Professional Documents

Culture Documents

Taxation Notes: BY Atty. Roberto A. Demigillo For Class Use Only

Taxation Notes: BY Atty. Roberto A. Demigillo For Class Use Only

Uploaded by

Francis Palabay0 ratings0% found this document useful (0 votes)

40 views2 pagesThis document contains notes on taxation law from Atty. Roberto A. Demigillo. Some key points include:

1) The rule of uniform taxation requires all property of the same class to be taxed alike.

2) Congress has the power to classify subjects of taxation but must impose uniformity within each class.

3) Indirect taxes that are regressive are allowed under the Constitution as long as direct taxes are preferred and indirect taxes are minimized.

Original Description:

Constitutional law

Original Title

Taxation Notes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains notes on taxation law from Atty. Roberto A. Demigillo. Some key points include:

1) The rule of uniform taxation requires all property of the same class to be taxed alike.

2) Congress has the power to classify subjects of taxation but must impose uniformity within each class.

3) Indirect taxes that are regressive are allowed under the Constitution as long as direct taxes are preferred and indirect taxes are minimized.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

40 views2 pagesTaxation Notes: BY Atty. Roberto A. Demigillo For Class Use Only

Taxation Notes: BY Atty. Roberto A. Demigillo For Class Use Only

Uploaded by

Francis PalabayThis document contains notes on taxation law from Atty. Roberto A. Demigillo. Some key points include:

1) The rule of uniform taxation requires all property of the same class to be taxed alike.

2) Congress has the power to classify subjects of taxation but must impose uniformity within each class.

3) Indirect taxes that are regressive are allowed under the Constitution as long as direct taxes are preferred and indirect taxes are minimized.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

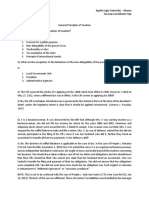

TAXATION NOTES

BY

ATTY. ROBERTO A. DEMIGILLO

FOR CLASS USE ONLY

1. UNIFORMITY MEANS THAT ALL PROPERTY BELONGING TO SAME

CLASS SHALL BE TAXED ALIKE.

2. THE RULE OF UNIFORM TAXATION DOES NOT DEPRIVE CONGRESS

OF THEPOWER TO CLASSIFY SUBJECTS OF TAXATION AND ONLY

DEMANDS UNIFORMITY WITHIN THE PARTICULAR CLASS.

3. THE CONSTITUTION DOES NOT PROHIBIT THE IMPOSITION OF

INDIRECT TAXES, WHICH ARE REGRESSIVE. THE PROVISION SIMPLY

MEANS THAT DIRECT TAXES ARE TO BE PREFERRED AND INDIRECT

TAXES SHOULD BE MINIMIZED AS MUCH AS POSSIBLE. OTHERWISE,

SALES TAXES, WHICH THE OLDEST FORM OF INDIRECT TAXES, WILL

BE PROHIBITED. THEMANDATE OF CONGRESS IS NOT TO PRESCRIBE

BUT TO EVOLVE A PROGRESSIVE SYSTEM OF TAXATION . TOLENTINO

VS SEC. OF FINANCE.

4. THE PRIMARY USE OF THE LOT AND BUILDING IS THE TEST TO

DETERMINEIF THEY ARE EXEMPT FROM TAX AND NOT FOR MERE

INCIDENTAL USE. THE PHRASE ‘EXCLUSIVELY USED FOR

EDUCATIONAL PURPOSES’ EXTENDS TO FACILITIES WHICH ARE

INCIDENTAL TO AND REASONABLE NECESSARY FOR THE

ACCOMPLISHMENT OF THE MAIN PURPOSE. ABRA VALLEY COLLEGE

V. AQUINO.

5. A CHARITABLE INSTITUTION DOES NOT LOSE ITS CHARACTER AS

SUCH AND ITS EXEMPTION FROM TAXES SIMPLY BECAUSE IT

DERIVES INCOME FROM PAYING PATIENTS OR RECEIVING SUBSIDIES

FROM THE GOVERNMENT SO LONG AS THE MONEY IS DEVOTED

ALTOGETHER TO THE CHARITABLE OBJECT WHICH IT IS INTENDED

TO ACHIEVE. HOWEVER, THE POTIONS OF ITS REAL PROPERTY THAT

ARE LEASED TO PRIVATE ENTITIES ARE NOT EXEMPT FROM REAL

PROPERTY TAXES AS THESE ARE NOT ACTUALLY, DIRECTLY AND

EXCLUSIVELY USED FOR CHARITABLE PURPOSE. LUNG CENTER V

QUEZON CITY.

6. THE POWER TO GRANT TAX EXEMPTION IS VESTED IN CONGRESS

AND TO A CERTAIN EXTENT IN LOCAL LEGISLATIVE BODIES.

7. TAX IS CONSIDERED FOR PUBLIC PURPOSE IF THE PROCEEDS

THEREOF ARE USED FOR THE SUPPORT OF GOVERNMENT OR FOR

SOME ORGANIZED OBJECT OF GOVERNMENT OR FOR THE WELFARE

OF THE COMMUNITY.

2

8. THE REQUIREMENT OF TERRITORIALITY IN TAXATION MEANS

THAT THE POWER TO TAX OPERATES ONLY WITHIN

THETERRITORIAL JURISDICTION OF THE TAXING AUTHORITY. IT

CANNOT BE EXERCISED BEYOND THE BOUNDARIES EXCEPT UNDER

CERTAIN CIRCUMSTANCES. . MANILA GAS V. COLLECTOR.

9. THETAXABLE SITUS OF REAL PROPERTIES IS THE PLACE WHERE

THE PROPERTY IS SITUATED. HOWEVER, WITH RESPECT TO

INTANGIBLE PERSONAL PROPERTIES, THE SITUS FOLLOWS THE

DOMICILE OF THE OWNER UNDER THE PRINCIPLE OF MOBILIA

SEQUANTUR PERSONAM.

10. COOPERATIVES INCLUDING THEIR MEMBERS, DESERVE A

PREFERENTIAL TAX TREATMENT BECAUSE OF THE VITAL ROLE

THEY PLAY IN THE ATTAINMENT OF ECONOMIC DEVELOPMENT AND

SOCIAL JUSTICE. DUMAGUETE CREDICT COOPERATIVE V CIR.

11. CONTRACTUAL TAX EXEMPTIONS IN THE REAL SENSE OF THE

TERM AND WHERE THE NON IMPAIRMENT CLAUSE OF THE

CONSTITUTION CAN RIGHTLY BE INVOKED, ARE THOSE AGREED TO

BY THE TAXING AUTHORITY IN CONTRACTS, SUCH AS THOSE

CONTAINED IN GOVERNMENT BONDS OR DEBENTURES, LAWFULLY

ENTERED INTO BY THEM UNDER ENABLING LAWS IN WHICH THE

GOVERNMENT, ACTING INITS PRIVATE CAPACITY, SHEDS ITS CLOAK

OFAUTHORITY AND WAIVES ITS GOVERNMENTAL IMMUNITY.

12. CONTRACTUAL TAX EXEMPTIONS ARE NOT TO BE CONFUSED

WITH TAX EXEMPTIONS GRANTED UNDER FRANCHISES.

13. EXEMPTIONS FROM TAXATION ARE CONSTRUED IN STRICTISSIMI

JURIS AGAINST THE TAXPAYER AND LIBERALLY IN FAVOR OF THE

TAXING AUTHORITY PRIMIARILY BECAUSE TAXES ARE THE

LIFEBLOOD OF THE OGVERNMENT AND THEIR PROMPT AND CERTAIN

AVAILABILITY IS AN IMPERIOUS NEED. PROVINC OF TARLAC V

FERNANDO ALCANTARA.

14. WHEN ADDITIONAL TAXES ARE LAID ON THE SAME SUBJECT BY

THE SAME TAXING JURISDICTION DURING THE SAME TAXING PERIOD

AND FOR THE SAME PURPOSE, THERE IS DOUBLE TAXATION.

15. THE MIAA IS NOT A GOVERNMENT OWNED OR CONTROLLED

CORPORATION BUT AN INSTRUMENTALITY OF THE NATIONAL

GOVERNMENT AND THUS EXEMPT FORM LOCAL TAXATION. THE

REAL PROPERTIES OF MIAA ARE OWNED BY THE REPUBLIC OF THE

PHILIPPINES AND THUS EXEMPT FROM REAL ESTATE TAX.

16. READ CITY ASSESSOR OF CEBU CITY V ASSOCIATION OF

BENEVOLA DE CEBU, JUNE 8, 2007

You might also like

- Chapter 1 Income TaxationDocument7 pagesChapter 1 Income TaxationAihla Michelle Berido100% (1)

- CPPREP4002 - Annotated Unit GuideDocument8 pagesCPPREP4002 - Annotated Unit Guidecgao30No ratings yet

- Tax CasesDocument63 pagesTax CasesImelda Arreglo-AgripaNo ratings yet

- DoctrinesDocument3 pagesDoctrinesRoi Vincent RomeroNo ratings yet

- Tax Material - General PrinciplesDocument38 pagesTax Material - General PrinciplesJevi RuiizNo ratings yet

- Recoletos Law Center Pre-Week Notes in Taxation Law Bar Exam 2021Document23 pagesRecoletos Law Center Pre-Week Notes in Taxation Law Bar Exam 2021Daniel BrownNo ratings yet

- Taxes Are Enforced Proportional Contributions From Persons andDocument5 pagesTaxes Are Enforced Proportional Contributions From Persons andNate AlfaroNo ratings yet

- Part IV TaxDocument4 pagesPart IV TaxMichael SanchezNo ratings yet

- Taxation Law Pages 1-3Document3 pagesTaxation Law Pages 1-3Tey TorrenteNo ratings yet

- Purpose and Scope of TaxationDocument6 pagesPurpose and Scope of TaxationMaria ThereseNo ratings yet

- CHAPTER 1 EXAM (PolSci)Document23 pagesCHAPTER 1 EXAM (PolSci)Leonardo WenceslaoNo ratings yet

- Tax DoctrinesDocument8 pagesTax DoctrinesLouNo ratings yet

- Taxation Law Pre Bar Notes 2019 Part 2 TermsDocument10 pagesTaxation Law Pre Bar Notes 2019 Part 2 TermsThea Faye Buncad CahuyaNo ratings yet

- Answer in TaxationDocument11 pagesAnswer in TaxationMarella GemperoNo ratings yet

- Philex - Mining - Corp. - v. CIR (1998)Document11 pagesPhilex - Mining - Corp. - v. CIR (1998)Jemar DelcampoNo ratings yet

- Andrea TaxDocument4 pagesAndrea TaxAndrea IvanneNo ratings yet

- Income TaxationDocument48 pagesIncome TaxationAmelyn Kim DimaNo ratings yet

- Table of Contents IntroductionDocument25 pagesTable of Contents IntroductionRowena EspirituNo ratings yet

- Power of TaxationDocument7 pagesPower of Taxationlei ann venturaNo ratings yet

- Tax 1 FinalsDocument16 pagesTax 1 FinalsDenise DuriasNo ratings yet

- LimitationDocument3 pagesLimitationNaomiJean InotNo ratings yet

- Report TaxDocument17 pagesReport TaxMarcela PalanasNo ratings yet

- NPC v. Cabanatuan CityDocument35 pagesNPC v. Cabanatuan CitymonagbayaniNo ratings yet

- Petitioner Respondent The Solicitor General Edgardo G. Villarin Trese D. WenceslaoDocument23 pagesPetitioner Respondent The Solicitor General Edgardo G. Villarin Trese D. WenceslaoArste GimoNo ratings yet

- Gen. Principles and Income TaxDocument46 pagesGen. Principles and Income TaxLeidi Kyohei NakaharaNo ratings yet

- Petitioner Respondent The Solicitor General Edgardo G. Villarin Trese D. WenceslaoDocument22 pagesPetitioner Respondent The Solicitor General Edgardo G. Villarin Trese D. WenceslaoAggy AlbotraNo ratings yet

- Acco 20133 - Unit 1Document35 pagesAcco 20133 - Unit 1Eustaquio Jr., Felix C.No ratings yet

- Learning Module (Tax Law Review) - Definition, Nature, Characteristics, Kinds, Sources of Tax, and Tax Laws, Rules, Regulations and Taxpayer's SuitDocument12 pagesLearning Module (Tax Law Review) - Definition, Nature, Characteristics, Kinds, Sources of Tax, and Tax Laws, Rules, Regulations and Taxpayer's Suitjoan mziNo ratings yet

- Tax Reviewer Constitutional Limitations (Dual-Pi Vet-F E RNS-J)Document11 pagesTax Reviewer Constitutional Limitations (Dual-Pi Vet-F E RNS-J)Sherleen Anne Agtina DamianNo ratings yet

- TAX I NotesDocument17 pagesTAX I NotesthebeautyinsideNo ratings yet

- Topic 1 Fundamental Principle of TaxationDocument9 pagesTopic 1 Fundamental Principle of TaxationsoloparentsresearchNo ratings yet

- Prelim CoverageDocument14 pagesPrelim CoverageMil MalicayNo ratings yet

- Tax Law LMT Aquila Legis FraternityDocument17 pagesTax Law LMT Aquila Legis FraternityWilbert ChongNo ratings yet

- Taxation Law - Case Digest (Part 1)Document64 pagesTaxation Law - Case Digest (Part 1)Miro100% (3)

- Uniform Bonding Code What Is Bonding AllDocument46 pagesUniform Bonding Code What Is Bonding Allmlo356100% (7)

- Tax Cases FinalDocument10 pagesTax Cases FinalBINAYAO NAIZA MAENo ratings yet

- Doctrines in Taxation LawDocument9 pagesDoctrines in Taxation LawCarlos JamesNo ratings yet

- PROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimDocument16 pagesPROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimXerjiah YuagaNo ratings yet

- General Principles of TaxationDocument36 pagesGeneral Principles of Taxationnicole5anne5ddddddNo ratings yet

- Tax 1 Midterms AnswerDocument3 pagesTax 1 Midterms AnswerCacapablen GinNo ratings yet

- Sample Exam From QUAMTO Tax 1Document3 pagesSample Exam From QUAMTO Tax 1Jairah CruzNo ratings yet

- NEU Taxation Law Pre-Week NotesDocument35 pagesNEU Taxation Law Pre-Week NotesKin Pearly FloresNo ratings yet

- NEU Taxation Law Pre-Week Notes PDFDocument35 pagesNEU Taxation Law Pre-Week Notes PDFKin Pearly FloresNo ratings yet

- Chapter 1 NotesDocument12 pagesChapter 1 NotesGerald Nitz PonceNo ratings yet

- CACAYAN GINES Tax REVMidterms-AnswerDocument3 pagesCACAYAN GINES Tax REVMidterms-AnswerCacapablen GinNo ratings yet

- TaxationDocument82 pagesTaxationCherry Ann LayuganNo ratings yet

- Notes On TaxationDocument30 pagesNotes On TaxationBeyond PaperNo ratings yet

- General PrinciplesDocument15 pagesGeneral PrinciplesattywithnocaseyetNo ratings yet

- AUSL LMT TaxDocument16 pagesAUSL LMT TaxMaria GarciaNo ratings yet

- PM Reyes Notes On Taxation 1 - General Principles (Working Draft) (Updated 28 Dec 2012)Document28 pagesPM Reyes Notes On Taxation 1 - General Principles (Working Draft) (Updated 28 Dec 2012)JonJon Miv100% (1)

- MLDC Is Subject To Improperly Accumulated Earnings Tax (IAET)Document2 pagesMLDC Is Subject To Improperly Accumulated Earnings Tax (IAET)Franco David BaratetaNo ratings yet

- Federal Polytechnic Bali: SGT/PA/ND/20/090Document10 pagesFederal Polytechnic Bali: SGT/PA/ND/20/090Joseph JboyNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- How to Uplift the Uae Economy Without Oil RevenueFrom EverandHow to Uplift the Uae Economy Without Oil RevenueNo ratings yet

- How to Invest in Real Estate And Pay Little or No Taxes: Use Tax Smart Loopholes to Boost Your Profits By 40%: Use Tax Smart Loopholes to Boost Your Profits By 40%From EverandHow to Invest in Real Estate And Pay Little or No Taxes: Use Tax Smart Loopholes to Boost Your Profits By 40%: Use Tax Smart Loopholes to Boost Your Profits By 40%No ratings yet

- SC - COMELEC May Be Compelled To Allow Witnessing of Printing Ballots, Disclose VCM Transmission Diagram - Supreme Court of The PhilippinesDocument7 pagesSC - COMELEC May Be Compelled To Allow Witnessing of Printing Ballots, Disclose VCM Transmission Diagram - Supreme Court of The PhilippinesFrancis PalabayNo ratings yet

- SC Finds Lawyer Guilty of Grave Misconduct For Unlawful Taking of Case Records Re: Murder of Ruby Rose Barrameda-JimenezDocument6 pagesSC Finds Lawyer Guilty of Grave Misconduct For Unlawful Taking of Case Records Re: Murder of Ruby Rose Barrameda-JimenezFrancis PalabayNo ratings yet

- Legitimacy and Paternity Issues Cannot Be Resolved in Petition For Correction of Birth Certificate EntriesDocument3 pagesLegitimacy and Paternity Issues Cannot Be Resolved in Petition For Correction of Birth Certificate EntriesFrancis PalabayNo ratings yet

- SC Upholds COA's Disallowance of CNA Incentive To DARPO-Cavite and DPWH IV-A EmployeesDocument2 pagesSC Upholds COA's Disallowance of CNA Incentive To DARPO-Cavite and DPWH IV-A EmployeesFrancis PalabayNo ratings yet

- 3.21.19 SC Upholds Drug Conviction of Irish NationalDocument1 page3.21.19 SC Upholds Drug Conviction of Irish NationalFrancis Palabay0% (1)

- 3.15.19 SC Dismisses Admin Case Against Retired CJ de Castro For Lack of Prima Facie BasisDocument1 page3.15.19 SC Dismisses Admin Case Against Retired CJ de Castro For Lack of Prima Facie BasisFrancis PalabayNo ratings yet

- Chief Justice Bersamin Calls On Judges For Support For His 4-Point AgendaDocument1 pageChief Justice Bersamin Calls On Judges For Support For His 4-Point AgendaFrancis PalabayNo ratings yet

- Summary Reviewer Persons and Family Relations Sta Maria PDFDocument174 pagesSummary Reviewer Persons and Family Relations Sta Maria PDFFrancis PalabayNo ratings yet

- $upreme JAN 1 7 2019: L/.epublic of TbeDocument13 pages$upreme JAN 1 7 2019: L/.epublic of TbeFrancis PalabayNo ratings yet

- Gloriajean Posadas December 2005 Taxicab Hotline Service A Feasibility StudyDocument1 pageGloriajean Posadas December 2005 Taxicab Hotline Service A Feasibility StudyFrancis PalabayNo ratings yet

- PP Vs KalaloDocument5 pagesPP Vs KalaloFrancis PalabayNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument1 pageBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledFrancis PalabayNo ratings yet

- Referring Unit Subject/Name of Client Date Received by LD Date Received by FAP Updates 5/10/2017Document2 pagesReferring Unit Subject/Name of Client Date Received by LD Date Received by FAP Updates 5/10/2017Francis PalabayNo ratings yet

- Taxation Notes: BY Atty. Roberto A. Demigillo For Class Use OnlyDocument2 pagesTaxation Notes: BY Atty. Roberto A. Demigillo For Class Use OnlyFrancis PalabayNo ratings yet

- People V JanuarioDocument4 pagesPeople V JanuarioFrancis PalabayNo ratings yet

- QC Story #2:: Determine The Scope of The Prioritized ProblemDocument4 pagesQC Story #2:: Determine The Scope of The Prioritized ProblemFrancis PalabayNo ratings yet

- Template - Executive SummaryDocument1 pageTemplate - Executive SummaryFrancis PalabayNo ratings yet

- QC Story #1:: Brainstorm On 3 - 5 Potential ProblemsDocument2 pagesQC Story #1:: Brainstorm On 3 - 5 Potential ProblemsFrancis PalabayNo ratings yet

- Grounds For Judicial EjectmentDocument2 pagesGrounds For Judicial EjectmentFrancis PalabayNo ratings yet

- Grounds For Judicial EjectmentDocument2 pagesGrounds For Judicial EjectmentFrancis PalabayNo ratings yet

- UGJ21-06 Contract ProjectDocument15 pagesUGJ21-06 Contract ProjectCharvi KwatraNo ratings yet

- Revised Rules of Procedures Before The Administrative Disciplinary Authorities and The Internal Affairs Service of The Philippine National PoliceDocument50 pagesRevised Rules of Procedures Before The Administrative Disciplinary Authorities and The Internal Affairs Service of The Philippine National PoliceVALENTINO ZUNIGANo ratings yet

- AbhinavDocument11 pagesAbhinavShubham AgrawalNo ratings yet

- Constitution and by Laws - YFCDocument8 pagesConstitution and by Laws - YFCJasper SuquilaNo ratings yet

- MCQ On Company Law IMBA 5th SemDocument9 pagesMCQ On Company Law IMBA 5th SemGyaneshNo ratings yet

- G.R. No. 227777.Document3 pagesG.R. No. 227777.Francess PiloneoNo ratings yet

- 4) Habeas CorpusDocument9 pages4) Habeas CorpusPaul EsparagozaNo ratings yet

- York County Court Sept. 8Document4 pagesYork County Court Sept. 8York Daily Record/Sunday NewsNo ratings yet

- McCORMICK Kevin Iman AffidavitDocument14 pagesMcCORMICK Kevin Iman AffidavitHelen BennettNo ratings yet

- Forensic Chemist Notes. LawphilDocument5 pagesForensic Chemist Notes. Lawphilmadz maderazoNo ratings yet

- Georgia Evidence Quick Reference Guide 1707358659Document4 pagesGeorgia Evidence Quick Reference Guide 1707358659kirakimneyNo ratings yet

- FACE Act Repeal BillDocument2 pagesFACE Act Repeal BillKate AndersonNo ratings yet

- City of Naga vs. Hon. Elvi John S. AsuncionDocument2 pagesCity of Naga vs. Hon. Elvi John S. AsuncionJillian Asdala100% (1)

- State of Iowa, Ex Rel E.J.C. Minor Child vs. Joshua Alan Pranschke vs. Megan M CombesDocument117 pagesState of Iowa, Ex Rel E.J.C. Minor Child vs. Joshua Alan Pranschke vs. Megan M CombesthesacnewsNo ratings yet

- US V FlynnDocument8 pagesUS V FlynnTechno Fog100% (8)

- Presidential Documents: Transfers of Defense Articles or Services For Libya For Chemical Weapons DestructionDocument1 pagePresidential Documents: Transfers of Defense Articles or Services For Libya For Chemical Weapons DestructionJustia.comNo ratings yet

- The Limits of Free Speech, Pornography and The Law: Steven Balmer, JRDocument17 pagesThe Limits of Free Speech, Pornography and The Law: Steven Balmer, JRAbner Casallo TraucoNo ratings yet

- State of Missouri: Request For TerminationDocument3 pagesState of Missouri: Request For TerminationvickykirschNo ratings yet

- NAFTA CertificateDocument2 pagesNAFTA Certificateapi-522706100% (4)

- State of California CDCR 2142 (Rev. 10/06)Document2 pagesState of California CDCR 2142 (Rev. 10/06)Liane BuckNo ratings yet

- Family Support AgreementDocument6 pagesFamily Support AgreementDiazNo ratings yet

- British Airways vs. Court of Appeals Case DigestDocument2 pagesBritish Airways vs. Court of Appeals Case DigestMarianne Hope VillasNo ratings yet

- Management of LeaveDocument30 pagesManagement of LeaveTatenda GutsaNo ratings yet

- Right To Self OrganizationDocument7 pagesRight To Self OrganizationSALMAN JOHAYRNo ratings yet

- Summons Produce Document Civil Rules R 120Document1 pageSummons Produce Document Civil Rules R 120anj lawyersNo ratings yet

- Impeachment in The United States - WikipediaDocument19 pagesImpeachment in The United States - WikipediaMohsin KhanNo ratings yet

- TechRumble - Mahindra IgnitersDocument5 pagesTechRumble - Mahindra Ignitersbbdgei_tnpNo ratings yet

- Supreme Court of The State of New York Appellate Division: Second Judicial DepartmentDocument6 pagesSupreme Court of The State of New York Appellate Division: Second Judicial DepartmentDinSFLA100% (1)

- Client Acadclient0126Document4 pagesClient Acadclient0126Mark Aaron CalibaraNo ratings yet