Professional Documents

Culture Documents

Q3 FY2014 Financial Reconciliation

Q3 FY2014 Financial Reconciliation

Uploaded by

Ђорђе МалешевићCopyright:

Available Formats

You might also like

- The RMBC MethodDocument128 pagesThe RMBC MethodFaizan Ahmed100% (2)

- Fce 2015 Complete Tests 1 e 2 AnswersDocument4 pagesFce 2015 Complete Tests 1 e 2 AnswersMárcia Bonfim83% (23)

- Nollet 2015 - Handbook of Food Analysis PDFDocument1,531 pagesNollet 2015 - Handbook of Food Analysis PDFემილი ონოფრე100% (3)

- Charging All Costs To Expense When IncurredDocument27 pagesCharging All Costs To Expense When IncurredAnonymous N9dx4ATEghNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Q2 FY2014 Financial ReconciliationDocument2 pagesQ2 FY2014 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q2 FY2013 Financial ReconciliationDocument2 pagesQ2 FY2013 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q1 FY2015 Financial ReconciliationDocument2 pagesQ1 FY2015 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q4 FY2007 Financial ReconciliationDocument4 pagesQ4 FY2007 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Reconciliation q2 Fy2016Document2 pagesReconciliation q2 Fy2016Ђорђе МалешевићNo ratings yet

- Sun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsDocument1 pageSun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsYash HardowarNo ratings yet

- Reconciliation q4 Fy2016Document3 pagesReconciliation q4 Fy2016Ђорђе МалешевићNo ratings yet

- 1Q23 - Trending SchedulesDocument11 pages1Q23 - Trending SchedulesStephano Gomes GabrielNo ratings yet

- Statement of Changes in EquityDocument1 pageStatement of Changes in EquityRommel VinluanNo ratings yet

- 2021Q2 Alphabet Earnings ReleaseDocument10 pages2021Q2 Alphabet Earnings ReleasextrangeNo ratings yet

- Reconciliation q2 Fy17Document2 pagesReconciliation q2 Fy17Ђорђе МалешевићNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- 1Q16 - Financial ReconciliationDocument2 pages1Q16 - Financial ReconciliationSenthil KumarNo ratings yet

- (In Thousands, Except Per Share Amounts) : Snap Inc. Consolidated Statements of OperationsDocument2 pages(In Thousands, Except Per Share Amounts) : Snap Inc. Consolidated Statements of OperationsPhan DuyetNo ratings yet

- SBI Annual Report 2022-244-245Document2 pagesSBI Annual Report 2022-244-245Radhika GoelNo ratings yet

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Document11 pagesRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaNo ratings yet

- Ayala Corporation and Subsidiaries Consolidated Statements of Changes in EquityDocument2 pagesAyala Corporation and Subsidiaries Consolidated Statements of Changes in EquitybyuntaexoNo ratings yet

- Eurasia Drilling Company LimitedDocument19 pagesEurasia Drilling Company LimitedKaiserNo ratings yet

- Estados Financieros 2017 PDFDocument82 pagesEstados Financieros 2017 PDFWilsonNo ratings yet

- 2021Q3 Alphabet Earnings ReleaseDocument10 pages2021Q3 Alphabet Earnings ReleasegigokiNo ratings yet

- Reconciliation q1 Fy17Document2 pagesReconciliation q1 Fy17Ђорђе МалешевићNo ratings yet

- 2018 GrubHub 10-K ExtractsDocument4 pages2018 GrubHub 10-K ExtractsShuting QinNo ratings yet

- Reconciliation q4 Fy23Document5 pagesReconciliation q4 Fy23Shady FathyNo ratings yet

- A04 Xgpr15n5xduon8yb.1Document30 pagesA04 Xgpr15n5xduon8yb.1Hiya ByeNo ratings yet

- Interfresh FY 2012 ResultsDocument1 pageInterfresh FY 2012 ResultsaddyNo ratings yet

- Alphabet Reports Fouth Quarter ResultsDocument11 pagesAlphabet Reports Fouth Quarter ResultsTim MooreNo ratings yet

- Walt Disney Corporation FSDocument6 pagesWalt Disney Corporation FSJannefah Irish SaglayanNo ratings yet

- Walt Disney Corporation FSDocument6 pagesWalt Disney Corporation FSJannefah Irish SaglayanNo ratings yet

- Interim Financial Statement - 3rd Quarter: Aitken Spence Hotel Holdings PLCDocument16 pagesInterim Financial Statement - 3rd Quarter: Aitken Spence Hotel Holdings PLCnowfazNo ratings yet

- Fajarbaru Builder Group BHDDocument5 pagesFajarbaru Builder Group BHDShungchau WongNo ratings yet

- Q3 2009 UTV Software Communications Financials Uploaded by MediaNamaDocument1 pageQ3 2009 UTV Software Communications Financials Uploaded by MediaNamamixedbagNo ratings yet

- LVMH 2020 Consolidated Financial StatementDocument99 pagesLVMH 2020 Consolidated Financial StatementGEETIKA PATRANo ratings yet

- IESL Draft 2014Document32 pagesIESL Draft 2014Manzoor ElahiNo ratings yet

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Overview and Regulation G Disclosure Q2 2014Document10 pagesFinancial Overview and Regulation G Disclosure Q2 2014Christopher TownsendNo ratings yet

- Consolidated Statements of Operations: Years Ended September 26, 2015 September 27, 2014 September 28, 2013Document5 pagesConsolidated Statements of Operations: Years Ended September 26, 2015 September 27, 2014 September 28, 2013Anna Mae Corpuz PrioloNo ratings yet

- Recipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)Document46 pagesRecipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)polodeNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- Aecon - Project IDocument39 pagesAecon - Project IRaji MohanNo ratings yet

- HUL Directors Report Ar 2013 14Document24 pagesHUL Directors Report Ar 2013 14Lakshmi MNo ratings yet

- TASK Investor Metrics Q4 2021 FINALDocument29 pagesTASK Investor Metrics Q4 2021 FINALKim Sydpraise FloresNo ratings yet

- EWI Q2-2018 ResultsDocument20 pagesEWI Q2-2018 ResultskimNo ratings yet

- 2016 08 04 BWG Q22016 Results Ann v7Document19 pages2016 08 04 BWG Q22016 Results Ann v7knightridNo ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- Chipotle 2021 Q4 Non GAAPDocument5 pagesChipotle 2021 Q4 Non GAAPSean IsaiahNo ratings yet

- q4 Fy23 EarningsDocument22 pagesq4 Fy23 EarningsShady FathyNo ratings yet

- United Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Document40 pagesUnited Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Евно АзефNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- AlphabetDocument12 pagesAlphabetandre.torresNo ratings yet

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathoreNo ratings yet

- ? Quarterly Report Pursuant To Section 13 or 15 (D) of The Securities Exchange Act OF 1934Document113 pages? Quarterly Report Pursuant To Section 13 or 15 (D) of The Securities Exchange Act OF 1934Makuna NatsvlishviliNo ratings yet

- Dufu Technology Corp. Berhad: (The Figures Have Not Been Audited)Document18 pagesDufu Technology Corp. Berhad: (The Figures Have Not Been Audited)seliper biruNo ratings yet

- 2021Q4 Alphabet Earnings ReleaseDocument10 pages2021Q4 Alphabet Earnings Releaseclaus_44No ratings yet

- Asl Marine Holdings Ltd.Document30 pagesAsl Marine Holdings Ltd.citybizlist11No ratings yet

- 2022Q2 Alphabet Earnings ReleaseDocument9 pages2022Q2 Alphabet Earnings ReleaseTey Boon KiatNo ratings yet

- (In Philippine Pesos) : Se Detendre La Plage IncDocument5 pages(In Philippine Pesos) : Se Detendre La Plage IncJheza Mae PitogoNo ratings yet

- GAR02 28 02 2024 FY2023 Results ReleaseDocument29 pagesGAR02 28 02 2024 FY2023 Results Releasedesifatimah87No ratings yet

- SGA Report Digital PDFDocument42 pagesSGA Report Digital PDFЂорђе МалешевићNo ratings yet

- Ivanka Trump Takes Donald Trump Seat at G20 Leaders' Table - BBC NewsDocument1 pageIvanka Trump Takes Donald Trump Seat at G20 Leaders' Table - BBC NewsЂорђе МалешевићNo ratings yet

- Heidegger Martin Sojourns The Journey To GreeceDocument49 pagesHeidegger Martin Sojourns The Journey To GreeceЂорђе МалешевићNo ratings yet

- Q2 FY2013 Financial ReconciliationDocument2 pagesQ2 FY2013 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Gipe 005893Document246 pagesGipe 005893Ђорђе МалешевићNo ratings yet

- Q1 FY2010 Financial ReconciliationDocument3 pagesQ1 FY2010 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Reconciliation q2 Fy2016Document2 pagesReconciliation q2 Fy2016Ђорђе МалешевићNo ratings yet

- Reconciliation q1 Fy17Document2 pagesReconciliation q1 Fy17Ђорђе МалешевићNo ratings yet

- q2 Fy17 EarningsDocument14 pagesq2 Fy17 EarningsЂорђе МалешевићNo ratings yet

- q1 Fy18 EarningsDocument15 pagesq1 Fy18 EarningsЂорђе МалешевићNo ratings yet

- Q1 FY2011 Financial ReconciliationDocument3 pagesQ1 FY2011 Financial ReconciliationЂорђе МалешевићNo ratings yet

- 2003 Proxy StatementDocument48 pages2003 Proxy StatementЂорђе МалешевићNo ratings yet

- Q1 FY2015 Financial ReconciliationDocument2 pagesQ1 FY2015 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q2 FY2014 Financial ReconciliationDocument2 pagesQ2 FY2014 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Reconciliation q4 Fy2016Document3 pagesReconciliation q4 Fy2016Ђорђе МалешевићNo ratings yet

- Reconciliation q2 Fy17Document2 pagesReconciliation q2 Fy17Ђорђе МалешевићNo ratings yet

- Q4 FY2007 Financial ReconciliationDocument4 pagesQ4 FY2007 Financial ReconciliationЂорђе МалешевићNo ratings yet

- q3 Fy17 EarningsDocument14 pagesq3 Fy17 EarningsЂорђе МалешевићNo ratings yet

- The Walt Disney Company Reports First Quarter Earnings For Fiscal 2017Document14 pagesThe Walt Disney Company Reports First Quarter Earnings For Fiscal 2017Ђорђе МалешевићNo ratings yet

- Form 4Document1 pageForm 4Ђорђе МалешевићNo ratings yet

- FSA Enrollment Form - English PDFDocument1 pageFSA Enrollment Form - English PDFLupita MontalvanNo ratings yet

- Construction Contract: Contract For Construction of Apco Hyundai Car Showroom at Uppala, Kasaragod, KeralaDocument2 pagesConstruction Contract: Contract For Construction of Apco Hyundai Car Showroom at Uppala, Kasaragod, KeralakrishnanunniNo ratings yet

- 11 Ultimate Protection Video Charitable Religious TrustsDocument12 pages11 Ultimate Protection Video Charitable Religious TrustsKing FishNo ratings yet

- Philo ExamDocument2 pagesPhilo ExamJohn Albert100% (1)

- Authentic Assessment ToolsDocument24 pagesAuthentic Assessment ToolsJessica De QuintosNo ratings yet

- Anatomy GuDocument13 pagesAnatomy Gujefel umarNo ratings yet

- Teacher'S Class Program: Artment of UcationDocument1 pageTeacher'S Class Program: Artment of UcationJeurdecel Laborada Castro - MartizanoNo ratings yet

- A Resource-Based View of The FirmDocument15 pagesA Resource-Based View of The Firmannu nandalNo ratings yet

- 11 Business Studies SP 1Document11 pages11 Business Studies SP 1Meldon17No ratings yet

- Identification and Certification of Labconco Class Ii Safety CabinetsDocument9 pagesIdentification and Certification of Labconco Class Ii Safety CabinetscobramcNo ratings yet

- Disaster Recovery Best PracticesDocument8 pagesDisaster Recovery Best PracticesJose RosarioNo ratings yet

- Brooklyn Mitsubishi Petition Notice To Respondents Schedules A-GDocument98 pagesBrooklyn Mitsubishi Petition Notice To Respondents Schedules A-GQueens PostNo ratings yet

- QUANTIFICATIONDocument4 pagesQUANTIFICATIONJohn Edsel SalavariaNo ratings yet

- (GUARANTEED RATE AFFINITY) & (8905 BEAVER FALLS) - UCC1 Financial Statement LIENDocument9 pages(GUARANTEED RATE AFFINITY) & (8905 BEAVER FALLS) - UCC1 Financial Statement LIENHakim-Aarifah BeyNo ratings yet

- Nuclear PhysicsDocument85 pagesNuclear PhysicsKy2ST3z4No ratings yet

- KS2 How Do We See ThingsDocument6 pagesKS2 How Do We See ThingsMekala WithanaNo ratings yet

- Project On SunsilkDocument16 pagesProject On Sunsilkiilm00282% (22)

- KPI RepositoryDocument33 pagesKPI RepositoryBONo ratings yet

- Arm Muscles OverviewDocument20 pagesArm Muscles OverviewLilian JerotichNo ratings yet

- Case ReportDocument16 pagesCase ReportSabbir ThePsychoExpressNo ratings yet

- By Laws Amended As at 1 July 2022 PDFDocument364 pagesBy Laws Amended As at 1 July 2022 PDFJING YI LIMNo ratings yet

- Blockchain-Enabled Drug Supply Chain: Sheetal Nayak, Prachitee Shirvale, Nihar Naik, Snehpriya Khul, Amol SawantDocument4 pagesBlockchain-Enabled Drug Supply Chain: Sheetal Nayak, Prachitee Shirvale, Nihar Naik, Snehpriya Khul, Amol SawantWaspNo ratings yet

- Lessons & Carols Service 2017Document2 pagesLessons & Carols Service 2017Essex Center UMCNo ratings yet

- The DJ Test: Personalised Report and Recommendations For Alex YachevskiDocument34 pagesThe DJ Test: Personalised Report and Recommendations For Alex YachevskiSashadanceNo ratings yet

- Presstonic Engineering Ltd.Document2 pagesPresstonic Engineering Ltd.Tanumay NaskarNo ratings yet

- Lesson 9. Phylum Mollusca PDFDocument44 pagesLesson 9. Phylum Mollusca PDFJonard PedrosaNo ratings yet

- BandiniDocument17 pagesBandiniShilpa GowdaNo ratings yet

Q3 FY2014 Financial Reconciliation

Q3 FY2014 Financial Reconciliation

Uploaded by

Ђорђе МалешевићOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q3 FY2014 Financial Reconciliation

Q3 FY2014 Financial Reconciliation

Uploaded by

Ђорђе МалешевићCopyright:

Available Formats

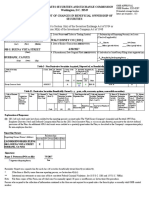

Reconciliation of Non-GAAP Financial Measures

To Corresponding GAAP Financial Measures

June 28, 2014

Free cash flow, aggregate segment operating income, and earnings per share excluding certain items affecting comparability are

not measures of performance defined by, or calculated in accordance with, generally accepted accounting principles (GAAP).

These measures should not be considered in isolation, or as a substitute for the corresponding GAAP financial measure. These

measures, as calculated by the Company, may not be comparable to similarly titled measures employed by other companies.

Free cash flow

The following table presents a reconciliation of the Company's consolidated cash provided by operations to free cash flow

(unaudited, in millions):

Quarter Ended

June 28, June 29,

2014 2013 Change

Cash provided by operations $ 2,936 $ 3,413 $ (477)

Less: Investments in parks, resorts and other property (889) (690) (199)

Free cash flow $ 2,047 $ 2,723 $ (676)

(25)%

Nine Months Ended

June 28, June 29,

2014 2013 Change

Cash provided by operations $ 6,675 $ 6,717 $ (42)

Investments in parks, resorts and other property (2,248) (1,809) (439)

Free cash flow $ 4,427 $ 4,908 $ (481)

(10)%

The following table presents a summary of the Company's consolidated cash flows (unaudited, in millions):

Quarter Ended Nine Months Ended

June 28, June 29, June 28, June 29,

2014 2013 2014 2013

Cash provided by operations $ 2,936 $ 3,413 $ 6,675 $ 6,717

Cash used in investing activities (1,281) (672) (2,292) (3,662)

Cash used in financing activities (1,652) (2,746) (4,090) (2,436)

Impact of exchange rates on cash and cash equivalents 9 (15) (134) (74)

Change in cash and cash equivalents 12 (20) 159 545

Cash and cash equivalents, beginning of period 4,078 3,952 3,931 3,387

Cash and cash equivalents, end of period $ 4,090 $ 3,932 $ 4,090 $ 3,932

Aggregate segment operating income

The following table presents a reconciliation of segment operating income to net income (unaudited, in millions):

Quarter Ended Nine Months Ended

June 28, June 29, June 28, June 29,

2014 2013 2014 2013

Segment operating income $ 3,857 $ 3,351 $ 10,230 $ 8,240

Corporate and unallocated shared expenses (137) (115) (408) (367)

Restructuring and impairment charges — (60) (67) (121)

Other income/(expense), net — — (31) (92)

Interest income/(expense), net (50) (83) 61 (209)

Hulu Equity Redemption charge — — — (55)

Income before income taxes 3,670 3,093 9,785 7,396

Income taxes (1,251) (1,059) (3,406) (2,303)

Net income $ 2,419 $ 2,034 $ 6,379 $ 5,093

Earnings per share excluding certain items affecting comparability

The following table reconciles reported EPS to EPS excluding certain items affecting comparability (unaudited):

Quarter Ended Nine Months Ended

June 28, June 29, June 28, June 29,

2014 2013 2014 2013

Diluted EPS as reported $ 1.28 $ 1.01 $ 3.40 $ 2.61

Exclude:

Restructuring and impairment charges (1) — 0.02 0.03 0.04

Favorable tax adjustments related to pre-tax earnings of prior

years — — — (0.06)

Tax benefit from prior-year foreign earnings indefinitely

reinvested outside the United States (2) — — — (0.04)

Hulu Equity Redemption charge (3) — — — 0.02

Other income/(expense), net (4) — 0.01 0.04

Diluted EPS excluding certain items affecting comparability(5) $ 1.28 $ 1.03 $ 3.43 $ 2.62

(1)

Charges for the current quarter and nine-month period totaled $0 million and $67 million (pre-tax), respectively, driven

by severance costs. Charges for the prior-year quarter and nine-month period totaled $60 million and $121 million (pre-

tax), driven by severance costs.

(2)

The prior-year nine-month period includes a tax benefit due to an increase in prior-year earnings from foreign operations

indefinitely reinvested outside the United States and subject to tax rates lower than the federal statutory income tax rate

($64 million).

(3)

Our share of expense associated with an equity redemption at Hulu LLC ($55 million pre-tax).

(4)

Significant items in the nine-month period include a loss from Venezuelan foreign currency translation ($143 million

pre-tax and before noncontrolling interest), a gain on the sale of property ($77 million pre-tax) and income related to a

portion of a settlement of an affiliate contract dispute ($29 million pre-tax). Significant items in the prior-year nine-

month period include the Celador litigation charge ($321 million pre-tax) and a gain on the sale of our interest in ESPN

STAR Sports ($219 million pre-tax and before noncontrolling interest).

(5)

May not equal the sum of the rows due to rounding.

You might also like

- The RMBC MethodDocument128 pagesThe RMBC MethodFaizan Ahmed100% (2)

- Fce 2015 Complete Tests 1 e 2 AnswersDocument4 pagesFce 2015 Complete Tests 1 e 2 AnswersMárcia Bonfim83% (23)

- Nollet 2015 - Handbook of Food Analysis PDFDocument1,531 pagesNollet 2015 - Handbook of Food Analysis PDFემილი ონოფრე100% (3)

- Charging All Costs To Expense When IncurredDocument27 pagesCharging All Costs To Expense When IncurredAnonymous N9dx4ATEghNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Q2 FY2014 Financial ReconciliationDocument2 pagesQ2 FY2014 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q2 FY2013 Financial ReconciliationDocument2 pagesQ2 FY2013 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q1 FY2015 Financial ReconciliationDocument2 pagesQ1 FY2015 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q4 FY2007 Financial ReconciliationDocument4 pagesQ4 FY2007 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Reconciliation q2 Fy2016Document2 pagesReconciliation q2 Fy2016Ђорђе МалешевићNo ratings yet

- Sun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsDocument1 pageSun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsYash HardowarNo ratings yet

- Reconciliation q4 Fy2016Document3 pagesReconciliation q4 Fy2016Ђорђе МалешевићNo ratings yet

- 1Q23 - Trending SchedulesDocument11 pages1Q23 - Trending SchedulesStephano Gomes GabrielNo ratings yet

- Statement of Changes in EquityDocument1 pageStatement of Changes in EquityRommel VinluanNo ratings yet

- 2021Q2 Alphabet Earnings ReleaseDocument10 pages2021Q2 Alphabet Earnings ReleasextrangeNo ratings yet

- Reconciliation q2 Fy17Document2 pagesReconciliation q2 Fy17Ђорђе МалешевићNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- 1Q16 - Financial ReconciliationDocument2 pages1Q16 - Financial ReconciliationSenthil KumarNo ratings yet

- (In Thousands, Except Per Share Amounts) : Snap Inc. Consolidated Statements of OperationsDocument2 pages(In Thousands, Except Per Share Amounts) : Snap Inc. Consolidated Statements of OperationsPhan DuyetNo ratings yet

- SBI Annual Report 2022-244-245Document2 pagesSBI Annual Report 2022-244-245Radhika GoelNo ratings yet

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Document11 pagesRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaNo ratings yet

- Ayala Corporation and Subsidiaries Consolidated Statements of Changes in EquityDocument2 pagesAyala Corporation and Subsidiaries Consolidated Statements of Changes in EquitybyuntaexoNo ratings yet

- Eurasia Drilling Company LimitedDocument19 pagesEurasia Drilling Company LimitedKaiserNo ratings yet

- Estados Financieros 2017 PDFDocument82 pagesEstados Financieros 2017 PDFWilsonNo ratings yet

- 2021Q3 Alphabet Earnings ReleaseDocument10 pages2021Q3 Alphabet Earnings ReleasegigokiNo ratings yet

- Reconciliation q1 Fy17Document2 pagesReconciliation q1 Fy17Ђорђе МалешевићNo ratings yet

- 2018 GrubHub 10-K ExtractsDocument4 pages2018 GrubHub 10-K ExtractsShuting QinNo ratings yet

- Reconciliation q4 Fy23Document5 pagesReconciliation q4 Fy23Shady FathyNo ratings yet

- A04 Xgpr15n5xduon8yb.1Document30 pagesA04 Xgpr15n5xduon8yb.1Hiya ByeNo ratings yet

- Interfresh FY 2012 ResultsDocument1 pageInterfresh FY 2012 ResultsaddyNo ratings yet

- Alphabet Reports Fouth Quarter ResultsDocument11 pagesAlphabet Reports Fouth Quarter ResultsTim MooreNo ratings yet

- Walt Disney Corporation FSDocument6 pagesWalt Disney Corporation FSJannefah Irish SaglayanNo ratings yet

- Walt Disney Corporation FSDocument6 pagesWalt Disney Corporation FSJannefah Irish SaglayanNo ratings yet

- Interim Financial Statement - 3rd Quarter: Aitken Spence Hotel Holdings PLCDocument16 pagesInterim Financial Statement - 3rd Quarter: Aitken Spence Hotel Holdings PLCnowfazNo ratings yet

- Fajarbaru Builder Group BHDDocument5 pagesFajarbaru Builder Group BHDShungchau WongNo ratings yet

- Q3 2009 UTV Software Communications Financials Uploaded by MediaNamaDocument1 pageQ3 2009 UTV Software Communications Financials Uploaded by MediaNamamixedbagNo ratings yet

- LVMH 2020 Consolidated Financial StatementDocument99 pagesLVMH 2020 Consolidated Financial StatementGEETIKA PATRANo ratings yet

- IESL Draft 2014Document32 pagesIESL Draft 2014Manzoor ElahiNo ratings yet

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Overview and Regulation G Disclosure Q2 2014Document10 pagesFinancial Overview and Regulation G Disclosure Q2 2014Christopher TownsendNo ratings yet

- Consolidated Statements of Operations: Years Ended September 26, 2015 September 27, 2014 September 28, 2013Document5 pagesConsolidated Statements of Operations: Years Ended September 26, 2015 September 27, 2014 September 28, 2013Anna Mae Corpuz PrioloNo ratings yet

- Recipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)Document46 pagesRecipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)polodeNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- Aecon - Project IDocument39 pagesAecon - Project IRaji MohanNo ratings yet

- HUL Directors Report Ar 2013 14Document24 pagesHUL Directors Report Ar 2013 14Lakshmi MNo ratings yet

- TASK Investor Metrics Q4 2021 FINALDocument29 pagesTASK Investor Metrics Q4 2021 FINALKim Sydpraise FloresNo ratings yet

- EWI Q2-2018 ResultsDocument20 pagesEWI Q2-2018 ResultskimNo ratings yet

- 2016 08 04 BWG Q22016 Results Ann v7Document19 pages2016 08 04 BWG Q22016 Results Ann v7knightridNo ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- Chipotle 2021 Q4 Non GAAPDocument5 pagesChipotle 2021 Q4 Non GAAPSean IsaiahNo ratings yet

- q4 Fy23 EarningsDocument22 pagesq4 Fy23 EarningsShady FathyNo ratings yet

- United Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Document40 pagesUnited Company RUSAL PLC Consolidated Interim Condensed Financial Information For The Three-And Six-Month Periods Ended 30 June 2018Евно АзефNo ratings yet

- Cashflow 2007Document1 pageCashflow 2007Zeeshan SiddiqueNo ratings yet

- AlphabetDocument12 pagesAlphabetandre.torresNo ratings yet

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathoreNo ratings yet

- ? Quarterly Report Pursuant To Section 13 or 15 (D) of The Securities Exchange Act OF 1934Document113 pages? Quarterly Report Pursuant To Section 13 or 15 (D) of The Securities Exchange Act OF 1934Makuna NatsvlishviliNo ratings yet

- Dufu Technology Corp. Berhad: (The Figures Have Not Been Audited)Document18 pagesDufu Technology Corp. Berhad: (The Figures Have Not Been Audited)seliper biruNo ratings yet

- 2021Q4 Alphabet Earnings ReleaseDocument10 pages2021Q4 Alphabet Earnings Releaseclaus_44No ratings yet

- Asl Marine Holdings Ltd.Document30 pagesAsl Marine Holdings Ltd.citybizlist11No ratings yet

- 2022Q2 Alphabet Earnings ReleaseDocument9 pages2022Q2 Alphabet Earnings ReleaseTey Boon KiatNo ratings yet

- (In Philippine Pesos) : Se Detendre La Plage IncDocument5 pages(In Philippine Pesos) : Se Detendre La Plage IncJheza Mae PitogoNo ratings yet

- GAR02 28 02 2024 FY2023 Results ReleaseDocument29 pagesGAR02 28 02 2024 FY2023 Results Releasedesifatimah87No ratings yet

- SGA Report Digital PDFDocument42 pagesSGA Report Digital PDFЂорђе МалешевићNo ratings yet

- Ivanka Trump Takes Donald Trump Seat at G20 Leaders' Table - BBC NewsDocument1 pageIvanka Trump Takes Donald Trump Seat at G20 Leaders' Table - BBC NewsЂорђе МалешевићNo ratings yet

- Heidegger Martin Sojourns The Journey To GreeceDocument49 pagesHeidegger Martin Sojourns The Journey To GreeceЂорђе МалешевићNo ratings yet

- Q2 FY2013 Financial ReconciliationDocument2 pagesQ2 FY2013 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Gipe 005893Document246 pagesGipe 005893Ђорђе МалешевићNo ratings yet

- Q1 FY2010 Financial ReconciliationDocument3 pagesQ1 FY2010 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Reconciliation q2 Fy2016Document2 pagesReconciliation q2 Fy2016Ђорђе МалешевићNo ratings yet

- Reconciliation q1 Fy17Document2 pagesReconciliation q1 Fy17Ђорђе МалешевићNo ratings yet

- q2 Fy17 EarningsDocument14 pagesq2 Fy17 EarningsЂорђе МалешевићNo ratings yet

- q1 Fy18 EarningsDocument15 pagesq1 Fy18 EarningsЂорђе МалешевићNo ratings yet

- Q1 FY2011 Financial ReconciliationDocument3 pagesQ1 FY2011 Financial ReconciliationЂорђе МалешевићNo ratings yet

- 2003 Proxy StatementDocument48 pages2003 Proxy StatementЂорђе МалешевићNo ratings yet

- Q1 FY2015 Financial ReconciliationDocument2 pagesQ1 FY2015 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Q2 FY2014 Financial ReconciliationDocument2 pagesQ2 FY2014 Financial ReconciliationЂорђе МалешевићNo ratings yet

- Reconciliation q4 Fy2016Document3 pagesReconciliation q4 Fy2016Ђорђе МалешевићNo ratings yet

- Reconciliation q2 Fy17Document2 pagesReconciliation q2 Fy17Ђорђе МалешевићNo ratings yet

- Q4 FY2007 Financial ReconciliationDocument4 pagesQ4 FY2007 Financial ReconciliationЂорђе МалешевићNo ratings yet

- q3 Fy17 EarningsDocument14 pagesq3 Fy17 EarningsЂорђе МалешевићNo ratings yet

- The Walt Disney Company Reports First Quarter Earnings For Fiscal 2017Document14 pagesThe Walt Disney Company Reports First Quarter Earnings For Fiscal 2017Ђорђе МалешевићNo ratings yet

- Form 4Document1 pageForm 4Ђорђе МалешевићNo ratings yet

- FSA Enrollment Form - English PDFDocument1 pageFSA Enrollment Form - English PDFLupita MontalvanNo ratings yet

- Construction Contract: Contract For Construction of Apco Hyundai Car Showroom at Uppala, Kasaragod, KeralaDocument2 pagesConstruction Contract: Contract For Construction of Apco Hyundai Car Showroom at Uppala, Kasaragod, KeralakrishnanunniNo ratings yet

- 11 Ultimate Protection Video Charitable Religious TrustsDocument12 pages11 Ultimate Protection Video Charitable Religious TrustsKing FishNo ratings yet

- Philo ExamDocument2 pagesPhilo ExamJohn Albert100% (1)

- Authentic Assessment ToolsDocument24 pagesAuthentic Assessment ToolsJessica De QuintosNo ratings yet

- Anatomy GuDocument13 pagesAnatomy Gujefel umarNo ratings yet

- Teacher'S Class Program: Artment of UcationDocument1 pageTeacher'S Class Program: Artment of UcationJeurdecel Laborada Castro - MartizanoNo ratings yet

- A Resource-Based View of The FirmDocument15 pagesA Resource-Based View of The Firmannu nandalNo ratings yet

- 11 Business Studies SP 1Document11 pages11 Business Studies SP 1Meldon17No ratings yet

- Identification and Certification of Labconco Class Ii Safety CabinetsDocument9 pagesIdentification and Certification of Labconco Class Ii Safety CabinetscobramcNo ratings yet

- Disaster Recovery Best PracticesDocument8 pagesDisaster Recovery Best PracticesJose RosarioNo ratings yet

- Brooklyn Mitsubishi Petition Notice To Respondents Schedules A-GDocument98 pagesBrooklyn Mitsubishi Petition Notice To Respondents Schedules A-GQueens PostNo ratings yet

- QUANTIFICATIONDocument4 pagesQUANTIFICATIONJohn Edsel SalavariaNo ratings yet

- (GUARANTEED RATE AFFINITY) & (8905 BEAVER FALLS) - UCC1 Financial Statement LIENDocument9 pages(GUARANTEED RATE AFFINITY) & (8905 BEAVER FALLS) - UCC1 Financial Statement LIENHakim-Aarifah BeyNo ratings yet

- Nuclear PhysicsDocument85 pagesNuclear PhysicsKy2ST3z4No ratings yet

- KS2 How Do We See ThingsDocument6 pagesKS2 How Do We See ThingsMekala WithanaNo ratings yet

- Project On SunsilkDocument16 pagesProject On Sunsilkiilm00282% (22)

- KPI RepositoryDocument33 pagesKPI RepositoryBONo ratings yet

- Arm Muscles OverviewDocument20 pagesArm Muscles OverviewLilian JerotichNo ratings yet

- Case ReportDocument16 pagesCase ReportSabbir ThePsychoExpressNo ratings yet

- By Laws Amended As at 1 July 2022 PDFDocument364 pagesBy Laws Amended As at 1 July 2022 PDFJING YI LIMNo ratings yet

- Blockchain-Enabled Drug Supply Chain: Sheetal Nayak, Prachitee Shirvale, Nihar Naik, Snehpriya Khul, Amol SawantDocument4 pagesBlockchain-Enabled Drug Supply Chain: Sheetal Nayak, Prachitee Shirvale, Nihar Naik, Snehpriya Khul, Amol SawantWaspNo ratings yet

- Lessons & Carols Service 2017Document2 pagesLessons & Carols Service 2017Essex Center UMCNo ratings yet

- The DJ Test: Personalised Report and Recommendations For Alex YachevskiDocument34 pagesThe DJ Test: Personalised Report and Recommendations For Alex YachevskiSashadanceNo ratings yet

- Presstonic Engineering Ltd.Document2 pagesPresstonic Engineering Ltd.Tanumay NaskarNo ratings yet

- Lesson 9. Phylum Mollusca PDFDocument44 pagesLesson 9. Phylum Mollusca PDFJonard PedrosaNo ratings yet

- BandiniDocument17 pagesBandiniShilpa GowdaNo ratings yet