Professional Documents

Culture Documents

Capital Alert 6/13/2008

Capital Alert 6/13/2008

Uploaded by

Russell KlusasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Alert 6/13/2008

Capital Alert 6/13/2008

Uploaded by

Russell KlusasCopyright:

Available Formats

6-13-2008

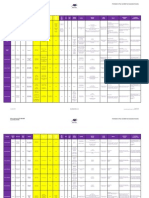

Multi-Family Loan Programs > $3 Million

Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

5 Yr. 80% 6.36% to 6.51% 75% 5.95% to 6.25%

7 Yr. 80% 6.30% to 6.45% 75% 6.40% to 6.65%

10 Yr. 80% 6.40% to 6.60% 75% 6.55% to 6.85%

15 Yr. 80% 6.81% to 7.41% 75% 6.85% to 7.35%

*Rates based on Act/360

Multi-Family Loan Programs < $3 Million

Fixed Rate Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

3 Yr. 80% 6.24% to 6.68% 75% 5.80% to 6.25%

5 Yr. 80% 6.28% to 6.66% 75% 5.95% to 6.35%

7 Yr. 80% 6.23% to 6.53% 75% 6.40% to 6.65%

10 Yr. 80% 6.32% to 6.62% 75% 6.55% to 6.85%

15 Yr. 80% 6.88% to 7.79% 75% 6.85% to 7.35%

*Rates based on Act/360

Commercial Loan Programs

Fixed Rate Portfolio Lenders* Index Rates

Term Leverage Max. Interest Rates

as of 6/13/2008 5:45 p.m. ET

5-Year Treasury: 3.73%

5 Yr. 75% 6.15% to 6.40%

7 Yr. 75% 6.40% to 6.65% 10-Year Treasury: 4.26%

10 Yr. 75% 6.65% to 6.90% 5-Year Swap: 4.65%

15 Yr. 75% 6.95% to 7.45% 10-Year Swap: 4.95%

Bridge Floating Leverage Max. Spread Over Libor LIBOR: 3.26% Prime: 5.00%

Stabilized 75% 225 to 300

Re-Position 90% 275 to 350

(*Portfolio Lenders include Banks, Life Insurance Companies and Credit Unions)

Economic Commentary

Rates continued their upward climb with the 10-year U.S. Treasury

closing out the week at a yield of 4.26 percent, an increase of 32 basis

points since its close last Friday. Swaps also increased with the 10-year

swap at 4.96 percent and the 5-year swap at 4.65 percent. This swap

spread increase translates to an increase in fixed-term interest rates of

more than 50 basis points during the last two weeks. Many economists

speculate that the credit markets have stabilized over the past 90 days

with reduced concern about deepening recession driving the Fed’s focus

to containment of inflation which could prompt the Fed to increase rates.

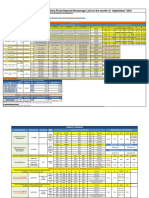

Recent Transactions

780 Bradford 1735 E. Plaza Blvd. Woodcreek Lane 547 Glover Ave.

25-Unit Apartment Multi-Family 20-Unit apartment Multi-Family

Redwood City, CA National City, CA Woodinville, WA Chula Viista, CA

$1,780,000 $1,600,000 $1,450,000 $1,450,000

6.25% Interest rate 5.75% Interest rate 5.79% Interest rate 5.85% Interest rate

30-yr. Amort./10-yr. Term 30-yr. Amort./10-yr. Term 30-yr. Amort./3-yr. Term 30-yr. Amort./10-yr. Term

For more information, contact:

William Hughes

Senior Vice President/Managing Director

Newport Beach, CA

Office: (949) 851-3030

whughes@marcusmillichap.com

Terms, rates and conditions subject to change. www.MMCapCorp.com

You might also like

- Talent Management in GodrejDocument5 pagesTalent Management in GodrejTharani Sona100% (1)

- MCQ Chapter Pom - Unit 1 PDFDocument7 pagesMCQ Chapter Pom - Unit 1 PDFanishjohna33% (3)

- 2007 Change Management Survey ReportDocument52 pages2007 Change Management Survey ReportShandy WilobudiargoNo ratings yet

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasNo ratings yet

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasNo ratings yet

- Capital Alert - 5/30/2008Document1 pageCapital Alert - 5/30/2008Russell KlusasNo ratings yet

- Capital Markets - 6/30/2008Document1 pageCapital Markets - 6/30/2008Russell KlusasNo ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Capital Alert - 7/3/2008Document1 pageCapital Alert - 7/3/2008Russell KlusasNo ratings yet

- Capital Markets - 4/25/2008Document1 pageCapital Markets - 4/25/2008Russell KlusasNo ratings yet

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- Capital Markets - 4/18/2008Document1 pageCapital Markets - 4/18/2008Russell KlusasNo ratings yet

- Multi-Family Loan Programs $3 MillionDocument1 pageMulti-Family Loan Programs $3 MillionRussell KlusasNo ratings yet

- Capital Markets - 5/16/2008Document1 pageCapital Markets - 5/16/2008Russell KlusasNo ratings yet

- Website Disclosure Effective 05 Apr 2024Document4 pagesWebsite Disclosure Effective 05 Apr 2024Ab CdNo ratings yet

- Bank A: Housing Loan Property Equity LoanDocument6 pagesBank A: Housing Loan Property Equity LoanRaesa BadelNo ratings yet

- Capital Alert - 2/1/2008Document1 pageCapital Alert - 2/1/2008Russell KlusasNo ratings yet

- HDFC Deposit FormDocument4 pagesHDFC Deposit FormnaguficoNo ratings yet

- Bank A: Housing Loan Property Equity LoanDocument5 pagesBank A: Housing Loan Property Equity LoanRaesa BadelNo ratings yet

- Website Disclosure Effective 02nd May 2023Document3 pagesWebsite Disclosure Effective 02nd May 2023Prathamesh PatikNo ratings yet

- Capital Markets - 2/29/2008Document1 pageCapital Markets - 2/29/2008Russell KlusasNo ratings yet

- BankingDocument4 pagesBankingBhavin GhoniyaNo ratings yet

- Tel No: 022-4215 9068Document3 pagesTel No: 022-4215 9068mamatha niranjanNo ratings yet

- Website Disclosure Effective 03 Feb 2024Document3 pagesWebsite Disclosure Effective 03 Feb 2024abhishek sharmaNo ratings yet

- Capital Markets - 3/07/2008Document1 pageCapital Markets - 3/07/2008Russell KlusasNo ratings yet

- Capital Markets - 3/14/2008Document2 pagesCapital Markets - 3/14/2008Russell KlusasNo ratings yet

- Website Disclosure Effective 30 Nov 2023Document3 pagesWebsite Disclosure Effective 30 Nov 2023bggbggNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankDocument1 pageInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssasi 'sNo ratings yet

- Cho RM 73 2020-21Document1 pageCho RM 73 2020-21Steve WozniakNo ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- Yield CurveDocument3 pagesYield CurveRochelle Anne OpinaldoNo ratings yet

- Effective Annualized Rate of Return - Resident-NRO TD 1-09-2023Document1 pageEffective Annualized Rate of Return - Resident-NRO TD 1-09-2023Arun sharmaNo ratings yet

- Interest Rates On FDR: Monthly Benefit PlanDocument2 pagesInterest Rates On FDR: Monthly Benefit Planmushfik arafatNo ratings yet

- Capital Markets - 4/11/2008Document1 pageCapital Markets - 4/11/2008Russell KlusasNo ratings yet

- Excel FormatDocument38 pagesExcel FormatSaad QureshiNo ratings yet

- IIFL Associate FD List September'2021Document4 pagesIIFL Associate FD List September'2021BHARAT SNo ratings yet

- Rates of Return On PLSDeposits OtherDepositsDocument2 pagesRates of Return On PLSDeposits OtherDepositsranamkhan553No ratings yet

- FD Customer Leaflet-A4 - WEBDocument1 pageFD Customer Leaflet-A4 - WEBmyloan partnerNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsY_AZNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsV NaveenNo ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaNo ratings yet

- Interest Rates On Deposits Above Rs 2 Crs Wef 15092022Document5 pagesInterest Rates On Deposits Above Rs 2 Crs Wef 15092022Manish bishnoiNo ratings yet

- Rights of BusinessDocument2 pagesRights of BusinessHimanshu MilanNo ratings yet

- 08 - Term Structure of Interest Rate and Yield Curve - AnnotatedDocument6 pages08 - Term Structure of Interest Rate and Yield Curve - AnnotatedFindri Palias BokyNo ratings yet

- Interest Rate RetailDocument6 pagesInterest Rate RetailRavie S DhamaNo ratings yet

- Nre FD New RateDocument5 pagesNre FD New RateMidhunRameshThuvasseryNo ratings yet

- FD Leaflet - A5 - 13 Dec 23Document2 pagesFD Leaflet - A5 - 13 Dec 23Shaily Sinha100% (1)

- Slabs Profit Rate: Deposit and Prematurity RatesDocument1 pageSlabs Profit Rate: Deposit and Prematurity RatesJay KhanNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsD SunilNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsIndranil Roy ChoudhuriNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsspshekarNo ratings yet

- Deposits Deposits: IndividualsDocument5 pagesDeposits Deposits: IndividualskaushikNo ratings yet

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDocument5 pagesInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659No ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed DepositsRaghav sharmaNo ratings yet

- Interest RatesDocument5 pagesInterest Ratesagupta_16No ratings yet

- Interest Rates On Domestic Fixed Deposit and Recurring DepositDocument1 pageInterest Rates On Domestic Fixed Deposit and Recurring DepositMuditNo ratings yet

- The Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsFrom EverandThe Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsNo ratings yet

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasNo ratings yet

- Chicago - Southwest Submarket - Retail - 1/1/2008Document2 pagesChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- Milwaukee - Office - 8/7/08Document4 pagesMilwaukee - Office - 8/7/08Russell KlusasNo ratings yet

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasNo ratings yet

- Chicago - Industrial - 1/1/2008Document1 pageChicago - Industrial - 1/1/2008Russell KlusasNo ratings yet

- Indianapolis - Retail - 4/1/2008Document4 pagesIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Milwaukee - Retail Construction - 4/1/2008Document3 pagesMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasNo ratings yet

- Chicago - South Submarket - Retail - 7/1/2007Document2 pagesChicago - South Submarket - Retail - 7/1/2007Russell KlusasNo ratings yet

- DesMoines Submarket - Retail - 10/1/2007Document2 pagesDesMoines Submarket - Retail - 10/1/2007Russell KlusasNo ratings yet

- Milwaukee - Retail - 4/1/2008Document4 pagesMilwaukee - Retail - 4/1/2008Russell KlusasNo ratings yet

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Document2 pagesMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasNo ratings yet

- Indianapolis - Apartment - Construction - 4/1/2008Document3 pagesIndianapolis - Apartment - Construction - 4/1/2008Russell Klusas100% (1)

- Chicago - Near West Submarket - Retail - 7/1/2007Document2 pagesChicago - Near West Submarket - Retail - 7/1/2007Russell KlusasNo ratings yet

- Evansville - Apartment - 1/1/2008Document2 pagesEvansville - Apartment - 1/1/2008Russell KlusasNo ratings yet

- Chicago - Retail - 4/1/2008Document4 pagesChicago - Retail - 4/1/2008Russell KlusasNo ratings yet

- Paul Coker - CV PDFDocument3 pagesPaul Coker - CV PDFPaulCokerNo ratings yet

- OB Group Project - Group08Document25 pagesOB Group Project - Group08Ayush MittalNo ratings yet

- TI Cycles Project ReportDocument4 pagesTI Cycles Project Reportgmbhuvaneswari50% (2)

- How Government Spends and Accounts For Public Money in ZambiaDocument145 pagesHow Government Spends and Accounts For Public Money in ZambiaMichael MbangwetaNo ratings yet

- A Comparison Between Monistic and Pluralistic Corporate Board Structures by Mahmudur RahmanDocument10 pagesA Comparison Between Monistic and Pluralistic Corporate Board Structures by Mahmudur RahmanMahmudur Rahman0% (1)

- Theories of Exchange RateDocument11 pagesTheories of Exchange RateNiharika Satyadev Jaiswal100% (1)

- Unit 1 Exam TechniqueDocument1 pageUnit 1 Exam TechniquenancyllluNo ratings yet

- Jorc Geo e STT MDocument176 pagesJorc Geo e STT MAde PrayudaNo ratings yet

- Statement of Cash FlowDocument9 pagesStatement of Cash FlowJoyce Ann Agdippa BarcelonaNo ratings yet

- Contract DraftingDocument2 pagesContract DraftingSineepa PLOYNo ratings yet

- Managing Supply Chain With Third Party Logistics Provider - An Overview of The IntegrationDocument8 pagesManaging Supply Chain With Third Party Logistics Provider - An Overview of The IntegrationKishore Kumar Galla100% (1)

- Agriculture Marketing Lec No 6Document27 pagesAgriculture Marketing Lec No 6MUZAMMIL GHORINo ratings yet

- Chapter 1Document3 pagesChapter 1MaiNo ratings yet

- California Cultural and Heritage Tourism Council "Working Together" SymposiumDocument51 pagesCalifornia Cultural and Heritage Tourism Council "Working Together" SymposiumAniela Maria BrasoveanuNo ratings yet

- LSCM-1-2015 #2 Introduction To LSCMDocument42 pagesLSCM-1-2015 #2 Introduction To LSCMVithaya SuharitdamrongNo ratings yet

- Risk of BispDocument3 pagesRisk of BisppalwashaNo ratings yet

- Dialog FixDocument3 pagesDialog FixmaharaniNo ratings yet

- Planning 101Document68 pagesPlanning 101ralph vasquezNo ratings yet

- (A Book & Stationery Shop) : "Reader's Advisory". We Hope It Would BeDocument15 pages(A Book & Stationery Shop) : "Reader's Advisory". We Hope It Would Bejahan_nusNo ratings yet

- Nepal TaxDocument7 pagesNepal Taxsanjay kafleNo ratings yet

- QSB ProfessionalDocument76 pagesQSB ProfessionalAdeniran AfolamiNo ratings yet

- BACHELOR OF ARTS (BA) in Economics: Republic of The Philippines Naval State University Naval, BiliranDocument3 pagesBACHELOR OF ARTS (BA) in Economics: Republic of The Philippines Naval State University Naval, BiliranJaica Mae YusonNo ratings yet

- Wa0112.Document10 pagesWa0112.ali aliNo ratings yet

- Analysis and Improvement of A Tea Value ChainDocument6 pagesAnalysis and Improvement of A Tea Value ChainSheetal AntilNo ratings yet

- Fact Sheet Iata 1Document2 pagesFact Sheet Iata 1Nadeem RindNo ratings yet

- Student Biryani Case StudyDocument6 pagesStudent Biryani Case StudyYousaf SaeedNo ratings yet

- Risk in SCM: Procurement: AssignmentDocument4 pagesRisk in SCM: Procurement: AssignmentBhavya K BalanNo ratings yet