Professional Documents

Culture Documents

IDirect RallisInd CoUpdate Apr17

IDirect RallisInd CoUpdate Apr17

Uploaded by

saran21Copyright:

Available Formats

You might also like

- Original PDF Financial Management Core Concepts 4th Edition by Raymond Brooks PDFDocument42 pagesOriginal PDF Financial Management Core Concepts 4th Edition by Raymond Brooks PDFmathew.robertson818100% (39)

- Risk, Cost of Capital, and Valuation: Multiple Choice QuestionsDocument34 pagesRisk, Cost of Capital, and Valuation: Multiple Choice QuestionsDũng Hữu0% (1)

- Aladdin Synthetic CDO II, Offering MemorandumDocument216 pagesAladdin Synthetic CDO II, Offering Memorandumthe_akinitiNo ratings yet

- Syllabus CFA Level 2Document2 pagesSyllabus CFA Level 2Phi Anh100% (1)

- Rallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsDocument12 pagesRallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsJatin SoniNo ratings yet

- Cox & Kings (CNKLIM) : Weak Performance Debt Concerns AddressedDocument9 pagesCox & Kings (CNKLIM) : Weak Performance Debt Concerns Addressedsaran21No ratings yet

- Bodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!Document9 pagesBodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!P.B VeeraraghavuluNo ratings yet

- Aarti Industries LTDDocument5 pagesAarti Industries LTDViju K GNo ratings yet

- Jyothy Laboratories LTDDocument5 pagesJyothy Laboratories LTDViju K GNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- IDirect RallisIndia ICDocument35 pagesIDirect RallisIndia ICArun DubeyNo ratings yet

- Marico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthDocument10 pagesMarico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthAshokNo ratings yet

- Aditya Birla Fashion & Retail (ADIFAS) : Shift in Festive Season Spurs PerformanceDocument10 pagesAditya Birla Fashion & Retail (ADIFAS) : Shift in Festive Season Spurs Performance4nagNo ratings yet

- Hikal LTD: Crop Protection Propels Growth But Margins MissDocument10 pagesHikal LTD: Crop Protection Propels Growth But Margins MissRakesh KumarNo ratings yet

- Essel Propack (ESSPRO) : Performance Remains WeakDocument9 pagesEssel Propack (ESSPRO) : Performance Remains WeakVeronika AkheevaNo ratings yet

- 28162192019882apex IC Report PDFDocument9 pages28162192019882apex IC Report PDFAshutosh GuptaNo ratings yet

- Escorts: Expectation of Significant Recovery Due To A Better Monsoon BuyDocument7 pagesEscorts: Expectation of Significant Recovery Due To A Better Monsoon BuynnsriniNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- Somany Ceramics (SOMCER) : Multiple Triggers For Margin RevivalDocument4 pagesSomany Ceramics (SOMCER) : Multiple Triggers For Margin Revivalsaran21No ratings yet

- Ambuja Cement: Volume Push Drives Topline Maintain HOLDDocument9 pagesAmbuja Cement: Volume Push Drives Topline Maintain HOLDanjugaduNo ratings yet

- CMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistDocument5 pagesCMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistVikrant SadanaNo ratings yet

- Music BroadcastDocument12 pagesMusic BroadcastSBNo ratings yet

- Asian Paints 18012024 MotiDocument12 pagesAsian Paints 18012024 Motigaurav24021990No ratings yet

- Cipla - 2QFY19 Results - ICICI DirectDocument13 pagesCipla - 2QFY19 Results - ICICI DirectSheldon RodriguesNo ratings yet

- Agri Inputs: Sector Valuations Price in A Good SeasonDocument12 pagesAgri Inputs: Sector Valuations Price in A Good SeasonPrahladNo ratings yet

- Atul LTD Buy Report IIFLDocument6 pagesAtul LTD Buy Report IIFLBhaveek OstwalNo ratings yet

- Vinati Organics LTD: Growth To Pick-Up..Document5 pagesVinati Organics LTD: Growth To Pick-Up..Bhaveek OstwalNo ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- Asian Paints - Q4FY20 Result Update - 25062020 - 25-06-2020 - 17Document7 pagesAsian Paints - Q4FY20 Result Update - 25062020 - 25-06-2020 - 17tanmayamohanNo ratings yet

- Astral Poly Technik (ASTPOL) : Strong Play in Piping SegmentDocument4 pagesAstral Poly Technik (ASTPOL) : Strong Play in Piping SegmentADNo ratings yet

- Page Industries (PAGIND) : Consistency in Volume Growth Remains CrucialDocument12 pagesPage Industries (PAGIND) : Consistency in Volume Growth Remains CrucialRahul DhawanNo ratings yet

- IDirect Biocon Q3FY17Document16 pagesIDirect Biocon Q3FY17Jagadish TangiralaNo ratings yet

- Princpip 11 8 23 PLDocument6 pagesPrincpip 11 8 23 PLAnubhi Garg374No ratings yet

- KSB Pumps (KSBPUM) : Resounding Topline Growth Instils ConfidenceDocument11 pagesKSB Pumps (KSBPUM) : Resounding Topline Growth Instils Confidencedarshanmade100% (1)

- IDirect Lupin Q3FY17Document16 pagesIDirect Lupin Q3FY17dipshi92No ratings yet

- Navneet Education (NAVEDU) : Syllabus Change Drives Revenue GrowthDocument9 pagesNavneet Education (NAVEDU) : Syllabus Change Drives Revenue GrowthAshokNo ratings yet

- Ojit 240619Document5 pagesOjit 240619Gaurav kumarNo ratings yet

- Reliance Capital (RELCAP) : Businesses Growing, Return Ratios ImprovingDocument15 pagesReliance Capital (RELCAP) : Businesses Growing, Return Ratios Improvingratan203No ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- Indian Oil Corporation: Interesting Times AheadDocument9 pagesIndian Oil Corporation: Interesting Times AheadNeelesh KumarNo ratings yet

- Company Report - IMPACT - E - 20180219081453Document8 pagesCompany Report - IMPACT - E - 20180219081453bodaiNo ratings yet

- Deepak Nitrite - EdelDocument24 pagesDeepak Nitrite - EdelarhagarNo ratings yet

- Meghmani Organics Limited Corporate Presentation FY2021Document27 pagesMeghmani Organics Limited Corporate Presentation FY2021Rohit KNo ratings yet

- UltratechCement Edel 190118Document15 pagesUltratechCement Edel 190118suprabhattNo ratings yet

- Asian Paints: Volume Led Growth ContinuesDocument9 pagesAsian Paints: Volume Led Growth ContinuesanjugaduNo ratings yet

- Motilal Oswal Sees 15% UPSIDE in CEAT Earnings Below Estimate DueDocument12 pagesMotilal Oswal Sees 15% UPSIDE in CEAT Earnings Below Estimate DueSiddharthNo ratings yet

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDocument13 pagesZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokNo ratings yet

- Indofood CBP: Navigating WellDocument11 pagesIndofood CBP: Navigating WellAbimanyu LearingNo ratings yet

- Icici Sec Berger PaintsDocument6 pagesIcici Sec Berger PaintsvenugopallNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Greenply Industries Dec17Document13 pagesGreenply Industries Dec17narayanan_rNo ratings yet

- JK Cement: Valuations Factor in Positive Downgrade To HOLDDocument9 pagesJK Cement: Valuations Factor in Positive Downgrade To HOLDShubham BawkarNo ratings yet

- AIA Engineering LTD: Q3FY18 Result UpdateDocument6 pagesAIA Engineering LTD: Q3FY18 Result Updatesaran21No ratings yet

- Dabur India: Strong Domestic Volume Growth Lifts RevenuesDocument9 pagesDabur India: Strong Domestic Volume Growth Lifts RevenuesRaghavendra Pratap SinghNo ratings yet

- PI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13Document8 pagesPI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13SandeepNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Gulf Oil Lubricants: Stable Performance..Document8 pagesGulf Oil Lubricants: Stable Performance..Doshi VaibhavNo ratings yet

- HDFC Sec Report On Vinati OrganicsDocument21 pagesHDFC Sec Report On Vinati Organicssujay85No ratings yet

- AIA Engineering - Q4FY22 Result Update - 30 May 2022Document7 pagesAIA Engineering - Q4FY22 Result Update - 30 May 2022PavanNo ratings yet

- Coromandel Report - MotilalDocument12 pagesCoromandel Report - MotilalAkshaya SrihariNo ratings yet

- ABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementDocument4 pagesABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementShanti RanganNo ratings yet

- Aarti Industries: All Round Growth ImminentDocument13 pagesAarti Industries: All Round Growth ImminentPratik ChhedaNo ratings yet

- Promoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesFrom EverandPromoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesNo ratings yet

- Sharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khanDocument9 pagesSharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khansaran21No ratings yet

- APL Apollo Tubes 01 01 2023 KhanDocument7 pagesAPL Apollo Tubes 01 01 2023 Khansaran21No ratings yet

- Titan Company 01 01 2023 KhanDocument8 pagesTitan Company 01 01 2023 Khansaran21No ratings yet

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Document22 pagesIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21No ratings yet

- HDFC 01 01 2023 KhanDocument7 pagesHDFC 01 01 2023 Khansaran21No ratings yet

- Britannia Industries 01 01 2023 KhanDocument7 pagesBritannia Industries 01 01 2023 Khansaran21No ratings yet

- Daily Currency Outlook: September 11, 2019Document7 pagesDaily Currency Outlook: September 11, 2019saran21No ratings yet

- Sharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khanDocument10 pagesSharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khansaran21No ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Dolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatDocument22 pagesDolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatsaran21No ratings yet

- Housing Development Finance Corporation 27082019Document6 pagesHousing Development Finance Corporation 27082019saran21No ratings yet

- KEC International 01 01 2023 PrabhuDocument7 pagesKEC International 01 01 2023 Prabhusaran21No ratings yet

- Fundamental Outlook Market Highlights: Indian RupeeDocument2 pagesFundamental Outlook Market Highlights: Indian Rupeesaran21No ratings yet

- South Indian Bank (SIB IN) : Q3FY19 Result UpdateDocument10 pagesSouth Indian Bank (SIB IN) : Q3FY19 Result Updatesaran21No ratings yet

- Dabur India (DABUR IN) : Analyst Meet UpdateDocument12 pagesDabur India (DABUR IN) : Analyst Meet Updatesaran21No ratings yet

- Somany Ceramics (SOMCER) : Multiple Triggers For Margin RevivalDocument4 pagesSomany Ceramics (SOMCER) : Multiple Triggers For Margin Revivalsaran21No ratings yet

- Confidence Petroleum India 020119Document17 pagesConfidence Petroleum India 020119saran21No ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- JK Lakshmi Cement 18062019Document6 pagesJK Lakshmi Cement 18062019saran21No ratings yet

- Ahluwalia Contracts: Industry OverviewDocument20 pagesAhluwalia Contracts: Industry Overviewsaran21No ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocument8 pagesTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21No ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- ODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps EuropeDocument4 pagesODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps Europesaran21No ratings yet

- Federal Bank LTD: Q3FY19 Result UpdateDocument4 pagesFederal Bank LTD: Q3FY19 Result Updatesaran21No ratings yet

- Coal India: CMP: INR234 Sputtering Production Growth Impacting VolumesDocument10 pagesCoal India: CMP: INR234 Sputtering Production Growth Impacting Volumessaran21No ratings yet

- Stock Update: Icici BankDocument3 pagesStock Update: Icici Banksaran21No ratings yet

- IME Echnoplast TD: P R - 100 T R .128 BUYDocument9 pagesIME Echnoplast TD: P R - 100 T R .128 BUYsaran21No ratings yet

- JK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000Document9 pagesJK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000saran21No ratings yet

- Bank of Baroda (BOB) BUY: Retail Equity ResearchDocument5 pagesBank of Baroda (BOB) BUY: Retail Equity Researchsaran21No ratings yet

- Factors Affecting The Location of IndustriesDocument10 pagesFactors Affecting The Location of Industriessumedha bhartiNo ratings yet

- 2024 l1 Topics CombinedDocument27 pages2024 l1 Topics CombinedShaitan LadkaNo ratings yet

- Commodity Futures Prices: Some Evidence On Forecast Power, Premiums, and The Theory of StorageDocument24 pagesCommodity Futures Prices: Some Evidence On Forecast Power, Premiums, and The Theory of StorageLuis FernandoNo ratings yet

- Corporation NotesDocument5 pagesCorporation NotesPrestine Faith SalinasNo ratings yet

- Essentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test BankDocument28 pagesEssentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test Bankdipolarramenta7uyxw100% (24)

- Principles of Microeconomics - IDocument2 pagesPrinciples of Microeconomics - IRajni KumariNo ratings yet

- Economics Assignment 1Document3 pagesEconomics Assignment 1GbengaNo ratings yet

- Chart of Accounts For BanksDocument26 pagesChart of Accounts For BankscahyoNo ratings yet

- Globalization and Its ImpactDocument18 pagesGlobalization and Its ImpactSurya Prakash Singh100% (1)

- FINE 342 SummaryDocument17 pagesFINE 342 SummaryJohn ThompsonNo ratings yet

- Comparative Analysis of Commercial Paper and Certificate of DepositsDocument16 pagesComparative Analysis of Commercial Paper and Certificate of DepositsRiddhi Mehta100% (2)

- Entrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaDocument24 pagesEntrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaAbduahi asadNo ratings yet

- E-Commerce: Mechanisms, Infrastructures, and ToolsDocument38 pagesE-Commerce: Mechanisms, Infrastructures, and ToolshulahopNo ratings yet

- Quiz Two IntaccDocument11 pagesQuiz Two IntaccUNKNOWNNNo ratings yet

- Export Documentation (MBA)Document296 pagesExport Documentation (MBA)HarshitSinhaNo ratings yet

- Session 11 and 12 - Accounting For DepreciationDocument57 pagesSession 11 and 12 - Accounting For DepreciationKashish Manish JariwalaNo ratings yet

- PSSC Economics QPDocument43 pagesPSSC Economics QPAndrew ArahaNo ratings yet

- Multi-Act MSSP PMSDocument39 pagesMulti-Act MSSP PMSAnkurNo ratings yet

- Average Cost MethodDocument3 pagesAverage Cost MethodRaja MonemNo ratings yet

- CaseDocument27 pagesCasearuba ansariNo ratings yet

- Hyperion Lite PaperDocument13 pagesHyperion Lite PaperajdCruiseNo ratings yet

- Waris Raees (905) Hassan Sardaar (973) Project MarketingDocument19 pagesWaris Raees (905) Hassan Sardaar (973) Project Marketingafia malikNo ratings yet

- FJFJFJFJDocument12 pagesFJFJFJFJnuravcool76No ratings yet

- CHAPTER 12 Maintain Inventory Records: Examining and Working Through Different Methods of Accounting For InventoriesDocument18 pagesCHAPTER 12 Maintain Inventory Records: Examining and Working Through Different Methods of Accounting For InventoriesCJNo ratings yet

- Brand Positioning of Deodorant Brands in IndiaDocument8 pagesBrand Positioning of Deodorant Brands in IndiaAlisha JainNo ratings yet

IDirect RallisInd CoUpdate Apr17

IDirect RallisInd CoUpdate Apr17

Uploaded by

saran21Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDirect RallisInd CoUpdate Apr17

IDirect RallisInd CoUpdate Apr17

Uploaded by

saran21Copyright:

Available Formats

Company Update

April 5, 2017

Rating matrix

Rating : Buy Rallis India (RALIND) | 255

Target : | 300

Target Period

Potential Upside

:

:

12-18 months

18%

On firm footing; quality play…

Rallis India (Rallis) is a major agri input player domestically with a

What’s changed?

presence across the agri value chain viz. seeds & agro-chemicals

Target Changed from | 250 to | 300

In the agro-chemical space, the company has ~7% market share

EPS FY17E Changed from | 8.7 to | 8.8

EPS FY18E Changed from | 9.9 to | 10.1

domestically while in the seeds segment through its subsidiary i.e.

EPS FY19E Changed from | 11.4 to | 12.0

Metahelix, it commands a market share of ~3%

Rating Unchanged With incremental steps being implemented by various state

governments to augment farm income amid increasing streamlining

Key financials of farm benefits from the central government, we believe agri-input

| Crore FY16 FY17E FY18E FY19E companies will report robust sales growth in FY17-19E

Net Sales 1,611.6 1,665.1 1,845.9 2,006.7 Majority of agro-chemicals domestically find application in cotton

EBITDA 230.1 266.2 313.2 350.6 crop, which witnessed a decline in acreages to the tune of ~12% in

Normalized PAT 143.0 170.3 197.0 233.4 FY17 primarily tracking low profitability in FY15-16 and occurrence of

Normalized EPS (|) 7.4 8.8 10.1 12.0 increasing pests. However, given remunerative cotton crop prices

currently and low pest occurrence in FY17, we expect cotton

Valuation summary acreages to witness strong double digit growth in FY18E, driving

FY16 FY17E FY18E FY19E growth in earnings on both the Metahelix (cotton seeds) as well as

P/E 34.7 29.5 25.2 21.2

domestic agro-chemical front

Target P/E 40.8 20.3 29.6 25.0

Although private weather agency Skymet has sounded the alarm

EV / EBITDA 21.9 18.1 15.1 13.1

over below normal monsoon for 2017 at 95% of LPA due to

P/BV 5.5 4.4 4.0 3.6

development of El Niño conditions, we believe the impact will be

RoNW (%) 15.9 15.1 16.0 17.0

limited due to its occurrence in the later part of the monsoon season.

RoCE (%) 20.1 19.9 22.8 23.6

Moreover, we derive confidence from the statements of senior IMD

officials in the recent past wherein they have negated El-Nino

Stock data conditions impacting the upcoming monsoon season

Particular Amount We revise our earnings estimates and also roll over our valuation to

Market Capitalization | 4960 crore

FY19E numbers. We expect sales, on a consolidated basis, to grow

Total Debt (FY17E) | 40 crore

at 9.8% CAGR in FY17-19E with PAT growing at a CAGR of 17.1% in

Cash and Investments (FY17E) | 187 crore

FY17-19E, factoring in 150 bps improvement in EBITDA margins. We

EV | 4812 crore

value Rallis at | 300 i.e. 25x P/E on FY19E EPS of | 12.0

52 week H/L 265 / 165

Equity capital | 19.5 crore Farmer centric Budget 2017-18; focused to double farm income by 2022

Face value 1.0 Union Budget 2017-18 delivered on its expectations with a clear focus on

MF Holding (%) 11.9 achieving its vision to double farm income by 2022. Due emphasis was

FII Holding (%) 6.0 given to both productivity and better farm realisations. Total allocation

towards agriculture & farmer welfare was increased 16% YoY to | 41,855

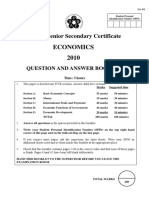

Price Chart crore in FY18E. Notably, a sizable increase in allocation to the insurance

10,000 300 scheme PMFBY to | 9000 crore (up 64% YoY) and irrigation scheme

9,000 (PMKSY) to | 7377 crore (up 28% YoY) in FY18E was encouraging.

250

8,000 Moreover, the government increased allocation towards subsidy under

7,000 200 farm mechanisation to | 525 crore in FY18E (vs. | 358 crore in FY17E).

6,000 150 Furthermore, agricultural credit in 2017-18 was fixed at record levels of |

5,000 100 10 lakh crore (up 11% YoY). This will boost farm productivity &

4,000 consequent farm income thereby benefiting all agri-input companies,

50

3,000 including Rallis India.

2,000 0

Portfolio stock; healthy balance sheet & return ratios, retain BUY!

May-15 Oct-15 Feb-16 Jun-16 Nov-16 Apr-17

Rallis is a portfolio stock with a presence across the agricultural value

Price (R.H.S) Nifty (L.H.S)

chain and good brand recall. It is a debt-free company with net cash of

~| 150 crore as of FY17E. The company will generate ~| 200 crore as

Research Analyst free cash flow per year in FY17-19E. Rallis also has robust return ratios

Chirag J Shah with average FY16-19E RoCE & RoIC at 22% & 34%, respectively. We

shah.chirag@icicisecurities.com value Rallis at | 300 i.e. 25x P/E on FY19E EPS of | 12.0. We have a BUY

Shashank Kanodia, CFA rating on the stock with a target price of | 300. Rallis is indeed a stock

shashank.kanodia@icicisecurities.com worth holding in one’s portfolio with a long term investment horizon.

ICICI Securities Ltd | Retail Equity Research

Financial summary (Consolidated)

Profit and loss statement | Crore Cash flow statement | Crore

(Year-end March) FY16 FY17E FY18E FY19E (Year-end March) FY16 FY17E FY18E FY19E

Net Sales 1611.6 1665.1 1845.9 2006.7 Normalized PAT 143.0 170.3 197.0 233.4

Other Operating Income 17.1 24.2 22.8 24.6 Add: Depreciation 44.6 46.7 48.0 49.8

Total Operating Income 1628.6 1689.3 1868.7 2031.3 (Inc)/dec in Current Assets 30.7 -25.1 -100.4 -66.4

Growth (%) -10.6 3.7 10.6 8.7 Inc/(dec) in CL and Provisions 20.1 12.3 47.9 46.1

Raw Material Expenses 839.2 937.9 1,031.7 1,120.6 Others 13.5 5.9 7.2 0.4

Employee Expenses 132.4 149.6 159.9 173.4 CF from operating activities 252.0 210.1 199.7 263.3

Other Operating Expense 426.8 335.6 363.9 386.7 (Inc)/dec in Investments -3.9 -170.6 -50.0 -135.0

Total Operating Expenditure 1,398.5 1,423.1 1,555.5 1,680.7 (Inc)/dec in Fixed Assets -76.5 87.0 -30.0 -30.0

EBITDA 230.1 266.2 313.2 350.6 Others -65.7 0.0 0.0 0.0

Growth (%) -16.9 15.7 17.7 12.0 CF from investing activities -146.1 -83.6 -80.0 -165.0

Depreciation 44.6 46.7 48.0 49.8 Issue/(Buy back) of Equity 0.0 0.0 0.0 0.0

Interest 13.5 5.9 7.2 0.4 Inc/(dec) in loan funds -33.4 -50.0 -30.0 0.0

Other Income 13.7 10.2 17.9 24.6 Dividend paid & dividend tax -58.5 -70.0 -81.7 -93.4

PBT 185.7 223.7 275.9 325.0 Inc/(dec) in Share Cap 0.0 0.0 0.0 0.0

Exceptional Item 0.0 158.4 0.0 0.0 Others -13.5 -6.8 -7.2 -0.4

Total Tax 39.0 94.8 78.9 91.5 CF from financing activities -105.4 -126.8 -118.9 -93.8

PAT 146.7 287.3 197.0 233.4 Net Cash flow 0.5 -0.3 0.8 4.5

Minority Interest 3.7 0.0 0.0 0.0 Opening Cash 7.2 7.7 7.4 8.2

Reported Net Profit 143.0 287.3 197.0 233.4 Closing Cash 7.7 7.4 8.2 12.7

Normalized Net Profit 143.0 170.3 197.0 233.4 Source: Company, ICICIdirect.com Research

Growth (%) -8.2 19.1 15.7 18.5

Normalized EPS (|) 7.4 8.8 10.1 12.0

Source: Company, ICICIdirect.com Research

Balance sheet | Crore Key ratios

(Year-end March) FY16 FY17E FY18E FY19E (Year-end March) FY16 FY17E FY18E FY19E

Liabilities Per share data (|)

Equity Capital 19.5 19.5 19.5 19.5 EPS 7.4 8.8 10.1 12.0

Reserve and Surplus 879.6 1,096.0 1,211.3 1,351.3 Cash EPS 9.6 17.2 12.6 14.6

Total Shareholders funds 899.0 1,115.4 1,230.7 1,370.7 BV 46.2 57.3 63.3 70.5

Total Debt 89.7 39.7 9.7 9.7 DPS 2.5 3.0 3.5 4.0

Deferred Tax Liability 38.8 38.8 38.8 38.8 Cash Per Share (Incl Invst) 0.4 0.4 0.4 0.7

Minority Interest / Others 8.6 8.6 8.6 8.6 Operating Ratios (%)

Total Liabilities 1,036.1 1,202.5 1,287.8 1,427.8 EBITDA Margin 14.1 15.8 16.8 17.3

PBT / Total Op. income 11.4 13.2 14.8 16.0

Assets PAT Margin 8.8 17.0 10.5 11.5

Gross Block 734.2 784.7 814.7 844.7 Inventory days 91.7 90.0 90.0 90.0

Less: Acc Depreciation 316.8 363.5 411.5 461.3 Debtor days 44.5 50.0 55.0 55.0

Net Block 417.4 421.2 403.2 383.4 Creditor days 85.5 85.0 85.0 85.0

Capital WIP 40.5 20.0 20.0 20.0 Return Ratios (%)

Total Fixed Assets 457.9 441.2 423.2 403.4 RoE 15.9 15.1 16.0 17.0

Liquid Investments 9.4 180.0 230.0 365.0 RoCE 20.1 19.9 22.8 23.6

Other Investments 18.7 18.7 18.7 18.7 RoIC 25.8 29.8 34.4 39.0

Goodwill on Consolidation 259.1 259.1 259.1 259.1 Valuation Ratios (x)

Inventory 404.8 410.6 455.2 494.8 P/E 34.7 29.5 25.2 21.2

Debtors 196.6 228.1 278.1 302.4 EV / EBITDA 21.9 18.1 15.1 13.1

Loans and Advances 144.7 133.2 138.4 140.5 EV / Net Sales 3.1 2.9 2.6 2.3

Other Current Assets 5.6 5.0 5.5 6.0 Market Cap / Sales 3.1 3.0 2.7 2.5

Cash 7.7 7.4 8.2 12.7 Price to Book Value 5.5 4.4 4.0 3.6

Total Current Assets 759.5 784.3 885.5 956.4 Solvency Ratios

Creditors 377.3 387.8 429.9 467.3 Debt/EBITDA 0.4 0.1 0.0 0.0

Provisions 91.2 93.1 98.9 107.5 Debt / Equity 0.1 0.0 0.0 0.0

Current Liabilities & Prov 468.6 480.8 528.7 574.8 Current Ratio 1.6 1.6 1.7 1.6

Net Current Assets 291.0 303.5 356.8 381.6 Quick Ratio 0.7 0.8 0.8 0.8

Others Assets 0.0 0.0 0.0 0.0 Source: Company, ICICIdirect.com Research

Application of Funds 1,036.1 1,202.5 1,287.8 1,427.8

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 2

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional

target price is defined as the analysts' valuation for a stock.

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;

Buy: >10%/15% for large caps/midcaps, respectively;

Hold: Up to +/-10%;

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities Ltd | Retail Equity Research Page 3

Disclaimer

ANALYST CERTIFICATION

We /I, Chirag Shah PGDBM, Shashank Kanodia, CFA MBA (Capital Markets), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this

research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific

recommendation(s) or view(s) in this report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities

Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has

its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which

are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking

and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts

and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current.

Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended

temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this

company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment

in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in

respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned

in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any

compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts

and their relatives have any material conflict of interest at the time of publication of this report.

It is confirmed that Chirag Shah PGDBM, Shashank Kanodia, CFA MBA (Capital Markets), Research Analysts of this report have not received any compensation from the companies mentioned in the report

in the preceding twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month

preceding the publication of the research report. ,

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

It is confirmed that Chirag Shah PGDBM, Shashank Kanodia, CFA MBA (Capital Markets). Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment

in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in

respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned

in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its analysts did not receive any compensation

or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts have any

material conflict of interest at the time of publication of this report.

It is confirmed that Chirag Shah PGDBM, Shashank Kanodia, CFA MBA (Capital Markets), Research Analysts of this report have not received any compensation from the companies mentioned in the report

in the preceding twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities Ltd | Retail Equity Research Page 4

You might also like

- Original PDF Financial Management Core Concepts 4th Edition by Raymond Brooks PDFDocument42 pagesOriginal PDF Financial Management Core Concepts 4th Edition by Raymond Brooks PDFmathew.robertson818100% (39)

- Risk, Cost of Capital, and Valuation: Multiple Choice QuestionsDocument34 pagesRisk, Cost of Capital, and Valuation: Multiple Choice QuestionsDũng Hữu0% (1)

- Aladdin Synthetic CDO II, Offering MemorandumDocument216 pagesAladdin Synthetic CDO II, Offering Memorandumthe_akinitiNo ratings yet

- Syllabus CFA Level 2Document2 pagesSyllabus CFA Level 2Phi Anh100% (1)

- Rallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsDocument12 pagesRallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsJatin SoniNo ratings yet

- Cox & Kings (CNKLIM) : Weak Performance Debt Concerns AddressedDocument9 pagesCox & Kings (CNKLIM) : Weak Performance Debt Concerns Addressedsaran21No ratings yet

- Bodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!Document9 pagesBodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!P.B VeeraraghavuluNo ratings yet

- Aarti Industries LTDDocument5 pagesAarti Industries LTDViju K GNo ratings yet

- Jyothy Laboratories LTDDocument5 pagesJyothy Laboratories LTDViju K GNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- IDirect RallisIndia ICDocument35 pagesIDirect RallisIndia ICArun DubeyNo ratings yet

- Marico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthDocument10 pagesMarico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthAshokNo ratings yet

- Aditya Birla Fashion & Retail (ADIFAS) : Shift in Festive Season Spurs PerformanceDocument10 pagesAditya Birla Fashion & Retail (ADIFAS) : Shift in Festive Season Spurs Performance4nagNo ratings yet

- Hikal LTD: Crop Protection Propels Growth But Margins MissDocument10 pagesHikal LTD: Crop Protection Propels Growth But Margins MissRakesh KumarNo ratings yet

- Essel Propack (ESSPRO) : Performance Remains WeakDocument9 pagesEssel Propack (ESSPRO) : Performance Remains WeakVeronika AkheevaNo ratings yet

- 28162192019882apex IC Report PDFDocument9 pages28162192019882apex IC Report PDFAshutosh GuptaNo ratings yet

- Escorts: Expectation of Significant Recovery Due To A Better Monsoon BuyDocument7 pagesEscorts: Expectation of Significant Recovery Due To A Better Monsoon BuynnsriniNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- Somany Ceramics (SOMCER) : Multiple Triggers For Margin RevivalDocument4 pagesSomany Ceramics (SOMCER) : Multiple Triggers For Margin Revivalsaran21No ratings yet

- Ambuja Cement: Volume Push Drives Topline Maintain HOLDDocument9 pagesAmbuja Cement: Volume Push Drives Topline Maintain HOLDanjugaduNo ratings yet

- CMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistDocument5 pagesCMP 69 Rating BUY Target 94 Upside 35%: Key Takeaways: Headwinds PersistVikrant SadanaNo ratings yet

- Music BroadcastDocument12 pagesMusic BroadcastSBNo ratings yet

- Asian Paints 18012024 MotiDocument12 pagesAsian Paints 18012024 Motigaurav24021990No ratings yet

- Cipla - 2QFY19 Results - ICICI DirectDocument13 pagesCipla - 2QFY19 Results - ICICI DirectSheldon RodriguesNo ratings yet

- Agri Inputs: Sector Valuations Price in A Good SeasonDocument12 pagesAgri Inputs: Sector Valuations Price in A Good SeasonPrahladNo ratings yet

- Atul LTD Buy Report IIFLDocument6 pagesAtul LTD Buy Report IIFLBhaveek OstwalNo ratings yet

- Vinati Organics LTD: Growth To Pick-Up..Document5 pagesVinati Organics LTD: Growth To Pick-Up..Bhaveek OstwalNo ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- Asian Paints - Q4FY20 Result Update - 25062020 - 25-06-2020 - 17Document7 pagesAsian Paints - Q4FY20 Result Update - 25062020 - 25-06-2020 - 17tanmayamohanNo ratings yet

- Astral Poly Technik (ASTPOL) : Strong Play in Piping SegmentDocument4 pagesAstral Poly Technik (ASTPOL) : Strong Play in Piping SegmentADNo ratings yet

- Page Industries (PAGIND) : Consistency in Volume Growth Remains CrucialDocument12 pagesPage Industries (PAGIND) : Consistency in Volume Growth Remains CrucialRahul DhawanNo ratings yet

- IDirect Biocon Q3FY17Document16 pagesIDirect Biocon Q3FY17Jagadish TangiralaNo ratings yet

- Princpip 11 8 23 PLDocument6 pagesPrincpip 11 8 23 PLAnubhi Garg374No ratings yet

- KSB Pumps (KSBPUM) : Resounding Topline Growth Instils ConfidenceDocument11 pagesKSB Pumps (KSBPUM) : Resounding Topline Growth Instils Confidencedarshanmade100% (1)

- IDirect Lupin Q3FY17Document16 pagesIDirect Lupin Q3FY17dipshi92No ratings yet

- Navneet Education (NAVEDU) : Syllabus Change Drives Revenue GrowthDocument9 pagesNavneet Education (NAVEDU) : Syllabus Change Drives Revenue GrowthAshokNo ratings yet

- Ojit 240619Document5 pagesOjit 240619Gaurav kumarNo ratings yet

- Reliance Capital (RELCAP) : Businesses Growing, Return Ratios ImprovingDocument15 pagesReliance Capital (RELCAP) : Businesses Growing, Return Ratios Improvingratan203No ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- Indian Oil Corporation: Interesting Times AheadDocument9 pagesIndian Oil Corporation: Interesting Times AheadNeelesh KumarNo ratings yet

- Company Report - IMPACT - E - 20180219081453Document8 pagesCompany Report - IMPACT - E - 20180219081453bodaiNo ratings yet

- Deepak Nitrite - EdelDocument24 pagesDeepak Nitrite - EdelarhagarNo ratings yet

- Meghmani Organics Limited Corporate Presentation FY2021Document27 pagesMeghmani Organics Limited Corporate Presentation FY2021Rohit KNo ratings yet

- UltratechCement Edel 190118Document15 pagesUltratechCement Edel 190118suprabhattNo ratings yet

- Asian Paints: Volume Led Growth ContinuesDocument9 pagesAsian Paints: Volume Led Growth ContinuesanjugaduNo ratings yet

- Motilal Oswal Sees 15% UPSIDE in CEAT Earnings Below Estimate DueDocument12 pagesMotilal Oswal Sees 15% UPSIDE in CEAT Earnings Below Estimate DueSiddharthNo ratings yet

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDocument13 pagesZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokNo ratings yet

- Indofood CBP: Navigating WellDocument11 pagesIndofood CBP: Navigating WellAbimanyu LearingNo ratings yet

- Icici Sec Berger PaintsDocument6 pagesIcici Sec Berger PaintsvenugopallNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Greenply Industries Dec17Document13 pagesGreenply Industries Dec17narayanan_rNo ratings yet

- JK Cement: Valuations Factor in Positive Downgrade To HOLDDocument9 pagesJK Cement: Valuations Factor in Positive Downgrade To HOLDShubham BawkarNo ratings yet

- AIA Engineering LTD: Q3FY18 Result UpdateDocument6 pagesAIA Engineering LTD: Q3FY18 Result Updatesaran21No ratings yet

- Dabur India: Strong Domestic Volume Growth Lifts RevenuesDocument9 pagesDabur India: Strong Domestic Volume Growth Lifts RevenuesRaghavendra Pratap SinghNo ratings yet

- PI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13Document8 pagesPI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13SandeepNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Gulf Oil Lubricants: Stable Performance..Document8 pagesGulf Oil Lubricants: Stable Performance..Doshi VaibhavNo ratings yet

- HDFC Sec Report On Vinati OrganicsDocument21 pagesHDFC Sec Report On Vinati Organicssujay85No ratings yet

- AIA Engineering - Q4FY22 Result Update - 30 May 2022Document7 pagesAIA Engineering - Q4FY22 Result Update - 30 May 2022PavanNo ratings yet

- Coromandel Report - MotilalDocument12 pagesCoromandel Report - MotilalAkshaya SrihariNo ratings yet

- ABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementDocument4 pagesABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementShanti RanganNo ratings yet

- Aarti Industries: All Round Growth ImminentDocument13 pagesAarti Industries: All Round Growth ImminentPratik ChhedaNo ratings yet

- Promoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesFrom EverandPromoting Agrifood Sector Transformation in Bangladesh: Policy and Investment PrioritiesNo ratings yet

- Sharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khanDocument9 pagesSharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khansaran21No ratings yet

- APL Apollo Tubes 01 01 2023 KhanDocument7 pagesAPL Apollo Tubes 01 01 2023 Khansaran21No ratings yet

- Titan Company 01 01 2023 KhanDocument8 pagesTitan Company 01 01 2023 Khansaran21No ratings yet

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Document22 pagesIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21No ratings yet

- HDFC 01 01 2023 KhanDocument7 pagesHDFC 01 01 2023 Khansaran21No ratings yet

- Britannia Industries 01 01 2023 KhanDocument7 pagesBritannia Industries 01 01 2023 Khansaran21No ratings yet

- Daily Currency Outlook: September 11, 2019Document7 pagesDaily Currency Outlook: September 11, 2019saran21No ratings yet

- Sharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khanDocument10 pagesSharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khansaran21No ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Dolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatDocument22 pagesDolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatsaran21No ratings yet

- Housing Development Finance Corporation 27082019Document6 pagesHousing Development Finance Corporation 27082019saran21No ratings yet

- KEC International 01 01 2023 PrabhuDocument7 pagesKEC International 01 01 2023 Prabhusaran21No ratings yet

- Fundamental Outlook Market Highlights: Indian RupeeDocument2 pagesFundamental Outlook Market Highlights: Indian Rupeesaran21No ratings yet

- South Indian Bank (SIB IN) : Q3FY19 Result UpdateDocument10 pagesSouth Indian Bank (SIB IN) : Q3FY19 Result Updatesaran21No ratings yet

- Dabur India (DABUR IN) : Analyst Meet UpdateDocument12 pagesDabur India (DABUR IN) : Analyst Meet Updatesaran21No ratings yet

- Somany Ceramics (SOMCER) : Multiple Triggers For Margin RevivalDocument4 pagesSomany Ceramics (SOMCER) : Multiple Triggers For Margin Revivalsaran21No ratings yet

- Confidence Petroleum India 020119Document17 pagesConfidence Petroleum India 020119saran21No ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- JK Lakshmi Cement 18062019Document6 pagesJK Lakshmi Cement 18062019saran21No ratings yet

- Ahluwalia Contracts: Industry OverviewDocument20 pagesAhluwalia Contracts: Industry Overviewsaran21No ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocument8 pagesTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21No ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- ODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps EuropeDocument4 pagesODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps Europesaran21No ratings yet

- Federal Bank LTD: Q3FY19 Result UpdateDocument4 pagesFederal Bank LTD: Q3FY19 Result Updatesaran21No ratings yet

- Coal India: CMP: INR234 Sputtering Production Growth Impacting VolumesDocument10 pagesCoal India: CMP: INR234 Sputtering Production Growth Impacting Volumessaran21No ratings yet

- Stock Update: Icici BankDocument3 pagesStock Update: Icici Banksaran21No ratings yet

- IME Echnoplast TD: P R - 100 T R .128 BUYDocument9 pagesIME Echnoplast TD: P R - 100 T R .128 BUYsaran21No ratings yet

- JK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000Document9 pagesJK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000saran21No ratings yet

- Bank of Baroda (BOB) BUY: Retail Equity ResearchDocument5 pagesBank of Baroda (BOB) BUY: Retail Equity Researchsaran21No ratings yet

- Factors Affecting The Location of IndustriesDocument10 pagesFactors Affecting The Location of Industriessumedha bhartiNo ratings yet

- 2024 l1 Topics CombinedDocument27 pages2024 l1 Topics CombinedShaitan LadkaNo ratings yet

- Commodity Futures Prices: Some Evidence On Forecast Power, Premiums, and The Theory of StorageDocument24 pagesCommodity Futures Prices: Some Evidence On Forecast Power, Premiums, and The Theory of StorageLuis FernandoNo ratings yet

- Corporation NotesDocument5 pagesCorporation NotesPrestine Faith SalinasNo ratings yet

- Essentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test BankDocument28 pagesEssentials of Entrepreneurship and Small Business Management 7th Edition Scarborough Test Bankdipolarramenta7uyxw100% (24)

- Principles of Microeconomics - IDocument2 pagesPrinciples of Microeconomics - IRajni KumariNo ratings yet

- Economics Assignment 1Document3 pagesEconomics Assignment 1GbengaNo ratings yet

- Chart of Accounts For BanksDocument26 pagesChart of Accounts For BankscahyoNo ratings yet

- Globalization and Its ImpactDocument18 pagesGlobalization and Its ImpactSurya Prakash Singh100% (1)

- FINE 342 SummaryDocument17 pagesFINE 342 SummaryJohn ThompsonNo ratings yet

- Comparative Analysis of Commercial Paper and Certificate of DepositsDocument16 pagesComparative Analysis of Commercial Paper and Certificate of DepositsRiddhi Mehta100% (2)

- Entrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaDocument24 pagesEntrepreneurship: Mr. Ibrahim Mohamed Ali Bba, Mba (HRM) Human Resource Director Hormuud University Mogadishu-SomaliaAbduahi asadNo ratings yet

- E-Commerce: Mechanisms, Infrastructures, and ToolsDocument38 pagesE-Commerce: Mechanisms, Infrastructures, and ToolshulahopNo ratings yet

- Quiz Two IntaccDocument11 pagesQuiz Two IntaccUNKNOWNNNo ratings yet

- Export Documentation (MBA)Document296 pagesExport Documentation (MBA)HarshitSinhaNo ratings yet

- Session 11 and 12 - Accounting For DepreciationDocument57 pagesSession 11 and 12 - Accounting For DepreciationKashish Manish JariwalaNo ratings yet

- PSSC Economics QPDocument43 pagesPSSC Economics QPAndrew ArahaNo ratings yet

- Multi-Act MSSP PMSDocument39 pagesMulti-Act MSSP PMSAnkurNo ratings yet

- Average Cost MethodDocument3 pagesAverage Cost MethodRaja MonemNo ratings yet

- CaseDocument27 pagesCasearuba ansariNo ratings yet

- Hyperion Lite PaperDocument13 pagesHyperion Lite PaperajdCruiseNo ratings yet

- Waris Raees (905) Hassan Sardaar (973) Project MarketingDocument19 pagesWaris Raees (905) Hassan Sardaar (973) Project Marketingafia malikNo ratings yet

- FJFJFJFJDocument12 pagesFJFJFJFJnuravcool76No ratings yet

- CHAPTER 12 Maintain Inventory Records: Examining and Working Through Different Methods of Accounting For InventoriesDocument18 pagesCHAPTER 12 Maintain Inventory Records: Examining and Working Through Different Methods of Accounting For InventoriesCJNo ratings yet

- Brand Positioning of Deodorant Brands in IndiaDocument8 pagesBrand Positioning of Deodorant Brands in IndiaAlisha JainNo ratings yet