Professional Documents

Culture Documents

2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805

2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805

Uploaded by

Rainy GoodwillOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805

2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805

Uploaded by

Rainy GoodwillCopyright:

Available Formats

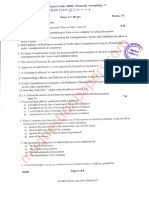

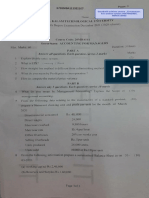

E 1558 (Fages : 4\ Reg. No...lAe fr&l}.9,il.39.9...

Nam*.... "..G88. [IJ.. .*/t& "b ila

B"Com. DEGREE (C.B.C.S.S.) EXAMINATION, APRIL Z0t8

Fourth Semester

Core Course XI-CORPORATE ACCOUNTING

(Common for Model I, Model II and U.G.C. Sponsored B.Com. Degree Programmes)

t2013 Admission onwardsl

Time : Three I{cur-q Maximum Marks:80

Part A

Ans ur*s,r all questions. Each question carcies L m,arh,.

{ ,ilIhat is capital redemp'bion }"eserve ?

</ What are free reserves ?

is escrclw acco*nt ?

V*^at

is unclaimed dividend ?

{'What

g. Sihat is nei worth ?

6. What is subdivision of sha:'e,I

7. What is internal reconstruction ?

8. What do you mea.n by continlreni iiai,ilities ?

9. \Yho is a liquidator ?

10. What is fraudulent preference ?

(10x1=10)

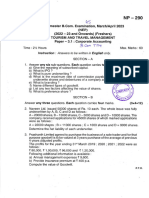

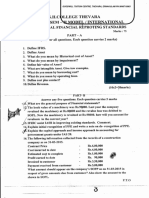

Part B

Answer any eight questi,ons. Each question carries 2 marks.

/

q/ Wfrut is securities premium ? What are the rlurposes for which it can be utilised ?

72. Mention the profits and reserves avaiiable for issue of bonus shares.

13. State the sources ofbuyback ofshares.

/

Jg What are the powers entrusted with the iiquidator ?

r{/ What is external reconstruction ?

16. What is alteration of capital ?

17. What is l,nurchase

- . ., sr vrr4oE consideration ?i

UUllDlUgl4!Mr

{f. What is interini dividend and final dividend ?

t

19. What is consolidation of shares ?

I

39/ firt the items required to be presented under the hearling'Reserves and surplus'.

Turn over

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

E 1558

21. What are the grounds of voluntary winding up ?

I

Zz/ Acompany'with equity share capital of Rs. 3.q,0q,0q0"dn shares of Rs. 20 each reduces the shares

\/ Uv ns.io each under capital reduction scheme, the amount thus available is utilised for writing off

goodwill. Give entries in the books of the company'

(8x)=16)

Part C

Answer any six questions" Each question carcies 4 mafks.

q/ n*pUin the different methods of calculating purchase consideration'

24. What are the conditions to be complied with on buy-back of equity shares ?

25. Write a note on preferential creditors.

4

v

Distinguish between Amalgamation and external reconstruction.

27. A company has equity share capital of Rs. 7,50,000 consisting 7,500 shares

of Rs. 100 (a) It is

(b) To ask the shareholders to surrender

resolved to sub-divide the share into shares of Rs' 10 each ;

7c debenture holders of

b0 vo oftheir shares ; (c) To issue 60 Vo of the surrendered shares to 15

Rs. 8,00,000 in full settlement of their claims ; and

(d) To cancel the unissued surrendered shares'

Give entries in the book of the company'

period

zg. From the following particulars, calculate weighted time ratio for pre and post incorporation

and share the salaries accordingly '-

Accounting period -L-L'2015 to 31- L2-2015'

Date of incorporation-Lst MaI.h 20L5.

Total salaries of the year Rs. 30,00,000.

Total number of workers.

Pre - incorPoration Period-l5'

Post incorPoration Period-3O'

par. For the

z{ $ Ltd. resorved to buyback 60,000 fuily paid equity shares of Rs. 10 each at

V par, the total sum being payable

purpose, it issued 20,000 lb Vo preference shares ofRs. 10 each at

fulfrl the'legal

with applications. The company has Rs. 9,00,000 in general reserve account to

to Rs' 40,000' Pass journal

requirements regarding buyback. The expense on buyback amounted

-- for all the

,entries transactions involved in the buyback.

/---- .,! --r--,r-

How it is calculated

€/ ** is profit prior to incorporation ? ?

81. On liquidation of MTT Ltd. the amount realised by sale of assets is Rs. 7, 50,000 and the amount

due is Rs. g,b0,000. Including Rs. 25,000 preferential creditors.

Calculate remuneration of liquidator

distributed amongst

if he is entitled to a cornmission of 37o on amount realised ard'ZVo on. amount

the unsecured creditors.

(6 x 4-24)

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

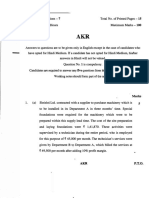

3 E 1558

part D

Answer any two of the following questions.

Each question carries LS marks.

From the following trial balance and additional information provided, prepare

accounts of Superior

and Co. Ltd. for the year ending 31"t March 2010 :

Particulars I)r. Cr.

Rs" Rs.

Capital 60,000 eqwr(ry shares of Rs" 10 each fully paid 6,00,000

Stock (L.4.2AW ... 41501000

Purchase a$aJes ... L4r701000 2L,00,000

Productive wagds-- ... 3r00r000

Disco urryt ... 421000 30,000

surruifr- ... 451000

P;e$,2 ,.. 29,700

Gener al exysrttses

Profit and Loss aqcount ( 1.4.2009) ...L,02,300 7 0,000

Dividend paid for lrcWear 54,000

r4ebtors and .r"bitors

2,25,000 1,05,000

Elant and mac!4;dery L,7 4,000

Cash atbas{ 97,200

Reserve 1, 13 ,000

Loan to Managing Directors 19,500

Bad debts 11,300

30,19,000 30,19,000

Val Stock on 31st March 2010 Rs. 4,}2,OOO.

fbl Depreciate machinery @ l0 Vo p.a.

(c) Reserve 5 ?o on debtors for doubtful debts.

(d) Provide 2 Vo fordiscount on creditors.

(e) One months rent ns.47dO was due on Blsi March 2010.

(f) Six months insurance was unexpired at Rs. 4,800 p", ga{u .

(S) Provide Rs. 27,336 for inco{tax.

(h) The Board recommends a dividend@ 2OClo per annum-

(i) Make provision for corporate dividgrd tax at the applicable rate.

0) Transfer to general resyfve 5 Vo of netprofit.

Turn over

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

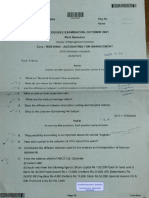

4 , 81558

33. Miya Ltd. went into voluntary liquidation on SlstDecembe\20L4 when their balance sheet read

as follows :

, Liabilities Ambunt Assefs Am,outtt

Rs" ,

Rs.

Issued and subscribed capital Land and Buildings 5,00,000

10,000, \OVo eumulative Plant and machinery L2,50,000

preference shares of Rs. 100 Patents 2,00,000

each full paid 10,00,000 Stock 2,75,000

5,000 equity shares of Rs. 100 Sundry debtors 5,50,000

each, Rs . 75 paid '.

... 3rT5r000 Cash at bank 1,50,000

15,000 equity shares of Rs. 100 Profit and Loss Account 5,62,500

each, Rs. 60 paid ... 9r00r000

15 7o Debentures securecl bY a

floating charge .., 5r00r0oo

Interest outstanding on

debentures ... 7 5 1000

Trade Creditors ... 61371500

34,87,500 34,87,500

Preference dividends were in arrear for 2 years and the creditors included preferential creditors of

Rs. 76,000.

The assets realised as follows :

Land and building Rs. 6,00,000 ; Plant and machinery Rs. 10,00,000 ; Patents Rs. 1,50,000 ; Stock

Rs. 3,00,000 ; Sundry debtors Rs. 4,00,000.

The expenses of liquidation amounted to Rs. 54,500. The liquidator is entitied to a commission

of 3 Vo on assets realised except cash. Assuming the final payment including those on debentures

is made on 30th June, 2016. Show the liquidator's Final statement of account.

PQ Ltd. is formed to take over P Ltd" for Rs. 12,50,000 and 6,25,000', payable in equity shares of

Rs. 10 each. The balance sheets of trvo companies as on 31-st March 2010 are given below :

Lis,bilities P Ltd. Q Ltd. Assets P Ltd. Q Ltd.

Rs. Rs. Rs. Rs.

Share capital .. 18,75,000 15,00,000 Land and building 5,00,000 2,50,000

Reserue .. 5,00,000 62,500 Plant and machinery .. 5,62,500 1,87,500

Sundry Creditors .. 7,50,000 2,50,000 Stock '. 8,75,000 3,75,000

Bills payabtre .. L,25,000 L,87,500 SundrY debtors ,. 10,00,000 5,0o,ooo

Bills receivable .. 1,87,500 2,50,000

Cash and bank .. 1,25,000 4,37,500

32,50,000 20,00,000 32,50,000 20,00,000

Additional information :

(a) Sundry Debtors of Q Ltd. include Rs. 1,25,000 due from P Ltd. and

(b) Bills payable of P Ltd. includes Rs. I-,00,000 acceptances in favour of Q Ltd. But bills

receivable of Q Ltd. includes Rs. 62,500 accepted by P Ltd.

Bills discounted by Q Ltd. but not yet matured amounts to Rs. 37,500.

You are required to pass acquisition entries in the books of PQ Ltd. and to prepare Balance Sheet

,ofPQ Ltd.

** is Liquidator's {inal statement of account ? Give a specimen of it with imaginary

Y ffrl.i,,

GOODWILL TUITION CENTRE, THEVARA 9567902805, 9846710963

You might also like

- Sample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaDocument36 pagesSample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaChristen CastilloNo ratings yet

- 11e Ch3 Mini Case Client ContDocument10 pages11e Ch3 Mini Case Client ContHao Cui100% (1)

- Best Practices For Continuous Monitoring of Your SAP HR and Payroll ProcessesDocument55 pagesBest Practices For Continuous Monitoring of Your SAP HR and Payroll Processescabhijit100% (1)

- Financial Planning and ForecastingDocument28 pagesFinancial Planning and ForecastingSara Ghulam Muhammed SheikhaNo ratings yet

- ESG Ratings MethodologyDocument9 pagesESG Ratings Methodologydclermont100% (3)

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNo ratings yet

- Advanced Accounting and Financial ReportingDocument6 pagesAdvanced Accounting and Financial ReportingAhmed Raza MirNo ratings yet

- CSD HP Scheme Remittance of InsDocument4 pagesCSD HP Scheme Remittance of InsJack Al100% (1)

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Suggested Answers CAP III - Dec 2018 PDFDocument144 pagesSuggested Answers CAP III - Dec 2018 PDFsarojdawadiNo ratings yet

- Methods For Calculating Profitability: CH-403 Process Economics and Plant DesignDocument35 pagesMethods For Calculating Profitability: CH-403 Process Economics and Plant DesignShyam Pratap SinghNo ratings yet

- 6.trail BalanceDocument4 pages6.trail Balancesujan BhandariNo ratings yet

- HI5020Document13 pagesHI5020takeshiru000No ratings yet

- Maynard Solutions Ch10Document21 pagesMaynard Solutions Ch10Anton VitaliNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Corporate Accounting Question Paper March 2015 MG (CBCSS)Document4 pagesCorporate Accounting Question Paper March 2015 MG (CBCSS)Sharon sharoNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- 34 Corporate Accounting F+R CBCS 2015 16 and OnwardsDocument15 pages34 Corporate Accounting F+R CBCS 2015 16 and Onwardspremium info2222No ratings yet

- Accounting AndFinancial Management 2015-16Document4 pagesAccounting AndFinancial Management 2015-16Ashish AgarwalNo ratings yet

- Answers May Be Written Either in English or in Malayalam: Reg. No - NameDocument8 pagesAnswers May Be Written Either in English or in Malayalam: Reg. No - Namevimal johnsonNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- 44 Corporate Accounting May 2022Document8 pages44 Corporate Accounting May 2022premium info2222No ratings yet

- 70 Elective 1 Advance Financial Management Repeaters Prior To 2014 15Document4 pages70 Elective 1 Advance Financial Management Repeaters Prior To 2014 15premium info2222No ratings yet

- Corp. AccountingDocument6 pagesCorp. AccountingUtkalika R SahooNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2022Document4 pagesBangalore University Previous Year Question Paper AFM 2022Ramakrishna NagarajaNo ratings yet

- 35 Corporate Accounting Repeaters 2013 14 and OnwardsDocument15 pages35 Corporate Accounting Repeaters 2013 14 and Onwardspremium info2222No ratings yet

- 38 Corporate Accounting Repeaters 2013 14 and OnwardsDocument4 pages38 Corporate Accounting Repeaters 2013 14 and Onwardspremium info2222No ratings yet

- 14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)Document8 pages14 Corporate Accounting - April May 2021 (Repeaters 2013-14 and Onwards)premium info2222No ratings yet

- 18u3cm06 CC06Document8 pages18u3cm06 CC06Manoj MJNo ratings yet

- Lesson 1 To 5-1Document3 pagesLesson 1 To 5-1Aayush PatelNo ratings yet

- Bangalore University Previous Year Question Paper AFM 1Document3 pagesBangalore University Previous Year Question Paper AFM 1Ramakrishna NagarajaNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document3 pages2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- Rah DP2 J 2 CBLPE9 Mev ODh Kksa CLAMq 0Document3 pagesRah DP2 J 2 CBLPE9 Mev ODh Kksa CLAMq 0aa0820463No ratings yet

- CBSE Class 12 Accountancy Retirement and Death of Partner Worksheet Set ADocument4 pagesCBSE Class 12 Accountancy Retirement and Death of Partner Worksheet Set AMeena DhimanNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- Tybaf Sem5 Fa-V Nov19Document8 pagesTybaf Sem5 Fa-V Nov19katejagruti3No ratings yet

- 36571suggans Ipcc Nov14-P5 PDFDocument25 pages36571suggans Ipcc Nov14-P5 PDFAvinash GanesanNo ratings yet

- SEM III - Advanced Accounting (EM)Document4 pagesSEM III - Advanced Accounting (EM)Abdul MalikNo ratings yet

- Corporate Accounting II (T)Document6 pagesCorporate Accounting II (T)BISLY MARIAM BINSONNo ratings yet

- Sem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758Document5 pagesSem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758hussain shahidNo ratings yet

- FM M.com 2nd Sem 2015Document4 pagesFM M.com 2nd Sem 2015Khurshid AlamNo ratings yet

- Fa 5Document14 pagesFa 5divyayella024No ratings yet

- 45 Corporate Accounting March 2023 TTMDocument4 pages45 Corporate Accounting March 2023 TTMvenuv4269No ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- 18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 2021Document5 pages18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 202119BCS531 Nisma FathimaNo ratings yet

- FM QP 2008-20Document18 pagesFM QP 2008-20Jubin JacobNo ratings yet

- FA - Pre Foundation Phase - Sample PaperDocument5 pagesFA - Pre Foundation Phase - Sample PaperJaved MohammedNo ratings yet

- Code No.: BB-133: Online Annual Examination, 2022Document8 pagesCode No.: BB-133: Online Annual Examination, 2022Roshan ArjunkarNo ratings yet

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- Bachelor'S Degree Programme Term-End Examination June, 2016Document11 pagesBachelor'S Degree Programme Term-End Examination June, 2016sahithi rudrarajuNo ratings yet

- Companies Equity Share Questions Class 12thDocument19 pagesCompanies Equity Share Questions Class 12thambika9290No ratings yet

- I Sem B.com Financial Accounting I 2011 12 BatchDocument8 pagesI Sem B.com Financial Accounting I 2011 12 Batchlion kingNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Paper Finance IVDocument3 pagesPaper Finance IVAbhijeetNo ratings yet

- CA IPCC Old Accounts Question Paper Nov 2018 StudycafeDocument15 pagesCA IPCC Old Accounts Question Paper Nov 2018 Studycafeadityatiwari122006No ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Paper 12 Intermediate Company Accounts and AuditDocument24 pagesPaper 12 Intermediate Company Accounts and AuditGajju ChautalaNo ratings yet

- Dec 17Document10 pagesDec 17cacow83838No ratings yet

- Bangalore University Previous Year Question Paper AFM 2019Document3 pagesBangalore University Previous Year Question Paper AFM 2019Ramakrishna NagarajaNo ratings yet

- MBG-206 2019-20 - 1Document4 pagesMBG-206 2019-20 - 1senthil.jpin8830No ratings yet

- Second Semester October 2022 Financial Accounting 2 Question Paper MGUDocument5 pagesSecond Semester October 2022 Financial Accounting 2 Question Paper MGURainy GoodwillNo ratings yet

- Income Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Document4 pagesIncome Tax 1 B.com St. Alberts College Mgu 5th Semester Question Paper Free Download October 2022Rainy GoodwillNo ratings yet

- October 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperDocument4 pagesOctober 22 Semester 3 Corporate Accounting S H College, Thevara Question PaperRainy GoodwillNo ratings yet

- Income Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGUDocument3 pagesIncome Tax 5th Sem B.com November 2022 Question Paper Rajagiri College MGURainy GoodwillNo ratings yet

- MGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryDocument6 pagesMGU B.com 1st Semester Financial Accounting Question Paper 2022 FebruaryRainy GoodwillNo ratings yet

- Agriculture Income - Income TaxDocument5 pagesAgriculture Income - Income TaxRainy GoodwillNo ratings yet

- Accounting For Management SCMS Question PapersDocument7 pagesAccounting For Management SCMS Question PapersRainy GoodwillNo ratings yet

- Final Accounts AdjustmentsDocument7 pagesFinal Accounts AdjustmentsRainy GoodwillNo ratings yet

- MGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Income Tax Assessment and Procedure.Rainy GoodwillNo ratings yet

- Cusat Question Paper Mba Accounting For Managers 2022 MarchDocument3 pagesCusat Question Paper Mba Accounting For Managers 2022 MarchRainy GoodwillNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- IGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Document4 pagesIGNOU Elements of Income Tax Question Paper Free Download B.com June 2017Rainy GoodwillNo ratings yet

- IFRS B.com SH College Model Question Paper 2017 March 2Document2 pagesIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNo ratings yet

- MGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFDocument62 pagesMGU B.Com Syllabus 2017 Onward Free Download Goodwill Tuition Centre 9846710963 9567902805 PDFRainy GoodwillNo ratings yet

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Document7 pagesAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillNo ratings yet

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- 2017 March B.com 5th Semester Special Accounting Question Paper MG University Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2017 March B.com 5th Semester Special Accounting Question Paper MG University Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy Goodwill50% (2)

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document3 pages2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- MGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Document4 pagesMGU CBCSS March 2018 Sixth Sem Question Paper Applied Cost Accounting CBCSS Goodwill Tuition Centre 9846710963 9567902805Rainy GoodwillNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- 2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- 2017 March B.com 5th SemesterDocument4 pages2017 March B.com 5th SemesterRainy GoodwillNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationAung Zaw HtweNo ratings yet

- Punjab Relief of Indebtedness Act, 1934 PDFDocument23 pagesPunjab Relief of Indebtedness Act, 1934 PDFLatest Laws Team0% (1)

- Amit Vadhadiya Saving Ac PDFDocument11 pagesAmit Vadhadiya Saving Ac PDFKotadiya ChiragNo ratings yet

- Case No. 5: Verzosa V. Bucag: G.R NO. L-8031 DATE: October 29, 1955 TOPIC: AntichresisDocument2 pagesCase No. 5: Verzosa V. Bucag: G.R NO. L-8031 DATE: October 29, 1955 TOPIC: AntichresisLoreen DanaoNo ratings yet

- Chapter 12 DrillsDocument4 pagesChapter 12 DrillsBaderNo ratings yet

- Income TaxDocument85 pagesIncome TaxvicsNo ratings yet

- Labour Law Compliance Check ListDocument8 pagesLabour Law Compliance Check ListkaushikNo ratings yet

- Mphasis - Company BriefDocument6 pagesMphasis - Company BriefSantosh KathiraNo ratings yet

- 48 PY WP I-1 Notes PayableDocument1 page48 PY WP I-1 Notes PayableMuhammad FarhanNo ratings yet

- Part - 2 - Dashboard - Changes in Accounting TreatmentDocument4 pagesPart - 2 - Dashboard - Changes in Accounting TreatmentJaquelyn JacquesNo ratings yet

- SynthesisDocument14 pagesSynthesisKrizza MaeNo ratings yet

- Open Economy Macroeconomics Class 12 Notes CBSE Macro Economics Chapter 6 PDFDocument5 pagesOpen Economy Macroeconomics Class 12 Notes CBSE Macro Economics Chapter 6 PDFganeshNo ratings yet

- Working Capital - Synopsis-2022-23Document19 pagesWorking Capital - Synopsis-2022-23archana bagal100% (1)

- 4 Main PartDocument35 pages4 Main PartShamsuddin AhmedNo ratings yet

- Akshay JangraDocument4 pagesAkshay JangraVipinNo ratings yet

- RSM 324 Notes 5Document65 pagesRSM 324 Notes 5xsnoweyxNo ratings yet

- Managemet AccountingDocument163 pagesManagemet AccountingGunjeet Singh SachdevaNo ratings yet

- HSBC 2012 IrnDocument55 pagesHSBC 2012 Irnraylin66No ratings yet

- Chapter 1 Basic Tax ConceptsDocument13 pagesChapter 1 Basic Tax ConceptsJoey Aw YongNo ratings yet

- Capital Gain ProblemsDocument6 pagesCapital Gain Problems20-UCO-517 AJAY KELVIN ANo ratings yet

- Fiori AppDocument26 pagesFiori Appamguna4056No ratings yet

- Internet CafeDocument16 pagesInternet CafeKamal Shah67% (3)

- Kebs 102Document31 pagesKebs 102Dev Krishna GoyalNo ratings yet

- Cointech2u Tutarial Plan PDFDocument32 pagesCointech2u Tutarial Plan PDFd3km4rd1k4No ratings yet

- Growth Strategies: MBA-Day (BPSA)Document19 pagesGrowth Strategies: MBA-Day (BPSA)cmukherjeeNo ratings yet