Professional Documents

Culture Documents

Patriotic Millionaires Letter To Cuomo Calling For Closure of Carried Interest Loophole in The Budget (January 15 2018)

Patriotic Millionaires Letter To Cuomo Calling For Closure of Carried Interest Loophole in The Budget (January 15 2018)

Uploaded by

Nick ReismanCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ipo Fact SheetDocument18 pagesIpo Fact SheetManali ShahNo ratings yet

- OCM LawsuitDocument29 pagesOCM LawsuitNick Reisman100% (1)

- Matter of Demetriou V New York State Department of Health 2022-00532Document2 pagesMatter of Demetriou V New York State Department of Health 2022-00532Nick ReismanNo ratings yet

- Assembly Senate Response.2.10.21. Final PDFDocument16 pagesAssembly Senate Response.2.10.21. Final PDFZacharyEJWilliamsNo ratings yet

- Aml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")Document9 pagesAml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")rajsalgyanNo ratings yet

- Notice of Appeal Nassau County Mask RulingDocument8 pagesNotice of Appeal Nassau County Mask RulingNick ReismanNo ratings yet

- U.S. v. Brian Benjamin IndictmentDocument23 pagesU.S. v. Brian Benjamin IndictmentNick ReismanNo ratings yet

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanNo ratings yet

- EndorsementsDocument4 pagesEndorsementsNick ReismanNo ratings yet

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanNo ratings yet

- E2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Document18 pagesE2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Nick ReismanNo ratings yet

- As Filed PetitionDocument67 pagesAs Filed PetitionNick ReismanNo ratings yet

- Covid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21Document3 pagesCovid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21News10NBCNo ratings yet

- Lottery Commission Increase Letter To Governor HochulDocument3 pagesLottery Commission Increase Letter To Governor HochulNick ReismanNo ratings yet

- Cuomo ReportDocument63 pagesCuomo ReportCasey Seiler100% (2)

- Letter - FL Region - Booster Healthcare Mandate 1-12-22Document2 pagesLetter - FL Region - Booster Healthcare Mandate 1-12-22Nick ReismanNo ratings yet

- Hochul Housing Coalition Letter PrsDocument4 pagesHochul Housing Coalition Letter PrsNick ReismanNo ratings yet

- Contract c000271Document21 pagesContract c000271Nick ReismanNo ratings yet

- News Release Redistricting August 2021 FinalDocument2 pagesNews Release Redistricting August 2021 FinalNick ReismanNo ratings yet

- Letter To Gov Hochul 8.31Document2 pagesLetter To Gov Hochul 8.31Nick Reisman100% (1)

- NY Gig Labor Clergy LetterDocument3 pagesNY Gig Labor Clergy LetterNick ReismanNo ratings yet

- Accountability Waiver Announcement Memo 062221Document5 pagesAccountability Waiver Announcement Memo 062221Nick ReismanNo ratings yet

- SNY0521 CrosstabsDocument7 pagesSNY0521 CrosstabsNick ReismanNo ratings yet

- OGS ResponseDocument1 pageOGS ResponseNick ReismanNo ratings yet

- CFNY CAC Letter FinalDocument8 pagesCFNY CAC Letter FinalNick ReismanNo ratings yet

- DeRosa TranscriptDocument40 pagesDeRosa TranscriptNick ReismanNo ratings yet

- SaveNYsSafetyNet SignOnLetter 02Document4 pagesSaveNYsSafetyNet SignOnLetter 02Nick ReismanNo ratings yet

- AQE BuildingBackBetterDocument12 pagesAQE BuildingBackBetterNick ReismanNo ratings yet

- CDPAP Budget Letter SigsDocument4 pagesCDPAP Budget Letter SigsNick ReismanNo ratings yet

- Cannabis and Scaffold LawDocument4 pagesCannabis and Scaffold LawNick ReismanNo ratings yet

- Ratio Problems 2Document7 pagesRatio Problems 2Vivek Mathi100% (1)

- Chap 11 & 12Document4 pagesChap 11 & 12ElizabethNo ratings yet

- From: To:: Annexure-ADocument3 pagesFrom: To:: Annexure-AAnilNo ratings yet

- Abdul Sattar 2018Document48 pagesAbdul Sattar 2018ABDUL sattarNo ratings yet

- Partnerships Operations - Lecture NotesDocument10 pagesPartnerships Operations - Lecture NotesShei AlquenoNo ratings yet

- 7EC503 International Economics For Business and Finance: 01 - IntroductionDocument20 pages7EC503 International Economics For Business and Finance: 01 - IntroductionWahab Nurudeen OpeyemiNo ratings yet

- Niruword 3Document11 pagesNiruword 3Raju BhaiNo ratings yet

- Must Do (Social Science - English Medium) - 1Document67 pagesMust Do (Social Science - English Medium) - 1SHIVAM KUMARNo ratings yet

- Checklist of Documentary Requirements For Additional CategoryDocument1 pageChecklist of Documentary Requirements For Additional CategoryLorilyn JaysonNo ratings yet

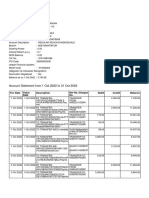

- Account Statement From 1 Dec 2019 To 21 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Dec 2019 To 21 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUDAY SOLUTIONS100% (1)

- Stock Market For Beginners 2022 - Step by Step CDocument49 pagesStock Market For Beginners 2022 - Step by Step Cdaniel nicolaeNo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- Credit Market Outlook ApolloDocument133 pagesCredit Market Outlook ApolloManeeshNo ratings yet

- Yes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesDocument2 pagesYes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesTushar SharmaNo ratings yet

- Gondolin Capital LP Investor Letter 2Q22 (Prospective)Document10 pagesGondolin Capital LP Investor Letter 2Q22 (Prospective)Josh WeissNo ratings yet

- Fundraising For Warren: Service Dogs Retrievers PO Box Madison, 22727Document12 pagesFundraising For Warren: Service Dogs Retrievers PO Box Madison, 22727TMJ4 NewsNo ratings yet

- Actual4Test: Actual4test - Actual Test Exam Dumps-Pass For IT ExamsDocument5 pagesActual4Test: Actual4test - Actual Test Exam Dumps-Pass For IT Examsminiexchange2No ratings yet

- Chair. Comm. On Appropriations: Jeann T. EcleDocument17 pagesChair. Comm. On Appropriations: Jeann T. EcleAida AntipoloNo ratings yet

- UCPB v. BelusoDocument4 pagesUCPB v. BelusotemporiariNo ratings yet

- Ifc Digital Scoping: Country Report: PalestineDocument31 pagesIfc Digital Scoping: Country Report: PalestineManvi PareekNo ratings yet

- Equity Valuation Report - AppleDocument3 pagesEquity Valuation Report - AppleFEPFinanceClubNo ratings yet

- FM & I - Group AssignmentDocument12 pagesFM & I - Group AssignmentEdlamu AlemieNo ratings yet

- Chapter 10 PAS 28 INVESTMENT IN ASSOCIATESDocument2 pagesChapter 10 PAS 28 INVESTMENT IN ASSOCIATESgabriel ramosNo ratings yet

- Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CityDocument70 pagesComprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CitySampath DontaNo ratings yet

- Jun 2007 - AnsDocument10 pagesJun 2007 - AnsHubbak KhanNo ratings yet

- Case: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalDocument3 pagesCase: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalROSE AUGUSTINE CHERUKARA 2227044No ratings yet

- СHASE 20181218-statements-7322Document6 pagesСHASE 20181218-statements-7322Myt WovenNo ratings yet

- FM 1Document3 pagesFM 1anon-940489No ratings yet

Patriotic Millionaires Letter To Cuomo Calling For Closure of Carried Interest Loophole in The Budget (January 15 2018)

Patriotic Millionaires Letter To Cuomo Calling For Closure of Carried Interest Loophole in The Budget (January 15 2018)

Uploaded by

Nick ReismanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Patriotic Millionaires Letter To Cuomo Calling For Closure of Carried Interest Loophole in The Budget (January 15 2018)

Patriotic Millionaires Letter To Cuomo Calling For Closure of Carried Interest Loophole in The Budget (January 15 2018)

Uploaded by

Nick ReismanCopyright:

Available Formats

The Honorable Andrew Cuomo

Governor of the State of New York

State Capitol

Albany, NY

12224

January 15, 2018

Dear Governor Cuomo,

We are the Patriotic Millionaires, a group of wealthy individuals deeply concerned about our

country’s destabilizing concentration of wealth and power.

New York is an innovative state. As you continue to lead and inspire the nation, we urge you to

close the carried interest tax loophole as part of this year’s state budget.

Closing that loophole - a fundamental mischaracterization of income that allows for fund

managers to pay a tax rate that is half what every other working American pays - would capture

an estimated $3.5 billion (please see attached) in tax receipts for the great state of New York.

We strongly encourage you to include language to close the loophole in the budget bills

you will be submitting to the Legislature tomorrow, and we stand ready to work with you

to pass these bills into law.

By doing so, other states in the Northeast with similar measures - New Jersey, Massachusetts,

Connecticut, and Rhode Island - will be pressed to pass their own carried interest

loophole-closing legislation more quickly. Since New York is the national center of private equity

and hedge fund activity, your leadership on this critical issue is vital.

Quick passage of this bill means additional revenue for your priorities for New York: education,

housing, job creation, healthcare improvement, and infrastructure that could potentially start

flowing as soon as next year.

There is widespread support for closing the carried interest tax loophole - indeed every major

2016 presidential candidate made it part of their campaign. But since Congress just passed a

major tax bill that fails to close this loophole, it is critical that the states take this matter up.

In every state there are many budgetary needs, and with the state bill, New Yorkers could

immediately start seeing additional revenues that you and your colleagues could put into the

public services that need it most in your state.

1701 K Street NW, Suite 750 • info@patrioticmillionaires.org • 202.446.0489

The carried interest loophole is the poster child for money overcoming logic and decency in our

public policy process. This loophole benefits a few thousand of the richest Americans while

offering absolutely no economic benefit to anyone else. By closing it in New York, you can lead

the nation in restoring a sense of fairness to our tax code.

Over a billion of dollars in campaign contributions and lobbying over the past decade have

succeeded in blocking action on carried interest in Washington, giving New York State a unique

opportunity to demonstrate to the American people that government is capable of working for

the people, not just for a wealthy few.

At a time when our national political system is fraught with uncertainty, we respectively urge you

to lead the way on this critical issue.

Yours in service,

Morris Pearl

Chair

1701 K Street NW, Suite 750 • info@patrioticmillionaires.org • 202.446.0489

Assets Under Expected Expected Incenti Expected aggregate fund Tax Expected carried

Halved

Management return annual return ve fee manager annual earning rate interest loss

H $3,088,400,3 $90,490,130,1 $6,786,759 19.6

2.93%

F 45,317.00 17 15% $13,573,519,517 ,758 0% $1,330,204,912

P $1,115,392,2 $147,901,016, $11,092,57 19.6

13.26%

E 82,823.00 702 15% $22,185,152,505 6,252 0% $2,174,144,945

TOT

AL: $3,504,349,858

Methodology:

The “master list” of all fund registered investment advisors were obtained from the SEC. Data for

Schedule D of Question 7(b)(1) of the investment advisor public disclosure for the previous five filing

quarters was matched, using the reference ID field, with firm data provided Question 1. Matched data

was then de-duplicated by file date and reference ID, yielding 37,602 unique funds. Of these, 14,060

were managed by registrants who listed their principal office within New York State. Exempt reporting

advisors were totaled similarly, and comprised 504 hedge funds and 430 private equity funds.

Combined, these New York hedge funds reported gross assets under management of $3.08T, while New

York private equity funds had $1.15T.

To estimate total earnings, we used private equity and hedge fund return benchmarks for a five year

period. One uses the five year average of leading hedge fund and private equity benchmarks, assuming

that the large state sample sizes roughly track the mean. For hedge funds, we used the HFRI Fund

Weighted Composite’s 36 month average.1 For private equity, we used the Cambridge Associates U.S.

Private Equity Index 5 year end-to-end pooled return published Q4 2015.2 By multiplying the return

benchmarks by the AUM, we came up with a rough estimation of expected annual earnings.

Next, the carried interest apportioned to hedge fund and private equity managers is estimated. Carried

interest applies only to the incentive fee earned by hedge fund and private equity managers. We used

15% of the total of hedge fund and private equity expected annual earnings to arrive at the expected

1

https://www.hedgefundresearch.com/family-indices/hfrx#

http://40926u2govf9kuqen1ndit018su.wpengine.netdna-cdn.com/wp-content/uploads/2016/05/Public-2015-Q4-

US-Private-Equity.pdf

1701 K Street NW, Suite 750 • info@patrioticmillionaires.org • 202.446.0489

aggregated fund manager annual earnings. We went with 15% because we believe this number to be

extremely conservative. With hedge funds, 20% is the industry standard and 17.14% was the industry

average for new funds launched in 2013, as tracked by Preqin.3 In private equity, the 20% standard is

prevalent in 85% of commingled funds, according to a 2015 report by Preqin.4 Separate accounts, where

approximately one-third of investor capital was committed in late 20145, are less likely to charge a 20%

carry, although 90% charge 10% or more6.

To calculate the amount lost to carried interest exemptions, we halved the expected aggregate fund

manager annual earnings. This was done to reflect the individual reporting of taxes paid on partnerships

interest in financial service partnerships. As Professor Victor Fleisher discovered in his work on the

subject, the IRS Statistics of Income shows that roughly half of financial industry partnership income is

paid at the favorable carried interest rate.7 8

After halving this sum, we multiplied the remaining amount by 19.6%, the difference between the top

bracket for short-term capital gains (equivalent to ordinary income, at 39.6%) and the top bracket for

long-term capital gains (20%).

3

https://www.preqin.com/blog/0/8340/hedge-funds-fees

4

https://www.preqin.com/docs/press/Fund-Terms-Sep-15.pdf

http://www.pionline.com/article/20141222/PRINT/312229973/assets-invested-in-separate-accounts-starting-to-a

dd-up

6

http://www.valuewalk.com/2015/09/48-of-private-equity-separate-accounts-charge-a-20-performance-fee/

7

56% of the income generated by finance and insurance partnerships in 2012 was taxed at this rate

8

www.nytimes.com/2015/06/06/business/dealbook/how-a-carried-interest-tax-could-raise-180-billion.html

1701 K Street NW, Suite 750 • info@patrioticmillionaires.org • 202.446.0489

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ipo Fact SheetDocument18 pagesIpo Fact SheetManali ShahNo ratings yet

- OCM LawsuitDocument29 pagesOCM LawsuitNick Reisman100% (1)

- Matter of Demetriou V New York State Department of Health 2022-00532Document2 pagesMatter of Demetriou V New York State Department of Health 2022-00532Nick ReismanNo ratings yet

- Assembly Senate Response.2.10.21. Final PDFDocument16 pagesAssembly Senate Response.2.10.21. Final PDFZacharyEJWilliamsNo ratings yet

- Aml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")Document9 pagesAml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")rajsalgyanNo ratings yet

- Notice of Appeal Nassau County Mask RulingDocument8 pagesNotice of Appeal Nassau County Mask RulingNick ReismanNo ratings yet

- U.S. v. Brian Benjamin IndictmentDocument23 pagesU.S. v. Brian Benjamin IndictmentNick ReismanNo ratings yet

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanNo ratings yet

- EndorsementsDocument4 pagesEndorsementsNick ReismanNo ratings yet

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanNo ratings yet

- E2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Document18 pagesE2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Nick ReismanNo ratings yet

- As Filed PetitionDocument67 pagesAs Filed PetitionNick ReismanNo ratings yet

- Covid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21Document3 pagesCovid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21News10NBCNo ratings yet

- Lottery Commission Increase Letter To Governor HochulDocument3 pagesLottery Commission Increase Letter To Governor HochulNick ReismanNo ratings yet

- Cuomo ReportDocument63 pagesCuomo ReportCasey Seiler100% (2)

- Letter - FL Region - Booster Healthcare Mandate 1-12-22Document2 pagesLetter - FL Region - Booster Healthcare Mandate 1-12-22Nick ReismanNo ratings yet

- Hochul Housing Coalition Letter PrsDocument4 pagesHochul Housing Coalition Letter PrsNick ReismanNo ratings yet

- Contract c000271Document21 pagesContract c000271Nick ReismanNo ratings yet

- News Release Redistricting August 2021 FinalDocument2 pagesNews Release Redistricting August 2021 FinalNick ReismanNo ratings yet

- Letter To Gov Hochul 8.31Document2 pagesLetter To Gov Hochul 8.31Nick Reisman100% (1)

- NY Gig Labor Clergy LetterDocument3 pagesNY Gig Labor Clergy LetterNick ReismanNo ratings yet

- Accountability Waiver Announcement Memo 062221Document5 pagesAccountability Waiver Announcement Memo 062221Nick ReismanNo ratings yet

- SNY0521 CrosstabsDocument7 pagesSNY0521 CrosstabsNick ReismanNo ratings yet

- OGS ResponseDocument1 pageOGS ResponseNick ReismanNo ratings yet

- CFNY CAC Letter FinalDocument8 pagesCFNY CAC Letter FinalNick ReismanNo ratings yet

- DeRosa TranscriptDocument40 pagesDeRosa TranscriptNick ReismanNo ratings yet

- SaveNYsSafetyNet SignOnLetter 02Document4 pagesSaveNYsSafetyNet SignOnLetter 02Nick ReismanNo ratings yet

- AQE BuildingBackBetterDocument12 pagesAQE BuildingBackBetterNick ReismanNo ratings yet

- CDPAP Budget Letter SigsDocument4 pagesCDPAP Budget Letter SigsNick ReismanNo ratings yet

- Cannabis and Scaffold LawDocument4 pagesCannabis and Scaffold LawNick ReismanNo ratings yet

- Ratio Problems 2Document7 pagesRatio Problems 2Vivek Mathi100% (1)

- Chap 11 & 12Document4 pagesChap 11 & 12ElizabethNo ratings yet

- From: To:: Annexure-ADocument3 pagesFrom: To:: Annexure-AAnilNo ratings yet

- Abdul Sattar 2018Document48 pagesAbdul Sattar 2018ABDUL sattarNo ratings yet

- Partnerships Operations - Lecture NotesDocument10 pagesPartnerships Operations - Lecture NotesShei AlquenoNo ratings yet

- 7EC503 International Economics For Business and Finance: 01 - IntroductionDocument20 pages7EC503 International Economics For Business and Finance: 01 - IntroductionWahab Nurudeen OpeyemiNo ratings yet

- Niruword 3Document11 pagesNiruword 3Raju BhaiNo ratings yet

- Must Do (Social Science - English Medium) - 1Document67 pagesMust Do (Social Science - English Medium) - 1SHIVAM KUMARNo ratings yet

- Checklist of Documentary Requirements For Additional CategoryDocument1 pageChecklist of Documentary Requirements For Additional CategoryLorilyn JaysonNo ratings yet

- Account Statement From 1 Dec 2019 To 21 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Dec 2019 To 21 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUDAY SOLUTIONS100% (1)

- Stock Market For Beginners 2022 - Step by Step CDocument49 pagesStock Market For Beginners 2022 - Step by Step Cdaniel nicolaeNo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- Credit Market Outlook ApolloDocument133 pagesCredit Market Outlook ApolloManeeshNo ratings yet

- Yes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesDocument2 pagesYes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesTushar SharmaNo ratings yet

- Gondolin Capital LP Investor Letter 2Q22 (Prospective)Document10 pagesGondolin Capital LP Investor Letter 2Q22 (Prospective)Josh WeissNo ratings yet

- Fundraising For Warren: Service Dogs Retrievers PO Box Madison, 22727Document12 pagesFundraising For Warren: Service Dogs Retrievers PO Box Madison, 22727TMJ4 NewsNo ratings yet

- Actual4Test: Actual4test - Actual Test Exam Dumps-Pass For IT ExamsDocument5 pagesActual4Test: Actual4test - Actual Test Exam Dumps-Pass For IT Examsminiexchange2No ratings yet

- Chair. Comm. On Appropriations: Jeann T. EcleDocument17 pagesChair. Comm. On Appropriations: Jeann T. EcleAida AntipoloNo ratings yet

- UCPB v. BelusoDocument4 pagesUCPB v. BelusotemporiariNo ratings yet

- Ifc Digital Scoping: Country Report: PalestineDocument31 pagesIfc Digital Scoping: Country Report: PalestineManvi PareekNo ratings yet

- Equity Valuation Report - AppleDocument3 pagesEquity Valuation Report - AppleFEPFinanceClubNo ratings yet

- FM & I - Group AssignmentDocument12 pagesFM & I - Group AssignmentEdlamu AlemieNo ratings yet

- Chapter 10 PAS 28 INVESTMENT IN ASSOCIATESDocument2 pagesChapter 10 PAS 28 INVESTMENT IN ASSOCIATESgabriel ramosNo ratings yet

- Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CityDocument70 pagesComprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CitySampath DontaNo ratings yet

- Jun 2007 - AnsDocument10 pagesJun 2007 - AnsHubbak KhanNo ratings yet

- Case: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalDocument3 pagesCase: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalROSE AUGUSTINE CHERUKARA 2227044No ratings yet

- СHASE 20181218-statements-7322Document6 pagesСHASE 20181218-statements-7322Myt WovenNo ratings yet

- FM 1Document3 pagesFM 1anon-940489No ratings yet