Professional Documents

Culture Documents

137 Associated Bank V Tan

137 Associated Bank V Tan

Uploaded by

karl doceoCopyright:

Available Formats

You might also like

- Student Exploration - Weight and Mass (ANSWER KEY)Document3 pagesStudent Exploration - Weight and Mass (ANSWER KEY)Jaila Palmer [STUDENT]No ratings yet

- Practical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchDocument32 pagesPractical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchVINCENT BIALEN80% (30)

- Basic Life SupportDocument39 pagesBasic Life SupportGendrux Zibbzibb100% (1)

- Gotardo v. BulingDocument3 pagesGotardo v. BulingJosef MacanasNo ratings yet

- Benedicto vs. Board of Administrators of Television Stations RPN BBC and IBCDocument12 pagesBenedicto vs. Board of Administrators of Television Stations RPN BBC and IBCral cbNo ratings yet

- Pacheco V CADocument2 pagesPacheco V CAJaisatine Acushla HermosadoNo ratings yet

- 95 RCBC Vs CADocument1 page95 RCBC Vs CAangelo doceoNo ratings yet

- US v. Carlos 21 Phil 553 Ruling: Yes! by Using A: - Property Law - Atty. GasgoniaDocument1 pageUS v. Carlos 21 Phil 553 Ruling: Yes! by Using A: - Property Law - Atty. Gasgoniajuan aldabaNo ratings yet

- 040 Republic V SandiganbayanDocument3 pages040 Republic V SandiganbayanJudy Ann ShengNo ratings yet

- Padura v. BaldovinoDocument2 pagesPadura v. BaldovinoVloudy Mia Serrano PangilinanNo ratings yet

- Legal Med-De Jesus vs. SyquiaDocument1 pageLegal Med-De Jesus vs. SyquiaCo Sep DongNo ratings yet

- Case Digest ObliconDocument3 pagesCase Digest ObliconKrish LicupNo ratings yet

- Reyes v. CADocument14 pagesReyes v. CAAiyla AnonasNo ratings yet

- Persons and Family RelationsDocument136 pagesPersons and Family RelationsThea P PorrasNo ratings yet

- Sinaon v. SorongonDocument3 pagesSinaon v. SorongonCarie LawyerrNo ratings yet

- Republic Vs CatubagDocument3 pagesRepublic Vs CatubagamazingmomNo ratings yet

- Obli Digest Reviewer Chap 2Document9 pagesObli Digest Reviewer Chap 2RL N DeiparineNo ratings yet

- Tribiana v. TribianaDocument2 pagesTribiana v. TribianaChaoSisonNo ratings yet

- People v. TudtudDocument34 pagesPeople v. TudtudlabellejolieNo ratings yet

- Berot v. Siapno 1Document6 pagesBerot v. Siapno 1CZARINA ANN CASTRONo ratings yet

- Succession (My Legal Whiz)Document79 pagesSuccession (My Legal Whiz)Alyssa GomezNo ratings yet

- Genato v. de LorenzoDocument2 pagesGenato v. de LorenzoAngelicaNo ratings yet

- Cojuanco Vs SandiganbayanDocument20 pagesCojuanco Vs SandiganbayansirynspixeNo ratings yet

- Bachrach Motor Co Vs EspirituDocument2 pagesBachrach Motor Co Vs EspirituElaiza OngNo ratings yet

- Froilan Vs Pan Oriental ShippingDocument4 pagesFroilan Vs Pan Oriental Shippingeunice demaclidNo ratings yet

- Finman General Assurance Corp Vs InocencioDocument2 pagesFinman General Assurance Corp Vs InocencioAldrin TangNo ratings yet

- 32 - Commonweath Act 142, RA 6085Document1 page32 - Commonweath Act 142, RA 6085Regina CoeliNo ratings yet

- Encarncion v. BaldomarDocument1 pageEncarncion v. BaldomarMirabel VidalNo ratings yet

- In Re ChristensenDocument2 pagesIn Re ChristensenabbyNo ratings yet

- Rule 88 - Payment of The Debts of The EstateDocument18 pagesRule 88 - Payment of The Debts of The EstateJan kristelNo ratings yet

- Hernandez Versus HernandezDocument1 pageHernandez Versus HernandezremingiiiNo ratings yet

- Agapay V PalangDocument13 pagesAgapay V PalangSuho KimNo ratings yet

- Any Person Who Is Prejudiced by A Simulated Contract May Set Up Its InexistenceDocument2 pagesAny Person Who Is Prejudiced by A Simulated Contract May Set Up Its InexistenceMonicaSumangaNo ratings yet

- In Re Cunanan, Et Al., March 18, 1954Document39 pagesIn Re Cunanan, Et Al., March 18, 1954yanyan yuNo ratings yet

- in Re Atty. Rufillo D. BucanaDocument2 pagesin Re Atty. Rufillo D. BucanaShantle Taciana P. FabicoNo ratings yet

- Amigo vs. Court of AppealsDocument3 pagesAmigo vs. Court of AppealsRhenfacel ManlegroNo ratings yet

- Digest 4th BatchDocument9 pagesDigest 4th BatchBeverlyn JamisonNo ratings yet

- Ramirez vs. Vda. de RamirezDocument7 pagesRamirez vs. Vda. de RamirezFrancis De CastroNo ratings yet

- Conde Vs Abaya Full and Digested CaseDocument10 pagesConde Vs Abaya Full and Digested CasePearl Regalado MansayonNo ratings yet

- Rodelas v. Aranza (1982)Document2 pagesRodelas v. Aranza (1982)Nap GonzalesNo ratings yet

- BPI Express CaseDocument2 pagesBPI Express CaseEloisa SalitreroNo ratings yet

- Tamargo Vs CADocument3 pagesTamargo Vs CAMaria Cherrylen Castor QuijadaNo ratings yet

- Sps. Castro Vs - TanDocument12 pagesSps. Castro Vs - TanJhonrey LalagunaNo ratings yet

- 02 Case Digests - Kinds of Civil ObligationsDocument37 pages02 Case Digests - Kinds of Civil ObligationsRochelle Ann EstradaNo ratings yet

- R58-04 Dagupan Elec vs. Cruz-PanoDocument3 pagesR58-04 Dagupan Elec vs. Cruz-PanoMichael JosephNo ratings yet

- 124894-1997-Agapay v. Palang PDFDocument8 pages124894-1997-Agapay v. Palang PDFKim RoxasNo ratings yet

- Teddy G. Pabugais, Petitioner, vs. Dave P. Sahijwani, Respondent.Document8 pagesTeddy G. Pabugais, Petitioner, vs. Dave P. Sahijwani, Respondent.Angelo FulgencioNo ratings yet

- Civpro Case DigestsDocument12 pagesCivpro Case DigestsGwynn BonghanoyNo ratings yet

- Lopez Vs Constantino (Property)Document4 pagesLopez Vs Constantino (Property)Chris InocencioNo ratings yet

- 8 Republic v. EugenioDocument3 pages8 Republic v. EugenioNicole PTNo ratings yet

- DEL ROSARIO Vs FERRERDocument2 pagesDEL ROSARIO Vs FERRERAices SalvadorNo ratings yet

- Republic v. Orbecido: G.R. No. 154380, 5 October 2005 FactsDocument1 pageRepublic v. Orbecido: G.R. No. 154380, 5 October 2005 FactsPaul Joshua SubaNo ratings yet

- CIV2-part 1Document79 pagesCIV2-part 1c@rpe_diemNo ratings yet

- Sarmienta Vs Manalite Home Owners AssociationDocument3 pagesSarmienta Vs Manalite Home Owners AssociationRubenNo ratings yet

- Maglasang vs. CabatinganDocument2 pagesMaglasang vs. CabatinganMarilou GaralNo ratings yet

- Ledesma Vs ClimacoDocument7 pagesLedesma Vs ClimacoNikkiAgeroNo ratings yet

- Summary of Cases - MidtermDocument6 pagesSummary of Cases - MidtermAizza JopsonNo ratings yet

- PERSONS Willan V WillanDocument1 pagePERSONS Willan V WillanPlaneteer PranaNo ratings yet

- G.R. No. 123586. August 12, 2004: Spouses Beder Morandarte and Marina FebreraDocument3 pagesG.R. No. 123586. August 12, 2004: Spouses Beder Morandarte and Marina FebreraArdenNo ratings yet

- Rem Landmark CasesDocument8 pagesRem Landmark CasesKev BayonaNo ratings yet

- ASSOCIATED BANK Vs TANDocument4 pagesASSOCIATED BANK Vs TANJules VosotrosNo ratings yet

- Assoc Bank Vs TanDocument2 pagesAssoc Bank Vs TanBeverlyn Jamison100% (1)

- FEBTC Vs Diaz RealtyDocument1 pageFEBTC Vs Diaz RealtyDaniela Erika Beredo InandanNo ratings yet

- 3 People Vs SequinoDocument1 page3 People Vs Sequinokarl doceoNo ratings yet

- 53 Malayan Employees Association - FFW and Mangalino v. Malayan Insurance Co.Document2 pages53 Malayan Employees Association - FFW and Mangalino v. Malayan Insurance Co.karl doceoNo ratings yet

- Fredco Vs HarvardDocument3 pagesFredco Vs Harvardkarl doceoNo ratings yet

- 30 Dolores Villar Et Al Vs InciongDocument3 pages30 Dolores Villar Et Al Vs Inciongkarl doceoNo ratings yet

- 131 Abrogar Vs Cosmos BottlingDocument3 pages131 Abrogar Vs Cosmos Bottlingkarl doceoNo ratings yet

- 105 Carumba v. CADocument2 pages105 Carumba v. CAkarl doceo100% (1)

- 44 Manufacturers Life Insurance V MeerDocument3 pages44 Manufacturers Life Insurance V Meerkarl doceo100% (1)

- 44 Manufacturers Life Insurance V MeerDocument7 pages44 Manufacturers Life Insurance V Meerkarl doceoNo ratings yet

- Search WarrantDocument8 pagesSearch Warrantkarl doceoNo ratings yet

- 131 People Vs BalinganDocument2 pages131 People Vs Balingankarl doceo100% (1)

- 97 Allan C Go V CorderoDocument5 pages97 Allan C Go V Corderokarl doceoNo ratings yet

- 31 Frias V San Diego-SisonDocument2 pages31 Frias V San Diego-Sisonkarl doceoNo ratings yet

- 65 Garcia Vs SalvadorDocument3 pages65 Garcia Vs Salvadorkarl doceoNo ratings yet

- People Vs IntingDocument2 pagesPeople Vs Intingkarl doceoNo ratings yet

- 67 People Vs PavillareDocument3 pages67 People Vs Pavillarekarl doceoNo ratings yet

- 81 Young V Midland Textile InsuranceDocument2 pages81 Young V Midland Textile Insurancekarl doceoNo ratings yet

- 103 Roan v. GonzalesDocument2 pages103 Roan v. Gonzaleskarl doceoNo ratings yet

- 22 Villa Rey Transit V CADocument2 pages22 Villa Rey Transit V CAkarl doceoNo ratings yet

- People Vs Puig and PorrasDocument1 pagePeople Vs Puig and Porraskarl doceoNo ratings yet

- Vda de Reyes Vs CADocument9 pagesVda de Reyes Vs CAkarl doceoNo ratings yet

- Philam Vs ArnaldoDocument2 pagesPhilam Vs Arnaldokarl doceoNo ratings yet

- People Vs SequinoDocument1 pagePeople Vs Sequinokarl doceoNo ratings yet

- 15 Ty Vs First NationaDocument2 pages15 Ty Vs First Nationakarl doceoNo ratings yet

- De Lima V GuerreroDocument3 pagesDe Lima V Guerrerokarl doceoNo ratings yet

- Pangandaman Vs CasarDocument2 pagesPangandaman Vs Casarkarl doceoNo ratings yet

- Austin v. United States, 509 U.S. 602 (1993)Document23 pagesAustin v. United States, 509 U.S. 602 (1993)Scribd Government DocsNo ratings yet

- NCF - 2015 - Npe - 1986Document20 pagesNCF - 2015 - Npe - 1986sanchitNo ratings yet

- NEW Junior School Curriculum Handbook 2023Document39 pagesNEW Junior School Curriculum Handbook 2023Dan LearyNo ratings yet

- SPM Add Maths Paper 2Document6 pagesSPM Add Maths Paper 2Mohd_Puzi_2051No ratings yet

- Research Methods - SamplingDocument34 pagesResearch Methods - SamplingMohsin RazaNo ratings yet

- Constitution and By-Laws of SSCDocument12 pagesConstitution and By-Laws of SSCJaypee Mercado Roaquin100% (1)

- DOLE Philippines, Inc. vs. Medel Esteva, Et Al. G.R. No. 161115, November 30, 2006 Chico-Nazario, J.Document2 pagesDOLE Philippines, Inc. vs. Medel Esteva, Et Al. G.R. No. 161115, November 30, 2006 Chico-Nazario, J.Natalio Repaso IIINo ratings yet

- A Novel TRPC6 Mutation in A Family With Podocytopathy and Clinical VariabilityDocument5 pagesA Novel TRPC6 Mutation in A Family With Podocytopathy and Clinical VariabilityIgnacio TabuadaNo ratings yet

- HSPA - Network Optimization & Trouble Shooting v1.2Document15 pagesHSPA - Network Optimization & Trouble Shooting v1.2Ch_L_N_Murthy_273No ratings yet

- Cwts - Module - 1st Semester A.Y 2022-2023Document71 pagesCwts - Module - 1st Semester A.Y 2022-2023Jae Ashlie BernabeNo ratings yet

- Every Praise: Hezekiah WalkerDocument1 pageEvery Praise: Hezekiah WalkerPamela CabelloNo ratings yet

- Kibor HistoryDocument3 pagesKibor HistorymaheenwarisNo ratings yet

- Citrix XenApp 6.5 AdministrationDocument22 pagesCitrix XenApp 6.5 AdministrationTjako1No ratings yet

- Injunction Draft Padre CrisostomoDocument7 pagesInjunction Draft Padre CrisostomoJoseph Nikolai ChiocoNo ratings yet

- Coca Cola ManagementDocument87 pagesCoca Cola Managementgoswamiphotostat43% (7)

- Sultans of Swing TabDocument5 pagesSultans of Swing TabNadiaNo ratings yet

- Part A Reading Task 6 InfluenzaDocument7 pagesPart A Reading Task 6 InfluenzamigsbricksNo ratings yet

- NI Executive - Letter To Faith LeadersDocument5 pagesNI Executive - Letter To Faith LeadersDUPNo ratings yet

- SEC AssignmentDocument5 pagesSEC AssignmentChandra Prakash DixitNo ratings yet

- Psychiatric SymptomsDocument65 pagesPsychiatric SymptomsEslam HamadaNo ratings yet

- Advanced Modeling of Online Consumer BehaviorDocument17 pagesAdvanced Modeling of Online Consumer BehaviorCesar GranadosNo ratings yet

- From Court of Dar Es at Kisutu in Civil Application No. 107 2022)Document17 pagesFrom Court of Dar Es at Kisutu in Civil Application No. 107 2022)Emmanuel ShekifuNo ratings yet

- Parts Tohatsu MFS25B-30B (2005) - (00221050-2)Document90 pagesParts Tohatsu MFS25B-30B (2005) - (00221050-2)rebliaNo ratings yet

- Brexit Complete Detail PDFDocument5 pagesBrexit Complete Detail PDFAnshul PalNo ratings yet

- Azul de Metileno ChoqueDocument10 pagesAzul de Metileno Choquenoel luisNo ratings yet

- Geotechnical Engineering - Serbulea ManoleDocument229 pagesGeotechnical Engineering - Serbulea ManoleNecula Bogdan MihaiNo ratings yet

- Consumer Behavior PP Chapter 7Document35 pagesConsumer Behavior PP Chapter 7tuongvyvyNo ratings yet

137 Associated Bank V Tan

137 Associated Bank V Tan

Uploaded by

karl doceoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

137 Associated Bank V Tan

137 Associated Bank V Tan

Uploaded by

karl doceoCopyright:

Available Formats

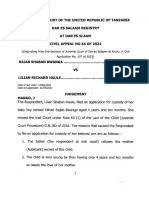

Topic Compensation the dishonour.

Moreso, it averred that it had no liability because the

Case No. 137 Central Bank was in charge of check clearing they are merely a collecting

Case Name Associated Bank v Tan agent.

Full Case ASSOCIATED BANK (now WESTMONT BANK),

Name petitioner, vs VICENTE HENRY TAN, respondent RTC ruled in favour of respondent awarding him moral damage,

Ponente PANGANIBAN, J. exemplary damages and attorney’s fees. Petitioner appealed to the CA.

Doctrine Legal compensation may be claimed if the requisites in

CA ruled that the bank should not have authorized withdrawal of the value

Article 1279 are all present

(1) That they are debtors and creditors of one another

prior to clearing. The bank failed to uphold its own policy. Had the 101k

(2) Both debts consist a sum of money, kind or quality not been debited, the respondent would have had sufficient funds for the

(3) Both debts are due checks he had issued.

(4) Both debts are liquidated and demandable

(5) That neither of them there be any retention or ISSUES

(1) Did the bank have the right to debit the amount from respondent’s

controversy, commenced by third persons and

account? No, it did not. Since the relationship of the depositor and

communicated in due time to the debtor

the bank are that of creditors and debtors of each other, Article 1278

is applicable.

RELEVANT FACTS

Respondent is a businessman and already a regular-depositor of the

RATIO DECIDENDI

petitioner. September 1990, he deposited a post-dated check in the amount

1. Did the bank have the right to debit the amount from respondent’s

of 101,000. According to the bank, the check was already cleared and account?

credited and that his account had 297,000. Respondent then withdrew

240,000 and a day after deposited 50,000 because he issued several checks No, it did not. Since the relation of the depositor and the bank are that

to his suppliers. of creditors and debtors of each other, Article 1278 is applicable.

His suppliers and business partners contacted him saying that the checks The real issue to be considered is not the actual right of set-off exercised

he issued bounced for insufficiency of funds. Respondent informed the by the bank but the manner it has been exercised. Banks are granted by

petitioner bank to take steps regarding the matter but the bank did not the law to debit the accounts of the depositors but to do so, they must

even offer an apology or even remedy the problem. Respondent then filed exercise the highest degree of care. The degree required of banks is more

a case with the RTC. than that of the diligence of a good father of a family.

Respondent, for he was already considered of good record and reputation In the petition, the bank did not treat the account of the depositor with

in the community, demanded for moral damages, lost profits and such standard of care and it resulted to damages. The premature

attorney’s fees from petitioner bank. authorization of the bank to withdraw the amount was what caused the

alleged insufficiency in the account of the respondent when he issued his

PETITIONER alleged that the bank would not give the assurance to any checks for his suppliers and business partners.

client that the check had already been cleared and that it takes a substantial

amount of time for a check to be cleared. Additionally, the bank claimed DECISION

that it had the right to debit the account of the respondent by reason of The petition is DENIED and the CA’s decision is AFFIRMED.

Respondent is entitled to damages.

You might also like

- Student Exploration - Weight and Mass (ANSWER KEY)Document3 pagesStudent Exploration - Weight and Mass (ANSWER KEY)Jaila Palmer [STUDENT]No ratings yet

- Practical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchDocument32 pagesPractical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchVINCENT BIALEN80% (30)

- Basic Life SupportDocument39 pagesBasic Life SupportGendrux Zibbzibb100% (1)

- Gotardo v. BulingDocument3 pagesGotardo v. BulingJosef MacanasNo ratings yet

- Benedicto vs. Board of Administrators of Television Stations RPN BBC and IBCDocument12 pagesBenedicto vs. Board of Administrators of Television Stations RPN BBC and IBCral cbNo ratings yet

- Pacheco V CADocument2 pagesPacheco V CAJaisatine Acushla HermosadoNo ratings yet

- 95 RCBC Vs CADocument1 page95 RCBC Vs CAangelo doceoNo ratings yet

- US v. Carlos 21 Phil 553 Ruling: Yes! by Using A: - Property Law - Atty. GasgoniaDocument1 pageUS v. Carlos 21 Phil 553 Ruling: Yes! by Using A: - Property Law - Atty. Gasgoniajuan aldabaNo ratings yet

- 040 Republic V SandiganbayanDocument3 pages040 Republic V SandiganbayanJudy Ann ShengNo ratings yet

- Padura v. BaldovinoDocument2 pagesPadura v. BaldovinoVloudy Mia Serrano PangilinanNo ratings yet

- Legal Med-De Jesus vs. SyquiaDocument1 pageLegal Med-De Jesus vs. SyquiaCo Sep DongNo ratings yet

- Case Digest ObliconDocument3 pagesCase Digest ObliconKrish LicupNo ratings yet

- Reyes v. CADocument14 pagesReyes v. CAAiyla AnonasNo ratings yet

- Persons and Family RelationsDocument136 pagesPersons and Family RelationsThea P PorrasNo ratings yet

- Sinaon v. SorongonDocument3 pagesSinaon v. SorongonCarie LawyerrNo ratings yet

- Republic Vs CatubagDocument3 pagesRepublic Vs CatubagamazingmomNo ratings yet

- Obli Digest Reviewer Chap 2Document9 pagesObli Digest Reviewer Chap 2RL N DeiparineNo ratings yet

- Tribiana v. TribianaDocument2 pagesTribiana v. TribianaChaoSisonNo ratings yet

- People v. TudtudDocument34 pagesPeople v. TudtudlabellejolieNo ratings yet

- Berot v. Siapno 1Document6 pagesBerot v. Siapno 1CZARINA ANN CASTRONo ratings yet

- Succession (My Legal Whiz)Document79 pagesSuccession (My Legal Whiz)Alyssa GomezNo ratings yet

- Genato v. de LorenzoDocument2 pagesGenato v. de LorenzoAngelicaNo ratings yet

- Cojuanco Vs SandiganbayanDocument20 pagesCojuanco Vs SandiganbayansirynspixeNo ratings yet

- Bachrach Motor Co Vs EspirituDocument2 pagesBachrach Motor Co Vs EspirituElaiza OngNo ratings yet

- Froilan Vs Pan Oriental ShippingDocument4 pagesFroilan Vs Pan Oriental Shippingeunice demaclidNo ratings yet

- Finman General Assurance Corp Vs InocencioDocument2 pagesFinman General Assurance Corp Vs InocencioAldrin TangNo ratings yet

- 32 - Commonweath Act 142, RA 6085Document1 page32 - Commonweath Act 142, RA 6085Regina CoeliNo ratings yet

- Encarncion v. BaldomarDocument1 pageEncarncion v. BaldomarMirabel VidalNo ratings yet

- In Re ChristensenDocument2 pagesIn Re ChristensenabbyNo ratings yet

- Rule 88 - Payment of The Debts of The EstateDocument18 pagesRule 88 - Payment of The Debts of The EstateJan kristelNo ratings yet

- Hernandez Versus HernandezDocument1 pageHernandez Versus HernandezremingiiiNo ratings yet

- Agapay V PalangDocument13 pagesAgapay V PalangSuho KimNo ratings yet

- Any Person Who Is Prejudiced by A Simulated Contract May Set Up Its InexistenceDocument2 pagesAny Person Who Is Prejudiced by A Simulated Contract May Set Up Its InexistenceMonicaSumangaNo ratings yet

- In Re Cunanan, Et Al., March 18, 1954Document39 pagesIn Re Cunanan, Et Al., March 18, 1954yanyan yuNo ratings yet

- in Re Atty. Rufillo D. BucanaDocument2 pagesin Re Atty. Rufillo D. BucanaShantle Taciana P. FabicoNo ratings yet

- Amigo vs. Court of AppealsDocument3 pagesAmigo vs. Court of AppealsRhenfacel ManlegroNo ratings yet

- Digest 4th BatchDocument9 pagesDigest 4th BatchBeverlyn JamisonNo ratings yet

- Ramirez vs. Vda. de RamirezDocument7 pagesRamirez vs. Vda. de RamirezFrancis De CastroNo ratings yet

- Conde Vs Abaya Full and Digested CaseDocument10 pagesConde Vs Abaya Full and Digested CasePearl Regalado MansayonNo ratings yet

- Rodelas v. Aranza (1982)Document2 pagesRodelas v. Aranza (1982)Nap GonzalesNo ratings yet

- BPI Express CaseDocument2 pagesBPI Express CaseEloisa SalitreroNo ratings yet

- Tamargo Vs CADocument3 pagesTamargo Vs CAMaria Cherrylen Castor QuijadaNo ratings yet

- Sps. Castro Vs - TanDocument12 pagesSps. Castro Vs - TanJhonrey LalagunaNo ratings yet

- 02 Case Digests - Kinds of Civil ObligationsDocument37 pages02 Case Digests - Kinds of Civil ObligationsRochelle Ann EstradaNo ratings yet

- R58-04 Dagupan Elec vs. Cruz-PanoDocument3 pagesR58-04 Dagupan Elec vs. Cruz-PanoMichael JosephNo ratings yet

- 124894-1997-Agapay v. Palang PDFDocument8 pages124894-1997-Agapay v. Palang PDFKim RoxasNo ratings yet

- Teddy G. Pabugais, Petitioner, vs. Dave P. Sahijwani, Respondent.Document8 pagesTeddy G. Pabugais, Petitioner, vs. Dave P. Sahijwani, Respondent.Angelo FulgencioNo ratings yet

- Civpro Case DigestsDocument12 pagesCivpro Case DigestsGwynn BonghanoyNo ratings yet

- Lopez Vs Constantino (Property)Document4 pagesLopez Vs Constantino (Property)Chris InocencioNo ratings yet

- 8 Republic v. EugenioDocument3 pages8 Republic v. EugenioNicole PTNo ratings yet

- DEL ROSARIO Vs FERRERDocument2 pagesDEL ROSARIO Vs FERRERAices SalvadorNo ratings yet

- Republic v. Orbecido: G.R. No. 154380, 5 October 2005 FactsDocument1 pageRepublic v. Orbecido: G.R. No. 154380, 5 October 2005 FactsPaul Joshua SubaNo ratings yet

- CIV2-part 1Document79 pagesCIV2-part 1c@rpe_diemNo ratings yet

- Sarmienta Vs Manalite Home Owners AssociationDocument3 pagesSarmienta Vs Manalite Home Owners AssociationRubenNo ratings yet

- Maglasang vs. CabatinganDocument2 pagesMaglasang vs. CabatinganMarilou GaralNo ratings yet

- Ledesma Vs ClimacoDocument7 pagesLedesma Vs ClimacoNikkiAgeroNo ratings yet

- Summary of Cases - MidtermDocument6 pagesSummary of Cases - MidtermAizza JopsonNo ratings yet

- PERSONS Willan V WillanDocument1 pagePERSONS Willan V WillanPlaneteer PranaNo ratings yet

- G.R. No. 123586. August 12, 2004: Spouses Beder Morandarte and Marina FebreraDocument3 pagesG.R. No. 123586. August 12, 2004: Spouses Beder Morandarte and Marina FebreraArdenNo ratings yet

- Rem Landmark CasesDocument8 pagesRem Landmark CasesKev BayonaNo ratings yet

- ASSOCIATED BANK Vs TANDocument4 pagesASSOCIATED BANK Vs TANJules VosotrosNo ratings yet

- Assoc Bank Vs TanDocument2 pagesAssoc Bank Vs TanBeverlyn Jamison100% (1)

- FEBTC Vs Diaz RealtyDocument1 pageFEBTC Vs Diaz RealtyDaniela Erika Beredo InandanNo ratings yet

- 3 People Vs SequinoDocument1 page3 People Vs Sequinokarl doceoNo ratings yet

- 53 Malayan Employees Association - FFW and Mangalino v. Malayan Insurance Co.Document2 pages53 Malayan Employees Association - FFW and Mangalino v. Malayan Insurance Co.karl doceoNo ratings yet

- Fredco Vs HarvardDocument3 pagesFredco Vs Harvardkarl doceoNo ratings yet

- 30 Dolores Villar Et Al Vs InciongDocument3 pages30 Dolores Villar Et Al Vs Inciongkarl doceoNo ratings yet

- 131 Abrogar Vs Cosmos BottlingDocument3 pages131 Abrogar Vs Cosmos Bottlingkarl doceoNo ratings yet

- 105 Carumba v. CADocument2 pages105 Carumba v. CAkarl doceo100% (1)

- 44 Manufacturers Life Insurance V MeerDocument3 pages44 Manufacturers Life Insurance V Meerkarl doceo100% (1)

- 44 Manufacturers Life Insurance V MeerDocument7 pages44 Manufacturers Life Insurance V Meerkarl doceoNo ratings yet

- Search WarrantDocument8 pagesSearch Warrantkarl doceoNo ratings yet

- 131 People Vs BalinganDocument2 pages131 People Vs Balingankarl doceo100% (1)

- 97 Allan C Go V CorderoDocument5 pages97 Allan C Go V Corderokarl doceoNo ratings yet

- 31 Frias V San Diego-SisonDocument2 pages31 Frias V San Diego-Sisonkarl doceoNo ratings yet

- 65 Garcia Vs SalvadorDocument3 pages65 Garcia Vs Salvadorkarl doceoNo ratings yet

- People Vs IntingDocument2 pagesPeople Vs Intingkarl doceoNo ratings yet

- 67 People Vs PavillareDocument3 pages67 People Vs Pavillarekarl doceoNo ratings yet

- 81 Young V Midland Textile InsuranceDocument2 pages81 Young V Midland Textile Insurancekarl doceoNo ratings yet

- 103 Roan v. GonzalesDocument2 pages103 Roan v. Gonzaleskarl doceoNo ratings yet

- 22 Villa Rey Transit V CADocument2 pages22 Villa Rey Transit V CAkarl doceoNo ratings yet

- People Vs Puig and PorrasDocument1 pagePeople Vs Puig and Porraskarl doceoNo ratings yet

- Vda de Reyes Vs CADocument9 pagesVda de Reyes Vs CAkarl doceoNo ratings yet

- Philam Vs ArnaldoDocument2 pagesPhilam Vs Arnaldokarl doceoNo ratings yet

- People Vs SequinoDocument1 pagePeople Vs Sequinokarl doceoNo ratings yet

- 15 Ty Vs First NationaDocument2 pages15 Ty Vs First Nationakarl doceoNo ratings yet

- De Lima V GuerreroDocument3 pagesDe Lima V Guerrerokarl doceoNo ratings yet

- Pangandaman Vs CasarDocument2 pagesPangandaman Vs Casarkarl doceoNo ratings yet

- Austin v. United States, 509 U.S. 602 (1993)Document23 pagesAustin v. United States, 509 U.S. 602 (1993)Scribd Government DocsNo ratings yet

- NCF - 2015 - Npe - 1986Document20 pagesNCF - 2015 - Npe - 1986sanchitNo ratings yet

- NEW Junior School Curriculum Handbook 2023Document39 pagesNEW Junior School Curriculum Handbook 2023Dan LearyNo ratings yet

- SPM Add Maths Paper 2Document6 pagesSPM Add Maths Paper 2Mohd_Puzi_2051No ratings yet

- Research Methods - SamplingDocument34 pagesResearch Methods - SamplingMohsin RazaNo ratings yet

- Constitution and By-Laws of SSCDocument12 pagesConstitution and By-Laws of SSCJaypee Mercado Roaquin100% (1)

- DOLE Philippines, Inc. vs. Medel Esteva, Et Al. G.R. No. 161115, November 30, 2006 Chico-Nazario, J.Document2 pagesDOLE Philippines, Inc. vs. Medel Esteva, Et Al. G.R. No. 161115, November 30, 2006 Chico-Nazario, J.Natalio Repaso IIINo ratings yet

- A Novel TRPC6 Mutation in A Family With Podocytopathy and Clinical VariabilityDocument5 pagesA Novel TRPC6 Mutation in A Family With Podocytopathy and Clinical VariabilityIgnacio TabuadaNo ratings yet

- HSPA - Network Optimization & Trouble Shooting v1.2Document15 pagesHSPA - Network Optimization & Trouble Shooting v1.2Ch_L_N_Murthy_273No ratings yet

- Cwts - Module - 1st Semester A.Y 2022-2023Document71 pagesCwts - Module - 1st Semester A.Y 2022-2023Jae Ashlie BernabeNo ratings yet

- Every Praise: Hezekiah WalkerDocument1 pageEvery Praise: Hezekiah WalkerPamela CabelloNo ratings yet

- Kibor HistoryDocument3 pagesKibor HistorymaheenwarisNo ratings yet

- Citrix XenApp 6.5 AdministrationDocument22 pagesCitrix XenApp 6.5 AdministrationTjako1No ratings yet

- Injunction Draft Padre CrisostomoDocument7 pagesInjunction Draft Padre CrisostomoJoseph Nikolai ChiocoNo ratings yet

- Coca Cola ManagementDocument87 pagesCoca Cola Managementgoswamiphotostat43% (7)

- Sultans of Swing TabDocument5 pagesSultans of Swing TabNadiaNo ratings yet

- Part A Reading Task 6 InfluenzaDocument7 pagesPart A Reading Task 6 InfluenzamigsbricksNo ratings yet

- NI Executive - Letter To Faith LeadersDocument5 pagesNI Executive - Letter To Faith LeadersDUPNo ratings yet

- SEC AssignmentDocument5 pagesSEC AssignmentChandra Prakash DixitNo ratings yet

- Psychiatric SymptomsDocument65 pagesPsychiatric SymptomsEslam HamadaNo ratings yet

- Advanced Modeling of Online Consumer BehaviorDocument17 pagesAdvanced Modeling of Online Consumer BehaviorCesar GranadosNo ratings yet

- From Court of Dar Es at Kisutu in Civil Application No. 107 2022)Document17 pagesFrom Court of Dar Es at Kisutu in Civil Application No. 107 2022)Emmanuel ShekifuNo ratings yet

- Parts Tohatsu MFS25B-30B (2005) - (00221050-2)Document90 pagesParts Tohatsu MFS25B-30B (2005) - (00221050-2)rebliaNo ratings yet

- Brexit Complete Detail PDFDocument5 pagesBrexit Complete Detail PDFAnshul PalNo ratings yet

- Azul de Metileno ChoqueDocument10 pagesAzul de Metileno Choquenoel luisNo ratings yet

- Geotechnical Engineering - Serbulea ManoleDocument229 pagesGeotechnical Engineering - Serbulea ManoleNecula Bogdan MihaiNo ratings yet

- Consumer Behavior PP Chapter 7Document35 pagesConsumer Behavior PP Chapter 7tuongvyvyNo ratings yet