Professional Documents

Culture Documents

The Return On Corporate Performance Management

The Return On Corporate Performance Management

Uploaded by

kotakunguOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Return On Corporate Performance Management

The Return On Corporate Performance Management

Uploaded by

kotakunguCopyright:

Available Formats

Return on Investment

The Return

on Corporate

Performance

Management

Jay Robbins

Abstract

The return on investment (ROI) of corporate performance

management (CPM) is a critical measure of the technology’s

business benefit. In this article we will discuss the nature,

magnitude, and feasibility of achieving a measurable ROI

from investments in CPM. We will draw upon independent

research (surveys and studies), industry best practices, and

consulting experience in working with hundreds of clients to

Jay Robbins is the vice president of advisory implement CPM solutions.

services at ISA Consulting.

jay_robbins@isaconsulting.com Formal projections on the actual ROI that organizations will

achieve are not possible because of variations in project scope,

system design, management commitment, and willingness to

change processes. Instead, we will examine the definition of

CPM, its potential ROI, and ROI elements and approaches. We

will also look at several examples of companies that achieved

ROI on corporate performance management.

Defining CPM

CPM includes the processes used to manage corporate

performance, such as strategy formulation, financial

and management reporting (including consolidations),

and budgeting and forecasting. CPM also includes the

methodologies that drive some processes (such as the

balanced scorecard or value-based management) and the

metrics used to measure performance against strategic

and operational performance goals. However, CPM also

comprises a series of analytic applications that provide the

functionality to support these processes, methodologies,

and metrics, targeted at the CFO, finance team, senior

executives, and corporate-level decision makers.

8 BUSINESS INTELLIGENCE Journal • vol. 14, No. 1

Return on Investment

Many terms are used to reference CPM. Some research ported by the analytic applications. The second leading

entities and software vendors refer to the technology as benefit was enhanced productivity—all the efficiency

business performance management (BPM), while others savings of reduced time and effort for tasks such as

call it enterprise performance management (EPM). The planning and budgeting—which accounted for nearly

underlying concepts and tools are the same; these terms 42 percent of the resulting ROI. The final 4 percent was

are interchangeable. related directly to savings in technology costs, including

costs for unnecessary applications.

The actual scope to which CPM is implemented within

an organization will affect the benefits or ROI achieved. A benefit that went unaddressed in this survey is the

The examples and/or data referenced in this article use true value of making “better” decisions. This is typically

the definition just presented as the baseline scope. Where classified as a qualitative benefit. However, based on

there are identifiable variances (e.g., one organization ISA’s experience in the marketplace, this is where we

implemented a CPM tool for forecasting only), they will believe the true potential lies for ROI in CPM. Although

be clearly identified. this benefit is more difficult to quantify, the impact is

often considerably greater than process improvements

ROI Potential of CPM or improved productivity. We will discuss some real life

Companies today are taking more strategic, “process- examples later in this article.

centric” approaches to the management of their organiza-

tions, focusing on improving processes and systems to According to research on planning and performance

support budgeting, forecasting, financial, and management management by The Hackett Group, organizations

reporting. CPM software is increasingly being deployed that have implemented an integrated planning and

as a key enabler of this strategy. performance management (i.e., CPM) solution have a

13.6 percent lower overall cost of the finance function or

Companies leveraging CPM software in this way have department as a percent of revenue (see References).

the potential to achieve numerous qualitative and

quantitative benefits. Examples of potential qualitative In addition to this, Hackett found that organizations

benefits include improved decision making, increased without an integrated environment:

accountability from better information visibility, and

the proverbial “single version of the truth.” Quantitative n Spend 27 percent more on planning and analysis

benefits include head count reductions or redeployments

(in business units and IT), shorter cycle times for key n Maintain, on average, six separate planning and

management processes, a lower cost of compliance, and performance management systems

reduced technology spending primarily through rational-

ization of redundant systems and less reliance on outside n Have and use twice as many reports

maintenance support for outdated technology.

According to Aberdeen Research Group, more than 70

IDC, a leading research and analysis firm, sums up the percent of companies that adopted some type of CPM

benefits as business process enhancements, productiv- program generated high-impact improvements in key per-

ity benefits, and technology-related savings. When formance metrics, and these results were consistent across

evaluating the real dollar return of CPM initiatives, IDC industry segments and company size (see References). The

found that nearly 54 percent of the total ROI for CPM average improvement from a CPM initiative included:

initiatives achieved by companies participating in a recent

survey came from business process enhancements. Such n A gain in return on assets (ROA) of 5.0 percentage points

enhancements include all identifiable annual savings that

were realized from changes in business processes sup- n A gain in percent gross margin of 4.9 percentage points

BUSINESS INTELLIGENCE Journal • vol. 14, No. 1 9

Return on Investment

However, the Aberdeen study found that best-in-class n Implementing one portion of CPM at a time and

companies take a significantly different approach than not buying into the hype of the very large

their peers to corporate performance management and software companies

achieve better performance as a result. Best-in-class

companies approach CPM analysis with a far greater Finally, an online survey conducted by CFO Research

focus than their competitors on: Services speaks directly to how organizations that have

invested in CPM solutions rated their performance versus

Tracking new product introductions

n companies that had not invested in CPM (see Refer-

ences). In all, 164 senior finance executives were surveyed,

Balanced scorecards versus individual metrics

n representing a broad range of industries (primarily

companies with annual revenue over $1 billion). Respon-

Continuous improvement and closed loop

n dents were segmented into two groups:

decision processes

Heavy investors: Organizations that had invested in

Cross-functional root cause analysis

n technology for financial planning and analysis

Forward-looking business data analysis and simulation

n Light investors: Organizations that had “point

solutions” or spreadsheet-based processes and had

Performance metrics aligned with corporate strategy

n not invested in technology for financial planning

and monitored with balanced scorecard and executive and analysis

dashboard software applications

Analysis of the results found that heavy investors reported

less difficulty with financial planning and analysis, were

more satisfied with ad hoc analysis and decision support

capabilities, found budgeting and reporting less conten-

Benefits tious and political, and provided end users with line-item

Quantifiable Revenue enhancements detail on budgets and results.

Cost savings

Cost avoidance ROI Elements and Approaches

ROIs for CPM technology are typically expressed as

Qualitative Information timeliness

either the net present value (NPV) or internal rate of

Improved employee satisfaction return (IRR) of the expected net cash flows over a stated

Improved decision making time horizon. Time horizons can vary, but are usually

5, 7, or 10 years long. The details of these calculations

Costs are beyond the scope of this article. However, an

Hardware/ Software License fees understanding of the key elements that make up an ROI

Server costs analysis lays the foundation for organizations to explore

Ongoing maintenance

potential benefits.

Internal Labor Costs One-time At the most basic level, the elements of ROI include

Ongoing support benefits and costs; see Table 1. These categories reflect

the line items of cash inflows and outflows in ROI for

External Services Consulting

CPM solutions. Quantifying costs is typically more

straightforward than quantifying benefits, so this will not

Table 1: Benefits and costs for ROI calculations be a focus of our discussion. While many organizations

10 BUSINESS INTELLIGENCE Journal • vol. 14, No. 1

Return on Investment

find it difficult to quantify benefits, it is possible, as this could not project, track, or report on the profitability of

article will demonstrate. each contract.

Cost savings and cost avoidance benefits typically rely The revenue often cut across multiple systems, and costs

on the traditional method of establishing a baseline of associated with providing that revenue were recorded

costs in your current environment and then identifying in a third system. Each of these systems had different

opportunities to leverage your investment in a CPM codes to identify the data, so it was impractical to report

solution to eliminate some of these costs. Examples on contract profitability. Implementing a CPM solution

include eliminating systems, process steps, and entire would enable a common management reporting hierarchy

processes. In addition, other processes and process steps and would bring together the disparate data from the

may be made more efficient (i.e., they may be performed three systems.

with less effort) via the CPM solution; this also generates

cost savings.

Organizations typically struggle

Organizations typically struggle to achieve these benefits

because organizational follow-through and commit- to reduce or avoid costs because

ment are poor. For example, a large consumer products

company was considering implementing a CPM solution organizational follow-through and

to support its budgeting, forecasting, and management

reporting processes. The company developed a business commitment are poor.

case that identified six full-time equivalents (FTEs) of

effort that would be eliminated by implementing the

CPM solution. However, this effort was spread across a Once this specific decision was identified as a potential

finance team of approximately 35 individuals. To achieve benefit of the CPM solution, the project team met with

these savings, the organization would have to be willing the sales management team responsible for the decision

to reorganize the finance department. and manually calculated the profitability of a sample

of service contracts. The results of this manual analysis

Most organizations cite “improved decision making” to allowed the team to reasonably quantify the benefit from

justify investments in CPM technology, but they struggle improving this decision process.

to quantify this benefit. In fact, most do not quantify

it at all. Decisions are made so frequently and factor in ROI Examples

so many different variables that it is often impossible to We have researched and identified four examples of compa-

analyze the process and quantify a benefit. Our experi- nies that were able to gain ROI from implementing CPM

ence has shown that the best approach is to identify one or solutions. A brief description of each company is provided

two key decisions the organization makes that the CPM below; Table 2 summarizes the ROI that was achieved.

solution will specifically support and focus on analyzing

each individual case to identify and quantify a benefit. Blue Mountain Resort

Blue Mountain Resort is a diversified, year-round resort

For example, a $500 million financial services company located in northern Ontario. It is the third busiest ski

was evaluating whether to invest in a CPM solution to resort in Canada, and sells 700,000 skier visits per year,

support its management reporting needs. Most of its on average. In addition to ski slopes, the resort has golf

business was done via service contracts with key insti- courses, mountain biking trails, gondolas, tennis courts,

tutional customers. Setting and maintaining the terms and conference facilities. In 2001, Intrawest, a publicly held

of these contracts was a key decision process for this leading North American operator and owner of resorts,

organization. However, in the current environment they purchased a 50 percent interest in Blue Mountain Resort.

BUSINESS INTELLIGENCE Journal • vol. 14, No. 1 11

Return on Investment

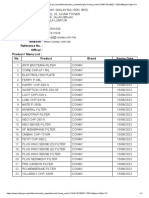

Company Name ROI Payback Project Scope Key Benefit Areas Key Cost Areas

Blue Mountain Resort 1,822% 1 month Consolidations Avoided increased head count Software

Financial and management Reduced labor costs Personnel

reporting

Reduced inventory costs Hardware

Forecasting

Better pricing Training

More frequent reporting Consulting

Trillium Health Center 46% 2.17 years Budgeting and forecasting Reduced software costs Software

Management reporting Improved analyst productivity Personnel

Improved employee productivity Hardware

Training

Ryerson Steel 63% 1.60 years Budgeting and forecasting Improved manager productivity Software

Consolidations Improved accountant productivity Personnel

Financial and management Improved close process Hardware

reporting

Rapid production of financial Training

statements

Consulting

OfficeMax 27% 3.24 years Management reporting Reduced inventory costs Software

Inventory analytics Improved analyst productivity Personnel

More frequent reporting Hardware

Training

Consulting

Table 2: Return on investment achieved by four companies

Trillium Health Center Ryerson Steel

Trillium Health Center is one of the leading community Ryerson is a steel products distributor with operations

hospitals in the Canadian province of Ontario and in the U.S. and Canada and joint ventures in Mexico,

meets the healthcare needs of more than one million India, and China. The company sells a broad range

residents in Mississauga, West Toronto, and surrounding of steel products to a variety of steel users, including

areas. With sites in both Mississauga and West Toronto machinery manufacturers, electrical machinery produc-

providing diagnostic, laboratory, and pharmaceutical ers, transportation equipment producers, metals mills,

services, Trillium delivers comprehensive services for and foundries.

both inpatient and ambulatory care.

As a result of both acquisitions and internal growth,

The hospital is rapidly growing, and in 2008 opened a Ryerson’s revenues have more than doubled since 2003.

new seven-story wing in its Mississauga location that The company is now the third largest publicly held

showcased the innovative thinking and patient-centered steel company in the U.S. Despite its rapid growth, the

philosophy fueling Trillium’s mission. The hospital is also company remains well managed. In 2006, Ryerson was

aggressively improving its use of information technology included in Fortune’s list of America’s most admired

to support patient care. companies, a list that ranks companies according to

12 BUSINESS INTELLIGENCE Journal • vol. 14, No. 1

Return on Investment

factors such as financial soundness, quality of products, Conclusion

and the ability to innovate and utilize employee talent. There is ample evidence that CPM solutions offer a

substantial ROI. Critical to achieving a return on the

OfficeMax CPM investment is spending time and effort to analyze

OfficeMax is a leader in both business-to-business office the expected cost and benefits up front, then focusing

products solutions and retail office products. The com- organizational commitment on following through with

pany provides office supplies and paper, in-store print and the necessary changes. Finally, the benefits of “better

document services through OfficeMax ImPress, technol- decision making” can sometimes be quantified if a

ogy products and solutions, and furniture to consumers specific opportunity can be identified and examined. n

and businesses of all sizes. OfficeMax customers are

served by approximately 35,000 associates through direct References

sales, catalogs, e-commerce, and more than 900 stores. Aberdeen Research Group [2005]. Retrieved from

Managing inventory—knowing what’s in stock down to MGISolutions.com, “Benefits of CPM.” http://www.

the last eraser, and where it is located on the shelves—is mgisolutions.com/mgi_solutions_benefits_of_CPM.htm

key to the high turnover of goods required for an office

supply store’s profitability. Products sitting on shelves for Knox, Sam, and Trevor Walker [2006]. CFO Survey:

weeks or months on end equates to lost revenue. Learn How to Improve Financial Analytics, CFO

Research Services, February 16. http://www.cartesis.

OfficeMax must be savvy about inventory levels and com/rsc/soxconsurvey.pdf

customer preferences to make the most of its shelf space

and maintain its competitive position. The deployment The Hackett Group [2008]. Planning & Performance

of a data warehouse and an analytic application to handle Management Research Study, April 17. http://www.

replenishment enables OfficeMax to predict inventory thehackettgroup.com

levels, optimize store content, and link marketing

practices with optimized store content.

BUSINESS INTELLIGENCE Journal • vol. 14, No. 1 13

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Operator Controls: Operation and Maintenance ManualDocument29 pagesOperator Controls: Operation and Maintenance ManualJairo GarayNo ratings yet

- Band 6 Eit ExampleDocument37 pagesBand 6 Eit Exampleapi-294518117100% (1)

- PTS 60.0303Document112 pagesPTS 60.0303Atuk SafizNo ratings yet

- Software TestingDocument21 pagesSoftware TestingAK MAHESWARANNo ratings yet

- Low Voltage Fuses For Voltage Not Exceeding 1000 V Ac or 1500 V DC - SpecificationDocument52 pagesLow Voltage Fuses For Voltage Not Exceeding 1000 V Ac or 1500 V DC - SpecificationNaresh Raju100% (1)

- Product and Brand Management Syllabi r15Document2 pagesProduct and Brand Management Syllabi r15sureshexecutiveNo ratings yet

- LBSM Proces At014 en eDocument88 pagesLBSM Proces At014 en eshijub_001No ratings yet

- Assignment 3Document2 pagesAssignment 3younkushanks0% (1)

- UTC LM8560 Mos Ic: Digital Alarm ClockDocument9 pagesUTC LM8560 Mos Ic: Digital Alarm ClockAntonio De NobregaNo ratings yet

- Eardley Resume FinalDocument2 pagesEardley Resume Finalapi-298854508No ratings yet

- Series: Automation With "Pratico System" For Sliding GatesDocument18 pagesSeries: Automation With "Pratico System" For Sliding GatesandreasprovostNo ratings yet

- Cable Accessories: Systems, IncDocument4 pagesCable Accessories: Systems, IncLuis MurilloNo ratings yet

- Catálogo PanWorld - enDocument16 pagesCatálogo PanWorld - enIsaias Exequiel Zapata GutierrezNo ratings yet

- App Cache 132174726311461242Document43 pagesApp Cache 132174726311461242Ayrton MeloNo ratings yet

- Pvelite Seminar NotesDocument314 pagesPvelite Seminar NotesRafael_Yevgeny100% (3)

- HD CowayDocument1 pageHD Cowaynur hidayahNo ratings yet

- Final PresentationDocument274 pagesFinal Presentationjefrey san miguelNo ratings yet

- Oman's Key IndustriesDocument9 pagesOman's Key IndustriesibrahimkhansahilNo ratings yet

- Tyler ResumeDocument2 pagesTyler Resumeapi-513315428No ratings yet

- SPHE1003Ax PDFDocument29 pagesSPHE1003Ax PDFGuillermito PelosiNo ratings yet

- Lead CodeDocument6 pagesLead CodeAndres GutierrezNo ratings yet

- Roswell - Truth and Consequences - Martin CannonDocument20 pagesRoswell - Truth and Consequences - Martin Cannonlenny bruce100% (2)

- 551 - 550 - 545-12 Round BalerDocument60 pages551 - 550 - 545-12 Round Balercartron seNo ratings yet

- "Yellow" Will Have To Be Should Make Is Expected To Might Lift Can BeDocument4 pages"Yellow" Will Have To Be Should Make Is Expected To Might Lift Can Bewesleygomes84No ratings yet

- Army Chemical Review #1 (2002)Document52 pagesArmy Chemical Review #1 (2002)Reid Kirby100% (1)

- Specifications 7 Series 730i 730li PDFDocument2 pagesSpecifications 7 Series 730i 730li PDFKhawaja Arslan AhmedNo ratings yet

- RM3100 Breakout Board Sales SheetDocument2 pagesRM3100 Breakout Board Sales Sheetkostya_4524No ratings yet

- Batch2 2018Document55 pagesBatch2 2018Muumini De Souza NezzaNo ratings yet

- Vaishal Patliputra Dugdh Utpadak Sahkari Sangh Limited: NIT No: VPMU: Engg: 2618 Date:08-08-19Document3 pagesVaishal Patliputra Dugdh Utpadak Sahkari Sangh Limited: NIT No: VPMU: Engg: 2618 Date:08-08-19Hitesh GoyalNo ratings yet

- Dale Hunt 80 MeterDocument7 pagesDale Hunt 80 MeterbuffeNo ratings yet