Professional Documents

Culture Documents

Toa 34a-3

Toa 34a-3

Uploaded by

Arvin Glen BeltranCopyright:

Available Formats

You might also like

- Sample DJ Contract PDF Format PDFDocument4 pagesSample DJ Contract PDF Format PDFTфmmy WilmarkNo ratings yet

- PFRS 15 Revenue From Contracts With CustomersDocument7 pagesPFRS 15 Revenue From Contracts With Customerspanda 1100% (2)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- AFAR-04: PFRS 15 - Revenue From Contracts With Customers & Other TopicsDocument14 pagesAFAR-04: PFRS 15 - Revenue From Contracts With Customers & Other TopicsJenver BuenaventuraNo ratings yet

- 11Document137 pages11Alex liao100% (1)

- Revenue Recognition Accounting TheoryDocument4 pagesRevenue Recognition Accounting TheorychristoperedwinNo ratings yet

- (AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesDocument6 pages(AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesPolinar Paul MarbenNo ratings yet

- Sec 30-50 (Negotiation)Document10 pagesSec 30-50 (Negotiation)Arvin Glen BeltranNo ratings yet

- SilverStrand by The Corrs PDFDocument1 pageSilverStrand by The Corrs PDFArvin Glen Beltran100% (1)

- Contract LawDocument16 pagesContract LawEdenNo ratings yet

- Sebastisan vs. Calis A.C. NO. 5118/314SCRA1 SEPTEMBER 9, 1999 J. - FactsDocument1 pageSebastisan vs. Calis A.C. NO. 5118/314SCRA1 SEPTEMBER 9, 1999 J. - FactsAleezah Gertrude RegadoNo ratings yet

- 438 PDFDocument17 pages438 PDFshubhamNo ratings yet

- IFRS 15 Revenue From Contracts With Customers-2Document8 pagesIFRS 15 Revenue From Contracts With Customers-2abbyNo ratings yet

- Revenue Revisited: Student Accountant Hub PageDocument4 pagesRevenue Revisited: Student Accountant Hub PageNozimanga ChiroroNo ratings yet

- Corporate Reporting Homework (Day 1)Document9 pagesCorporate Reporting Homework (Day 1)Sara MirchevskaNo ratings yet

- PFRS 15 Discussion StudentsDocument33 pagesPFRS 15 Discussion StudentsMiru YuNo ratings yet

- Pfrs 15 Summary NotesDocument5 pagesPfrs 15 Summary NotesSHARON SAMSONNo ratings yet

- Module 1 - PDFDocument4 pagesModule 1 - PDFMelanie SamsonaNo ratings yet

- Ifrs 15: Revenue From Contracts With CustomersDocument4 pagesIfrs 15: Revenue From Contracts With CustomersALMA MORENA100% (2)

- AAFR SummariesDocument48 pagesAAFR SummariesKazumiNo ratings yet

- PWC Reportinginbrief Companies Indian Accounting Standards Amendment Rules 2018Document12 pagesPWC Reportinginbrief Companies Indian Accounting Standards Amendment Rules 2018sourabhbansal108No ratings yet

- Revenue From Contracts Team 14% PDFDocument32 pagesRevenue From Contracts Team 14% PDFMarian MarNo ratings yet

- PFRS 15 - Revenue From Contracts With CustomersDocument27 pagesPFRS 15 - Revenue From Contracts With Customersdaniel coronia100% (1)

- PFRS 15 Summary NotesDocument4 pagesPFRS 15 Summary NotesDaniel Nichole MerindoNo ratings yet

- CFAS Unit 1 - Module 5.1Document11 pagesCFAS Unit 1 - Module 5.1Ralph Lefrancis DomingoNo ratings yet

- Chapter 12 Revenue From Contracts With CustomersDocument24 pagesChapter 12 Revenue From Contracts With CustomersJane DizonNo ratings yet

- Acca Ifrs 15Document19 pagesAcca Ifrs 15Ittihadul islamNo ratings yet

- Ind As 115 Revenue From Contracts With Customers Overview and Impact OnDocument34 pagesInd As 115 Revenue From Contracts With Customers Overview and Impact OnVM educationzNo ratings yet

- Ifrs 15 - Chapter 1Document7 pagesIfrs 15 - Chapter 1LumingNo ratings yet

- Revenue Recognition Ifrs 15 ModelDocument4 pagesRevenue Recognition Ifrs 15 ModelAbdulhameed Babalola0% (1)

- 11 10 PDF FreeDocument137 pages11 10 PDF FreeKristenNo ratings yet

- IFRS 15 (IAS) - Revenue From Contracts With CustomersDocument10 pagesIFRS 15 (IAS) - Revenue From Contracts With CustomersAngie MagnayeNo ratings yet

- IFRSDocument8 pagesIFRSrahulhsharmaNo ratings yet

- PFRS 15, MarbellaDocument3 pagesPFRS 15, MarbellaDazzelle BasarteNo ratings yet

- NIC 15 InfografíaDocument1 pageNIC 15 Infografíavv2fknzhv8No ratings yet

- Revenue From Contracts With CustomersDocument21 pagesRevenue From Contracts With Customersnot meNo ratings yet

- Ifrs 15Document37 pagesIfrs 15Noor IslamNo ratings yet

- Revenue Revisited: The Global Body For Professional AccountantsDocument3 pagesRevenue Revisited: The Global Body For Professional AccountantsPANTUGNo ratings yet

- MFRS 15 Version 2022Document9 pagesMFRS 15 Version 2022ting biiNo ratings yet

- SBR - Reporting The Financial Performance of Entities: Ifrs 15 - Revenue RecognitionDocument3 pagesSBR - Reporting The Financial Performance of Entities: Ifrs 15 - Revenue RecognitionbigblaseNo ratings yet

- Ifrs 15Document7 pagesIfrs 15Nauman KhalidNo ratings yet

- Ifrs 15: Revenue From Contracts With CustomersDocument46 pagesIfrs 15: Revenue From Contracts With CustomersHace AdisNo ratings yet

- Week 1 Revenue Part 1Document19 pagesWeek 1 Revenue Part 1AnselmNo ratings yet

- MFRS 15 Revenue From Contracts With CustomersDocument61 pagesMFRS 15 Revenue From Contracts With CustomersDIVA RTHININo ratings yet

- PRFS 15Document3 pagesPRFS 15Heneir FloresNo ratings yet

- 3117ias 18 2017Document6 pages3117ias 18 2017Oyeleye TofunmiNo ratings yet

- Ifrs 15: Revenue From Contracts With CustomersDocument8 pagesIfrs 15: Revenue From Contracts With CustomersAira Nhaira MecateNo ratings yet

- 43219A IFRS 15 - GAAP - bd1Document30 pages43219A IFRS 15 - GAAP - bd1DimakatsoNo ratings yet

- IFRS 15 Garuda - AnalysisDocument8 pagesIFRS 15 Garuda - Analysisratu shaviraNo ratings yet

- Module 1 Accounting ReportDocument12 pagesModule 1 Accounting ReportLovely Joy SantiagoNo ratings yet

- Contabilidad Superior Informe de InglesDocument9 pagesContabilidad Superior Informe de Ingleskevin caceres pimetenlNo ratings yet

- AFAR-06 (Revenue From Contracts With Customers - Other Topics)Document26 pagesAFAR-06 (Revenue From Contracts With Customers - Other Topics)MABI ESPENIDONo ratings yet

- IFRS 15 Revenue From Contracts With CustomersDocument5 pagesIFRS 15 Revenue From Contracts With CustomersADEYANJU AKEEMNo ratings yet

- IFRS 15-1 Five Steps ModelDocument59 pagesIFRS 15-1 Five Steps ModelJIAYING LIUNo ratings yet

- Ind As 115 VS Ind As 18Document7 pagesInd As 115 VS Ind As 18Yogendrasinh RaoNo ratings yet

- View PDFDocument50 pagesView PDFMd Raihan SobujNo ratings yet

- MODULE 1 - Revenue From Contracts With CustomersDocument12 pagesMODULE 1 - Revenue From Contracts With CustomersEdison Salgado CastigadorNo ratings yet

- 15 IfrsDocument13 pages15 Ifrssuruth242100% (1)

- Revenues From Contracts With CustomersDocument8 pagesRevenues From Contracts With CustomersSandia EspejoNo ratings yet

- IFRS 15 New FridayDocument73 pagesIFRS 15 New Fridaynati67% (3)

- Scope: The Five-Step Model FrameworkDocument3 pagesScope: The Five-Step Model FrameworkPeejay Adame MasongsongNo ratings yet

- PFRS15Document14 pagesPFRS15cris allea catacutanNo ratings yet

- 7 - Long-Term Construction ContractsDocument6 pages7 - Long-Term Construction ContractsDarlene Faye Cabral RosalesNo ratings yet

- IAS18Document12 pagesIAS18Ali AmirAliNo ratings yet

- Revenue From Contracts With Customers (Ind As-115) : Applicable From May 2019 Exam OnwardsDocument5 pagesRevenue From Contracts With Customers (Ind As-115) : Applicable From May 2019 Exam OnwardsVM educationzNo ratings yet

- Gov Acc Assignment JohnDocument5 pagesGov Acc Assignment JohnArvin Glen BeltranNo ratings yet

- Sec 7, 8, 9Document2 pagesSec 7, 8, 9Arvin Glen BeltranNo ratings yet

- Background InfoDocument1 pageBackground InfoArvin Glen BeltranNo ratings yet

- Juan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Document6 pagesJuan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Arvin Glen BeltranNo ratings yet

- Sec 5,6, 11-13Document3 pagesSec 5,6, 11-13Arvin Glen BeltranNo ratings yet

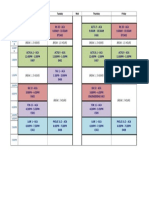

- Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursDocument1 pageBreak: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursArvin Glen BeltranNo ratings yet

- De Los Santos vs. de La Cruz (Beltran & Mauna)Document2 pagesDe Los Santos vs. de La Cruz (Beltran & Mauna)Arvin Glen BeltranNo ratings yet

- Acc 5 Course OutlineDocument7 pagesAcc 5 Course OutlineArvin Glen BeltranNo ratings yet

- 3rd Year ScheduleDocument2 pages3rd Year ScheduleArvin Glen BeltranNo ratings yet

- NBA 2K16 Keyboard MappingDocument1 pageNBA 2K16 Keyboard MappingArvin Glen BeltranNo ratings yet

- Law OutlineDocument11 pagesLaw OutlineArvin Glen BeltranNo ratings yet

- Time Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursDocument3 pagesTime Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursArvin Glen BeltranNo ratings yet

- Infinity Ex Canon Rock Intermediate Sheetmusic Trade ComDocument3 pagesInfinity Ex Canon Rock Intermediate Sheetmusic Trade ComivyNo ratings yet

- Teachers, Take A Bow: By: Arvin Glen B. Beltran of 4-VizDocument1 pageTeachers, Take A Bow: By: Arvin Glen B. Beltran of 4-VizArvin Glen BeltranNo ratings yet

- Sanchez Vs RigosDocument8 pagesSanchez Vs RigosLeyla AureNo ratings yet

- NotesDocument3 pagesNotesmishrakumkum526No ratings yet

- Contract Act NotesDocument18 pagesContract Act NotesMinal Gandhi100% (1)

- Article 1458 - 1488Document3 pagesArticle 1458 - 1488MarkNo ratings yet

- Contract LawDocument59 pagesContract Lawmaubarak0% (1)

- Law of ContractDocument131 pagesLaw of ContractTrailer HubNo ratings yet

- Art. 1323-1330 GAWDocument3 pagesArt. 1323-1330 GAWChris Gaw100% (1)

- Paul Petrino Employment ContractDocument17 pagesPaul Petrino Employment ContractHKMNo ratings yet

- Pajarillo Vs Intermediate Appellate CourtDocument5 pagesPajarillo Vs Intermediate Appellate CourtMyra Mae J. DuglasNo ratings yet

- FBRT LawDocument8 pagesFBRT LawALESSANDRA YSABELLE CIMACIO CONZONNo ratings yet

- Contract Act LawDocument8 pagesContract Act Lawmukmin09No ratings yet

- CAFC - CSEETThe Indian Contract Act 1872Document74 pagesCAFC - CSEETThe Indian Contract Act 1872Snozzerr TechNo ratings yet

- Sanchez Vs RigosDocument3 pagesSanchez Vs RigosPau JoyosaNo ratings yet

- KICT Vs FBR Pakistan Customs Karachi QICTDocument13 pagesKICT Vs FBR Pakistan Customs Karachi QICTDr. Hussain NaqviNo ratings yet

- Wa0018Document5 pagesWa0018omkolhe0007No ratings yet

- Risk CH 4 PDFDocument12 pagesRisk CH 4 PDFWonde BiruNo ratings yet

- Contract Word 1 (1) - 1Document5 pagesContract Word 1 (1) - 1Avril smith100% (1)

- Harbour Portfolio SettlementDocument24 pagesHarbour Portfolio SettlementWCPO 9 NewsNo ratings yet

- CA Foundation LAW SUGGESTED ANSWERSDocument7 pagesCA Foundation LAW SUGGESTED ANSWERSthrinadh0123No ratings yet

- Contract BDocument21 pagesContract Byin-pasiya nabiaNo ratings yet

- LAW436 (Contract) - ConsiderationDocument1 pageLAW436 (Contract) - ConsiderationIntan NadhirahNo ratings yet

- Types of ContractDocument63 pagesTypes of Contractmanjunatha TKNo ratings yet

- Abalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Document18 pagesAbalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Leizl A. VillapandoNo ratings yet

- Types of ContractsDocument13 pagesTypes of ContractssafdarnazeerNo ratings yet

- ANA - Reed Smith Legal Guide The Impact of COVID19 On Brand Advertising and MarketingDocument31 pagesANA - Reed Smith Legal Guide The Impact of COVID19 On Brand Advertising and MarketingArber NikqiNo ratings yet

- T Test - 2: Business Laws Answer KeyDocument7 pagesT Test - 2: Business Laws Answer KeyRohit JainNo ratings yet

Toa 34a-3

Toa 34a-3

Uploaded by

Arvin Glen BeltranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Toa 34a-3

Toa 34a-3

Uploaded by

Arvin Glen BeltranCopyright:

Available Formats

I R"2e - '7L Ror;*,, */-rt "V

A.ro,".L"*a?-

INSTALLMENT SALES & CONSTRUCTION CONTRACTS

Important notes on "PFRS 15 - REVENUE FROM CONTRACTS WITH CUST9MERS"

. Effective date: 01 January 2018 (deferredfrom its original effective date of Al January20lT

on the decision made by IASB dated I I September 2A15).

TA-34A

based

. PFRS 15 eventually replaces/supersedes the fotlowing standards: PAS 11 (Construction

Contracts), PAS 18 (Revenue) and related interpretations (IFRIC 13, IFRIC 15, IFRIC 18, SIC

31).

Objective of PFRS 15: to establish the principles that entity shall apply to report useful

information to users of financial statements about the nature, amount, timing and uncertainty

of revenue and cash flows arisirrg frorn a contract with a customer.

Scope limitation: PFRS 15 does not covercustomer contracts under PAS 17 (Leases), PFRS 4

(Insurance Contracts), PFRS 9 (Financial Instruments), PFRS 11 (loint Arrangements),

among others.

The core principle of PFRS 15 is that an entity shall recognize revenue to depict the transfer

of promised gobds or services to customers in an amount that reflects the consideration to

which the entity expects to be entitled in exchange for those goods or services. This core

principle is delivered in a FIVE-IiTEP MODEL FRAMEWORK:

'/ Revenue from a contract with a customer cannot be recognized until a contract exists.

{CONTRACT is an agreemenl between two or more parties that creates enforceable rights &

obligotion!

{CUSTOMER i.s a parry* thqt hos contracted with entity to obtain.goods or serviees that are an

output rl lhe entit.v"'s ordinary activilies in exchangefor consideration.)

{PERFORM4\;CE OBLIGATION i:; a promise in a contact with a customer to transfer to the

customer distinct goods and/or services.]

|TRAI\SACTIO\: PRICE is the amount of consideration to which an entity expects to be entitled in

exchange frtr tran.sferring promised goods or services to a customer, excluding smounts callected

on behalf of third parties.rt

obligations in the contract.

'/ When a sales transaction involves a significant financing component, the fair value is

determined either by rteasuring the consideration received or by discounting the

payment using an imputed interest rate.

'/ When a company sells a bundle of goods at a discount, the discount should be

allocated to the product that caused the discount and not to the entire bundle.

performa nce obl igation.

'/ Revenue is recognized in the accounting period when the performance obligation is

satisfied.

'/ A company recognizes revenue from a performance obligation over time by measuring

the progress toward completion

Unless BoA issues a separate memo that would effectively include PFRS 15 in the CPA Board

Exam coverage, PFRS 15 is not yet covered nor included in the October zAfl CPA Board

Exam.

You might also like

- Sample DJ Contract PDF Format PDFDocument4 pagesSample DJ Contract PDF Format PDFTфmmy WilmarkNo ratings yet

- PFRS 15 Revenue From Contracts With CustomersDocument7 pagesPFRS 15 Revenue From Contracts With Customerspanda 1100% (2)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- AFAR-04: PFRS 15 - Revenue From Contracts With Customers & Other TopicsDocument14 pagesAFAR-04: PFRS 15 - Revenue From Contracts With Customers & Other TopicsJenver BuenaventuraNo ratings yet

- 11Document137 pages11Alex liao100% (1)

- Revenue Recognition Accounting TheoryDocument4 pagesRevenue Recognition Accounting TheorychristoperedwinNo ratings yet

- (AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesDocument6 pages(AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesPolinar Paul MarbenNo ratings yet

- Sec 30-50 (Negotiation)Document10 pagesSec 30-50 (Negotiation)Arvin Glen BeltranNo ratings yet

- SilverStrand by The Corrs PDFDocument1 pageSilverStrand by The Corrs PDFArvin Glen Beltran100% (1)

- Contract LawDocument16 pagesContract LawEdenNo ratings yet

- Sebastisan vs. Calis A.C. NO. 5118/314SCRA1 SEPTEMBER 9, 1999 J. - FactsDocument1 pageSebastisan vs. Calis A.C. NO. 5118/314SCRA1 SEPTEMBER 9, 1999 J. - FactsAleezah Gertrude RegadoNo ratings yet

- 438 PDFDocument17 pages438 PDFshubhamNo ratings yet

- IFRS 15 Revenue From Contracts With Customers-2Document8 pagesIFRS 15 Revenue From Contracts With Customers-2abbyNo ratings yet

- Revenue Revisited: Student Accountant Hub PageDocument4 pagesRevenue Revisited: Student Accountant Hub PageNozimanga ChiroroNo ratings yet

- Corporate Reporting Homework (Day 1)Document9 pagesCorporate Reporting Homework (Day 1)Sara MirchevskaNo ratings yet

- PFRS 15 Discussion StudentsDocument33 pagesPFRS 15 Discussion StudentsMiru YuNo ratings yet

- Pfrs 15 Summary NotesDocument5 pagesPfrs 15 Summary NotesSHARON SAMSONNo ratings yet

- Module 1 - PDFDocument4 pagesModule 1 - PDFMelanie SamsonaNo ratings yet

- Ifrs 15: Revenue From Contracts With CustomersDocument4 pagesIfrs 15: Revenue From Contracts With CustomersALMA MORENA100% (2)

- AAFR SummariesDocument48 pagesAAFR SummariesKazumiNo ratings yet

- PWC Reportinginbrief Companies Indian Accounting Standards Amendment Rules 2018Document12 pagesPWC Reportinginbrief Companies Indian Accounting Standards Amendment Rules 2018sourabhbansal108No ratings yet

- Revenue From Contracts Team 14% PDFDocument32 pagesRevenue From Contracts Team 14% PDFMarian MarNo ratings yet

- PFRS 15 - Revenue From Contracts With CustomersDocument27 pagesPFRS 15 - Revenue From Contracts With Customersdaniel coronia100% (1)

- PFRS 15 Summary NotesDocument4 pagesPFRS 15 Summary NotesDaniel Nichole MerindoNo ratings yet

- CFAS Unit 1 - Module 5.1Document11 pagesCFAS Unit 1 - Module 5.1Ralph Lefrancis DomingoNo ratings yet

- Chapter 12 Revenue From Contracts With CustomersDocument24 pagesChapter 12 Revenue From Contracts With CustomersJane DizonNo ratings yet

- Acca Ifrs 15Document19 pagesAcca Ifrs 15Ittihadul islamNo ratings yet

- Ind As 115 Revenue From Contracts With Customers Overview and Impact OnDocument34 pagesInd As 115 Revenue From Contracts With Customers Overview and Impact OnVM educationzNo ratings yet

- Ifrs 15 - Chapter 1Document7 pagesIfrs 15 - Chapter 1LumingNo ratings yet

- Revenue Recognition Ifrs 15 ModelDocument4 pagesRevenue Recognition Ifrs 15 ModelAbdulhameed Babalola0% (1)

- 11 10 PDF FreeDocument137 pages11 10 PDF FreeKristenNo ratings yet

- IFRS 15 (IAS) - Revenue From Contracts With CustomersDocument10 pagesIFRS 15 (IAS) - Revenue From Contracts With CustomersAngie MagnayeNo ratings yet

- IFRSDocument8 pagesIFRSrahulhsharmaNo ratings yet

- PFRS 15, MarbellaDocument3 pagesPFRS 15, MarbellaDazzelle BasarteNo ratings yet

- NIC 15 InfografíaDocument1 pageNIC 15 Infografíavv2fknzhv8No ratings yet

- Revenue From Contracts With CustomersDocument21 pagesRevenue From Contracts With Customersnot meNo ratings yet

- Ifrs 15Document37 pagesIfrs 15Noor IslamNo ratings yet

- Revenue Revisited: The Global Body For Professional AccountantsDocument3 pagesRevenue Revisited: The Global Body For Professional AccountantsPANTUGNo ratings yet

- MFRS 15 Version 2022Document9 pagesMFRS 15 Version 2022ting biiNo ratings yet

- SBR - Reporting The Financial Performance of Entities: Ifrs 15 - Revenue RecognitionDocument3 pagesSBR - Reporting The Financial Performance of Entities: Ifrs 15 - Revenue RecognitionbigblaseNo ratings yet

- Ifrs 15Document7 pagesIfrs 15Nauman KhalidNo ratings yet

- Ifrs 15: Revenue From Contracts With CustomersDocument46 pagesIfrs 15: Revenue From Contracts With CustomersHace AdisNo ratings yet

- Week 1 Revenue Part 1Document19 pagesWeek 1 Revenue Part 1AnselmNo ratings yet

- MFRS 15 Revenue From Contracts With CustomersDocument61 pagesMFRS 15 Revenue From Contracts With CustomersDIVA RTHININo ratings yet

- PRFS 15Document3 pagesPRFS 15Heneir FloresNo ratings yet

- 3117ias 18 2017Document6 pages3117ias 18 2017Oyeleye TofunmiNo ratings yet

- Ifrs 15: Revenue From Contracts With CustomersDocument8 pagesIfrs 15: Revenue From Contracts With CustomersAira Nhaira MecateNo ratings yet

- 43219A IFRS 15 - GAAP - bd1Document30 pages43219A IFRS 15 - GAAP - bd1DimakatsoNo ratings yet

- IFRS 15 Garuda - AnalysisDocument8 pagesIFRS 15 Garuda - Analysisratu shaviraNo ratings yet

- Module 1 Accounting ReportDocument12 pagesModule 1 Accounting ReportLovely Joy SantiagoNo ratings yet

- Contabilidad Superior Informe de InglesDocument9 pagesContabilidad Superior Informe de Ingleskevin caceres pimetenlNo ratings yet

- AFAR-06 (Revenue From Contracts With Customers - Other Topics)Document26 pagesAFAR-06 (Revenue From Contracts With Customers - Other Topics)MABI ESPENIDONo ratings yet

- IFRS 15 Revenue From Contracts With CustomersDocument5 pagesIFRS 15 Revenue From Contracts With CustomersADEYANJU AKEEMNo ratings yet

- IFRS 15-1 Five Steps ModelDocument59 pagesIFRS 15-1 Five Steps ModelJIAYING LIUNo ratings yet

- Ind As 115 VS Ind As 18Document7 pagesInd As 115 VS Ind As 18Yogendrasinh RaoNo ratings yet

- View PDFDocument50 pagesView PDFMd Raihan SobujNo ratings yet

- MODULE 1 - Revenue From Contracts With CustomersDocument12 pagesMODULE 1 - Revenue From Contracts With CustomersEdison Salgado CastigadorNo ratings yet

- 15 IfrsDocument13 pages15 Ifrssuruth242100% (1)

- Revenues From Contracts With CustomersDocument8 pagesRevenues From Contracts With CustomersSandia EspejoNo ratings yet

- IFRS 15 New FridayDocument73 pagesIFRS 15 New Fridaynati67% (3)

- Scope: The Five-Step Model FrameworkDocument3 pagesScope: The Five-Step Model FrameworkPeejay Adame MasongsongNo ratings yet

- PFRS15Document14 pagesPFRS15cris allea catacutanNo ratings yet

- 7 - Long-Term Construction ContractsDocument6 pages7 - Long-Term Construction ContractsDarlene Faye Cabral RosalesNo ratings yet

- IAS18Document12 pagesIAS18Ali AmirAliNo ratings yet

- Revenue From Contracts With Customers (Ind As-115) : Applicable From May 2019 Exam OnwardsDocument5 pagesRevenue From Contracts With Customers (Ind As-115) : Applicable From May 2019 Exam OnwardsVM educationzNo ratings yet

- Gov Acc Assignment JohnDocument5 pagesGov Acc Assignment JohnArvin Glen BeltranNo ratings yet

- Sec 7, 8, 9Document2 pagesSec 7, 8, 9Arvin Glen BeltranNo ratings yet

- Background InfoDocument1 pageBackground InfoArvin Glen BeltranNo ratings yet

- Juan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Document6 pagesJuan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Arvin Glen BeltranNo ratings yet

- Sec 5,6, 11-13Document3 pagesSec 5,6, 11-13Arvin Glen BeltranNo ratings yet

- Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursDocument1 pageBreak: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursArvin Glen BeltranNo ratings yet

- De Los Santos vs. de La Cruz (Beltran & Mauna)Document2 pagesDe Los Santos vs. de La Cruz (Beltran & Mauna)Arvin Glen BeltranNo ratings yet

- Acc 5 Course OutlineDocument7 pagesAcc 5 Course OutlineArvin Glen BeltranNo ratings yet

- 3rd Year ScheduleDocument2 pages3rd Year ScheduleArvin Glen BeltranNo ratings yet

- NBA 2K16 Keyboard MappingDocument1 pageNBA 2K16 Keyboard MappingArvin Glen BeltranNo ratings yet

- Law OutlineDocument11 pagesLaw OutlineArvin Glen BeltranNo ratings yet

- Time Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursDocument3 pagesTime Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursArvin Glen BeltranNo ratings yet

- Infinity Ex Canon Rock Intermediate Sheetmusic Trade ComDocument3 pagesInfinity Ex Canon Rock Intermediate Sheetmusic Trade ComivyNo ratings yet

- Teachers, Take A Bow: By: Arvin Glen B. Beltran of 4-VizDocument1 pageTeachers, Take A Bow: By: Arvin Glen B. Beltran of 4-VizArvin Glen BeltranNo ratings yet

- Sanchez Vs RigosDocument8 pagesSanchez Vs RigosLeyla AureNo ratings yet

- NotesDocument3 pagesNotesmishrakumkum526No ratings yet

- Contract Act NotesDocument18 pagesContract Act NotesMinal Gandhi100% (1)

- Article 1458 - 1488Document3 pagesArticle 1458 - 1488MarkNo ratings yet

- Contract LawDocument59 pagesContract Lawmaubarak0% (1)

- Law of ContractDocument131 pagesLaw of ContractTrailer HubNo ratings yet

- Art. 1323-1330 GAWDocument3 pagesArt. 1323-1330 GAWChris Gaw100% (1)

- Paul Petrino Employment ContractDocument17 pagesPaul Petrino Employment ContractHKMNo ratings yet

- Pajarillo Vs Intermediate Appellate CourtDocument5 pagesPajarillo Vs Intermediate Appellate CourtMyra Mae J. DuglasNo ratings yet

- FBRT LawDocument8 pagesFBRT LawALESSANDRA YSABELLE CIMACIO CONZONNo ratings yet

- Contract Act LawDocument8 pagesContract Act Lawmukmin09No ratings yet

- CAFC - CSEETThe Indian Contract Act 1872Document74 pagesCAFC - CSEETThe Indian Contract Act 1872Snozzerr TechNo ratings yet

- Sanchez Vs RigosDocument3 pagesSanchez Vs RigosPau JoyosaNo ratings yet

- KICT Vs FBR Pakistan Customs Karachi QICTDocument13 pagesKICT Vs FBR Pakistan Customs Karachi QICTDr. Hussain NaqviNo ratings yet

- Wa0018Document5 pagesWa0018omkolhe0007No ratings yet

- Risk CH 4 PDFDocument12 pagesRisk CH 4 PDFWonde BiruNo ratings yet

- Contract Word 1 (1) - 1Document5 pagesContract Word 1 (1) - 1Avril smith100% (1)

- Harbour Portfolio SettlementDocument24 pagesHarbour Portfolio SettlementWCPO 9 NewsNo ratings yet

- CA Foundation LAW SUGGESTED ANSWERSDocument7 pagesCA Foundation LAW SUGGESTED ANSWERSthrinadh0123No ratings yet

- Contract BDocument21 pagesContract Byin-pasiya nabiaNo ratings yet

- LAW436 (Contract) - ConsiderationDocument1 pageLAW436 (Contract) - ConsiderationIntan NadhirahNo ratings yet

- Types of ContractDocument63 pagesTypes of Contractmanjunatha TKNo ratings yet

- Abalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Document18 pagesAbalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Leizl A. VillapandoNo ratings yet

- Types of ContractsDocument13 pagesTypes of ContractssafdarnazeerNo ratings yet

- ANA - Reed Smith Legal Guide The Impact of COVID19 On Brand Advertising and MarketingDocument31 pagesANA - Reed Smith Legal Guide The Impact of COVID19 On Brand Advertising and MarketingArber NikqiNo ratings yet

- T Test - 2: Business Laws Answer KeyDocument7 pagesT Test - 2: Business Laws Answer KeyRohit JainNo ratings yet