Professional Documents

Culture Documents

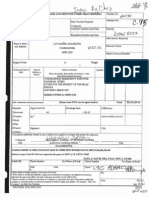

Street Address or Brief Form of Legal Description (For Vacant Land, Use APN) City (For Vacant Land Use County) State Zip

Street Address or Brief Form of Legal Description (For Vacant Land, Use APN) City (For Vacant Land Use County) State Zip

Uploaded by

vas eefOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Street Address or Brief Form of Legal Description (For Vacant Land, Use APN) City (For Vacant Land Use County) State Zip

Street Address or Brief Form of Legal Description (For Vacant Land, Use APN) City (For Vacant Land Use County) State Zip

Uploaded by

vas eefCopyright:

Available Formats

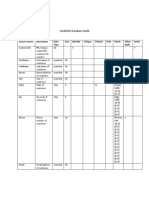

1099-S INPUT

Company No. Office No. Type Order/Escrow/File Number Actual Closing Date

«VALUE(EOPRC «VALUE(EOID «VALUE(TEXT1,This)» Add «VALUE(TEXT2,This)» Change «VALUE(TEXT3,This)» Delete «VALUE(FILENO,This)» «VALUE(FDSETL,This)»

,This)»

[1] CD,This)»

[2] [3] («VALUE(ESOFINIT,This)

[4] [5]

»)

SUBJECT PROPERTY INFORMATION

Street Address or Brief Form of Legal Description (for vacant land, use APN)

[6] «IF(PI1ADA>1,PI1ADA,This)» «IF(PI1ADA<1,PI1TXID,This)»

City (for vacant land use county) State Zip

«IF(PI1ADA>1,PI1CTY,This)» «VALUE(PI1STA «VALUE(PI1ZIP,This)»

«IF(PI1ADA<1,PI1CNT,This)» ,This)»

Transaction Data

Contract Sales Price. No. of 1099-S 2 or More 1099-S Buyers Part of Real Contingent Exchange. Was

(Line 401 of HUD-1 Form) forms required Forms. Estate Tax. Show any Transaction. Is this a (or will there be)

Note: If this is an for the sale of If 2 or more 1099-S real estate tax, on a contingent transaction other property or

exchange, provide total this property. forms are required for residence, charged to wherein gross proceeds services received?

dollar value of cash, notes this transaction, record the buyer at settlement. cannot be determined

and debt relief received by the dollar amount for with certainty at time of

this exchanger. this seller based on the closing?

seller’s declaration.

[7] [8] $«VALUE(TEXT5,T $«VALUE(TEXT6,Thi « Yes « Yes

$«VALUE(SALEPRICE, «VALUE(TEX his)» s)» V V

SELLER INFORMATION – PLEASE PRINT CLEARLY

This)» T4,This)» A A

Seller’s Name L L

[9] «VALUE(SENAME,This)» U U

Seller’s Forwarding Street Address E E

«VALUE(SEFADA,This)» ( (

City State

T

Zip (or country if not USA)

T

E E

«VALUE(SEFCSZ,This)»

X X

SELLER’S SOCIAL SECURITY NUMBER T

SELLER’S TAX IDENTIFICATION NUMBER T

[10] «VALUE(SETXID,This)» OR «VALUE(SETRNO,This)»7 8

You are required by law to provide your closing agent with your correct Under penalties of perjury, I certify that the number shown ,above is my

,

T

Taxpayer Identification Number. If you do not provide your closing correct Taxpayer Identification Number. T

agent with your correct Taxpayer Identification Number, you may be h h

subject to civil or criminal penalties imposed by law under the Tax [11] i i

Reform Act of 1986 under Internal Revenue Code Section 6045(E), 6676, √

6722, 6723, and 7203. Seller’s Signature s s Date

) )

» »

INSTRUCTIONS

A) Make sure all data fields and areas indicated by numbers are accurately completed.

B) If there is more than one seller in this transaction, each seller must have a separate 1099-S form. In most cases a husband and

wife are considered one seller and only one name and corresponding Social Security Number or Tax Identification Number can

appear on this form.

C) Also, if more than one seller, indicate the total number of 1099-S forms required for the transaction and report the correct dollar value for this

seller in area number [8].

D) Make sure all seller’s information (name, forwarding address, Social Security or Taxpayer Identification Number, and seller’s signature) is

obtained. Missing or incorrect information may be subject to IRS penalty.

E) Double check all information for completeness and accuracy before submitting for processing.

Reproduced by «VALUE(UWNAME,This)» 1/2001

You might also like

- Dalia Quiles Smallville Database BuildDocument18 pagesDalia Quiles Smallville Database Buildapi-573686577100% (1)

- 1 Learner Development Case Study For PE (CIA 1)Document10 pages1 Learner Development Case Study For PE (CIA 1)api-596436208No ratings yet

- TCS BaNCS Service Repository Document - ReverseUUIDDocument9 pagesTCS BaNCS Service Repository Document - ReverseUUIDMohit GuptaNo ratings yet

- Market Internals v2 PDFDocument30 pagesMarket Internals v2 PDFJayBajrang100% (1)

- Agile One Pager PDFDocument2 pagesAgile One Pager PDFEgeruoh Chigoziri CyrinusNo ratings yet

- Department of Civil Engineering, ISM Dhanbad Structural Analysis-I Practical ManualDocument6 pagesDepartment of Civil Engineering, ISM Dhanbad Structural Analysis-I Practical ManualanpyaaNo ratings yet

- Summary Purchases TemplateDocument7 pagesSummary Purchases TemplateKarla MarasiganNo ratings yet

- Database 1Document28 pagesDatabase 1madhuhl15No ratings yet

- WHVAT ReturnDocument6 pagesWHVAT ReturnbatuchemNo ratings yet

- Lacls Co BancoomevaDocument7 pagesLacls Co BancoomevaluisNo ratings yet

- Lacls Co GNB BankDocument6 pagesLacls Co GNB BankluisNo ratings yet

- F 8300Document5 pagesF 8300IRSNo ratings yet

- Template For Summary List of Sales and PurchasesDocument7 pagesTemplate For Summary List of Sales and PurchasesSuccess Technical and Vocational IncorporatedNo ratings yet

- Lacls Co Credicorp BankDocument5 pagesLacls Co Credicorp BankluisNo ratings yet

- SQLDocument19 pagesSQLStudy ForestNo ratings yet

- Lacls Co Itau BankDocument4 pagesLacls Co Itau BankluisNo ratings yet

- US Internal Revenue Service: f2438 - 2004Document3 pagesUS Internal Revenue Service: f2438 - 2004IRSNo ratings yet

- 5-23-08 Pentagon IG Polish VoucherDocument1 page5-23-08 Pentagon IG Polish Voucherapi-1105720100% (2)

- Fedex Commercial Give ThanksDocument3 pagesFedex Commercial Give ThanksBanh Mi Cua EmNo ratings yet

- Lacls Co Santander BankDocument3 pagesLacls Co Santander BankluisNo ratings yet

- Galileo Guide PDFDocument36 pagesGalileo Guide PDFrcharlesNo ratings yet

- Naples Councilman Paul Perry Donates $500 To Ethics Naples Inc. - November 2020Document2 pagesNaples Councilman Paul Perry Donates $500 To Ethics Naples Inc. - November 2020Omar Rodriguez OrtizNo ratings yet

- HelbizDocument211 pagesHelbizGustavo MoreiraNo ratings yet

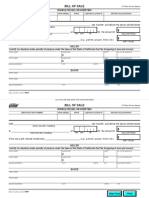

- Bill of Sale: Vehicle/Vessel DescriptionDocument1 pageBill of Sale: Vehicle/Vessel DescriptionDainette WoodsNo ratings yet

- Bill of SaleDocument1 pageBill of SalelayoNo ratings yet

- Lacls Co Bac BankDocument2 pagesLacls Co Bac BankluisNo ratings yet

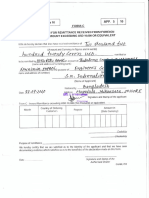

- Form C PDFDocument1 pageForm C PDFS M Labu HassanNo ratings yet

- Generic US NACHA Format Format Setup:: Mapping of Payment Format: Date: 3/9/2006Document9 pagesGeneric US NACHA Format Format Setup:: Mapping of Payment Format: Date: 3/9/2006kotiNo ratings yet

- Income Tax Return For Individuals: Taxpayer InformationDocument6 pagesIncome Tax Return For Individuals: Taxpayer InformationSYDNEYNo ratings yet

- US Internal Revenue Service: f2438 - 2002Document3 pagesUS Internal Revenue Service: f2438 - 2002IRSNo ratings yet

- MqwertyDocument2 pagesMqwertyJam MarzanNo ratings yet

- "Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Document3 pages"Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Anonymous 2evaoXKKdNo ratings yet

- Lacls Co Occidente BankDocument4 pagesLacls Co Occidente BankluisNo ratings yet

- 50 Fixed Assets RegisterDocument30 pages50 Fixed Assets RegisterKiran NanduNo ratings yet

- IBYDE F DE enDocument16 pagesIBYDE F DE enRajendra PilludaNo ratings yet

- Img 20200130 0001Document1 pageImg 20200130 0001KIMBERLY BALISACANNo ratings yet

- R Williams DasDocument6 pagesR Williams DasCalWonkNo ratings yet

- Ibyde CTX enDocument5 pagesIbyde CTX enRajendra PilludaNo ratings yet

- Corning Incorporated: United States Securities and Exchange Commission WASHINGTON, D.C. 20549 FORM 10-QDocument49 pagesCorning Incorporated: United States Securities and Exchange Commission WASHINGTON, D.C. 20549 FORM 10-QhidulfiNo ratings yet

- Confirm Market Direction Tick by Tick With: Order Flow +Document12 pagesConfirm Market Direction Tick by Tick With: Order Flow +Adolfo0% (2)

- Nasdaq Tsla 2017 PDFDocument276 pagesNasdaq Tsla 2017 PDFgetNo ratings yet

- SharePoint Cheat Sheet PDFDocument4 pagesSharePoint Cheat Sheet PDFJimmyHImNo ratings yet

- Toaz - Info Timebook Payroll PRDocument3 pagesToaz - Info Timebook Payroll PRChar MaineNo ratings yet

- The Real Options Model of Land Value and Development Project ValuationDocument109 pagesThe Real Options Model of Land Value and Development Project ValuationFungai MukundiwaNo ratings yet

- Itr 1Document2 pagesItr 1zakirhusssainNo ratings yet

- Top50moviesp44091 2 2Document11 pagesTop50moviesp44091 2 2p44091No ratings yet

- TD SYNNEX Corporation - Noviembre 2021Document165 pagesTD SYNNEX Corporation - Noviembre 2021Hugo Nicolas Gutierrez DuranNo ratings yet

- Proforma Invoice - UputstvoDocument1 pageProforma Invoice - Uputstvoskripta.resavskaNo ratings yet

- Company SchemaDocument2 pagesCompany SchemaHamza MaherNo ratings yet

- Scott Tiger Demo SQL ServerDocument2 pagesScott Tiger Demo SQL ServerDavid MoralesNo ratings yet

- Mathematical FunctionsDocument16 pagesMathematical FunctionsAniket KarnNo ratings yet

- AM Only-OfferSheet USDDocument1 pageAM Only-OfferSheet USDMatt JolleyNo ratings yet

- Fórmulas Gen5 BiotekDocument4 pagesFórmulas Gen5 BiotekjosliNo ratings yet

- The Weighted Average Cost of Capital Some Questions PDFDocument5 pagesThe Weighted Average Cost of Capital Some Questions PDFmjay moredoNo ratings yet

- Final ScriptDocument10 pagesFinal ScriptmortinNo ratings yet

- EMP and Dept Tables ScriptsDocument10 pagesEMP and Dept Tables Scriptsnagarajuvcc123No ratings yet

- Convert Galileo Commands To Sabre 01Document7 pagesConvert Galileo Commands To Sabre 01yasithaNo ratings yet

- Pendulo No LinealDocument2 pagesPendulo No LinealMafe VelásquezNo ratings yet

- Harkin Mike - 1280 - ScannedDocument2 pagesHarkin Mike - 1280 - ScannedZach EdwardsNo ratings yet

- Oi Amendment5 Schedule To 20151005Document7 pagesOi Amendment5 Schedule To 20151005marcelagynNo ratings yet

- Celanese ReportDocument188 pagesCelanese ReportMasha NikolovaNo ratings yet

- 6890736-HR Schema MySQLDocument45 pages6890736-HR Schema MySQLPraveen PuniaNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Laurie Mook, John R. Whitman, Jack Quarter, Ann Armstrong - Understanding The Social Economy of The United States (2015, University of Toronto Press) PDFDocument411 pagesLaurie Mook, John R. Whitman, Jack Quarter, Ann Armstrong - Understanding The Social Economy of The United States (2015, University of Toronto Press) PDFAndrewNo ratings yet

- Character Styles Introduction PDFDocument4 pagesCharacter Styles Introduction PDFKOSTAS BOUYOUNo ratings yet

- Rachel Frawley Resume Directors 2Document1 pageRachel Frawley Resume Directors 2api-19274858No ratings yet

- Business PlanDocument97 pagesBusiness PlanMylene SalvadorNo ratings yet

- 2008 RESENHAthePeriodicTable HJORLANDDocument100 pages2008 RESENHAthePeriodicTable HJORLANDIgor AmorimNo ratings yet

- OptoelectronicsDocument23 pagesOptoelectronicsChristian Dave TamparongNo ratings yet

- Aisha Ra AgeDocument11 pagesAisha Ra Agepoco X3No ratings yet

- UD11T4107 English Maritime History Human FactorDocument4 pagesUD11T4107 English Maritime History Human FactorParminder singh parmarNo ratings yet

- Impression Materials and Techniques in Fixed ProsthesisDocument116 pagesImpression Materials and Techniques in Fixed ProsthesisSharvaree100% (1)

- Import Plan Rossmann GMBHDocument27 pagesImport Plan Rossmann GMBHAntoni DragnevNo ratings yet

- Casolita Vs CADocument1 pageCasolita Vs CAJL A H-DimaculanganNo ratings yet

- State SuccessionDocument5 pagesState Successionhaiderbukhari1998No ratings yet

- Dealing With Competition: Presented byDocument41 pagesDealing With Competition: Presented bySunil SinghNo ratings yet

- Corp Law CasesDocument15 pagesCorp Law CasesNoel IV T. BorromeoNo ratings yet

- Core Element of Human Resource ManagementDocument29 pagesCore Element of Human Resource ManagementambasimonicNo ratings yet

- Step 3 Test Chapter 8Document3 pagesStep 3 Test Chapter 8nicodzNo ratings yet

- Masterthesis: Technische Universität München Lehrstuhl Für Netzarchitekturen Und Netzdienste Prof. Dr. Georg CarleDocument1 pageMasterthesis: Technische Universität München Lehrstuhl Für Netzarchitekturen Und Netzdienste Prof. Dr. Georg Carlenashwan mustafaNo ratings yet

- NewsletterDocument2 pagesNewsletterboonchuan20095886No ratings yet

- 3 - PRobabilityDocument17 pages3 - PRobabilityAnonymous UP5RC6JpGNo ratings yet

- TORs For Engaging A Risk ConsultantDocument4 pagesTORs For Engaging A Risk ConsultantAMARA KEKALINo ratings yet

- Peace and Conflict Study: 1 The Ongoing Ethio-Eritrea Peace Building Process: Successes, Challenges and ProspectsDocument11 pagesPeace and Conflict Study: 1 The Ongoing Ethio-Eritrea Peace Building Process: Successes, Challenges and ProspectsAsmerom MosinehNo ratings yet

- VonGaluss MansionDocument19 pagesVonGaluss MansionMatthew Cordle100% (1)

- Available Form: CNS: Headcahe,: Older Than 14 Years Old Acute PainDocument4 pagesAvailable Form: CNS: Headcahe,: Older Than 14 Years Old Acute PainKevin Miguel RiveraNo ratings yet

- DNA Rules On EvidenceDocument4 pagesDNA Rules On EvidenceZoe Gacod Takumii UsuiiNo ratings yet

- Sav 4741Document47 pagesSav 4741tlidiaNo ratings yet

- Final Test Revision Part 1Document4 pagesFinal Test Revision Part 1Milica RoskicNo ratings yet

- International Econ Salvatore CH 1 4 Practice QuestionsDocument17 pagesInternational Econ Salvatore CH 1 4 Practice QuestionsalliNo ratings yet