Professional Documents

Culture Documents

Diaz Vs SoF 2011

Diaz Vs SoF 2011

Uploaded by

Jacinto Jr JameroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diaz Vs SoF 2011

Diaz Vs SoF 2011

Uploaded by

Jacinto Jr JameroCopyright:

Available Formats

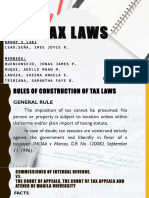

Diaz vs.

Secretary of Finance

GR NO. 193007 July 19, 2011

Facts: Petitioners Renato V. Diaz and Aurora Ma. F. Timbol (petitioners) filed this petition

for declaratory relief assailing the validity of the impending imposition of value-added tax

(VAT) by the Bureau of Internal Revenue (BIR) on the collections of toll way operators.

Court treated the case as one of prohibition. Petitioners hold the view that Congress did

not, when it enacted the NIRC, intend to include toll fees within the meaning of "sale of

services" that are subject to VAT; that a toll fee is a "user's tax," not a sale of services; that

to impose VAT on toll fees would amount to a tax on public service; and that, since VAT

was never factored into the formula for computing toll fees, its imposition would violate the

non-impairment clause of the constitution. The government avers that the NIRC imposes

VAT on all kinds of services of franchise grantees, including toll way operations; that the

Court should seek the meaning and intent of the law from the words used in the statute;

and that the imposition of VAT on toll way operations has been the subject as early as

2003 of several BIR rulings and circulars. The government also argues that petitioners

have no right to invoke the non-impairment of contracts clause since they clearly

have no personal interest in existing toll operating agreements (TOAs) between the

government and toll way operators. At any rate, the non-impairment clause cannot limit

the State's sovereign taxing power which is generally read into contracts.

Issue: May toll fees collected by toll way operators be subjected to VAT (Are toll way

operations a franchise and/or a service that is subject to VAT)?

Ruling: When a toll way operator takes a toll fee from a motorist, the fee is in effect for the

latter's use of the toll way facilities over which the operator enjoys private proprietary rights

that its contract and the law recognize. In this sense, the toll way operator is no different

from the service providers under Section108 who allow others to use their properties

or facilities for a fee. Toll way operators are franchise grantees and they do not belong to

exceptions that Section 119 spares from the payment of VAT. The word "franchise" broadly

covers government grants of a special right to do an act or series of acts of public

concern. Toll way operators are, owing to the nature and object of their business,

"franchise grantees." The construction, operation, and maintenance of toll facilities on

public improvements are activities of public consequence that necessarily require a

special grant of authority from the state. A tax is imposed under the taxing power of the

government principally for the purpose of raising revenues to fund public expenditures.

Toll fees, on the other hand, are collected by private toll way operators as reimbursement

for the costs and expenses incurred in the construction, maintenance and operation of the

toll ways, as well as to assure them a reasonable margin of income. Although toll fees are

charged for the use of public facilities, therefore, they are not government exactions that

can be properly treated as a tax. Taxes may be imposed only by the government under

its sovereign authority, toll fees may be demanded by either the government or private

individuals or entities, as an attribute of ownership.

You might also like

- Bubble and Bee Organic - TemplateDocument7 pagesBubble and Bee Organic - TemplateAkanksha SaxenaNo ratings yet

- Lobj19 - 0000055 CR 1907 02 A PDFDocument28 pagesLobj19 - 0000055 CR 1907 02 A PDFqqqNo ratings yet

- DIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUEDocument2 pagesDIAZ AND TIMBOL v. SECRETARY OF FINANCE AND THE COMMISSIONER OF INTERNAL REVENUERose De JesusNo ratings yet

- Tax CasesDocument79 pagesTax CasesFAMIDA BALINDONGNo ratings yet

- Payroll & Bookkeeping Services in The US Industry Report From IBIS WorldDocument33 pagesPayroll & Bookkeeping Services in The US Industry Report From IBIS WorldKhristopher J. Brooks100% (1)

- Uber Financial StatementDocument6 pagesUber Financial StatementAdrean GonzalesNo ratings yet

- MAS 2 Case Analysis SampleDocument3 pagesMAS 2 Case Analysis Sampleshin ruña100% (2)

- Diaz Vs Sec of FinanceDocument1 pageDiaz Vs Sec of FinanceArjay Balanquit100% (3)

- DIAZ v. SECRETARY OF FINANCEDocument1 pageDIAZ v. SECRETARY OF FINANCEKristine VillanuevaNo ratings yet

- Diaz-vs-Sec-of-Finance DIGESTDocument2 pagesDiaz-vs-Sec-of-Finance DIGESTMiguel100% (1)

- Diaz-vs-Sec-of-Finance DIGESTDocument2 pagesDiaz-vs-Sec-of-Finance DIGESTMiguelNo ratings yet

- Diaz v. Secretary of Finance DigestDocument2 pagesDiaz v. Secretary of Finance DigestTzarlene Cambaliza100% (2)

- Timbol & Diaz v. Sec. of Finance, 654 SCRA 96 DigestDocument3 pagesTimbol & Diaz v. Sec. of Finance, 654 SCRA 96 DigestMa. Melissa Jamella LindoNo ratings yet

- Diaz V Director of FinanceDocument7 pagesDiaz V Director of Financechappy_leigh118No ratings yet

- Diaz vs. Secretary of FinanceDocument3 pagesDiaz vs. Secretary of FinanceKim Fernández100% (1)

- Timbol and Diaz Vs Secretary of FinanceDocument2 pagesTimbol and Diaz Vs Secretary of FinancehaydeeNo ratings yet

- DIAZ and TIMBOL Vs Sec of Finance and CIRDocument2 pagesDIAZ and TIMBOL Vs Sec of Finance and CIRBrylle Deeiah TumarongNo ratings yet

- Diaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Document2 pagesDiaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Kent UgaldeNo ratings yet

- Diaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Document3 pagesDiaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)EvangerylNo ratings yet

- Renato v. Diaz & Aurora Ma. F. TimbolDocument3 pagesRenato v. Diaz & Aurora Ma. F. TimbolBernadetteGaleraNo ratings yet

- Diaz V SofDocument5 pagesDiaz V SofLiana AcubaNo ratings yet

- Renato Diaz V Secretary of FinanceDocument2 pagesRenato Diaz V Secretary of FinanceDexter MantosNo ratings yet

- Diaz Vs Secretary of Finance PDFDocument3 pagesDiaz Vs Secretary of Finance PDFPatrice Alexandra DeVeraNo ratings yet

- Diaz Vs TimbolDocument1 pageDiaz Vs TimbolFrancis Coronel Jr.No ratings yet

- Diaz VS Sec of FinanceDocument2 pagesDiaz VS Sec of Financefermo ii ramosNo ratings yet

- Diaz V Secretary of FinanceDocument2 pagesDiaz V Secretary of FinanceEllenNo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Renato Diaz Vs Secretary of FinanceDocument5 pagesRenato Diaz Vs Secretary of FinanceLouis BelarmaNo ratings yet

- Diaz v. Sec of Finance and CIRDocument1 pageDiaz v. Sec of Finance and CIRCaroline A. LegaspinoNo ratings yet

- 87.diaz Vs SecretaryDocument9 pages87.diaz Vs SecretaryClyde KitongNo ratings yet

- Tax 2 VAT CASESDocument136 pagesTax 2 VAT CASEScezz2386No ratings yet

- Renato Diaz & Aurora Tumbol vs. Secretary of Finance DOCTRINE: The Law Imposes Value Added Tax (VAT) On "All Kinds of Services"Document21 pagesRenato Diaz & Aurora Tumbol vs. Secretary of Finance DOCTRINE: The Law Imposes Value Added Tax (VAT) On "All Kinds of Services"Vicente Del Castillo IVNo ratings yet

- Diaz and Timbol V Sec of FinanceDocument4 pagesDiaz and Timbol V Sec of FinanceErgel Mae Encarnacion RosalNo ratings yet

- Diaz vs. Secretary of Finance (July 19, 2011)Document8 pagesDiaz vs. Secretary of Finance (July 19, 2011)chrisNo ratings yet

- SalesDocument120 pagesSalespit1xNo ratings yet

- Diaz vs. Secretary of FinanceDocument2 pagesDiaz vs. Secretary of FinanceHappy Dreams PhilippinesNo ratings yet

- Diaz Vs Sec. of Finance, G.R. No. 193007Document7 pagesDiaz Vs Sec. of Finance, G.R. No. 193007R.A. GregorioNo ratings yet

- RENATO V. DIAZ and AURORA MA. F. TIMBOL Vs THE SECRETARY OF FINANCE G.R. No. 193007 July 19, 2011Document10 pagesRENATO V. DIAZ and AURORA MA. F. TIMBOL Vs THE SECRETARY OF FINANCE G.R. No. 193007 July 19, 2011sherwin pulidoNo ratings yet

- Tax As A ProcessDocument4 pagesTax As A ProcessAnonymous aNVp7LzNo ratings yet

- Diaz vs. Secretary of FinanceDocument17 pagesDiaz vs. Secretary of FinanceBethany MangahasNo ratings yet

- Tom DigestDocument53 pagesTom DigestGuilgamesh EmpireNo ratings yet

- 3 and 4 Vat Taxable Vat ExemptDocument12 pages3 and 4 Vat Taxable Vat ExemptGuilgamesh EmpireNo ratings yet

- DIAZ Vs SECRETARY OF FINANCEDocument2 pagesDIAZ Vs SECRETARY OF FINANCEMCNo ratings yet

- Renato v. Diaz v. Secretary of Finance, GR No. 193007, 2011-07-19Document3 pagesRenato v. Diaz v. Secretary of Finance, GR No. 193007, 2011-07-19Anonymous NiKZKWgKqNo ratings yet

- Renato V. Diaz V. Secretary of Finance, GR No. 193007, 2011-07-19 FactsDocument2 pagesRenato V. Diaz V. Secretary of Finance, GR No. 193007, 2011-07-19 FactsyetyetNo ratings yet

- Diaz V Secretary of FinanceDocument2 pagesDiaz V Secretary of FinanceTrxc MagsinoNo ratings yet

- T2-1819 (76) Diaz and Timbol v. Secretary of Finance - VILLANUEVADocument1 pageT2-1819 (76) Diaz and Timbol v. Secretary of Finance - VILLANUEVACJVNo ratings yet

- Diaz v. SOF, GR 193007, 2011Document12 pagesDiaz v. SOF, GR 193007, 2011Santos, CarlNo ratings yet

- Tax DigestDocument18 pagesTax DigestMhayBinuyaJuanzonNo ratings yet

- Cir vs. Isabela Cultural Corporation (Icc) : Issue/SDocument5 pagesCir vs. Isabela Cultural Corporation (Icc) : Issue/SMary AnneNo ratings yet

- Tax Set 1 Case 1 2Document5 pagesTax Set 1 Case 1 2Patatas SayoteNo ratings yet

- Group 5 Tax LawsDocument122 pagesGroup 5 Tax LawsAngeliqueGiselleCNo ratings yet

- C.2 - Diaz v. Secretary of FinanceDocument15 pagesC.2 - Diaz v. Secretary of FinanceKristine Irish GeronaNo ratings yet

- Diaz Vs Secretary of FinanceDocument8 pagesDiaz Vs Secretary of FinanceShane JardinicoNo ratings yet

- Tax2 DigestDocument28 pagesTax2 DigestRizza MoradaNo ratings yet

- Compilation-of-Case-Digests TaxDocument47 pagesCompilation-of-Case-Digests TaxAbseniNalangKhoUyNo ratings yet

- Case Digest in TAXATionDocument7 pagesCase Digest in TAXATionanthonyjohntarreNo ratings yet

- Taxation Cases RulingDocument8 pagesTaxation Cases RulingnorzeNo ratings yet

- Pupose of TaxDocument10 pagesPupose of TaxJohnny Castillo SerapionNo ratings yet

- Land Bank of The Philippines Vs Eduardo M. CacayuranDocument3 pagesLand Bank of The Philippines Vs Eduardo M. CacayurankennethNo ratings yet

- NPC v. Cabanatuan CityDocument35 pagesNPC v. Cabanatuan CitymonagbayaniNo ratings yet

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintFrom EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- AEL - Cases of Galang Vs CA To Fortich Vs CoronaDocument23 pagesAEL - Cases of Galang Vs CA To Fortich Vs CoronaCayen Cervancia CabiguenNo ratings yet

- Ael-Kapisanan Vs NorielDocument5 pagesAel-Kapisanan Vs NorielCayen Cervancia CabiguenNo ratings yet

- Bail Tejano Vs Marigomen FCDocument3 pagesBail Tejano Vs Marigomen FCCayen Cervancia CabiguenNo ratings yet

- TAX REV 2 - CIR vs. ASALUS CORPORATIONDocument5 pagesTAX REV 2 - CIR vs. ASALUS CORPORATIONCayen Cervancia CabiguenNo ratings yet

- Taxrev2 - RCBC VS CirDocument3 pagesTaxrev2 - RCBC VS CirCayen Cervancia CabiguenNo ratings yet

- Cir V CaDocument1 pageCir V CaCayen Cervancia CabiguenNo ratings yet

- Bail Napoles Vs Sandiganbayan FCDocument8 pagesBail Napoles Vs Sandiganbayan FCCayen Cervancia CabiguenNo ratings yet

- Bail People Vs Valdez FCDocument5 pagesBail People Vs Valdez FCCayen Cervancia CabiguenNo ratings yet

- Bail People Vs Calo FCDocument5 pagesBail People Vs Calo FCCayen Cervancia CabiguenNo ratings yet

- Bail-Okabe Vs de Leon-Fc - Important CaseDocument8 pagesBail-Okabe Vs de Leon-Fc - Important CaseCayen Cervancia CabiguenNo ratings yet

- Bail-Delos Santos Vs Montesa-FcDocument4 pagesBail-Delos Santos Vs Montesa-FcCayen Cervancia CabiguenNo ratings yet

- Bail Leviste Vs CA FCDocument7 pagesBail Leviste Vs CA FCCayen Cervancia CabiguenNo ratings yet

- Bail Leviste Vs Alameda FCDocument7 pagesBail Leviste Vs Alameda FCCayen Cervancia CabiguenNo ratings yet

- BP 22Document3 pagesBP 22Cayen Cervancia CabiguenNo ratings yet

- Amendment - Albert Vs Sandiganbayan DigestDocument1 pageAmendment - Albert Vs Sandiganbayan DigestCayen Cervancia CabiguenNo ratings yet

- Bail Enrile Vs Sandiganbayan FCDocument6 pagesBail Enrile Vs Sandiganbayan FCCayen Cervancia CabiguenNo ratings yet

- Cima F1 May 2013Document20 pagesCima F1 May 2013MHasankuNo ratings yet

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- Day Care Providers Income and Expenses 2022Document2 pagesDay Care Providers Income and Expenses 2022Finn KevinNo ratings yet

- RMC 38-2018Document3 pagesRMC 38-2018Nikki SiaNo ratings yet

- CA Inter Accounts Suggested Answer Nov 2022Document29 pagesCA Inter Accounts Suggested Answer Nov 2022adityatiwari122006No ratings yet

- Guerero CHAPTER 5Document15 pagesGuerero CHAPTER 5MARC OLIVER CASTANEDANo ratings yet

- Intermediate Acctg 3 Finals With Answers PDFDocument6 pagesIntermediate Acctg 3 Finals With Answers PDFPrincesNo ratings yet

- Capital GainDocument22 pagesCapital GainVikas SinghNo ratings yet

- GovAcc HO No. 3 - The Government Accounting ProcessDocument9 pagesGovAcc HO No. 3 - The Government Accounting Processbobo kaNo ratings yet

- Management Glossary - PDF Version 1Document75 pagesManagement Glossary - PDF Version 1Fàrhàt HossainNo ratings yet

- Business PlanDocument15 pagesBusiness PlanArsalan Habib100% (1)

- 5 Long Term Construction Contract 3e5ca4a29cf252303 Ffcc2ab83e9ecba CompressDocument12 pages5 Long Term Construction Contract 3e5ca4a29cf252303 Ffcc2ab83e9ecba Compressgelly studiesNo ratings yet

- Adjustments Points To Be Kept in Mind: Term ExplanationDocument1 pageAdjustments Points To Be Kept in Mind: Term ExplanationSachinSharmaNo ratings yet

- Unified Fire Authority (UFA) State AuditDocument68 pagesUnified Fire Authority (UFA) State AuditCity WeeklyNo ratings yet

- SMEDA Fabric Weaving Unit (Auto Looms)Document18 pagesSMEDA Fabric Weaving Unit (Auto Looms)Shoaib Kamran100% (1)

- Single Entry SystemDocument4 pagesSingle Entry SystemRhea Royce CabuhatNo ratings yet

- Ias 12Document27 pagesIas 12Kuti KuriNo ratings yet

- Projects-Basics of IntegrationDocument7 pagesProjects-Basics of IntegrationGaneshkumarNo ratings yet

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Document8 pagesMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNo ratings yet

- Sindh ABS 0910Document86 pagesSindh ABS 0910Wajiha SaeedNo ratings yet

- Accounts 2015 SamDocument24 pagesAccounts 2015 SamBIKASH166No ratings yet

- GogglesDocument39 pagesGogglesVatsal GadhiaNo ratings yet

- Chapter 16 Non Profit OrganizationsDocument28 pagesChapter 16 Non Profit Organizationslou-924No ratings yet

- ACCT 504 Midterm Exam 2Document7 pagesACCT 504 Midterm Exam 2DeVryHelpNo ratings yet

- HOEC Investor Presentation 20 April 2017 Final ExecutiveDocument27 pagesHOEC Investor Presentation 20 April 2017 Final Executivedeba01234No ratings yet