Professional Documents

Culture Documents

India First Mahajeevan Plan

India First Mahajeevan Plan

Uploaded by

K.b. MisraCopyright:

Available Formats

You might also like

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Sem4 qp2Document2 pagesSem4 qp2iyerchandraNo ratings yet

- Financial Plan SampleDocument3 pagesFinancial Plan SampleShruti SrivastavaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Indian Cost Accountants Service - Notes: By: Tarun MahajanDocument38 pagesIndian Cost Accountants Service - Notes: By: Tarun MahajanAKSHAYA RAVINo ratings yet

- HW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahDocument12 pagesHW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahPutera IzwanNo ratings yet

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Document24 pagesDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Test 3 Corprate FinanceDocument10 pagesTest 3 Corprate FinancekeelyNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- Answer Paper 2 SFM May 17Document22 pagesAnswer Paper 2 SFM May 17Ekta Saraswat VigNo ratings yet

- Minimum Alternative TaxDocument27 pagesMinimum Alternative TaxYash TiwariNo ratings yet

- S. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementDocument9 pagesS. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementAmisha Singh VishenNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Lecture 10 502 1ppDocument12 pagesLecture 10 502 1ppJohn SmithNo ratings yet

- Computation of NAVDocument33 pagesComputation of NAVMannu SolankiNo ratings yet

- Cash and Credit ManagementDocument11 pagesCash and Credit Managementaoishic2025No ratings yet

- Financial Management V2 PDFDocument28 pagesFinancial Management V2 PDFNeeraj SinghNo ratings yet

- Sol - PTP 29 11 2018Document6 pagesSol - PTP 29 11 2018riyagoel12329dspsNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- Source: Investor Presentation Q3FY20 Includes Individual and Group Claim SettlementDocument5 pagesSource: Investor Presentation Q3FY20 Includes Individual and Group Claim SettlementSuhas VaishnavNo ratings yet

- Cia FMDocument5 pagesCia FMYASHASWI 20212166No ratings yet

- FM Questions MSDocument7 pagesFM Questions MSUdayan KarnatakNo ratings yet

- Assignment FMDocument6 pagesAssignment FMAbdulaziz HbllolNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Principles of Financial Management Practice QsDocument4 pagesPrinciples of Financial Management Practice Qs22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Company Account SuggestionDocument34 pagesCompany Account SuggestionAYAN DATTANo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Alpesh RathodDocument7 pagesAlpesh Rathodriteshg000007No ratings yet

- Answers For Workshop 13Document5 pagesAnswers For Workshop 13Jeevika Basnet0% (1)

- Edelweiss Tokio Life - GCAP - : OverviewDocument2 pagesEdelweiss Tokio Life - GCAP - : OverviewarunNo ratings yet

- EGOV QUESTIONNAIRE (Repaired)Document5 pagesEGOV QUESTIONNAIRE (Repaired)M ShahZeb KhanNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Accounting-Financial Statements of Companies-1653399167327513Document37 pagesAccounting-Financial Statements of Companies-1653399167327513Badhrinath ShanmugamNo ratings yet

- R RT Acc Test EngDocument3 pagesR RT Acc Test Engmdtahmidurrahman7701No ratings yet

- DBE Sem-2 Question PapersDocument16 pagesDBE Sem-2 Question PapersTanmay AroraNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2NOEL ThomasNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Net Present Value MethodDocument3 pagesNet Present Value Methodmaha SriNo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

India First Mahajeevan Plan

India First Mahajeevan Plan

Uploaded by

K.b. MisraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India First Mahajeevan Plan

India First Mahajeevan Plan

Uploaded by

K.b. MisraCopyright:

Available Formats

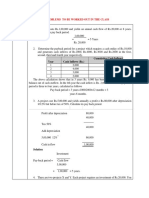

No.

of years Premium

1 100000 25000 India First Mahajeevan Plan

2 100000 25000

3 100000 25000 Total Investment in 15 years = 15 lakhs.

4 100000 25000

Benefits

5 100000 25000 1. Interest rate @8% per annum (4% flat +2 % terminal bonus+2%

6 100000 25000 bonus + {2%variable company revisionary bonus }

7 100000 25000 2. Loan facility after 5th year(90% of invested amount without an

for 1 year)

8 100000 25000 3. Tax benifits under 80c(Rs. 150,000 exemption on investment )

9 100000 25000 earned interest on investment)

4. Transferable

10 100000 25000

11 100000 25000 5. If death occurs in between then company returns (16 times of

12 100000 25000 Investment+Interst +bonus )

6. Age min 5 and max 55 yrs

13 100000 25000 7. Max 3 nominee can be divided for amounts .

14 100000 25000 8. covered under 1961 income tax act

15 100000 25000 9. after 7 years company will help to get the policy break if there

requirement in family is there.

TOTAL 1500000 375000

Total maturity value is 2932887 727232.9

8.1

t +2 % terminal bonus+2% company performance

ary bonus }

ested amount without any payment of interest

emption on investment ) & 10(10D)(no tax on

pany returns (16 times of 1st premium+ total

mounts .

t the policy break if there is some major

You might also like

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Sem4 qp2Document2 pagesSem4 qp2iyerchandraNo ratings yet

- Financial Plan SampleDocument3 pagesFinancial Plan SampleShruti SrivastavaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- Indian Cost Accountants Service - Notes: By: Tarun MahajanDocument38 pagesIndian Cost Accountants Service - Notes: By: Tarun MahajanAKSHAYA RAVINo ratings yet

- HW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahDocument12 pagesHW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahPutera IzwanNo ratings yet

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Document24 pagesDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Test 3 Corprate FinanceDocument10 pagesTest 3 Corprate FinancekeelyNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- Answer Paper 2 SFM May 17Document22 pagesAnswer Paper 2 SFM May 17Ekta Saraswat VigNo ratings yet

- Minimum Alternative TaxDocument27 pagesMinimum Alternative TaxYash TiwariNo ratings yet

- S. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementDocument9 pagesS. S. Prasad - Tax Planning & Financial Management, M. Com. Semester IV, Corporate Tax Planning & ManagementAmisha Singh VishenNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Lecture 10 502 1ppDocument12 pagesLecture 10 502 1ppJohn SmithNo ratings yet

- Computation of NAVDocument33 pagesComputation of NAVMannu SolankiNo ratings yet

- Cash and Credit ManagementDocument11 pagesCash and Credit Managementaoishic2025No ratings yet

- Financial Management V2 PDFDocument28 pagesFinancial Management V2 PDFNeeraj SinghNo ratings yet

- Sol - PTP 29 11 2018Document6 pagesSol - PTP 29 11 2018riyagoel12329dspsNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- Source: Investor Presentation Q3FY20 Includes Individual and Group Claim SettlementDocument5 pagesSource: Investor Presentation Q3FY20 Includes Individual and Group Claim SettlementSuhas VaishnavNo ratings yet

- Cia FMDocument5 pagesCia FMYASHASWI 20212166No ratings yet

- FM Questions MSDocument7 pagesFM Questions MSUdayan KarnatakNo ratings yet

- Assignment FMDocument6 pagesAssignment FMAbdulaziz HbllolNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Principles of Financial Management Practice QsDocument4 pagesPrinciples of Financial Management Practice Qs22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Company Account SuggestionDocument34 pagesCompany Account SuggestionAYAN DATTANo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Alpesh RathodDocument7 pagesAlpesh Rathodriteshg000007No ratings yet

- Answers For Workshop 13Document5 pagesAnswers For Workshop 13Jeevika Basnet0% (1)

- Edelweiss Tokio Life - GCAP - : OverviewDocument2 pagesEdelweiss Tokio Life - GCAP - : OverviewarunNo ratings yet

- EGOV QUESTIONNAIRE (Repaired)Document5 pagesEGOV QUESTIONNAIRE (Repaired)M ShahZeb KhanNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Accounting-Financial Statements of Companies-1653399167327513Document37 pagesAccounting-Financial Statements of Companies-1653399167327513Badhrinath ShanmugamNo ratings yet

- R RT Acc Test EngDocument3 pagesR RT Acc Test Engmdtahmidurrahman7701No ratings yet

- DBE Sem-2 Question PapersDocument16 pagesDBE Sem-2 Question PapersTanmay AroraNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2NOEL ThomasNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Net Present Value MethodDocument3 pagesNet Present Value Methodmaha SriNo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet