Professional Documents

Culture Documents

Questions

Questions

Uploaded by

sahilkuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions

Questions

Uploaded by

sahilkuCopyright:

Available Formats

Discussion Questions:

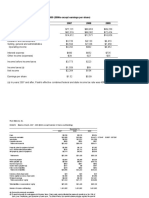

1. Assuming the company does not invest in the new product line, prepare forecast income

statement and balance sheets at year end 2010, 2011 and 2012. Based on these forecasts,

estimate Flash's required external financing: in this case all required external financing

takes the form of additional notes payable from its commercial bank, for the same period.

2. What course of action do you recommend regarding the proposed investment in the new

product line? Should the company accept or reject this investment opportunity?

3. How does your recommendation from question no 2 above impact your estimate of the

company's foretasted income statements and balance sheets, and required external

financing in 2010, 2011 and 2012? How do these foretasted statements differ if the

company relied solely on additional notes payable from its commercial bank, compared to

a sale of new equity?

4. As CFO Hathway Browne, what financing alternatives would you recommend to the

board of directors to meet financing needs you estimated in question no 1 through 3

above? what are the costs and benefits of each alternatives?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Flash Memory Case SolutionDocument10 pagesFlash Memory Case SolutionsahilkuNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Partners Healthcare (Tables and Exhibits)Document9 pagesPartners Healthcare (Tables and Exhibits)sahilkuNo ratings yet

- AtlanticDocument2 pagesAtlanticsahilkuNo ratings yet

- What Is CIBIL Score and How To Improve It?Document4 pagesWhat Is CIBIL Score and How To Improve It?sahilkuNo ratings yet

- A Bank Branch For The Digital Age - McKinsey & CompanyDocument13 pagesA Bank Branch For The Digital Age - McKinsey & CompanysahilkuNo ratings yet

- Application of Blockchain in Bfsi: Submitted by Group 4Document2 pagesApplication of Blockchain in Bfsi: Submitted by Group 4sahilkuNo ratings yet

- Year Capital Purchasing Power CD Interest RateDocument2 pagesYear Capital Purchasing Power CD Interest RatesahilkuNo ratings yet

- Minimum No. of Stocks Needed For DiversificationDocument3 pagesMinimum No. of Stocks Needed For DiversificationsahilkuNo ratings yet

- Example of Real Rate of Return FormulaDocument19 pagesExample of Real Rate of Return FormulasahilkuNo ratings yet

- Hi Tech Challenge Terms and ConditionsDocument4 pagesHi Tech Challenge Terms and ConditionssahilkuNo ratings yet

- Hero Motocorp FinancialsDocument41 pagesHero Motocorp FinancialssahilkuNo ratings yet

- Porter's Framework of Jet AirwaysDocument3 pagesPorter's Framework of Jet AirwayssahilkuNo ratings yet

- Example 1 Dividend PolicyDocument7 pagesExample 1 Dividend PolicysahilkuNo ratings yet

- India Vs China GDPDocument2 pagesIndia Vs China GDPsahilkuNo ratings yet

- Strategic Management - Learning DiaryDocument2 pagesStrategic Management - Learning DiarysahilkuNo ratings yet

- Mint Ratio: Mints (Mexico, Indonesia, Nigeria, Turkey)Document2 pagesMint Ratio: Mints (Mexico, Indonesia, Nigeria, Turkey)sahilkuNo ratings yet

- Quiz QuestionsDocument3 pagesQuiz QuestionssahilkuNo ratings yet

- Lifting of Corporate Veil Lifting of The Corporate Veil Means Disregarding The Corporate Personality and Looking Behind The Real Person Who Are Controlling The Company's AffairsDocument1 pageLifting of Corporate Veil Lifting of The Corporate Veil Means Disregarding The Corporate Personality and Looking Behind The Real Person Who Are Controlling The Company's AffairssahilkuNo ratings yet

- About Camaro: Automobile Chevrolet Pony Car Muscle Car Model Year Ford Mustang Platform Pontiac FirebirdDocument1 pageAbout Camaro: Automobile Chevrolet Pony Car Muscle Car Model Year Ford Mustang Platform Pontiac FirebirdsahilkuNo ratings yet

- About Us Careers Media Center Investor Relations Coverage MapDocument13 pagesAbout Us Careers Media Center Investor Relations Coverage MapsahilkuNo ratings yet