Professional Documents

Culture Documents

DCB Benefit Savings Account

DCB Benefit Savings Account

Uploaded by

DesikanCopyright:

Available Formats

You might also like

- New Surrender Application Questionnaire PDFDocument1 pageNew Surrender Application Questionnaire PDFDesikan50% (2)

- Reckitt Benckiser PLCDocument10 pagesReckitt Benckiser PLCRia Agustriana100% (1)

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Schedule of Benefits and Fees For DCB Privilege Savings AccountDocument4 pagesSchedule of Benefits and Fees For DCB Privilege Savings AccountYusuf KhanNo ratings yet

- SOC DCB Privilege Savings AccountDocument4 pagesSOC DCB Privilege Savings AccountBVS NAGABABUNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Service Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Mukunda MukundaNo ratings yet

- SOC DCB Premium Savings AccountDocument4 pagesSOC DCB Premium Savings Accountmadddy7012No ratings yet

- HDFC Current Account ChargesDocument2 pagesHDFC Current Account ChargesRAGHAVA NAIDU .KNo ratings yet

- DownloadDocument2 pagesDownloadlaxanboxerNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- DownloadDocument2 pagesDownloadHNo ratings yet

- SOC DCB Classic Savings AccountDocument4 pagesSOC DCB Classic Savings AccountMohammed ZuhaibNo ratings yet

- SOC DCB Privilege Current AccountDocument4 pagesSOC DCB Privilege Current Accountsunilverma202320No ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- SOC DCB Classic Current AccountDocument4 pagesSOC DCB Classic Current AccountpanditipabmaNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Schedule of Fees & ChargesDocument8 pagesSchedule of Fees & ChargesJamesNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Business Essential AccountDocument4 pagesBusiness Essential Accountshekharsap284No ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Cbi First Schedule of ChargesDocument9 pagesCbi First Schedule of ChargesAshNo ratings yet

- Umang Account IdbiDocument4 pagesUmang Account Idbimajhi.deepashreeNo ratings yet

- Unnati Business AccountDocument4 pagesUnnati Business Accountmajhi.deepashreeNo ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- GSFC MpowerDocument2 pagesGSFC Mpowerneerajsibgh434No ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Document4 pagesYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNo ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerAnkur SarafNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- Schedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Document4 pagesSchedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Sathishraam CPNo ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Idfc First MitcDocument12 pagesIdfc First Mitcsrikanth reddyNo ratings yet

- Indus AdvantageDocument1 pageIndus Advantagesubhasish paulNo ratings yet

- 2918 Stanbic August TarrifsDocument1 page2918 Stanbic August TarrifsNyamutatanga MakombeNo ratings yet

- Pubali Bank Visa Credit Card BrochureDocument5 pagesPubali Bank Visa Credit Card Brochuresamin3shohelNo ratings yet

- HDFCDocument2 pagesHDFCrocowi4677No ratings yet

- SOC-Citygem 30062021Document2 pagesSOC-Citygem 30062021Super 247No ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerSwapnil PankeNo ratings yet

- DTB KE Products Guide BookDocument33 pagesDTB KE Products Guide Bookkefiyalew BNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Prestige BankingDocument6 pagesPrestige BankingobakkandoNo ratings yet

- Charges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids CardDocument5 pagesCharges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids Cardrose thomsan thomsanNo ratings yet

- Schedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Document2 pagesSchedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Badri ShaikhNo ratings yet

- YES FIRST SOC February 2020 PDFDocument2 pagesYES FIRST SOC February 2020 PDFAyush JadhavNo ratings yet

- Soc Idfc 2Document1 pageSoc Idfc 2rk4322016No ratings yet

- MyMoBiz Account Pricing Guide 2023Document6 pagesMyMoBiz Account Pricing Guide 2023gadlampumeNo ratings yet

- Wealth CA Schedule of ChargesDocument6 pagesWealth CA Schedule of ChargesSayan Kumar PatiNo ratings yet

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- Canara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDocument3 pagesCanara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDesikanNo ratings yet

- Form 35Document1 pageForm 35Desikan0% (2)

- Children Education AllowanceDocument1 pageChildren Education AllowanceDesikanNo ratings yet

- Account Opening Forms PDFDocument11 pagesAccount Opening Forms PDFDesikanNo ratings yet

- Corporate Re Kyc FormDocument3 pagesCorporate Re Kyc FormDesikanNo ratings yet

- New Surrender Application Questionnaire PDFDocument1 pageNew Surrender Application Questionnaire PDFDesikan0% (1)

- Demat FormDocument22 pagesDemat FormDesikanNo ratings yet

- SCR-1 LIC State Central Registry Disclosure FormDocument1 pageSCR-1 LIC State Central Registry Disclosure FormDesikanNo ratings yet

- Pradhan Mantri Vaya Vandana Plan 842 Form PDFDocument6 pagesPradhan Mantri Vaya Vandana Plan 842 Form PDFDesikan100% (1)

- SCR-1 LIC State Central Registry Disclosure FormDocument1 pageSCR-1 LIC State Central Registry Disclosure FormDesikanNo ratings yet

- Mandate Form For Payment of Pension Annuity - LICDocument3 pagesMandate Form For Payment of Pension Annuity - LICDesikanNo ratings yet

- New APPS Mandate Form Final - 796381968Document2 pagesNew APPS Mandate Form Final - 796381968DesikanNo ratings yet

- Nurse Lic Ver Request InfoDocument1 pageNurse Lic Ver Request InfoDesikanNo ratings yet

- Request For Cancellation of SIP-STP-SWPDocument2 pagesRequest For Cancellation of SIP-STP-SWPDesikanNo ratings yet

- Surety FormDocument1 pageSurety FormDesikanNo ratings yet

- LIC500Document2 pagesLIC500DesikanNo ratings yet

- Pradhan Mantri Vaya Vandana Plan 842 Form PDFDocument6 pagesPradhan Mantri Vaya Vandana Plan 842 Form PDFDesikan100% (1)

- Notice of Change of Nomination (Form No. 3750) PDFDocument3 pagesNotice of Change of Nomination (Form No. 3750) PDFDesikan100% (1)

- Request For Issue of Duplicate PasswordDocument1 pageRequest For Issue of Duplicate PasswordDesikanNo ratings yet

- Black & Decker - New Sub Brand Is Category NOT CompanyDocument21 pagesBlack & Decker - New Sub Brand Is Category NOT CompanyhkboozNo ratings yet

- Rebuilding Business and Investment in Post-Conflict Sierra LeoneDocument23 pagesRebuilding Business and Investment in Post-Conflict Sierra LeoneInternational Finance Corporation (IFC)No ratings yet

- Agile ResourcesDocument4 pagesAgile ResourcescmarrivadaNo ratings yet

- 14 Zutter Smart MFBrief 15e Ch14 RevDocument106 pages14 Zutter Smart MFBrief 15e Ch14 RevhaiNo ratings yet

- Case Teaching and Writing Workshop-Sept. 05-08 2017Document5 pagesCase Teaching and Writing Workshop-Sept. 05-08 2017RajyaLakshmiNo ratings yet

- JBE-Instructions For AuthorsDocument16 pagesJBE-Instructions For AuthorsUsman KokabNo ratings yet

- Chapter 1Document11 pagesChapter 1Ayesha GuptaNo ratings yet

- About Basic BudgetingDocument44 pagesAbout Basic BudgetingatifhassansiddiquiNo ratings yet

- W6 NoteDocument1 pageW6 NoteAkyrioz FoxNo ratings yet

- Life-Cycle Cost Analysis: 4.1 OverviewDocument7 pagesLife-Cycle Cost Analysis: 4.1 OverviewWayne ChuNo ratings yet

- MisDocument17 pagesMisAyan SnehashisNo ratings yet

- Rapiscan Integrated Cargo ScanningDocument2 pagesRapiscan Integrated Cargo ScanningAmit ChaudharyNo ratings yet

- Market Analysis and Study On Amul Milk IndustryDocument39 pagesMarket Analysis and Study On Amul Milk IndustrysanuNo ratings yet

- Customer Relationship Management (CRM) in The Hotel IndustryDocument8 pagesCustomer Relationship Management (CRM) in The Hotel IndustryAssignmentLab.comNo ratings yet

- Assessing The Effectiveness of The Internal Control System in The Commercial Banks of Ethiopia: A Case of Hawassa CityDocument5 pagesAssessing The Effectiveness of The Internal Control System in The Commercial Banks of Ethiopia: A Case of Hawassa CityIjsrnet EditorialNo ratings yet

- 3017 Tutorial 6 SolutionsDocument3 pages3017 Tutorial 6 SolutionsNguyễn HảiNo ratings yet

- Seller Listing PresentationDocument18 pagesSeller Listing PresentationPath & Post Real Estate100% (1)

- Petty Cash CycleDocument22 pagesPetty Cash CycleSAlah MOhammed100% (1)

- Quick Lube FranchiseDocument5 pagesQuick Lube FranchisemorgytrashNo ratings yet

- 5s PPT NewDocument39 pages5s PPT NewChethan Nagaraju KumbarNo ratings yet

- In Case of Errors or Questions About Your Electronic Funds TransfersDocument2 pagesIn Case of Errors or Questions About Your Electronic Funds TransfersMuhammad AdeelNo ratings yet

- (Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionDocument2 pages(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionHRish BhimberNo ratings yet

- Heineken Faces Possible APB Bidding WarDocument2 pagesHeineken Faces Possible APB Bidding WarbismarckNo ratings yet

- Grade 5 Grand Finals Contest Problems: Printed Name: - Country: - ScoreDocument3 pagesGrade 5 Grand Finals Contest Problems: Printed Name: - Country: - ScoreHoa NguyễnNo ratings yet

- Business Plan SampleDocument8 pagesBusiness Plan Sampleankitjuneja6661No ratings yet

- Data StructuresDocument72 pagesData StructuresDrHarman Preet SinghNo ratings yet

- SOP List With AttachmentsDocument6 pagesSOP List With AttachmentsjignashaNo ratings yet

- Sums For Practice in StatisticsDocument5 pagesSums For Practice in StatisticsRahul WaniNo ratings yet

DCB Benefit Savings Account

DCB Benefit Savings Account

Uploaded by

DesikanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCB Benefit Savings Account

DCB Benefit Savings Account

Uploaded by

DesikanCopyright:

Available Formats

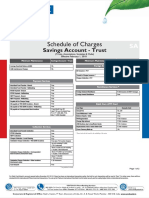

Penal Charges for Non-Maintenance of AQB

Non-maintenance charges Will be charged in proportion to the extent of shortfall in AQB

requirement.

For DCB Benefit SB account, the maximum penal charge for

non-maintenance of AQB is ` 350/- per Quarter.

For example:

If the AQB stipulated for an account is ` 500/- and actual

AQB maintained is ` 250/-.

The percentage shortfall of AQB is by 50%.

In this example, therefore Penal Charge for non maintenance

of AQB will be 350x50/100 i.e. ` 175/- for the Quarter.

Penal Charge may be calculated similarly for any percentage

shortfall in the stipulated AQB amount.

Schedule of Benefits and Fees

Penal charges^ for cheque book ` 2 per leaf^

Penal charges^ for cash First 3 transactions in a quarter - Free

for DCB Benefit Savings Account

transactions at branch Thereafter ` 50 per transaction (maximum ` 1000)

Account Maintenance

Scheme transfer fees# ` 200

Account closure If closed within 30 days of first credit in the account - Free

If closed after 30 days of first credit but within 12 months - ` 250

If closed after 12 months - ` 100

Mode of calculation of average quarterly balance: Sum of end of day balances for the quarter / No of

days in the quarter.

*Out of Pocket expenses - Interest, postage / courier, cable, telex, correspondent bank charges and

other expenses, if any.

^Cheque book taken or transaction done in the quarter in which AQB is not maintained.

#Scheme transfer to lower AQB scheme code can be made only during first fortnight of the quarter

through a written request. Scheme transfer fees are applicable only for opting for a lower scheme

code from the existing one.

Inter - city: Outside the city, Intra - city: Within the city.

(Charges specified are exclusive of service tax).

Terms and condition apply.

DCB 24-Hour Customer Care

Aug 15 / 2.4

Email customercare@dcbbank.com

Call Toll Free 1800 209 5363

Website www.dcbbank.com

DCB Bank Limited (Formerly Development Credit Bank Limited)

Remittance

Schedule of Benefits and Fees for Pay Orders (Local DD)

DCB Benefit Savings Account Non cash transactions - Free limit Nil

(with effect from 01.04.2015) Charges above free limit ` 1 per 1000. Minimum ` 50, Maximum ` 3000

Cash transactions ` 300 per instrument

Demand Drafts (Payable at DCB Bank & HDFC Bank Branch Locations)

Average Quarterly Balance ` 500 Non cash transactions - Free limit Nil

(AQB) & Account Opening ` 2 per 1000. Minimum ` 50, Maximum ` 5000

Charges above free limit

Amount (AOA)

Cash transactions ` 300 per instrument

DCB Visa Debit Card Domestic Card International Card

ATM withdrawal limit ` 25,000 per day Demand Drafts (Payable at Non DCB Bank & HDFC Bank Branch Locations)

POS spending limit ` 40,000 per day Non cash transactions - Free limit Nil

DCB Debit Card Fee Charges above free limit Correspondent bank charges + 0.10%. Minimum ` 50

Issuance fee (one time) Free ` 199 Cash transactions Correspondent bank charges + ` 300

Annual fee Free Free Electronic Fund Transfers

Replacement of card Free Free RTGS (inward & outward) Free

Damaged card Free Free NEFT (inward & outward) Free

DCB Debit Card Usage Visa Money Transfer ` 25 per transaction

Usage at DCB Bank ATMs Free Other Services

Usage at Visa ATMs - Cash Free if Monthly Average Balance (MAB) of ` 10,000 is Cheque Deposited & Returned Unpaid

withdrawal and balance inquiry maintained, else first 5 transactions free per month. Thereafter

Local ` 100 per instrument

(Domestic) ` 18 per financial transaction and ` 7 per non financial

transaction. Outstation cheque ` 100 per instrument

Usage at Visa ATMs - Balance ` 25 per transaction Cheque Issued & Returned

inquiry (International) ` 500 per instrument

Cheque issued & returned

Usage at Visa ATMs - Cash ` 125 per transaction (financial reasons)

withdrawal (International) ` 500 per instance

ECS returns

Value Added Services

Charges for cheques appearing ` 25 per instrument (except for FD proceeds and clearing

DCB Mobile Banking Free in validation report for funds regularisation)

DCB Internet Banking Free reasons

DCB Phone Banking Free Stop Payments

DCB Utility Bill Payment Free Stop payments ` 50 per cheque, Maximum ` 200 per series

Personalised Cheque Book Statement of Account

Payable at par cheque book 25 leaves per month E - Mail (monthly) Free

Charges above free limit ` 2 per leaf Physical (quarterly) Free

Issue of loose cheque leaves ` 5 per leaf ` 200 p.a.

Physical (monthly)

Cash Transactions (Any DCB Bank Branch)

Duplicate statement ` 25 per page. More than 1 year = ` 100 per page

Cash Deposits (Any DCB Bank Branch)

Demand Drafts / Pay Order Cancellation / Revalidation & Duplicate Issuance

Free limit Unlimited free if Monthly Average Balance (MAB) of ` 25,000/-

is maintained. Else: Free Limit: 5 free cash deposit transactions Cancellation / Revalidation ` 50 per instrument

per month. Charges: ` 100/- per transaction from 6th charges

transaction onwards. Issue of duplicate instrument ` 50 per instrument

Charges above free limit ` 100 per transaction Balance Confirmation Certificate & Interest Certificate

Maximum daily limit (third party) ` 50,000 per day Current year Free

Cash Withdrawal (Any DCB Bank Branch) Previous year upto last 2 years ` 100 per year

Free limit Free unlimited Above 2 years ` 500 per year

Maximum daily limit (third party) ` 50,000 per day Duplicate ` 25 per certificate

Clearing Transactions

Standing Instructions

Fund transfer within DCB Bank Free (excluding transfer to / from deposit / loan a/c & transfer to savings accounts)

Any Branch Banking (ABB) Free Setup Free

clearing - Outward clearing

Execution ` 25 per transaction + courier/other out of pocket expenses*

Outstation Cheque Collection

Verifications

DCB Bank & HDFC Bank Upto ` 5,000 - ` 25 per instrument

Locations / Non DCB Bank & Above ` 5,000 to ` 10,000 - ` 50 per instrument Signature verification ` 50 per document

HDFC Bank Locations* Above ` 10,000 to ` 1 lakh - ` 100 per instrument Photo attestation ` 50 per attestation

Above ` 1 lakh - ` 150 per instrument (only if the account opening form with

(All inclusive of other bank charges) photo is available at the branch)

You might also like

- New Surrender Application Questionnaire PDFDocument1 pageNew Surrender Application Questionnaire PDFDesikan50% (2)

- Reckitt Benckiser PLCDocument10 pagesReckitt Benckiser PLCRia Agustriana100% (1)

- Service-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Document2 pagesService-Charges-And-Fees-For-Current-Account-Privilage (CABPL) - Effective-July-01-2022Mukunda MukundaNo ratings yet

- Schedule of Charges and Fees Burgundy (CABGY) 20102020Document2 pagesSchedule of Charges and Fees Burgundy (CABGY) 20102020Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage (CAADV) Effective July 01 2022Mukunda MukundaNo ratings yet

- Cadel Soc 01 01 23 D Lite (CADEL)Document2 pagesCadel Soc 01 01 23 D Lite (CADEL)Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Classic (CABCA) Effective July 01 2022Mukunda MukundaNo ratings yet

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNo ratings yet

- Schedule of Benefits and Fees For DCB Privilege Savings AccountDocument4 pagesSchedule of Benefits and Fees For DCB Privilege Savings AccountYusuf KhanNo ratings yet

- SOC DCB Privilege Savings AccountDocument4 pagesSOC DCB Privilege Savings AccountBVS NAGABABUNo ratings yet

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03No ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- CABCA - SOC - July 22Document2 pagesCABCA - SOC - July 22anjumNo ratings yet

- Service Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Document2 pagesService Charges and Fees For Current Account Select (CASEL) Effective July 01 2022Mukunda MukundaNo ratings yet

- SOC DCB Premium Savings AccountDocument4 pagesSOC DCB Premium Savings Accountmadddy7012No ratings yet

- HDFC Current Account ChargesDocument2 pagesHDFC Current Account ChargesRAGHAVA NAIDU .KNo ratings yet

- DownloadDocument2 pagesDownloadlaxanboxerNo ratings yet

- Service Charges and Fees of Current Account For Arthiyas 21102020Document2 pagesService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNo ratings yet

- DownloadDocument2 pagesDownloadHNo ratings yet

- SOC DCB Classic Savings AccountDocument4 pagesSOC DCB Classic Savings AccountMohammed ZuhaibNo ratings yet

- SOC DCB Privilege Current AccountDocument4 pagesSOC DCB Privilege Current Accountsunilverma202320No ratings yet

- Sba 2 0 Ivy PDFDocument2 pagesSba 2 0 Ivy PDFChandan SahNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- SOC DCB Classic Current AccountDocument4 pagesSOC DCB Classic Current AccountpanditipabmaNo ratings yet

- SOC Savings AdityaDocument2 pagesSOC Savings AdityaDenny PjNo ratings yet

- SOC Next Gen Savings AccountDocument2 pagesSOC Next Gen Savings AccountSUBHRAKANTA DASNo ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Schedule of Fees & ChargesDocument8 pagesSchedule of Fees & ChargesJamesNo ratings yet

- Casil Soc 01 07 23Document2 pagesCasil Soc 01 07 23rishisiliveri95No ratings yet

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDocument2 pagesSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNo ratings yet

- Business Essential AccountDocument4 pagesBusiness Essential Accountshekharsap284No ratings yet

- Burgundy Fees and Charges As On 2019 09Document7 pagesBurgundy Fees and Charges As On 2019 09Shivanshu SinghNo ratings yet

- Cbi First Schedule of ChargesDocument9 pagesCbi First Schedule of ChargesAshNo ratings yet

- Umang Account IdbiDocument4 pagesUmang Account Idbimajhi.deepashreeNo ratings yet

- Unnati Business AccountDocument4 pagesUnnati Business Accountmajhi.deepashreeNo ratings yet

- Regular Savings SOC 2023Document2 pagesRegular Savings SOC 2023megha90909No ratings yet

- GSFC MpowerDocument2 pagesGSFC Mpowerneerajsibgh434No ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Document4 pagesYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNo ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerAnkur SarafNo ratings yet

- Indus Infotech December292017Document1 pageIndus Infotech December292017Harssh S ShrivastavaNo ratings yet

- Burgundy Fees and Charges 14 08Document8 pagesBurgundy Fees and Charges 14 08ShipaNo ratings yet

- Schedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Document4 pagesSchedule of Service Charges: Trust, Associations Clubs, Societies (TASC)Sathishraam CPNo ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Idfc First MitcDocument12 pagesIdfc First Mitcsrikanth reddyNo ratings yet

- Indus AdvantageDocument1 pageIndus Advantagesubhasish paulNo ratings yet

- 2918 Stanbic August TarrifsDocument1 page2918 Stanbic August TarrifsNyamutatanga MakombeNo ratings yet

- Pubali Bank Visa Credit Card BrochureDocument5 pagesPubali Bank Visa Credit Card Brochuresamin3shohelNo ratings yet

- HDFCDocument2 pagesHDFCrocowi4677No ratings yet

- SOC-Citygem 30062021Document2 pagesSOC-Citygem 30062021Super 247No ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerSwapnil PankeNo ratings yet

- DTB KE Products Guide BookDocument33 pagesDTB KE Products Guide Bookkefiyalew BNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Prestige BankingDocument6 pagesPrestige BankingobakkandoNo ratings yet

- Charges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids CardDocument5 pagesCharges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids Cardrose thomsan thomsanNo ratings yet

- Schedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Document2 pagesSchedule of Benefits & Charges RBL Aspire Banking: (Individual) (Entity)Badri ShaikhNo ratings yet

- YES FIRST SOC February 2020 PDFDocument2 pagesYES FIRST SOC February 2020 PDFAyush JadhavNo ratings yet

- Soc Idfc 2Document1 pageSoc Idfc 2rk4322016No ratings yet

- MyMoBiz Account Pricing Guide 2023Document6 pagesMyMoBiz Account Pricing Guide 2023gadlampumeNo ratings yet

- Wealth CA Schedule of ChargesDocument6 pagesWealth CA Schedule of ChargesSayan Kumar PatiNo ratings yet

- Interest Rate Idfc BankDocument4 pagesInterest Rate Idfc BankDesikanNo ratings yet

- Canara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDocument3 pagesCanara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDesikanNo ratings yet

- Form 35Document1 pageForm 35Desikan0% (2)

- Children Education AllowanceDocument1 pageChildren Education AllowanceDesikanNo ratings yet

- Account Opening Forms PDFDocument11 pagesAccount Opening Forms PDFDesikanNo ratings yet

- Corporate Re Kyc FormDocument3 pagesCorporate Re Kyc FormDesikanNo ratings yet

- New Surrender Application Questionnaire PDFDocument1 pageNew Surrender Application Questionnaire PDFDesikan0% (1)

- Demat FormDocument22 pagesDemat FormDesikanNo ratings yet

- SCR-1 LIC State Central Registry Disclosure FormDocument1 pageSCR-1 LIC State Central Registry Disclosure FormDesikanNo ratings yet

- Pradhan Mantri Vaya Vandana Plan 842 Form PDFDocument6 pagesPradhan Mantri Vaya Vandana Plan 842 Form PDFDesikan100% (1)

- SCR-1 LIC State Central Registry Disclosure FormDocument1 pageSCR-1 LIC State Central Registry Disclosure FormDesikanNo ratings yet

- Mandate Form For Payment of Pension Annuity - LICDocument3 pagesMandate Form For Payment of Pension Annuity - LICDesikanNo ratings yet

- New APPS Mandate Form Final - 796381968Document2 pagesNew APPS Mandate Form Final - 796381968DesikanNo ratings yet

- Nurse Lic Ver Request InfoDocument1 pageNurse Lic Ver Request InfoDesikanNo ratings yet

- Request For Cancellation of SIP-STP-SWPDocument2 pagesRequest For Cancellation of SIP-STP-SWPDesikanNo ratings yet

- Surety FormDocument1 pageSurety FormDesikanNo ratings yet

- LIC500Document2 pagesLIC500DesikanNo ratings yet

- Pradhan Mantri Vaya Vandana Plan 842 Form PDFDocument6 pagesPradhan Mantri Vaya Vandana Plan 842 Form PDFDesikan100% (1)

- Notice of Change of Nomination (Form No. 3750) PDFDocument3 pagesNotice of Change of Nomination (Form No. 3750) PDFDesikan100% (1)

- Request For Issue of Duplicate PasswordDocument1 pageRequest For Issue of Duplicate PasswordDesikanNo ratings yet

- Black & Decker - New Sub Brand Is Category NOT CompanyDocument21 pagesBlack & Decker - New Sub Brand Is Category NOT CompanyhkboozNo ratings yet

- Rebuilding Business and Investment in Post-Conflict Sierra LeoneDocument23 pagesRebuilding Business and Investment in Post-Conflict Sierra LeoneInternational Finance Corporation (IFC)No ratings yet

- Agile ResourcesDocument4 pagesAgile ResourcescmarrivadaNo ratings yet

- 14 Zutter Smart MFBrief 15e Ch14 RevDocument106 pages14 Zutter Smart MFBrief 15e Ch14 RevhaiNo ratings yet

- Case Teaching and Writing Workshop-Sept. 05-08 2017Document5 pagesCase Teaching and Writing Workshop-Sept. 05-08 2017RajyaLakshmiNo ratings yet

- JBE-Instructions For AuthorsDocument16 pagesJBE-Instructions For AuthorsUsman KokabNo ratings yet

- Chapter 1Document11 pagesChapter 1Ayesha GuptaNo ratings yet

- About Basic BudgetingDocument44 pagesAbout Basic BudgetingatifhassansiddiquiNo ratings yet

- W6 NoteDocument1 pageW6 NoteAkyrioz FoxNo ratings yet

- Life-Cycle Cost Analysis: 4.1 OverviewDocument7 pagesLife-Cycle Cost Analysis: 4.1 OverviewWayne ChuNo ratings yet

- MisDocument17 pagesMisAyan SnehashisNo ratings yet

- Rapiscan Integrated Cargo ScanningDocument2 pagesRapiscan Integrated Cargo ScanningAmit ChaudharyNo ratings yet

- Market Analysis and Study On Amul Milk IndustryDocument39 pagesMarket Analysis and Study On Amul Milk IndustrysanuNo ratings yet

- Customer Relationship Management (CRM) in The Hotel IndustryDocument8 pagesCustomer Relationship Management (CRM) in The Hotel IndustryAssignmentLab.comNo ratings yet

- Assessing The Effectiveness of The Internal Control System in The Commercial Banks of Ethiopia: A Case of Hawassa CityDocument5 pagesAssessing The Effectiveness of The Internal Control System in The Commercial Banks of Ethiopia: A Case of Hawassa CityIjsrnet EditorialNo ratings yet

- 3017 Tutorial 6 SolutionsDocument3 pages3017 Tutorial 6 SolutionsNguyễn HảiNo ratings yet

- Seller Listing PresentationDocument18 pagesSeller Listing PresentationPath & Post Real Estate100% (1)

- Petty Cash CycleDocument22 pagesPetty Cash CycleSAlah MOhammed100% (1)

- Quick Lube FranchiseDocument5 pagesQuick Lube FranchisemorgytrashNo ratings yet

- 5s PPT NewDocument39 pages5s PPT NewChethan Nagaraju KumbarNo ratings yet

- In Case of Errors or Questions About Your Electronic Funds TransfersDocument2 pagesIn Case of Errors or Questions About Your Electronic Funds TransfersMuhammad AdeelNo ratings yet

- (Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionDocument2 pages(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionHRish BhimberNo ratings yet

- Heineken Faces Possible APB Bidding WarDocument2 pagesHeineken Faces Possible APB Bidding WarbismarckNo ratings yet

- Grade 5 Grand Finals Contest Problems: Printed Name: - Country: - ScoreDocument3 pagesGrade 5 Grand Finals Contest Problems: Printed Name: - Country: - ScoreHoa NguyễnNo ratings yet

- Business Plan SampleDocument8 pagesBusiness Plan Sampleankitjuneja6661No ratings yet

- Data StructuresDocument72 pagesData StructuresDrHarman Preet SinghNo ratings yet

- SOP List With AttachmentsDocument6 pagesSOP List With AttachmentsjignashaNo ratings yet

- Sums For Practice in StatisticsDocument5 pagesSums For Practice in StatisticsRahul WaniNo ratings yet