Professional Documents

Culture Documents

Are Hedge Funds Prudent For Taxable Investors? - Trust & Estates

Are Hedge Funds Prudent For Taxable Investors? - Trust & Estates

Uploaded by

Preston McSwainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Are Hedge Funds Prudent For Taxable Investors? - Trust & Estates

Are Hedge Funds Prudent For Taxable Investors? - Trust & Estates

Uploaded by

Preston McSwainCopyright:

Available Formats

COMMITTEE REPORT:

INVESTMENTS

By Preston D. McSwain

Are Hedge Funds Prudent for

Taxable Investors?

Inspiration from a true story

T

he couple had done well. Together, they’d started Despite the persuasive presentation, buoyed, per-

a business, built it and recently sold it to a stra- haps, by the knowledge that they’d built a successful

tegic investor in a deal that netted them approx- business by always fully understanding strategies before

imately $100 million in after-tax cash. executing them, the couple decided to keep it simple

They weren’t comfortable investing this wealth them- and not invest in hedge funds.

selves, so they hired an independent trustee and a

third-party investment consultant to help them design Prudent Approach?

a coordinated wealth plan. These advisors arranged The couple in this story is a real one—I was the invest-

meetings with wealth management firms that could ment consultant in the room at the meeting described

both assist with investment management and offer trust above. Were my clients prudent to select a simple invest-

company services. ment approach that didn’t include hedge funds? Initially,

One of the firms, a large trust bank, hosted an elegant you might think not.

lunch for the couple, their trustee and consultant. The The couple had set up a dynasty trust, and their

firm brought in an impressive team that included the time horizon for investment and distribution of funds

president of the trust division and the chief investment to beneficiaries was going to be measured not in years

officer. or decades, but generations. What does that sound like?

After the first course, the president summarized the Maybe an endowment?

firm’s capabilities. Particular emphasis was given to the If trusts for ultra-high-net-worth (UHNW) families

strength of the alternatives and hedge fund selection have characteristics that resemble endowments, and

team. He concluded by saying: “You’ve done well. We’re endowments, like say Yale’s, have some of the most

here to make sure your family continues to do well over well respected and sophisticated long-term investment

generations by building you a prudently diversified port- strategies, shouldn’t more UHNW portfolios look like

folio that includes global equities, bonds and a world Yale-style endowments?

class mix of alternative managers.” Why mention Yale? In the investment world, Yale is

While the couple appreciated the presentation, nei- known for having a top performing endowment, which

ther fully understood the complex hedge fund strate- many try to replicate with what’s called an “endowment

gies included in the proposal. When they questioned model.” Yale also has one of the most well respected

the necessity of these strategies, the CIO said: “To be CIOs, David Swensen. Based on his writings and his use

prudent investors and good fiduciaries, it’s important of non-traditional investments, such as hedge funds,

to invest in an endowment-style portfolio that includes Swensen is a major contributor to the endowment-style

hedge funds.” investment model, which traditionally includes sizeable

allocations to hedge funds.

Preston D. McSwain is a managing The Tax Trap

partner and founder of Fiduciary Wealth So, what’s the problem with using an endowment

Partners in Boston approach for UHNW families?

I could write about fees, or recent less than favorable

48 TRUSTS & ESTATES / trustsandestates.com SEPTEMBER 2015

COMMITTEE REPORT: INVESTMENTS

performance by some hedge funds, but how about taxes? presumes that indexed equities are also available.

Yes, taxes. Regardless of your political leanings, no Notice that the allocations to absolute return (a term

one likes writing a big check to the Internal Revenue Aperio used as a proxy for hedge funds) shift from

Service, but unlike endowments, UHNW individuals 17.8 percent of the portfolio to 0 percent when factoring

and taxable trusts can’t avoid a yearly payment to the in taxes (see green and blue columns). In other words,

IRS on gains. when you properly account for the tax drag, hedge funds

As illustrated in the story at the beginning of this should have little, if any, place inside taxable portfolios.

article, many investment managers and advisors now Describing the impact of its hypothetical Yale endow-

recommend endowment-style portfolios, which include ment having been shifted to a taxable environment,

sizable allocations to hedge funds or hedge funds of Aperio noted that, “Given that an investor now has to

funds. Many of the presentations fail to point out, how- pay taxes on what had been a tax-exempt portfolio,

ever, that allocations to hedge funds frequently generate suddenly active equity and absolute return [hedge fund]

large short-term gains, which now carry taxes that can allocations become far less attractive.”

exceed 50 percent in states such as California. Aperio reached this conclusion even assuming

that hedge fund strategies would otherwise benefit

Strategies in a Taxable World the portfolio by offering diversification through a low

I specifically mention California not only because

of its high concentration of UHNW individuals,

but also because it’s the home of the Aperio Group,

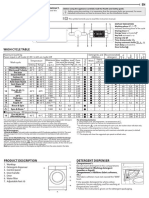

If Yale Were Taxable

which published a study that, better than almost Pre- and after-tax returns*

anything else I’ve seen, provides sophisticated evi- Returns Weights

dence to counter the endowment-style proposals Yale P/T Yale A/T Yale Yale Yale A/T Yale A/T

of some firms. Implied Implied Tax P/T Active Indexed

In a white paper entitled, “What Would Yale Asset Class Return Return Haircut Weight Equity Equity

Do If It Were Taxable?” Aperio collected endow- Absolute Return 2.2% 1.7% –0.5% 17.8% 0.0% 0.0%

ment asset allocations, asset class returns and

Equity, Active 9.7% 7.5% –2.2% 15.7% 0.0% 0.0%

volatility and correlation data from multiple third

party sources, including Yale’s annual report and Equity, Indexed 9.7% 9.2% –0.5% 0.0% 0.0% 45.6%

an independent study of endowments by the Bonds 1.5% 0.9% –0.7% 4.9% 35.0% 25.8%

Commonfund and the National Association

Nat. Resources 10.7% 9.7% –1.0% 7.9% 12.2% 0.0%

of College and University Business Offices

(NACUBO). Real Estate 12.3% 10.7% –1.6% 20.2% 13.9% 9.0%

Aperio took this data and calculated pre-tax Private Equity 11.7% 10.4% –1.3% 32.0% 38.9% 19.6%

and after-tax returns for Yale’s asset classes. Then,

Cash 1.5% 0.8% –0.7% 1.5% 0.0% 0.0%

using an allocation optimizer, they generated a

tax-adjusted optimal asset allocation—evaluating, * Please see Aperio’s important disclosures about its assumptions and methodology at

in other words, what Yale might do differently if it http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2447403

were taxable. ** Pre-tax

The “If Yale Were Taxable,” chart on this *** After-tax

page, illustrates some of Aperio’s conclusions.

The green column presumes that the equity — Aperio Group, LLC based on data for the period

allocation in the portfolio is available only Dec. 31, 1998 through June 30, 2013

through active strategies, while the blue

SEPTEMBER 2015 TRUSTS & ESTATES / trustsandestates.com 49

COMMITTEE REPORT: INVESTMENTS

correlation to equities. In fact, many hedge funds, fiduciary with responsibility for taxable assets

such as long-short strategies, have a relatively high recognizes that only extraordinary circumstances

correlation to equities (for example, the well-respected justify deviation from a simple strategy…

HFRI Fund Weighted Composite hedge fund index

has a 0.88 correlation to equities), making the case for Beyond Swensen’s caution and the Aperio research,

using them for diversification even less attractive. In I’ve been surprised at the dearth of publicly available

Aperio’s words: research on the impact of taxes on hedge fund returns.

Admittedly, coming up with metrics to evaluate

If a hedge fund strategy reflects the risk patterns returns and annual taxable gain assumptions across

of the HFRI index, with its higher correlation to a range of hedge funds is difficult (transparency on

equities, then the model never allocates anything returns, turnover and the mix of long-term versus

to hedge funds. short-term taxable gains is limited). I don’t think it’s a

stretch, though, to suggest, as John Rekenthaler from

Morningstar wrote in January 2015, that: “hedge funds

are notoriously tax-inefficient” and that a sizeable por-

tion of yearly returns comes in the form of short-term

“Don’t forget that most [hedge taxable gains.

One article of note is a piece written by Henry

fund investments] come with a Blodget several years ago for Slate magazine called “The

Wall Street Self Defense Manual.” Instead of the complex

healthy dollop of the biggest cost analysis done by Aperio, Blodget used simple assump-

tions and calculations to question the appropriateness

of all: taxes.” of hedge funds for individual investors.

As Blodget pointed out, most hedge funds charge a

2 percent annual fee on assets per year plus a 20 percent

Lest you think that there’s anything unique about fee on gains. He assumed that an S&P 500 fund charges

Yale, Aperio performed similar analyses across the 0.2 percent on assets (this is quite high by the way—

previously mentioned Commonfund/NACUBO study Vanguard charges only 0.05 percent) and generates a

of the allocations and performances of all U.S. endow- net return of 9.8 percent per year (10 percent gross less

ments. The conclusions they reached from this data 0.2 percent in fees). Using simple math, he determined

were the same: allocations to hedge fund and active that an equity-oriented hedge fund charging “2 and 20”

equity strategies shift to zero in a taxable environment. (that is, 2 percent of total asset value as a management

Who else offers a similarly strong caution about fee and an additional 20 percent of profits earned)

taxes? David Swensen. would need to produce a 15 percent gross return just to

Following the publication of Swensen’s first book in match the index fund. Looking at funds of funds that

2000, Pioneering Portfolio Management, many UHNW charge “1 and 10” on top of the underlying hedge funds,

advisors started promoting the endowment model he’d Blodget calculated that the return would need to be

helped create. The UHNW investment world eagerly 18.5 percent to keep pace with the index fund.

embraced this new “sophisticated” approach and yet, Blodget then cautioned, “Don’t forget that most

15 years on, still seems to be forgetting the fact that [hedge fund investments] come with a healthy dollop of

Swensen’s book was designed for tax-exempt investors. the biggest cost of all: taxes.”

As Swensen wrote in his second book, Unconventional Offering another simple calculation, he assumed that

Success, (this one for taxable investors): a hedge fund generates annual pre-tax net gains (after

expenses) of 10 percent per year and that 75 percent of

The management of taxable … assets without the gains come from short-term trading. With a 50 per-

considering the consequences of trading activity cent total short-term gain tax liability and a 20 percent

represents a … little considered scandal. A serious tax on the balance of the return, this would produce an

50 TRUSTS & ESTATES / trustsandestates.com SEPTEMBER 2015

COMMITTEE REPORT: INVESTMENTS

after-tax return of just under 6 percent. A 40 percent Of hedge funds of funds or endowment-in-a-box-

haircut. Ouch. style limited partnerships, Rogers went on to say:

When you put all the costs together—fees and taxes—

you get a sense of just how skilled a hedge fund manager In the case of a fund of hedge funds, the investor

has to be to generate an above-market after-tax return for is asking heroic results from manager selection,

a taxable investor. Blodget’s calculation was that: strategy allocation and the hedge fund managers

themselves—all three competencies have proven

[t]o equal the net after-tax return of an S&P 500 to have limited sustainability over extended peri-

fund that generates a 10 percent gross return, a ods of time, to say the least. Not to mention that

hedge fund would have to generate a gross return the majority of our leading list of 400 hedge fund

of no less than 20 percent. A fund of funds would managers are closed to new business because they

have to post a gross return of 24 percent. Few, if realize the negative impact of managing too much

any, managers are skilled enough to produce such capital. And frankly, they don’t need your money.2

returns consistently.

If you think Blodget’s math must be off, Matthew Klein, Where To Go From Here?

writing for Bloomberg View in 2013, highlighted com- The tax practitioners among you may already appreciate

parable research from Greenline Partners.1 Greenline that the significant tax headwind for hedge funds may

calculated that hedge fund investors keep only about have gotten even stronger. As Andy Parker and Bob

40 percent of returns after fees and taxes. Of the Gordon of Twenty-First Securities reminded me, for

Greenline research, Klein wrote: investors in hedge vehicles that are categorized as “inves-

tor” funds, expenses aren’t netted against income before

To get an equivalent return after taxes and fees flowing through on a K-1. Gross income jurisdictions,

[to that of a low cost index fund that tracked the such as Connecticut (home to many hedge funds), only

S&P 500, which generated 9.6% annually over the magnify the problem by not allowing any deductions for

time period they used going back to 1970], an hedge fund costs, while my home state of Massachusetts,

investor would have to find a hedge fund that con- for example, further denies any deductions for interest.

sistently earned almost 21 percent a year. Even the Stiff headwinds for sure.

best hedge funds usually earn much less than that. So, the next time you hear the hedge fund or funds

of funds endowment model pitch or the suggestion

Of course, some hedge fund managers are outliers that fiduciary prudence demands that you consider an

and have produced attractive after-tax returns, but evi- allocation to hedge funds, step back and ask a few more

dence like the Aperio study and the simple calculations questions, especially about taxes.

above make me question the use of most hedge funds in In light of the severity of the tax drag, were the hus-

UHNW portfolios. band and wife team mentioned at the start of this article

As my friend Greg Rogers (a family office leader prudent to forego an allocation to hedge funds in favor

from RayLign Advisory), noted: of a keep-it-simple approach?

I think so.

For me, what keeps me up at night is overly

compensating my portfolio manager friends [per- Endnotes

formance fees], Wall Street Managing Directors 1. Greenline Partners is staffed by folks who once worked at the well-regarded

[trading fees] and government coffers [taxes]. A hedge fund Bridgewater Associates.

sobering stream of logic goes as follows: if 5% of 2. Note that Greg Rogers knows the hedge fund and alternative space better

the 8,000 hedge fund managers can actually deliv- than most. Before running his own family office and RayLign, he was exec-

er on the required returns to overcome fees and utive vice president and chief operating officer at the publicly traded asset

taxes over the long-term, then why do the other management firm John A. Levin & Co. and a managing director at a leading

7,600 hedge fund managers exist? institutional investment consultant, RogersCasey.

SEPTEMBER 2015 TRUSTS & ESTATES / trustsandestates.com 51

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Periodization - Nick WinkelmanDocument54 pagesPeriodization - Nick WinkelmanSteve Brown100% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IEC 60950 Rev1Document3 pagesIEC 60950 Rev1Rip_BarNo ratings yet

- Vegan AestheticsDocument12 pagesVegan AestheticselyseNo ratings yet

- Codes Standards RegulationsDocument11 pagesCodes Standards RegulationsEslNo ratings yet

- Is Your Body Infested With Self-Replicating Nano-FibersDocument4 pagesIs Your Body Infested With Self-Replicating Nano-Fibersthisdraft100% (3)

- Dietary Computation For Pregnant ClientDocument12 pagesDietary Computation For Pregnant ClientLuis WashingtonNo ratings yet

- Whirlpool BIWDWG861484uk enDocument4 pagesWhirlpool BIWDWG861484uk ennadaljoachim77No ratings yet

- Mbarang 10102022Document3 pagesMbarang 10102022zeta chenkNo ratings yet

- Economics 9732/01: Pioneer Junior College, Singapore Preliminary Examinations 2014 Higher 2Document8 pagesEconomics 9732/01: Pioneer Junior College, Singapore Preliminary Examinations 2014 Higher 2Yvette LimNo ratings yet

- Academy of American Franciscan HistoryDocument36 pagesAcademy of American Franciscan HistoryCESAR HUAROTO DE LA CRUZNo ratings yet

- Wear Solutions BrochureDocument16 pagesWear Solutions BrochureOkan KalendarNo ratings yet

- Bossing Nicole PDFDocument47 pagesBossing Nicole PDFMark CastilloNo ratings yet

- NeoCryl A-662 MsdsDocument4 pagesNeoCryl A-662 MsdsLeandro EsvizaNo ratings yet

- Ebook Chemistry For Today General Organic and Biochemistry PDF Full Chapter PDFDocument67 pagesEbook Chemistry For Today General Organic and Biochemistry PDF Full Chapter PDFrobert.davidson233100% (31)

- Chapter4 Questions WithoutSupersonicDocument5 pagesChapter4 Questions WithoutSupersonicsh1999No ratings yet

- Stilboestrol Tablets MSDSDocument6 pagesStilboestrol Tablets MSDSIsaac lauricNo ratings yet

- VegDocument130 pagesVegAnanda PreethiNo ratings yet

- WWW - Livelaw.In: in The Supreme Court of India Criminal Appellate JurisdictionDocument10 pagesWWW - Livelaw.In: in The Supreme Court of India Criminal Appellate JurisdictionSheetalNo ratings yet

- Bence Bays Resume July 2015Document2 pagesBence Bays Resume July 2015api-292242662No ratings yet

- Furnace SoftwareDocument7 pagesFurnace SoftwareolaNo ratings yet

- Busbar Protect1Document9 pagesBusbar Protect1syahira87No ratings yet

- PCB HandlingDocument8 pagesPCB HandlingscanlonlNo ratings yet

- Wagner and Traud ArticleDocument13 pagesWagner and Traud Articlegrimaguil100% (1)

- Product Manual 26361V1 (Revision F) : 505DE Digital Governor For Steam TurbinesDocument198 pagesProduct Manual 26361V1 (Revision F) : 505DE Digital Governor For Steam TurbinesGuilherme Marquezin100% (1)

- Rice Sector PACRA - 1604759631Document29 pagesRice Sector PACRA - 1604759631Huzefa SarayiNo ratings yet

- MASB7 Construction Contract7Document3 pagesMASB7 Construction Contract7hyraldNo ratings yet

- Ocean Aerosols Climate ImpactDocument14 pagesOcean Aerosols Climate ImpactSustainability ManagementNo ratings yet

- Catálogo de Referencias - Power Conversion SystemsDocument60 pagesCatálogo de Referencias - Power Conversion SystemsBENo ratings yet

- ME Lab 2 LectureDocument5 pagesME Lab 2 LectureIan Paul TongolNo ratings yet

- Cadet College Skardu One Year Model Question PaperDocument5 pagesCadet College Skardu One Year Model Question PaperashrafNo ratings yet