Professional Documents

Culture Documents

Maynard Company

Maynard Company

Uploaded by

Archin PadiaCopyright:

Available Formats

You might also like

- Maynard Company (A) : EXHIBIT 1 Account BalancesDocument2 pagesMaynard Company (A) : EXHIBIT 1 Account Balancesriya lakhotiaNo ratings yet

- CASE 4-1 PC DepotDocument7 pagesCASE 4-1 PC Depotkimhyunna75% (4)

- CASE 6-1 - Browning Manufacturing Company - 2Document7 pagesCASE 6-1 - Browning Manufacturing Company - 2Weng Torres AllonNo ratings yet

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Accounting:Text and Cases 2-1 & 2-3Document3 pagesAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- GROUP ASSIGNMENT (Chapter 3, Case 3-62)Document6 pagesGROUP ASSIGNMENT (Chapter 3, Case 3-62)T Yoges Thiru MoorthyNo ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Grennell Farm SolutionDocument6 pagesGrennell Farm SolutionMichael TorresNo ratings yet

- Genmo CorporationDocument12 pagesGenmo CorporationAarushi Pawar100% (1)

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- CASE 6-1 - Browning Manufacturing CompanyDocument4 pagesCASE 6-1 - Browning Manufacturing CompanyWeng Torres AllonNo ratings yet

- Date Details of Transaction Capital Acc. Payable Notes PayableDocument3 pagesDate Details of Transaction Capital Acc. Payable Notes PayablerudypatilNo ratings yet

- 6 - Browning MFTG Company Case SolutionDocument12 pages6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- Save Mart and Copies Express CaseDocument7 pagesSave Mart and Copies Express CaseanushaNo ratings yet

- Browning Manufacturing CaseDocument6 pagesBrowning Manufacturing CaseChleo EsperaNo ratings yet

- Maynard Solutions Ch04Document17 pagesMaynard Solutions Ch04Anton VitaliNo ratings yet

- Chemalite Inc - Assignment - AccountingDocument2 pagesChemalite Inc - Assignment - Accountingthi_aar100% (1)

- ACCOUNTING STERN CORPORATION (A) AnswerDocument4 pagesACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNo ratings yet

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Document33 pagesChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNo ratings yet

- QED Electronics - Problem 3.7Document1 pageQED Electronics - Problem 3.7ivanyongforexNo ratings yet

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- Browning Manufactur Company C6-1Document18 pagesBrowning Manufactur Company C6-1Faizal Pradhana100% (1)

- PC DepotDocument2 pagesPC DepotJohn Carlos WeeNo ratings yet

- Case Analysis 3 1 Maynard BusinessDocument6 pagesCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZNo ratings yet

- Medieval Case SolutionDocument7 pagesMedieval Case SolutionTarry BerryNo ratings yet

- Case 6-1 BrowningDocument7 pagesCase 6-1 BrowningPatrick HariramaniNo ratings yet

- Maynard CompanyDocument5 pagesMaynard CompanySantosh GovindarajanNo ratings yet

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDocument3 pagesV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNo ratings yet

- PC Depot (Accounting)Document4 pagesPC Depot (Accounting)Ange Buenaventura Salazar100% (2)

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Case 6 1Document10 pagesCase 6 1cashmerehitNo ratings yet

- Chapter 7-1 SternDocument7 pagesChapter 7-1 SternPatrick HariramaniNo ratings yet

- Case 2-3 Lone Pine Café (A)Document15 pagesCase 2-3 Lone Pine Café (A)Cynthia Anggi Maulina100% (1)

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- PC Depot Trial Balance - Hezekiah PardedeDocument5 pagesPC Depot Trial Balance - Hezekiah PardedeHezekiah PardedeNo ratings yet

- Pine Tree Motel Case 3-4: Answer To Q1Document2 pagesPine Tree Motel Case 3-4: Answer To Q1Om PrakashNo ratings yet

- Tugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDocument10 pagesTugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDenssNo ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Case 8-1 Norman Corp, Patrick AnalysisDocument2 pagesCase 8-1 Norman Corp, Patrick AnalysisPatrick HariramaniNo ratings yet

- Joan Holtz Case SolutionsDocument5 pagesJoan Holtz Case SolutionsRahul KaulNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case 5-3Document2 pagesCase 5-3ragil1988No ratings yet

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Assignment Iii Mansa Building Case Study: Submitted by Group IVDocument14 pagesAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniNo ratings yet

- Group 1-Java SourceDocument5 pagesGroup 1-Java SourceLorena Mae LasquiteNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazNo ratings yet

- Leadership - Peter BrowningDocument2 pagesLeadership - Peter BrowningMohammad Fidi Abganis HermawanNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Case 4-4 Octane SS - PurwaningrumDocument5 pagesCase 4-4 Octane SS - PurwaningrumPurwaningrum Gunantoko50% (4)

- Case 4-1 PC DepotDocument5 pagesCase 4-1 PC Depotamitsemt67% (3)

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersamsa100% (1)

- Final Trial Exam k6 Sbs Final PaDocument32 pagesFinal Trial Exam k6 Sbs Final PaChi PhanNo ratings yet

- Accounting Test 00001Document4 pagesAccounting Test 00001Nanya BisnestNo ratings yet

- EOC Ross 7th Edition Case SolutionsDocument6 pagesEOC Ross 7th Edition Case SolutionsKhan Abdullah0% (1)

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newRahasia RommelNo ratings yet

- Fsa Questions FBNDocument34 pagesFsa Questions FBNsprykizyNo ratings yet

- 1 RMFDDocument27 pages1 RMFDArchin PadiaNo ratings yet

- Financial DerivativesDocument36 pagesFinancial DerivativesArchin PadiaNo ratings yet

- SMKT Shouldice HospitalDocument37 pagesSMKT Shouldice HospitalArchin PadiaNo ratings yet

- Parle Industrial ReportDocument12 pagesParle Industrial ReportArchin PadiaNo ratings yet

Maynard Company

Maynard Company

Uploaded by

Archin PadiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maynard Company

Maynard Company

Uploaded by

Archin PadiaCopyright:

Available Formats

Maynard Company

Synopsis of the case:-

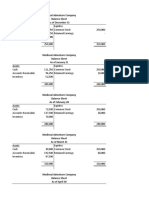

Ans.1- Findings by comparing the balance sheet of the end of June with start of June:-

i).No investment on Building and Capital was made in the month of June.

ii). Heavy investment of $23,400 on equipment, which increased the production and

thereby increased the sales.

iii). The A/c payables increased by $12,798, which means the company has purchased more

goods on credit which increases the cost for the company, instead they could have used the

surplus cash available of $66,660.

iv). Return on Investment= Net Income/ Capital Employed

which is= 19,635/3,90,000 = 5.03%

which signifies a very low rate of return.

v).Changes in assets and Liabilities:-

Assets Increased:- Cash, Equipment & Accounts Receivable.

Assets Decreased:- Inventory & Prepaid Insurance.

Liabilities Increased:- Accounts Payable, Accrued Wages, Bank Notes, Retained Earnings

and Tax Payable.

Conclusion:- By analysing the balance sheet we can conclude that there was a significant

increase in the cash balance, but it also raised the current liabilities, which is not good for a

company because the cost of borrowings will affect the profit of the company in the future.

Ans 2. There was an increase of only $7935 in retained earnings, although the profit

increased by $19,635, this happened because from the net income $11,700 was paid as the

dividend to Diane Maynard.

Ans3. Amount in shareholder`s equity = Share Capital + Retained earnings.

= $3,90,000 + $2,29,446 = $6,19,446

The total shareholders fund amounts to $6,19,446, but apart from this the company

has certain other liabilities which are to be paid off, the shareholders fund by the

end of June is worth $6,19,446.

Ans4. The change in cash balance was greater than net income because a). Various non cash

expenses like depreciation is there, we follow accrual concept and expenditure on capital

asset does not have effect on net income.

Ans5. Cost of Sales:- Opening Stock+ Purchases- Closing Stock

= 29835+14715+8517+12798-26520= 39345

It would have been 14715 if there was no opening stock and closing stock left.

You might also like

- Maynard Company (A) : EXHIBIT 1 Account BalancesDocument2 pagesMaynard Company (A) : EXHIBIT 1 Account Balancesriya lakhotiaNo ratings yet

- CASE 4-1 PC DepotDocument7 pagesCASE 4-1 PC Depotkimhyunna75% (4)

- CASE 6-1 - Browning Manufacturing Company - 2Document7 pagesCASE 6-1 - Browning Manufacturing Company - 2Weng Torres AllonNo ratings yet

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Accounting:Text and Cases 2-1 & 2-3Document3 pagesAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- GROUP ASSIGNMENT (Chapter 3, Case 3-62)Document6 pagesGROUP ASSIGNMENT (Chapter 3, Case 3-62)T Yoges Thiru MoorthyNo ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Grennell Farm SolutionDocument6 pagesGrennell Farm SolutionMichael TorresNo ratings yet

- Genmo CorporationDocument12 pagesGenmo CorporationAarushi Pawar100% (1)

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- CASE 6-1 - Browning Manufacturing CompanyDocument4 pagesCASE 6-1 - Browning Manufacturing CompanyWeng Torres AllonNo ratings yet

- Date Details of Transaction Capital Acc. Payable Notes PayableDocument3 pagesDate Details of Transaction Capital Acc. Payable Notes PayablerudypatilNo ratings yet

- 6 - Browning MFTG Company Case SolutionDocument12 pages6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- Save Mart and Copies Express CaseDocument7 pagesSave Mart and Copies Express CaseanushaNo ratings yet

- Browning Manufacturing CaseDocument6 pagesBrowning Manufacturing CaseChleo EsperaNo ratings yet

- Maynard Solutions Ch04Document17 pagesMaynard Solutions Ch04Anton VitaliNo ratings yet

- Chemalite Inc - Assignment - AccountingDocument2 pagesChemalite Inc - Assignment - Accountingthi_aar100% (1)

- ACCOUNTING STERN CORPORATION (A) AnswerDocument4 pagesACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNo ratings yet

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Document33 pagesChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNo ratings yet

- QED Electronics - Problem 3.7Document1 pageQED Electronics - Problem 3.7ivanyongforexNo ratings yet

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- Browning Manufactur Company C6-1Document18 pagesBrowning Manufactur Company C6-1Faizal Pradhana100% (1)

- PC DepotDocument2 pagesPC DepotJohn Carlos WeeNo ratings yet

- Case Analysis 3 1 Maynard BusinessDocument6 pagesCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZNo ratings yet

- Medieval Case SolutionDocument7 pagesMedieval Case SolutionTarry BerryNo ratings yet

- Case 6-1 BrowningDocument7 pagesCase 6-1 BrowningPatrick HariramaniNo ratings yet

- Maynard CompanyDocument5 pagesMaynard CompanySantosh GovindarajanNo ratings yet

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDocument3 pagesV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNo ratings yet

- PC Depot (Accounting)Document4 pagesPC Depot (Accounting)Ange Buenaventura Salazar100% (2)

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Case 6 1Document10 pagesCase 6 1cashmerehitNo ratings yet

- Chapter 7-1 SternDocument7 pagesChapter 7-1 SternPatrick HariramaniNo ratings yet

- Case 2-3 Lone Pine Café (A)Document15 pagesCase 2-3 Lone Pine Café (A)Cynthia Anggi Maulina100% (1)

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- PC Depot Trial Balance - Hezekiah PardedeDocument5 pagesPC Depot Trial Balance - Hezekiah PardedeHezekiah PardedeNo ratings yet

- Pine Tree Motel Case 3-4: Answer To Q1Document2 pagesPine Tree Motel Case 3-4: Answer To Q1Om PrakashNo ratings yet

- Tugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDocument10 pagesTugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDenssNo ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Case 8-1 Norman Corp, Patrick AnalysisDocument2 pagesCase 8-1 Norman Corp, Patrick AnalysisPatrick HariramaniNo ratings yet

- Joan Holtz Case SolutionsDocument5 pagesJoan Holtz Case SolutionsRahul KaulNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case 5-3Document2 pagesCase 5-3ragil1988No ratings yet

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Assignment Iii Mansa Building Case Study: Submitted by Group IVDocument14 pagesAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniNo ratings yet

- Group 1-Java SourceDocument5 pagesGroup 1-Java SourceLorena Mae LasquiteNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazNo ratings yet

- Leadership - Peter BrowningDocument2 pagesLeadership - Peter BrowningMohammad Fidi Abganis HermawanNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Case 4-4 Octane SS - PurwaningrumDocument5 pagesCase 4-4 Octane SS - PurwaningrumPurwaningrum Gunantoko50% (4)

- Case 4-1 PC DepotDocument5 pagesCase 4-1 PC Depotamitsemt67% (3)

- Hampton Suggested AnswersDocument5 pagesHampton Suggested Answersamsa100% (1)

- Final Trial Exam k6 Sbs Final PaDocument32 pagesFinal Trial Exam k6 Sbs Final PaChi PhanNo ratings yet

- Accounting Test 00001Document4 pagesAccounting Test 00001Nanya BisnestNo ratings yet

- EOC Ross 7th Edition Case SolutionsDocument6 pagesEOC Ross 7th Edition Case SolutionsKhan Abdullah0% (1)

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newRahasia RommelNo ratings yet

- Fsa Questions FBNDocument34 pagesFsa Questions FBNsprykizyNo ratings yet

- 1 RMFDDocument27 pages1 RMFDArchin PadiaNo ratings yet

- Financial DerivativesDocument36 pagesFinancial DerivativesArchin PadiaNo ratings yet

- SMKT Shouldice HospitalDocument37 pagesSMKT Shouldice HospitalArchin PadiaNo ratings yet

- Parle Industrial ReportDocument12 pagesParle Industrial ReportArchin PadiaNo ratings yet