Professional Documents

Culture Documents

PC - Monthly Technicals - The 20 - 80 Report - January - 2018

PC - Monthly Technicals - The 20 - 80 Report - January - 2018

Uploaded by

Subodh GuptaCopyright:

Available Formats

You might also like

- Introduction To Stock MarketDocument108 pagesIntroduction To Stock Marketsvmani100% (6)

- RR 9-98Document5 pagesRR 9-98matinikkiNo ratings yet

- PruLink Surrender Form PDFDocument4 pagesPruLink Surrender Form PDFHui Jia JunnNo ratings yet

- DSP FIDELITYWorksheetDocument6 pagesDSP FIDELITYWorksheetvivek_recNo ratings yet

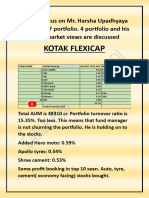

- Kotak Harsha Upadhyaya PortfolioDocument8 pagesKotak Harsha Upadhyaya PortfoliomiddlecricketwarriorsNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- Market Outlook 2Document26 pagesMarket Outlook 2amrejpal773No ratings yet

- 62 Solvency Ratio of General InsurersDocument6 pages62 Solvency Ratio of General InsurersAnirudh BommiNo ratings yet

- ValueResearchFundcard QuantumLongTermEquity 2011jan06Document6 pagesValueResearchFundcard QuantumLongTermEquity 2011jan06jayaram_mca83No ratings yet

- FinsSoc Zerodha 1 - Introduction To Stock MarketsDocument80 pagesFinsSoc Zerodha 1 - Introduction To Stock MarketsShuvam GuptaNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- HTTPS: - Zerodha-Common.s3.ap-South-1.amazonaws - Com - Varsity - Modules - Module 1 - Introduction To Stock Markets PDFDocument111 pagesHTTPS: - Zerodha-Common.s3.ap-South-1.amazonaws - Com - Varsity - Modules - Module 1 - Introduction To Stock Markets PDFbhaveshNo ratings yet

- Etwm MP 21 1 Col R1.inddDocument1 pageEtwm MP 21 1 Col R1.inddsekhargNo ratings yet

- Module 1 Introduction To Stock MarketsDocument111 pagesModule 1 Introduction To Stock MarketsManpreet Singh JassalNo ratings yet

- VarsityDocument1,483 pagesVarsityBharath kumarNo ratings yet

- Zerodha Stock Market PDFDocument108 pagesZerodha Stock Market PDFAnshu GauravNo ratings yet

- Module 1 - Introduction To Stock MarketsDocument111 pagesModule 1 - Introduction To Stock Marketskjhbgv bnmk,lNo ratings yet

- Trade Performance and Fund Flow Week Ended 9 February 2024-258Document5 pagesTrade Performance and Fund Flow Week Ended 9 February 2024-258Shabandi MnNo ratings yet

- Year Oil Palm Planted Area (Hectares) Production of CPO (Tonnes) Exports of Palm Oil (Tonnes)Document8 pagesYear Oil Palm Planted Area (Hectares) Production of CPO (Tonnes) Exports of Palm Oil (Tonnes)Shaeera sulaimanNo ratings yet

- Comparison of All Mutual Funds: Anish Vyas Roll No: 2Document12 pagesComparison of All Mutual Funds: Anish Vyas Roll No: 2Anish VyasNo ratings yet

- Factsheet Nifty500 ShariahDocument2 pagesFactsheet Nifty500 ShariahAejaz shaikhNo ratings yet

- Level 1Document111 pagesLevel 1Amol PatilNo ratings yet

- Apparel Sector SheetDocument3 pagesApparel Sector SheetSmriti DurehaNo ratings yet

- Financial Accounting: Bharti Airtel LimitedDocument75 pagesFinancial Accounting: Bharti Airtel Limitedadani9No ratings yet

- Banana Pack HouseDocument5 pagesBanana Pack Housevskaarthi100% (2)

- ValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Document4 pagesValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Rahul AnandNo ratings yet

- Sip-Week1: Submitted To Dr. (Prof.) Hanish Rajpal Presented by - Priyanka Valechha 201911030Document7 pagesSip-Week1: Submitted To Dr. (Prof.) Hanish Rajpal Presented by - Priyanka Valechha 201911030priyanka valechhaNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFPankaj LodwalNo ratings yet

- ValueResearchFundcard RelianceGrowth 2010dec30Document6 pagesValueResearchFundcard RelianceGrowth 2010dec30Maulik DoshiNo ratings yet

- 6 October, 2023: Suma Vinayak UpparattiDocument36 pages6 October, 2023: Suma Vinayak Upparattinaishal.pNo ratings yet

- ValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Document6 pagesValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Ravindra MisalNo ratings yet

- Solvency Ratio of Life InsurersDocument2 pagesSolvency Ratio of Life InsurersSundararajan SrinivasanNo ratings yet

- Annual Report 2000Document43 pagesAnnual Report 2000Enamul HaqueNo ratings yet

- JM Daily - 23 Aug - EquityDocument183 pagesJM Daily - 23 Aug - EquityPravin SinghNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Prashant DalviNo ratings yet

- Insights EdelMFDocument81 pagesInsights EdelMFSindhuja AvinashNo ratings yet

- Value Research Fundcard - Aditya Birla Sun Life New Millennium Fund-2018 Apr 16Document4 pagesValue Research Fundcard - Aditya Birla Sun Life New Millennium Fund-2018 Apr 16hotalamNo ratings yet

- ValueResearchFundcard AIGIndiaEquityReg 2011may02Document6 pagesValueResearchFundcard AIGIndiaEquityReg 2011may02Chetan SinhaNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- ValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26Document4 pagesValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26James HughesNo ratings yet

- June 30, 2017: Portfolio Characteristics StatisticsDocument2 pagesJune 30, 2017: Portfolio Characteristics StatisticsAnonymous 5mSMeP2jNo ratings yet

- ValueResearchFundcard Kotak50RegularPlan 2018jan21Document4 pagesValueResearchFundcard Kotak50RegularPlan 2018jan21rdhNo ratings yet

- Introduction To Nepali Stock Market Final FinalDocument75 pagesIntroduction To Nepali Stock Market Final FinalAadarsh AkshyataNo ratings yet

- ValueResearchFundcard L&TMidcapFund DirectPlanDocument4 pagesValueResearchFundcard L&TMidcapFund DirectPlanreachrajatNo ratings yet

- Foreword I-3 Acknowledgement I-5 About NISM Certifications I-7 About The NISM-Series-XI: Equity Sales Certification Examination I-9Document4 pagesForeword I-3 Acknowledgement I-5 About NISM Certifications I-7 About The NISM-Series-XI: Equity Sales Certification Examination I-9ABC 123No ratings yet

- Fundcard: Indiabulls Bluechip FundDocument4 pagesFundcard: Indiabulls Bluechip FundashokarunachalamNo ratings yet

- Symbol Underlying Asset Open HighDocument6 pagesSymbol Underlying Asset Open HighutkarshgadiaNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- Sector-Wise PLF (%) Targets and Achievements: APRIL, 07 - JULY, 07 JULY, 07Document1 pageSector-Wise PLF (%) Targets and Achievements: APRIL, 07 - JULY, 07 JULY, 07Udhayakumar VenkataramanNo ratings yet

- RelianceTaxSaver (ELSS) Fund 2017jul25Document4 pagesRelianceTaxSaver (ELSS) Fund 2017jul25Krishnan ChockalingamNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- ValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02Document4 pagesValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02JoydeepSuklabaidyaNo ratings yet

- Ind Next50Document2 pagesInd Next50blessNo ratings yet

- 1 Vermicelli: Project Profiles - MP Agros Global Agrisystem Pvt. Ltd. Your Partner in Agri-Business 1Document6 pages1 Vermicelli: Project Profiles - MP Agros Global Agrisystem Pvt. Ltd. Your Partner in Agri-Business 1Chilton John DuatNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Javal ChaniyaraNo ratings yet

- HTC 3Q14 Investor Conference Final PDFDocument15 pagesHTC 3Q14 Investor Conference Final PDFyaposiNo ratings yet

- Marico RatiosDocument2 pagesMarico RatiosAbhay Kumar SinghNo ratings yet

- ValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18Document4 pagesValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18santoshk.mahapatraNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeFrom EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeNo ratings yet

- BLT Final Pre-Boards NCPARDocument12 pagesBLT Final Pre-Boards NCPARlorenceabad07No ratings yet

- Correspondent Bank Charges For International Transfers Fixed ChargesDocument5 pagesCorrespondent Bank Charges For International Transfers Fixed ChargesManikandanNo ratings yet

- واقع تطبيق إتفاقية بازل III في النظام المصرفي الجزائري دراسة حالة بنك الفلاحة والتنمية الريفيةDocument11 pagesواقع تطبيق إتفاقية بازل III في النظام المصرفي الجزائري دراسة حالة بنك الفلاحة والتنمية الريفيةChaima BouguerraNo ratings yet

- RBS Turriff Branch Closure FactsheetDocument6 pagesRBS Turriff Branch Closure FactsheetMy TurriffNo ratings yet

- Essential For Islamic Finance 2012Document90 pagesEssential For Islamic Finance 2012voguishrock927No ratings yet

- Assgmt1 2 ProbDocument14 pagesAssgmt1 2 ProbSyurga Fathonah0% (2)

- Word Formation Prov VDocument4 pagesWord Formation Prov VAnonymous BF9P5gWINo ratings yet

- Placement Consultants in Bangalore: Christ Career SolutionsDocument6 pagesPlacement Consultants in Bangalore: Christ Career SolutionsSumit LalwaniNo ratings yet

- My Persimmon BrochureDocument6 pagesMy Persimmon BrochureSarith SamarajeewaNo ratings yet

- Arc Exploration Limited: Appendix 5BDocument4 pagesArc Exploration Limited: Appendix 5BJackzidNo ratings yet

- Merger and Acquisition in Indian Banking Sector: A Case Study of Bank of BarodaDocument21 pagesMerger and Acquisition in Indian Banking Sector: A Case Study of Bank of BarodaAishwarya LakshmiNo ratings yet

- Property HeroesDocument18 pagesProperty HeroesAnonymous KUGdwwb4iXNo ratings yet

- Wallstreetjournal 20190930 TheWallStreetJournalDocument30 pagesWallstreetjournal 20190930 TheWallStreetJournalAmmi Julian0% (1)

- Literature ReviewDocument9 pagesLiterature ReviewAnkur Upadhyay0% (1)

- Esearch Ethodology: (Type Text)Document65 pagesEsearch Ethodology: (Type Text)Majeed MujawarNo ratings yet

- Wollega University Shambu Campus: Advisor: Adugna (MSC)Document38 pagesWollega University Shambu Campus: Advisor: Adugna (MSC)Adugna Megenasa100% (1)

- Analyzing A Bank's Financial StatementsDocument8 pagesAnalyzing A Bank's Financial StatementsMinh Thu Nguyen100% (1)

- BYJUS k10Document24 pagesBYJUS k10victor dNo ratings yet

- IN RE: OLD CARCO, LLC (DONOFRIO - PIDGEON) - 6340 - Affidavit of Service of Steven Indelicato - Nysb-Mega-12607848843 6340Document16 pagesIN RE: OLD CARCO, LLC (DONOFRIO - PIDGEON) - 6340 - Affidavit of Service of Steven Indelicato - Nysb-Mega-12607848843 6340Jack RyanNo ratings yet

- Act 153 Islamic Development Bank Act 1975Document10 pagesAct 153 Islamic Development Bank Act 1975Adam Haida & CoNo ratings yet

- QB GSTDocument12 pagesQB GSTJeevitha ReddyNo ratings yet

- Ayesha Internship 2 PDFDocument59 pagesAyesha Internship 2 PDFAisha rashidNo ratings yet

- ArundeepDocument3 pagesArundeepapi-533037897No ratings yet

- Jan 1st Week Top60 (Eng) by ACDocument43 pagesJan 1st Week Top60 (Eng) by ACThe ShayarNo ratings yet

- Marifas Practical Guide To Islamic Banking and FinanceDocument244 pagesMarifas Practical Guide To Islamic Banking and FinanceClaudia Stefania100% (1)

- Kore BankDocument2 pagesKore BankOzz UychNo ratings yet

- Airmech EngineersDocument2 pagesAirmech EngineersSUNIL PATELNo ratings yet

- Section 20Document2 pagesSection 20einel dcNo ratings yet

PC - Monthly Technicals - The 20 - 80 Report - January - 2018

PC - Monthly Technicals - The 20 - 80 Report - January - 2018

Uploaded by

Subodh GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PC - Monthly Technicals - The 20 - 80 Report - January - 2018

PC - Monthly Technicals - The 20 - 80 Report - January - 2018

Uploaded by

Subodh GuptaCopyright:

Available Formats

INSTITUTIONAL EQUITY RESEARCH

The 20:80 report

Top 25 companies in Nifty 50 comprise 80% of Weightage

INDIA | TECHNICALS 1 January 2018

How To Read This Report?

This report is more focused on Relative Performance of Stocks in Relation to Nifty rather Subodh Gupta (+ 91 09833255368)

than an individual BUY/SELL. As mentioned the Top 25 companies constitute 80% of the subgupta@phillipcapital.in

weightage of Nifty 50, and hence are important in every portfolio. By this report our

objective is helping in PORTFOLIO OUTPERFORMANCE DESPITE THE TREND OF OVERALL

MARKETS.

Each Stock Analysis comprises of two charts (1) Price Charts (2) Relative Strength Chart

(Stock/Nifty). A breakout in price chart may not be followed by breakout in RS chart and

vice‐versa. We therefore use a combination of both these charts to find the right mix of

stocks which will be OUTPERFORMERS / UNDERPERFORMERS in days to come.

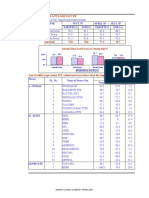

Nifty 50 Weightage

Nifty Phillip Capital Our View

Weightage (%) Weightage (%)

HDFCBANK 9.6 9 MARKET PERFORMER

RELIANCE 7.77 8.6 OUTPERFORMER

HDFC 6.79 6.5 MARKET PERFORMER

ITC 5.55 4.5 UNDER PERFORMER

ICICIBANK 5.01 5.01 MARKET PERFORMER

INFY 4.96 5.25 MARKET PERFORMER

LT 3.81 4.2 OUTPERFORMER

KOTAKBANK 3.39 2.7 UNDER PERFORMER

TCS 3.33 3.4 MARKET PERFORMER

SBIN 3.02 2.5 MARKET PERFORMER

MARUTI 2.9 3.2 OUTPERFORMER

AXISBANK 2.32 2.1 MARKET PERFORMER

HINDUNILVR 2.31 2.8 OUTPERFORMER

INDUSINDBK 2.15 2.6 OUTPERFORMER

TATAMOTORS 1.93 2 MARKET PERFORMER

BHARTIARTL 1.66 2 OUTPERFORMER

M&M 1.66 1.7 MARKET PERFORMER

SUNPHARMA 1.51 1.2 UNDER PERFORMER

YESBANK 1.43 1.2 UNDER PERFORMER

VEDL 1.39 1.75 OUTPERFORMER

ASIANPAINT 1.31 1 UNDER PERFORMER

ONGC 1.3 1.3 MARKET PERFORMER

HCLTECH 1.2 1.2 MARKET PERFORMER

HEROMOTOCO 1.2 1.3 MARKET PERFORMER

ULTRACEMCO 1.11 1.6 OUTPERFORMER

Total 78.61 78.61

Page | 1 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

KEY TAKEAWAYS

• Downgrading YES BANK to UNDER PERFORMER from MARKET PERFORMER

Our Recommendation

• Our Top 3 Likely OUTPERFORMERS: Infosys, TCS, LT

• Our Top 3 Likely UNDERPERFORMERS: Indusind Bank, Kotak Bank, Asian Paint

Review of Our Previous Months Portfolio (During The Month Nifty ROSE by 267

Points)

Nifty Phillip Capital

Weightage (%) Weightage (%) Performance

HDFCBANK 9.27 9 0.94

RELIANCE 7.84 9 -0.37

HDFC 6.84 7 1.56

ITC 5.69 4.5 2.45

ICICIBANK 4.84 5 1.39

INFY 4.63 4.8 6.40

LT 3.79 4.0 3.46

KOTAKBANK 3.43 3 0.72

TCS 3.28 3.2 2.51

SBIN 2.85 2.5 -3.61

MARUTI 2.7 3.1 12.35

AXISBANK 2.2 2.2 4.55

HINDUNILVR 2.22 3.0 7.50

INDUSINDBK 2.08 3 -0.72

TATAMOTORS 2 2 5.87

BHARTIARTL 1.7 2.0 6.16

M&M 1.57 1.6 10.34

VEDL 1.55 2 10.91

SUNPHARMA 1.53 1.0 4.99

YESBANK 1.45 1.70 2.39

ONGC 1.36 1 7.25

ASIANPAINT 1.3 1.0 0.99

HEROMOTOCO 1.26 1.3 3.93

HCLTECH 1.20 1.3 5.14

ULTRACEMCO 1.15 1.6 2.19

Total 77.82 77.81

On an investment of 1 OUT Performance

lakh 102963.3368 103108.2926 of 14 basis points

Our Previous Months Recommendations

Top Buy Returns % Top Sell Returns %

INFY 6.40 HEROMOTOCO 3.93

AXISBANK 4.55 ITC 2.45

M&M 10.34 Maruti 12.35

Page | 2 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

HDFC (CMP Rs 1704)

• HDFC Limited is trading in a consolidation for past 5 months. From here we expect VIEW: MARKETPERFORMER

a breakout in the stock In coming months which may lead to next upside rally.

• The Weekly Relative Strength Chart of HDFC Ltd. has breached an important BUYING ZONE: Only on BREAKOUT of

channel support and continues to trade weaker. From here we would like to 1750

maintain our view of MARKET PERFORMER on the stock.

HDFC Monthly Chart

HDFC /Nifty: Weekly Relative Strength Chart

Page | 3 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

HDFC Bank (CMP Rs 1877)

• HDFC Bank is trading in a sideways consolidation for past 4 months trading VIEW: MARKETPERFORMER

between 1910 and 1765. As of now we expect this consoliation to continue in

coming days and do not see emergence of any trend. BUYING ZONE: Only above 1920

• The Weekly Relative Strength Chart of HDFC Bank is consolidating in the

sideways direction. We expect the RS chart to be under pressure in coming day.

Expect the stock to be a MARKET PERFORMER.

HDFC Bank Monthly Chart

HDFC Bank/Nifty: Weekly Relative Strength Chart

Page | 4 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Reliance (CMP Rs 924)

• Reliance Industries has been consolidating for last 2 months in a sideways VIEW : OUTPERFORMER

direction. From here We expect the stock to head towards 1050 and 1100 levels

on next breakout which will be above 960 levels. BUYING ZONE: BUY above 950 levels

• The Weekly Relative Strength Chart of RELIANCE Vis a vis NIFTY is consolidating in

the sideways direction after an upside rally. We expect the uptrend in RS chart to

resume in coming months. We would like to maintain an OUTPERFORMER on the

stock as of now.

Reliance Ind: Monthly Chart

RIL/Nifty: Weekly Relative Strength Chart

Page | 5 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Infosys (CMP Rs 1038)

• Infosys has given a breakout after sideways consolidation. From here we expect VIEW : MARKETPERFORMER

the stock to head towards 1080 and 1110 levels

• The Weekly Relative Strength Chart of Infy Vis a vis NIFTY has breached out of its BUYING ZONE: CMP.for a target of

downward sloping channel. From here we would like to maintain our view of 1080 and 1110

MARKETPERFORMER on the stock.

Infosys Monthly Chart

Infosys/Nifty: Weekly Relative Strength Chart

Page | 6 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

ITC (CMP Rs 263)

• ITC has not recovered after the sudden fall. From here we expect ITC to head VIEW: UNDERPERFORMER

towards 240‐235 levels.

• The Weekly Relative Strength Chart of ITC Vis a vis NIFTY continues its downfall. BUYING ZONE: AOID

We would like to downgrade ITC to UNDER PERFORMER .

ITC Monthly Chart

ITC/Nifty: Weekly Relative Strength Chart

Page | 7 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

ICICI Bank (CMP Rs 315)

• ICICI bank continues to trade in a sideways direction for past 6 months now. From VIEW: MARKETPERFORMER

here we expect a rally in the stock only on BREAKOUT of 330 levels which will the

take it to 360-370 levels which is the previous top. BUYING ZONE: BUY Above 330 levels.

• The Weekly Relative Strength Chart of ICICI Vis a vis NIFTY had breached an important

support after a breakout. From here we would like to maintain the stock as MARKET

PERFORMER.

ICICI Bank Monthly Chart

ICICI Bank/Nifty: Weekly Relative Strength Chart

Page | 8 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

TCS (CMP Rs 2666)

• TCS continues to trade in a channel as the stock fails to show any major trend. VIEW: MARKETPERFORMER

Only on the breakout of the channel, will a trend emerge in the stock. We

recommend Buying this stock only on breakout of 2730 BUYING ZONE: Buy Above 2730

• The Weekly Relative Strength Chart of TCS Vis a vis NIFTY is trading in a sideways

consodliation and can be called as a wedge formation. However we would like to

maintain a MARKETPERFORMER call on the stock till it enters a sustained bull run.

TCS Quarterly Chart

TCS/Nifty: Weekly Relative Strength Chart

Page | 9 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

L&T (CMP Rs 1261)

L&T has breached the consolidation in which the stock was trading for past 5 VIEW: OUTPERFORMER

months. A breakout of such a important resistance will lead to a new uptrend in

the index which will take it towards 1300 and 1320 levels. BUYING ZONE: Buy at CMP

The Weekly Relative Strength Chart of L&T Vis a vis NIFTY has touched an

important support and bounced from there. From here we expect the stock to

OUTPERFORM the markets

LT Monthly Chart

LT/Nifty: Weekly Relative Strength Chart

Page | 10 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Tata Motors (CMP Rs 426)

• Tata Motors is trading in a downward sloping channel for past 13 months. VIEW: MARKETPERFORMER

However only a breakout above 450 will lead to the next uptrend in the stock.

• The Weekly Relative Strength Chart of Tata Motors Vis a vis NIFTY has breached BUYING ZONE:

an important consolidation . From here we would like to maintain our outlook of

MARKET PERFORMER in the stock.

Tata Motors Monthly Chart

Tata Motors/Nifty: Weekly Relative Strength Chart

Page | 11 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Sun Pharma (CMP Rs 572)

• Sun Pharma continues to trade in downward sloping channel with prices trading VIEW: UNDERPERFORMER

at a channel support. As of now we do not see any momentum buildup on the

stock. BUYING ZONE: AVOID

• The Weekly Relative Strength Chart of Sun Pharma Vis a vis NIFTY has given a

breakout. However with no support from prices as a whole we would like to

maintain our UNDERPERFORMER stance on the stock.

Sun Pharma Monthly Chart

Sun Pharma/Nifty: Weekly Relative Strength Chart

Page | 12 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Axis Bank (CMP Rs 554)

• Axis Bank breached out of consolidation in which it has been trading for past 8 VIEW: MARKETPERFORMER

months. From here we expect the stock to head towards 590 and 620 levels.

• The Weekly Relative Strength Chart of Axis Bank Vis a vis NIFTY has breached our BUYING ZONE: BUY on BREAKOUT of

of a crucial trendline resistance. From here we would like to maintain the view of 570

to MARKET PERFORMER of the stock.

Axis Bank Monthly Chart

Axis Bank/Nifty: Weekly Relative Strength Chart

Page | 13 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Kotak Bank (CMP Rs 1006)

• Kotak Bank is trading in a sideways consolidation and from here only a breakout VIEW: UNDERPERFORMER

above 1070 will lead to the next rally in the stock.

• The Weekly Relative Strength Chart of KOTAK BANK Vis a vis NIFTY is trading in a BUYING ZONE: Only on BREAKOUT of

downside direction. We continue see a drop in Relative Chart of Kotak Bank. We 1070

continue with our UNDERPERFORMANCE stance on Kotak bank.

Kotak Bank Monthly Chart

Kotak Bank /Nifty: Weekly Relative Strength Chart

Page | 14 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

IndusInd Bank (CMP Rs 1652)

VIEW: OUTPERFORMER

• Indusind Bank has has touched an important trendline resistance and has been in a

corrective trend. From here we expect the stock to breakout of the consolidation BUYING ZONE: Above 1750

and head towards a target of 1800‐1850 levels.

• The Weekly Relative Strength Chart of Indusind Bank Vis a vis NIFTY has breached

an important trendline support. However we feel that relative to most of the

banks the stock is an OUTPERFORMER .

Indusind Bank Monthly Chart

Indusind Bank/Nifty: Weekly Relative Strength Chart

Page | 15 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

M&M (CMP Rs 747)

• M&M has breached out of its sideways consolidation and from here we expect VIEW: MARKETPERFORMER

the stock to head towards 780 and 820 levels

• The Weekly Relative Strength Chart of M&M Vis a vis NIFTY hs breached out of BUYING ZONE: CMP: for a target of 780

Downside consolidation in which it had been trading since June 2016. From here and 820

we expect the stock to OUTPERFORM

M&M Monthly Chart

M&M/Nifty: Weekly Relative Strength Chart

Page | 16 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Hindustan Unilever (CMP Rs 1367)

• Hindustan Unilever has breached out of consolidation and from here we expect a VIEW: OUTPERFORMER

Rally in the stock which can see it towards 1450-1480 levels.

• The Weekly Relative Strength Chart of Hindustan Unilever Vis a vis NIFTY has BUYING ZONE: At CMP

given a breakout from its previous high. From here we continue to hold our view

of OUTPERFORMANCE on the stock.

Hindustan Unilever: Weekly Chart

Hindustan Unilever /Nifty: Weekly Relative Strength Chart

Page | 17 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Maruti (CMP Rs 9733)

• Maruti continues to trade in the bullish trend as prices continue to make a higher VIEW: OUTPERFORMER

high and higher low. From here we expect the stock to head towards 10,00-10300

levels. BUYING ZONE: BUY at CMP

• The Weekly Relative Strength Chart of MARUTI Vis a vis NIFTY continues to

OUTPERFORM. As of now we would like to maintain this status of Maruti

Maruti Monthly Chart

Maruti /Nifty: Weekly Relative Strength Chart

Page | 18 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

SBI (CMP Rs 310)

• SBI tried to breach the important consolidation in which it has been trading for VIEW: MARKETPERFORMER

past 29 quarters. However the prices did not sustain the breakout and fell below

the important trendline level. However we feel that the breakout will occur in BUYING ZONE: Buy Above 320

next 2 quarters.

• The Weekly Relative Strength Chart of SBI Vis a vis NIFTY has reversed because of

sudden rise but is still shy to breach the trendline resistance. From here we would

like to maintain MARKETPERFORMER on the stock and wait for the breakout.

SBI Quarterly Chart

SBI/Nifty: Weekly Relative Strength Chart

Page | 19 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Asian Paints (CMP Rs 1168)

• Asian paints has been trading in a sideways consolidation and only a breakout VIEW: UNDERPERFORMER

above 1260 will lead to next uptrend in the stock.

• The Weekly Relative Strength Chart of ASIAN PAINTS Vis a vis NIFTY has been BUYING ZONE: AVOID

turned in a downside direction. From here we expect the stock to

UNDERPERFORM the index.

Asian Paints Monthly Chart

Asian paints /Nifty: Weekly Relative Strength Chart

Page | 20 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

HCL Tech (CMP Rs 901)

• HCL Tech is trading below an important trendline support which was holding the VIEW: MARKETPERFORMER

stock for past 5 quarters. We feel that this is a significant breakdown and from

here HCL tech can go down further towards 970-1000 levels. BUYING ZONE: Buy at CMP

• The Weekly Relative Strength Chart of HCL Tech Vis a vis NIFTY continues to trade

in the sideways direction with breakout still Far away. We would like to continue

with our call of MARKET PERFORMER on the stock.

HCL Tech Monthly Chart

HCL Tech/Nifty: Weekly Relative Strength Chart

Page | 21 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

HeroMoto Corp (CMP Rs 3777)

• HeroMoto is presently trading on an important trendline support. From here we VIEW: UNDERPERFORMER

expect some consolidation and expect it to head towards 4000-4200 levels.

• The Weekly Relative Strength Chart of Hero Moto Vis a vis NIFTY is on an important BUYING ZONE:

support zone. From here we would like to maintain UNDERPERFORMER in the stock.

Hero Moto Corp Monthly Chart

HeroMoto Corp /Nifty: Weekly Relative Strength Chart

Page | 22 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Ultratech (CMP Rs 4320)

• Ultratech Cement has rallied after a correction which lasted for 5 months. From VIEW: OUTPERFORMER

here we expect the stock prices to continue their upsdie rally and head towards

4700 and 5000 levels. BUYING ZONE: CMP

• The Weekly Relative Strength Chart of Ultratech Vis a vis NIFTY has bounced from

its important support and from here we would like to maintain our

OUTPERFORMER stand on the stock

Ultratech Monthly Chart

HDFC/Nifty: Weekly Relative Strength Chart

Page | 23 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Bharti Airtel (CMP Rs 530)

• Bharti airtel has breached an important resistance zone on Quarterly chart and VIEW: OUTPERFORMER

from here we expect the stock to start a new uptrend which will take it towards

its previous top of 590 and beyond. BUYING ZONE: CMP

• The Weekly Relative Strength Chart of Bharti Vis a vis NIFTY had breached an

important resistance to start a new uptrend. However we continue to be an

OUTPRFORMER in the stock.

Bharti Airtel Quarterly Chart

Bharti Airtel /Nifty: Weekly Relative Strength Chart

Page | 24 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Yes Bank (CMP Rs 315)

• Yes Bank has breached an important trendline support and form here we see a VIEW: DOWN GRADE to

potential weakness in the stock. Technically the stock can head towards 280 to UNDERPERFORMER from

250 levels. MARKETPERFORMER

• The Weekly Relative Strength Chart of Yes Bank Vis a vis NIFTY has breached out

of its important support . From here we would like to DOWNFRADE the stock BUYING ZONE: AVOID

to UNDERPERFORMER from MARKET PERFORMER

YES BANK Monthly Chart

YES BANK/Nifty: Weekly Relative Strength Chart

Page | 25 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

ONGC (CMP Rs 195)

• ONGC is consolidating in the sideways direction after a rally and only a breakout VIEW: MARKETPERFORMER

above 208 will lead to next round of rally.

• The Weekly Relative Strength Chart of ONGC vis a vis Nifty has also breached an BUYING ZONE: ABOVE 206

important resistance and from here we would like to maintain our view of

MARKETPERFORMER on the stock.

ONGC Monthly Chart

ONGC/Nifty: Weekly Relative Strength Chart

Page | 26 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Vedanta (CMP Rs 330)

• Vedl is in an uptrend and from here it is expected to head towards 340 to 370 VIEW: OUTPERFORMER

levels which is the important channel resistance.

• The Weekly Relative Strength Chart of VEDL Vis a vis NIFTY continues to be in an BUYING ZONE: CMP

uptrend and from here we continue to expect the stock to be an OUTPERFORMER

VEDL : Monthly Chart

VEDL/Nifty: Weekly Relative Strength Chart

Page | 27 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Rating Methodology

We rate stock on absolute return basis. Our target price for the stocks has an investment horizon of one year.

Rating Criteria Definition

BUY >= +15% Target price is equal to or more than 15% of current market price

NEUTRAL -15% > to < +15% Target price is less than +15% but more than -15%

SELL <= -15% Target price is less than or equal to -15%.

Management

Vineet Bhatnagar (Managing Director) (91 22) 2483 1919

Kinshuk Bharti Tiwari (Head – Institutional Equity) (91 22) 6246 4101

Jignesh Shah (Head – Equity Derivatives) (91 22) 6667 9735

Research

Automobiles Engineering, Capital Goods Pharma & Specialty Chem

Dhawal Doshi (9122) 6246 4128 Jonas Bhutta (9122) 6246 4119 Surya Patra (9122) 6246 4121

Nitesh Sharma, CFA (9122) 6246 4126 Vikram Rawat (9122) 6246 4120 Mehul Sheth (9122) 6246 4123

Banking, NBFCs IT Services & Infrastructure Strategy

Manish Agarwalla (9122) 6246 4125 Vibhor Singhal (9122) 6246 4109 Naveen Kulkarni, CFA, FRM (9122) 6246 4122

Pradeep Agrawal (9122) 6246 4113 Shyamal Dhruve (9122) 6246 4110 Neeraj Chadawar (9122) 6246 4116

Paresh Jain (9122) 6246 4114 Logistics, Transportation & Midcap Telecom

Consumer & Retail Vikram Suryavanshi (9122) 6246 4111 Naveen Kulkarni, CFA, FRM (9122) 6246 4122

Naveen Kulkarni, CFA, FRM (9122) 6246 4122 Media

Preeyam Tolia (9122) 6246 4129 Naveen Kulkarni, CFA, FRM (9122) 6246 4122 Technicals

Vishal Gutka (9122) 6246 4118 Vishal Gutka (9122) 6246 4118 Subodh Gupta, CMT (9122) 6246 4136

Cement Metals Production Manager

Vaibhav Agarwal (9122) 6246 4124 Dhawal Doshi (9122) 6246 4128 Ganesh Deorukhkar (9122) 6667 9966

Economics Vipul Agrawal (9122) 6246 4127 Editor

Anjali Verma (9122) 6246 4115 Mid-Caps Roshan Sony 98199 72726

Shruti Bajpai (9122) 6246 4135 Deepak Agarwal (9122) 6246 4112 Sr. Manager – Equities Support

Oil & Gas Rosie Ferns (9122) 6667 9971

Sabri Hazarika (9122) 6246 4130

Sales & Distribution Corporate Communications

Ashvin Patil (9122) 6246 4105 Asia Sales Zarine Damania (9122) 6667 9976

Kishor Binwal (9122) 6246 4106 Dhawal Shah 8522 277 6747

Bhavin Shah (9122) 6246 4102 Sales Trader

Ashka Mehta Gulati (9122) 6246 4108 Dilesh Doshi (9122) 6667 9747 Execution

Archan Vyas (9122) 6246 4107 Suniil Pandit (9122) 6667 9745 Mayur Shah (9122) 6667 9945

Contact Information (Regional Member Companies)

SINGAPORE: Phillip Securities Pte Ltd MALAYSIA: Phillip Capital Management Sdn Bhd HONG KONG: Phillip Securities (HK) Ltd

250 North Bridge Road, #06-00 RafflesCityTower, B-3-6 Block B Level 3, Megan Avenue II, 11/F United Centre 95 Queensway Hong Kong

Singapore 179101 No. 12, Jalan Yap Kwan Seng, 50450 Kuala Lumpur Tel (852) 2277 6600 Fax: (852) 2868 5307

Tel : (65) 6533 6001 Fax: (65) 6535 3834 Tel (60) 3 2162 8841 Fax (60) 3 2166 5099 www.phillip.com.hk

www.phillip.com.sg www.poems.com.my

JAPAN: Phillip Securities Japan, Ltd INDONESIA: PT Phillip Securities Indonesia CHINA: Phillip Financial Advisory (Shanghai) Co. Ltd.

4-2 Nihonbashi Kabutocho, Chuo-ku ANZTower Level 23B, Jl Jend Sudirman Kav 33A, No 550 Yan An East Road, OceanTower Unit 2318

Tokyo 103-0026 Jakarta 10220, Indonesia Shanghai 200 001

Tel: (81) 3 3666 2101 Fax: (81) 3 3664 0141 Tel (62) 21 5790 0800 Fax: (62) 21 5790 0809 Tel (86) 21 5169 9200 Fax: (86) 21 6351 2940

www.phillip.co.jp www.phillip.co.id www.phillip.com.cn

THAILAND: Phillip Securities (Thailand) Public Co. Ltd. FRANCE: King & Shaxson Capital Ltd. UNITED KINGDOM: King & Shaxson Ltd.

15th Floor, VorawatBuilding, 849 Silom Road, 3rd Floor, 35 Rue de la Bienfaisance 6th Floor, Candlewick House, 120 Cannon Street

Silom, Bangrak, Bangkok 10500 Thailand 75008 Paris France London, EC4N 6AS

Tel (66) 2 2268 0999 Fax: (66) 2 2268 0921 Tel (33) 1 4563 3100 Fax : (33) 1 4563 6017 Tel (44) 20 7929 5300 Fax: (44) 20 7283 6835

www.phillip.co.th www.kingandshaxson.com www.kingandshaxson.com

UNITED STATES: Phillip Futures Inc. AUSTRALIA: PhillipCapital Australia SRI LANKA: Asha Phillip Securities Limited

141 W Jackson Blvd Ste 3050 Level 10, 330 Collins Street Level 4, Millennium House, 46/58 Navam Mawatha,

The Chicago Board of TradeBuilding Melbourne, VIC 3000, Australia Colombo 2, Sri Lanka

Chicago, IL 60604 USA Tel: (61) 3 8633 9800 Fax: (61) 3 8633 9899 Tel: (94) 11 2429 100 Fax: (94) 11 2429 199

Tel (1) 312 356 9000 Fax: (1) 312 356 9005 www.phillipcapital.com.au www.ashaphillip.net/home.htm

INDIA

PhillipCapital (India) Private Limited

No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400013 Tel: (9122) 2483 1919 Fax: (9122) 6667 9955 www.phillipcapital.in

Page | 28 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Disclosures and Disclaimers

PhillipCapital (India) Pvt. Ltd. has three independent equity research groups: Institutional Equities, Institutional Equity Derivatives, and Private Client Group.

This report has been prepared by Institutional Equities Group. The views and opinions expressed in this document may, may not match, or may be contrary at

times with the views, estimates, rating, and target price of the other equity research groups of PhillipCapital (India) Pvt. Ltd.

This report is issued by PhillipCapital (India) Pvt. Ltd., which is regulated by the SEBI. PhillipCapital (India) Pvt. Ltd. is a subsidiary of Phillip (Mauritius) Pvt. Ltd.

References to "PCIPL" in this report shall mean PhillipCapital (India) Pvt. Ltd unless otherwise stated. This report is prepared and distributed by PCIPL for

information purposes only, and neither the information contained herein, nor any opinion expressed should be construed or deemed to be construed as

solicitation or as offering advice for the purposes of the purchase or sale of any security, investment, or derivatives. The information and opinions contained in

the report were considered by PCIPL to be valid when published. The report also contains information provided to PCIPL by third parties. The source of such

information will usually be disclosed in the report. Whilst PCIPL has taken all reasonable steps to ensure that this information is correct, PCIPL does not offer

any warranty as to the accuracy or completeness of such information. Any person placing reliance on the report to undertake trading does so entirely at his or

her own risk and PCIPL does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements

and past performance is not necessarily an indication of future performance.

This report does not regard the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report.

Investors must undertake independent analysis with their own legal, tax, and financial advisors and reach their own conclusions regarding the appropriateness

of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future

prospects may not be realised. Under no circumstances can it be used or considered as an offer to sell or as a solicitation of any offer to buy or sell the

securities mentioned within it. The information contained in the research reports may have been taken from trade and statistical services and other sources,

which PCIL believe is reliable. PhillipCapital (India) Pvt. Ltd. or any of its group/associate/affiliate companies do not guarantee that such information is accurate

or complete and it should not be relied upon as such. Any opinions expressed reflect judgments at this date and are subject to change without notice.

Important: These disclosures and disclaimers must be read in conjunction with the research report of which it forms part. Receipt and use of the research

report is subject to all aspects of these disclosures and disclaimers. Additional information about the issuers and securities discussed in this research report is

available on request.

Certifications: The research analyst(s) who prepared this research report hereby certifies that the views expressed in this research report accurately reflect the

research analyst’s personal views about all of the subject issuers and/or securities, that the analyst(s) have no known conflict of interest and no part of the

research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific views or recommendations contained in this research report.

Additional Disclosures of Interest:

Unless specifically mentioned in Point No. 9 below:

1. The Research Analyst(s), PCIL, or its associates or relatives of the Research Analyst does not have any financial interest in the company(ies) covered in

this report.

2. The Research Analyst, PCIL or its associates or relatives of the Research Analyst affiliates collectively do not hold more than 1% of the securities of the

company (ies)covered in this report as of the end of the month immediately preceding the distribution of the research report.

3. The Research Analyst, his/her associate, his/her relative, and PCIL, do not have any other material conflict of interest at the time of publication of this

research report.

4. The Research Analyst, PCIL, and its associates have not received compensation for investment banking or merchant banking or brokerage services or for

any other products or services from the company(ies) covered in this report, in the past twelve months.

5. The Research Analyst, PCIL or its associates have not managed or co-managed in the previous twelve months, a private or public offering of securities for

the company (ies) covered in this report.

6. PCIL or its associates have not received compensation or other benefits from the company(ies) covered in this report or from any third party, in

connection with the research report.

7. The Research Analyst has not served as an Officer, Director, or employee of the company (ies) covered in the Research report.

8. The Research Analyst and PCIL has not been engaged in market making activity for the company(ies) covered in the Research report.

9. Details of PCIL, Research Analyst and its associates pertaining to the companies covered in the Research report:

Sr. no. Particulars Yes/No

1 Whether compensation has been received from the company(ies) covered in the Research report in the past 12 months for No

investment banking transaction by PCIL

2 Whether Research Analyst, PCIL or its associates or relatives of the Research Analyst affiliates collectively hold more than 1% of No

the company(ies) covered in the Research report

3 Whether compensation has been received by PCIL or its associates from the company(ies) covered in the Research report No

4 PCIL or its affiliates have managed or co-managed in the previous twelve months a private or public offering of securities for the No

company(ies) covered in the Research report

5 Research Analyst, his associate, PCIL or its associates have received compensation for investment banking or merchant banking or No

brokerage services or for any other products or services from the company(ies) covered in the Research report, in the last twelve

months

Independence: PhillipCapital (India) Pvt. Ltd. has not had an investment banking relationship with, and has not received any compensation for investment

banking services from, the subject issuers in the past twelve (12) months, and PhillipCapital (India) Pvt. Ltd does not anticipate receiving or intend to seek

compensation for investment banking services from the subject issuers in the next three (3) months. PhillipCapital (India) Pvt. Ltd is not a market maker in the

securities mentioned in this research report, although it, or its affiliates/employees, may have positions in, purchase or sell, or be materially interested in any

of the securities covered in the report.

Suitability and Risks: This research report is for informational purposes only and is not tailored to the specific investment objectives, financial situation or

particular requirements of any individual recipient hereof. Certain securities may give rise to substantial risks and may not be suitable for certain investors.

Each investor must make its own determination as to the appropriateness of any securities referred to in this research report based upon the legal, tax and

accounting considerations applicable to such investor and its own investment objectives or strategy, its financial situation and its investing experience. The

value of any security may be positively or adversely affected by changes in foreign exchange or interest rates, as well as by other financial, economic, or

political factors. Past performance is not necessarily indicative of future performance or results.

Page | 29 | PHILLIPCAPITAL INDIA RESEARCH

THE 20:80 REPORT TECHNICALS UPDATE

Sources, Completeness and Accuracy: The material herein is based upon information obtained from sources that PCIPL and the research analyst believe to be

reliable, but neither PCIPL nor the research analyst represents or guarantees that the information contained herein is accurate or complete and it should not

be relied upon as such. Opinions expressed herein are current opinions as of the date appearing on this material, and are subject to change without notice.

Furthermore, PCIPL is under no obligation to update or keep the information current. Without limiting any of the foregoing, in no event shall PCIL, any of its

affiliates/employees or any third party involved in, or related to computing or compiling the information have any liability for any damages of any kind

including but not limited to any direct or consequential loss or damage, however arising, from the use of this document.

Copyright: The copyright in this research report belongs exclusively to PCIPL. All rights are reserved. Any unauthorised use or disclosure is prohibited. No

reprinting or reproduction, in whole or in part, is permitted without the PCIPL’s prior consent, except that a recipient may reprint it for internal circulation only

and only if it is reprinted in its entirety.

Caution: Risk of loss in trading/investment can be substantial and even more than the amount / margin given by you. Investment in securities market are

subject to market risks, you are requested to read all the related documents carefully before investing. You should carefully consider whether

trading/investment is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances. PhillipCapital and any of

its employees, directors, associates, group entities, or affiliates shall not be liable for losses, if any, incurred by you. You are further cautioned that

trading/investments in financial markets are subject to market risks and are advised to seek independent third party trading/investment advice outside

PhillipCapital/group/associates/affiliates/directors/employees before and during your trading/investment. There is no guarantee/assurance as to returns or

profits or capital protection or appreciation. PhillipCapital and any of its employees, directors, associates, and/or employees, directors, associates of

PhillipCapital’s group entities or affiliates is not inducing you for trading/investing in the financial market(s). Trading/Investment decision is your sole

responsibility. You must also read the Risk Disclosure Document and Do’s and Don’ts before investing.

Kindly note that past performance is not necessarily a guide to future performance.

For Detailed Disclaimer: Please visit our website www.phillipcapital.in

For U.S. persons only: This research report is a product of PhillipCapital (India) Pvt Ltd., which is the employer of the research analyst(s) who has prepared the

research report. The research analyst(s) preparing the research report is/are resident outside the United States (U.S.) and are not associated persons of any

U.S.-regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are not required to satisfy the

regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among other things, communications with

a subject company, public appearances, and trading securities held by a research analyst account.

This report is intended for distribution by PhillipCapital (India) Pvt Ltd. only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S.

Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by the U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a

6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return the same to the

sender. Further, this report may not be copied, duplicated, and/or transmitted onward to any U.S. person, which is not a Major Institutional Investor.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain

business with Major Institutional Investors, PhillipCapital (India) Pvt Ltd. has entered into an agreement with a U.S. registered broker-dealer, Decker & Co, LLC.

Transactions in securities discussed in this research report should be effected through Decker & Co, LLC or another U.S. registered broker dealer.

If Distribution is to Australian Investors

This report is produced by PhillipCapital (India) Pvt Ltd and is being distributed in Australia by Phillip Capital Limited (Australian Financial Services Licence No.

246827).

This report contains general securities advice and does not take into account your personal objectives, situation and needs. Please read the Disclosures and

Disclaimers set out above. By receiving or reading this report, you agree to be bound by the terms and limitations set out above. Any failure to comply with

these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced,

distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the

sender immediately.

PhillipCapital (India) Pvt. Ltd.

Registered office: No. 1, 18th Floor, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel West, Mumbai 400013

Page | 30 | PHILLIPCAPITAL INDIA RESEARCH

You might also like

- Introduction To Stock MarketDocument108 pagesIntroduction To Stock Marketsvmani100% (6)

- RR 9-98Document5 pagesRR 9-98matinikkiNo ratings yet

- PruLink Surrender Form PDFDocument4 pagesPruLink Surrender Form PDFHui Jia JunnNo ratings yet

- DSP FIDELITYWorksheetDocument6 pagesDSP FIDELITYWorksheetvivek_recNo ratings yet

- Kotak Harsha Upadhyaya PortfolioDocument8 pagesKotak Harsha Upadhyaya PortfoliomiddlecricketwarriorsNo ratings yet

- ValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Document6 pagesValueResearchFundcard BirlaSunLifeFrontlineEquity 2011apr20Venkatesh VijayakumarNo ratings yet

- Market Outlook 2Document26 pagesMarket Outlook 2amrejpal773No ratings yet

- 62 Solvency Ratio of General InsurersDocument6 pages62 Solvency Ratio of General InsurersAnirudh BommiNo ratings yet

- ValueResearchFundcard QuantumLongTermEquity 2011jan06Document6 pagesValueResearchFundcard QuantumLongTermEquity 2011jan06jayaram_mca83No ratings yet

- FinsSoc Zerodha 1 - Introduction To Stock MarketsDocument80 pagesFinsSoc Zerodha 1 - Introduction To Stock MarketsShuvam GuptaNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- HTTPS: - Zerodha-Common.s3.ap-South-1.amazonaws - Com - Varsity - Modules - Module 1 - Introduction To Stock Markets PDFDocument111 pagesHTTPS: - Zerodha-Common.s3.ap-South-1.amazonaws - Com - Varsity - Modules - Module 1 - Introduction To Stock Markets PDFbhaveshNo ratings yet

- Etwm MP 21 1 Col R1.inddDocument1 pageEtwm MP 21 1 Col R1.inddsekhargNo ratings yet

- Module 1 Introduction To Stock MarketsDocument111 pagesModule 1 Introduction To Stock MarketsManpreet Singh JassalNo ratings yet

- VarsityDocument1,483 pagesVarsityBharath kumarNo ratings yet

- Zerodha Stock Market PDFDocument108 pagesZerodha Stock Market PDFAnshu GauravNo ratings yet

- Module 1 - Introduction To Stock MarketsDocument111 pagesModule 1 - Introduction To Stock Marketskjhbgv bnmk,lNo ratings yet

- Trade Performance and Fund Flow Week Ended 9 February 2024-258Document5 pagesTrade Performance and Fund Flow Week Ended 9 February 2024-258Shabandi MnNo ratings yet

- Year Oil Palm Planted Area (Hectares) Production of CPO (Tonnes) Exports of Palm Oil (Tonnes)Document8 pagesYear Oil Palm Planted Area (Hectares) Production of CPO (Tonnes) Exports of Palm Oil (Tonnes)Shaeera sulaimanNo ratings yet

- Comparison of All Mutual Funds: Anish Vyas Roll No: 2Document12 pagesComparison of All Mutual Funds: Anish Vyas Roll No: 2Anish VyasNo ratings yet

- Factsheet Nifty500 ShariahDocument2 pagesFactsheet Nifty500 ShariahAejaz shaikhNo ratings yet

- Level 1Document111 pagesLevel 1Amol PatilNo ratings yet

- Apparel Sector SheetDocument3 pagesApparel Sector SheetSmriti DurehaNo ratings yet

- Financial Accounting: Bharti Airtel LimitedDocument75 pagesFinancial Accounting: Bharti Airtel Limitedadani9No ratings yet

- Banana Pack HouseDocument5 pagesBanana Pack Housevskaarthi100% (2)

- ValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Document4 pagesValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Rahul AnandNo ratings yet

- Sip-Week1: Submitted To Dr. (Prof.) Hanish Rajpal Presented by - Priyanka Valechha 201911030Document7 pagesSip-Week1: Submitted To Dr. (Prof.) Hanish Rajpal Presented by - Priyanka Valechha 201911030priyanka valechhaNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFPankaj LodwalNo ratings yet

- ValueResearchFundcard RelianceGrowth 2010dec30Document6 pagesValueResearchFundcard RelianceGrowth 2010dec30Maulik DoshiNo ratings yet

- 6 October, 2023: Suma Vinayak UpparattiDocument36 pages6 October, 2023: Suma Vinayak Upparattinaishal.pNo ratings yet

- ValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Document6 pagesValueResearchFundcard ICICIPrudentialGrowthInstI 2011mar14Ravindra MisalNo ratings yet

- Solvency Ratio of Life InsurersDocument2 pagesSolvency Ratio of Life InsurersSundararajan SrinivasanNo ratings yet

- Annual Report 2000Document43 pagesAnnual Report 2000Enamul HaqueNo ratings yet

- JM Daily - 23 Aug - EquityDocument183 pagesJM Daily - 23 Aug - EquityPravin SinghNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Prashant DalviNo ratings yet

- Insights EdelMFDocument81 pagesInsights EdelMFSindhuja AvinashNo ratings yet

- Value Research Fundcard - Aditya Birla Sun Life New Millennium Fund-2018 Apr 16Document4 pagesValue Research Fundcard - Aditya Birla Sun Life New Millennium Fund-2018 Apr 16hotalamNo ratings yet

- ValueResearchFundcard AIGIndiaEquityReg 2011may02Document6 pagesValueResearchFundcard AIGIndiaEquityReg 2011may02Chetan SinhaNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- ValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26Document4 pagesValueResearchFundcard AdityaBirlaSunLifeFrontlineEquityFund 2018jun26James HughesNo ratings yet

- June 30, 2017: Portfolio Characteristics StatisticsDocument2 pagesJune 30, 2017: Portfolio Characteristics StatisticsAnonymous 5mSMeP2jNo ratings yet

- ValueResearchFundcard Kotak50RegularPlan 2018jan21Document4 pagesValueResearchFundcard Kotak50RegularPlan 2018jan21rdhNo ratings yet

- Introduction To Nepali Stock Market Final FinalDocument75 pagesIntroduction To Nepali Stock Market Final FinalAadarsh AkshyataNo ratings yet

- ValueResearchFundcard L&TMidcapFund DirectPlanDocument4 pagesValueResearchFundcard L&TMidcapFund DirectPlanreachrajatNo ratings yet

- Foreword I-3 Acknowledgement I-5 About NISM Certifications I-7 About The NISM-Series-XI: Equity Sales Certification Examination I-9Document4 pagesForeword I-3 Acknowledgement I-5 About NISM Certifications I-7 About The NISM-Series-XI: Equity Sales Certification Examination I-9ABC 123No ratings yet

- Fundcard: Indiabulls Bluechip FundDocument4 pagesFundcard: Indiabulls Bluechip FundashokarunachalamNo ratings yet

- Symbol Underlying Asset Open HighDocument6 pagesSymbol Underlying Asset Open HighutkarshgadiaNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- Sector-Wise PLF (%) Targets and Achievements: APRIL, 07 - JULY, 07 JULY, 07Document1 pageSector-Wise PLF (%) Targets and Achievements: APRIL, 07 - JULY, 07 JULY, 07Udhayakumar VenkataramanNo ratings yet

- RelianceTaxSaver (ELSS) Fund 2017jul25Document4 pagesRelianceTaxSaver (ELSS) Fund 2017jul25Krishnan ChockalingamNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- ValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02Document4 pagesValueResearchFundcard KotakTaxSaver DirectPlan 2019aug02JoydeepSuklabaidyaNo ratings yet

- Ind Next50Document2 pagesInd Next50blessNo ratings yet

- 1 Vermicelli: Project Profiles - MP Agros Global Agrisystem Pvt. Ltd. Your Partner in Agri-Business 1Document6 pages1 Vermicelli: Project Profiles - MP Agros Global Agrisystem Pvt. Ltd. Your Partner in Agri-Business 1Chilton John DuatNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Javal ChaniyaraNo ratings yet

- HTC 3Q14 Investor Conference Final PDFDocument15 pagesHTC 3Q14 Investor Conference Final PDFyaposiNo ratings yet

- Marico RatiosDocument2 pagesMarico RatiosAbhay Kumar SinghNo ratings yet

- ValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18Document4 pagesValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18santoshk.mahapatraNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeFrom EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeNo ratings yet

- BLT Final Pre-Boards NCPARDocument12 pagesBLT Final Pre-Boards NCPARlorenceabad07No ratings yet

- Correspondent Bank Charges For International Transfers Fixed ChargesDocument5 pagesCorrespondent Bank Charges For International Transfers Fixed ChargesManikandanNo ratings yet

- واقع تطبيق إتفاقية بازل III في النظام المصرفي الجزائري دراسة حالة بنك الفلاحة والتنمية الريفيةDocument11 pagesواقع تطبيق إتفاقية بازل III في النظام المصرفي الجزائري دراسة حالة بنك الفلاحة والتنمية الريفيةChaima BouguerraNo ratings yet

- RBS Turriff Branch Closure FactsheetDocument6 pagesRBS Turriff Branch Closure FactsheetMy TurriffNo ratings yet

- Essential For Islamic Finance 2012Document90 pagesEssential For Islamic Finance 2012voguishrock927No ratings yet

- Assgmt1 2 ProbDocument14 pagesAssgmt1 2 ProbSyurga Fathonah0% (2)

- Word Formation Prov VDocument4 pagesWord Formation Prov VAnonymous BF9P5gWINo ratings yet

- Placement Consultants in Bangalore: Christ Career SolutionsDocument6 pagesPlacement Consultants in Bangalore: Christ Career SolutionsSumit LalwaniNo ratings yet

- My Persimmon BrochureDocument6 pagesMy Persimmon BrochureSarith SamarajeewaNo ratings yet

- Arc Exploration Limited: Appendix 5BDocument4 pagesArc Exploration Limited: Appendix 5BJackzidNo ratings yet

- Merger and Acquisition in Indian Banking Sector: A Case Study of Bank of BarodaDocument21 pagesMerger and Acquisition in Indian Banking Sector: A Case Study of Bank of BarodaAishwarya LakshmiNo ratings yet

- Property HeroesDocument18 pagesProperty HeroesAnonymous KUGdwwb4iXNo ratings yet

- Wallstreetjournal 20190930 TheWallStreetJournalDocument30 pagesWallstreetjournal 20190930 TheWallStreetJournalAmmi Julian0% (1)

- Literature ReviewDocument9 pagesLiterature ReviewAnkur Upadhyay0% (1)

- Esearch Ethodology: (Type Text)Document65 pagesEsearch Ethodology: (Type Text)Majeed MujawarNo ratings yet

- Wollega University Shambu Campus: Advisor: Adugna (MSC)Document38 pagesWollega University Shambu Campus: Advisor: Adugna (MSC)Adugna Megenasa100% (1)

- Analyzing A Bank's Financial StatementsDocument8 pagesAnalyzing A Bank's Financial StatementsMinh Thu Nguyen100% (1)

- BYJUS k10Document24 pagesBYJUS k10victor dNo ratings yet

- IN RE: OLD CARCO, LLC (DONOFRIO - PIDGEON) - 6340 - Affidavit of Service of Steven Indelicato - Nysb-Mega-12607848843 6340Document16 pagesIN RE: OLD CARCO, LLC (DONOFRIO - PIDGEON) - 6340 - Affidavit of Service of Steven Indelicato - Nysb-Mega-12607848843 6340Jack RyanNo ratings yet

- Act 153 Islamic Development Bank Act 1975Document10 pagesAct 153 Islamic Development Bank Act 1975Adam Haida & CoNo ratings yet

- QB GSTDocument12 pagesQB GSTJeevitha ReddyNo ratings yet

- Ayesha Internship 2 PDFDocument59 pagesAyesha Internship 2 PDFAisha rashidNo ratings yet

- ArundeepDocument3 pagesArundeepapi-533037897No ratings yet

- Jan 1st Week Top60 (Eng) by ACDocument43 pagesJan 1st Week Top60 (Eng) by ACThe ShayarNo ratings yet

- Marifas Practical Guide To Islamic Banking and FinanceDocument244 pagesMarifas Practical Guide To Islamic Banking and FinanceClaudia Stefania100% (1)

- Kore BankDocument2 pagesKore BankOzz UychNo ratings yet

- Airmech EngineersDocument2 pagesAirmech EngineersSUNIL PATELNo ratings yet

- Section 20Document2 pagesSection 20einel dcNo ratings yet