Professional Documents

Culture Documents

Fundamental Principles For Disbursement of Public Funds Section 4 of P

Fundamental Principles For Disbursement of Public Funds Section 4 of P

Uploaded by

Ralf ObordoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Principles For Disbursement of Public Funds Section 4 of P

Fundamental Principles For Disbursement of Public Funds Section 4 of P

Uploaded by

Ralf ObordoCopyright:

Available Formats

Fundamental Principles for Disbursement of Public Funds Section 4 of P.D. No.

1445,

the Government Auditing Code of the Philippines, provides that all financial transactions

and operations of any government entity shall be governed by the following fundamental

principles:

a. No money shall be paid out of any public treasury or depository except in pursuance of

an appropriation law or other specific statutory authority.

b. Government funds or property shall be spent or used solely for public purposes.

c. Trust funds shall be available and may be spent only for the specific purpose for which

the trust was created or the funds received.

d. Fiscal responsibility shall, to the greatest extent, be shared by all those exercising

authority over the financial affairs, transactions, and operations of the government agency.

e. Disbursement or disposition of government funds or property shall invariably bear the

approval of the proper officials.

f. Claims against government funds shall be supported with complete documentation.

g. All laws and regulations applicable to financial transactions shall be faithfully adhered to.

h. Generally accepted principles and practices of accounting as well as of sound

management and fiscal administration shall be observed, provided that they do not

contravene existing laws and regulations.

You might also like

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 3Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 3jasperkennedy084% (25)

- Answer Key For Cpa Board Exam ReviewerDocument4 pagesAnswer Key For Cpa Board Exam ReviewerMaria LopezNo ratings yet

- Notes For Government Procurement LawDocument12 pagesNotes For Government Procurement LawRodelLaborNo ratings yet

- Pup Jpia Manila Constitution Final Copy As of 6.2.2014Document33 pagesPup Jpia Manila Constitution Final Copy As of 6.2.2014PangitkaNo ratings yet

- Registry of Public Infrastructures: - Registry of Reforestation Projects - Shall Be Maintained For Each CategoryDocument31 pagesRegistry of Public Infrastructures: - Registry of Reforestation Projects - Shall Be Maintained For Each CategoryAllen Gonzaga100% (1)

- Accounting For LGUsDocument34 pagesAccounting For LGUsKath O100% (1)

- Special Tax Laws PDFDocument34 pagesSpecial Tax Laws PDFJAY AUBREY PINEDANo ratings yet

- Chapter 13 - Answer PDFDocument18 pagesChapter 13 - Answer PDFjhienellNo ratings yet

- Chapter 14 - Test BankDocument29 pagesChapter 14 - Test BankVictor MedinaNo ratings yet

- 2010 Accounting Alert - PFRS For SMEsDocument56 pages2010 Accounting Alert - PFRS For SMEsMary Joy BalbontinNo ratings yet

- Bustamante, Jilian Kate A. (Activity 3)Document4 pagesBustamante, Jilian Kate A. (Activity 3)Jilian Kate Alpapara BustamanteNo ratings yet

- Barangay Financial Management Implementation in San Jose City, Nueva Ecija, PhilippinesDocument12 pagesBarangay Financial Management Implementation in San Jose City, Nueva Ecija, PhilippinesJOHN JERALD P. MIRANDANo ratings yet

- Midterm - Exam PDFDocument16 pagesMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Manila Water Case StudyDocument5 pagesManila Water Case StudyJonnabel Sulasco100% (1)

- 6 - Notes On Government AccountingDocument6 pages6 - Notes On Government AccountingLabLab ChattoNo ratings yet

- Coa C97-002Document4 pagesCoa C97-002Hoven MacasinagNo ratings yet

- Chapter 4 The Budget CycleDocument12 pagesChapter 4 The Budget CycleMark DaryllNo ratings yet

- The PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingDocument98 pagesThe PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingJhopel Casagnap EmanNo ratings yet

- What Steps Shall I Do To Compel A Colleague To Pay The P32,000 Which He Owed MeDocument1 pageWhat Steps Shall I Do To Compel A Colleague To Pay The P32,000 Which He Owed MejonquintanoNo ratings yet

- Basic Concepts of Government AccountingDocument10 pagesBasic Concepts of Government AccountingLyra EscosioNo ratings yet

- Fundamental Principles For Revenue Collections and ReceiptsDocument3 pagesFundamental Principles For Revenue Collections and ReceiptsalliahnahNo ratings yet

- CHAPTER 3.pptx - ACC9 EditedDocument30 pagesCHAPTER 3.pptx - ACC9 EditedAngelica CastilloNo ratings yet

- Chan - A Comparison of Government Accounting and Business AccountingDocument10 pagesChan - A Comparison of Government Accounting and Business AccountingInternational Consortium on Governmental Financial Management100% (4)

- Quiz 1 - ACGN PrelimsDocument9 pagesQuiz 1 - ACGN Prelimsnatalie clyde matesNo ratings yet

- Module 1 Nature and Scope of The NGASDocument22 pagesModule 1 Nature and Scope of The NGAScha11No ratings yet

- Legal Basis of Government AccountingDocument2 pagesLegal Basis of Government AccountingAndyGonzalesAlagarNo ratings yet

- Income Collection Deposit System With ConversionDocument6 pagesIncome Collection Deposit System With ConversionDane LavegaNo ratings yet

- Basic Features of The New Government Accounting SystemDocument4 pagesBasic Features of The New Government Accounting SystemabbiecdefgNo ratings yet

- BTAX 302 Gross EstateDocument1 pageBTAX 302 Gross Estatechasing bluesNo ratings yet

- Discussion Problem No. 1Document3 pagesDiscussion Problem No. 1Ching Cabrera GalauraNo ratings yet

- Ac 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesDocument53 pagesAc 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesHarley Gumapon100% (1)

- General Concepts and Principles MeaningDocument5 pagesGeneral Concepts and Principles MeaningParker Andrian YPalma100% (2)

- Reflection Paper #3 - Overview of Mining IndustryDocument3 pagesReflection Paper #3 - Overview of Mining IndustrynerieroseNo ratings yet

- Law Art 1511 - 1525Document14 pagesLaw Art 1511 - 1525zcel delos ReyesNo ratings yet

- Chapter 1 - General Provisions, Basic Standards and PoliciesDocument10 pagesChapter 1 - General Provisions, Basic Standards and Policiesdar •No ratings yet

- Auditing Problem SolutionsDocument13 pagesAuditing Problem SolutionsjhobsNo ratings yet

- Chapter 7Document26 pagesChapter 7Jenny Rose Castro FernandezNo ratings yet

- When The Workplace Becomes A Crime SceneDocument4 pagesWhen The Workplace Becomes A Crime SceneAmy Rose AbalunanNo ratings yet

- CPAR Filing, Penalties, and Remedies (Batch 89) HandoutDocument25 pagesCPAR Filing, Penalties, and Remedies (Batch 89) HandoutlllllNo ratings yet

- Quiz - Chapter 1 - Overview of Government AccountingDocument2 pagesQuiz - Chapter 1 - Overview of Government AccountingRoselyn Mangaron SagcalNo ratings yet

- Lesson 1: Introduction To Strategic Management Topic: Learning OutcomesDocument10 pagesLesson 1: Introduction To Strategic Management Topic: Learning OutcomesmarieieiemNo ratings yet

- Melchor v. COA, G.R No. 95398, August 16, 1991Document2 pagesMelchor v. COA, G.R No. 95398, August 16, 1991Carie LawyerrNo ratings yet

- University of Perpetual Help System Dalta Calamba Campus, Brgy. Panciano Rizal, Calamba City College of AccountancyDocument16 pagesUniversity of Perpetual Help System Dalta Calamba Campus, Brgy. Panciano Rizal, Calamba City College of AccountancyChristine Jane AbangNo ratings yet

- Liquidation Based Valuation 03.06.2023Document6 pagesLiquidation Based Valuation 03.06.2023Ivan Jay E. EsminoNo ratings yet

- Income Collection Deposit System With ConversionDocument6 pagesIncome Collection Deposit System With ConversionKaye Alyssa EnriquezNo ratings yet

- Articles of Cooperation of The Puerto Princesa Market Credit CooperativeDocument10 pagesArticles of Cooperation of The Puerto Princesa Market Credit CooperativeKha Mo Teh0% (1)

- Article 1479:: vs. Lourdes Q. Del Rosario-Suarez, Catalina R. Suarez-De Leon, Wilfredo de Leon, MiguelDocument5 pagesArticle 1479:: vs. Lourdes Q. Del Rosario-Suarez, Catalina R. Suarez-De Leon, Wilfredo de Leon, Miguelzee pNo ratings yet

- 5 - Notes On Government AccountingDocument3 pages5 - Notes On Government AccountingLabLab Chatto0% (1)

- Government Accounting 2018 Questions AnswersDocument199 pagesGovernment Accounting 2018 Questions AnswersAldrich De VeraNo ratings yet

- Reviewer in Project ManagementDocument8 pagesReviewer in Project ManagementJenny Liza100% (1)

- Prelim Advac Set ADocument3 pagesPrelim Advac Set ANah HamzaNo ratings yet

- Credit AbejarDocument2 pagesCredit AbejarGerwin AbejarNo ratings yet

- Accounting-Gov-Reviewer Accounting-Gov-ReviewerDocument20 pagesAccounting-Gov-Reviewer Accounting-Gov-ReviewerReggie AlisNo ratings yet

- Philippine SEC Mandate and FunctionsDocument2 pagesPhilippine SEC Mandate and FunctionsfccarlosNo ratings yet

- Reviewer in LeasesDocument3 pagesReviewer in LeasesNicolaus CopernicusNo ratings yet

- FM112 Students Chapter IIDocument12 pagesFM112 Students Chapter IIThricia Mae IgnacioNo ratings yet

- Financial Analysis of Perpetual Help Community Cooperative (PHCCI)Document17 pagesFinancial Analysis of Perpetual Help Community Cooperative (PHCCI)Jasmine Lilang ColladoNo ratings yet

- To Improve Accountability and TransparencyDocument2 pagesTo Improve Accountability and TransparencyPons Mac PacienteNo ratings yet

- Yap Vs COADocument1 pageYap Vs COAiamnoelNo ratings yet

- Management of Government ExpendituresDocument26 pagesManagement of Government ExpendituresAh MhiNo ratings yet

- Government Accounting: ObjectivesDocument102 pagesGovernment Accounting: ObjectivesMarie GarpiaNo ratings yet

- College of Business and Accountancy: Jose Rizal Memorial State UniversityDocument8 pagesCollege of Business and Accountancy: Jose Rizal Memorial State UniversityRalf ObordoNo ratings yet

- SchemaDocument1 pageSchemaRalf ObordoNo ratings yet

- Ecotourism Activities: TOUR 108Document4 pagesEcotourism Activities: TOUR 108Ralf ObordoNo ratings yet

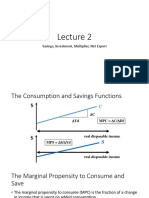

- Savings, Investment, Multiplier, Net ExportDocument32 pagesSavings, Investment, Multiplier, Net ExportRalf ObordoNo ratings yet

- Ecotourism Activities: Hazel G. Lunjas Bst-IiiDocument4 pagesEcotourism Activities: Hazel G. Lunjas Bst-IiiRalf ObordoNo ratings yet

- Ecotourism Activities: Melvin R. Inding Bst-IiiDocument4 pagesEcotourism Activities: Melvin R. Inding Bst-IiiRalf ObordoNo ratings yet