument2 pagesElasticity (XED) PracticeSandy SaddlerNo ratings yet

- The Market Failure Revision and ResitsDocument25 pagesThe Market Failure Revision and ResitsSandy SaddlerNo ratings yet

- Market Failure Mind MapDocument1 pageMarket Failure Mind MapSandy SaddlerNo ratings yet

- Historical Cost Accounting InflationDocument9 pagesHistorical Cost Accounting Inflationankit9336No ratings yet

- Hyper InflationDocument4 pagesHyper InflationMjhayeNo ratings yet

- P510 Infusor 3.0 06.14 GBDocument2 pagesP510 Infusor 3.0 06.14 GBGuillermo Jesus Avila ArrietaNo ratings yet

- 122 1003Document34 pages122 1003api-27548664No ratings yet

- Objectives of TaxationDocument3 pagesObjectives of TaxationPoojaNo ratings yet

- Credit ControlDocument5 pagesCredit ControlHimanshu GargNo ratings yet

- Term Paper: "Balance of Payment Accounting-Meaning, Principles and Accounting"Document12 pagesTerm Paper: "Balance of Payment Accounting-Meaning, Principles and Accounting"hina4No ratings yet

- Economics TerminologiesDocument21 pagesEconomics TerminologiesamarNo ratings yet

- Solved Is Overshooting in Theory and in Practice Consistent With PurchasingDocument1 pageSolved Is Overshooting in Theory and in Practice Consistent With PurchasingM Bilal SaleemNo ratings yet

- Charles W. L. Hill / Gareth R. Jones: External Analysis: The Identification of Opportunities and ThreatsDocument25 pagesCharles W. L. Hill / Gareth R. Jones: External Analysis: The Identification of Opportunities and ThreatsNisreen Al-shareNo ratings yet

- Business CycleDocument15 pagesBusiness CycleParth MidhaNo ratings yet

- Macro Economics NotesDocument7 pagesMacro Economics NoteskulsoomalamNo ratings yet

- Monetory Policy AssignmentDocument6 pagesMonetory Policy AssignmentAwais AhmadNo ratings yet

- Group Project Guidelines PDFDocument3 pagesGroup Project Guidelines PDFRami BadranNo ratings yet

- Solution 2Document75 pagesSolution 2Asiful MowlaNo ratings yet

- Economic Challenges Facing Contemoprary BusinessesDocument24 pagesEconomic Challenges Facing Contemoprary BusinessesMHPNo ratings yet

- Velocity of MoneyDocument1 pageVelocity of MoneyGood Myrmidon100% (1)

- The Orthodox Monetarist SchoolDocument4 pagesThe Orthodox Monetarist SchoolEnp Gus AgostoNo ratings yet

- Macroeconomics MCQsDocument11 pagesMacroeconomics MCQsIAs100% (1)

- Appendix 1 - How To Read GraphsDocument6 pagesAppendix 1 - How To Read GraphsStevenRJClarkeNo ratings yet

- Ten Principles of EconomicsDocument5 pagesTen Principles of EconomicsANo ratings yet

- August Monthly Investment Bulletins Bedlam Asset Management August 20, 2013Document4 pagesAugust Monthly Investment Bulletins Bedlam Asset Management August 20, 2013alphathesisNo ratings yet

- Two Words Women Love To Hear - Chateau Heartiste PDFDocument32 pagesTwo Words Women Love To Hear - Chateau Heartiste PDFKhalaf SpencerNo ratings yet

- Course Outline Business Economics MBADocument5 pagesCourse Outline Business Economics MBAMaryam KhushbakhatNo ratings yet

- Inflation and Economic Growth in MalaysiaDocument20 pagesInflation and Economic Growth in MalaysiaNurulSyahidaHassanNo ratings yet

- Assignment of Managerial Economics: Topic:Steps Taken by RBI To Control InflationDocument7 pagesAssignment of Managerial Economics: Topic:Steps Taken by RBI To Control Inflationliyakat_khanNo ratings yet

- Solution: Macroeconomics: The Big PictureDocument6 pagesSolution: Macroeconomics: The Big PictureStefan Neagoe100% (1)