Professional Documents

Culture Documents

AB Photo Arts

AB Photo Arts

Uploaded by

Joshua Chavez100%(1)100% found this document useful (1 vote)

543 views1 pageAndrea Bonito started her photography business, AB Photo Arts, by investing $300,000. Throughout October, she purchased camera and office equipment, supplies, and paid rent and salaries. She also received $25,000 for photography services and withdrew $12,000 for personal use.

Original Description:

AB Photo Arts Accounting Question

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAndrea Bonito started her photography business, AB Photo Arts, by investing $300,000. Throughout October, she purchased camera and office equipment, supplies, and paid rent and salaries. She also received $25,000 for photography services and withdrew $12,000 for personal use.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

543 views1 pageAB Photo Arts

AB Photo Arts

Uploaded by

Joshua ChavezAndrea Bonito started her photography business, AB Photo Arts, by investing $300,000. Throughout October, she purchased camera and office equipment, supplies, and paid rent and salaries. She also received $25,000 for photography services and withdrew $12,000 for personal use.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

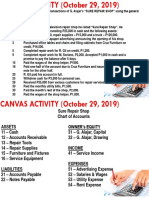

AB Photo Arts:

Problem 1:

Andrea Bonito has decided to go into the business for herself as a professional photographer and the

following transactions transpired in October.

October 1 She invested P300,000 to open the AB Photo Arts

3 Paid rental for the month, P12,000

5 Purchased camera equipment for cash worth P220,000

7 Bought photo and developing supplies worth P18,000 on account

15 Bought office equipment worth P45,000 on credit from Burroughs Company

17 Received P25,000 for photography services rendered

19 Andrea Bonito withdrew P12,000 from the business for her personal use

23 Paid Burroughs Company P30,000 as partial payment of account

24 Took wedding pictures and agreed to accept payment fifteen days later, P12,000

30 Paid salary of assistant for the month, P6, 000.

Use the listed chart of accounts below to journalize the above transactions:

101 Cash 301 Andrea Bonito, Capital

102 Accounts Receivable 302 Andrea Bonito, Withdrawal

103 Supplies 501 Fees Earned

104 Camera Equipment 601 Rent Expense

105 Office Equipment 602 Salaries and Wages Expense

106 Computer Equipment

201 Accounts Payable

REQUIRED:

1. Journalize the above transaction

Post the journal entries to the General Ledger

2. Post the transactions in T-Accounts

3. Prepare the trial balance

You might also like

- 24-Month Note Due To BDODocument3 pages24-Month Note Due To BDOEliza CruzNo ratings yet

- 2 CHAPTER Lesson 2 1 AssetsDocument6 pages2 CHAPTER Lesson 2 1 AssetsRegine BaterisnaNo ratings yet

- Exercises - 5 Cs of CreditDocument1 pageExercises - 5 Cs of Creditmarissa casareno almueteNo ratings yet

- Pre Test Module 1 - DoneDocument1 pagePre Test Module 1 - DoneMary Joy Barlisan Calinao100% (1)

- 01 Quiz 1Document2 pages01 Quiz 1Laisan SantosNo ratings yet

- FundamentalsofAccounting IDSDocument2 pagesFundamentalsofAccounting IDSYu Babylan33% (3)

- Assessment QuizDocument2 pagesAssessment QuizFrancis Raagas67% (3)

- RBSG Distributors Statement of Cash Flow As of MAY 31 20xx (In Pesos)Document5 pagesRBSG Distributors Statement of Cash Flow As of MAY 31 20xx (In Pesos)Nashley Trina100% (1)

- AccountingDocument5 pagesAccountingAbe Loran PelandianaNo ratings yet

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- Midterm 2nd 3rd Meeting RevisedDocument6 pagesMidterm 2nd 3rd Meeting RevisedChristopher CristobalNo ratings yet

- Accounting ExercisesDocument6 pagesAccounting ExercisesMichaella EsparesNo ratings yet

- Spreadsheet Exam ReviewDocument2 pagesSpreadsheet Exam Reviewapi-265873784No ratings yet

- ACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsDocument1 pageACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsMiguel Lulab100% (1)

- Name: - Section: - Schedule: - Class Number: - DateDocument8 pagesName: - Section: - Schedule: - Class Number: - DateBridgette Hanna MortellNo ratings yet

- Canvas Activity - Journalizing - Oct - 29 PDFDocument2 pagesCanvas Activity - Journalizing - Oct - 29 PDFJian Francisco100% (2)

- Special Journal ExercisesDocument1 pageSpecial Journal ExercisesRolly Baroy67% (3)

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Financial Statement AnalysisDocument25 pagesFinancial Statement AnalysisAldrin CustodioNo ratings yet

- Accounting General Ledger - Activity Lesson 6Document1 pageAccounting General Ledger - Activity Lesson 6LUKE ADAM CAYETANONo ratings yet

- PERPETUAL INVENTORY System TransactionDocument1 pagePERPETUAL INVENTORY System TransactionJayMorales100% (2)

- General Journal, GeveraDocument2 pagesGeneral Journal, GeveraFeiya LiuNo ratings yet

- Bhulero Merchandise Periodic 11 25Document10 pagesBhulero Merchandise Periodic 11 25Mary Jane PalermoNo ratings yet

- May 1 110 P100,000 310: W. Kayayan Accounting Firm General JournalDocument14 pagesMay 1 110 P100,000 310: W. Kayayan Accounting Firm General JournalShania ReighnNo ratings yet

- Bart M ManuelDocument27 pagesBart M ManuelBea TiuNo ratings yet

- General Ledger - Adrianne, Mendoza-BSBA-1 BLK BDocument6 pagesGeneral Ledger - Adrianne, Mendoza-BSBA-1 BLK BJaks ExplorerNo ratings yet

- Well" - A New Way of Saying - "Do Well by Doing Good."Document3 pagesWell" - A New Way of Saying - "Do Well by Doing Good."Rinna Lynn FraniNo ratings yet

- Abm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaDocument22 pagesAbm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Business Finance: Financial Planning Tools and ConceptsDocument14 pagesBusiness Finance: Financial Planning Tools and ConceptsElyzel Joy Tingson100% (1)

- Acctg 1Document3 pagesAcctg 1HoneyzelOmandamPonceNo ratings yet

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- Enclosure 1. Teacher-Made Learner's Home Task (Week 3)Document7 pagesEnclosure 1. Teacher-Made Learner's Home Task (Week 3)Kim FloresNo ratings yet

- Dela Pena, C. Marygold Bank Recon AnswerDocument6 pagesDela Pena, C. Marygold Bank Recon AnswerDe Nev OelNo ratings yet

- FS ActivityDocument4 pagesFS ActivityJace LavaNo ratings yet

- PT .1 in AccountingDocument8 pagesPT .1 in AccountingMerdwindelle Allagones100% (1)

- Accounting Module 2 AssignmentDocument2 pagesAccounting Module 2 AssignmentGenner RazNo ratings yet

- Special ExamDocument3 pagesSpecial ExamAdoree Ramos50% (2)

- Republic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorDocument7 pagesRepublic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorJessie Mark AnapadaNo ratings yet

- Trucking and StorageDocument2 pagesTrucking and StorageMichael San Luis100% (1)

- S. Roces Answer To Journal EntryDocument4 pagesS. Roces Answer To Journal EntryChoco LebbyNo ratings yet

- Name of Examinee: - : Prepare The FollowingDocument15 pagesName of Examinee: - : Prepare The FollowingNoel CarpioNo ratings yet

- Chapter 5 Financial Statement Analysis 1Document3 pagesChapter 5 Financial Statement Analysis 1Syrill CayetanoNo ratings yet

- TransactionDocument1 pageTransactionMARVIN ROSEL0% (1)

- Journal, T Accounts, Worksheet and PostingDocument29 pagesJournal, T Accounts, Worksheet and Postingkenneth coronelNo ratings yet

- Virtudazo Ween Trading GJDocument15 pagesVirtudazo Ween Trading GJMary Rose Ann VirtudazoNo ratings yet

- Assets Equity LiabilitiesDocument2 pagesAssets Equity LiabilitiesMathew VisarraNo ratings yet

- PeriodicDocument23 pagesPeriodicalmorsNo ratings yet

- Saint Louis College-Cebu: (Servant Leaders For Mission)Document4 pagesSaint Louis College-Cebu: (Servant Leaders For Mission)Marc Graham NacuaNo ratings yet

- 600 Assembly Work: 2x + 6y 480Document5 pages600 Assembly Work: 2x + 6y 480John Louie DungcaNo ratings yet

- Actbas 2 Downloaded Lecture NotesDocument57 pagesActbas 2 Downloaded Lecture NotesCharles Reginald K. Hwang100% (2)

- Chart of AccountsDocument4 pagesChart of AccountsMikez Diputado100% (1)

- Acctg+ Accounting Cycle/ProcessDocument2 pagesAcctg+ Accounting Cycle/ProcessJudy Mar ValdezNo ratings yet

- Fundamentals of Accountancy, Business, and Management Final Assessment ActivityDocument6 pagesFundamentals of Accountancy, Business, and Management Final Assessment ActivityWerNo ratings yet

- Exercises-Journalizing - Posting, Trial BalanceDocument2 pagesExercises-Journalizing - Posting, Trial BalanceRIANE PADIERNOSNo ratings yet

- CBA112 Practice SetDocument4 pagesCBA112 Practice SetMichael SanchezNo ratings yet

- Journal Entries To FSDocument3 pagesJournal Entries To FSJadon MejiaNo ratings yet

- AssetsDocument2 pagesAssetsJoshua ChavezNo ratings yet

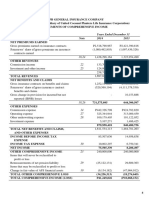

- December 31 Note 2014 2013Document1 pageDecember 31 Note 2014 2013Joshua ChavezNo ratings yet

- Years Ended December 31 Increase (Decrease) Note 2014 2013 Amount PercentageDocument2 pagesYears Ended December 31 Increase (Decrease) Note 2014 2013 Amount PercentageJoshua ChavezNo ratings yet

- 8Document2 pages8Joshua ChavezNo ratings yet

- Years Ended December 31 Vertical Analysis Note 2014 2013 2014 20.13Document2 pagesYears Ended December 31 Vertical Analysis Note 2014 2013 2014 20.13Joshua ChavezNo ratings yet

- 6Document2 pages6Joshua ChavezNo ratings yet

- Company Backround: Ucpb General Insurance Company Inc.Document12 pagesCompany Backround: Ucpb General Insurance Company Inc.Joshua ChavezNo ratings yet

- Obligation of The Agent (Explanation)Document3 pagesObligation of The Agent (Explanation)Joshua Chavez100% (1)

- Financial Ratio Analysis For Ucpb General Insurance Company, IncDocument1 pageFinancial Ratio Analysis For Ucpb General Insurance Company, IncJoshua ChavezNo ratings yet

- Years Ended December 31 Note 2014 2013Document1 pageYears Ended December 31 Note 2014 2013Joshua ChavezNo ratings yet

- Obligation of The AgentDocument1 pageObligation of The AgentJoshua ChavezNo ratings yet

- UCPB GEN Brief HistoryDocument3 pagesUCPB GEN Brief HistoryJoshua ChavezNo ratings yet