Professional Documents

Culture Documents

Other Comprehensive Income

Other Comprehensive Income

Uploaded by

Maan Caboles0 ratings0% found this document useful (0 votes)

13 views2 pagesOther comprehensive income comprises items of income and expenses not recognized in profit or loss under PFRSs. Reclassification adjustments transfer amounts from other comprehensive income to profit or loss in the current period that were recognized in other comprehensive income in the current or previous periods, such as revaluation surplus from disposed property, plant, and equipment or unrealized gains/losses on equity instruments measured at fair value through other comprehensive income transferred to retained earnings upon derecognition. The components of other comprehensive income have different reclassification rules.

Original Description:

Accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOther comprehensive income comprises items of income and expenses not recognized in profit or loss under PFRSs. Reclassification adjustments transfer amounts from other comprehensive income to profit or loss in the current period that were recognized in other comprehensive income in the current or previous periods, such as revaluation surplus from disposed property, plant, and equipment or unrealized gains/losses on equity instruments measured at fair value through other comprehensive income transferred to retained earnings upon derecognition. The components of other comprehensive income have different reclassification rules.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views2 pagesOther Comprehensive Income

Other Comprehensive Income

Uploaded by

Maan CabolesOther comprehensive income comprises items of income and expenses not recognized in profit or loss under PFRSs. Reclassification adjustments transfer amounts from other comprehensive income to profit or loss in the current period that were recognized in other comprehensive income in the current or previous periods, such as revaluation surplus from disposed property, plant, and equipment or unrealized gains/losses on equity instruments measured at fair value through other comprehensive income transferred to retained earnings upon derecognition. The components of other comprehensive income have different reclassification rules.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

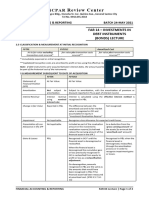

OTHER COMPREHENSIVE INCOME comprises items of income and expenses

that not recognized in profit or loss as required by other PFRSs.

RECLASSIFICATION ADJUSTMENTS

Reclassification adjustments are amounts reclassified to Pro fit or Loss in the current

period that were recognized in OCTHER COMPREHENSIVE INCOME in the current or

previous periods.

Reclassification adjustments arise, for example, on disposal of revalued

PPE. Revaluation surplus is transferred directly to retained earnings when the revalued

asset is derecognized. The CUMULATIVE UNREALIZED GAINS OR LOSSES on fair

value changes (gain or loss) of equity instrument thru FVOCI is transferred directly to

Retained Earnings when the FVOCI is derecognized.

Ex. Investment in Equity 10,000

Cash 10,000

Investment in Equity 5,000

Unrealized Gain -OCI 5,000

Unrealized Gain/Loss 1,000

Investment in Equity 1,000

When sold/derecognized:

Cash 14,000

Investment 14,000

Unrealized Gain (Cumulative) 4,000

Retained Earnings 4,000

COMPONENTS OF OTHER COMPREHENSIVE RECLASSIFICATION

INCOME

A. REVALUATION SURPLUS NO

B. UNREALIZED GAINS/LOSSES

ON EQUITYINSRUMENTS AT FAIR NO

VALUE THRU OCI

C. REMEASUREMENTS OF THE NET

NO

DEFINED BENEFIT PLAN

D. UNREALIZED GAINS/LOSSES

ON DEBT INSTRUMENTS AT FAIR YES

VALUE THRU OCI

E. TRANSALATION DIFFERENCES ON

YES

FOREIGN OPERATIONS

F. UNREALIZED GAIN OR LOSS ON

YES

DERIVATIVE OF CASH FLOW HEDGE

G. GAIN/LOSS ATTRIBUTABLE TO CREDIT

RISK OF A FINANCIAL LIABILITY DESIGNATED YES

AT FVPL

PRESENTATION OF OTHER COMPREHENSIVE INCOME

1. Net of related tax effects or

2. Before related tax effects with one amount shown for the aggregate amount of

income tax relating to those

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Budgeting ExercisesDocument3 pagesBudgeting ExercisesMaan Caboles100% (1)

- Budgeting ExercisesDocument3 pagesBudgeting ExercisesMaan Caboles100% (1)

- 6903 PPT Materials For UploadDocument13 pages6903 PPT Materials For UploadAljur SalamedaNo ratings yet

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- Investment NotesDocument12 pagesInvestment NotesLenrey CobachaNo ratings yet

- Other Comprehensive Income Reclassified Subseq. To P/L Reclassified To Retained EarningsDocument2 pagesOther Comprehensive Income Reclassified Subseq. To P/L Reclassified To Retained EarningsKonrad Lorenz Madriaga UychocoNo ratings yet

- AE 17 Lesson 03Document25 pagesAE 17 Lesson 03JAJANo ratings yet

- Preparation of Separate Financial StatementsDocument29 pagesPreparation of Separate Financial StatementschingNo ratings yet

- Investments DiscussionDocument5 pagesInvestments DiscussionKathrine CruzNo ratings yet

- PFRS PresentationDocument19 pagesPFRS PresentationHanna Shiloh MontalanNo ratings yet

- T4 - Cash Flow StatementDocument26 pagesT4 - Cash Flow StatementJhonatan Perez VillanuevaNo ratings yet

- Ap106 Investments Lecture NotesDocument6 pagesAp106 Investments Lecture NotesheyriccaNo ratings yet

- Intacc 1 Notes - Financial Assets StartDocument8 pagesIntacc 1 Notes - Financial Assets StartKing BelicarioNo ratings yet

- Financial StatementsDocument40 pagesFinancial StatementsNelzen GarayNo ratings yet

- Reclassification AdjustmentsDocument3 pagesReclassification AdjustmentsRanilo HeyanganNo ratings yet

- Didaw - OCIDocument2 pagesDidaw - OCIDoneagle VillaluzNo ratings yet

- CFAS Millan CHAPTERS 9-10Document8 pagesCFAS Millan CHAPTERS 9-10Maria Mikaela ReyesNo ratings yet

- Income Statement To The NetDocument26 pagesIncome Statement To The NetOman SherNo ratings yet

- Philippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Document13 pagesPhilippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Thalia UyNo ratings yet

- Tax Treatment of Income Sources Sources of Income Subject To Tax Within The Philippines Without The PhilippinesDocument15 pagesTax Treatment of Income Sources Sources of Income Subject To Tax Within The Philippines Without The PhilippinesGiee De GuzmanNo ratings yet

- Aggregation of IncomesDocument47 pagesAggregation of IncomesdoramonbhaiyaNo ratings yet

- The Accounting EquationDocument19 pagesThe Accounting EquationkristinejoycecamposNo ratings yet

- Other Comprehensive IncomeDocument4 pagesOther Comprehensive Incomesoonie leeNo ratings yet

- Other Comprehensive Income OciDocument5 pagesOther Comprehensive Income OciGenesis Anne MagsicoNo ratings yet

- Statement of Comprehensive IncomeDocument33 pagesStatement of Comprehensive IncomeHelda Estrada LoreteNo ratings yet

- Investment in Debt SecuritiesDocument7 pagesInvestment in Debt SecuritiesRoma Suliguin0% (1)

- CFS - Lecture Notes - Updated 2023Document53 pagesCFS - Lecture Notes - Updated 2023Kiệt Lê Hoàng TuấnNo ratings yet

- Other Comprehensive IncomeDocument5 pagesOther Comprehensive Incometikki0219No ratings yet

- VALIX - Chapter 6Document14 pagesVALIX - Chapter 6glenn langcuyanNo ratings yet

- Statement of Comprehensive IncomeDocument11 pagesStatement of Comprehensive IncomeAmiel Jay DuraNo ratings yet

- The Philippine Financial Reporting Standards: PFRS Updates TrainingDocument74 pagesThe Philippine Financial Reporting Standards: PFRS Updates TrainingMara Shaira Siega100% (1)

- Trading: Both Held For Trading or NonDocument2 pagesTrading: Both Held For Trading or NonjoyjoyjoyNo ratings yet

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsChinNo ratings yet

- Functions: DisclosesDocument10 pagesFunctions: Disclosesdownlodemaster1No ratings yet

- Cash Flow Ratios SampleDocument3 pagesCash Flow Ratios Samplewaqas akramNo ratings yet

- Cfs - Lecture Notes - Updated 2023Document49 pagesCfs - Lecture Notes - Updated 2023Thanh Uyên100% (1)

- Investment in Associate 18Document3 pagesInvestment in Associate 18gab camonNo ratings yet

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 2Document20 pagesFinancial Statement Analysis - Concept Questions and Solutions - Chapter 2stefy934100% (2)

- Cashflow: Direct Method-Accrual Method To Cash Basis. Gross Cash Receipts and Gross Cash PaymentsDocument3 pagesCashflow: Direct Method-Accrual Method To Cash Basis. Gross Cash Receipts and Gross Cash PaymentsRicci OcampoNo ratings yet

- Cbea Intact 03 Lect 02Document23 pagesCbea Intact 03 Lect 02sheeeaaannnnNo ratings yet

- NotesDocument2 pagesNotesNoella Marie BaronNo ratings yet

- CHAPTER 26 Statement of Comprehensive Income (Concept Map)Document1 pageCHAPTER 26 Statement of Comprehensive Income (Concept Map)kateyy99100% (1)

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- 2024 - Week 3 - Comm 217 Notes - Ch03Student 1to UploadDocument13 pages2024 - Week 3 - Comm 217 Notes - Ch03Student 1to Uploadsamuelrodriguezch12No ratings yet

- Presentation On Fund Flow StatementDocument20 pagesPresentation On Fund Flow StatementanishkakakakakkakNo ratings yet

- FAR.3040 Statement of Profit or Loss and OCIDocument4 pagesFAR.3040 Statement of Profit or Loss and OCITatianaNo ratings yet

- FAR 04 Investment in Debt Instruments LectureDocument4 pagesFAR 04 Investment in Debt Instruments Lecturebyunb3617No ratings yet

- PAS 27 - Separate Financial StatementsDocument1 pagePAS 27 - Separate Financial StatementsZehra LeeNo ratings yet

- Chapter 4 - RoblesDocument18 pagesChapter 4 - RoblesYesha SibayanNo ratings yet

- Accounting Unit 3Document12 pagesAccounting Unit 3alok beheraNo ratings yet

- Chapter 3 2023Document7 pagesChapter 3 2023Linh DieuNo ratings yet

- Cfas Report Pas 1 & 7Document57 pagesCfas Report Pas 1 & 7sean lawrenceNo ratings yet

- Session 03 - Part I - Presentation of Financial StatementsDocument32 pagesSession 03 - Part I - Presentation of Financial StatementsVidarshaNo ratings yet

- BIWS REIT Projection ReferenceDocument3 pagesBIWS REIT Projection ReferenceLisaNo ratings yet

- AFAR MIDTERM EXAM REVIEWER - Part 2 (With Answers)Document7 pagesAFAR MIDTERM EXAM REVIEWER - Part 2 (With Answers)AuroraNo ratings yet

- IND AS 110 - Part 2Document6 pagesIND AS 110 - Part 2pratikdubey9586No ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument14 pagesChapter 2 Statement of Comprehensive Incomemichelle cadiaoNo ratings yet

- AP 200 6 Audit of InvestmentDocument5 pagesAP 200 6 Audit of Investmentshai santiagoNo ratings yet

- Chapter 5 Investments in Equity SecuritiesDocument13 pagesChapter 5 Investments in Equity SecuritiesKrissa Mae Longos100% (2)

- 2016-Recon Retained EarningsDocument4 pages2016-Recon Retained Earningsbadette PaningbatanNo ratings yet

- Working Capital PDFDocument10 pagesWorking Capital PDFMaan CabolesNo ratings yet

- Persian Empire Report ScriptDocument3 pagesPersian Empire Report ScriptMaan CabolesNo ratings yet

- The CeltsDocument19 pagesThe CeltsMaan CabolesNo ratings yet

- Business Combination - SubsequentDocument2 pagesBusiness Combination - SubsequentMaan CabolesNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementMaan CabolesNo ratings yet

- HR Headline Facing The Workforce of The Future: Chapter 5: Managing Equal Employment and DiversityDocument26 pagesHR Headline Facing The Workforce of The Future: Chapter 5: Managing Equal Employment and DiversityMaan CabolesNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- Value Reengineering PPT DocuDocument3 pagesValue Reengineering PPT DocuMaan CabolesNo ratings yet

- HR Headline: Chapter 4: Legal Framework of HRMDocument39 pagesHR Headline: Chapter 4: Legal Framework of HRMMaan CabolesNo ratings yet

- Exercises On Hyperinflation and Cost AccountingDocument4 pagesExercises On Hyperinflation and Cost AccountingMaan CabolesNo ratings yet

- Cabinet Members of The PhilippinesDocument4 pagesCabinet Members of The PhilippinesMaan CabolesNo ratings yet

- 2 - History of ComputersDocument9 pages2 - History of ComputersMaan CabolesNo ratings yet

- Lecture 2 - HTML TableDocument16 pagesLecture 2 - HTML TableMaan CabolesNo ratings yet

- Introduction To HTML: Created By: Blesilda B. VocalDocument20 pagesIntroduction To HTML: Created By: Blesilda B. VocalMaan CabolesNo ratings yet