Professional Documents

Culture Documents

ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - Bloomberg

ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - Bloomberg

Uploaded by

Immanuel Billie AllenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - Bloomberg

ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - Bloomberg

Uploaded by

Immanuel Billie AllenCopyright:

Available Formats

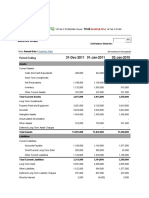

INDUSTRIALS SECTOR » CONSTRUCTION & ENGINEERING INDUSTRY » ROADS

Roads Nigeria Plc (ROADS:Lagos)

ROADS On Other Exchanges

Snapshot News Charts Financials Earnings People Transactions

Financial Statements Ratios Pensions & Options SEC Filings

Financial Statements For Roads Nigeria Plc (ROADS)

Although debt as a percent of total capital increased at Roads Nigeria Plc over the last fiscal year to 25.94%,

it is still in-line with the Construction and Engineering industry's norm. However, there are not enough liquid

assets to satisfy current obligations. Cash Collection is a strong suit as the company is more effective than

most in the industry. As of the end of 2015, its uncollected receivables totaled 1.9B NGN, which, at the current

sales rate provides a Days Receivables Outstanding of 355.44. Last, inventories seem to be well managed as

the Inventory Processing Period is typical for the industry, at 42.16 days.

Annual Income Statement Balance Sheet Cash Flow

Mar 31 Mar 31 Mar 31 Mar 31 4 Year

Currency in 2012 2013 2014 2015 Trend

As of: Press NGN Reclassified NGN

Millions of Nigerian Nairas Release NGN

NGN

Assets

Cash And Equivalents -- 183.6 128.6 12.2

TOTAL CASH AND SHORT TERM INVESTMENTS -- 183.6 128.6 12.2

Accounts Receivable -- 1,010.6 1,764.6 1,932.5

Other Receivables -- 20.0 20.0 14.5

TOTAL RECEIVABLES -- 1,030.7 1,784.6 1,947.0

Inventory -- 256.8 227.6 223.8

Other Current Assets -- 120.8 106.6 3.7

TOTAL CURRENT ASSETS -- 1,591.9 2,247.4 2,186.7

Gross Property Plant And Equipment -- 1,919.8 1,931.1 1,931.9

Accumulated Depreciation -- -1,278.5 -1,392.9 -1,503.1

NET PROPERTY PLANT AND EQUIPMENT -- 641.4 538.2 428.8

Long-Term Investments -- -- 130.0 130.0

Deferred Tax Assets, Long Term -- 225.7 246.3 312.5

Other Long-Term Assets -- 508.5 427.6 460.0

TOTAL ASSETS -- 2,967.4 3,589.4 3,518.0

LIABILITIES & EQUITY

Accounts Payable -- 126.9 245.1 219.2

Accrued Expenses -- 968.1 1,172.5 1,483.9

Short-Term Borrowings -- -- 107.6 --

Current Portion Of Long-Term Debt/Capital Lease -- -- -- 82.6

Current Income Taxes Payable -- 182.4 132.5 30.2

Other Current Liabilities, Total -- 119.7 71.0 88.2

Unearned Revenue, Current -- 998.9 1,184.4 1,179.2

TOTAL CURRENT LIABILITIES -- 2,396.0 2,913.1 3,083.3

Long-Term Debt -- -- -- 19.1

Deferred Tax Liability Non-Current -- 184.6 158.4 125.3

TOTAL LIABILITIES -- 2,580.6 3,071.5 3,227.7

Common Stock -- 10.0 10.0 10.0

Retained Earnings -- 376.8 501.8 268.2

Comprehensive Income And Other -- -- 6.1 12.1

TOTAL COMMON EQUITY -- 386.8 517.9 290.3

TOTAL EQUITY -- 386.8 517.9 290.3

TOTAL LIABILITIES AND EQUITY -- 2,967.4 3,589.4 3,518.0

Request Profile Update

From Around the Web Sponsored Links by Taboola

California Homeowners Born Before 1985 Get A Big Pay Day

Improve Mortgage Quotes

CES Vendors: Reduce Costs - Outsource Accounts Receivable

CIT Bank

Everyone is Getting Walk-in Tubs in 2017 - See Why

Walk-In Bathtub Quotes

2018 Lasik Costs Have Arrived, And They Might Surprise You

Lasik | Sponsored Links

Single in Mountain View? See Who’s on Match

Match.com

We Tried HelloFresh: Here's What Happened

Popdust for HelloFresh

You might also like

- 12e Ch3 Mini Case MaterialityDocument9 pages12e Ch3 Mini Case MaterialityDom Gravero100% (1)

- Accounting For Non Specialists Australian 7th Edition Atrill Test BankDocument26 pagesAccounting For Non Specialists Australian 7th Edition Atrill Test BankJessicaMitchelleokj100% (53)

- Management Accounts For The Year 2022Document6 pagesManagement Accounts For The Year 2022Clyton MusipaNo ratings yet

- Genmo CorporationDocument12 pagesGenmo CorporationAarushi Pawar100% (1)

- Chapter 14Document31 pagesChapter 14MARY JUSTINE PAQUIBOT100% (1)

- Pidilite IndustriesDocument5 pagesPidilite IndustriesPrena JoshiNo ratings yet

- Max Healthcare Institute Limited BSE 539981 Financials Balance SheetDocument3 pagesMax Healthcare Institute Limited BSE 539981 Financials Balance Sheetakumar4uNo ratings yet

- Waste Wizard Table AppendeciesDocument4 pagesWaste Wizard Table AppendeciesRahul SethiNo ratings yet

- Liquidity Ratios: Profitability RatiosDocument4 pagesLiquidity Ratios: Profitability RatioslobnadiaaNo ratings yet

- Balance Sheet of NLC IndiaDocument8 pagesBalance Sheet of NLC IndiaSweety RoyNo ratings yet

- Assignment On Ratio Analysis of Tata Motors For 2007 and 2008Document8 pagesAssignment On Ratio Analysis of Tata Motors For 2007 and 2008Chetan AgrawalNo ratings yet

- Course Activity 1: Comparison Of: YearsDocument6 pagesCourse Activity 1: Comparison Of: YearsNae InsaengNo ratings yet

- Slides Week 8 No AnswerDocument38 pagesSlides Week 8 No Answerchingwen731No ratings yet

- BEMLDocument7 pagesBEMLdurgesh varunNo ratings yet

- Magellan Financial Group Limited 2018 AGM Presentation: Brett Cairns - Executive ChairmanDocument8 pagesMagellan Financial Group Limited 2018 AGM Presentation: Brett Cairns - Executive Chairmanfrenz17No ratings yet

- Final Project Financial ManagementDocument10 pagesFinal Project Financial ManagementMaryam SaeedNo ratings yet

- Ratio Analysis of TATA MOTORSDocument8 pagesRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements3 - BloombergDocument1 pageROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements3 - BloombergImmanuel Billie AllenNo ratings yet

- Income Statement: Khybey Tobacco Company LTDDocument15 pagesIncome Statement: Khybey Tobacco Company LTDMuzamil Ur rehmanNo ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- Financial Analysis For NIKEDocument12 pagesFinancial Analysis For NIKEAnny Cloveries GabayanNo ratings yet

- Accounts AssignDocument9 pagesAccounts AssigngauravdangeNo ratings yet

- Nissan Motor Co LTDDocument11 pagesNissan Motor Co LTDShamsa AkbarNo ratings yet

- Netflix Inc.: Balance SheetDocument16 pagesNetflix Inc.: Balance SheetLorena JaupiNo ratings yet

- Chapter-2-3 2Document41 pagesChapter-2-3 2xfmf5bk5wfNo ratings yet

- Maruti Vs Tata - EXCELDocument15 pagesMaruti Vs Tata - EXCELParth MalikNo ratings yet

- Particulars 2014 2015 2016 2017: Balance Sheet of Whirlpool India Ltd. (Absolute Value)Document100 pagesParticulars 2014 2015 2016 2017: Balance Sheet of Whirlpool India Ltd. (Absolute Value)Nishant SharmaNo ratings yet

- AIS Final ReqDocument10 pagesAIS Final ReqSucreNo ratings yet

- Sample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementDocument7 pagesSample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementsanjusarkarNo ratings yet

- HBL GROUP 6 Strategic Finance ReportDocument11 pagesHBL GROUP 6 Strategic Finance ReportFaizan JavedNo ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- WCM Hind Zinc and CopperDocument23 pagesWCM Hind Zinc and CopperPrajwal nayakNo ratings yet

- Spring 2009 NBA 5060 Lectures 9 - Pro Forma Financial Statements & Forecasting IIDocument10 pagesSpring 2009 NBA 5060 Lectures 9 - Pro Forma Financial Statements & Forecasting IIbat0oNo ratings yet

- Financial Position of The STCDocument13 pagesFinancial Position of The STCSalwa AlbalawiNo ratings yet

- Suzuki Motors (AutoRecovered)Document8 pagesSuzuki Motors (AutoRecovered)AIOU Fast AcademyNo ratings yet

- Financial Statements For The Financial Year 2022Document6 pagesFinancial Statements For The Financial Year 2022Clyton MusipaNo ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- Nike Balance SheetDocument2 pagesNike Balance SheetDukeIClub100% (1)

- Statement August 31 2020Document30 pagesStatement August 31 2020NicolasNo ratings yet

- Ceylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021Document14 pagesCeylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021hvalolaNo ratings yet

- Roll No-010,011,012,013 (Group No 3)Document7 pagesRoll No-010,011,012,013 (Group No 3)Ayush SatyamNo ratings yet

- Gradable Assignments 1 & 2Document5 pagesGradable Assignments 1 & 2Sameer Ramachandra KasargodNo ratings yet

- Financial Statement Analysis Report of For The Years 2017 & 2018Document15 pagesFinancial Statement Analysis Report of For The Years 2017 & 2018Lawrence Joshua ManzoNo ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- ABC Cement FM (Final)Document24 pagesABC Cement FM (Final)Muhammad Ismail (Father Name:Abdul Rahman)No ratings yet

- Avenue Supermarts - Template With Past DataDocument12 pagesAvenue Supermarts - Template With Past DataNJ NagarajNo ratings yet

- Fortis Healthcare: Previous YearsDocument20 pagesFortis Healthcare: Previous YearsShuBham KanswalNo ratings yet

- Inbamfi Equity CaseDocument19 pagesInbamfi Equity CaseBinsentcaragNo ratings yet

- GRP Balance Sheet Structure Merck Ar23Document1 pageGRP Balance Sheet Structure Merck Ar23HA NGUYEN THUYNo ratings yet

- ValuationDocument31 pagesValuationAman TaterNo ratings yet

- Coca-Cola and Pepsi Economic Analysis ReportDocument39 pagesCoca-Cola and Pepsi Economic Analysis ReportJing Xiong67% (3)

- Ey Aarsrapport 2021 22 15Document1 pageEy Aarsrapport 2021 22 15Ronald RunruilNo ratings yet

- Tarea Semana 3 Excel FBDocument14 pagesTarea Semana 3 Excel FBNoely EspinalNo ratings yet

- Financial Statements ConsolidatedDocument14 pagesFinancial Statements ConsolidatedAnkitNo ratings yet

- MBA5002 Sample Case Study 2Document13 pagesMBA5002 Sample Case Study 2Mohamed NaieemNo ratings yet

- Traveller Balance SheetDocument4 pagesTraveller Balance SheetMathi Mahi JayanthNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance SheetDocument3 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance Sheetakumar4uNo ratings yet

- BUSI 2505 Assignment 1Document8 pagesBUSI 2505 Assignment 1Mona GreenNo ratings yet

- Britannia X Ls XDocument15 pagesBritannia X Ls Xshubham9308No ratings yet

- Reliance Industries LTD.: Balance SheetDocument10 pagesReliance Industries LTD.: Balance SheetAayush PeriwalNo ratings yet

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- Through:: Mr. Kingsley EbitoDocument1 pageThrough:: Mr. Kingsley EbitoImmanuel Billie AllenNo ratings yet

- Chapter FourDocument18 pagesChapter FourImmanuel Billie AllenNo ratings yet

- Udoh, Emmanuel Billy: Personal StatementsDocument3 pagesUdoh, Emmanuel Billy: Personal StatementsImmanuel Billie AllenNo ratings yet

- Umanahs ProjectDocument10 pagesUmanahs ProjectImmanuel Billie AllenNo ratings yet

- Verb Artistry: Pro Forma InvoiceDocument4 pagesVerb Artistry: Pro Forma InvoiceImmanuel Billie AllenNo ratings yet

- BNF GloryDocument10 pagesBNF GloryImmanuel Billie AllenNo ratings yet

- Agba, P. C.Document1 pageAgba, P. C.Immanuel Billie AllenNo ratings yet

- Chapter One: Globalization and Trade Liberalization HaveDocument7 pagesChapter One: Globalization and Trade Liberalization HaveImmanuel Billie AllenNo ratings yet

- ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements3 - BloombergDocument1 pageROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements3 - BloombergImmanuel Billie AllenNo ratings yet

- JanetDocument3 pagesJanetImmanuel Billie AllenNo ratings yet

- Balance Sheet Annual of Jollibee Food CorporationDocument2 pagesBalance Sheet Annual of Jollibee Food CorporationJan Harvey Rivera BalingaoNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- Informa??es de Companhias em Recupera??o Judicial Ou ExtrajudicialDocument35 pagesInforma??es de Companhias em Recupera??o Judicial Ou ExtrajudicialMPXE_RINo ratings yet

- AMG - Auplata Mining Group Perú S.A.C. 31.12.2020 (Inglés)Document58 pagesAMG - Auplata Mining Group Perú S.A.C. 31.12.2020 (Inglés)dianacarolinapcNo ratings yet

- The Expenditure Cycle: Payroll Processing and Fixed Asset ProceduresDocument19 pagesThe Expenditure Cycle: Payroll Processing and Fixed Asset ProceduresHassanNo ratings yet

- Worksheet 02a Balance SheetDocument3 pagesWorksheet 02a Balance SheetryanNo ratings yet

- Ap 12345Document29 pagesAp 12345Diane RoallosNo ratings yet

- Round: 6 Dec. 31, 2027: Selected Financial StatisticsDocument15 pagesRound: 6 Dec. 31, 2027: Selected Financial StatisticsVrajesh IyengarNo ratings yet

- Practice Cases For Chapter 12 Case 1Document3 pagesPractice Cases For Chapter 12 Case 1Lê Minh TríNo ratings yet

- Ratio Analysis - SlidesDocument53 pagesRatio Analysis - SlidesLysss EpssssNo ratings yet

- Balaji Telefilms LTD: Key Financial IndicatorsDocument4 pagesBalaji Telefilms LTD: Key Financial IndicatorsGagandeep KaurNo ratings yet

- Financial Management & Int Finance Study Text P-12Document744 pagesFinancial Management & Int Finance Study Text P-12Saleem Ahmed100% (4)

- Draft Racm Cupipl - FaDocument56 pagesDraft Racm Cupipl - FaPrateekNo ratings yet

- MBA Finance Interview Questions and Answers 995Document9 pagesMBA Finance Interview Questions and Answers 995Shriya SurekaNo ratings yet

- Cape Accounting Unit 1 NotesDocument27 pagesCape Accounting Unit 1 NotesDajueNo ratings yet

- New Era University: College of AccountancyDocument3 pagesNew Era University: College of AccountancyJoan LaroyaNo ratings yet

- Financial Reporting ConceptsDocument240 pagesFinancial Reporting ConceptsDeepsikha maitiNo ratings yet

- College Accounting 14th Edition Price Solutions ManualDocument26 pagesCollege Accounting 14th Edition Price Solutions Manualniblicktartar.nevn3100% (31)

- CFAS - Theory Review QuestionsDocument12 pagesCFAS - Theory Review QuestionsRi ChardNo ratings yet

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikNo ratings yet

- Investment PropertyDocument19 pagesInvestment PropertyXyrille ReyesNo ratings yet

- Co 1815Document4 pagesCo 1815Josh JosephNo ratings yet

- Profitability AnalysisDocument18 pagesProfitability AnalysisRahul VichareNo ratings yet

- Preliminary Examination - ACTG21cDocument9 pagesPreliminary Examination - ACTG21cJuanito TanamorNo ratings yet

- 02 Long-Lived Assets - Implications For Financial Statements and RatiosDocument30 pages02 Long-Lived Assets - Implications For Financial Statements and RatiosIan ChanNo ratings yet

- Summary of IFRS 3Document14 pagesSummary of IFRS 3bobo kaNo ratings yet